Following Paddle’s recent $200 million funding round with a valuation of $1.4 billion, the London firm is making a significant purchase to expand the capability of its SaaS payments platform. It bought ProfitWell, a company that has developed a well-known collection of tools for providing analytics and retention capabilities to businesses who sell their products through subscriptions.

In addition to purchasing technology and products, Paddle is also acquiring an intriguing user base. ProfitWell claims to have more than 30,000 clients, including well-known SaaS providers Canva, Hubspot, Notion, Zenefits, Prezi, and Autodesk, all of whom have joined Paddle.

According to Paddle, the purchase is worth more than $200 million in cash and stock. An alternative to Apple’s native in-app payments flow for iOS publishers who want to take more direct control of their subscriptions and billing has been built and is ready to launch (provided Apple opens up its platform or is required to). Paddle itself has about 3,000 customers, and beyond that it has gained some notoriety around being a fly in the ointment for Apple.

“Paddle and ProfitWell have the same objective: to increase the income of our software clients by addressing the operational and financial challenges that waste time and resources. Christian Owens, the CEO and co-founder of Paddle, said in a statement that both businesses want to “do it for you” rather than merely assist you in finding a solution. “For this reason, we’re pleased to announce that we’re buying ProfitWell. ProfitWell would significantly enhance our offering because it built the leading subscription metrics product on the market and established itself as a recognized expert on revenue growth in the $400 billion SaaS sector. We are beyond thrilled to have Patrick and the team on board to support us in achieving our goal of automatically managing and expanding SaaS businesses.

ProfitWell, a Boston-based company, looks to have been bootstrapped, and its co-founders, including CEO Patrick Campbell, have made a nice profit. All of the startup’s workers will join Paddle, and one of the co-founders, Campbell, will take on the role of chief strategy officer while another, Facundo Chamut, will take on the role of chief product officer. The agreement highlights Paddle’s desire to create a more comprehensive platform around its core payments business. Not only are digital payments still a low-margin industry, but also because offering a wider range of services around those payments helps diversify revenues and builds up a larger ecosystem of products to help attract and retain consumers, it is a pretty traditional playbook for a payments firm.

The payments powerhouse Stripe has likewise followed this path as it has grown its offerings (most recently, introducing an app store to supplement Stripe’s core products). In the instance of Paddle, ProfitWell provides the firm with a rather comprehensive package of services geared for SaaS businesses: Taxes, billing, reporting, and now retention and pricing analytics will be offered alongside its core payment product. These are all services that SaaS-based companies require to manage their subscription businesses and lower churn, but which are not necessarily “core” to the technology that they are developing to sell to others.

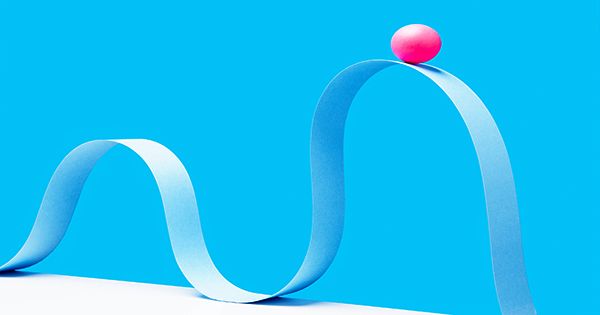

In the field of SaaS, the problem of retention (and its opposite, churn) is significant. Users of subscription services sometimes enter their payment information just once and then intentionally or unintentionally forget to pay again, becoming repeat customers. However, some people may wish to move away from that and take a more proactive part in limiting expenditure as the market develops and we find ourselves swinging into a tighter period of the economy and spending.