Introduction:

The report has been prepared as a requirement of the internship program which is based on the financial organization Southeast Bank ltd. this report will definitely increase the knowledge of other students to know the banking industry of Bangladesh, and various services SEBL is providing to sustain as leading bank in Bangladesh.

A bank is a government-licensed financial institutionwhose primary activity is to lend money. Many other financial activities were allowed over time. For example banks are important players in financial markets and offer financial services such as investment funds. In some countries such as Germany, banks have historically owned major stakes in industrial corporations while in other countries such as the United- States banks are prohibited from owning non-financial companies.

Banks have influenced economies and politics for centuries. Historically, the primary purpose of a bank was to provide loans to trading companies. Banks provided funds to allow businesses to purchase inventory, and collected those funds back with interest when the goods were sold. For centuries, the banking industry only dealt with businesses, not consumers. Banking services have expanded to include services directed at individuals, and risk in these much smaller transactions is pooled.

Banks today are under great pressure to perform towards achieving the objectives of their stockholders, employees, depositors and borrowing customers, while somehow keeping government regulators satisfied that the bank policies, loans and investment are sound. But the principal reason banks are chartered by state and federal authorities is to make loans to their customers. Indeed, making loan is the principal economic function of banks to fund consumption and investment spending by individuals and businesses. Hoe well a bank performs its lending function has a great deal to do with the economic health of its origin, because bank loan support the growth of new business and jobs within the bank’s trade territory and promote economic vitality. As banking organizations have grown in recent years in Bangladesh, many of them have been forced to turn to the money and capital markets to raise funds by selling stocks and bonds. Banks entry into the open market to raise funds means that their financial statements are increasingly being scrutinized by investors and by the general public. This development has placed management under great pressure to set and meet bank performance goals.

At the same time, competition for banks traditional loan and deposit customers has increased dramatically. Bankers are dealing with risk—especially the risk of loss due to changing interests rates. Today banks are highly complex organizations. Bankers have been called upon to continually reevaluate their loan and deposits policies, review their plans for expansion and growth, assets their returns and risk in the light of this new competitive environment. Thus the effective management tools can be marshaled in a coordinated fashion to handle many of the risks banks face.

In MBA program, everything we have learnt is purely theoretical. It was needed to do some practical work for more clarification. Because of my great interest on Foreign Exchange procedure of bank, the internship had chosen the Southeast Bank Ltd., Kakrail branch.

Rationale of the study:

With the rapid growing competition (due to free market economy) among nationalized, foreign and private commercial banks as to how the banks operates its banking and how customer service can be made more attractive, the expectations of the customers have immensely increased. Reciprocating the sentiment, commercial/private banks are trying to evaluate their traditional banking service to a better standard. Under the above circumstance, it has focused its attention towards the improvement of the customer service. That’s why it is quite justified to make improvement .The study may help formulating policy regarding the ideas relating to the feeling of the customers and banks. Furthermore, Southeast Bank Limited actually executes the policies undertaken by the top management will have a chance to communicate their feelings and will have the feedback about their dealings with the customers.

Objectives of the Study:

The general objective of the study is to get an on-the-job experience to practical business world and an opportunity for translation of theoretical concept into real life situation. However the specific objectives of the study are as follows:

- To present theoretical aspects of Southeast Bank’s Foreign Exchange mechanism.

- To achieve Practical idea about overall activities of Bank regarding Foreign Exchange, Credit Dept. and General Banking.

- To study the Foreign Exchange mechanism of Southeast Bank Ltd.

- To familiarize with practical job environment.

- To observe banker-customer relationship.

- To find out some problems and limitations of Southeast Bank and it’s Foreign Exchange mechanism.

- To suggest some possible remedial measures to overcome the problems of Foreign Exchange Division.

- To have an exposure on the financial institutions such as banking environment of Bangladesh.

- To relate the theories of banking with the practical in banking.

The internship gathered data from the customers and bankers. When they (customers) came for service to this Bank, The internship provided questionnaire to those customers who were interested in participating in the survey. As well as internship asked questionnaire to the bankers, when they were free.

Data Collection:

This internee is prepared on the basis of mixed methodology. Both the primary and secondary data have been used in this internee. So the report was based on both the secondary and primary data.

Sources of Data: The sources of data were of two types-

Primary Sources–

- Discussion with employees (unstructured questionnaire)

- Keen observation

- Conversation with clients.

Secondary Sources/ External Sources-

- Official papers of Southeast Bank Ltd.

- Web site of Southeast Bank Ltd and other bank’s web site.

- Annual report of Southeast Bank Ltd and other banks.

- Various journals of various Banks.

- Various Internship reports of various Banks.

- Various leaflet of Southeast Bank Ltd.

- The archive of the Southeast Bank Limited

- Bangladesh Bank Report.Newspaper, magazines

Data Analysis Procedure:

After collecting the data, it was analyzed by Microsoft Word & Excel. Then the findings were made. Based on the findings, the present situation was explained and recommendation was made.

Banking Sector in Bangladesh:

The Jews in Jerusalem introduced a kind of banking in the form of money lending before the birth of Christ. The word ‘bank’ was probably derived from the word ‘bench’ as during ancient time Jews used to do money -lending business sitting on long benches. First modern banking was introduced in 1668 in Stockholm as ‘Savings Pis Bank’ which opened up a new era of banking activities throughout the European Mainland. The number of banks in all now stands at 49 in Bangladesh. Out of the 49 banks, four are Nationalized Commercial Banks (NCBs), 28 local private commercial banks, 12 foreign banks and the rest five are Development Financial Institutions (DFIs). Sonali Bank is the largest among the NCBs while Pubali is leading in the private ones. Among the 12 foreign banks, Standard Chartered has become the largest in the country. Besides the scheduled banks, Samabai (Cooperative) Bank, Ansar-VDP Bank, Karmasansthan (Employment) Bank and Grameen bank are functioning in the financial sector.

The number of total branches of all scheduled banks is 6,038 as of June 2000. Of the branches, 39.95 per cent (2,412) are located in the urban areas and 60.05 per cent (3,626) in the rural areas. Of the branches NCBs hold 3,616, private commercial banks 1,214 foreign banks 31and specialized bank 1,177. Bangladesh Bank (BB) regulates and supervises the activities of all banks. The BB is now carrying out a reform programmed to ensure quality services

- BB

- NCBs

- PCBs

- Specialized bank

About Southeast Bank Ltd (SEBL):

Southeast Bank Limited is a fast growing second generation bank. SEBL has been achieving a continuous growth rate in different spheres of banking operations since its establishment in the year 1995 The philosophy of the bank is “A Bank with Vision” that indicates its sincerity, integrity as well as the strength of mind to cope with the global competitiveness and advancement.

Overview of Southeast Bank Limited

Table no-1 Overview of Southeast Bank

| Name | Southeast Bank Limited |

| Head Office | Eunoos Trade Center,52-53 dilkusha C/A |

| Date of Incorporation | 12th March 1995 |

| Principal Activity | Commercial Banking |

| Number of Branches | 56 |

| Chairman | Mr. Alamgir Kabir Chowdhury |

| Telephone No. | (8802) 9550081,9567271-2 |

| website | www.sebankbd.com. |

Bank Profile:

Southeast Bank Limited is a scheduled commercial bank in the private sector established under the ambit of Bank Company Act, 1991 and incorporated as a Public Limited Company under Companies Act, 1994 on March 12, 1995. The Bank started commercial banking operations on May 25, 1995. During this short span of time the Bank is successful in positioning itself as a progressive and dynamic financial institution in the country. The bank had been widely acclaimed by the business community, from small entrepreneurs to large traders and industrial conglomerates, including the top-rated corporate borrowers for its forward – looking business outlook and innovative financial solutions. Thus within this very short period of time it has been able to create an image and earn significant reputation in the country’s banking sector as a Bank with Vision.

Southeast Bank Limited has been licensed by the Government of Bangladesh as a Scheduled commercial bank in the private sector in pursuance of the policy of liberalization of banking and financial services and facilities in Bangladesh. In view of the above, the Bank within a period of 14 years of its operation achieved a remarkable success and met up capital adequacy requirement of Bangladesh Bank. It has been growing fast as one of the leaders of the new generation banks in the private sector in respect of business and profitability as it is evident from the financial statements for the last 14 years.

Southeast Bank Limited has 56 branches throughout Bangladesh and its aim is to be the leading bank in the country’s principal markets. The bank by concentrating on the activities in its area of specialization has achieved good market reputation with efficient customer service. The Bank is committed to providing continuous training to its staff to keep them up to date with modern practices in their respective fields of work. The Bank also tries to fulfill its share in community responsibilities. By such measures the Bank intends to grow and increase shareholders’ earning per share. Southeast Bank Limited pledges to maximize customer satisfaction through services and build a trusting relationship with customers, which has stood the test of time for the last fourteen years.

Vision of SEBL:

It is especial!” important for managers and executives in any organization to agree upon the basic vision that the firm strives of achieve in the long term. A clear vision provides the foundation for developing a comprehensive mission statement. So the vision statement should be established first and foremost. Southeast Bank has established their vision statement to achieve their long-term Objectives, Their vision is to stand out as a pioneer banking institution in Bangladesh and contribute significantly to the national economy.

Mission of SEBL:

A business mission is the foundation for priorities, strategies, plans and work assignment. Nothing may seem simpler or more oblivious than to know what a company’s business is. Southeast Bank is very much concern about their mission because divergent views among managers can only be revealed and resolved through the mission statement.

The mission of the hank is stated below:

High quality financial services with the help of latest technology.

Fast & accurate customer service.

Balanced growth strategy.

High standard business ethics.

Steady return on shareholders’ equity.

Innovative banking at a competitive price.

Deep commitment to the society and the growth of national economy.

Attract and retain quality human resource.

Core values of SEBL:

Southeast Bank has established their objectives to achieve their strategic and financial targets to have strong competitive advantage in the banking sector. Their core values or the principles are given below:

Integrity

Fairness

Harmony

Courtesy

Commitment

Insight and Spirit

Enthusiasm for Work

Business Ethics

Some Achievements of SEBL in 2009:

A fair evaluation of any bank’s performance should start with the sources of fund and whether the funds have been utilized properly by the internship to earn profit at short run and to maximize stakeholders’ wealth in the long run. For SEBL, the sources of fund are: share capital (IPO), term deposits (in the form of FDR, STD balances, savings account balances, etc. which are also called core deposits) and reserve capital (the unutilized portion of annual profit). The key performance points are highlighted below:

Deposits:

Since the commencement of baking operation, Southeast Bank Limited has not only gained enormous popularity but also succeeded in raising the deposit unto Tk. 9666.90 crore throughout the long fourteen years of its operation. The growth rate was 29.16% than that of the previous year.

Advances:

The advance portfolio of the bank is well diversified and broad based covering various sectors of the economy. The bulk of its credit facilities are extended to the private sector

For trade, project finances as well as to meet working capital finances. Southeast Bank Ltd. recorded an overall loan growth of 28.33% in FY2009 than that of the succeeding year.

Foreign Exchange Business:

The foreign trade operation of the bank is very strong. At the early years of its banking operations the bank could establish a large network of foreign correspondents covering most of the important business centers around the world. Moreover, the foreign exchange dealings were further enhanced by joining the international electronic fund transfer network S.W.I.F.T. (Society for Worldwide Interbank Financial Telecommunication). Over the long eleven years the foreign exchange business of the Bank grew from Tk.233.69 crore in 1995 to Tk. 11630.74 crore in 2009.

Investments:

With the increase in investment the amount of risk weighted assets of the Bank have also increased. Therefore, the need to raise capital base of the bank has arisen considerably because the Bank is allowed to take exposure of a group or a single individual unto a maximum of 25% of its paid-up capital in the case of funded credit facility and 50% in the case of non-funded credit facility. The proceeds from issuance of right shares are employed to meet capital adequacy of the Bank to maintain a steady growth. The credit portfolio of the Bank was Tk.27.70 crore in 1995 which grew to Tk.1430.31 crore in 2009.

Profit:

The bank has increased its net profit dramatically. The highest net income earned during the year 2001. Even though the profit decreased after that but the bank is trying to increase their investments as well as earnings. The operating profit was Tk.3.34 crore in 1995 and increased to 461.50 crore in 2009. The net profit of 2009 was Tk. 187 crore.

SEBL Services:

General Banking Services:

- Accounts Opening

- Account maintaining.

- Account closing

- Issuing Pay order.

- Bank draft.

- Demand draft.

- Opening of Fixed Deposit.

- Clearing of Bank cheques.

Foreign Exchange Business Services:

- Letter of credit

- Parties to Letter of Credit

- Operations of Documentary Letters of Credit

- L/C Application

- Scrutiny of Documents

- Scrutiny of L/C Application

Investment Services:

- Investment Scheme for Doctors

- Small Business Investment Scheme

- Housing Investment Scheme

- Small Transport Scheme

- Car Loan Scheme

- Transport Investment scheme.

- Agriculture Implements Investment Scheme Rural Development Scheme

Other Consumer Savings Schemes:

- Pension Savings Scheme (PSS)

- Education Savings scheme (ESS)

- Marriage Savings Scheme (MSS)

Sanchaypatra schemes:

- Eight years Protirakha Sanchaypatra ( PSP)

- Five years Bangladesh Sanchaypatra (BSP)

- Sanchaypatra Interest on half yearly rest (SP)

- Sanchaypatra Interest on quarterly rest (SP)

Technology:

At present, all banking transactions of Southeast Bank are fully automated. Moreover, all activities of trade and operations are being done through computers and other automation tools Such as ATM, SWIFT. The bank is the member of the shared ATM Network provided by Electronic Transaction Network ltd. (ETN). At present 25 ATM booths are available all over Dhaka city and in the cities of Chittagong and Sylhet.

In order to provide round-the-clock and correct information on the bank to the business community all over the world, the bank has a web page which can be accessed under the domain name: www.southeastbank-bangladesh.com. Bank has made an agreement with Square Informatics Ltd to have real time on-line transaction facility. The bank facilitates its clients to deposit, draw or remit funds from their accounts from one branch to another by providing on-line banking services.

Management of SEBL:

For any financial and non-financial organization, management are the most valuable and important resources of any kind of organization. And, a well-organize management provides the organization to reach its ultimate goal. Management means planning, organizing, staffing, directing and controlling of all financial and non- financial recourses of am organization. Different aspects of manage4menat practice in SEBL are discussed below.

Planning:

SEBL have done its planning within the preview of the corporate plan. The overall planning approach in SEBL is top-down. Each branch can plan according to the goal imposed by the corporate level. It doesn’t plan independently. And, SEBL has a planning division. This is mainly responsible for the overall planning.

Organizing:

SEBL is organized as per the existing business locations. It has fifty three branches, each of which is a separate entity. Each unit is responsible for its performance and each is headed at least by a senior assistant vice president (SAVP) in designation followed by manager (operations). He is directly responsible for the performance of their unit. Within each branch, it is organized functionally.

Staffing:

The recruitment in SEBL is done in two ways. One as a “provisional officer” for the management program and it has a probation period of two years. Another one is non-management level as “trainee officer”. Provisional officers are recruited in officer category and their career path is headed towards different managerial jobs.

Directing:

The management approach in SEBL is top-down or authoritative. Each information just seeks through lower management layer. Works are designed in such a way that one cannot leave without clearing the task as he is assigned for a day. Sitting arrangement in all office is done in way that the superior can monitor the subordinate all time. Management (HOB) and manager operation all time watch the operation of the bank through CC camera. Security is maintained properly. Budgeting, rewarding, punishing etc are also practice as control program.

Controlling:

SEBL doesn’t believe in the traditional banking. It tries to increase and maintain its market share in the private banking sector through two types of control techniques:

- Feed forward control

- Feedback control

Feedback control technique monitor output of a process and feed into the system to obtain desired outputs. On the other hand feed control technique monitors inputs into a process to ascertain weather these are as planned; if they are not, the inputs are changed in order to get the desired result.

Operation Strategy:

Presently the bank uses bank Ultimus branch banking software developed by leads C Corporation developed on SQL on windows platform. The head office and some branches use the software for book keeping, automatic interest calculation, daily transaction listing and audit trails, auto maturity and auto renewal of FDRs, automatic integration of customers ledger position including balance of subsidiaries, monthly income and expenditure position etc. the bank has joined the shared ATM Network Bangladesh offered by ETN along with eight other member banks. This service is presently available in Dhaka, Chittagong and Sylhet. SBL is member of SWIFT. It has also installed Reuter System at the Head Office to have live access to information from international money market for dealing in Foreign Exchange. But from the viewpoint of ideal requirement for modern bank, competing with international banks, the IT facilities of SBL need further improvement.

Top-Down Management Strategy:

The dimension of organization structure of Southeast Bank is centralization. In this dimension, the decision-making authority resides at the top of the organization char. Different works being assigned under strict control and monitoring to the lower level employees.

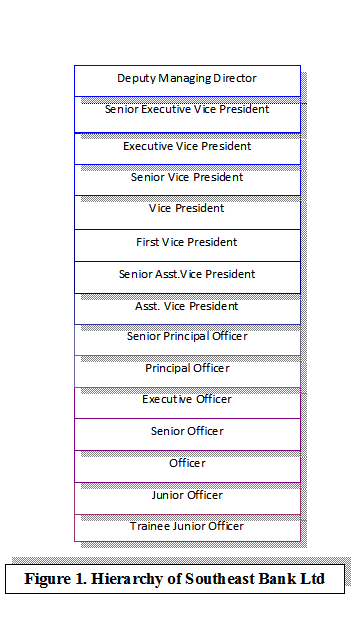

Organogram:

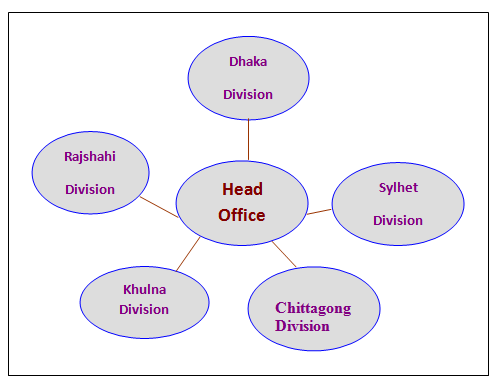

Network of the Branches:

Southeast Bank has 48 existing branches and some other proposed branch all over Bangladesh to provide better services to their valuable customer. The objective of SEBL is not only to earn profit but also keep the social commitment and to ensure its co-operation to the persons of all levels, to the businessmen, industrialists-specially who are engaged in establishing large scale industries by consortium and the agro-based export oriented medium and small scale industries by self inspiration. SEBL as the largest private bank is committed to continue its endeavor by rapidly increasing the investment of honorable shareholders into asset. The network of this bank is centralize.

Human Resource Department of the Bank:

The Human resource department of Southeast Bank performs many different roles and responsibilities. They take full responsibility for human activities like employment are recruiting, training and development, employee services, employee and community relations, personnel records, rewarding employees etc. The HR officers of this bank are very much concern to design and deliver efficient and effective HRM system, process and practices. They spend a lot of time to ensure employee’s satisfaction. They work on finding creative ways to ensure a positive and encouraging work environment.

Recruitment Policy:

The goal of an organizational recruitment program is to ensure that the organization has a number of reasonably qualified applicants to choose from when a vacancy occurs. As Southeast Bank is concern to bring about their long- term objectives so that they accomplish the recruiting process cautiously. The process for the recruitment of Management Trainee and Provision Officer is:

- Circular / Advertisements placed in notice boards of different educational institutions and news dailies.

- Written test

- Checking the test scripts.

- Call for interview

- On the job training

- Outside training (e.g., foundation training at BIBM)

- Confirmation

Whole process takes maximum of one to two months. The incumbents are appreciated who have practical experience and knowledge in the relevant fields.

Training:

The bank is very much conscious for the training of their employees to make them master in knowledge, skill and behaviors in their day-to-day activities. It the bank retains and motivates employees. Generally, Southeast Bank United arranges training for junior level officers at BIBM, Mirpur, Dhaka to enhance their skill and efficiency. Executive officers are also required for training attending seminars in abroad to develop their managerial and operational proficiency. Every year, officers attended training courses at BIBM whereas this executives or officers were sent abroad for training o” international Trade, Credit management and other areas of banking and financial services.

Job Evaluation:

Job evaluation is very much necessary to measure internal job worth of an organization SEBL follows a performance evaluation strategy to evaluate their employees as well as to make them more effective and efficient in their responsibilities. The branch managers monitor their employees to give performance feedback to the Head Office. They complete a “Performance Appraisal Form” to rate their employees. Generally it is conducted at the end of each year. SEBL encourages the industrious and active employees by giving promotion or bonus to make them more productive.

Rating is mainly done on following factors:

Professional knowledge: Knowledge of assigned, current trends and developments in functional area.

Planning: Ability to plan activities in advance and to accomplish by setting priorities.

Analytical Ability: Ability to analyze, assimilate and present facts clearly and concisely.

Judgment: Ability to take decisions and the quality of the decisions taken.

Attitude: How does he/she look upon his/her job and his/her associates? Can he/she make positive effect on others?

Communication: The force and felicity with which thoughts are expressed /conveyed in writing are to be considered.

Innovation: Extent of imagination and the practicability of the ideas as applicable to the job.

Leadership: Ability to inspire subordinates and to develop them.

Interpersonal relationship: Ability to get along with superiors, equals, subordinates and customers.

Resourcefulness: Reaction towards difficulties and the drive and initiative displayed to overcome them.

Pension Policy:

The employees are provided the following benefits during their pension:

- Insurance

- Gratuity

- Provident fund

Other Facilities:

SEBL also provides the following facilities to their employees:

- House building -can

- Marriage leave

- Maternity leave

- Festival bonus

- 10 days as core leave

- 24 days as privileged leave

- 14 days of sick leave

- Specially approved leave-without-pay.

SWOT Analysis:

SWOT analysis facilitates the organization to make their existing line of performance and also foresee the future to improve their performance in comparison to their competitors. As though this tool, an organization can also study its current position, it can also be considered as an important tool for making changes in the strategic management of the organization.

STRENGTHS:

SEBL has already established a favorable reputation in the banking industry of the country with its significant business growth. Within a period of 14 years, SEBL has already established a firm footing in the banking sector having tremendous growth in the profits and deposits. All these have leaded them to earn a reputation in the banking field.

SEBL is showing upward trend in profitability which can indicate the fact that the bank is growing to its potential year by year and achieving business growth steadily.

SEBL has established fin-n footing comers in the banking industry of Bangladesh. They have already achieved a high growth rate accompanied by an impressive profit growth rate in 2009. The number of deposits and the loans and advances are also increasing rapidly from year to year.

Southeast Bank Limited has strong, financial resources to run the banking business. It is expected that in the near future the banks financial resources will get much stronger.

WEAKNESSES:

The greatest irony is that despite claiming to be “A Bank with Vision” which is used as its advertising platform and mission statement, the bank as of today has failed to develop a prescribed set of vision as it embarks in to the cyber age of twenty first century. The bank still could not identify the core area of business and where it should concentrate in its business, as the new millennium is about to start. The bank does not have any long-term strategies of whether it wants to focus on retail banking or become a corporate bank. Till now, the bank is in a nowhere situation. Unofficially, retail banking is discouraged but at the same time the bank is not being able to pull itself away from retail banking. At the same time SEBL has failed to be a full-fledged corporate bank. The path for the future should be determined right now.

Significant shortage in capital adequacy is another major setback that Southeast bank Limited is facing in recent years. Its capital adequacy ratio is just above the requirement of 9.00% set by Bangladesh Bank and this aspect needs to be improved.

This has also become growing problem at SEBL. Currently there are “Too many heads but few hands.” Again this is related to the problem of reference appointment. There are people who are only drawing salaries at the end of the month but making a minimum or no contribution towards the organization. On the other hand there are officers who work hard but are not apprised accordingly.

OPPORTUNITIES:

SEBL can pursue a diversification strategy in expanding its current line of business. The management can consider options of starting client service in its merchant banking division. There are several opportunities for SEBL to expand its product line. In this competitive environment SEBL must expand its product line to enhance its Sustainable Competitive Advantage (SCA). As a part of its product line proliferation, SEBL can concentrate more on SME & Agro based industrial loan because these two sectors have huge potential. If SEBL can grab this opportunity then it will be better for the bank.

SEBL should move towards the real time on line banking operations. It is high time that they should go for this because the foreign banks as well as some local banks are already in to the total on line banking operations.

THREATS:

Multinational Banks: The emergence of the multinational banks and their rapid expansion poses a potential threat to the new PCB’s. Due to the booming energy sector, more foreign banks are expected to arrive in Bangladesh. Moreover, the already existing foreign banks such as Standard Chartered are now pursuing an aggressive branch expansion strategy. These banks are establishing more branches countrywide and are expected to get into for operation soon. Since the foreign banks have tremendous financial strength, it will pose a threat to local banks to a certain extent in terms of grabbing the lucrative clients.

Upcoming Banks: The upcoming private local banks can also pose a threat to the existing PCB’S. It is expected that in the next few years more local private banks may emerge. If that happens the intensity of competition will rise further and banks will have to develop strategies to complete against an on slaught of foreign banks.

Mergers and acquisitions: The worldwide trend of mergers and acquisition in financial institutions is causing concentration in power in the industry and competitors are increasing in power in their respective areas.

Contemporary Banks: The contemporary banks of SEBL such as Dhaka Bank, Prime Bank Eastern Bank and Dutch-Bangla Bank are its major rivals. Prime Bank and others are carrying out aggressive campaign to attract lucrative corporate clients as well as big time depositors. SEBL should remain vigilant about the steps taken by these banks as these will in turn affect SEBL strategies.

Foreign Trade:

The foreign trade department deals with the export and import business of various clients. The clients open L/C for importing and exporting goods from and to abroad through this division. In the case of import, the bank usually works as the issuing bank and in the case of export the bank works as advising bank or negotiating bank or as both. In importing goods from abroad the clients have to give a percentage of total cost of goods, as advance. The clients also have to flay a certain amount of commission to the bank. After receipt of the goods in .ports, the clients have to pay the rest or me money to the banks to clear the goods from the ports. Foreign trade mainly deals with various kinds of documents and papers. These documents and papers work as claim of the credits.

International and Foreign Exchange Business:

One of the major businesses of the International Division is Foreign Exchange dealing. Southeast Bank Limited, Kakrail Branch earned substantial amount from this wing’s operation.

Southeast Bank Limited, kakrail Branch has already established correspondent banking relationship with many important countries of the world to facilitate cross boarder trade and payment.

Below the internship present the FORIGEN EXCHANGE SECTION of Southeast Bank Limited, Kakrail Branch.

Import Section:

Import of merchandise involves two things: bringing of goods physically into the country and remittance of foreign exchange towards the cost of merchandise and services. In case of Import, the importers are asked by their exporters to open a letter of credit .So that their payment against goods is ensured. Documentary credit has emerged as a vital system of trade payment. It is a key player of foreign trade. This Department is mainly done two tasks, i.e.

1) Import

2) BLC

Export Section:

According to Foreign Exchange Regulation Act, 1947, nobody can export by post and otherwise than by post any goods either directly or indirectly to any place outside Bangladesh, unless a declaration is furnished by the exporter to the collector of customs or to such other person as the Bangladesh Bank may specify in this behalf that foreign exchange representing the full Export value of the goods has been or will be disposed of in a manner and within a period specified by Bangladesh Bank. Payment for goods exported from Bangladesh should be received through an Authorized Dealer in freely convertible foreign currency or in Bangladeshi Taka from a Non-Resident Account. The Export section deals with two types of Letter of credit that are as follows-

- Export Letter of Credit

- Back-to-Back Letter of Credit

Remittance Section:

Remittance means transfer of fund. If we pronunciations of the word “Remittance” we under stand transfer of fund through a Bank from one place to another place which may be executed the country or between two countries. Remittance which is affected within the country is called Local Remittance and which is affected between two countries is called Foreign Remittance. Remittance plays a vital role in the development of the country. Without effect of remittance no country can develop her. Bangladesh is rich enough in respect of human resources. So Inward Remittance has great importance in our country. Below discuss in shortly.

Inward Remittance:

The remittances, which are received from abroad and paid to the beneficiary, are Inward Remittance. In ward remittance are mainly received in US Dollar, pound sterling and Taka Currency. Very few remittances in miscellaneous currencies are also received.

Mode of inward Remittance:

1. T.T ———- Telegraphic Transfer.

2. M.T ——— Mail Transfer.

3. D.D ——— Demand Draft.

4. P.O ———- Payment Order.

5. I.M.O ——– International Money Order.

5. T.C ———- Traveler’s Cheque.

Outward remittance:

The Remittance in Foreign Currency which are effected from our country to abroad is called outward remittance. Form remitter’s point of view is called outward Remittance and from payee’s point of view is called Inward Remittance.

Mode of outward remittance:

The Remittance may be made by means of T.T, D.D& T.C, etc. Ideation to these the sale of Foreign Currency under letter of credit against retirement of bill is include as outward remittance.

Procedure of payment:

To make payment the points mentioned below are to be observed.

Demand Draft:

- The D.D must be in original

- The name of bank, name of Branch, Date, name and A/C number of the payee, amount in word and figures must be mentioned.

- The D.D must be as per prescribed format or specimen copy supplied earlier.

- The amount is protecting graphed.

- Payment is not stopped.

- Draft is not reported lost.

- Verification of drawer’s signature.

- Telex confirmation from the issuing Bank, if the amount exceeds the limit as per agreement made earlier.

Telegraphic Transfer:

1. The message must be in original.

2. It must be authenticated under test, Test must be decoded and found correct.

3. T.T. must contain the name of Bank, name of Branch, name and A/C number of the beneficiary.

If the above points are Okay, payment made to the beneficiary as soon as possible.

1. Capital Area 24 hours.

2. Major Cities 48 hours.

3. Other Towns 72 hours

4. Remote Areas 120 hours.

Settlement of claims:

As the remittance is received from abroad or remote places, some claim, may occur for non receipts of fund. These claims may arise by the Beneficiary or remittance through issuing/Remitting Bank. As such the claims are to the settled.

If the TT is lost or stolen, remitter will report to the remitting bank. R/B will ask / advise the Beneficiary. Bank to mark stop payment or not to make payment. Beneficiary bank

Will confirm the stop payment to the Remitting. Bank if the DD is not paid earlier. If the DD is paid earlier the mode of payment is to be confirmed to the Remitting, Bank. If necessary a duplicate DD is to be issued to make payment to the beneficiary for settlement of the claim.

If the TT contains any wrong information, Beneficiary. Bank is to contact with the issuing / Remitting Bank for correct information. On getting the correct information payment is to be made accordingly.

Above Remittance Section’s all works were done by General Banking (GB) Section in SEBL; KAKRAIL Branch. The internship doesn’t discuss this section in broadly in another Chapter; so, the internship discusses this section in here shortly, because this Report’s topic is “FORIGEN EXCHANGE PRACTICE OF SEBL”

Letter of Credit:

Definition:

Letter of credit (L/C) can be defined as a ‘Credit Contract’ whereby the buyer’s bank is committed (on behalf of the buyer) to place an agreed amount of money at the sellers disposal under some agreed conditions since the agreed conditions include amongst other things, the presentation some specified documents the letter of credit is called documentary letter of credit the uniform customs & practices for documentary credit (UCPDC) published by international chamber of commerce (ICC) (193) revision publication No. 500 defines documentary:

Any arrangement, however harmed or described, whereby where by a bank (the “Issuing Bank”), acting at the request and on the instructions (the “Application”) or on its own behalf,

1) Is not make a payment to or to the order of third party (the beneficiary) , or is to accept and pay bill of exchange (Drafts) drawn by the Beneficiary, or

2) authorizes another bank to effect such payment , or to accept and such bills of exchange (Draft),

3) Authorized another bank to negotiate, against stipulated document(S), provided that the terms and conditions are compiled with.

Types:

Documentary credits either:

1) Revocable or,

2) Irrevocable.

Revocable Letter of Credit:

According to Foreign Exchange Regulation Act, A Revocable Credit is one which can be amended or cancelled by the issuing Bank at any moment and without prior notice to the beneficiary, but the issuing bank is bound to reimburse the negotiating bank for any payment made prior to receipt of notice of cancellation, against shipping documents which are apparently in accordance with the terms of L/C. So this is clear that Revocable L/C can be amended any time without prior notice to the beneficiary.

Irrevocable Letter of Credit:

As per Foreign Exchange Act, an Irrevocable unconfirmed L/C cannot be cancelled or amended without the consent of all the parties, particularly that of the beneficiary. It is a definite and absolute undertaking of the issuing bank to make payment for goods supplied on presentation of stipulated shipping documents, if all the terms and conditions of the credit are complied with. Of any indication, it will be deemed as an irrevocable Letter of Credit.

Sometimes, Letter of credits is marked as either,” With recourse to drawer” or” without recourse to drawer”.

Forms of Documentary Credit:

The Letter of Credit can be either Revocable or Irrevocable. It needs to be clearly indicated whether the L/C is revocable or irrevocable. As per Uniform Customs and Practice for Documentary Credit (UCPDC) ICC Publication No 500, 1993, in the absent.

Types of Letter of credit According to Payment Method:

On the basis of time of payment, Letter of Credit can be of two types-

i) Sight L/C: In case of Sight L/C, the bank makes payment against presentation sight Draft and documents drawn strictly as per terms under the letter of credit. Here issuing bank release fund immediately on presentation of stipulated documents.

ii) Deferred L/C: Deferred Payment means delayed payment against L/C. The amount availed of, is not put at the seller’s disposal immediately on presentation of documents, but only after a specified period. The credit wording always specifies duration of the period and time at which the payment will be effected against presentation of documents drawn under the letter of credit.

Special Documentary credits:

1) Revolving credit: The revolving credit is one which provides for restoring the creditor the original amount after it has been utilized. How many times it will be taking place must be specifically mentioned in the credit. The revolving credit may be either cumulative or non-cumulative.

2) Transferable credit: A Transferable credit is one that can be transferred by the original beneficiary in full or in part to one or more subsequent beneficiaries are not prohibited.

3) Back to Back Credit: The back to back credit is a new credit opened on the basis of an original credit in favor or another beneficiary. Under to back to back concept the seller as the beneficiary of the first credit offer it as “security” to the adducing bank for the issuance of the second credit .The beneficiary of the back to back credit may be located insider or outside the original beneficiary’s country.

4) Anticipatory Credits: The anticipatory credits make provision for pre-shipment payment, to the beneficiary in anticipation of his effecting the shipment as per L/C conditions.

5) Red Clause: When the clause of the credit authorizing the negotiating bank to provide pre-shipment payment to the advance to the beneficiary is printed/ typed in red, the credit is called ‘Red Clause Letter of Credit’.

Under the above mentioned clause, the opening bank is liable for the pre-shipment advances made by the negotiated bank, in case the beneficiary fails to repay or deliver the documents for negotiation.

Parties to Letter of Credit:

A letter of credit is issued by the bank at the request of an importer in favor of an exporter from whom he has contracted to purchase some commodities or services. Generally the letter of credit is transmitted to the beneficiary through a bank in the beneficiary’s country. Therefore, parties of letter of credit are mainly:

Obligatory Parties:

a) Importer / Buyer/ Applicant

b) Opening Bank / Issuing Bank

c) Advising Bank / Notifying Bank

d) Exporter /Seller / Beneficiary

Besides, there are one or more than one banks who are involved in various capacities and various stages to play an important role in the total operations of credit which are as follows:

Optional Parties:

- Negotiating Bank

b) Confirming Bank

c) Transferring Bank

d) Reimbursing / Paying Bank

Involved Parties:

a) Importer/Buyer/Applicant

Importer is the person who requests/instructs the opening bank to open a L/C. He is also called opener of Applicant of the credit.

b) Opening/Issuing Bank

Opening Bank is the bank which opens/issues a L/C on behalf of the importer. It is also called the importer’s/buyer’s bank. Exporter / Seller / Beneficiary is the party in whose favor the L/C is established.

c) Advising / Notifying Bank

Advising Bank is the bank through which the L/C is advised to the exporter. It is a bank situated in the exporting country and it may be a branch of the opening bank or a correspondent bank. It may also assume the role of confirming and/or negotiating bank depending upon the conditions of the credit.

d) Exporter/ Seller/ Beneficiary

Beneficiary of the L/C is the party in whose favor the letter of credit is issued. Usually they are the seller or exporter.

e) Negotiating Bank

A Negotiating Bank is the bank nominated or authorized by the issuing bank to negotiate the documents and to pay the amount to the beneficiary, to incur a deferred payment liability, to accept draft. If the negotiation of the documents is not restricted to a particular bank in the L/C, normally the negotiating bank is the banker of the beneficiary.

f) Confirming Bank

The Bank, which under the instruction in the letter of credit, adds guarantee to the credit, thereby undertaking the responsibility of payment/ negotiation/ acceptance under the credit in addition to that of issuing bank. A confirming bank does so if requested by the issuing bank having arrangement with them.

g) Transferring Bank

Original beneficiary may transfer the L/C to second beneficiary as per clause of the L/C. transfer may be made once only. The bank of the original beneficiary authenticates the transfer and the bank is known as transferring bank. Normally transferring bank authenticate the transfer and keeps record of transfer without any engagement on their part.

h) Reimbursing Bank / Paying Bank

A reimbursing Bank nominated or authorized by the issuing bank to make payment against stipulated documents, complying with the credit terms. Normally issuing bank maintains an account with the reimbursing bank to make the payment.

Details regarding the rights and obligations of the different parties involved in the documentary credit operations may be had from UCPDC (Article Nos. 13 to 19).

Operations of Documentary Letters of Credit:

The following five major steps are involved in the operation of a documentary letter of credit:

Issuing;

Advising;

Amendment (if necessary);

Presentation; and

Settlement.

Issuing a Letter of Credit:

Before issuing a L/C, the buyer and seller located in different concludes a ‘sales contract’ providing for payment by documentary credit. As per requirement of the seller, the buyer then instructs the bank the issuing bank-to issue a credit in favor of the seller (beneficiary). Instruction/Application for issuing a credit should be made by the buyer (importer) in the issuing bank’s standard form. The credit application which contains the full details of the proposed credit, also serves as an agreement between the bank and the buyer. After being convinced about the ‘necessary conditions’ contained in the application form and ‘sufficient conditions’ to be fulfilled by the buyer for opening a credit, the opening bank then proceeds for opening the credit to be addressed to the beneficiary.

Advising a Letter of Credit:

Advising through a bank is a apparent authenticity of the credit to the seller. The process of advising a credit consists of forwarding the original credit to the beneficiary to whom it is addressed. Before forwarding, the advising bank has to verify the signature (s) of the officer (s) of the opening bank and ensure that the terms and conditions of the credit are not in violation of the existing exchange control regulations and other regulations relating to export. In such act of advising, the advising bank does not undertake any liability.

Amendment of Credit:

Parties involved in a L/C, particularly the seller and the buyer, can not always satisfy the terms and conditions in full as expected due to some obvious and genuine reasons. In such a situation, the credit should be amended.

In case of revocable credit, it can be amended or canceled or canceled by the issuing bank at any moment and without prior notice to the beneficiary. But in case of irrevocable credit, it can neither be amended nor canceled without the agreement of the issuing bank, the confirming bank (if any) and the beneficiary.

Presentation of Documents:

The seller being satisfied with the terms and conditions of the credit proceeds to dispatch the buyer and after that, has to present the documents evidencing dispatching of goods to the negotiating bank on or before the stipulated expiry date of the credit. After receiving all the documents, the negotiating bank then checks the documents against the credit. If the documents are found in order, the bank will pay, accept or negotiate to the issuing bank. The issuing bank also checks the documents and if they are found as per credit requirements, either.

a) Effects payment, or

b) Reimburses in the pre-agreed manner

Settlement:

Settlement means fulfilling the commitment of issuing bank in regard to effecting payment subject to satisfying the credit terms fully. This settlement may be done under three separate arrangements as stipulate in the credit. These are:

a) Settlement by Payment: Here the seller presents the documents to the paying bank and the bank then scrutinizes the documents. If satisfied, the paying bank makes payment to the beneficiary and in case this bank is other than the issuing bank, then sends the documents to the issuing bank. If the issuing bank is satisfied with the requirements, payment is obtained by the paying bank from the issuing bank.

b) Settlement by Acceptance: Under the arrangement, the seller submits the documents evidencing the shipment to the accepting bank accompanied by the draft drawn on the bank (where credit is available) at the specified tenor. After being satisfied with the documents, the bank accepts the document and the draft and if it is a bank other than the issuing bank, then sends the documents to the issuing bank stating that it has accepted the draft and at maturity the reimbursement will be obtained in the pre-agreed manner.

c) Settlement by Negotiation: This settlement procedure starts with the submission of documents by the seller to the negotiating bank accompanied by a draft drawn or the buyer or any other draw, at sight or at a tenor, as specified in the credit. After scrutinizing that the documents meet the credit requirements, the bank may negotiate the draft. This bank, if other than the issuing bank, then sends the documents and the draft to the issuing bank. As usual, reimbursement will be obtained in the pre agreed manner.

L/C Application:

L/C Application is a sort of arrangement between client and the bank. Southeast Bank Limited provides a printed form for opening a L/C to the importer. A special adhesive stamp of value Tk.150 is affixed on the form. While opening, the stamp is cancelled. Usually the importer expresses his desire to open a L/C quoting the amount of margin in percentage. The importer gives the following details-

- Full name and address of the Applicant.

- Full name and address of the Beneficiary.

- Draft amount (both in figure and word)

- The form of credit whether Revocable or Irrevocable.

- Whether the credit is available by payment, acceptance or negotiation.

- On which party the draft are to be drawn and the tenure of such draft.

- A brief description of goods, including details of quantity and unit price.

- Whether the freight is to be prepaid or not.

- The country of origin

- The port of shipment and destination.

- Whether the transfer of goods from one vessel to another, or from one mode of transport to another, en route, is prohibited or allowed.

- The last date of shipment.

- Partial shipment is allowed or not.

- The date and place of expiry of the credit.

- Negotiation period.

- Details of the documents required and mode of transmission of documents( Swift/ mail/ telex).

- The time bar within which the documents should be presented.

- Whether the credit is to be transferable one or not.

- Sales terms (FOB/ C&F/ CIF)

- Shipping Mark

- IRC Number and LCA Number

- Insurance cover note

Scrutiny of L/C Application:

On receipt of L/C Application, the branch officials scrutinize the same very carefully giving emphasis to the following.

The terms and conditions of the L/C must be complied with UCPDC 500 and Exchange Control & Import Trade Regulation.

L/C application is stamped as it is a guarantee of payment.

All the information mentioned in different columns has been furnished.

Eligibility of the goods to be imported.

If L/C is opened against indent, Bangladesh Bank’s permission, valid registration, authority to issue indent by indenter are to be checked.

The L/C must not be opened in favor of the importer or his agent.

L/C must be signed by the importer agreeing all terms and conditions mentioned in the application.

IMP form duly filled and signed.

Validity of IRC.

HS code of the goods.

Insurance cover note with date of shipment.

Radioactivity report in case of food items.

Survey reports or certificate in case of old machinery.

Certificate declaring that the item is in operation not more than 5 years in case of car.

Scrutiny of Documents:

First of all it must be ensured that full set of documents as mentioned in the L/C has been received. The branch will proceed carefully look into some main points of each of the documents keeping in view the terms of L/C. Some key check points for the documents are as follows-

Bill of Exchange

Commercial Invoice

Bill of lading

Certificate of Origin

Other Documents

Other documents called for in the credit such as packing list, weight list, inspection certificate etc. to be checked whether drawn and issued in accordance with the terms of the credit.

Export Procedure:

According to Foreign Exchange Regulation Act, 1947, nobody can export by post and otherwise than by post any goods either directly or indirectly to any place outside Bangladesh, unless a declaration is furnished by the exporter to the collector of customs or to such other person as the Bangladesh Bank may specify in this behalf that foreign exchange representing the full export value of the goods has been or will be disposed of in a manner and within a period specified by Bangladesh Bank. Payment for goods exported from Bangladesh should be received through an Authorized Dealer in freely convertible foreign currency or in Bangladeshi Taka from a Non-Resident Account. The Export section deals with two types of Letter of credit that are as follows-

A) Export Letter of Credit

B) Back-to-Back Letter of Credit

Export financing can be done by Pre-shipment Credit and Post-shipment credit. In case of pre-shipment financing 90% is financed by the bank. Of the portion 75% is by Back-to-Back L/C and 15% by cash credit. Below the internship stated in broadly those two types of L/C.

Export Letter of Credit:

The other type of L/C facility offered by Southeast Bank Limited Kakrail branch is Export L/C. Bangladesh exports a large quantity of goods and services to foreign households. Readymade textile garments (both knitting and wove) jute, jute-made products, frozen shrimps, tea are the main goods that the Bangladeshi exporters export to foreign countries. Garments sector is the largest sector that exports the lion share of the country’s export. Bangladesh exports most of its readymade garments products to USA and European Community (EC) countries. Bangladesh exports about 40% of its readymade garments products to USA. Most of the exporter who exports through Southeast Bank Limited Kakrail branch is readymade garment exporters. They open L/C in this branch to export their goods, which they open against the import L/C opened by their foreign importers.

Services against Export L/C:

Advising of Export L/C:

The advising bank getting the import L/C sent by the issuing bank located abroad will advise the L/C to the beneficiary without any engagement or responsibility on their part. It will see the following only:

- i. Authenticity of L/C (Test agreed in case of Telex L/C and signature verified in case (air mail L/C).

- ii. Merchandise specified in the L/C is permissible and clauses incorporated in the L/C are not against country’s regulations.

Add Confirmation of Export L/C:

Bank may add additional confirmation to export L/C where there is specific instruction from the L/ C issuing bank to do so. Additional confirmation of L/C gives the seller a double assurance of payment. Bank’s requirement of adding confirmation:

- Issuing Bank should be a reputed bank.

- Credit line/Arrangement with the L/C issuing bank.

- L/C clause are to be acceptable to confirming bank

- Approval from the competent authority for adding confirmation of export L/C.

Confirmation charges are to be recovered as per rules.

Negotiation of Export Bill:

‘Negotiation means that negotiating banker pays to the drawer the value of the bill on the assurance given by the opening banker. When documents are presented for negotiation under letter of credit, the same is thoroughly examined from the point of view of correctness and completeness in all respect of terms of credit. The exporter submits the documents to bank as per requirement of bank.

Acceptance of Export Bill:

In this case, the exporter presents a bill of exchange payable to him and drawn on a specified future date or event, to the bank that accept it. The bank signs its acceptance on the bill and returns it to the exporter. The exporter then can present it for payment on maturity or he can discount it in order to obtain immediate payment.

Formalities for Export Letter of Credit:

The Export trade of the country is regulated by the Import & Export (Control) Act, 1950. There are a number of formalities that an exporter has to fulfill before and after shipment of goods. These formalities or procedures are enumerated as follows-

Export Registration Certificate (ERC):

The exports from Bangladesh are subject to export trade control exercised by the Ministry of Commerce through Chief Controller of Import & Exports (CCI&E). No exporter is allowed to export any commodity permissible for export from Bangladesh unless he is registered with CCI&E and holds valid ERC. The ERC is required to be renewed every year. The ERC number is to be incorporated on EXP (Export) Forms and other documents related with export.

The EXP Form:

After having the registration, the exporter applies to Southeast Bank Limited, Kakrail branch with the Trade License, ERC and the Certificate from the concerned Government Organization to get EXP Form. If the branch is satisfied, an EXP Form is issued to the exporter. An EXP Form usually contains the following –

- Name and address of the Authorized Dealer.

- Particulars of the commodity to be exported with description and code number.

- Name and address of the exporter

- Name and address of the importer

- Country of origin

- Port of shipment

vii. Port of destination

viii. Quality

- L/C value in foreign currency

- Terms of sale

- Bill of lading/ Railway Receipt/ Airway Bill/ Truck Receipt number and date.

. Shipment date

CCI& E’s registration number and date

Securing the Order:

Upon registration, the exporter may proceed to secure the export order. This can be done by contracting the buyer directly through correspondence.

Signing of the contract:

While making a contract, the following points are to be mentioned: (a) description of goods, (b) quantity of the commodity, (c) price of the commodity, (d) shipment, (e) insurance and marks, (f) inspection.

Procuring the material:

After making the deal and having the L/C opened in his favor, the next step for the exporter is set about task of procuring the merchandise.

Registration of Sale:

This is needed when the proposed items to be exported are raw jute and jute-made good.

Shipment of Goods:

The following documents are normally involved at the stage of shipment: (a) EXP Form, (b) registration certificate, (c) contract, (d) copy of L/C (e) freight certificate from the bank in case of payment of freight, if the port of lading is involved, (f) truck receipt, railway receipt,(g) shipping instruction,(i) insurance policy.

The following points should be checked-

The follows terms of L/C are in conformity with those of the contract.

The L/C is an irrevocable one, preferably confirmed by the Advising Bank.

The L/C allows sufficient time for shipment and reasonable time for registration.

If the exporter wants the L/C to be transferable, advisable, he should ensure those stipulation are mentioned in the L/C.

At last the exporter submits all these documents along with a Letter of Indemnity to Southeast Bank Limited, Kakrail branch for negotiation. An officer scrutinizes all the documents. If the documents are clean one the bank might decide to purchases the documents within the limit sanctioned to the exporter, after verifying the confirmed order covering each export. This is known as Foreign Documentary Bill Collection (FDBC).

Procedure for Foreign Documentary Bill Collection:

After purchasing the documents, Southeast Bank Limited, Kakrail branch gives the following Entries-

Before realization of proceeds:

FDBC A/C……………………………..Debit

Customer A/C………………………….Credit

Adjustment after realization

Southeast Bank, Head office General A/C……………………..Debit

FDBC A/C……………………………Credit

A FDBC register is maintained for recording all the particulars. The salient contents of a FDBC register are as follows-

- FDBC Ref. No

- Date

- Drawer/ Beneficiary

- Drawee / Applicant

- Foreign currency

- Rate

Local currency

Margin (% of amount)

- Modes of transport

- Merchandise

- Documents

L/C no. and name of the opening bank

Name of the collecting bank

Initial, due date, date realized, bank charges recovered with remarks

Negotiation:

If the documents are free from Discrepancy or if the discrepancies are covered by Indemnity of the party, Bank has to negotiate the Export Bills. For negotiation of cash export bill buying rate prevailing on the date of negotiation is applied for conversion of the foreign currency into Bangladesh currency. For this, the following entry is given

Foreign Bills Negotiated A/C………………Debit

Party A/C…………………………………..Credit

Before the close of the business, a consolidated voucher is passed against the total amount of all the bills negotiated on that particular day.

Southeast Bank, Head office General A/C………………………Debit

Foreign bills negotiated A/C…………….Credit

All the transaction is reported to the Head Office. The Head Office credits the Foreign Bills Negotiated A/C by debit the balance with Foreign banks abroad A/C.

After negotiation of the export bill, the documents are to be sent abroad (Normally to the L/C issuing bank) as per the instruction of L/C and claim Reimbursement of the proceeds from the Bank as mentioned in the L/C.

Risk Involved in Negotiation:

If the bank failed to identify any discrepancy in documents, prepared by the Exporter, on that time if the amounts are paid to the exporter then the Bank face a great loss. In this situation the Negotiating Bank try to contact with the party and if they agree to deliver the required documents, the Bank get rid of the huge loss.

Inland Letter of Credit (ILC):

Inland letter of credit means L/C within the country. This type of L/C is opened when seller does not have trustworthy relationship with the buyer though they are in the same country and also in the case where the business involved a big amount. This L/C‘s are two types:

1) Local L/C (without EPZ)

2) EPZ (Export Processing Zone) L/C

Settlement of Local Bill

The settlement of local bill is done in the following ways-

- The customer submits the L/C to the branch along with the documents to negotiate;

- The branch officials scrutinizes the documents to ensure conformity with the terms and conditions;

- The documents are then forwarded to the L/C Issuing Bank;

- The L/C Issuing Bank gives the acceptance and forwards an acceptance letter;

- Payment is made to the customer on either by collection basis or by purchasing the documents.

Accounting entries are made for purchasing the local bill-

Local Bill Purchase A/C…………………..Debit

Client’s A/C……………………………….Credit

Commission……………………………….Credit

Interest A/C……………………………….Credit

A Local Bill Purchase (LBP) Register is maintained to record the acceptance of the issuing bank. Until the acceptance is obtained, the record is kept in a collection register.

Back-to-Back Letter of Credit:

Back-to-Back L/C is a secondary L/C opened by the seller’s bank based on the original/ master L/C to purchase the raw materials and accessories for manufacturing of the export products required by the seller.

Under the ‘Back to Back’ concept, the seller as the beneficiary of the master L/C offers it as a security to the advising bank for the issuance of the second L/C. the beneficiary of the Back to Back L/C may be located inside or outside the original beneficiary’s country. In case of Back-to-Back L/C, the bank takes no cash security (margin). Bank liens the Master L/C and the drawn bill is a Time bill.

Readymade garment industries and specialized Textile units have been allowed the facility of importing fabrics and other material/accessories needed for manufacturing garments/specialized textile, free of duty under bonded warehouse system against back-to-back L/C arrangement, without involving cash foreign exchange from Bangladesh Bank. The Bangladesh Bank has therefore allowed the authorized dealer to open Back-to-Back L/C for import of raw materials by the readymade garment industries/ Specialized textile unit to carry out their export orders against export L/C.

In our country, export oriented Garment Industry, operating under bonded warehouse system are availing Back-to-Back facilities. In Southeast Bank Limited, Kakrail branch most of the Back-to-Back L/Cs opened on Garment Industry Account. Therefore the discussion is based on account of Garment Industry in Bangladesh.

Opening of Back-to-Back L/C:

Besides normal formalities and requirements for L/C opening, the following points are considered.

a) No Back-to-Back L/C on account of Garment industries should be opened without prior approval from Head Office. Branches are required to obtain prior approval from Head Office Division/ Credit Committee for opening all Back-to-Back L/Cs.

b) While opening of Back-to-Back L/C following instruction should be followed-

- Separate L/C number should be used for Back-to-Back L/C and are to be recorded in separate Register.

- L/C opening commission and charges are to be realized as usual.

- The following contingent liability voucher is to be passed at the time of opening the L/C.

Customer liability for Back-to-Back L/C…………….Debit

Banker’s liability for Back-to-Back L/C……………..Credit

Documents Required for Opening a Back-to-Back L/C:

In Southeast Bank Limited, kakrail branch, following papers/documents are required for opening a Back-to-Back L/C-

Master L/C

Valid Import Registration certificate (IRC) and Export Registration Certificate (ERC).

L/C Application and LCAF duly filled and signed.

Performa Invoice

Indemnity or undertaking

No objection from previous bank (if any)

Factory Inspection Certificate

Insurance cover note with money receipt.

IMP form duly signed.

VAT Registration

In addition to above documents, the following are also required to export oriented garments industries while requesting for opening a Back-to-Back L/C-

Textile Permission.

Valid bonded warehouse license.

Quota Allocation Letter issued by the Export Promotion Bureau (EPB) in favor of applicant for quota items.

BGMEA Membership

In case the factory premises is a rented one, the Letter of Disclaimer duly executed by the owner of the house / premises to be submitted. A check list to open a Back-to-Back L/C is as follows-

i) Applicant is registered with CCI&E and has bonded warehouse license;

ii) The master L/C has adequate validity period and has no defective clause;

iii) L/C value shall not exceed the admissible percentage of net FOB value of relative master L/C;

iv) Usage period is up to 180 days;

Payment of Back-to-Back L/C:

Payment of import bills against Back-to-Back L/Cs are made from relative export proceeds of export oriented Garment Industry operating under bonded warehouse system. Therefore at the time of negotiation of export bills on account of garment factory, bank retains a portion covering to Back-to-Back liability to a separate foreign currency account from the export proceeds. The amount is kept in Deposit Awating for Disposal (DAD) A/C and in Retention Account (Exporter can bear this money without given any answer to customs, if one’s will go aboard.) if customer had given indication. After realization of export proceed, payment against import bills are made from DAD A/C. L/C wise and party wise A/Cs are maintained in DAD A/C ledger.

On 30/60/90/120/180 days of maturity period, deferred payment is made. Payment is given after realizing export proceeds from the L/C Issuing Bank. For garment sector, the duration can be maximum 180 days. In case of export failure or non realization/ short realization of export proceeds forced loan i.e. OAP has to be created in order to settle the Back-to-Back L/C payment.

Vouchers and accounting treatments are the same normal L/C opening except margin.

In this case, no margin is taken by the bank. After lodgment, maturity date of the import bill is intimated to foreign bank as per L/C terms. The documents are delivered to the order of opener duty endorsed for clearance of goods from custom authority. Goods are cleaned through approved clearing and forwarding agent of the bank.

Accounting Treatment of Back-to-Back L/C:

Negotiation

Foreign Bills Purchase……………….Debit

FBPARA/C…………………………..Credit

(Foreign Bills Purchase Acceptance Register)

Party’s A/C…………………………..Credit

(Deducting import & other liability)

On realization of export proceeds, usual realization vouchers are passed for adjustment of FBP. After realization of export proceeds payment of import bills are made from FBPAR A/C and following vouchers are passed

FBPAR A/C……………………………………Debit

(Foreign Bills Purchase Acceptance Register)

Southeast Bank, Head office General A/C…………………Credit

If the party is paid in foreign currency, BC rate is applied in this regard. Foreign remittance department takes the T.T & O.D rate.

Maintenance of Register:

The sanction must be recorded in the following register:

Document execution register. All the charge documents must be recorded in this

Register.

Limit register

Liability ledger.

Test Key Arrangement:

Test key arrangement is a secret code maintained by the banks for the authentication of their telex messages. It is a systematic procedure by which a test number is given and the person to whom this number is given can easily authenticate the same test number by maintaining the same procedure. Southeast Bank Limited has test arrangements with other banks for the authentication of L/C messages and transfer of funds.

Confidential Report (C.R) of Beneficiary of L/C:

According to exchange control regulations bankers are required to obtain confidential report of the beneficiary of L/C before opening the same, if the amount of L/C exceeds Tk.5.00 lac. bank can open L/C below Tk.5.00 lac without obtaining C.R .Bankers can write to their foreign correspondents to supply the C.R. But from practical experiences foreign correspondents of different country are not supply timely.

To overcome the above situation bankers can consult reference books i.e. MUWN / DUNN / BRADSTREET / Trade directory of various Chambers of Commerce of different countries.

On receipt of C.R from any source the banker can accumulate the same in one master file.

5.16 Disposal of L/C & LCA Form Copies and Filing:

L/Cs is normally typed in respective banks printed format in many folds. The original L/C is sent to the advising bank for beneficiary’s and 2nd copy sent to the above bank at the same time for their own purpose 3rd copy for importer, 4th copy for reimbursing bank 5th copy office copy of the bank,6th for Bangladesh Bank & 7th copy for CCI & E. One copy for importer is sent to them along with the memo of charges incurred by the opening bank for the L/C stating the amount has been so debited for the amount of Memo including that amount of margin.

LC authorization forms consisting of six copies. 1st copy for exchange control purpose, 2nd copies for the licensing authority,3rd and 4th copy for Bangladesh Bank and customs, 5th copy for the registration unit and 6th is the office copy of the bank.

Diagrammatic Representation of Export:

A) Export process: At a glance

E) Distribution process of LCA Form:

Import of merchandise involves two things: bringing of goods physically into the country and remittance of foreign exchange towards the cost of merchandise and services. In case of Import, the importers are asked by their exporters to open a letter of credit. So, that their payment against goods is ensured. Documentary credit has emerged as a vital system of trade payment. It is a key player of foreign trade.

6.2 Classification of Importer:

Importers are those who are authorized by the import Trade Control Authority that is CCI& E for import of goods essential for consumption or for production purposes.

There are mainly three types of Importer, viz:-

- Commercial Importer

- Industrial Importer.

- Importer under Wage Earner Scheme. (WES)

(1) Commercial Importer:

It means an importer registered under the importers, exporters and indenture registration order 1981 who import goods for sale.

(2) Industrial Importers:

When issued to an industrial consumer, gives the items of import as raw materials and packing materials and spare parts, the value of entitlement and ITC classification.

(3) Importers under WES:

It means registered importers who import only under the WES. WES importers can be importing all permissible items as declared by the import policy and notification. Besides all registered commercial and industrial importer also can import under WES.

Another Importer is as follows:

Lease Financing Import.

Govt. Sector Importer.

Import under Bonded Ware-House System.

Import by Actual Users.

Import by E.P.Z.

Import Mechanism:

An Importer is required to fulfill some conditions/ criteria to be eligible as an importer as per provisions of Import Policy Order and Guidelines for Foreign Exchange Transaction. An importer is required to submit the following documents along with L/C application to get a license to import goods through Southeast Bank-

An account with Southeast Bank Limited, Kakrail Branch.

Import Registration Certificate (IRC)

Proforma Invoice/ Indent

Tax paying Identification (TIN) Number

Membership Certificate from recognized Chamber of Commerce & Industry.

Letter of Credit Authorization (LCA) Form duly attested.

L/C Application duly signed by the importer.

One set of IMP Form

Insurance Cover note with money receipt

To import, a person should be competent to be an ‘Importer’. According to Import and Export Control Act, 1950, the Office of Chief Controller of Import and Export provides the registration (IRC) to the importer. After obtaining this, the person has to secure a letter of credit authorization (LCA) from Bangladesh Bank and then he becomes a qualified importer. He is the person who requests or instructs the issuing bank to open a letter of credit. He is also called applicant of the credit.

Letter of Credit Authorization Form (LCAF):

The Letter Of Credit Authorization Form is the form prescribed for the authorization of opening letter of credit or payment against import and used in lieu of import license. The authorized dealers are empowered to issue LCA forms to the importers to allow import in Bangladesh. If foreign exchange is intended to be bought from Bangladesh Bank against a LCAF, it has to be registered with Bangladesh Bank’s Registration Unit located in the concerned area office of the CCI&E. the LCA forms available with the authorized dealers are issued in a set of five copies each.

First copy is exchange control copy, which is used for opening of L/C and effecting remittance.

Second copy is the custom purpose copy, which is used for clearance of imported goods from custom authority.

Triplicate and Quadruplicate copy of LCAF are sent to concerned area of CCI&E office by authorized dealer / Registration Unit of Bangladesh Bank.

Quintuplicate copy is kept as office copy by Registration Unit.

Accounting procedure in case of L/C opening: