Executive Summary

BRAC Bank Limited is a scheduled Commercial Bank in Bangladesh. It established in Bangladesh under the Banking Companies Act, 1991 and incorporated as Private Limited Company on May 20, 1999 under the Companies Act, 1994. Its operation started on July 4, 2001 with a vision to be the market leader through providing all sorts’ support to people in term of promoting corporate and small entrepreneurs and individuals all over the Bangladesh. BRAC Bank will be a unique organization in Bangladesh. The bank consist of major divisions named 1) Corporate banking, 2) Retail banking, 3) Treasury, 4) Small & Medium Enterprise (SME). At present the Bank operating its business by 147 Branches.

BRAC Bank is the first local commercial banks that proving online banking service to its customers from the very beginning of its starts. BRAC Bank, for the first time among local commercial banks, starts providing loan facilities to small and medium trading, manufacturing and service oriented enterprises all over the country. The Bank has already established its network in different area of the country with assistance of BRAC.

SME Banking Division is a business division of BRAC Bank Limited that deals with Small and Medium sized Entrepreneurs involved in different types of business. SME banking division primarily provides loans to small and medium sized trading, manufacturing, service, agriculture, non-farm activities and agro-based industries located across the country.

The loan products offered by SME Banking Division are ANONNO, PROTHOMA RIN, PROSHAR, BIZNESS LOAN, TRADE PLUS and BUSINESS EQUITY LOAN (BEL). The SME loan range is from BDT 2 lac to BDT 350 lac (Funded: BDT 2 lac to BDT 350 lac, Non Funded: BDT 1 lac to BDT 30 lac). SME banking division offers Term loan, Continuous (Cash covered) loan and Letter of Credit. Short Term: up to 9 months, Long Term: from 12 to 120 months. Moreover there is also a deposit product named PRAPTTI CURRENT ACCOUNT for the SMEs.

To avail a funded SME loan 15 to 25 days are required and for Non Funded SME loan, the timeframe is 1 to 2 days from the date of application, if all the necessary papers are in order. At present, loans are only given to entrepreneurs who have a running business of at least one year. The interest rate of SME loans ranges from 14% to 17.8% on the reducing balance method, depending on the amount and the loan scheme. Collateral is necessary for loan amounts of BDT 10 lac and above. Generally collateral is not necessary for loan amounts ranging from BDT 2 lac to below BDT 10 lac.

The SME loans are usually given for working capital finance, fixed asset finance and trade finance. Loan amount is decided based on the fund requirement calculation, not on the basis of collateral value. However, Lawyer’s opinion is necessary for mortgage purpose. Registry Mortgage is necessary generally when the loan amount is BDT 10 lac or more. At present SME Banking Division has reach in all 64 districts of the country through 428 unit offices. The functional designation of the loan officers who operate at the unit offices is Customer Relations Officers (CROs).

A zone is comprised of 1-6 unit offices, where the person in-charge of the zone is known as a Zonal Manager. The reporting manager of a CRO is the Zonal Manager (ZM) or Associate Relationship Manager (ARM). Zonal Managers/ Associate Relationship Managers have the authority to approve a loan up to BDT 6 lac. There are 144 Zonal offices in SME Banking at present. A Territory is comprised of 6-12 zones. There are 15 territories at present. The reporting of a Zonal Manager is the Territory Manager. The Associate Relationship Managers however report to the Relationship Managers.

For disbursement of any SME loan a clean CIB report is required. A Valid trade license, rental deed, and any other authorization (if necessary) are the primary documents that are needed to get an SME loan. A number of information is required along with the loan application form i.e. Inventory list, Accounts Receivables list, Accounts Payables list, Buyers list, Suppliers list, and Fixed Asset list.

Minimum two guarantors are required for an SME loan, one of whom must be a third party guarantor and another from his /her own family. A third party guarantor may be a businessman or a service holder from the private sector with minimum wealth of 125% of the loan amount. However, for a family guarantor the net wealth condition is not applicable. A guarantor of SME loan can not avail a loan from BRAC Bank as long as he/she is a guarantor.

The core competence of the BRAC Bank is to provide the fastest loans to the clients in this country. To retain this competitive advantage BRAC Bank would provide computer and palmtop facilities whether they can give fastest services to clients than other banks. Also to convey the customer focus, BRAC Bank is trying to reduce collateral securities than other banks. It provides more collateral free secured loans to capture the market. Regarding the services by the CRO, almost all clients are satisfied by getting these quick facilities from them. Though it is pioneer division of this bank, I tried to give an in-depth analysis for every factor, which relates the SME division from the perspective of customer satisfaction and dissatisfaction.

| B |

rac Bank Limited is a scheduled commercial bank in Bangladesh. It established in Bangladesh under the Banking Companies Act, 1991 and incorporated as private limited company on May 20, 1999 under the Companies Act, 1994. Its operation started on July 4, 2001 with a vision to be the market leader by providing all sorts of support to people in term of promoting corporate and small entrepreneurs and individuals all over the Bangladesh.

Brac Bank will be a unique organization in Bangladesh. The Bank consists of major divisions named 1) Corporate banking, 2) Retail banking, 3) Treasury, 4) Small & Medium Enterprise (SME). At present the Bank operating its business by 147 Branches. BRAC Bank is the first local commercial banks that proving online banking service to its customers from the very beginning of its starts.

Brac Bank, for the first time among local commercial banks, starts providing loan facilities to small and medium trading, manufacturing and service oriented enterprises all over the country.

1.1 Origin of the Report

Free market economy is now world’s concern. Banks are key financial institutions that play a vital role in the country’s economy. The present economic state of Bangladesh demands immediate development of financial institutions. To keep pace with this situation, banks need executives with modern banking knowledge. To supply well-versed graduates, Ahsanullah University of Science & Technology “Master of Business Administration (MBA) program”. As the MBA program is the integrated, theoretical and practical method of teaching students of this program are required to have practical exposure in own different major disciplines in the preceding years of their courses.

After completing M.B.A program of (Ahsanullah University of Science & Technology) are required to undertaken an internship program or Project Report for three months at any organization to get exposure to the real life business practice. To serve this purpose, each student is attached with an organization. I am assigned for preparing a project report on “Financing SME Loans: A Study on BRAC Bank Limited”.

I was authorized to prepare a report on central function of BRAC Bank Ltd. for partial fulfillment of my course requirement. My faculty supervisor Dr. Shyama Pada Biswas, Faculty of Business Studies, Ahsanullah University of Science & Technology has approved the topic and authorized me to prepare this report.

1.2 Objective of the study

Broad Objective

To know SME documentation process and disbursement activities.

Specific Objective

- To analyze the SME loan processing activities

- To know the operational procedure of Asset Operations Department for SME loan processing

- To analyze strength & weakness of the Asset Operations Department

- To access the key performance indicator of the department

- To know the disbursement and recovery procedures of SME loans

- To know the enterprise selection criteria to provide SME loan

- To know the terms and conditions of SME loans

- To know the success factor of SME banking at BRAC Bank Limited.

- To Analyze micro and macro environment of the economy

1.3 The Scope of the Study

The report covers the activities of different departments of Head Office of BRAC Bank Limited. It has identified the major activities of banking as well as department wise functions. It only focuses the overall mechanism of banking, in depth analysis of every department & sub sections are not covered here.

Scope of the study is quite clear. Since Asset Operations Department is dealing with all types of loan activities in the bank. So studying these core themes, Opportunities are there to learn other aspects of SME matters.

- Concept of SME and its impact in overall economy of Bangladesh

- Entrepreneurship development situation through SME banking

- Importance of SME banking in context of Bangladesh

- Pioneer’s strategy regarding SME banking

- Other bank’s performance in comparison to the SME banking at BBL

- Small entrepreneurs of rural & urban spectrum are enjoying the BRAC Bank loan

- Virtual banking concept through SME banking

1.4 Methodology of the Study

I went to BRAC Bank Limited, Head Office for my internee. The basic data both primary and secondary used in the preparation of this report are obtained form:

- Personal observation of different tasks.

- Face to face conversation with the bank officers studying of different files and books.

- Annual report of BRAC Bank Ltd.

- Periodicals published by Bangladesh Bank.

- Website of the BRAC Bank Ltd.

1.5 Sources of Data

Both the primary as well as the secondary form of data was used to prepare the report. The details of these sources are highlighted below.

1.5.1. Primary Sources

Primary data for this report had been collected through the interview, conversation & discussion of different officers in different sections. On the job observation of the officers has helped a lot to know information of banking. The executives & officers of BRAC Bank were quite friendly & cooperative to provide lots of information to prepare this report.

1.5.2. Secondary Sources

Secondary information was collected from:

- Annual report of BRAC Bank Ltd.

- Books on general banking.

1.6 SWOT Analysis

SWOT analysis is an important tool for evaluating the company’s Strengths, Weaknesses, Opportunities and Threats. It helps the organization to identify how to evaluate its performance and scan the macro environment, which in turn would help organization to navigate in the turbulent ocean of competition.

Strengths

Company reputation: BRAC bank has already established a favorable reputation in the banking industry of the country particularly among the new comers. Within a period of 10 years, BBL has already established a firm footing in the banking sector having tremendous growth in the profits and deposits. All these have lead them to earn a reputation in the banking field

Sponsors: BBL has been founded by a group of eminent entrepreneurs of the country having adequate financial strength. The sponsor directors belong to prominent resources persons of the country. The Board of Directors headed by its Chairman Mr. F H Abed. Therefore, BBL has a strong financial strength and it built upon a strong foundation.

Top Management: The top management of the bank is also major strength for the BBL has contributed heavily towards the growth and development of the bank. The top management officials have worked in reputed banks and their years of banking experience, skills, expertise will continue to contribute towards further expansion of the bank. At BBL, the top management is the driving force and the think tank of the organization where policies are crafted and often cascaded down.

Facilities and equipment: BBL has adequate physical facilities and equipments to provide better services to the customers. The bank has computerized and online banking operations under the software called MBS banking operations. Counting machines in the teller counters have been installed for speedy service and the cash counters. Computerized statements for the customers as well as for the internal use of the banks are also available.

Impressive branches: This creates a positive image in the minds of the potential customers and many people get attracted to the bank. This is also an indirect marketing campaign for the bank for attracting customers. 26 Branches of the bank are impressive and are compatible to foreign banks.

Interactive corporate culture: BBL has an interactive corporate culture. Unlike other local organization, BBL’s work environment is very friendly, interactive and informal. There are no hidden barriers or boundaries while interacting between superior or subordinate.

The environment is also lively though the nature of the banking job itself is monotonous and routine.

Teamwork at mid level and lower level: At BBL’s mid level and lower level management, there are often team works. Many jobs are performed in groups of two or three in order to reduce the burden of the workload and enhance the process of completion of the job. People are eager to help each other and people in general are devoted to work.

Weaknesses

Advertising and promotion of SME loan: This is a major setback for BBL and one of its weakest areas. BBL’s adverting and promotional activities are satisfactory but it SME loan is not advertised well. It does not expose its SME product to general public and are not in lime light. BBL does not have neon sign or any advertisement for SME loan in the city. As a result people are not aware of the existence of this bank.

NGO name (BRAC): BRAC is one of the largest NGO of the world and it is operating its activities in Bangladesh. BRAC bank is not a NGO bank but many people of the country consider it as a NGO bank like Grameen Bank which is not correct.

Low remuneration package: The remuneration package for the entry and the mid level management is considerably low. The compensation package for BBL entry-level positions is even lower than the contemporary banks. Under the existing low payment structure, it will be very difficult to attract and retain higher educated employees in BBL. Specially CRO’s are not satisfied with compensation package provided to them.

Opportunities

Diversification: BBL can pursue a diversification strategy in expanding its current line of business. The management can consider options of starting merchant banking or diversify in to leasing and insurance. By expanding their business portfolio, BBL can reduce their business risk.

Product line proliferation: In this competitive environment BBL must expand its product line to enhance its sustainable competitive advantage. As a part of its product line proliferation, BBL can introduce the following products.

ATM: This is the fastest growing modern banking concept. BBL should grab this opportunity and take preparation for launching ATM. Since BBL is a local bank, they can form an alliance with other contemporary banks in launching the ATM.

Threats

Multinational banks: The emergence of multinational banks and their rapid expansion poses a potential threat to the new growing private banks. Due to the booming energy sector, more foreign banks are expected to arrive in Bangladesh. Moreover, the already existing foreign banks: such as Standard Chartered is now pursuing an aggressive branch expansion strategy. This bank is establishing more branches countrywide and already launched is SME operation. Since the foreign banks have tremendous financial strength, it will pose a threat to local banks.

Upcoming banks: The upcoming private local banks can also pose a threat to the existing private commercial banks like BBL. It is expected that in the next few years more local private banks may emerge. If that happens the intensity of competition will rise further and banks will have to develop strategies to compete against an on slaughter of foreign banks.

Contemporary banks: The contemporary banks of BBL such as Dhaka bank, prime bank, and Dutch Bangla are its major rivals. Prime bank and other banks are carrying out aggressive campaign to attract lucrative clients as well as big time depositors.

Default culture: This is a major problem in Bangladesh. As BBL is a new organization, the problem of non-performing loans or default loans is very minimum or insignificant. However, as the bank becomes older this problem arises and the whole community suffers from this chronic diseases. BBL has to remain vigilant about this problem so that proactive strategies are taken to minimize this problem if not elimination.

1.7 Limitations of the Study

Like any other study the limitations of the study is not out of questions, but the following factors seem to me the main points of weakness of this study:

The major limitations of this report are as follows:

- Large-scale research was not possible due to time constraints.

- Relevant date and document collection were difficult due to the organization confidentiality.

- Non availability of data in a systematic way.

- Time constraint.

- Availability of the reference book is another limitation.

- It is very busy office. In this place employees get very little time to teach theoretical knowledge to the trainee.

- I was not able to visit the different branches of BRAC Bank Ltd.

2.1. An Overview of BRAC Bank Ltd.

| B |

rac Bank Limited, one of the latest generations of commercial banks, which started its journey on the 4th of July 2001 with a vision to be the absolute market leader. Brac Bank is a commercial scheduled bank extending full range of banking facilities as per the directives of Bangladesh bank. It intends to set standards as the absolute market leader by providing efficient, friendly and modern fully automated on-line service on a profitable basis. BRAC Bank in surviving in the large banking arena through its unique and competitive products and it is the only local bank providing 100% integrated on- line banking.

Brac Bank Limited, with institutional shareholdings by BRAC, International Finance Corporation (IFC) and Shore cap International, has been the fastest growing Bank in 2004 and 2005. At the year end of 2005, BRAC Bank had recorded a 103 percent growth in assets, and a 65 percent growth in liabilities, with an operating profit of 84 percent over the previous year 2004.

A fully operational commercial bank, Brac Bank focuses on pursuing unexplored market niches in the Small and Medium Enterprise Business, which hitherto has remained largely untapped within the country. In the last four years of operation, the Bank has disbursed over BDT 1200 crore in loans to nearly 32,000 small and medium entrepreneurs. The management of the Bank believes that this sector of the economy can contribute the most to the rapid generation of employment in Bangladesh.

The Bank is mainly owned by the largest NGO in Bangladesh- BRAC .The Bank has positioned itself as a new generation Bank with a focus to meet diverse financial need a growing and developing economy.

The Bank has embarked with an avowed policy to promote broad based participation in the Banish economy through the provision of high quality banking service based on latest information technology. The Bank will ensure this by increasing access to economic opportunities for all individuals and businesses in Bangladesh with a special focus on currently under served enterprises and households across the rural urban spectrum. We believe that increasing the ability’ of under served individuals and enterprises to build their asset base and access market opportunities will increase the economic well being for all Bangladeshis.

2.2 Brand Promise

“Astha Obichol”.

2.3 Vision

“Building a profitable and socially responsible financial institution focused on Markets and Business with growth potential, thereby assisting BRAC and stakeholders build a “just, enlightened, healthy, democratic and poverty free Bangladesh”. Breaking barrier within 2009.

2.4 Mission

- Sustained growth in ‘Small & Medium Enterprise’ sector.

- Continuous low cost deposit growth with controlled growth in Retained Assets.

- Corporate Assets to be funded through self-liability mobilization. Growth in Assets through Syndications and Investment in faster growing sectors.

- Continuous endeavor to increase fee based income.

- Keep our Debt Charged at 2% to maintain a steady profitable growth.

- Achieve efficient synergies between the bank’s Branches, SME Unit offices and BRAC field offices for delivery of Remittance and Bank’s other products and services.

- Manage various lines of business in a fully controlled environment with no compromise on service quality.

- Keep a diverse, far flung team fully motivated and driven towards materializing the bank’s vision into reality.

2.5 Objective of the bank

- To provide wide range of financial services professionally, efficiently and competitively to achieve per-eminent position in chosen market.

- Diversity revenue stream through product innovation.

- A Well-diversified credit portfolio, which produces a reliable and consistent return to investment.

2.6 Business Units

There are five different business units generating business BRAC Bank Limited:

- Small & Medium Enterprise (SME)

- Corporate Banking

- Retail Banking

- Treasury

- Remittance Services

All the units are being operated in a centralized manner to minimize costs and risks.

2.7 Information Technology in Banking Operation

Bank Limited has adopted automation in banking operation from the first day of its business. The main objective of this automation is to provide efficient and prompt services to its valued clients. At present all the branches of the bank are computerized to provide best security to the information.BRAC Bank Limited is providing comprehensive range of banking services with utmost care and efficiency to its Consumer. Ascend Millennium Banking System is developed and customized by South Tech Ltd. Several numbers of system analyst and programmers are dedicated towards development and customization of the software and after sale service.

2.8 Technology

BRAC Bank Limited Brings 19 branches under one umbrella, introducing SMS Banking, Internet Banking and interfacing ATM Network through the Online Banking software which has been the major achievements. Consequently our Consumer are enjoying services from Anywhere Anytime. BRAC Bank is the first bank to online the rural branches.

2.9 Challenges

- Ensure compliant BRAC Bank.

- Achieve satisfactory Audit rating for CSD.

- Ensure efficient CONSUMER services to our internal and external clients.

- ATM support.

- Smooth operation of CSD functions.

- Develop and retain efficient human resources for CSD team.

2.10 Initiatives

- Strength CSD tools by developing CSD Operation, monitoring processes and efficient people.

- Develop and implement quarterly self audit questionnaire.

- Set Smooth and efficient Service delivery Process for our CONSUMER.

- Develop efficient working force by providing hands on training, relevant HR training courses.

- Conduct in-house training program on B.Bank & BRAC Bank Regulations.

2.11 Corporate Social Responsibility

Just as BRAC Bank have a corporate identity and also a social identity too. As a bank BRAC Bank are socially responsible. Fifty percent of It’s Loan portfolio is diverted to Small and Medium Enterprise banking, and as a financial intermediary it channel funds from the surplus ends to the needy. Country-wide network of SME Units cater to the needs of small entrepreneurs to help them build their asset base. BRAC Bank is market leaders in SME, striving for socio-economic upheaval in Bangladesh.It does not support any finances that are detrimental to our environment. A portion of its revenue is channeled to support BRAC schools, where children study for free. 70% of these children are female.

2.12 Corporate Information

Date of Incorporation : May 20, 1999

Date of Commencement of Commercial Operation : July 04, 2001

No. of Branch : 19

No of Unit Office : 279

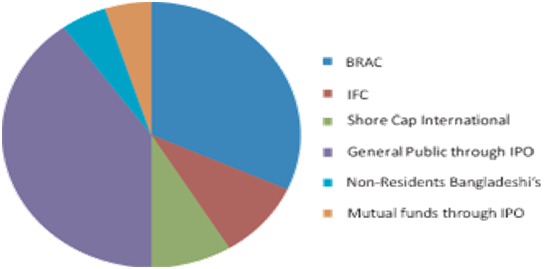

2.13 Shareholding Structure

Shareholding Structure

| Shareholders | Percent |

| BRAC | 31.74% |

| IFC | 9.50% |

| Shore Cap International | 8.76% |

| General Public through IPO | 40% |

| Non-Residents Bangladeshi’s | 5% |

| Mutual funds through IPO | 5% |

| Total | 100% |

2.14 Board of Directors

Board of Directors

| Mr. Muhammad A. (Rumee) Ali Chairman Mr. Quazi Md.Shariful Ala Mr. Mark A. Coffey (Nominated by ShoreCap International Limited) Ms. Tamara Hasan Abed | Mr. Shib Narayan Kairy Director Ms. Nihad Kabir Dr. Hafiz G.A. Siddiqi Mr. A. E. A. Muhaimen |

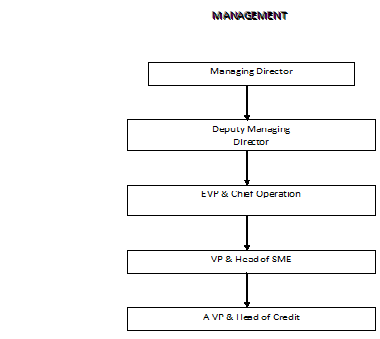

2.15 Management of the Brac Bank

The Board of Directors is the top management and policy-making body of BRAC Bank limited. Presently the Board consists of a chairman and four directors. It is to be noted that the Managing Director, is also a member of the Board. The Directors are appointed from amongst those who have had experience and shown capacity in the field of finance and banking, trade, commerce, industry agriculture.

The Chief Operations Officer executes all the activities under the direction of the Board. The officers and the other line and staff personnel are appointed by Bank’s own Recruitment Committee.

2.16 Management Team

| Mr. A. E. A. Muhaimen Managing Director & CEO Mr. Syed Mahbubur Rahman Mr. Tarique A Bhuiyan Mr. Nabil Mustafizur Rahman Mr. Mohd. Rafat Ullah Khan Mr. Rais Uddin Ahmad Mr. Naushad Hussain Ms. Tahniyat Ahmed Karim | Mr. Mohammed Rahmat Pasha Head of Treasury & Financial Institutions Mr. Abedur Rahman Sikder Mr. Khwaja Shahriar Mr. Md. Sarwar Ahmed Mr. Shah Alam Bhuiyan Mr. Faruk Ahammad Mr. Firoz Ahmed Khan |

3.1 Basic Appraisal of Small &Medium Enterprise

| B |

usiness or project appraisal is a technique of evaluating and analyzing Business from various aspects, primarily the risks associated with that business enterprise. At the time of appraisal of any manufacturing, trading or service related organization, factory or industry; one has to perform a feasibility study on the different aspects. These are:

- Management and Personal Aspects

- Technical Aspects

- Marketing Aspects

- Financial Aspects

- Social Economic Aspects

- Security Aspect

Management and personal aspects

During the appraisal prosecute the Customer Relation Officer (CRO) should endeavor to obtain details about the prospective borrowers, some of which are:

- Business related information

- Credit History

- Liquidity Information

- Management Background

In considering the above, one should look at the business is managed. CRO should also consider clients previous credit history like facilitates sought and availed, loan repayment an overdue record, if anyone checks the client’s bank account and amount of balance maintained. Management’s qualification, experience, successor and maintenance of records should provide insight in to the business.

Technical Aspects

From a business perspective, this aspects deals with design of the system in place, the operation of the business, the different type of physical resources used, the technology used, the capacity to handle business and all other inputs. Labor, raw materials, utilities etc.) Among the technical factors to be investigated during an appraisal are:

- The size of project

- The process, materials, equipment, and reliability of technical systems to be used

- Location of projects

- Sustainability of the plans, layout and design used

- Total quantity of the goods /Service produced/Traded monthly

- Environment of the business and its surrounding areas

- Availability to various factors of production, both physical and human

- Raw materials availability, price level and its variation to be considered

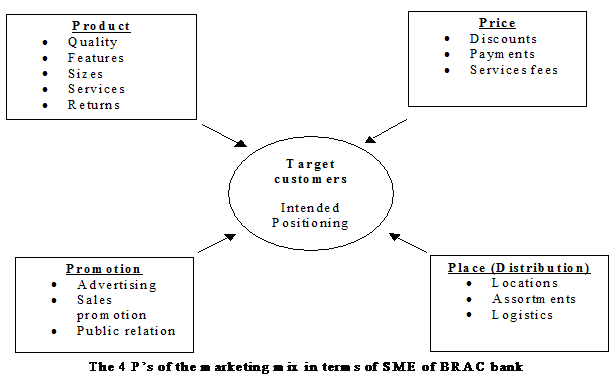

Marketing Aspects

A CRO should consider the following factors of a business before making any loan commitment with a customer:

Total demand and supply of the products in the market that the business operates in growth of sales and major marketing threats that the business may face.

Financial Aspects

This aspect allows us to check the financial health of a business, through an analysis of the profit and loss account, balance sheet, cash flows, ratios, and requirement of working capital. If the collection of the financial data can be done properly, then it may be able to make a somewhat realistic picture of the business financial position. How ever, all the data collected must be crosschecked as much as possible with the physical features of business.

The following things are to be considered and determined at the time of verifying the financial feasibility of the business:

- Current year’s profit/loss of the business & probable profitability of business after taking loan

- Determination of assets, liabilities and net worth of the manufacturing/ trading / service institution before and after taking loan

- Present net cash flow of the business after disbursement of loan should be determined,

- To know the cash position of the institution

- To know the source of income, production and other expenditure of the business probable financial risks of the business.

Socio Economic Aspects

Here the analyst like to observe the contribution of the business to the country’s GDP, the employment generated, the sort of adverse impact of the business on the environment, if another benefit to the country.

Security Aspects

Along with observation of different aspects and views of the projects, the CRO should also see closely the aspects of the projects and ensure about the reliability to the mortgaged property/assets. Ensure proper survey or verification of the security offered, Ensure attachment of survey report.

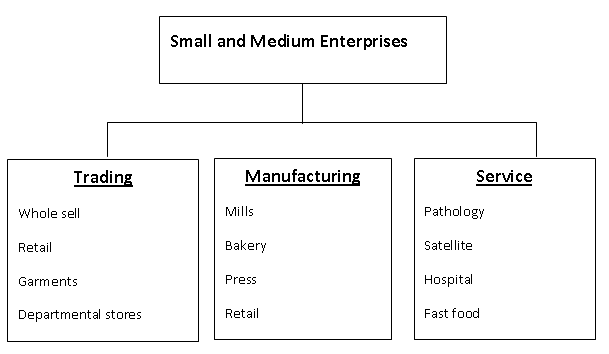

3.2 Products & Services

SME Banking Division is a business division of BRAC Bank Limited that deals with Small and Medium sized Entrepreneurs involved in different types of business. SME banking division primarily provides loans to small and medium sized trading, manufacturing, service, agriculture, non-farm activities and agro-based industries located across the country.

The loan products offered by SME Banking Division are ANONNO, PROTHOMA RIN, PROSHAR, BIZNESS LOAN, TRADE PLUS and BUSINESS EQUITY LOAN (BEL). The SME loan range is from BDT 2 lac to BDT 350 lac (Funded: BDT 2 lac to BDT 350 lac, Non Funded: BDT 1 lac to BDT 30 lac). SME banking division offers Term loan, Continuous (Cash covered) loan and Letter of Credit. Short Term: up to 9 months, Long Term: from 12 to 120 months. Moreover there is also a deposit product named PRAPTTI CURRENT ACCOUNT for the SMEs.

To avail a funded SME loan 15 to 25 days are required and for Non Funded SME loan the timeframe is 1 to 2 days from the date of application, if all the necessary papers are in order. At present generally, loans are only given to entrepreneurs who have a running business of at least one year.

The interest rate of SME loans ranges from 14% to 17.8% on the reducing balance method, depending on the amount and the loan scheme. Collateral is necessary for loan amounts of BDT 10 lac and above. Generally collateral is not necessary for loan amounts ranging from BDT 2 lac to below BDT 10 lac.

It is compulsory for a borrower to have a current A/C either with BBL or with a correspondent bank branch if there is no BBL branch or SME sales & service center in the locality. The City Bank Ltd, Janata Bank, Bangladesh Krishi Bank, Pubali Bank Ltd, Agrani Bank, Rupali Bank Limited are the correspondent banks of BRAC Bank. Bank transaction record is mandatory for Anonno (Ovedraft), Bizness Loan, Trade Plus & Business Equity Loan (BEL) only.

The SME loans are usually given for working capital finance, fixed asset finance and trade finance. Loan amount is decided based on the fund requirement calculation, not on the basis of collateral value. However, Lawyer’s opinion is necessary for mortgage purpose. Registry Mortgage is necessary generally when the loan amount is BDT 10 lac or more.

Working capital finance can be maximized up to 100% of the net required working capital or 75% of the sum total of inventory, advance payment and receivables whichever is lower. Fixed asset finance cannot be more than 90% of the purchase price, but the debt equity ratio in fixed assets investment in the projected year (after purchase of new fixed assets) cannot be more than 1 (one). A customer can apply for a repeat loan when 80% of the previous loan tenure has passed and made a satisfactory repayment. If all installments are paid on due dates, they will also get a concession on the existing interest rate.

Generally SME only provides business loans in the enterprise’s name. However, loan can be sanctioned in the personal name of the borrowers, if the tenant borrower cannot obtain trade license showing his name as owner of the business due to the conditionality imposed by the market committee/owner. Fire insurance is mandatory to avail a loan except for a few concerns like poultry, fishery, farming & wood business (preserve under water).

Process:

For disbursement of any SME loan a clean CIB report is required. A Valid trade license, rental deed, and any other authorization (if necessary) are the primary documents that are needed to get an SME loan. A number of information is required along with the loan application form i.e. Inventory list, Accounts Receivables list, Accounts Payables list, Buyers list, Suppliers list, and Fixed Asset list.

Guarantors:

Minimum two guarantors are required for an SME loan, one of whom must be a third party guarantor and another from his /her own family. A third party guarantor may be a businessman or a service holder from the private sector with minimum wealth of 125% of the loan amount. However, for a family guarantor the net wealth condition is not applicable. A guarantor of SME loan can not avail a loan from BRAC Bank as long as he/she is a guarantor.

3.3 Fees & Charges

Stamp cost:

It is the cost that will be needed in future for legal procedures. For an SME loan the stamp cost is BDT 620 only.

Loan Application Fees:

The borrower has to pay BDT 200 and 15% VAT thereon as the loan application fees at the time of loan disbursement.

Loan Processing Fees:

Loan Processing Fee of SME loan ranges from 1% to 2.5% plus VAT of the loan amount.

Early Settlement Fees:

Early settlement fees of 1% to 5% plus VAT thereon will be charged on the outstanding amount for early settlement of EMI loans of SME Banking. There is no early settlement fee for Non EMI loans. If a client misses the installment date, he/she will have to pay day-wise interest on the outstanding amount.

3.4 Repayment

EMI:

EMI stands for Equated Monthly Installments. It is the system where installments are paid in equal amount on a monthly basis.

Single payment system:

It is the system where interest is paid monthly and the total principle is paid at maturity (except for Anonno loan). For Anonno loan 70% repayment of the principal will be realized in the following month of the highest sales/cash collection and the rest 30% will be realized in the following second month.

Distribution:

At present SME Banking Division has a reach in all 64 districts of the country through 429 unit offices. The functional designation of the loan officers who operate at the unit offices is Customer Relations Officers (CROs).

A zone is comprised of 1-6 unit offices, where the person in-charge of the zone is known as a Zonal Manager. The reporting manager of a CRO is the Zonal Manager (ZM) or Associate Relationship Manager (ARM). Zonal Managers/ Associate Relationship Managers have the authority to approve a loan up to BDT 6 lac. There are 144 Zonal offices in SME Banking at present.

A Territory is comprised of 6-12 zones. There are 15 territories at present. The reporting of a Zonal Manager is the Territory Manager. The Associate Relationship Managers however report to the Relationship Managers.

SME Sales and Service Center:

SME Sales and Service Center is a distribution point of BRAC Bank Limited to render banking services to the SME sector across the country by reaching them quickly, effectively, conveniently & in a focused way.

Objectives of SME Sales and Service Center are attached below:

Rendering banking services to SMEs in a cost effective way

- Allowing SMEs to systematically withdraw loan amount

- Smooth recovery of SME loans

- Receive & deliver foreign remittance to concerned payees

- Reduce dependency on correspondent banks to disburse loans through & collect repayment

SME Sales and Service Center has added new dimensions in catering SMEs with both loan and deposit products i.e. a complete banking solutions.

3.5 Units of SMS Banking Division

Small Business

This largest business unit of SME Banking Division has long been providing loans to Small entrepreneurs. This business wing offers varying products. SME entrepreneurs mostly require small finance that this business unit has successfully been offering to all level of SME borrowers.

Medium Business

This business unit meets the financing requirements of medium entrepreneurs. Special products have been designed to serve the customers of this segment.

Product Development

This unit develops customized and need based products for small and medium entrepreneurs. Product Development wing also develops campaign and takes initiative to design merchandises, with the help of the creative and communication division.

SME Administration

This unit is comprised of several wings one of which is Compliance Reporting which ensure compliance of internal policies & Bangladesh Bank regulations to the unit offices, deals with client requests and queries. Another wing named Coordination maintains liaison of SME Head office with SME unit offices & other departments. Legal guidance and assistance is also extended to personnel at SME unit offices through this unit. Monitoring unit reviews prevailing processes of SME Banking Division & ensures meticulous business reporting for smooth operation.

3.6 Products of SMS Banking

ANONNO: A collateral free business loan to one year going concern i.e. small and medium sized trading, manufacturing, service, agriculture, non-farm activities, agro-based industries etc. all over Bangladesh.

PROTHOMA RIN: An asset product offered to women entrepreneurs to expand their businesses. This product’s main objective is to help women entrepreneurs to meet their short-term cash flow shortages or bridge the fund-flow gaps.

PROSHAR: Proshar is a loan facility for Small and medium sized manufacturing industries located in the surrounding areas of unit offices across the country. It is primarily meant for working capital finance/ fixed asset purchase for the business.

BIZNESS LOAN: This loan facility caters cash flow requirement of medium sized enterprises located around the unit offices which are at proximity of the BRAC Bank Branches. To avail this loan facility healthy banking track record is required and medium sized entrepreneurs can avail this loan facility against 30% to 50% cash security.

TRADE PLUS: This product offers both funded & non funded loan facility to import oriented Small & Medium Entrepreneurs and constantly supports them to smoothly operate their import activities.

Business Equity Loan (BEL): Business Equity Loan is the loan facility for SME entrepreneurs to meet their short or long term cash flow requirement or bridge the fund flow gaps.

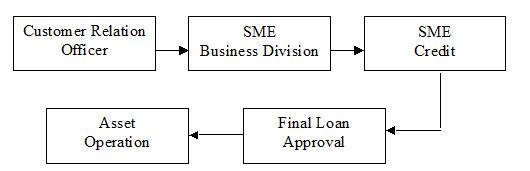

3.7 Organizational Layout of BRAC Bank SME Loan

- Credit Division

- Business Development Division

- MIS Division

SME Loan process flow is shown below-

When a client comes for a loan request, first he meets a CRO, then the following process take place:

4.1 World Economy- An over view

| A |

s we enter into the new millennium the process of trade liberalization and globalization have presented new challenges as well as greater opportunities. Economic boundaries of nations are being abolished and the world is gradually becoming a global village, in the beginning of the year 1999 the Euro currency started to replace the currency of eleven European Union countries.

In the financial service sector profound changes have been taking place globally. E-commerce is becoming the predominant mode of transactions. We are witnessing revolutionary changes in the fields of cost control, retail channels, range and delivery of services, accessibility and reach. These changes have already triggered off reorganization, amalgamation, and takeover of financial institution globally.

4.2 Bangladesh Economy An over view

The economy has grown 5-6% per year since 1996 despite political instability, poor infrastructure, corruption, insufficient power supplies, and slow implementation of economic reforms. Bangladesh remains a poor, overpopulated, and inefficiently-governed nation.

Although more than half of GDP is generated through the service sector, 45% of Bangladeshis are employed in the agriculture sector, with rice as the single-most-important product. Bangladesh’s growth was resilient during the 2008-09 global financial crisis and recession. Garment exports, totaling $12.3 billion in FY09 and remittances from overseas Bangladeshis totaling $9.7 billion in FY09 accounted for almost 25% of GDP.

GDP (purchasing power parity):

$259.3 billion (2010 est.)

$244.6 billion (2009 est.)

$231.4 billion (2008 est.)

GDP (official exchange rate):

$105.4 billion (2009 est.)

GDP – real growth rate:

6% (2010 est.)

5.7% (2009 est.)

6% (2008 est.)

GDP – per capita:

$1,700 (2010 est.)

$1,600 (2009 est.)

GDP – composition by sector:

agriculture: 18.4%

industry: 28.7%

services: 52.9% (2009 est.)

Labor force:

73.87 million

extensive export of labor to Saudi Arabia, Kuwait, UAE, Oman, Qatar, and Malaysia; workers’ remittances estimated at $10.9 billion in 2009-10 (2009 est.)

Labor force – by occupation:

agriculture: 45%

industry: 30%

services: 25% (2008)

Unemployment rate:

5.1% (2010 est.)

5.1% (2009 est.)

About 40% of the population is underemployed; many participants in the labor force work only a few hours a week, at low wages

Industrial production growth rate:

6.4% (2009 est.)

Population below poverty line:

36.3% (2008 est.)

Inflation rate (consumer prices):

8.1% (2010 est.)

5.4% (2009 est.)

Exports:

$16.24 billion (2010)

$15.58 billion (2009)

Imports:

$21.34 billion (2010)

$20.3 billion (2009)

Reserves of foreign exchange and gold:

$10.79 billion (31 December 2010 est.)

$10.34 billion (31 December 2009 est.)

Exchange rates:

taka (BDT) per US dollar – 70.59 (2010), 69.039 (2009), 68.554 (2008), 69.893 (2007), 69.031 (2006)

4.3 Economic development and the evolving of BRAC Bank Limited

The context of the financial and economic condition of Bangladesh, 2008-2009 was a remarkable year. September 11, 2005 tragedy when deteriorating the world economy, also affected our economy. But effort for implementation of the ongoing reforms in the financial and others of the economy were strengthened and a pragmatic approach to macroeconomic management was adopted during the year under report.

To bring about desired pace in overall economic activities a moderately accommodative monetary policy was pursued during 2007-2008 in close consonance with the rehabilitation and development programmed. Of course there was a policy for keeping inflection at a tolerable rate. The face of overall economic activities in the country gathered momentum during 2007-2008 for extending agricultural loans at easy terms and for arrangement and supply of agricultural input including fertilizers in a fair price.

As a result an agriculture friendly environment was created in the country. Growth rate of GDP has been strengthened during the year mainly due to strong expansion of agriculture sector and significant pickup of export demand right and effective policy at the right time in successful implementation of agriculture rehabilitation program and hard labor of the country’s toiling production contributed to humped production of food crops during the year. As a result, total food grain production increased by 14.2% bolstering overall output growth of the agricultural sector up from 3.3% in 2007-2008 to 5.5% in 2008-2009.

Improved global economic environment led to perceptible buoyancy of demand for Bangladesh export commodities, which also helped increased industrial productions. Growth rate of the industrial sector increased from 3.2% in 2007-2008 to 4.3% 2008-2009.

As a result, overall growth rate of GDP accelerated from 5.3% in the previous year to 5.52% in 2008-2009. The gross domestic savings in the current market prices during the year under report increased by Tk. 3999.80 crore or 10.3% to Tk. 42901.40 crore and gross investments increased by Tk. 5393.00 crore or 11.1% to Tk. 54150.5 crore.

In this context a new dynamic bank emerged named BRAC Bank, a fully online scheduled commercial bank opened in 2001, is dedicated to offer its clientele truly international standard banking services. BRAC Banks customer friendly product with convenient features is all designed to meet the grouting and changing needs. Most important, The BRAC Bank has a team of expert sales persons who will take banking at the doorsteps of customers.

Data Source: Source: http://www.Bangladesh-bank.org/econdata/Bangladesh..Php

| T |

he main focus of BRAC Bank is to develop human and economic position of a country. Its function is not limited only providing and recovering of loan. But also try to develop economy of a country. So reasons for this program from the viewpoint of BBL:

- Support Small Enterprise

The small enterprise, which requires 2 to 30, lacks Tk. loan, but these has no easy access to the banks/financial institutions. For example: In the of 3 to 8 lacs amount of loans is provided without any kind of mortgage.

- Economic Development

Economic development of a country largely depends on the small and medium seal enterprises. Such as, if we analyze the development history of Japan, the development of small & medium scale enterprises expedite the development of that country.

- Employment Generation

The bank gearing employment opportunities by two ways: Firstly, by providing loan to the small enterprises expanding, these businesses require more workers. Secondly, Small & Medium Enterprise (SME) program requires educated and energetic people to provide support to entrepreneurs.

- Profit Marking

SME program is a new dimensional banking system in the banking world. Most of the CRO’s are providing door-to-door services to the entrepreneurs. Entrepreneurs are satisfied by the service of the bank and make profit.

- Encourage Manufacturing

The focus of BRAC Bank is to encourage manufacturing by the entrepreneurs who produce by purchasing various types of materials. CRO try to educate them to produce material if possible because if they can produce in line of purchase profits will be high.

- Spread the experience

Another reason of BRAC Bank is to spread the knowledge on the importance of SME banking regarding various businesses. The customer services officer share their knowledge from various businesses and tries to help the entrepreneurs who have shortage of the gathered knowledge. CRO’s who are the driving force of SME division of BRAC Bank also gather knowledge about various businesses and make stronger knowledge base.

5.1. Security Documentation against Loan

A document is a written statement of facts and a proof or evidence of particular transaction between parties involved. While allowing any disbursements against credit facilities to borrowers, it should be ensured that prior to any disbursements; security documentation is fully and properly completed.

a) Purpose of Decorate Documentation and its Importance

Documentation is necessary for the acknowledgement of a debt and its terms and conditions by the borrower and the creation of charge on the securities in favor of the bank by the borrower. Correct and proper documentation allows a bank to take legal measures against the default borrowers.

If filing a suit with the courts against a default borrower becomes necessary, the court will first review all documents. If any of the documents is found to be defect or incomplete, the purpose of security documentation will be defeated and a court ruling in favor the bank cannot be expected. Proper care should, therefore, be taken while completing security documentation.

b) Type of Securities

The following listed securities may be obtained from borrower against loan to enterprises, either individually or in a combination.

It is really up to the bank what they would like to accept as security from the borrower as not all the securities stated below are suitable:

- Mortgage of loan and other immovable property with power of attorney to sell

- Lien of Fixed Deposits receipts with banks and other non-banking financial institutions, lined, these have to confirm by the issuer.

- Lien of Pratirakshay sanchay patra, Bangladesh sanchay patra, ICB unit certificates and wage earner development bond, all considered Quasi or Near cash items

- Lien of shares quoted in the stock exchange (This is rarely accepted)

- Pledge of goods (Banks are akin to stay away from such securities now a days)

- Hypothecation of Goods, Book Debt & Receivables, Plant & Machineries

- Charge on fixed assets of a manufacturing enterprise

- Lien of cheque, Drafts and order

- Shipping documents of imported goods

c) Land Related Securities Documentation Process

Each SME unit offices are lilies with at least two local lawyers who will work on behalf of the bank. These always will be employed whenever a borrower and where the security will be landed and immovable property accept a loan sanction.

Any one of the lawyers will be provided with photocopies of all the relevant land related documents and while handing over show the original documents to them, the lawyers will carry out checks of the originals and if satisfied returned to the borrower. The documents generally provided are:

- Title Deeds or Deed of conveyance otherwise known as ‘Jomeer Dalil’ which signifies ownership of a particular land.

- Baya Dalil or Chain of Documents, which signifies that the conveyance of titles has been proper and legal.

- Mutation Certificate if Khatian which signifies that the title if the land has been duly registered in the Government/Sub-registrar’s records.

- Duplicate Carbon Receipt or DCR

- Latest Khajna or land rent receipt

- Purchase such as CS Khatian, SA Khatian and BS Khatian

- Mouja Map

- Municipal rent receipts if the land falls within a municipal area

The lawyer will then carry out a search at the Sub-registrar of land’s office to check if the proffered land is actually registered in the name of the proposed mortgagor and whether the said land is free from any encumbrances. The Sub-register’s office, which means that the land or immovable property can be mortgaged to the bank, then the lawyer will provide his own opinion on the acceptability of the property, whether it is legally held and explain the chain of ownership.

If all is acceptable, the lawyer will draw up the Mortgage Deed that will be registered, the irrevocable power if attorney to sell the land and the Memorandum of Deposit of Title Deed. The lawyer will have the borrower or the Mortgagor, if different or 3rd party, sign the documents in front of the Sub-registrar of land to register the mortgage, The CRO must ensure that the receipt for the original Mortgage deed must be signed off (Discharged) at the back of the receipt so that the bank may obtain the originals in the future.

The borrower will bear all the charges and will pay directly at the Sub-Registrar’s office including the cost of the stamp paper required. The cost of the lawyer will also be realized from the borrower be an account payee cheque in favor of the lawyer and handed over to the lawyer straight away.

The charges related to the creation of mortgages and other associated costs are incorporated in a separated sheet and are attached herewith. The CRO will have all other security documents, as sent by SME HO, signed by the borrower and hand carry all the security documents including all the original land documents and deliver those to the credit administration officer who will check the list of documents and receive those through a check list in writing. The credit administration officer once satisfied will prepare the disbursement memo to disburse the loan.

d) Mortgage

i) Equitable Mortgage or Memorandum of Deposit of Title Deeds

It is created by a simple deposit of title deeds supported by a Memorandum of Deposit of Title Deeds along with all the relevant land documents. All the searches and verification of documents as stated above must be carried out to validate the correct ownership of the property. This deed also provides the bank power to register the property in favor of the bank for further security, if needed.

ii) Registered Mortgage

It is created by an execution of a Mortgage Deed registered irrevocably in favor of the bank at the Sub-Registrar of land’s office. This virtually gives the bank the right to posses and self if accompanied with a registered irrevocable power of attorney to sell the property executed by the owner of the property, in case of default.

e) Basic Charge Documents

i) Sanction Letter

Once a loan is approved, the borrower is advised by a ‘Sanction or offer letter’ which states the terms and condition s under which all credit facilities are offered and which forms an integral part of their security documentation. If the borrower accepts, then a contract between the bank and the borrower is formed and which both party are obligated to perform. Accordingly, all other charge documents and securities are drawn up and obtained.

A standard sanction letter is attached herewith. All documents shall be stamped correctly and adequately before or at the time of execution. An un-stamped or insufficiently stamped document will not form basis of suit. Stamps are of 4 (Four) kinds. These are Judicial, Non-judicial, Adhesive and embossed impressed. Documents to be executed (Signed) by the borrowers concerned must be competent to do so in official capacity.

Following precautions should be taken at the time of execution of the security documents:

- The signature on the documents should be made in the presence of the CRO. The CRO should sign as witness on all charge documents.

- The document are to be filled in with permanent ink or typed

- If the document consist more than 1 page, the borrower should sign on each page

- If the signature of any third party is required to be obtained whose specimen signature is not available, then the main applicant should verify the specimen signature of the third party

- No document or column in any document should remain blank

- As far as possible there should be no erasure, cancellation or alternation in the document. If, however, there is any correction, overwriting or alteration, then that must be authenticated by a full signature of the signatory.

After stamping and execution of documents, the question of registration comes up. However, not all documents are required to be registered. For the extension of any type of credit/loan facility, the following loan documents, which are considered basic, should be obtained from all borrowers:

- Demand Promissory Note

- Letter of Continuity (This is not always taken if there is only loan disbursement)

- Letter of Arrangement

- General Loan Agreement

- Letter of Disbursement

- General Loan Agreement

- Letter of Disbursement; Basically a letter requesting disbursement of the loan

- Letter of Installment, in case the facility is to be repaid in installment

Other Basic Charge Documents

i) Demand Promissory Note (DP Note)

It is a written promise by a borrower to pay the whole amount of existing or future loans/credit facilities on demand. It also gives the banks power to ask the borrower to repay the loan amount with interest without any prior notice. Section 4 of the Negotiable Instrument Act 1881 defines a promissory note as an instrument in writing, signed by the maker, to pay a certain sum of money only to, or the order of, a certain person, or to the bearer of the instrument, following precautions are to be taken while preparing a promissory note.

Type the amount of the credit facility/loan in words and in figures. Type the rate of interest for the loan, which the borrower will subject to verify the signature of the borrower.

ii) Letter of Continuity

This instrument is used in conjunction with the demand promissory note. This is to secure rights of recovery for existing and future credit facility, which are advanced in parts or on a recovery basis. Loan accounts may from time to time be reduced or even the balance in the said loan account may be in credit so this instrument, validates the said D.P Note, for making further drawings under the facility continuously possible.

iii) Letter of Arrangement

This is a right given by the borrower to the bank to cancel the facility at any time without having to assign any reason. This is also an acknowledgement by the borrower that the credit facility has been approved in his favor and the borrower has to execute all necessary documents to avail credit facility.

iv) General Loan Agreement

A loan agreement is an agreement of contract stating the general terms for the extension of a loan or credit facilities. The General loan agreement sets out the general standard terms and conditions governing the existing or future extension of loan or erudite facilities to the borrower.

v) Letter of Disbursement

This is a simple letter requesting disbursement of the loan/credit facilities at the agreed rate of interest.

Other Security Documents

i) Letter of Undertaking

This is a Deed of agreement executed by the borrower agreeing to commit to carry out any or a particular obligation to avail of loan/credit facility.

ii) Letter of Hypothecation of Goods & Stocks and Book Debt and Receivable:

These letters Hypothecation are actually two different sets of documents but because of their similarity, these are being explained together. These documents create an equitable or floating charge in favor of the bank over the goods and services and/ or book debts and receivables that are being financed where neither the ownership nor the possession is passed to the bank.

Under this agreement, the borrower undertakes to keep the percent stock of goods and that, which may increase from time to time in good condition in future, in good condition. This hypothecation gives the bank the power to possesses and sell the mentioned goods and stocks or claims the book debts directly from the debtors in order to settle the borrower’s dues to the bank.

iii) Letter of Hypothecation of Plant & Machinery

Under this agreement, the Borrower undertakes to keep the present plant and machinery at the present location in good condition and which gives the bank the power to posses and sell the mentioned plant and machinery to meet the borrower’s dues to the bank. In case of limited company, both private and public, these Letters of Hypothecation with schedules are usually registered with the Registrar of Joint Stock of Companies (RJSC) that provides more security to the banks.

iv) Letter of Lien

A lien the right of one person to retain property in his hands belonging to another until certain legal demands against the owner of the property by the person in possession are satisfied. Thus a bank or a creditor who has in its possession a lien over the goods in respect of the money due by the borrower, as a general rule has the right to exercise certain powers to hold on to the security.

In addition, if the bank has right to set off the value of the said goods or instrument in its possession, then the bank can sell the goods or encase the instrument to liquidate the dues by the borrower.

v) Right of Set Off

This deed of agreement gives the bank the right to offset the value of the goods or financial instrument in its possession and which has been discharged by the owner of that asset, against dues owned by the borrower.

vi) Letter of Disbursement

This agreement gives the bank the right to possess goods and other assets in rented or leased premises of the borrower despite the fact that owner or the premises may be unable to realize dues from the borrower himself.

vii) Personal Guarantees

This is a guarantee of a person or third who is not the direct beneficiary of the loan/credit facility but is equally liable for the loan. The involvement of a 3rd party creates additional pressure on the borrower to minimize the risk. The guarantor is the person who has to pay the entire outstanding loan and interest if the borrower fails to pay for any reason.

5.2 Selection of Potential Enterprise for SME

Enterprise Selection Criteria

The success of SME will largely depend on the selection of a business and man behind it. In terms of the business (Enterprise), the following attributes should be sought:

- The business must be in operation for at least one year

- The business should be environment friendly, no narcotics or tobacco business

- The business should be legally registered, i.e., valid trade license, income tax or VAT registration, wherever applicable.

- The business should be in legal trade, i.e.; smuggling will not be allowed or socially unacceptable business will not be entertained.

- The business must have a defined market with a clear potential growth

- The business must be located ideally close to the market and the source of its raw materials/suppliers. It should have access to all the utilities, skilled manpower’s that are required.

- Any risk assessed by the management in turn will become a credit risk for the bank. So effort should make to understand the risk faced by the business.

Entrepreneur Selection Criteria

In order to understand the capability of the management behind the business, the following should be assessed:

- The entrepreneur should be physically able and in good health, preferably between the age of 25-50. If he/she is an elderly person closer to 50, it should be seen what the succession process will be and whether it is clearly defined or not.

- The entrepreneur must have the necessary technical skill to run the business, i.e. academic background or vocational training, relevant work experience in another institution or years of experience in this line of business.

- The entrepreneur must have and acceptable social standing in the community (People should speak highly of him), he should possess a high level of integrity (Does not cheat anyone, generally helps people), and morally sound (Participates in community building)

- The entrepreneur must possess a high level of enthusiasm and should demonstrate that he is in control of his business (Confidently replies to all queries) and has the ability to take up new and fresh challenges to take the business forward.

- Suppliers or creditors should corroborate that he pays on time and is general in nature

- Clear-cut indication of source of income and reasonable ability to save.

Guarantor Selection Criteria

Equally important is the selection of a guarantor. The same attribute applicable for an entrepreneur is applicable to a guarantor. In addition he should posses the followings:

- The guarantor must have the ability to repay the entire loan and is economically solvent (Check his net worth)

- The guarantor should be aware about all the aspect of SEDF loan and his responsibility

- Govt. and semi-govt. officials can be selected as a Guarantor such as schoolteacher, college teacher, doctor etc.

- Police, BDR and Army persons, political leaders and workers, and Imam of mosque cannot be selected as a guarantor.

- The guarantor should know the entrepreneur reasonable well and should preferably live in the same community

5.3 Terms and Conditions of SME Loan

The SME department of BRAC Bank will provide small loans to potential borrower under the following terms and condition:

- The potential borrowers and enterprises have to fulfill the selection criteria

- The loan amount is between Tk. 2 lacs to 30 lacs.

- SME will impose loan processing fees for evaluation / processing a loan proposal as following;

Loan Amount | Loan Processing Fee |

| 2 lacs to 2.99 lacs | Tk. 5000 |

| 3 lacs to 5 lacs | Tk. 7500 |

| 5.01 lacs to 15 lacs | Tk. 10,000 |

| 15.01 lacs to 30 lacs | Tk. 15,000 |

- Loan can be repaid in two ways:

a) In equal monthly loan installment with monthly interest payment, or

b) By one single payment at maturity, with interest repayable a quarter end residual on maturity

- Loan may have various validates, such as, 3 months, 4 months, 6 months, 9 months, 12 months, 15 months, 18 months, 24 months, 30 months and 36 months.

- The borrower must open a bank account with the same bank and branch where the SME has its account

- Loan that approved will be disbursed to the client through that account by account payee cheque in the following manner: Borrower name, Account name, Banks name and Branch’s name

- The loan will be realized by 1st every months, starting from the very next months whatever the date of disbursement, through account payee cheque in favor of BRAC Bank Limited A/C . With Bank’s named and branches name

- The borrower has to issue an account payable blank cheque in favor of BRAC Bank Limited before any loan disbursement along with all other security.

- The borrower will install a signboard in a visible place of business of manufacturing unit mentioned that financed by “BRAC Bank Limited”.

- The borrower has to give necessary and adequate collateral and other securities as per bank’s requirement and procedures.

- SME, BRAC Bank may provide 100% of the Net Required Working Capital but not exceeding 75% of the aggregate value of the Inventory and Account Receivables. Such loan may be given for periods not exceeding 18 months. Loan could also be considered for shorter periods including one time principal repayment facility, as stated in loan product sheet.

- In case of fixed asset Financing 50% of the acquisition cost of the fixed asset may be considered. While evaluating loans against fixed asset, adequate grace period may be considered depending on the cash generation after the installation of the fixed assets. Maximum period to be considered including grace period may be for 36 months.

5.4 Monitoring

Monitoring is a system by which a bank can keep track of its clients and their operations. So monitoring is an essential task for a CRO to know the borrowers activities after the loan disbursement. This also facilitates the buildup of an information base for future reference.

Important of Monitoring

Through monitoring a CRO can see whether the enterprise invested the sanctioned amount in the pre-specified area of his business, how well the business is running, the attitude of the entrepreneur, cash credit sales and purchase, inventory position, work in process and finished goods etc, This information will help the CRO/BRAC Bank to recover the loan accruing to the schedule and to take the necessary decisions for repeat loans.

Moreover, monitoring will also help to reduce delinquency. Constant visit over the client /borrower ensures fidelity between the bank and the borrower and tends to foster a report between them.

Area of Monitoring

The purpose is to know the entire business condition and all aspects of the borrowers so that mishap can be avoided.

a. Business Condition

The most important task of the CRO to monitor the business frequently, it will help him to understand whether the business is running well or not, and accordingly advice the borrower, whenever necessary. The frequency of monitoring should be at least once month if all things are in order.

b. Production

The CRO will monitor the production activities of the business and if there is any problem in the production process, the CRO will try to help the entrepreneur to solve the problem. On the other hand the CRO can also stop the misuse of the loan other than for the purpose for which the loan was disbursed.

c. Sales

Monitoring sales proceed is another important task of the CRO it will help him to forecast the monthly sales revenue, credit sales etc. which will ensure the recovery of the monthly loan repayments from the enterprise as well as to take necessary steps for future loans.

d. Investment

It is very important to ensure that the entire loan has been invested in the manner invented. If the money is utilized in other areas, than it may not be possible to recover the loan.

e. Management of raw materials

In case of a manufacturing enterprise, management of raw materials is another important area for monitoring. If more money is blocked in raw materials then necessary, then the enterprise may face a fund crisis.

Monitoring System

a. The CRO can consider the following things for monitoring

The CRO will monitor each business at least once a month. He/she will make a monitoring plan/ schedule at beginning of the month. During monitoring the CRO must use the prescribed monitoring from and preserve in the client file and forward a copy of the report to SME head office immediately.

b. A SME branch will maintain the following files

The file will contain

Purchase Receipt,

Delivery Memo’s,

Quotations

In addition, all other papers related to furniture and fixture procurement

c. Other fixed assets and refurbishment

All fixed assets and refurbishment related papers such as purchase receipt, Delivery memo’s, Quotation, Guarantee and Warrantee papers, Servicing related papers and any other paper related to fixed assets are refurbishment will be in this file.

d. Lease agreement file

This file will contain all papers related to lease agreement between the SESDS office and owners of the leased premises.

e. Individual client file

Individual files are to be maintained for each borrower and will hold loan application, Loan Proposal, Copies of Loan Sanction Letter, Disbursement Memo, Monitoring Report, CIB application and Report, Credit report from other bank and all other correspondents including bank receipt.

f. Statement file

All types of statement sent to SME head office will be kept in this file chronologically

g. Office instruction file

All kind of office instruction regarding administration should be kept in this file.

h. Operating instruction and guideline files.

All kind office instruction and guidelines related to operating should be kept in this file

i. New forms introduction file

All minutes of meeting, whenever held, should be kept in this file.

j. Security documents and legal aspect file

One set of security documents and lawyer’s opinions and suggestions regarding issue will be kept in this file. The original should be send to SME head office on a weekly basis

k. Survey form file

After conducting survey, all survey will be kept in this file chronological.

Banking System

- Every SME unit office will have a current account with a designate bank in the area of a unit office. This bank account will be opened and operated by SME head office.

- To meet petty expense such as stationary, entertainment and other incidental expense, all unit office will be allowed patty cash of Tk. 2000/=

- The cheque of this patty cash will be issued from SME head office in the beginning of the month. All vouchers relating to such expenses should be send to the accounts from SME head office

- All the clients must open their account with the same bank account on the same day after receiving those from the borrowers, who should given a received as prescribed.

- Cheques should be deposited to the SME unit office bank account on the same day after receiving those from the borrowers, who should given a receipt as prescribed.

- Any loan installment credit should be transferred to the SME head office account in Gulshan, Dhaka on the same day as per agreement with bank.

- Every CRO should have an individual account in the same bank branch for their personal use and to receive their salaries and other benefits.

- Payment of lease rentals, utility bills and cheque drawn on the SME unit office bank account and issued by SME head office should pay other expenses (Large amount). If these bills are small amount, they should be paid from the patty cash and replenished later.

- All the financial accounting entries will be passed at the SME head office and will maintain separately on the basis of the unit office.

Economic Mapping Survey

After starting a SME, unit office in a new area the CRO will conduct a survey of the business. The objective of the survey is to collect relevant information about the business, which will help to select potential business for SME loans.

Mapping and Survey Method

To conduct the economic mapping and survey properly, the following process should be followed:

- The CRO will prepare a physical map of his working area showing main roads, businesses, markets, and industrial locations. In this map, the CRO will show different kinds of business in different colors. This map will show the approximate location of all kinds of business within the area and it will be kept on the display board at the SME unit office.

- The CRO will drive his total working area into several clusters, if possible, after that he will conduct the survey cluster wise. After completing one cluster, the CRO will start surveying another cluster.

- At the beginning of the survey, the CRO will screen out business that does not need loans over 2 lacs.

- After the survey, CRO will preserve the survey form cluster wise in a separate file. Based on the survey, the CRO will identify the potential businesses to pursue those for SME loans.

- Therefore, CRO will approach the potential borrowers immediately to process loan application

For initial assistance, CRO may approach

- BRAC office

- Trade Associations and Chambers

- Local govt. office like UNO and Municipal office

6.1 Customer Handling

| O |

ur country there are about 52 banks working with the people with varieties of their attractive products and services and there is a high level amongst competition each other. For sustaining, they offering various types of innovation for better service for the clients, so, to reach the closer best to the clients direct marketing gaining momentum in the country.

In terms of SME, its targeted entrepreneurs are the subjects of dealings to achieve the objectives of BRAC Bank and its policy is to contact with clients directly with a confident manner. Some key activities of a CRO:

- Conducting Survey Properly

- Individual contact with entrepreneur for selecting potential borrower

- Deliver BRAC Bank’s products and other services

- Keeping in close touch with clients to develop mutually beneficial long term relationship

There are two types of dealings which customer services officer do as follows:

Regular

The main duty of a CRO is to search new potential customer by providing door-to-door services. They talk with clients and monitor their manners, activities of their business and then provide the loan of the potential customers. Most customers take hypothecation loan, which are unsecured loan. Normally it carries 2-5 lacs.

Unique

They also handle some unique customers who come to their unit offices to get the loan. Especially this client demands 10-20 lacs for their business. In this case, clients have to provide collateral securities in favor of bank. The securities may be land or fixed deposits. It takes little bit of time to disburse the loan for a CRO.

6.2 Macro Environmental Analysis

It is very important to carry out a macro environment scanning for the banking industry in order to identify and analyze the external factor that affected the growth and development of the banking sector in Bangladesh. A thorough analysis of the macro environment in which the banks operate will allow the banks to develop pro-active strategies and navigate the organization in the turbulent ocean of competition.

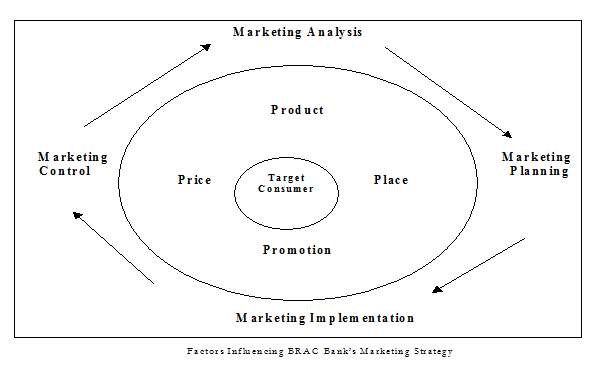

The financial institutions are always heavily influenced by the macro economic conditions both globally, regionally or locally. The key macroeconomic indicators like GDP growth rate, inflation, industrial growth rate, expansion of trade and commerce and other factors affects the operations and the pricing strategy of the bank. BRAC Bank Limited (BBL), since its inception has achieved a steady growth rate.