Procedure of Letter of credit (LC), Import, Export and Local trade of Mutual Trust Bank

Financial institutions have very wide range of activities in the economy of a country. Banks are the most important one in the financial sector as they play a very crucial role for the economy. Banking business mainly maintains flow of funds from depositors to investors. In doing so, banks need to collect deposit from the depositors and then distribute those as loan to the investors. Besides, banks provide assistance in international trade, money transfer, collection and payment of utility and other bills, etc.

This report is the very effective outcome of forty five days internship program. It tells the picture of export import Practices followed by The Mutual Trust Bank Limited (MTBL). This report is the conglomeration of a comprehensive and practical exposure to the field of export import Practices followed by Mutual Trust Bank Limited.

Internship program is the most significant part for completion of BBA program. After completing the academic courses I was placed in MTBL in order to complete my internship program. MTBL is a private Commercial Bank in Bangladesh, which plays a vital role in financial sector.

The internship report has been prepared on “Procedure of Letter of credit (LC), Import, Export and Local trade of Mutual Trust Bank”. Bank has a significant role in the economic development of the country. The successful banking business ensures the growth of the economy by the effective uses of the funds. In order to developing the national economy, banks keep in mind going for lending, maintaining safety, liquidity & profitability.

The report has been segregated into eight separate chapters for the convenience of the reader. Chapter 1 deals with the organization part of the Mutual Trust Bank Limited. Chapter 2 gives an idea about the nature of the job and responsibilities of the job and Critical observations and recommendations. Chapter 3 describes Report Summary and Description of the project. Chapter 4 is describing overall import export situation of Bangladesh from 2002 to 2011. Chapter 5 includes Local Trade, Back to Back L/C procedure and services of MTBL, chapter 6 includes the import pattern, financing procedure & some graphical presentations and chapter 7 contains Export pattern and & some graphical presentations chapter eight contains trend Analysis of 2 years of L/C of MTBL, Chapter 9 is told about commission income from MITS. Chapter 10 contains some problem of International trade at MITS Chapter 11 is recommendations, Findings and Chapter 12 is conclusion. Bibliography and appendices are enclosed at the end to help the reader to gain a detailed idea. All over the project I have tried to maintain the structure which I have got from my honorable faculty and I have tried to include all of those findings which were directly or indirectly related to my research. It was a great knowledge sharing time with my colleagues and my customers. I have enjoyed my internship period a lot.

MUTUAL TRUST BANK LTD

In the backdrop of economic liberalization and financial sector reforms, a group of highly successful local entrepreneurs conceived an idea of floating a commercial bank with different outlook. For them, it was competence, excellence and consistent delivery of reliable service with superior value products. Accordingly Mutual Trust Bank Ltd. was created and commencement of business started on September 29, 1999. The sponsors are reputed personalities in the field of trade and commerce and their stake ranges from shipping to textile and finance to energy, etc. As a fully licensed commercial bank, Mutual Trust Bank Ltd. is being managed by a highly professional and dedicated team with long experience in banking. They constantly focus on understanding and anticipating customer needs. As the banking scenario undergoes changes so is the bank and it repositions itself in the changed market condition.

Mutual Trust Bank Ltd has already made significant progress within a very short period of its existence. The bank has been graded as a top class bank in the country. It has already occupied an enviable position among its competitors after achieving success in most of the areas of business operation.

AN OVERVIEW

Mutual Trust Bank Ltd, a new generation private commercial bank strives to consolidate its position among the top banks in the country by offering competitive services and products. It was incorporated in Bangladesh in the year 1999 as a banking company under the Companies Act, 1994. All types of commercial banking services are provided by the bank within the stipulations laid down by the Bank Companies Act 1991and as directives received from Bangladesh Bank from time to time.

The bank has now 86 branches and 14 SME (Small and Medium sized Enterprises) service centers. The Bank operates through its Head Office situated in the Gulshan area of Dhaka. They are also looking forward to ten more branches and five more SME service centres to be added by the end of this year.

The bank carries out international operations through a global network of foreign correspondents banks. MTBL is also a member of SWIFT community as well. Their real time online banking facilities gave them a pioneer role among its competitors.

The bank floated its shares in 2003 to the general public and was subsequently listed with Dhaka Stock Exchange Ltd and Chittagong Stock Exchange Ltd.

As envisaged in the Memorandum of Association and as licensed by the Bangladesh Bank under the provisions of the Companies Act 1991, MTBL started its banking operations and entitled to carry out the following types of banking business:

- All types of Commercial Banking Activities including Money Market operations.

- Investment in Merchant Banking Activities.

- Investment in Company Activities.

- Financiers, Promoters, Capitalists etc.

- Financial Intermediary Services.

- Any related Financial Services.

ARRAYS OF SERVICES OF MTBL

Consumer Banking

―We aim to satisfy all clients, regardless of how big or small they may be – this is the motto of consumer banking sectors ‘officials of MTBL. Individuals are counseled on the best type of accounts suitable to them such as Current, Savings, Short Term Deposits, Fixed Deposits, Consumer Asset and Liability Products, etc.

Apart from the conventional banking operations MTB strives to introduce an array of products and services and already launched a number of consumer banking products with the aim of popularizing consumer banking operations and offer higher return to its clients. The most popular schemes offered are:

- Brick by Brick Savings Scheme 2. Monthly Benefit Plan 3. Save Everyday Plan 4. Children‘s Education Plan 5. Consumer Credit Scheme 6. Best Invest Plan

FOREIGN TRADE

MTB provides a wide range of banking services to all types of commercial concerns such as Import & Export Finance and Services, Investment Advice, Foreign Remittance and other specialized services as required. Although we are a private commercial Bank, we have a strong global network that helps us to undertake international trade smoothly and efficiently.

Import Business

Mutual Trust Bank supports its customers by providing facilities throughout the import process to ensure smooth running of their business. The facilities are:

- Import Letter of Credit

- Post Import Financing (LIM, LTR etc)

- Import collection services & Shipping Guarantees

Export Business

Mutual Trust Bank offers extra cover to its customers for the entire export process to speed up receipt of proceeds. The facilities are:

- Export Letters of Credit advising

- Pre-shipment Export Financing

- Export documents negotiation

- Letters of Credit confirmation

Remittance

Mutual Trust Bank provides to its customers the following services:

- Inward/ Outward Remittance Services

- TT/ DD Issue

- DD/ Cheque collection

- Endorsements

- Travelers Cheque Issuance

Correspondent Banking

The objective of our correspondent banking operations is to strengthen our existing relationships with foreign banks and financial institutions around the globe as well as exploring new relationships. In addition to that, we provide assistance in marketing the products of the correspondent banks.

At present MTB is maintaining relationships with 30 (thirty) foreign correspondents and the number is growing every day. Currently the bank has 18 (eighteen) NOSTRO A/Cs with large foreign banks abroad. The bank is a “SWIFT” member and its Bank Identification Number or BIC is ‘MTBL BDDH’

REMITTANCE SERVICES

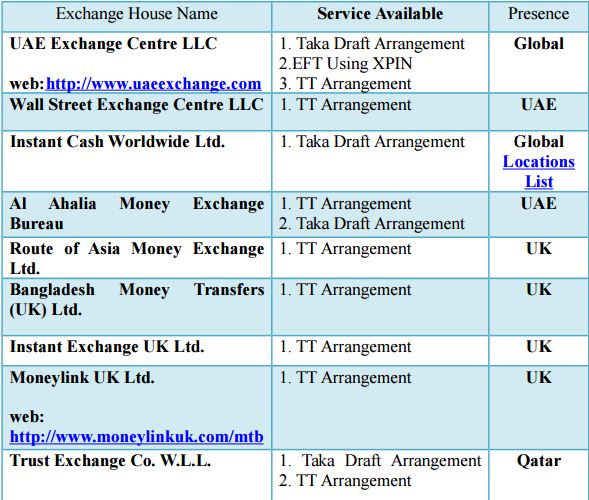

Mutual Trust Bank maintains a strong network with the Exchange Houses worldwide for ensuring better remittance services for its customers. The Bank having a network of 30 branches has established remittance arrangements with a number of exchange houses to facilitate wage earners to remit their money to Bangladesh. The following is the list of exchange houses having arrangement with al Mutual Trust Bank Ltd.

Web

The Internet has brought about a revolutionary change in the world leading to convergence of communication and computing technologies. In order to provide round the clock and up to date information on the Bank to the trade and business communities worldwide, the IT Team of Mutual Trust Bank Limited has developed a web for the Bank. It can be accessed under the domain name: www.mutualtrustbank.com

SWIFT

The Bank has become the member of SWIFT Alliance Access, a multi-branch secure financial messaging system provided by the Society for Worldwide Inter-bank Financial Telecommunication [SWIFT], Belgium. With the activation of the SWIFT system the Bank enjoys instant, low-cost, speedy and reliable connectivity for L/C transaction, fund transfers, message communication and other worldwide financial activities.

MUTUAL TRUST INTERNATIONAL TRADE SERVICE

Mutual Trust International Trade Service started its journey at July 1, 2011 by MITS Dhaka center. It is a trade service division of Mutual Trust Bank Ltd. Here all types of foreign activities and foreign banking activities are performed. MITS of Mutual Trust Bank Limited plays a very important role in effecting foreign exchange transaction of a country. Mainly transaction with overseas countries is respect of export and import comes under the preview. Foreign exchange affected, central bank records all sorts of foreign exchange transaction and therefore, transaction effected by the Mutual Trust Bank Limited. MITS plays a vital role to earn bank’s maximum profit. This department is classified according to their activities.

Definition of L/C:

L/C is a letter from a bank guaranteeing that a buyer’s payment to a seller will be received on time and for the correct amount. In the event that the buyer is unable to make payment on the purchase, the bank will be required to cover full or remaining amount of purchase.

It is a promise by buyer’s bank to seller’s or exporter bank that buyer’s bank will honour the invoice presented by the exporter on due date and make payment.

At present L/C is not just an instrument of international trade but it is a source of income of any profitable financial institution like Bank. Any reputed and well known institution can operate this activity as their regular activity.

Types of Letters of Credit:

Commercial Letters of Credit:

Commercial letters of credit are mainly used as a primary payment tool in international trade such as exporting and importing transactions. Majority of commercial letters of credit are issued subject to the latest version of UCP (Uniform Customs and Practice for Documentary Credits). The ICC publishes UCP, which are the set of rules that governs the commercial letters of credit procedures.

Standby Letters of Credit:

Commercial letters of credit are a means of payment to be utilized when the principal perform its duties. As an example, let us consider an exporter who ships the goods according to the sales contract and apply to the nominated bank for the payment. If the nominated bank decides that the presentation is conforming to the terms and conditions of the credit and the UCP rules then exporter will be paid. This situation is just contrary in standby letters of credit. Standby letters of credit have their own rules, which are called The International Standby Practices 1998 (ISP98).

Revocable Letters of Credit:

Revocable letters of credit give issuer the amendment or cancellation right of the credit any time without prior notice to the beneficiary. Since revocable letters of credit do not provide any protection to the beneficiary, they are not used frequently.

Irrevocable Letters of Credit

Irrevocable Letters of Credit cannot be amended or cancelled without the agreement of the credit parties. Unconfirmed irrevocable letters of credit cannot be modified without the written consent of both the issuing bank and the beneficiary. Confirmed irrevocable letters of credit need also confirming bank’s written consent in order any modification or cancellation to be effective.

Back-to-back Letter of Credit:

The beneficiary of the export credit, who is not the manufacturer of the goods, may approach a bank to open a letter of credit in favour of the manufacturer who is ready to supply the goods. Such a letter of credit is opened on the strength of the export letter of credit and hence called back-to-back letter of credit. Such a documentary credit should be opened on behalf of the good exporters and suppliers.

Common Mistakes Made With Letters Of Credit:

Exporters make the following common mistakes, which cause them to lose the sale or not get paid.

- Presenting documents after the letter of credit has expired.

- Shipping their goods after the specified date.

- Making a partial shipment when partial shipment is not allowed.

- Not presenting the proper documents.

- Not legalizing the documents.

- Not obtaining completed bills of lading.

- Not obtaining required insurance.

- Submitting copies instead of originals.

- Spelling mistakes.

- Mathematical mistakes.

Documentary Collection against L/C Payment:

Documentary collection against payment is the closest international equivalent to cash on delivery.

- It is not as expensive as a letter of credit.

- The seller must ship before getting paid.

- The buyer does not receive the goods until payment is made.

- The buyer receives the goods after signing a note promising to pay.

- This promissory note may be negotiable.

Risk with this form of payment:

The buyer may not contact the collecting bank to acknowledge acceptance.

The collecting bank is under no obligation to force such an acknowledgement.

Main Objective of the report:

- Contribution of Import and export to the total revenue of Mutual trust bank.

- Contribution of MTBL to export, import and in the local trade.

- Find out the problem in International business and local trade.

- L/C procedure at MITS (Mutual trust bank international trade and service).

Methodology:

The study is performed based on the information extracted from different sources collected by using a specific methodology. The detailed is given below:

Data collection:

Sources of data are as follow:

Collection of Primary Data:

- Face to Face conversation with the respective officers and staffs

- Sharing practical knowledge of officials.

- Relevant file study provided by the officers concerned

Collection of Secondary Data:

- Annual Report of MTBL.

- Website of MTBL

- Relevant books, Research papers, r4ewspapers, Journals and reports

- Internet and various study selected reports.

Analytical Tools Used:

To analyze the collected data chart & graph has been used for better presentation of financial data.

Scenario of IMPORT and EXPORT in Bangladesh:

The performance of Bangladesh’s export sector in recent years is quite impressive especially in the 1990s when we compare it with that of world. The average annual growth rate of Bangladesh export (11.91%) is higher than those of the world (9.48%) during 1990-2003. Because of the lower export performance in the 1980s, annual average growth rate of this sector during 1980-2003 is not as impressive compared to other Asian countries and the world.

Over the period of 1980-2003 Bangladesh’s exports as a percentage of the world’s exports remain around 0.11% to 0.12% with the exception of 1984, when it was 0.14%, and 1990-1994, when the ratio was around 0.09%. Exports show slightly increased trend especially in 2000 and 2001. For these two years Bangladesh’s exports are 11% exports was the lowest, 7.72%, in 1983. Bangladesh’s exports share in the Asian developing countries, however, shows a decreasing trend in the 1990s compared to the1980s though the ratio is slightly higher in 1998 and 1999 compared to immediate earlier years. The ratio dropped to 0.59% in 2003 from 1.46% in 1980 though it was 0.75% in 2001

A healthy performance of Bangladesh’s import compared to the rest of the world. Although Bangladesh’s import performance is behind that of the Asian developing countries, the average annual import growth rates of Bangladesh are much higher than those of the world during 1980-90, 1990-2003 and 1980-2003. When average annual growth rates of the world 12.92% and 22.42% respectively, that of Bangladesh is 31.79% during 1980-2003. Even the average growth rate of imports is higher for Bangladesh (22.59%) than that of the Asian developing countries (21.25%) during 1990-2003. Bangladesh’s imports as a percentage of world imports have also been increasing over the years, though this ratio varies with the Asian developing countries. While the ratio of Bangladesh’s imports to world imports was 0.04% in 1980, it reached around 0.1% in 2001, 2002 and 2003.

The contribution of the export sector to Bangladesh’s GDP has been gradually increasing over the years. While export share in GDP was 4.52% in 1980, this share has reached to 13.45% in 1999, reflecting 197.56% increase in GDP contribution in nineteen years (World Bank 2004). This ratio further increased in 2000, 2001 and 2002.

The ratio was 15.38% in 2001.

The imports-GDP ratio of Bangladesh has also been increasing every year with a few exceptions. During 1980-2002 the ratio was the lowest; 9.09% in 1986; and the highest 21.50% in 2001.

The trade openness (trade/GDP ratio) was around 14% to 16% till 1989. After that the ratio increased to 28% in 1995. In 2001 the ratio has increased to 36.88% which implies that trade has been liberalized.

BACK- TO-BACK L/C

In case of a “Back-to-Back” letter of credit, a new L/C (an import L/C) is opened on the basis of an original L/C (an export L/C). Under the “Back-to-Back” concept, the seller as the beneficiary of the first L/C offers it as a ‘security’ to the Advising Bank for the issuance of the second L/C. The beneficiary of the back-to-back L/C may be located inside or outside the original beneficiary’s country. In case of a back-to-back L/C, no cash security (no margin) is taken by the bank; bank liens the first L/C. In case of a back-to-back L/C, the drawn bill is usage/time bill.

In MITS Dhaka Center, papers/documents required for opening of back-to-back L/C are as follows –

- Master L/C

- Valid Import Registration Certificate (IRC) and Export Registration Certificate (ERC

- L/C Application and LCAF duly filled in and signed

- Pro forma Invoice or Indent

- Insurance Cover Note with money receipt

- IMP Form duly signed.

In addition to the above documents, the following papers/documents are also required to export oriented garment industries while requesting for opening of back-to-back letter of credit –

- Textile Permission

- Valid Bonded Warehouse License

- Quota Allocation Letter issued by the Export Promotion Bureau (EPB) in favour of the applicant for quota items

In case the factory premises is a rented one, Letter of Disclaimer duly executed by the owner of the house/premises to be submitted. A checklist to open back-to-back L/C is as follows –

- Applicant is registered with CCI&E and has bonded warehouse license

- The master L/C has adequate validity period and has no defective clause

- L/C value shall not exceed the admissible percentage of net FOB value of relative Master L/C

- Usage Period will be up to 180 days.

L/C opening Procedure (B2B):

First, Company has to open a current account in MTBL. To open an A/C in MTBL need some essential necessary Documents are TIN, VAT, IRC (Import register certificate), ERC (Export register certificate), Board of investment (BOI), bonded ware house Licenses and Main L/C. After receiving documents through Branch a relationship Manager will inspection all the Documents and applicant company. Next RM (relationship Manager) reports to head of department and Head office Sanction L/C amount for that Particular Company according to RM report.

After opening a current account company apply for L/C to MTBL. In that case company need to fill up an L/C

Application Form (L/CAF) and need to send pro-forma invoice to MTBL.

In pro-forma invoice everything is written about the export and import deal for the particular trade between exporter and importer. Information contain in pro-forma invoice are Goods description, goods amount, shipment date, price of the goods and signature of both party exporter and importer.

L/C Application Form (L/CAF) contain Applicant name, Address, IRC number, Shipment procedure, L/C value, Expired place, expired date, trade terms, description of Goods, Payment of charges, what are the documents are needed and other terms and condition. After receiving Application MTBL check the L/C amount written in the form and Head office sanction amount for that particular Company. Finally MTBL match the signature of importer in Pro-forma invoice.

Next, MITS Lien Main L/C opens another L/C against it. After opening a L/C MTBL will send a swift to exporter bank. With all the information written in the Application form assure them that MTBL will pay the payment after fulfilment all the requirement of Importer. That ends the L/C opening procedure.

Reporting to Bangladesh bank

At the end of every month, the reporting to Bangladesh Bank regarding the following information is mandatory –

- Filling of E-2/P-2 Schedule of S-1 category that covers the entire month’s amount of import, category of goods, currency, county etc.

- Filling of E-3/P-3 Schedule of for all charges, commission with T/M Form.

- Disposal of IMP Form that includes: (a) original IMP (Import form) is forwarded to Bangladesh Bank with invoice and indent, (b) duplicate IMP is kept with the branch along with the Bill of Entry/Certified Invoice, (c) triplicate IMP is kept with the branch for office record, (d) quadruplicate is kept for submission to Bangladesh Bank in case of imports where documents are retired.

Payment procedure of B2B L/C:

In case of back-to-back L/C for 30-60-90-120-180-360 days of maturity period, deferred payment is made.

Payment is given after realizing export proceeds from the L/C Issuing Bank. For Garments Sector, the duration can be maximum 180 days. For importing machinery, without permission from Bangladesh Bank, MITS Dhaka

Centre can authorize for 360 days. In such cases, the VP of the branch used to exercise his discretionary power. Payment procedure starts after receiving goods from exporter importer send documents to the MTBL. And they pay the payment of exporter to MTBL. After receiving payments MTBL can pay the payment of beneficiary before the maturity date. They in put in the register and create LDBC in case of local trade (local bill for payment). They made a payment in current USD rate for this reason MTBL earn some gain and that called treasury Exchange Gain. After bill payment to beneficiary bank they send SWIFT to the beneficiary bank.

Import L/C opening Procedure:

First, Company has to open a current account in MTBL. To open an A/C in MTBL need some essential necessary Documents are TIN, VAT, IRC (Import register certificate), ERC (Export register certificate), Board of investment (BOI), bonded ware house Licenses and Import clause during shipment. In case of import L/C MTBL want to know which PSI agency will inspect the International trade, pre shipment procedure and who will bear that cost. After receiving documents through Branch a relationship Manager will inspection all the Documents and applicant company. Next RM (relationship Manager) reports to head of department and Head office Sanction L/C amount for that Particular Company according to RM report.

After opening a current account company apply for L/C to MTBL. In that case company need to fill up an application from and need to send pro-forma invoice to MTBL.

In pro-forma invoice everything is written about the export and import deal for the particular trade between exporter and importer. Information contain in pro-forma invoice are Goods description, goods amount, shipment date, price of the goods and signature of both party exporter and importer.

L/C Application Form is a sort of an agreement between customer and bank on the basis of which letter of credit is opened. MITS Dhaka Center provides a printed form for opening of L/C to the importer. A special adhesive stamp of value Tk.150 is affixed on the form in accordance with Stamp Act in force. While opening, the stamp is cancelled. Usually the importer expresses his decision to open the L/C quoting the amount of margin in percentage. Application form contain Applicant name, Address, IRC number, Shipment procedure, L/C value,

Expired place, expired date, trade terms, description of Goods, Payment of charges, what are the documents are needed and other terms and condition. After receiving Application MTBL check the L/C amount written in the form and Head office sanction amount for that particular Company. Finally MTBL match the signature of importer in Pro-forma invoice.

After opening a L/C MTBL will send a swift to exporter bank. With all the information written in the Application form assure them that MTBL will pay the payment after fulfilment all the requirement of Importer.

That ends the L/C opening procedure.

PSI Agency is very in case of Import. MTBL is very careful about the report of PSI Agency.

In the world there are 4 PSI agencies. According to The customer ACT, 1969 section 25A. These PSI Agency will inspect the pre shipment goods according to their allocated country.

Lodgement of the Documents

After receiving the documents from the exporters, at first MTBL write it in the PAD Registrar. PAD Register contains date, PAD number, L/C number, and name of the drawer, name of the drawee, amount, and number of copies of various documents, name of the imported items. This written procedure is called Lodgment.

Open an account

- TIN

- VAT

- IRC (Import register certificate)

- ERC (Export register certificate)

- Board of investment (BOI)

- bonded ware house Licenses

- Main L/C

- Insurance Cover Note with money receipt.

- PSI Agency.

Retirement of the Documents

The process of collecting documents from bank by the importer is called retirement of the documents. The importer gives necessary instructions to the bank for retirement of the import bills or for the disposal of the shipping documents to clear the imported goods from the customs authority. The importer may instruct the bank to retire the documents by debiting his current account with the bank or by creating Loan against Trust Receipt (LTR). Following steps are taken while retiring the documents –

- Calculation of interest.

- Calculation of other charges.

- Passing vouchers.

- Entry in the register.

- Endorsement in the Bill of Lading and other transport documents and in the bill of exchange.

Procedure of Acceptance (Import):

In case of acceptance Like B2B L/C First, MTB consider the clients confirmation that who opened L/C for the beneficiary. Here client should send confirmation Documents such as Invoice, Bill of Lading, Certificate of Origin, Packing List, Shipping Advice, on-negotiable Copy of Bill of Lading, bill of exchange, Pre-shipment Inspection Report and Shipment Certificate to MTB that they received goods from the beneficiary. Then MTBL check pre-shipment report of PSI agency.

– After receiving Documents and report it is been entry to the Inward register. In this stage they input in the software what are the documents MTB has received then they compiling data.

– Next step MTB input in the Bill of acceptance. Here they input Date of negotiation, Date of shipment, Maturity Date, Beneficiary bank, Beneficiary name. In this stage they got ABP number.

– After that they deduct 15% VAT and commission and make a bill. Commission percentage (%) is predetermined when Head office sanction L/C amount.

– After giving acceptance they send swift SMS to beneficiary bank. Swift contain amount in BDT and USD and date of maturity. In swift SMS there will be reference number that is system generated. SWIFT sms need to be authorized by any of other senior executives.

Presentation & examination of shipping document:

The seller being satisfied with the terms and the conditions of the credit proceeds to dispatch the required goods to the buyer and after that, has to present the documents evidencing dispatching of goods to the Negotiating Bank on or before the stipulated expiry date of the credit. After receiving all the documents, the Negotiating Bank then checks the documents against the credit. If the documents are found in order, the bank will pay, accept or negotiate the documents and will dispatch to MITS Dhaka Centre. The branch checks the documents. The usual documents are –

- Invoice

- Bill of Lading

- Certificate of Origin

- Packing List

- Shipping Advice

- Non-negotiable Copy of Bill of Lading

- Bill of exchange

- Pre-shipment Inspection Report of PSI agency

- Shipment Certificate

Post-Import financing

If there is no available in cash in importer’s hand, he can rrequest the bank to grant loan against the documents for the purpose of post import finance. There is one following forms of post import finance available in MITS Dhaka center.

LTR (Loan against trust receipt)

On the arrival of goods and lodgment of import documents, importeer may request the bank for clearance of goods from the port (custom) and keep the same to bank godown. Propeer sanction from the cxompetent authority is to be obatained before clearance of consignment. For giving these types of loan, officer makes loan proposal and sends it to H/O for approval. After getting approval from H/O, bank grants loan in the form of LTR.

- Advance against a Trust Receipt obtained from the Customers are allowed to only first class tested parties when the documents covering an import shipment or other goods pledged to the Bank as security are given without payment. However, for such advances prior permission/sanction from Head Office must be obtained.

- The customer holds the goods or their sale-proceeds in trust for the Bank, till such time, the loan allowed against the Trust Receipts is fully paid off.

- The Trust Receipt is a document that creates the Banker’s lien on the goods and practically amounts to hypothecation of the proceeds of sale in discharge of the lien.

Procedure of payments:

After receiving goods from exporter importer send documents to the MTBL. And they pay the payment of exporter to MTBL. After receiving payments MTBL can pay the payment of beneficiary before the maturity date. They in put in the register and create LDBC (local bill for payment). They made a payment in current

USD rate for this reason MTBL earn some gain and that called treasury Exchange Gain. After bill payment to beneficiary bank they send SWIFT to the beneficiary bank. MTBL send bill to beneficiary Bank and next exporter can collect payment from their bank.

By working in foreign exchange division of Mutual Trust Bank Ltd. the following matters have been observed (Findings):

- Import and Export has great contribution to total national Economy and it is increasing day by day MTBL is taking part of that.

- MTBL open a different section MITS for international trade and service which leads to scope of employment of expert of this Sector.

- MITS always follow the rules and regulation of Bangladesh Bank. MITS always maintain the instruction of Bangladesh Bank and help them to keep record of Import- Export and Local trade.

- MITS contribute to total profit of MTBL as well as to total export – import and Local trade of our country.

- Process of MITS is decentralized.

- The Growth of MITS is increasing day by day.

- The monitoring system of the foreign exchange department of MTB is excellent. The chain of command is strictly maintained here. The executives now and then visit the department, which keeps all the officers alert about their duty.

- Although the bank uses Flora Banking software to operate their daily business, they still have technology phobia and they have lack of proper IT knowledge.

- It is observed that the exporters are very much eager for receiving incentives from Bangladesh Bank rather very much reluctant to fulfil bank’s rules and regulations.

- The department shall only remain engaged with the documentary aspects of International Trade like opening L/C‘s for all types of import and negotiation of export bills.

RECOMMENDATIONS

It is clear that the Mutual Trust Bank Ltd. Foreign Exchange Branch has ensured both productive utilization of loans and their recovery in due time, thus helping to improve the overall status of the Bank. The branch success has been made possible due to dynamic leadership of the Branch Management, proper guidelines, good counsel and devotion and sincerity of all categories of officers and the employees of the Branch. The branch learns through a process of trial and error. A large number of ideas about its loans, operations, recovery etc. are generated from the innovative and dynamic members of the branch. The branch tries out these ideas and attempts to improve upon the results. However the branch may have scope to improve in a few areas. For example:

- The number of exporter and importer who operate through this bank is not enough to achieve the goal. So MTBL should offer more facilities to attract them to be their client.

- In addition with the present services they should include more services. It is badly needed to provide more services to the customer in order to compete in the market.

- Banking is a service-oriented marketing. Its business profit depends on its service quality. That’s why the authority should always be aware about their service quality.

- Foreign exchange department should be fully computerized that the exchange process would be convenient for both the bankers and the clients

- Bank should offer more facilities to the customers such as credit card, visa card, ATM machine etc to survive in the competition.

- The loan sanction process should be easier that the clients can feel convenient to take loan from the bank.

- Now a day’s world is going very fast. Today most of the competing banks are offering online service system. So in order to compete in the world market the branch should adopt online banking system.

- The Branch should diversify its banking services and add new features in its services so that it can attract customers from all groups of people. Financial Engineers of MTBL should be innovative in developing new banking services, which will attract customers and reduce costs. It can provide bridge loan, or can engage in lease financing. It can also underwrite shares of newly incorporated public companies.

- One of the business strategies is promotion. Successful business depends how they can promote their products or services to the customers. In this connection to improve the business status the branch should introduce more promotional programs.

- The loan sanction procedure of the branch should be relaxed. Head office and the regional office should not try to dictate every aspect of the credit sanctioning process, which is creating problem for the branch.

Conclusion:

It is a great pleasure for me to have practical experience in Mutual Trust Bank Ltd. This Internship program is an integral part of BBA student. Mutual Trust Bank Limited (MTBL) is a third generation private commercial bank in the country with commendable operating performance directed by the mission to provide prompt and different services to clients. It provides a wide range of commercial banking services MTBL has achieved success among its peer group within a short span of time with its professional and dedicated team of management having long experience, commendable knowledge and expertise in conversation with modern banking. It also achieved very good will in foreign trade and service by providing excellent, dynamic and innovative service. MITS has the adequate modem technology to meet its present requirement of Global demand.