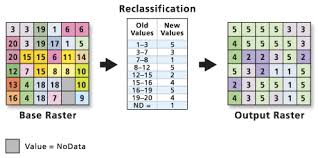

Reclassifications between categories are somewhat uncommon under IAS 39 and they are prohibited into and out of your fair value as a result of profit or burning category. Reclassifications from your held-to-maturity category because of a change involving intent or ability are treated seeing that sales and, in addition to in exceptional conditions; result in the full category being ‘tainted’. The most frequent reason for a reclassification out of your category, therefore, is when the full category is tainted and really needs to be reclassified as available-for-sale for two years. In these kinds of circumstances, the possessions are re-measured in order to fair value, together with any difference recognized in equity.

Reclassification of Assets