Executive Summary

The report is prepared to analyze to overall activities of EXIM Bank Ltd in Bangladesh. The aim of the study was to observe the way EXIM Bank Ltd is performing Banking business in interest free and Shari’ah complied methods.

In the chapter one, Objective of the study, Scope, Methodology, and Limitation of the report are emphasized.

In chapter two a brief discussion of the Bank’s History, Vision, Mission, Management profile, Functions and Overall financial Information are discussed.

In chapter Three Literature Review is showed. In chapter four Analysis and findings on the EXIM Banking Operations and Clearing Functions are discussed.

In chapter five Recommendations and Conclusions are discussed.

All over the report, the rules, regulations and problems are identified. The corresponding solutions are shows to improve the overall situation of the bank so that the services of the bank will be quick and unique. These will help the bank to develop its performance. The quality of the service of EXIM Bank is very high. The price of the service of EXIM Bank is moderate. The working schedule of EXIM Bank is easy to attend. The physical environment is good. The availability of the branch of EXIM Bank is good. The comparatives of the service of EXIM Bank are sufficient. The performance of the service of EXIM Bank is good.

Introduction of the Study

Bank lending is important for the economy in the sense that it can simultaneously finance all of the sub-sectors of financial arena, which comprises agricultural, commercial and industrial activities of a nation. In the present economic policy achieving the high economic growth is the basic principle, so in order to achieve the objective; the banking sector plays an important role. Through deposit mobilization and providing credit facilities for different business organizations, the banking sectors are playing a vital role in the economy of the country. The success of a bank depends up to how effectively the credit management recovers the funds. As a third generation commercial bank in Bangladesh, the EXIM Bank Ltd. has the responsibility to ensure efficient and effective banking operation. EXIM Bank Ltd. is always ready to maintain the highest quality services by upgrading banking technology in managing and applying high standard of business ethics through its established commitment and heritage. Objectives of a private institution like EXIM Bank are to maximize profit through optimum utilization of resources by providing best customer’s service.

Objectives of the Study:

Followings are the objectives of this study:

- To get on idea about Islamic Banking.

- To find out the general Banking and investment function EXIM Bank.

- To illustrate the foreign exchange.

- To evaluate the performance of EXIM Bank.

- To recommend some policies.

Finally, to sketch out the overview of EXIM Bank Limited as a Shariah Based bank.

Scope of the Study:

The report will cover About the Islamic banking system, frame work of development, situation of Islamic Banking in Bangladesh, overall department wise function, structure and performance of EXIM bank Bangladesh Ltd., etc.

- This report will be helpful for those who are seeking information about banking organization

- Islamic / Shariah based Banking System.

- Operation of EXIM Bank Limited.

- General Banking

- Loan, advances, and its states against deposit.

- The main focus of the report is the Islamic Banking system; which is indicated a way to the light. And a case study shown on EXIM Bank Ltd.

Methodology of the Research:

Research type:

It is a project report.

Source of data:

In this report all-necessary information to prepare are collected froms both sources of data. These are:

- Primary data:

Consist of information collected for the specific purpose at hand.

- Secondary data:

This source of data contains all the information & data that already existing somewhere

Data Collection Procedure:

Secondary data: The secondary data comes from:

- Different types of brochures of EXIM Bank Ltd.

- Annual Report of Export Import Bank of Bangladesh Limited

- www.google.com

- www.EXIBBAnkbd.com

Primary data: The primary data collection process includes:

- Direct observation.

- Conversation with officials.

- Conversation with client.

Research approach:

For this report I have to gather primary data through questionnaire to the employees and clients of different banks about their Institutions. Also have to gather data by observing relevant people’s action & situations. So I can say, I used two type of research approach for primary data collection these are observational & survey research approach.

Contact methods:

I use personal or face to face contact method which is flexible, quantitative, response rate is good & control of sample is fair.

Analysis & Reporting:

I have used different types of statistical tools and computer software for analyzing and reporting my gathered information, such as – Microsoft Excel, Microsoft Word.

Limitations of the Study:

The study had to be completed under certain constraints, which barred it to be more effective. Some of these constraints are listed:

- The time is insufficient to know all activities of the branch and prepare the study.

- Every organization has their own secrecy that is not revealed to others.

- It was very difficult to collect the information from various personnel for their job constraint.

- Lack of experience may also act as constraint in the way of meticulous exploration on the topic.

Despite the limitations, we are tried our best to prepare the report. If you find any mistakes please consider it cordially.

Historical Background:

EXIM Bank limited is the Private sector bank established on June 02 in 1999; the Bank has already occupied strong position among its competitors and has made significant contribution in national economy. The emergence of EXIM Bank Limited in the private sector is an important event in the Banking arena of Bangladesh. The important sector in economy they should more careful about their services and their ethics. EXIM Bank mainly focuses on export and import trade financing.

The Bank was established under the leadership of late Mr. Shahjahan Kabir, the founder chairman who had a dream to contribute in the socio-economic development of our country. A highly qualified group of entrepreneurs expanded their hands with the founder chairman to materialize his dream. All the sponsors are well experienced and successful in their respective business areas. Among them Mr. Nazrul Islam Mazumder became the honorable Chairman after the death of the founder Chairman.

At its inception in 1999, Bank was named as ‘BEXIM Bank Ltd’ (acronym for “Bengal Export Import Bank Limited”) and owing to raising an objection by BEXIMCO group regarding the similarity in names, the Bank was renamed in the same to the style of ‘EXIM Bank Ltd’ (acronym for ”Export Import Bank of Bangladesh Limited”).

Goals & Objectives of EXIM Bank Limited:

- To be the most caring and customer friendly and service oriented bank

- To create a technology based most efficient banking environment.

- To ensure ethics and transparency in all levels

- To ensures sustainable growth.

- To add effective contribution to the national economy.

Mission of EXIM Bank Limited:

- To provide high quality financial services in export and import trade.

- To provide efficient customer service.

- To maintenance of corporate and business ethics

- To become trusted repository of customer’s money and their financial adviser

- To make their products superior and rewarding to the customers

- To display team spirit and professionalism

- To become sound capital base

- To enhance shareholders wealth

- To fulfill social commitments by expanding their charitable and humanitarian activities

Vision of EXIM Bank Limited:

The gist of their vision is “Together towards Tomorrow”. Export Import Bank of Bangladesh Limited believes in togetherness with its customers, in its march on the road to growth and progress with services. To achieve the desired goal, there will be pursuit of excellence at all stages with a climate of continuous improvement, because, in EXIM Bank, they believe, the line of excellence is never ending. Bank’s strategic plans and networking will strengthen its competitive edge over others in rapidly changing competitive environments. Its personalized quality services to the customers with the trend of constant improvement will be cornerstone to achieve their operational success.

Shariah Board:

The Board of directors has formed ashariah supervisory Board for the Bank. Their duty is to monitor the entire Bank’s transactional procedures, & assuring its Shariah compliancy. This Board consists of the following members headed by its chairman.

The tasks of the Shariah supervisor in summary is replying to queries of the Bank’s administration, staff members, shareholders, depositors, & customers, follow up with the Shariah auditors and provide them with guidance, submitting reports & remarks to the Fatwa & Shariah Supervision Board and the administration, participating in the Bank’s training programs, participating in the supervision over the Al Iqtisad Al Islami magazine, & handling the duty of being the General Secretary of the Board.

Shariah Auditing:

This is the civil supervisory aspect that shapes the Bank’s main feature. Its existence is part of the shariah Supervision procedures. One of its main tasks is to check the shariah compliancy in the Bank’s transactional procedures in accordance to the Fatwa’s issued in that regard, under the guidance of the Shariah Supervisor.

The Shariah auditor is assigned the task of revising the Bank’s transactional procedures throughout the year to check the extent to which the staff members and the different department have abides by the regulations, advices, and Fatwa’s issued by the Fatwa & Shariah Supervision Board, forums, & banking conferences. As well assuring that all the contracts that states a right for the bank or an obligation on the bank is certified by the Fatwa & Shariah Supervision Board.

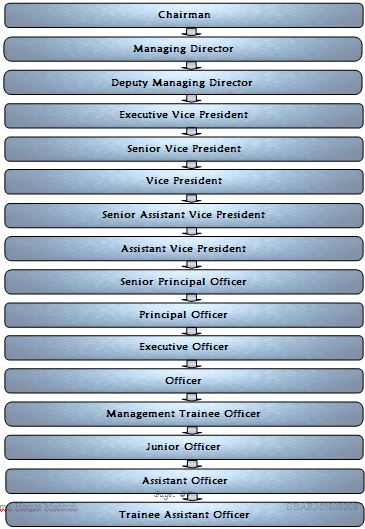

Organizational Hierarchy

Operational Area:

As a Commercial Bank, we provide all traditional banking services including a wide range of savings and investment scheme products, foreign exchange and ancillary, services with the support of modern technology and professional management. But our main stress is, as the name implies, put on export and import trade handling and financing and the bank has become the pioneer in promoting Readymade Garment industries and one of the largest financiers in this sector. Since inception, the Bank foresighted the bright prospects of this sector with financial support including market information and advice and today the garment sector constitutes the lion portion of the total export of the Company.

Corporate Culture:

Organizational culture means the common perception held by the organization’s members; a system of shared meaning that distinguishes from one organization to other organizations. This bank is one of the most disciplined banks with a distinctive corporate culture Here they believe in shared meaning, shared understanding and shared sense making. Their people can see and understand events, activates, objects and situation in a distinctive way. They would their manners and etiquette, character individual lay to suit the purpose of the Bank and the needs of the customers who are of remount importance to us. The people in the Bank see themselves as a tight knit team/family that believes in working together for growth. The corporate culture they belong has not been imposed; it has rather been achieved through their corporate conduct.

Competitive Forces:

EXIM Bank has been doing all traditional banking business including the wide range of savings, credit scheme products and trade services. Bank operates with a wide range of customers. If any innovative banking service launched then suddenly it is quickly duplicated by the other banks such as ATM, Tele-Banking, Online etc. hence the key to establish a competitive edge in banking industry of Bangladesh is to provide better customer service quality.

Bank

Usually bank is an establishment which trades in money; an establishment for deposit, custody, and issue of money and also for granting loans, discounting bill and facilitating transmission of remittances from one place to another.

The Principal functions of Bank’s are:

- To receive demand deposit and pay customers cheques drawn against them.

- To receive time deposit and pay interest thereon.

- To discount notes, make loans and invest in govt. or other securities.

- To collect cheques, drafts, notes etc.

- To issue drafts.

- To certify depositors cheques and

- When authorized by a chartering govt. it may act in a fiduciary capacity.

Banking:

Banking means the accepting for the purpose of lending or investment of deposits or money from the public, repayable on the demand or otherwise and withdrawn able by cheques, draft, order or otherwise.

Islamic Banking:

Islamic banking has been defined as banking in consonance with the ethos and value system of Islam and governed, in addition to the good governance and risk management rules, by the principles laid down by Islamic Shariah. Interest free banking is a narrow concept denoting a number of banking instruments or operations, which avoid interest. Islamic banking, the more general term is expected not only to avoid interest-based transactions, prohibited in the Islamic Shariah, but also to avoid unethical practices and participate actively in achieving the goals and objectives of an Islamic economy.

The General Secretaries of the Organization of Islamic Conference (OIC) defines an Islamic bank as “A financial institution whose statutes, rules and procedures expressly state banning of the receipt and payment of profit on any of its operation”. Section 2 of Islamic Banking Act 1983 of Malaysia (Act no. 276) has given the following definition:-

- “Islamic Bank” means any company which carries on Islamic Banking Business and holds a valid license;

- “Islamic Banking Business” means banking business whose aims and operations do not involve any element which is not approved by the religion of Islam.

Conventional Banking:

The banking system deal with interest and do not follow the rules of shariah is known as Conventional banking.

Usually the conventional banking system deals with the interest factor and in most of the cases we can see that it do not work in a partnership basis with its client.

Example: Mr. X want to start a plant. So he takes loan from a conventional bank. In this case bank interacts with him as a client because Mr. X as to repay the money with a specific interest, no matter Mr. X gains profit or loss. But Islamic banking system said there will be no specification of money up on the capital. The Islamic bank should claim money up on business profit (if gain) [as per contract]; The capital amount (loan) must repay within the specific time.

Definition of service:

Today service sector is growing faster. So we need to know about service clearly. Services are deeds, processes & performances. Its include all economic activities whose output is not a physical product or construction, is generally consumed at the time it is produced and provides added value in forms (such as convenience, amusement, timeliness, comfort or health) that are essentially intangible concerns of its first purchaser. Some examples of service industries are Banks, Health care, professional services, hospitality, travel etc.

Overall Differentiation: Islamic Banking vs. Conventional Banking:

Table 04: Islamic Banking vs. Conventional Banking

Conventional Banks | Islamic Banks |

| 1. The functions and operating modes of conventional banks are based on fully manmade principles. | 1. The functions and operating modes of Islamic banks are based on the principles of Islamic Shariah. |

| 2. The investor is assured of a predetermined rate of interest. | 2. In contrast, it promotes risk sharing between provider of capital (investor) and the user of funds (entrepreneur). |

| 3. It aims at maximizing profit without any restriction. | 3. It also aims at maximizing profit but subject to Shariah restrictions. |

| 4. Lending money and getting it back with compounding interest is the fundamental function of the conventional banks. | 5. Participation in partnership business is the fundamental function of the Islamic banks. So we have to understand our customer’s business very well. |

| 5. Very often it results in the bank’s own interest becoming prominent. It makes no effort to ensure growth with equity. | 5. It gives due importance to the public interest. Its ultimate aim is to ensure growth with equity. |

| 6. For interest-based commercial banks, borrowing from the money market is relatively easier. | 6. For the Islamic banks, it must be based on a Shariah approved underlying transaction. |

| 7. Since income from the advances is fixed, it gives little importance to developing expertise in project appraisal and evaluations. | 7. Since it shares profit and loss, the Islamic banks pay greater attention to developing project appraisal and evaluations. |

| 8. The conventional banks give greater emphasis on credit-worthiness of the clients. | 8. The Islamic banks, on the other hand, give greater emphasis on the viability of the projects. |

| 9. The status of a conventional bank, in relation to its clients, is that of creditor and debtors. | 9. The status of Islamic bank in relation to its clients is that of partners, investors and trader, buyer and seller. |

Source: Created

Difference between Bank Product & Service:

There is general agreement that inherent differences between goods & services exist and that they result in unique or at least different. These differences & associated marketing implications are shown in a table below:

Table 05: Difference between Bank Product & Service:

| Goods | Services | Resulting implications |

| Tangible | Intangible | Service cannot be inventoried. Service cannot be patented. Service cannot be readily displayed or communicated. Pricing is different. |

| Standardized | Heterogeneous | Service delivery and customer satisfaction depends on employee action. |

| Production separate from consumption | Simultaneous production & consumption | Customer participation affects the transaction. When service provides is consumed at the same time. |

| Nonperishable | Perishable | Service cannot be returned or restore. |

Source: Created

Meaning of Export

Export means lawful carrying out of anything from one country to another country for sale.

Definition of Exporter

The importers and exports trade of the country is regulated by the Imports Exports control Act 1950. No person / firm is allowed to export anything from Bangladesh unless he is registered with CCI and E under the registration order (Importer and Exporter) 1952. To become an exporter an ERC (export Registration Certificate) must be obtained from the office of CCI & E.

Meaning of Import

Import means lawfully carrying out of anything from one country to country to country for buying. It will be occurred according to the government law

Problems for the Islamic Banking / Islamic banks:

Lack of Unified Shariah Rulings: In our country there is a problem of insufficient Scholars about shariah based banking, it causes the shortage of Scholar (shariah know ledged) human resource in the Central bank. As a result Islamic Banks in Bangladesh facing the problem, lack of Unified Shariah Rulings.

Absence of Islamic Inter-Bank Money Market: Islamic Banks do not deal with Interest. But there is no Islamic Inter-Bank Money Market within the country. So at the time of shortage of fund the Islamic Banks con not take loan form present money market. Because call money rate is involved with interest which is mostly used in the present money market.

Terrorism: Now a day it is the major problem with the all Islamic banks of the world. There is a negative thinking already imposed with the Muslims and with their religious rulings. And as Islamic Banking system rules by the rule of Allah given in Al-Quran, a negative thinking also works with it.

Shortage of Skilled and Trained Manpower in Central Bank for Islamic Banking: There is a huge shortage of skilled and trained manpower in the central bank for observing the activities of Islamic Bank’s. As a result Islamic banks miss the appropriate guidance of Central Bank.

Economic slowdown and Political Situation of the Country: The political instability is the major problem for the banking industry. Because it reduce the overall flow of money within the country. As a result the growth of economy going down. As Islamic banking system concept for this country, people feel more unreliable to invest in Islamic banks, it causes negative reflection for the bank.

Inadequate Track Record of Islamic Banking: As Islamic banking is comparatively new concept in this country it do not have a huge track record in the Banking Industry, so some time public got confused at the time of invest in these bank.

Defaulting Culture of the Borrower: The defaulting culture of borrower is another problem for the Islamic Banks as well as Islamic banking system. Because Islamic banking system deals with the profit. Some time borrower does cheating with the bank by showing negative profit to his business.

General Banking Functions of EXIM Bank:

General banking department is the heart of all banking activities. This is the busiest and important department of a branch, because funds are mobilized, cash transactions are made; clearing, remittance and accounting activities are done here.

Since bank is confined to provide the services everyday, general banking is also known as ‘retail banking’. In EXIM Bank LTD Principal Branch, the following departments are under general banking section:

- Account opening section

- Deposit section

- Cash section

- Remittance section

- Clearing section

- Accounts section

- IT section

Account Opening Section:

Account opening is the gateway for clients to enter into business with bank. It is the foundation of banker customer relationship. This is one of the most important sections of a branch, because by opening accounts bank mobilizes funds for investment. Various rules and regulations are maintained and various documents are taken while opening an account. A customer can open different types of accounts through this department. Such as:

- Al –Wadia (Current) account.

- Mudaraba Savings (SB) account.

- Mudaraba Short Term Deposit (MSTD)

Cash Section

Banks, as a financial institution, accept surplus money from the people as deposit and give them opportunity to withdraw the same by cheque, etc. But among the banking activities, cash department play an important role. It does the main function of a commercial bank i.e. receiving the deposit and paying the cash on demand. As this department deals directly with the customers, the reputation of the bank depends much on it. The functions of a cash department are described below:

Function of Cash Department:

Cash Payment:

- Cash payment is made only against cheque

- This is the unique function of the banking system which is known as “payment on demand”

- It makes payment only against its printed valid Cherub

Cash Receipt

- It receives deposits from the depositors in form of cash

- So it is the “mobilization unit” of the banking system

- It collects money only its receipts forms

Cash packing:

After the banking hour cash is packed according to the denomination. Notes are counted and packed in bundles and stamped with initial.

Local Remittance:

Carrying cash money is troublesome and risky. That’s why money can be transferred from one place to another through banking channel. This is called remittance. Remittances of funds are one of the most important aspects of the Commercial Banks in rendering services to its customers.

Types of remittance:

- Between banks and non banks customer

- Between banks in the same country

- Between banks in the different centers.

- Between banks and central bank in the same country

- Between central bank of different customers.

- The main instruments used by the EXIM Bank of remittance of funds are

- Payment order ( PO)

- Demand Draft ( DD)

- Telegraphic Transfer (TT)

Pay Order gives the payee the right to claim payment from the issuing bank. Payment is made from issuing branch only. Generally remit fund within the clearinghouse area of issuing branch. Bank charge only commission for this. However party must have an account with the bank, so that whenever the fund refund they(party) can collect it. But for the student and the pay order for job purpose of any applicant, account with the bank is not mandatory. Because in this case fund are non-refundable.

Demand Draft is an order of issuing bank on another branch of the same bank to pay specified sum of money to payee on demand. Payment is made from ordered branch. Generally remit fund outside the clearinghouse area of issuing branch. Payee can also be the purchaser. Bank confirm through checking the ‘Test Code’ Bank charge a commission and telex charge for it.

Clearing Section:

Cheques, Pay Order (P.O), Demand Draft (D.D.) Collection of amount of other banks on behalf of its customer are a basic function of a Clearing Department.

- Clearing:

Clearing is a system by which a bank can collect customers fund from one bank to another through clearing house.

- Clearing House:

Clearing House is a place where the representatives of different banks get together to receive and deliver cheque with another banks.

Normally, Bangladesh Bank performs the Clearing House in Dhaka, Chittagong, Rajshahi, and Khulna & Bogra. Where there is no branch of Bangladesh Bank, Sonali bank arranges this function.

- Member Of Clearing House:

EXIM Bank LTD. is a scheduled Bank. According to the Article 37(2) of Bangladesh Bank Order, 1972, the banks, which are the member of the clearinghouse, are called as Scheduled Banks. The scheduled banks clear the cheque drawn upon one another through the clearinghouse.

- Types of clearing house: There are two type of clearing house: Those are

1) Normal clearing house

2) Same day clearing house

Normal clearing house:

1) 1st house: 1st house normally stands at 10 a.m. to 11a.m

2) 2nd house: 2nd house normally stands after 3 p.m. and it is known as return house.

Same day clearing house:

1) 1st house: 1st house normally stands at 11 a.m. to 12 p.m

2) 2nd house: 2nd house normally stands after 2 p.m. and it is known as return house.

Account Section:

Accounts Department is called as the nerve Centre of the bank. In banking business, transactions are done every day and these transactions are to be recorded properly and systematically as the banks deal with the depositors’ money. . Improper recording of transactions will lead to the mismatch in the debit side and in the credit side. To avoid these mishaps, the bank provides a separate department; whose function is to check the mistakes in passing vouchers or wrong entries or fraud or forgery. This department is called as Accounts Department. If any discrepancy arises regarding any transaction this department report to the concerned department.

Besides these, the branch has to prepare some internal statements as well as some statutory statements, which are to be submitted to the Central Bank and the Head Office. This department prepares all these statements.

Advance Banking (Foreign Exchange):

Foreign Exchange:

In terms of the F.E.R act, 1947 as adopted in Bangladesh “Foreign Exchange” means foreign currency and includes all deposits, credits and balances payable in foreign currency as well as all foreign currency instruments like, cash currency notes, checks, drafts, bill of exchange, traveler’s cheques, postal money order, commercial letter of credit etc.

- Import section

- Export section

Import section

Opening of Letter of credit

Letter of credit is an undertaking on the bank’s part on behalf of its customer under some legal consideration. It is also known as documentary credit. Thus, the documentary credit is a commitment on the bank’s part to place an agreement at the seller’s disposal on behalf of the buyer under precisely defined conditions.

The Main Parties to Documentary Credit:

- Buyer (Importer).

- Seller (Exporter).

- L/C Issuing Bank (Buyer’s Bank).

- Advising Bank (Issuing bank correspondent at seller’s place).

- Negotiating Bank (Seller’s Bank).

(Some time the advising bank and the negotiating bank become the same bank)

Documents required for opening a Letter of Credit are as follows;

- L/C application and agreement from duly filled and signed by proposed importer.

- Exchange control copy of L/C authorization form.

- Indent or preformed invoices (one kind of price list describing the details on the items wanted to import).

- Insurance cover note with premium paid receipt.

- L/C opening sheet.

- L/C forms (in set) FEX-1(A).

- L/C amendment form FEX-1 (B).

- L/C forwarding form FEX-1(C).

- IMP form (set in quadruplicate).

- Liability voucher.

Procedure, Scrutiny, Lodgment and Retirement

Imports and exports (control) Act 1950 regulate the import and export trade of the country. There are a number of formalities which on importer has to fulfill before import goods.

Procedures of import

The procedures which follow at the time of import are as follows:

- The buyer and seller conclude sales contact provided for payment by documentary credit.

- The buyer instructs his bank (the issuing bank) to issue a credit in favor of the seller/exporter/beneficiary.

- The issuing bank then sends message to other bank (advising bank/conforming bank), usually situated in the country of seller, advise or conform the credit issued.

- The advising/conforming bank then informs the seller through his bank that the credit has been issued.

- As soon as the seller receives the credit, if the credits satisfy him then he can reply that he can meet its terms and conditions, he is in a position to load the goods and dispatch them.

- The seller then sends the documents evidencing the shipment to the bank where the credit is available (the nominated bank). This can be issuing bank or conforming bank, bank named in the credit as the paying, accepting or negotiating bank.

- The bank then checks the documents against the credit. If the documents meet the requirement of the credit, the bank then pay, accept or negotiate according to the terms of credit. In the case of a credit available by negotiation, issuing bank will negotiate with recourse.

- The bank, if other then the issuing bank, sends the documents to the issuing bank.

- The issuing bank cheeks the documents and if they found that the document has meet the credit requirements, they released to the buyer upon payment of the amount due or other terms agreed between his and the issuing bank.

Export section

Literally, the term export, we mean that carrying of anything of from one country to another. On the other hand bankers define export as sending of visible things outside the country for deal. Export trade plays a vital role in the development process of an economy. With the export earning, we meet import bills.

Like any other business it needs registration. The chief controller of import and (CC&E) makes export registration. For registration, prospective exporters required to apply through Q.E.X.P form the CC&E along with the following documents:

- Trade license.

- Income tax clearance

- Nationality Certificate.

- Bank’s solvency Certificate.

- Asset Certificate.

- Registered partnership deed.

- Memorandum & Association of articles/certificate of incorporation.

Remittance section

Remittance can be classified broadly into two types:

a) Outward remittance, and

b) Inward remittance.

a)Outward Remittance

Outward remittance include sell of foreign currency by TT, MT, Drafts, Traveler cheque and as well as payment against import into Bangladesh. Outward remittance can be classified into two types. These are as follows:

- Private remittance, and

- Commercial remittance.

b) Inward Remittance

Inward remittance includes purchase of foreign currency by TT, MT, Drafts, Purchase of export bills and Traveler cheque. But due to lack of promotional activities the branch is failure to attract new customer for existing export and import business.

Investment Functions of EXIM Bank

Investment

Investment means ‘to lay out of money’ or fund provided for a legal purpose for a certain period. In Islamic Banking Investment means utilization of fund or deployment of fund a special legal purpose on profit /loss sharing basis for a certain period. Islamic Bank as per shariah deals goods & services, not money.

There are mainly three types of investment in Islamic Banking. These are:

- Partnership Mode

- Bai Mode

- Izara Mode

Customer Satisfaction Analysis:

These are the areas given below based on which, I was trying to find out the customer satisfaction level of EXIM Bank.

- Quality of the service

- Price of the service

- Working Schedule

- Physical Environment

- Availability of the branch

- Comparatives of the service

- Performance of the service

Grade Sheet for Satisfaction Area Selection:

Table-07: Grade Sheet for satisfaction Area Selection

| 1 | Delighted level | Above 90% (agree) |

| 2 | Desired level | 71% up to 90% (agree) |

| 3 | Zone of Tolerance level | 51% up to 70% (agree) |

| 4 | Adequate level | 31% up to 50%(agree) |

| 5 | Dissatisfaction level | Up to 30% (agree) |

Performance of EXIM Bank from the year 2006 to 2010

Table 08: Performance of EXIM Bank from the year 2006 to 2010 (In million Taka)

| Si. No. | Particulars | 2006 | 2007 | 2008 | 2009 | 2010 |

| 1 | Authorized Capital | 3500.00 | 3500.00 | 3500.00 | 10000.00 | 10000.00 |

| 2 | Paid-up Capital | 1713.76 | 2142.2 | 2677.75 | 3373.96 | 6832.27 |

| 3 | Shareholder’s Equity | 3111.69 | 4042.53 | 4989.2 | 6717.21 | 12474.85 |

| 4 | Total Capital (Tier I + Tier II) | 3467.37 | 4569.56 | 5763.89 | 7718.89 | 13928.40* |

| 5 | Statutory Reserve | 810.88 | 1134.64 | 1532.55 | 2092.97 | 3154.76 |

| 6 | Total Assets | 41793.54 | 51503.03 | 68446.46 | 86213.37 | 113070.98 |

| 7 | Total Liabilities | 38681.86 | 47460.5 | 63457.26 | 79496.16 | 100596.13 |

| 8 | Deposits | 35023.02 | 41546.57 | 57586.99 | 73835.46 | 94949.40 |

| 9 | Investment (General) | 32641.27 | 40195.24 | 53637.68 | 68609.91 | 9329.65 |

| 10 | Investment (Shares& Securities) | 2233.25 | 2457.72 | 2894.02 | 2189.54 | 6012.86 |

| 11 | Total Contingent liabilities | 18994.09 | 22632.65 | 26070.57 | 30109.11 | 55098.36 |

| 12 | Total Risk Weighted Assets | 32401.36 | 40706.47 | 53428.99 | 69058.87 | 142057.50 |

| 13 | Total Fixed Assets | 178.43 | 200.7 | 293.53 | 381.98 | 463.75 |

| 14 | Total Income | 4067.57 | 6407.96 | 8356.82 | 10383.62 | 13723.96 |

| 15 | Total Expenditure | 3588.89 | 4499.76 | 5838.43 | 7201.87 | 7830.16 |

| 16 | Profit before Provision and tax | 1378.67 | 1908.2 | 2518.39 | 3181.78 | 5793.79 |

| 17 | Profit before tax | 1199.49 | 1618.8 | 1989.55 | 2802.12 | 5308.96 |

| 18 | Net profit after provision and tax | 650.29 | 930.84 | 1096.63 | 1694.1 | 3476.01 |

| 19 | Foreign Exchange Business | 96175.1 | 117900.14 | 156434.57 | 162604.61 | 227966.60 |

| a) Import Business | 49596.7 | 61399.4 | 78540.49 | 83911.51 | 129570.73 | |

| b) Export Business | 46234.6 | 55790.42 | 76465.62 | 76240.77 | 95395.45 | |

| c) Remittance | 343.8 | 710.32 | 1428.46 | 2452.33 | 3036.42 | |

| 20 | No. of Foreign Correspondent | 246 | 256 | 278 | 333 | 354 |

| 21 | Profit earning assets | 35161.48 | 42357.65 | 56192.52 | 69006.57 | 97501.97 |

| 22 | Non profit earning assets | 6632.07 | 9145.38 | 12253.94 | 17206.81 | 15569.01 |

| 23 | Investment as a % of total Deposit | 93.18% | 96.75% | 93.14% | 92.92% | 98.26% |

| 24 | Capital Adequacy Ratio | 10.70% | 11.23% | 10.79% | 11.18% | 9.80%** |

| 25 | Dividend | 25 | 32 | 26 | 35 | 35 |

| Cash (%) | 0 | 7 | 0 | 0 | 0 | |

| Bonus (%) | 25 | 25 | 26 | 35 | 35 | |

| Rights Share | 1R:2 | 1R:2 | ||||

| 26 | Cost of fund | 9.17% | 9.07% | 9.52% | 9.09% | 7.10% |

| 27 | Net Asset Value Per Share | 181.57 | 188.71 | 186.32 | 199.09 | 18.26 |

| 28 | Earnings per share ( EPS) | 43.48 | 34.76 | 40.95 | 50.21 | 5.35 |

| 29 | Price earnings ratio (times) | 7.74 | 9.02 | 7.85 | 7.52 | 11.34 |

| 30 | Return on Assets (ROA) after tax | 1.73% | 2.0% | 1.83% | 2.19% | 3.54% |

| 31 | No. of Shareholders | 18771 | 23284 | 24387 | 29302 | 99882 |

| 32 | Number of Employees | 1020 | 1104 | 1312 | 1440 | 1686 |

| 33 | Number of Braches | 30 | 35 | 42 | 52 | 59 |

Source: Annual Report of EXIM Bank 2009-2010

SWOT Analysis:

The following SWOT analysis describes EXIM Bank Ltd. present Strengths, Weakness, Opportunities and Threats.

Strength

The major Strength of the bank has a lot of capital.

They have skillful workforce.

Good combination of young and experience workforce.

Weaknesses

- This bank is the Unavailability of ATM and credit services.

- Credit Cards need to be expanded vastly with market demand

- Insufficient advertising.

Opportunities

- Can offer credit scheme for student.

- To reach in market penetration through diversified products and banking network.

- To diversify online facility to more customer.

- To use of technology from entry level to top level.

- Can use public’s positive sentiment about Islamic Banking.

Threats

- Any newly established bank can be a threat for EXIM Bank. Newly established bank can provide better quality service than EXIM Bank. It will be worst for EXIM Bank.

- The large threat for the EXIM Bank is terrorism. As it is an Islamic Shariah based bank the negative public sentiment work beside it.

- All sustain multinational banks and private banks posse’s enormous threats to EXIM Bank Limited.

Findings of the Study:

From my study on the overall performance and activities of EXIM Bank I have got some major findings, which are given below:

- The financial performance of the Islamic banking & Exim bank is in satisfactory.

- Customer satisfaction of EXIM is in good enough.

- People specially on general banking are cooperative enough to communicate with customers.

- Implication of computer facility is comparatively low as a bank of third generation.

- Like other private banks in Bangladesh, branches of this bank are located in few metropolitan and urban cities neglecting the vast and potential rural areas. The rural people are almost outside the credit network of EXIM Bank.

- The quality of the service of EXIM Bank is very high.

- The price of the service of EXIM Bank is moderate.

- The working schedule of EXIM Bank is easy to attend.

- The physical environment is good.

- The availability of the branch of EXIM Bank is good.

- The comparatives of the service of EXIM Bank are sufficient.

- The performance of the service of EXIM Bank is good.

Recommendations

As a new Concept, Islamic banking system is facing some problems. Especially the Local Banks whose are performing the Islamic Banking system are the major sufferer. To avoid these problem Islamic Banks should take some steps which are given below:

- They should develop IBTC (Islamic Banking Training Center).

- They should provide training to their employee regularly.

- They should Increase follow up activity to stop defaulting culture of the borrower.

- Through providing better service they should Increase their reliability to minimize their problem of inadequate track record.

- To increase public awareness they should provide more advertisement.

- By maintaining more and more CSR (Corporate Social Responsibility) they should increase their public image.

- They should propose to the Central Bank to develop Islamic Inter-Bank money market.

Conclusions

The beginning of Islamic banking system in Bangladesh is not so far, it’s a new banking concept developing in Bangladesh, so there will be some problem what Islamic Banks have to face. But they must improve themselves too faster because the banking industry is growing too faster and many new banks are going to be open. So the competition is going to increase much more. Hence as for all banks the core product is same they have to emphasize on their supplementary product, price and also to the physical evidence and process. Because physical evidence affects the perception of the consumer and in case of Banks it required more to the customer. At last it can be said that in Bangladesh, Islamic Banking has a huge future and a bank like EXIM bank can prove itself as an Idol in Banking sector of Bangladesh. I hope that authority will consider my model and suggestions and apply them. And by implementing the model and suggestions EXIM bank and the other banks whose performs Islamic Banking will become a role model day by day.