For more parts of this same post, click the links below-

Procedure of Opening L/C: A Case of Uttara Bank Limited (Part-1)

Procedure of Opening L/C: A Case of Uttara Bank Limited (Part-2)

Procedure of Opening L/C: A Case of Uttara Bank Limited (Part-3)

Procedure of Opening L/C: A Case of Uttara Bank Limited (Part-4)

Importance of L/C

In international trade since the buyer and seller are quite distant from each other a problem often arises to make the delivery of goods and when to make the payment for the delivery. This problem is absent in home trade. But in foreign trade neither the importer nor the exporter can rely completely upon the others. L/C is effective instruments that can solve this problem also act as finance for the buyer. This method is a compromise between buyer and seller because it affords certain advantage to both parties. The exporter is assured of receiving payment from the issuing bank as long as its present documents in accordance with L/C. the issuing bank is obligate to honor drawing under l./c regardless of the ability or willingness to pay. Importer does not have to pay until shipment has been made and the documents presented in good order. However the importer still rely upon the exporter to ship the goods as described in the documents, since the L/C does not guarantee that the goods purchased will be those invoice and shipped. So the usual time under a L/C is when shipment has been made. While the goods are available after payment, the risk to the exporter is very little, depending on credit term, while the risk to the importer is that he has to rely on the exporter to ship goods described in the documents. Because of all the protection and benefits it can accords both exporter and importer.

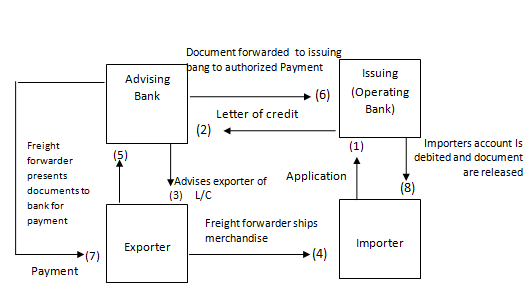

L/C procedure:

The various steps involved in the operation of credit are described as follows

- The importer and exporter have contract before a L/C has been issued.

- The importer applies for a L/C from his banker known as the issuing bank. He may use his credit lines.

- The issuing bank opens the L/C that is channeled through its overseas correspondent bank, known as advising bank.

- The advising bank informs the exporter of the arrival of the credit.

- Exporter ships the goods to the to the importer or other designed place as stipulated in the L/C.

- Meanwhile the exporter also prepares his own documents and collects transport documents or other documents from relevant parties. All documents will be sent to his banker, which is acting as negotiating bank.

- Negotiation of export bills occurs when the banker agrees to provide him with finance. In such case he obtains payment immediately upon presentation of documents. If not the documents will be sent to the issuing bank for payment or an approval basis in the next step.

- Documents are sent to issuing banker reimbursing bank, which is a bank nominated by the issuing bank to honor reimbursement from negotiating bank for reimbursement or payment.

- Issuing bank honors to its undertaken to pay the negotiating bank on condition that the documents comply with the L/C terms and conditions.

- Issuing bank releases documents to the importer when the letter makes payment to the former or against the letter trust receipt facilities.

- The importer takes delivery of goods upon presentation of the transport (usually shipping documents).

Parties involved in letter of credit

The applicant:

The applicant is the parties who generally approaches in order to issue the L/C. generally the applicant ids the exporter who reaches an agreement with the exporter before approach in the bank to issue the L/C.

The issuing bank;

The bank issuing the L/C is known as issuing bank and it is usually the bank with which the importer maintains an account. The issuing bank undertakes an absolute obligation to pay upon presentation of documents.

The advising bank:

The correspondent bank sends the L/C is commonly referred to as advising bank. The advising bank simply advises the L/C without any obligation on its part. However, the advising bank shall take reasonable care to check the apparent authenticity of the credit that it advises.

The beneficiary:

The beneficiary or exporter is the party entitled to draw payment under L/C. The Beneficiary will have to present the required documents to avail payment under L/C.

The Confirming bank:

The confirming bank confirms that the issuing bank has issued a letter of credit. The confirming directly obligated on the credit to the extent of its confirmation and by confirming it acquires the right and obligation of an issuer.

The negotiating bank;

The bank that agrees to examine the documents under the L/C and pay t5he beneficiary is called the negotiating bank. Typically, the advising bank is nominated as the negotiating bank.

Back to back L/C

Back to back L/C is mostly issued in Bangladesh. When a beneficiary receives a letter of credit, which is not transferable, and he cannot furnish the goods himself, he may arrange with his banker to issue a second credit, which is known as back-to-back L/C to supplier to supply the goods.

As both L/C cover the same goods the back to back credit must be issued with identical terms to the muster L/C, except that the credit amount, unit price if any are smaller. The expiry date under the back-to-back credit is earlier while the latest shipment date may have to be advanced. The bank issuing back-to-back credit will obtain repayment through muster credit, which is deposited to the issuing bank of the back-to-back credit. The bank must try to maintain control of the documents and hold them after payment to the supplier pending receipt of its customer’s invoices and present the documents itself for payment under the muster credit in favor of its customer.

Advantage and disadvantage of L/C

Advantages

- An importer can assure that the exporter has complied with certain terms and condition as specified in L/C before payment.

- Importer can insist on shipment of goods within a certain time stipulated a latest shipment date.

- He can get advice from the banker according to L/C terms.

- He can ask for financial assistance from the banker.

- Protection offered by UCP500.

Disadvantages

- Since bank deals with documents only goods may not be the same as those specified in the credit.

- Issuing bank obliged to pay even though the conditions of goods may be poor.

- L/C commission is relatively high.

Advantages for exporter

- The risk for nonpayment is lower as complies provided with L/C.

- It is a safe method through which prompt payment obtains after shipment.

- Exporter can get expertise advice from the banker.

- The exporter can get financial assistance before the buyer makes payment.

Disadvantages

- Sometimes terms and condition cannot fulfill such as unreasonable shipment date adding on L/C the clause of “restriction of a designated vessel to be informed by L/C amendment

- The goods shipped before receiving payment and so it is not 100 percent safe.

Main business of Foreign exchange department

The primary business of foreign exchange department of Barisal branch is to make reimbursements and payments on behalf of the issuing bank. Besides acting as the correspondent bank for reimbursing bank or the payee bank, branch also advice s negotiates, and confirm letter of credits. Acting as the negotiating and confirming Barisal branch earns a commission, which is a percentage of the total L/C amount. This

Percentage varies depending on the risk of non-payment by the importer. On the other hand branch earns a flat rate fixed commission when it acts as the advising bank as well as when it authorized to make reimbursement on behalf of the issuing bank. Reimbursement made either to ACU Dollar account AMEX Calcutta, or to US$ dollar account in AMEX new York. These reimbursements contribute to major portion revenue of foreign exchange department.

Service offered by foreign exchange department of Uttara branch

Barisal branch offered a wide services for its relationships other bank and clients both home and aboard. These service are related to trade finance, international payment, investment, trading services.

Credit items

- Letter of credit (L/C) negotiation

- Letter of credit (L/C) confirmation.

Non-credit items

- Letter of credit (L/C) advising.

- Reimbursement authorizations.

- Payment instruction.

- Export bills collections.

Foreign Remittance

All types of L/C money, student’s fees, and other charges are sending to foreign country through remittance. After negotiation between importer and exporter, getting all documents, payments of goods are made to the exporter bank (advising bank) from U.S.A. Amex bank. but must be arrangement with that bank. After entering the goods in the importer country, getting bills of entry from the custom, exporter send all documents to the issuing bank. Issuing bank then judge the accurateness of these documents and calculate total due with interest, commission, and other charges, deduct amount of margin that was prepaid while opening L/C after preparing dock statement-all the entry transaction is reported to a c-form to Bangladesh bank where total foreign currency record is maintain in commodity wise.

Problems of foreign exchange remittance

- Still many country of the world has not open exchange house like Japan, Korea, Canada , Belgium and others so clients cannot get promptly remittance.

- Every year many exporter collect cash assistance by showing false documents to Bangladesh bank. As a result much currency are go away of the country that are a major problem for import and foreign currency of the country.

- As still there Is no remittance with many countries taking this opportunities one class of broker are benefited, dollars are going away of the country, the rate of exchange of Tk. are decreases.

Solutions of cash remittance problems

- Adequate measure have been taken for quick remittance , exchange warehouse have to set in each country where Bangladeshi are available.

- Cash remittance may be a profitable sources of foreign income in th absence of others export business.

- Adequate rewards have to be given all those foreign Bangladeshi who send their money through remittance.

- Card system has to introduce opening a nostros account of each individual-then amount of cash remittance will be increases.

Suggestion for the Management for Future Improvement

Developing team sprit–manager have to take details information regarding employees i9ncome family, no of children, where they study, personal problem, claim of works and have to give solution for them, So those in case of any officer absence they can run official works cooperative with others and develop team spirit in their works.

- Make cautious to every Employee: Management has made cautious to every employee that they to work with make out, and opening their eyes and ear so that any mistake cannot occur in their works.

- Reducing all unnecessary charges: Manager has cautious about branch profit so unnecessary charges have to reduce.

- Proper utilization of Branch Resources: Branch has to use all resources, such as capital. Funds, deposit, loans and advances, assets, equipment properly. Manager has to use the work force properly, so that some of the employees cannot spend their time idly while others do works.

- Placement of officer to reduce workloads: Management has to write letter to head office for providing them more qualified staff to increase efficiency of the branch. Modern technology- management has to take measure for arrangement of modern technology to speed up works and reduce their labor.

- Q- Cash or ready cash services-n: In order to tackle competition, and speed up customer branch need to introduce new services, such as ready cash, or q-cash like other private bank- to increase customer satisfaction, and no. Of clients. As customer always interested about new services like ready cash that can reduce their time, cost risk, traffic jam. In ready cash system they can with draw their money from any branch where he intentioned, not need physically present that branch.

- Strictly followed of business ethics: Manage have to care about following of business ethics in all the activities-not take any gift from customer- in case of offer tactfully avoid gift.

- Not pending of official works: Management have to cautious about not pending of works, sending report to the head office accurate time, sending advice’s, TRV to different branch to appropriate time, quickly response to audit report.

- Shift the branch in suitable location: As customer feels many disturbances to come here so the branch has to be shifted in a suitable location with parking facility.

- Improving working environment: As the branch has space limitation, seating place, so management have to improve working environment. Branch need separate place for officials and customer saying prayers.

- Increasing deposits: As branch deposits are comparatively low than loans and advance so branch need to take measure to increase deposit through opening new clients account.

- Human resources development: Management always has to emphasis on human resources development of the branch they have not rely only on few employees. Management has to take measure for employee training for future improvement of their skills.

- Expanding service range: Branch should expand services range; they should introduce new service that are not copied by the competitor as well as service offered by competitor bank.

- Increasing branch assets: Branch has to emphasis on increasing its own assets, it should buy own building, purchases more equipment, and other assets to reduce extra charges.

- Implementation of new Pascal. As employees has strong expectation about to implement of new pay scale. It is great expectations that new pay scale have already design for them so management should immediately implement the new scale to increase their motivation level.

- Making list of non performer of the branch: Some of the employees who idly spend their time or busy other business branch need to make of those non-performer and take immediate action towards them such as suspend, demotion, transfer, fine etc.

- Work ethics: Employee of the branch has to be followed work ethic in all-official activities.

- Client satisfaction:Management should always work for their client satisfaction .they should listen customer complaint and take remedies to solve these. They should take all necessary arrangement for customer satisfaction through improvement of branch environment, location, security, parking facility new service etc.

- Customer retention: Management has to take steps to retain customer. They should build a strong relationship with their existing customer so that they cannot swift away to competitor bank. Because retention is six time important than attention of new customer.

- Expanding investment base: Branch should expand investment base, they should not depend only on limited sector of investment, they should invest all profitable sector to increase their profit and maintain growth level.

- Reducing bank charges where necessary: Branch should reduce charges for price sensitive customer especially who transaction high volume of business.

- Being more marketing oriented: Branch has to take more marketing oriented for success in future. They should take strategic marketing plan to increase their profit and growth.

A problem service organization face is that they may be unaware of all the capabilities they have. This is due to bank intangible elements particularly human skills and aptitude. Organization fails to audit all the areas to manage the farm capability. This is because intangibility of their capability.

The particular range of services offered will be developed in response to internal needs and external influences. Customer and user perceptions of product lines can often give services marketer insight into ways in which service product mix should extended or reduced service product lines stretched or shortened.

Letter of Credit (L/C):

Letter of Credit (L/C) can be defined as a credit contract whereby the buyer’s bank is committed (on behalf of the buyer) to place an agreed amount of money at the seller’s disposal under some agreed conditions. Since the agreed conditions include, amongst other things the presentation of some specified documents, the letter of credit is called Documentary Letter of Credit.

An arrangement, however named or described, whereby a bank (the “Issuing Bank”) acting at the request and on the instructions of a customer (the “Applicant”) or on its own behalf.

- Is to make a payment to or to the order of third party (the beneficiary) or is to accept any pay bills of exchange (Drafts) drawn by the Beneficiary, or

- Authorizes another bank to effect such payment, or to accept and pay such bills of exchange (Drafts).

- Authorizes another bank to negotiate, against stipulated documents, provided that the terms and conditions are complied with.

Types of Letter of Credit:Documentary credits may be either:

- Revocable Letter of Credit.

- Irrevocable Letter of Credit.

Revocable Letter of Credit:

A revocable credit is a credit, which can be amended or cancelled by the issuing bank at any time without prior notice to the seller.

Irrevocable Letter of Credit:

An irrevocable credit constitutes a definite undertaking of the issuing bank (since it cannot be amended or cancelled without the agreement of all parties thereto), provided that the stipulated documents are presented and the terms and conditions are satisfied by the seller. This sort of credit is always preferred to revocable letter of credit.

Parties to a Letter of Credit (L/C):

There are a number of parties involved in a L/C and the rights and obligations of the different involved parties also differ from each other. The involved parties can be named below:

- Importer/Buyer.

- Opening/Issuing Bank.

- Exporter/Seller/Beneficiary.

- Advising Bank.

- Confirming Bank.

- Negotiating Bank.

- Paying/Reimbursing Bank.

Importer/Buyer: Importer/Buyer is the person who requests/instructs the opening bank to open a L/C. He is also called the opener or the applicant of the credit.

Opening/Issuing Bank:It is the bank which opens/issues a L/C on behalf of the importer. It is also called the importer’s/buyer’s bank.

Exporter/Seller/Beneficiary:Exporter/Seller/Beneficiary is the party in whose favor the L/C is established.

Advising Bank:It is the bank through which the L/C is advised to the exporter. It is situated in the exporter country and it may be a branch of the opening bank or a correspondent bank.

Conforming Bank: It is a bank which adds its confirmation to the credit and it is done at the request of the issuing bank. The confirming bank may or may not the advising bank.

Negotiating Bank:It is a bank which negotiates the bill and pays the amount to the beneficiary. It has to carefully examine the documentary credit before negotiation in order to see whether the documents apparently are in order or not.

Paying /Reimbursing Bank: It is a bank from which the bill will be drawn (as per condition of the credit). It is nominated in the credit to make payments against stipulated documents complying with the terms and conditions of the credit. It may or may not the issuing bank.

Importer/Buyer Procedure or Formalities:

- Procurements of IRC (Import Registration Certificate) from the concerned authority.

- Signing purchase contract with the seller.

- Requesting the concerned bank (importer’s/issuing bank) to open a L/C on behalf of the importer favoring the exporter.

- The issuing bank opens or issues the L/C in accordance with the request of the importer and request another bank (advising bank) located in the exporter’s country to advice the L/C to the beneficiary.

- The advising bank advises or informs the seller that the L/C has been issued.

- As soon as the exporter receives the L/C and is satisfied that he can meet the L/C’s terms and conditions, he is in a position to make shipment of the goods.

- After making shipment of goods in favor of the importer, the exporter submits the documents to the negotiating bank for negotiation.

- The negotiating bank examines the documents and if found in order, negotiates the documents and send them to the issuing bank.

- After receiving the documents the L/C issuing bank also examines the documents and if found in order makes to the negotiating bank.

- The L/C opening bank then the importer to receive the documents on payment.

- The importer after paying all the dues receives the documents from the L/C issuing bank and releases the imported goods from the port authority.

Import Procedure Including Registration:

To carry on the business of import, the first thing one need is registration with the licensing authority. To get this registration the interested person submits the application along with the following papers or documents directly to the Chief Controller of Imports AND Exports or the respective Zonal Offices of CCI and E.

- Income tax registration certificate.

- Nationality certificate.

- Certificate from Chamber of Commerce and Industry or Registered Trade Association.

- Bank Solvency Certificate.

- Copy of Trade License.

- Any other documents if required by CCI and E.

On receiving application the respective CCI and E offices will examines the documents and conduct physical verification and issue demand notice to the prospective importers to submit the following papers through their nominated bank.

- Original Copy of Treasury Challan deposited as IRC fees.

- Asset certificate.

- Affidavit from 1st class Magistrate.

- Rent receipt.

- Two copies of passport size photograph.

- Partnership deed in case of partnership firms.

- Certificate of Registration, Memorandum, Articles of Association in case of limited company.

The nominated bank of the applicant will scrutinize the documents and verify the signature of the applicant. After scrutinization and verification, the nominated bank will forward the same to the respective CCI and E office with forwarding schedule in duplicate through bank’s representative. The CCI and E office will ac knowledge on duplicate copy of the forwarding schedule and return back the same to the bank representative.

On being satisfied, after scrutinization of the documents, the respective zonal offices of CCI and E will issue Import Registration Certificate (IRC) to the applicants.

Typical Letter of Credit (L/C):

If the relationship with the customer is good, other methods of financing can make business transactions easier. We might want to consider three special types of letters of credit that offer more flexibility:

1. Revolving Letter of Credit (L/C): This is useful when shipping a variety of goods to an established customer. It normally runs a period less than one year and it provides for prompt reinstatement when drawn against.

2. Assignable Letter of Credit (L/C): This type the same as the normal letter of credit, except that it includes the phrase “and/ or assignees” following the name of the beneficiary. This allows the exporter to make his or her domestic purchase by using the overseas buyer’s credit. That is, we agree that payment for the letter of credit may be made to us U.S. suppliers. This is a way for an exporter to conduct business with limited capital.

3. Banker’s Acceptances: As our business grows we will want to extend credit to our importer. One of the most efficient methods of doing this is through a banker’s acceptance. After agreeing to the terms (e.g. 90 days at sight), the importer opens a draft (check) under a letter of credit in favor of the exporter (beneficiary). The exporter presents the draft and the requested shipping documents to the paying bank. The bank reviews the documentation for correctness, then “accepts” the draft to become payable (mature) in 90 days, or if the exporter requires, “accepts” the draft and discounts the amount because of the need for immediate funds.