Executive summery

This paper explores the idea of finding a suitable and sustainable model for insurers by combining micro-insurance with micro credit. As the viability of the ‘credit-model’ was heavily constrained by contribution defaults, micro credit institutions needed to complement credit with social security type services, like micro-insurance models, to safeguard or reduce the likelihood of credit defaults by addressing certain high economic costs to credit groups and their family dependants resulting from emergency health expenditures, death of a family member, and damage to property caused by fires or natural disasters. The research finds several avenues where government can work helping the commercial insurers and micro finance institutions (MFIs) to go for agent partner model and design schemes for the clients based on respective strengths. Community based models should include people form the community as owners and vocal member of the schemes. All these will ensure the sustainability and the financial feasibility of the programs. Micro-insurance, a market product, along with business development service concept can help explore possibilities beyond horizon and alternative mechanisms to give the poor access to better health services and security to their investments.

1.0 Backgrounfd of the Study

Bangladesh a country of 140 million people is very densely populated. Majority of the population is living in the rural areas and are deprived of basic social services (e.g., health, medicare, etc.). Micro-insurance is rapidly expanding in Bangladesh. Micro-insurance products are becoming more competitive, and there are varieties of risk mitigation options available to the low-income market. The very first micro-insurance scheme was introduced 1972 by Gono Shashtho Kendro. Besides regulated insurers, many MFIs have some level of insurance provision covering disability and/or death. Recognizing the link between good health and productivity, some MFIs are also trying to bring quality health care to people who have not had access to these in the past).

The non-governmental organizations involved in micro-insurance are not registered with the Insurance Directorate and are not regulated or supervised under the Insurance Act. The NGOs are of the view that since the NGO regulations do not prohibit such a service, it is not illegal to provide health micro-insurance to its members.

The Insurance Directorate is currently not taking any action for or against unregistered micro-insurance schemes. The Chief Controller of Insurance notes regulations that guide the provident funds, and mutual and cooperative insurers provide a mechanism to formalize these organizations, as well as improving the potential for the consumer protection activities of the Insurance Directorate. The Directorate generally appears ambivalent toward micro-insurance.

1.2 OBJECTIVE

1.2.1 Broad Objective

The broad objective of the study is to suggest a flexible model to improve the exiting micro-insurance service delivery as a poverty alleviation tool. And to share existing experience on the topic, advance interest in the relevant issues and increase knowledge on the subject. The diversity provided potential for a good exchange of ideas and practices.

1.2.2 Specific Objective

To achieve this goal the following specific objectives are looked into:

a) An overview of micro insurance.

b) Analysis of micro insurance practices in Bangladesh.

c) Analysis of different models of micro insurance provisions.

d) Discussing the various types and variants of micro-insurance products

e) Discuss the various benefits of insurance to clients, service providers

f) Micro finance institutions performance as micro insurance providers.

g) Basic models of micro insurance provision augmenting micro finance

1.3 Scope of the study

This study deals with the micro insurance in the context of Bangladesh. This project will also focus on different aspects of micro insurance. The study encompasses a period of beginning to present. SWOT analysis is also under the scope of this report.

1.4 Limitations

One of the major constraints in conducting this proposal was Data Insufficiency. As there is a lacking of sufficient data regarding the current topic. Another problem that is also faced in conducting this project was lack of published materials related to the topic of this project. If more time was assigned this paper would have been more pragmatic, informative as well as educative.

1.5 METHODOLOGY

The research is confined to the ability of micro-insurance as a poverty alleviation tool. The research analyses micro-insurance schemes offered by different MFIs/NGOs in Bangladesh. Several focus group discussions were made for understanding the need and problems of micro-insurance for marginal households. Some depth interviews were carried out to understand the practical problems faced by the service providers.

OVERVIEW OF MICRO INSURANCE

2.1 Micro-Insurance and Its Connotation in Bangladesh

The term micro-insurance is gaining increasing usage in the world of micro-finance, often with little clarity regarding the definition. In the micro-insurance donor guideline for the micro-finance institutions the definition of micro-insurance is alienated in two parts: First, micro portion of the definition refers to the subset of a product that is designed to be beneficial and affordable for low-income individuals or groups. Second, insurance, which refers to a financial service that uses risk pooling to provide compensation to individuals or groups that are adversely affected by a specified risk or event.

ILO’s Social Finance Programme working group on micro-insurance, CGAP defines micro-insurance as “the protection of low income people against specific perils in exchange for regular premium payments proportionate to the likelihood of and the cost of the risk provided” (MRF 2006). Low-income people can use micro-insurance, where it is available, as one of several tools (specifically designed for this market in terms of premiums, terms, coverage, and delivery) to manage their risks (CGAP 2003a).

In Bangladesh, it is often assumed that a micro-insurance policy is simply a low-premium insurance policy, but this is not so. For a number of important reasons, low-income clients often:

I. live in remote rural areas, requiring a different distribution channel to urban insurance products;

II. are often illiterate and unfamiliar with the concept of insurance, requiring new approaches to both marketing and contracting;

III. tend to face more risks than wealthier people do because they cannot afford the same defenses (e.g., on average they are more prone to illness because they do not eat as well, work under hazardous conditions and do not have regular medical check-ups);

IV. have little experience of dealing with formal financial institutions; e) often have higher policyholder transaction costs.

Thus a middle class urban-policyholder can send a completed claims form to an insurance company with relative ease (e.g., a quick call to the insurance company, receipt of the claims form by post, and then return of the form by post); but for a low-income policyholder, submitting a claims form may require an expensive trip lasting a day to the nearest insurance office (thereby losing a day of work), obtaining a form and paying a typist to type up the claim, sending in the claim, followed by a long trip back home. Aside from the real costs of doing this, the low-income policyholder may be uncomfortable with the process; clerks and the other officials are often haughty with such low-income clients and can make clients feel ill at ease.

In the last decade or so, the country has seen the provision of insurance to the poor through the rapidly growing micro finance organizations and community based insurance initiatives. Micro-insurance is the term now commonly used for insurance services specially aimed at the poor. Definition of these relatively new terms is still evolving, but the term certainly implies focus on the poor (as in the case of micro credit) and involves insurance coverage with modest premium and sums insured.

2.2 Principles for providing micro-insurance:

Modern insurance provision is a concept that has been developed over centuries. There are some basic guidelines and principles.

- A large number of similar units should be exposed to the risk, relative to total population

- There should be limited policyholder control over the insured event

- There should be existence of insurable interest, i.e. the policyholder should be the one who suffers the loss in the event of a risky event

- Losses should be determinable and measurable.

- Losses should not be co-variant, i.e. insured risks should be unlikely to cause losses for a substantial portion of a population at the same time.

- Accurate information should be available to be used in setting premiums.

- Premiums should be economically affordable to potential policyholders.

2.3 Frequent Risks Encountered

2.3.1 Natural Risks

- Heavy Rainfall

- Flood

- Cyclone and Tornado

- Landslides/River erosion

- Drought etc

2.3.2 Socio-economic Risks

- Illness

- Disability

- Death

- Old Age

- Eviction

- Fire etc

2.4 How do People Manage Different Risks

Most poor people manage risk with their own means. Many depend on multiple informal mechanisms (e.g., cash savings, asset ownership, rotating savings and credit associations, moneylenders, etc.) to prepare for and cope with such risks like death of a family breadwinner, severe illness, or loss of livestock. Very few low-income households have access to formal insurance for such risks. These means include (i) prevention and avoidance, (ii) preparation and (iii) coping.

Prevention and avoidance: When possible, poor people avoid and/or actively work to reduce risk, often through non-financial methods. Careful sanitation, for example, is a non-financial way to reduce the risk of infectious illness. Using family networks to identify business opportunities is another such mechanism. The imperative to avoid risk often leads to conservative decision making by poor people, especially in business considerations.

Preparation: Poor people save, accumulate assets (such as livestock), buy insurance, and educate their children to handle future risks. For certain risks, informal community systems (e.g., Ghanaian burial societies) offer protection. However, such systems generally do not adequately protect against costly and unpredictable risks, such as the debilitating illness of a family income earner. Formal insurance products are beginning to be offered to low-income markets, such as simple credit life insurance, which covers an outstanding loan balance in the event of a borrower’s death; but these insurance products sometimes appear to be designed to protect the lending institution rather than its clients.

Coping: Ex post coping can result in desperate measures that leave poor households even more vulnerable to future risks. In the face of severe economic stress, poor people may take out emergency loans from moneylenders, micro-finance institutions (MFIs), and/or banks. They may also deplete savings, sell productive assets, default on loans, and/or reduce spending on food and schooling. In general, prevention and planning are far less costly than coping strategies for the individual.

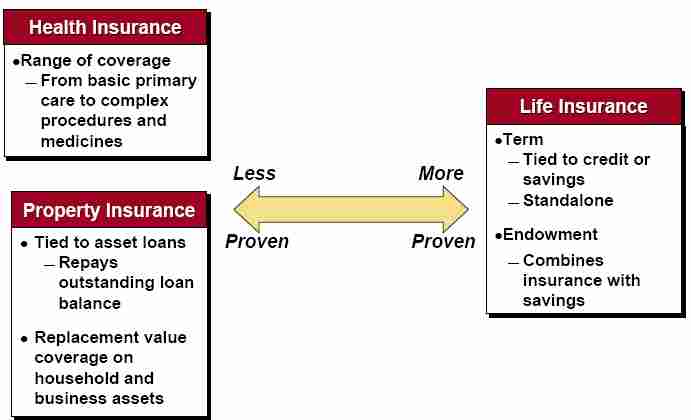

2.5 Different Financial Services for Different Risks

Two important parameters can be useful to identify and classify the risks households face: (1) the degree of uncertainty caused by the risk, and (2) the relative size of the loss. The uncertainty of a risk can be thought in terms of three elements: (i) if the risky event will occur, (ii) when it will occur, and (iii) how often it might occur. By positioning the risks faced by households along these two dimensions, it is possible to assess how well various risk management options protect low-income households against each type of risk.

Credit and savings products offer low-income households a method for converting a series of small contributions into a large sum of money. Emergency loan funds offered by institutions (e.g., Grameen Bank, Shakti Foundation, and Action Aid in Bangladesh) are good examples of providers reducing typical restrictions on credit products to provide more effective risk protection. However, credit and savings products cannot provide complete protection against risks resulting in a loss greater than what a household can save or repay. As the size of loss increases relative to a household’s expected future income, credit products become increasingly ineffective risk-management tools. Similarly, savings products offer only partial protection against risks causing large losses relative to household income. At this point, insurance becomes a more effective method of risk management.

Insurance products aim to protect people from a low probability of catastrophic loss. By pooling the risks of many households, insurance products can potentially offer more complete protection against property, health, death, and disability risks at an annual cost that is within the household’s budget. However, insurance becomes a less effective risk management response as the degree of uncertainty and relative cost associated with a risk reach extreme levels (Brown & Churchill 1999). As a result, most mass, covariant risks, such as epidemics and natural disasters, are difficult to insure. This is especially true if an insurance provider has a relatively small customer base and operates in a contained geographic area.

Some mass, covariant risks can be insured if an insurer spreads the risk among a sufficiently large group of policyholders. By directly offering policies to people over a large, dispersed geographic area, insurers have successfully developed products that protect against natural disasters, such as hurricanes and earthquakes. However, where the expected frequency of occurrence of a mass, covariant risk cannot be reasonably predicted from historical records, or where a risk occurs often in the same region, such as flooding in Bangladesh, insurance will not be an economically viable solution for low-income households. Access to liquid savings deposits and aid from the international relief community is alternative sources for partial coverage against these risks.

Frequent Micro-Insurance Products

3.1 Frequent micro insurance products

- Life micro-insurance (and retirement savings plans)

- Health micro-insurance (hospitalization, primary health care, maternity, etc.)

- Disability micro-insurance

- Property micro-insurance – assets, livestock, housing

- Crop micro-insurance

- Insurance for theft or fire,

- Insurance for natural disasters, etc

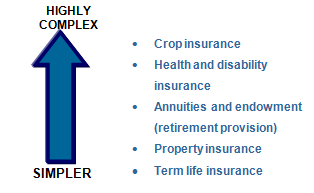

3.2 Complexity of different types of insurance policies

Complexity of different types of insurance policies is depicted in the following figure

3.3 Drawback of MFI products

In general drawback of MFI products are found to be as follows:

- Lack of knowledge of product design is very acute among the MFIs since they have never been to the risk calculation and insurance product designing.

- Lack of regulation for micro-insurance in government policy level is hindering their scope to be reinsured and work full fledged as commercial entity.

- Most of the MFIs don’t use specific methods to mitigate the risk associated with each insurance product. (Adverse selection, moral hazard and fraud)

- Majority of the MFIs don’t consider inflationary cost increase. Premium and cost is not adjusted with inflation.

3.4 List of MI Companies, Their Products as well as Target Group

| Insurer | Products | Targets | Since |

| Brac | Life (term) | Members | 1990 |

| Grameen Bank | Life, loan | Members | Early 1990s |

| ASA | Life (endown) | Micro Credit users | 1993 |

| Grameen Fisheries Foundation | Live stock (all risks) | Borrowers | Late 1990s |

| Grameen kalyan | Health | Members & family | |

| Gono Sasthya | Health | Suburban poor | |

| Padakhep | Life, Fire, Livestock(Partial) | Members | |

| Ghasful | Life (endown) | Urban poor | 1999 |

| Delta Life

Homeland Life

| Grameenr & Gono Bimas Life(endown)

Life(endown)

Life(endown)

Personal accidents

Crop, Cattle, Prawn | Low income Rural poor Urban poor Rural/Urban poor

Rural poor

Urban poor

Rural poor | 1988 1994 1996

1996

1977

1981, 1994, 1997 |

Table 1: MI products under the MFI-NGOs

3.5 Proposed framework for evaluating an insurance product

It is important to understand the three aspects of an insurance product:

- Policyholders should benefit from more than just the amount paid out if the insured risk occurs

- Providers should benefit from an additional source of income as well as the improved performance of the credit and savings portfolio.

- There is a complexity to the pricing and claims management

3.6 Components of policyholders’ benefits

The benefits policyholders receive from insurance coverage can be thought of as a function of four variables, namely:

- The size of the insurance benefit relative to the loss resulting from the covered risk

- Continuity of coverage

- Flexibility of coverage (ability to choose the amount of coverage)

- Timeliness of claims repayment

3.7 To what extent does the product cover losses?

- Time line for providing coverage?

- The length of the contract?

- Is the coverage consistent or broken up over time?

- Are there options?

- Is tailoring the product to needs an option?

- If claims are received months or years after the event, will value be the same or lower?

- How do insurance products other products in the portfolio of the institution?

- What types of expertise is required to provide process and disburse claims?

OVERVIEW OF MICRO-INSURANCE PRACTICES IN BANGLADESH

4.1 Micro insurance Status in Bangladesh

- Insurance is century back business in Bangladesh

- Under The Insurance Act 1938 (with several amended) Insurance Regulatory Authority, The Insurance Directorate under Ministry of Commerce, headed by the Chief Controller of Insurance, 62 Life and general Insurance Companies.

- Crop Insurance : Sadharan Bima Corporation (SBC) initiative in 1977.

- Crop Insurance Feasibility Study

– Ministry of Commerce, 1994

– Asian Development Bank, 1996

- Livestock Insurance.

- Delta- Life Insurance for Rural Bangladesh – Grameen Bima and Gono Bima

4.2 Insurance Companies in Bangladesh

| Insurance Companies in Bangladesh | No. |

| Public Sector Life Insurance Company | 1 |

| Private Sector Life Insurance Companies | 17 |

| Public Sector General Insurance Company | 1 |

| Private Sector General Insurance Companies | 43 |

| Total | 62 |

Table 2: Insurance Companies in Bangladesh

4.3 MFIs Involvement in Micro insurance

- Mostly MFI-Credit Life Insurance

- Basic Health and Disaster Insurance

- Not Based on Actuarial Calculation

- No Regulations

- Fraught with risk of exploitation

4.4 Distribution of Different Micro-Insurance Schemes in Bangladesh

Type of scheme | No. of schemes | Distribution |

Health | 13 | 39% |

Life | 12 | 36% |

Loans/Capital | 8 | 19% |

Livestock | 2 | 6% |

Disaster | 1 | 3% |

Total | 36 | 100 |

Table 3: Distribution of Different Micro-Insurance Schemes in Bangladesh

MODELS OF MICRO INSURANCE PROVISIONS

5.1 MODELS OF MICRO INSURANCE PROVISIONS

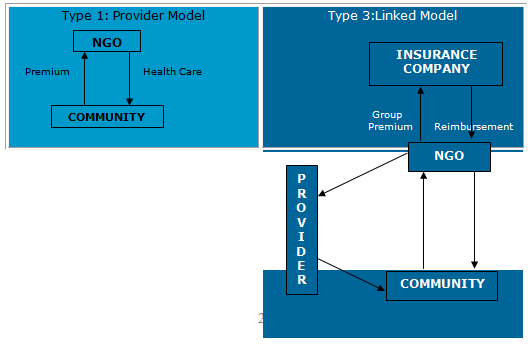

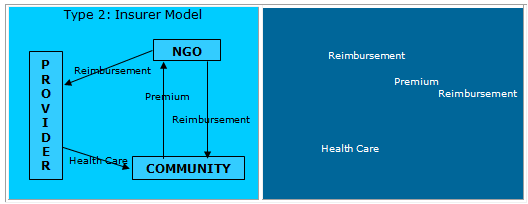

World wide three models are used to deliver micro-insurance services (Figure 4). These include:

1. Provider Model: NGO/MFI is the provider of the health care whereas the insurers take charge of the funds collected.

2. Insurer Model: NGO/CBO takes the responsibility of the funds and the associated financial risks. They purchase care either from other providers or reimburse the patients who have gone to other providers.

3. Linked Model: NGO/CBO collects premium and hands it over to a formal insurance company. So there is a minimum financial risk with NGO/CBO and their role is mainly in managing the scheme.

5.2 The main advantages and disadvantages of these three models

The main advantages and disadvantages are provided in the table 2 below:

Table 4: Advantages and Disadvantages of the Three Models of Micro-insurance

| Parameters | Provider Model | Insurer Model | Link Model |

| Freedom to suit the local market | – | Very free | Depends on the insurance companies’ products |

| Premium | Set by NGO and usually based on affordability | Set by insurance company and usually based on actual calculations | |

| Benefit package | Usually comprehensive and meets the local needs

| Traditional mediclaim policy with its exclusions and limitations | |

| Financial risk | With the NGO | With the insurance company | |

| Quality of care | Better due to NGO’s relationship with the provider | No difference in the quality of care between insured and non insured patients | |

| Community involvement | Minimal as the hospital in charge and usually too technocratic | Varies depending on the NGO | |

5.3 Name of Insurance Companies

General Insurance

| Name | Date Of Registration |

| State-owned | |

| 1. Sadharan Bima Corporation 33, Dilkusha C/A Dhaka | 1973 |

| Private | |

| 1. Bangladesh General Insurance Company Limited, 42, Dilkusha C/A Dhaka | 29-07-1985 |

| 2. Peoples Insurance Company Limited . Senakalyan Bhaban. 195, Motijheel C/A Dhaka | 31-07-1985 |

| 3. United Insurance Company Limited, Camellia House,. 22, Kazi Nazrul Islam Avenue Dhaka | 15-10-1985 |

| 4. Bangladesh Co- operative Ins. Ltd. Moon Mansion. , 12, Dilkusha C/A Dhaka | 24-10-1985 |

| 5. Green Delta Insurance Company Limited Hadi Mansion. 2, Dilkusha C/A Dhaka. | 30-12-1985 |

| ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

SWOT Analysis of MI in Bangladesh

6.1 Strengths

| Key Factors | MFIs/NGOs Perspective | Mainstream Insurance Companies Perspective |

| Product | ¨ Simple product design and packaging ¨ ¨Comprehensive coverage options (loan protection and life insurance) Diversified products (loan protection, life, health, asset/livestock insurance etc.) ¨ Affordable premium rate ¨ Short maturity time | ¨ Different simple term life insurance and life insurance products with endowment ¨ ¨Products are designed and packaged based on actuarial calculationDifferent premium rate based on clients age, sum insured amount, maturity time etc. ¨ Different maturity time ¨ Products contain various benefits ¨ Commitment to continuous improvement |

| Marketing | ¨ Set target clients usually Microfinance clients ¨ Large client base ¨ Wide providers network | ¨ Different cliental groups i.e. moderate poor, vulnerable non-poor and middle class people ¨ Concentrated business approach ¨ Country wide experienced and trained commissioned agent based marketing ¨ Reward system for commission agent |

| Operations | ¨ Simple underwriting process ¨ Easy premium collection process ( either once at a time or weekly) ¨ Relatively low administrative costs ¨ Simple claim settlement process ¨ Strongly committed staffs | ¨ Structured underwriting process ¨ Different premium collection procedures (monthly, quarterly, biannually, annually, single premium etc.) ¨ Innovative approaches Efficient management and professional staffs |

| Accounting | ¨ Books of accounts are maintained properly ¨Some organisations have automated system for Microfinance programme ¨Prepare weekly and monthly financial statements integrated with Microfinance reporting ¨Strong monitoring and internal control mechanismsInvest collected premium as revolving loan fund for higher rate of return | ¨ Proper documentation and accounts maintaining ¨ ¨Some companies have automated insurance tracking system ¨Prepare financial statements regularly Invest collected premium in government bonds and different financial instruments ¨ Financial strengths |

| Risk Management | ¨ Lower moral hazard due to long relationship and continuous visit to the clients, and strong monitoring ¨Less adverse selection due to set clients of Microfinance groupIntegration of insurance products with other products like savings and credit | ¨ Lower moral hazard due to standardised products ¨ Less adverse selection because of standard client selection format ¨ Reinsurance to minimise risks |

Table 5: SWOT Analysis – Strength

6.2 Weaknesses

| Key Factors | MFIs/NGOs Perspective | Mainstream Insurance Companies Perspective |

| Product |

| |

| Marketing | ¨ No insurance education and awareness for clients ¨ Lack of standardised marketing policy ¨ No market expansion strategy other than only concentrating on Microfinance clients ¨ Only adapt the push marketing strategy Lack of insurance knowledge among the staffs | ¨ No insurance education and awareness for diverse cliental groups ¨ Lack of standardised marketing ¨ Renewal rate is not satisfactory ¨ Uneven growth of different policies Lack of interconnectivity between head office and agencies |

| Operations | ¨ Insufficient knowledge and capacity to operate insurance programme ¨ Tendency to adjust outstanding loan with insurance claims ¨ Weak governance and management | ¨ Complex underwriting process ¨ Premium deposit difficulty ¨ Procrastination of claim settlement ¨ ¨ Poor monitoring enhances irregularities among the agentsLack of coordination among different departments ¨ Unfair business practices |

| Accounting | ¨ Limited insurance accounting knowledge ¨ Poor costing and pricing ability ¨ No separate financial statement ¨No separate sustainability and financial ratio analysisPoor Accounting and Management Information System for management decision making | ¨ Poor insurance accounting knowledge at agent office level ¨Some companies don’t have automated system for tracking insurance¨Poor Accounting and Management Information System at agent office level Inadequate tools to analyse performance of agent as well as each product |

| Risks Management | ¨ Limited ability to assess risks ¨ No compliance management system to comply with insurance regulation ¨ No policy for risks management ¨ Reinsurance is not possible ¨ Higher liquidity risks | ¨ Possibility of moral hazard due to poor monitoring of agents ¨The risk of adverse selection is higher due to weak monitoring of agents ¨Some companies don’t have reinsurance facility Some companies have liquidity risks |

Table 6: SWOT Analysis – Weaknesses

6.3 Opportunities

| Key Factors | MFIs/NGOs Perspective | Mainstream Insurance Companies Perspective |

| Product | ¨ Design product by addressing the need and demand of target market ¨Diverse and flexible product designing and packaging will enhance outreach. Product can be designed and packaged through actuarial calculation | ¨ Consider the need and demand of target market during product designing and packaging ¨ Design diverse products for different client segment

|

| Marketing | ¨ Wide untapped market ¨ Potential demand for diverse products ¨ Prospect of horizontal and vertical expansion ¨ Linkage with mainstream insurance companies | ¨ Large potential market ¨ Demand for differentiated products ¨ Possibility of horizontal and vertical expansion as people are becoming conscious about insurance ¨ Linkage with MFIs/NGOs Lower interest rate of banking sector encourages potential clients to purchase insurance |

| Operations | ¨ Potential of relatively low operating costs and enjoy economies of scale ¨Operate within the same organisational structure ¨Develop operational manual by following good practices Develop separate insurance department and gradually set up mainstream insurance company | ¨ Reduce operational cost through linkage with MFIs/NGOs( Partner-Agent Model: see next Slide) ¨ ¨Increase operational efficiency by providing specific responsibility to agents and MFIs/NGOs Develop operational manual by considering good practices ¨ Availability of professional staffs |

| Accounting | ¨ Develop expertise on insurance accounting, product costing and pricing ¨ Prepare separate financial statement ¨ Analyse sustainability and financial ratio Develop Accounting and Management Information System for management decision making | ¨ Enhance insurance accounting knowledge at agent office level through training ¨Develop automated system to track each insurance client ¨Develop Accounting and Management Information System at agent office levelDevelop effective tools and reporting system to analyse performance of agent as well as each product |

| Risks Management | ¨ Develop expertise to assess risks ¨ Follow the compliance of insurance regulation ¨ Develop risk management policy ¨Strong monitoring tools development to reduce risks of moral hazard and adverse selection¨Explore alternative of reinsurance and sign MOU with mainstreaming insurance companies in this regards Reduce liquidity risks through efficient portfolio management and invest premium amount in different financial instruments | ¨ Develop strong monitoring tools to reduce moral hazard and adverse selection ¨ ¨Sign MOU with Reinsurance companies and keep reserve for reinsurance Manage liquidity risks through efficient portfolio management and invest premium amount in different financial instruments according to investment guidelines of Insurance Act. ¨ Government support

|

Table 7: SWOT Analysis – Opportunities

6.4 Threats

| Key Factors | MFIs/NGOs Perspective | Mainstream Insurance Companies Perspective |

| Product | ¨ Regulation to design product through Actuarial calculation ¨Regulation to take approval of each product from Insurance Regulatory authority¨MFIs/NGOs may not get authorisation to offer insurance products according to regulation Regulation not to offer life and non-life insurance products together | ¨ Difficult to design products by considering needs and demand ¨ According to Insurance Regulation, life and non-life products can’t be offered together by a single entity ¨ The products may not be sustainable ¨Exclusion of large potential clients due to product features and packaging Sometimes it takes long time to get approval of product from Insurance Regulatory authority |

| Marketing | ¨ Difficult to position product due to lack of insurance knowledge among the clients ¨ ¨Might face problems both in horizontal and vertical expansion Probability of higher non-renewal or drop out ¨ Market competition | ¨ Market confusion and misconception about insurance ¨ Market expansion and penetration strategy may not be successful ¨ Emergence of market competitors ¨ Giant multinational insurance companies might enter in the market ¨ Merger and acquisition |

| Operations | ¨ Lack of knowledge and experience of staffs about insurance will hamper the growth and sustainability of insurance programme ¨ Weak governance and management will affect efficient operations

| ¨ Clients unwillingness to purchase insurance due to complex underwriting process ¨Higher non-renewal because of premium deposit difficulty ¨Probability of losing potential market and credibility due to procrastination of claim settlement ¨Irregularities and misappropriation of agent will affect efficient operations Inadequate support from MFIs/NGOs, if there is any Partner-Agent model operations |

| Accounting | ¨ Poor costing and pricing ability will make the insurance programme a losing concern in the long run ¨Limited insurance accounting knowledge may open the door to fraud ¨Without financial and sustainability analysis the insurance programme might face tremendous financial crisis Due to poor accounting and management Information System, the management may not able to take any strategic decision | ¨ Poor accounting knowledge may encourage fraudulent ¨ Poor performance analysis of agent and individual product might affect the revenue and sustainability

|

| Risks Management | ¨ Political and environmental risks ¨ Potential regulatory problems ¨Inadequate reserve for risks management and cope with liquidity risks Without reinsurance, it is not possible to settle claims during devastating natural disaster or epidemic | ¨ More moral hazard and adverse selection will affect revenue and sustainability ¨ Political and environmental risks ¨Lack of reserve for risks management and cope with liquidity risks No Reinsurance to cope with devastating natural disaster or epidemic |

Table 8: SWOT Analysis – Threats

Basic Models of Micro Insurance Provision in the aspect of Micro Finance

7.1 Full service model/Insurer model/Unit model

Under full service model, a single company undertakes all the tasks – from product design, sales and collecting premiums to reviewing claims, handling payments and even providing reinsurance. The insurance company undertakes all the insurance-related risk and deals directly with the policyholders. Commercial insurers, health care service providers and certain MFIs are examples of organizations that use the full service model. In some cases a third-party service providers may also be involved (Insurer model). For instance, in the case of health insurance, a third party may provide medical services. In specific where the insurer and service provider are the same entity, the model is known as a provider model.

These models have not been very successful in reaching lower-income groups in an efficient and effective manner. Traditionally, commercial insurers have not covered low-income households because of the high administrative and transaction costs involved in reaching these customers, particularly those in remote areas, and their lack of familiarity with the demand profile. When attempting to reach these customers they must often deal with issues of adverse selection and morel hazard, as well as a lack of actuarial information for setting premiums. MFIs face additional hurdles to offering micro-insurance products to their clients, including a lack of technical knowledge regarding insurance products, burdensome regulatory requirements, highly concentrated portfolios, and lack or reinsurance vehicles.

7.2 Community group based model

The second model is the community group-based model, under which policyholders own the insurance company and select a group form among them to manage the scheme. The group is responsible for all insurance related tasks, and may subcontract external service providers to supply specific services. Insurers in a community group-based model are typically mutual insurers, cooperatives, community-based organizations, and credit unions. This participatory model has the advantage of reducing moral hazard problems. Nevertheless, the absence of reinsurance mechanisms and the geographic concentration of risk could potentially lead to the failure of the scheme in the case of catastrophic events or large-scale claims. Finally, a sizeable investment may be required, along with long-term training and technical assistance to establish a sound administrative structure.

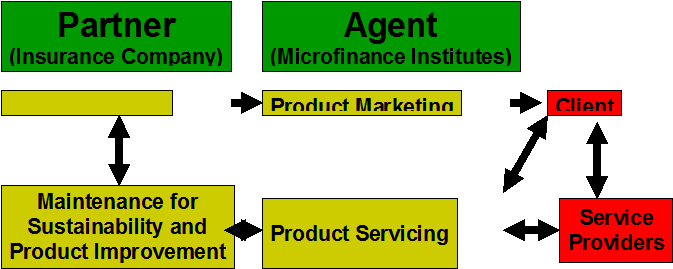

7.3 Partner-agent model/Linked model/Paradox model

The third type of micro-insurance provision scheme is the partner-agent model, under which an insurer enters into a contract with an agent who markets its products. The most popular partner-agent model used to serve low-income households is the MFI-insurer partnership. In this type of partnership, the micro-finance institutions serve as a sales agent for a commercial insurer. Four parties are involved: (i) the insurer, (ii) the agent (the MFI), (iii) the policyholder, and (iv) if applicable, the external service provider. The MFI and the insurer work together to design a product for low-income clients, and both entities negotiate the rate offered to the customer. The MFI handles marketing, premium collection, and other customer services. It also participates in claim reviews and issues payments on claims. In return, the MFI reviews a commission. The insurer absorbs all the risks, sets the final rate, pays the claims, and monitors that all legal requirements are being met.

Potential Partner-Agent Model

9.1 SUMMARY

In Bangladesh, micro-insurance is characterized by the strategy of catering income for poor and vulnerable social groups who lack purchasing power for the private services, access to quality public or private health services, and access to social security networks. This research paper constitutes a range of information on micro-insurance schemes available to ultra-poor and low-income earners in Bangladesh, as well as, their respective provider organizations. The study also explored the idea of finding a suitable and sustainable model for insurers combining micro-insurance with micro credit.

The micro-insurance concept is relatively new in Bangladesh. A small number of schemes have been in operation for more than six years while the majority has operated for three years or less. The evolution of the micro-insurance concept stems from the development and wide spread implementation of micro-credit models as a development strategy. As the viability of the credit-model was heavily constrained by contribution defaults, micro credit institutions needed to complement credit with social security type services. Today, the micro-insurance model has become an important development tool aiming to safeguard or reduce the likelihood of credit defaults by addressing certain high economic costs to credit groups and their family dependants resulting from emergency health expenditures, death of a family member, and damage to property caused by fires or natural disasters.

9.2 Conclusion

Most MFIs in Bangladesh are willing to start life insurance schemes since it is easy to design and operate and its fund generation prospect is good; but actual need in the market is for quality health care. The research finds several avenues where government can work helping the commercial insurers and MFIs to go for agent partner model and design schemes for the clients based on respective strengths. The study suggests that agent partner models are more applicable for MFIs to make the best use of the partner’s resources and own strengths. Community based models should include people form the community as owners and vocal member of the schemes. All these will ensure the sustainability and the financial feasibility of the programs.

9.3 Recommendations for microfinance institutions

- There should be a careful consideration of benefits and complexity deciding on what coverage to provide

- Clients must be involved in the design of the product in terms of amount and type of coverage

- The full service may not be a good idea to start of with given the high risk of insurance. Therefore, providing the full range or some of the more risky insurance products might be appropriate for the larger institutions.

- MFI NGOs should partner, if possible. If not they should be highly conscious of the complexity of providing Micro-insurance.

- MFI NGOs should consider how insurance can be integrated with savings

- Integration of MI into existing financial services & group, rather than individual, MI will reduce administration & transaction costs, moral hazard & advance selection.

- Cross subsidization (voluntary & policy based) from rich to poor to cover the total population/area.

- Mass education, awareness, R & D, & promotion of skills.

- Generation of information data base needed for MI

- Ensure transparency & accountability of insurers.

- Involve local community & opinion leaders in the MI process.

- Govt. subsity with donar assistance

- Provisions of reinsurance by multinationals.

- Promotions of mutual insurance.

- Partnership bet public, private organizations& MFI.

- Starting with simple procedures & products to customize to hit needs.

- Appropriate caps, deductibles / coinsurance.

- Strengthening institutional capability.

- To ensure an enabling policy regulatory framework.

- To commission some studies on climate risk & MI.

- To organize work shop on MI.