For more parts of this same post, click the links below-

Procedure of Opening L/C: A Case of Uttara Bank Limited (Part-1)

Procedure of Opening L/C: A Case of Uttara Bank Limited (Part-2)

Procedure of Opening L/C: A Case of Uttara Bank Limited (Part-3)

Procedure of Opening L/C: A Case of Uttara Bank Limited (Part-4)

Introduction

A standard, commercial letter of credit (L/C) is a document issued mostly by a financial institution, used primarily in trade finance, which usually provides an irrevocable payment undertaking.

The letter of credit can also be source of payment for a transaction, meaning that redeeming the letter of credit will pay an exporter. Letters of credit are used primarily in international trade transactions of significant value, for deals between a supplier in one country and a customer in another. In such cases the International Chamber of Commerce Uniform Customs and Practice for Documentary Credits applies. They are also used in the land development process to ensure that approved public facilities (streets, sidewalks, storm water ponds, etc.) will be built. The parties to a letter of credit are usually a beneficiary who is to receive the money, the issuing bank of whom the applicant is a client, and the advising bank of whom the beneficiary is a client. Almost all letters of credit are irrevocable, i.e., cannot be amended or canceled without prior agreement of the beneficiary, the issuing bank and the confirming bank, if any. In executing a transaction, letters of credit incorporate functions common to giros and Traveler’s cheques. Typically, the documents a beneficiary has to present in order to receive payment include a commercial invoice, bill of lading, and documents proving the shipment was insured against loss or damage in transit. However, the list and form of documents is open to imagination and negotiation and might contain requirements to present documents issued by a neutral third party evidencing the quality of the goods shipped, or their place of origin.

Origin Of the report:

A requirement for my Bachelor of Business Administration Program I have Conducted this report on “L/C Opening Procedure by Uttara Bank Limited.” During the project I am required to prepare a report on the organization where I have been attached. My Supervisor Mrs. Momena Akhter, Lecture of Business Administration “DhakaInternationalUniversity” Bangladesh assigned this topic to me.

Objectives of the report:

The following are the general and specific objectives of the report:

General Objectives:

The General objectives of the report are follows

- To fulfill the academic requirements of Project report.

- To acquire experience in different banking service of Uttara Bank.

Specific Objectives:

The specific objectives of the report are follows:

- To present an overall banking activities.

- To gather knowledge.

- To get a clear idea about Banks and how it runs and what funktion it dose

Scope of the Report:

The scope of the report is only limited to Letter of credit and Dar-Us-Salam Road Branch of Uttara Bank Ltd. The report covers its overall department wise function, structure and performance. The report also covers details about Uttara Bank Ltd.

Sources of data:

The Primary Sources of Data:

The primary sources of data are as flows;

- Face-to-face conversation with the respective officers and stuff of the branch and head office.

- Face-to-face conversation with the clients visited the branch.

- Practical work experience in the different desk of the department of the branch covered.

- Relevant field study as provided by the officer concern.

The Secondary Sources of Data:

Secondary sources of data are flows;

- Annual report of Uttara bank Ltd.

- Website of Uttara bank Ltd.

- Various book articles regarding general banking functions.

- Different procedure manual published by Uttara bank Ltd.

- Different circular sent by Uttara bank Ltd. and Bangladesh Bank.

Data Collection Method:

Relevant data for this report has been collected primarily by direct investigations of different records, papers, documents, operational process and different personnel. The interviews were administrated by formal and informal discussion. No structured questionnaire has been used. Information regarding office activities of the bank has been collected through consulting bank records and discussion with bank personnel.

Data processing:

Data collected from secondary sources have been processed manually and qualitative approach has been used through the study.

Data analysis and interpretation:

Qualitative approach has been adopted for data analysis and interpretation taking the processed data as the base. So the report relies primarily on an analytical judgment and critical reasoning.

Methodology:

This report has been prepared on the basis of experience gathered during the period of internship. For preparing this report, I have also get information from annual report and website of the Uttara bank limited. I have presented my experience and finding by using different charts and tables, which are presented in this analysis part.

Limitations:

- It was very different to collect the information from various personnel for the job constrain.

- Bank policy was not disclosing some data and information for obvious reasons.

- Due to the time limitation many of the aspects could not be discussed in the present report.

- Since the bank personnel’s ware very busy, they could provide me little time.

- Another significant problem faced during the preparation of this report was the contradictory explanation of a single subject by different employee.

- Because of the limitation of information some assumption was made. So there may be some personal mistake in the report.

Historical Background of Uttara Bank Limited:

Uttara Bank formed in 1972 as a scheduled bank with assets and liabilities of the Eastern Banking Corporation set up in East Pakistan on 28 January 1965. It started banking business 22 June 1965 and became a member of the Dhaka Clearing House on 17 September 1965. At the time of establishment, Eastern Banking Corporation had a paid up capital of Tk 1.42 million and deposit resources of about Tk 10 million. It was the only scheduled bank formed with capital raised entirely from the small income group of people of East Pakistan.

Eastern Banking Corporation was nationalized under the Bangladesh Banks Nationalization Order 1972 and its name was changed to Uttara Bank. At that time, the bank had 182 branches. The government retracted 95% of its share capital and allowed it to operate as a private bank. It was transformed into a limited company on 15 September 1983. On 31 December 2000, the authorized capital of the bank was Tk 200 million divided into 2 million ordinary shares of Tk 100 each. It issued and paid up capital was Tk 100 million, of which Tk 5 million is subscribed by the government. The bank is listed with both Dhaka and Chittagong Stock Exchanges.

The bank performs all traditional commercial banking functions. It renders agency services to the government in food procurement and collection of government revenue through the network of its branches all over the country. The total volume of foreign exchange business handled by the bank during 1998-99 amounted to Tk 16,600 million which comprised exports servicing Tk 4,450 million, imports financing Tk 10,560 million and remittances facilities Tk 1,590 million. The bank has correspondent relationships with 300 foreign banks/bank offices and exchange houses in 72 countries. With the objective of attracting the Bangladeshi wage earners abroad and the non-resident foreigners to invest in Bangladesh, the bank offered them the opportunity to open non-resident foreign currency deposit accounts and foreign currency current deposit accounts with it. Further, the bank floated Wage Earners’ Development Bond and established Wage Earners Investment Cell. The bank has some other schemes to induce the wage earners to invest their savings in the securities market of the country.

The volume of deposits at the bank in 1972 was Tk 4.43 million of which Tk 2.44 million comprised demand deposits. Prior to privatization in 1983, the deposits were Tk 21.81 million and their volume increased to Tk 24,730 million in December 2000. Total loans and advances including bills purchased and discounted amounted to Tk 2.34 million in 1972 and Tk 22,307 million in December 2000. The interest rate offered by the bank on the savings deposits in both rural and urban areas is 7.25%, while the lending rates charged by it on different sectors varied between 10% and 16.5%, the lowest being charged on export credits. The broad economic areas in which the bank provided lending and the total outstanding amount of advances to those areas upto June 1999 were

(a) Agriculture and fisheries Tk 26 million,

(b) Small and cottage, large and medium sized industry Tk 4,675 million,

(c) Retail/wholesale trade and hotels and restaurants Tk 2,202 million,

(d) Transport/communication and storage Tk 169 million,

(e) Special credit programmes including poverty alleviation Tk 134 million,

(f) insurance, real estate and business services Tk 5,523 million, and

(g) Others Tk 3,771 million.

In December 2000, the total assets including off-balance sheet items of the bank were valued at Tk 31,296.5 million. The quality of assets was severely deteriorated due to accumulation of a huge amount of non-performing loans. The bank’s classified loans amounted to Tk 7,372 million in December 2000. The bank’s investments in government securities, treasury bills, debentures and shares and other approved securities were Tk 108.5 million in 1972 and Tk 2,564 million in 1999. Up to December 1999, its loans to the government amounted to Tk 50 million. In addition, the bank lent Tk 115 million in 1999 in poverty alleviation projects and Tk 129 million in a special project called Uttaran, the objective of which was to assist the customers with credit facility for buying consumer goods.

In 2000, the total and net income of the bank was Tk 3,060 million and Tk 1,040 million respectively. The bank’s net interest income increased during the period from 1992 to 2000. But the increase in operating expenses arrested the growth of its net income. Also, the compulsory maintenance of provisions for classified loans from profit is responsible for slow growth of its net income.

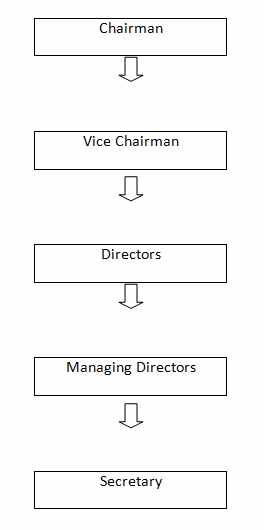

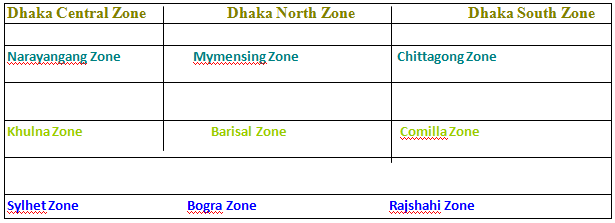

The management of the bank is vested in a 15-member board of directors consisting of a chairman and 14directors. The managing director is the chief executive assisted by a deputy managing director and 2 assistant managing directors. In 2001, the bank had 198 branches (150 urban and 48 rural) and the number of employees in all its branches 2,822 including 84 executives, 1,756 officers, 326 assistant officers, and 656 employees of non-officer grades. The bank’s branch banking is supervised through its 12 zonal offices in different parts of the country.

Corporate Information Of Uttara Bank Limited:

| Name of the Company: | Uttara Bank Limited |

| Legal Form: | Uttara Bank Limited had been a nationalization bank in the name of Uttara Bank under the Bangladesh Bank (Nationalization) order 1972, formerly known as the Eastern Banking Corporation Limited which was started functioning on and from 28.01.1965. Consequent upon the amendment of Bangladesh Bank (Nationalization) Order 1972, the Uttara Bank was converted into Uttara Bank Limited as a public limited company in the year 1983. The Uttara Bank Limited was incorporated as a banking company on 29.06.1983 and obtained business commencement certificate on 21.08.1983. The Bank floated its shares in the year 1984. It has 211 branches all over Bangladesh through which it carries out all its banking activities. The Bank is listed in the Dhaka Stock Exchange Ltd. and Chittagong Stock Exchange Ltd. as a publicly quoted company for trading of its shares. |

| Registered Office: | 90,Motijheel Commercial Area, Dhaka-1000, Bangladesh.GPO Box:818 & 217 |

| Telephone: | PABX 9551162 |

| Telefax: | 88-02-7168376,88-02-9553081,88-02-9560820 &88-02-9568941 |

| Cable: | BANKER |

| Swift Code: | UTBLBDDH |

| E-mail: | Uttara@citecho.net,ublmis@ciutechho.net,ubldgen@uttarabank.com |

| Web Site: | www.uttarabank-bd.com |

| Chairman: | Mr. Azharul Islam. |

| Vice Chairman: | Mr. Iftekharul Islam. |

| Managing Director: | Mr. Shamasuddin Ahmed. |

| Coimpany Secretary: | Mr.Md. Fazlur Rahman. |

| Auditors: | M/S. M. M. Rahman & Co.Chatered Accountants.M/S Rahman Mostafa Alam &Co.Chartered Accountants. |

Uttara Bank at a Glance

- UBL is one the largest private banks in Bangladesh

- It operates through 199 fully computerized branches ensuring best possible and fastest services to its valued clients.

- The bank has more than 600 foreign correspondents worldwide.

- Total number of employees nearly 3,000.

- The Board of directors consists of 14 members.

- The banks is headed by the Meaning Director who is the Chief Executive Officer

- The head office is located at Bank’s own 18-storied building at Motijheel, the commercial center of the capital, Dhaka.

| UBL Networks | |

| Corporate offices (corporate branch & Local office) | 2 |

| Regional office | 12 |

| World wide affiliates | 600 |

| Total Branches (including corporate branch & local office) | 202 |

| Authorized Dealer Branches | 38 |

| Treasury & Dealing Room | 1 |

| Training Institute | 1 |

| Man power | 300 |

The Board of Directors is the Apex Body of the Bank

EXECUTIVE COMMITEE

Chairman-Azharul Islam

Vice Chairman-Iftekharul Isalam

Directors-

Shah Habibul Haque

Col. Engr. M.S. Kamal (Retd.)

Dr. Md. Rezaul Karim Mazumder

Lt. Col. Dewn Zahedur Rahman (Retd.)

Managing Director-Shamsuddin Ahmed

Secretary-Md. Fazlur Rahman

DIFFERENT WINGS

HEAD OFFICE

- Chairman Secretariat

- Managing Director’s Secretariat

- Board Department

- Share Department

- MIS & Computer Department

- Establishment Department

- Stationary &Records Department

- Transport Department

Human Resources Division

- Personnel Department

- Test Key Department

- Disciplinary Department

Marketing Division

- Business Development Department

- Branches Department

- Engineering Department

- Public Relations Department

Credit Risk Management Division

- Credit Approval Department

- Credit Admin & Monitoring Department

- Credit Marketing Department

- Credit Recovery Department

Central Accounts Division

- Accounts Department

- Reconciliation Department

International control & Compliance Division

- Audit & Inspection Department

- Monitoring Department

Compliance Department

REGIONAL OFFICES

Functions of Uttara Bank Ltd.

The functions of Uttara bank Ltd. are divided into two categories:

i) Primary functions, and

ii) Secondary functions including agency functions.

i) Primary functions:

The primary functions of Uttara Bank Ltd. include:

a) accepting deposits; and

b) granting loans and advances;

a) Accepting deposits

The most important activity of the Uttara Bank Ltd. is to mobilize deposits from the public. People who have surplus income and savings find it convenient to deposit the amounts with banks. Depending upon the nature of deposits, funds deposited with bank also earn interest. Thus, deposits with the bank grow along with the interest earned. If the rate of interest is higher, publicare motivated to deposit more funds with the bank. There is also safety of funds deposited with the bank.

b) Grant of loans and advances

The second important function of Uttara Bank Ltd. is to grant loans and advances. Such loans and advances are given to members of the public and to the business community at a higher rate of interest than allowed by banks on various deposit accounts or both.

The rate of interest charged on loans and advances varies depending upon the purpose, period and the mode of repayment.

The difference between the rate of interest allowed on deposits and the rate charged on the Loans is the main source of Uttara Bank Ltd’s income.

i) Loans

A loan is granted for a specific time period. Generally, Uttara Bank Ltd.grant short-term loans. But term loans, that is, loan for more than a year, may also be granted.

The borrower may withdraw the entire amount in lump sum or in installments. However, interest is charged on the full amount of loan. Loans are generally granted against the

security of certain assets. A loan may be repaid either in lump sum or in installments.

ii) Advances

An advance is a credit facility provided by the Uttara Bank Ltd. to its customers. It differs from loan in the sense that loans may be granted for longer period, but advances are normally granted for a short period of time. Further the purpose of granting advances is to meet the day to day requirements of business. The rate of interest charged on advances varies from bank to bank. Interest is charged only on the amount withdrawn and not on the sanctioned amount.

Modes of short-term financial assistance

Uttara Banks grant short-term financial assistance by way of cash credit, overdraft and bill discounting.

a) Cash Credit

Cash credit is an arrangement whereby the Uttara bank Ltd. allows the borrower to draw amounts up to a specified limit. The amount is credited to the account of the customer. The customer can withdraw this amount as and when he requires. Interest is charged on the amount actually withdrawn. Cash Credit is granted as per agreed terms and conditions with the customers.

b) Overdraft

Overdraft is also a credit facility granted by bank. A customer who has a current account with the bank is allowed to withdraw more than the amount of credit balance in his account. It is a temporary arrangement. Overdraft facility with a specified limit is allowed either on the security of assets, or on personal security, or both.

c) Discounting of Bills

Uttara Banks provide short-term finance by discounting bills, which is, making payment of the amount before the due date of the bills after deducting a certain rate of discount. The party gets the funds without waiting for the date of maturity of the bills. In case any bill is dishonored on the due date, the bank can recover the amount from the customer.

ii) Secondary functions

Besides the primary functions of accepting deposits and lending money, Uttara banks perform a number of other functions which are called secondary functions. These are as follows –

a) Issuing letters of credit, traveler’s cheques, circular notes etc.

b) Undertaking safe custody of valuables, important documents, and securities by providing safe deposit vaults or lockers;

c) Providing customers with facilities of foreign exchange.

d) Transferring money from one place to another; and from one branch to another branch of the bank.

e) Standing guarantee on behalf of its customers, for making payments for purchase of goods, machinery, vehicles etc.

f) Collecting and supplying business information;

g) Issuing demand drafts and pay orders; and,

h) Providing reports on the credit worthiness of customers.

Map of Bangladesh Showing the Branches of UBL

Branches of UBL in Dhaka

| AGRABAD BRANCH | Contact Person |

| 74, Agrabad C/A. | Manager |

| Chittagong-4100 | Tel: 880-31-715846 |

| Mobile 01711-802218, | |

| E-mail: ublagr@ctpath.net agrabad@uttarabank-bd.com | |

| BANGABANDHU AVENUE BRANCH | Contact Person Manager |

| 12 Bangabandhu Avenue | Tel: 880-2-9554034 9569396 |

| Dhaka-1000 | E-Mail: ublbba@dhaka.net |

| bbavenue@uttarabank-bd.com | |

| BANIJYA SHAKHA BRANCH | Contact Person |

| 42, Dilkusha C/A (Ground Floor) | Manager |

| Dhaka-1000 | Tel: 880-2-9559343 ,9561046 |

| E-Mail: ublban@dhaka.net | |

| banijya@uttarabank-bd.com | |

| BARISAL BRANCH | Contact Person : |

| Aryya Laxmi Bhaban | Manager |

| Sadar Road Barisal-8200 | Tel: 880-2431-52175,53367 Mobile 01711-802214 |

| E-mail: ublbsl@bttb.net.bd barisal@uttarabank-bd.com | |

| BOGRA BRANCH | Contact Person |

| Habib Mansion (1st floor) | Manager |

| Kabi Nazrul Islam Road Bogra-5800 | Tel: 880-51-66228 ,73439 Mobile 01711-802258, |

| E-mail:ublbogura@dhaka.net bogra@uttarabank-bd.com | |

| CHAWKBAZAR BRANCH | Contact Person |

| 5,Begum Bazar Dhaka-1100 | Manager |

| Tel: 880-2-7319173 ,7312168 | |

| Mobile 01711-802239,01711-361572 | |

| E-mail: ublckbd@aitlbd.net | |

| chawkbzrdhk@uttarabank-bd.com | |

| COMILLA BRANCH | Contact Person |

| Dipika Cinema Building, Kandirpar, | Manager Tel: 880-81-76271 |

| Comilla-3500 | Mobile 01711 802225 |

| E-mail: ucomilla@dhaka.net | |

| comilla@uttarabank-bd.com | |

| CORPORATE BRANCH | Contact Person |

| Uttara Bank Bhaban | Manager |

| 90,Motijheel C/A | Tel: 880-2-9568186 |

| Dhaka-1000 | Mobile 01711 802233 |

| E-mail: ublcorp@dhaka.net | |

| corporate@uttarabank-bd.com | |

| DAR-US-SALAM BRANCH | Contact Person |

| 5-D, Dar-us-Salam Road | Manager |

| Mirpur-1, Dhaka-1216 | Tel: 880-2-8021865 ,7291801(R), |

| Mobile 01711-802250 | |

| E-mail: ubldar@dhaka.net | |

| darussalam@uttarabank-bd.com | |

| DILKUSHA BRANCH | Contact Person |

| 54, Dilkusha C/A | Manager |

| Dhaka-1000 | Tel: 880-2-9551718 ,9551856 |

| E-Mail: ubldilk@dhaka.net | |

| dilkusha@uttarabank-bd.com | |

| ENGLISH ROAD BRANCH | Contact Person |

| 9/A, Malitola Lane (North South | Manager |

| Road), Dhaka-1100 | Tel: 880-2-9556388 ,7114527, |

| Mobile 01711-802240 | |

| E-mail: ublegl@dhaka.net | |

| englishrd@uttarabank-bd.com | |

| E PZ BRANCH | Contact Person |

| Ganakbari, Dhamsona, Savar | Manager |

| Dhaka-1344 | Tel: 880-2-9350761 |

| Mobile 01711-438592 | |

| E-mail: ublepz@dhaka.net | |

| epz@uttarabank-bd.com | |

| FOREIGN EXCHANGE BRANCH | Contact Person |

| 69, Dilkusha C/A, | Manager |

| Dhaka-1000 | Tel: 02-9551881 ,9552375 |

| Mobile 01711-405145 | |

| E-Mail: ublfrx@dhaka.net | |

| foreignex@uttarabank-bd.com | |

| GULSHAN BRANCH | Contact Person |

| Landmark Shopping Centre(1st | Manager |

| Fl.) ,12-14, Gulshan North C/A | Tel: 880-2-8829667 ,8814476, |

| Gilshan-2 Gulshan Model | Mobile 01711-438591 |

| Dhaka | E-mail: ublgshan@dhaka.net |

| gulshan@uttarabank-bd.com | |

| ISLAMPUR BRANCH | Contact Person |

| 95, Islampur Road Dhaka-1100 | Manager |

| Tel: 880-2-244546,247479 | |

| Mobile 01711-802238 | |

| E-mail: ublisl@dhaka.net | |

| islampur@uttarabank-bd.com | |

| JESSORE BRANCH | Contact Person |

| Municipal Road, Near Chowrasta | Manager |

| Jessore-7400 | Tel: 880-421-72513 |

| Mobile 01711-802207 | |

| E-mail: ubljess@bttb.net.bd | |

| jessore@uttarabank-bd.com | |

| KALABAGAN BRANCH | Contact Person |

| 157, Lake Circus,Mirpur Road | Manager |

| Kalabagan, Dhaka-1205 | Tel: 880-2-9117528 ,8126136, |

| Mobile 01711-405139 | |

| 880-2-9117528 (Fax) | |

| E-mail: ublkbgn@dhaka.net | |

| kalabagan@uttarabank-bd.com | |

| KAWRAN BAZAR BRANCH | Contact Person |

| 25-26,Kawran Bazar C/A, | Manager |

| Dhaka-1215 | Tel: 880-2-8122891 ,8117499, |

| Mobile 01711-802265 | |

| E-mail: ublkbazar@dhaka.net | |

| kawranbzr@uttarabank-bd.com | |

| KHATUNGONJ BRANCH | Contact Person |

| 385-386, Ekhlas Market, | Manager |

| Khatunganj,Chittagonj-4000 | Tel: 880-31-638447 ,611306 |

| Mobile 01711-802220 | |

| E-mail: ublktj@spnetctg.net khatungonj@uttarabank-bd.com | |

| LALDIGHI BRANCH | Contact Person |

| 120, Laldighi (West) | Manager |

| Chittagong-4000 | Tel: 880-31-637276 ,630729, |

| Mobile 01711-802221 | |

| E-mail: ubllalctg@dhaka.net laldighi@uttarabank-bd.com | |

| LOCAL OFFICE | Contact Person |

| 129-130, Motijheel C/A | Manager |

| Dhaka-1000 | Tel: 880-2-9552032 ,9568627 |

| E-mail: ubllocal@dhaka.net | |

| localoffice@uttarabank-bd.com | |

| MOULAVIBAZAR BRANCH | Contact Person |

| 66,Moulvi Bazar( Tajmahol | Manager |

| Complex) ,Dhaka-1100 | Tel: 880-2-7317219 ,7315839, |

| Mobile 01711-802271 | |

| E-mail: ublmvi@dhaka.net | |

| moulvibzrdhk@uttarabank-bd.com | |

| MYMENSINGH BRANCH | Contact Person |

| 34, Bipin Sen Road Chotta Bazar | Manager |

| P.S.-Kotwali, Mymensingh-2200 | Tel: 880-91-54144 |

| Mobile 01711-802226 | |

| E-mail: ublmym@dhaka.net | |

| mymen@uttarabank-bd.com | |

| NAOGAON BRANCH | Contact Person |

| Main Road | Manager |

| Mofizuddin Market( 1st Floor) | Tel: 880-741-52340 |

| Naogaon-6500 | Mobile 01711-802286 |

| E-mail: ublnaoga@dhaka.net | |

| NARAYANGONJ BRANCH | Contact Person |

| Jibon Bima Building | Manager |

| 150, B. B. Road | Tel: 880-2-9711766 ,9711632 |

| Narayanganj-1400 | Mobile 01711-802275 |

| E-mail: ublnganj@dhaka.net | |

| narayangonj@uttarabank-bd.com | |

| NATORE BRANCH | Contact Person |

| Holding No.-98 ( 1st Floor ) | Manager |

| P.O.-Natore, Upazila:Natore, | Tel: 880-771-62269 |

| Natore | Mobile 01711-802256 |

| E-mail: ublntr@dhaka.net | |

| natore@uttarabank-bd.com | |

| NAWABPUR BRANCH | Contact Person |

| 150, Nawabpur Road | Manager |

| Dhaka-1100 | Tel: 880-2-9555690 ,9552302 |

| Mobile 01711-802248 | |

| E-mail: ublnawab@dhaka.net | |

| nawabpur@uttarabank-bd.com | |

| PABNA BRANCH | Contact Person |

| Sonapatty, P.O.-Pabna | Manager |

| Pabna-6600 | Tel: 880-731-66180 |

| Mobile 01711-802257 | |

| PALLABI BRANCH | Contact Person |

| Plot No.10, Pallabi Bus Stand | Manager |

| Mirpur, Dhaka-1218 | Tel: 880-2-8019222 ,8013982 |

| E-mail: ublpall@dhaka.net | |

| pallabi@uttarabank-bd.com | |

| RAMNA BRANCH | Contact Person |

| 68/1, Purana Paltan | Manager |

| Dhaka-1000 | Tel: 880-2-9551154 ,9565764 |

| Mobile 01711-405160 | |

| E-mail: ublramna@dhaka.net | |

| ramna@uttarabank-bd.com | |

| RANGPUR BRANCH | Contact Person |

| Dewanbari Road Betpatty | Manager |

| Rangpur-5400 | Tel: 880-521-662091/62132, |

| Mobile 01711-438610 | |

| E-mail: ublrgpur@dhaka.net | |

| rangpur@uttarabank-bd.com | |

| SATMASJID ROAD BRANCH | Contact Person |

| Eastern Elite Center | Manager |

| 741, Satmasjid Road ( 1st Fl.) | Tel: 880-2-9113211 ,9116420, |

| 3, Dhanmondi R/A. Dhaka-1209 | Mobile 01714-03591 |

| E-mail: ublstm@dhaka.net | |

| satmasjid@uttarabank-bd.com | |

| SHAHEB BAZAR BRANCH | Contact Person |

| Karim Super Market, Shaheb | Manager |

| Bazar, Ghoramara | Tel: 880-721-774906 |

| Rajshahi-6100 | Mobile 01711-802204 |

| E-mail: ublsbraj@bttb.net.bd | |

| shaheb@uttarabank-bd.com | |

| SHANTINAGAR BRANCH | Contact Person |

| 40 -41, Siddeswari Circular | Manager |

| Road, KULSUM (1st Floor) | Tel: 880-2-8319041 ,9333898 |

| Dhaka-1217 | Mobile 01711-405144 |

| E-mail: ublsnt@dhaka.net | |

| shantinagar@uttarabank-bd.com | |

| SIR IQBAL ROAD BRANCH | Contact Person |

| 2/A, Sir Iqbal Road | Manager |

| Khulna-9100 | Tel: 880-41-720417 ,721090, |

| Mobile 01711-802209 | |

| E-mail: ublksir@dhaka.net | |

| siriqbal@uttarabank-bd.com | |

| SUNAMGONJ BRANCH | Contact Person |

| Sufia Mansion (1st Floor) | Manager |

| Sunamganj Sadar | Tel: 880-871-61671 |

| Sunamganj-3000 | E-mail: ublsun@dhaka.net |

| sunam@uttarabank-bd.com | |

| SYLHET BRANCH | Contact Person |

| Shahir Plaza (1st Floor) | Manager |

| Zindabazar, Sylhet-3100 | Tel: 880-821-714484 ,711998, |

| Mobile 01711-802224 | |

| E-mail: ublsyl@dhaka.net | |

| sylhet@uttarabank-bd.com | |

| UTTARA BRANCH | Contact Person |

| Singapore Plaza ( 1st Floor ) | Manager |

| 17 Mymensingh Road | Tel: 880-2-8915292 ,8918039 |

| Sector-3,Uttara Model Town | E-mail: uttara@dhaka.net |

| Uttata | uttara@uttarabank-bd.com |