Executive Summary

Modern Banking system plays a vital role for a nation’s economic development. Over the last few years the Banking world has been undergoing a lot of change due to deregulation, technological innovations, globalization etc. These changes also made revolutionary changes of a country’s economy The organization commences its functions in the financial sector of the country as an investment company as named “National Credit Limited (NCL)” in 1985. For the greater impingement in financial market it coverts as National Credit & Commerce Bank Ltd. in 1993 under “Company Act, 1994”. It is also guided by the “Bank Company Act, 1991” (and its subsequent amendment) and “Bangladesh Bank Ordinance 1972”, so as to enable the company for doing banking business.

National Credit and Commerce Bank Limited is a new generation Bank. It is committed to provide high quality financial services/products to contribute to the GDP of the country through stimulating trade and commerce, accelerating the pace of industrialization, boosting up export, creating employment opportunity for the educated youth, poverty alleviation, raising standard of living of limited income group and over all sustainable socio-economic development of the country.

NCCBL extends its investment facilities to different sectors to diversity its Investment portfolio in compliance with credit policies of Bangladesh Bank. It provides different types of Investment facilities to its customers like Secured Over Draft, Cash Credit, House Building Loan, Trust Receipt (TR), Inland Bill Purchase (IBP), Foreign Bill Purchase etc. In a broader sense it provides loan for Agriculture & agro based ventures, Trade & commerce, Consumer financing, Real estate & civil construction, Industry, Business, Lease financing & Housing Loan scheme. These loans are primarily been divided into four prime sectors, which are Continuous loan, Term loan, Demand loan and Loan under SME.

NCCBL follows a clearly defined procedure for sanctioning a loan. This procedure just comprises obtaining Party’s application, Filling form-A, Collecting CIB report from Bangladesh Bank, Processing loan proposal, Project appraisal, Head office approval, Sanction letter, Documentation and lastly Disbursement.

INTRODUCTION

Origin of the Study

This report titled, “Loan Disbursement And Recovery System” prepared to fulfill the requirement of the internship program. It is a mandatory requirement of the program that requires a student to work in a particular organization for at least 90 days. As I have been joined as an internee in NCC Bank Ltd. from 01 June 2010 to1 September 2010, the project is focused on NCC Bank Limited with a reference to its motijhel main Branch.

BACKGROUND OF THE STUDY

Business world is becoming very much complex day by day. Without sufficient practical experience business becomes difficult and in some cases impossible. The whole world is moving because of business relation. Business plays a very important role in developing economy of a country. So, in the business world, practical experience is regarded as a media through whom we have an acquaintance with the real world. Through this report an individual can expect to have a good knowledge and understanding on the various methods of operation performed by NCC Bank Limited particularly in the area of Financial Institutional Services. From the last three months of the bank’s disbursement, everything is tried to include in precise form. I have tried my level best to put more emphasis on the welcome pack and its recovery process. Although it was not the topic of my internship programs. This report is to be used only for the academic purpose. I have collected all the necessary and relevant data from various primary, secondary and tertiary sources. After eight week long hard labor, it has become possible for me to make the report comprehensive and factual. The data is truly and strictly confidential and no one can use its components in full or partial. I would like to give thanks to everyone who has helped and encouraged me in the process of preparing this report.

I was authorized to prepare a report on loan division and performance evaluation of the NCC bank ltd. for partial fulfillment of my course requirement. I went to NCC in Loan Section, Motijheel Branch, where I worked as an intern from June 01 2010 to September 01 2010. This report has been prepared based on my practical experience on the day-to-day banking activities and collected information from Bank and under close supervision of my internal guide teacher as well as course teacher Shariful Haque.

RATIONALE OF THE STUDY

The principal function of the bank is to loan disbursement. Loan disbursement comprises a very large portion of a bank’s total activities. Sound loan disbursement practice therefore, is very important for profitability and success of a bank. Like other financial intermediary, commercial banks also intermediate between the savers and borrower to mobilize the financial surplus of the savers and allocate these savings to the creditworthy borrowers of different sectors of the economy. In this way they not only help in financial development of a country, but also facilitate its economic development.

For the sake of sound lending, it is necessary to develop a sound policy and modern lending techniques to ensure that loans/ advances are safe and the money will come back within the time set for repayment. For this purpose, proper and prior analysis of credit proposals is required to assess the risk.

Loan disbursement to the customer is a judgment, which depends upon ones ability to assess the shortcomings in the proposals and to identify the risk. Ability in taking prior measures to minimize the risk is very much important. In the background of the above things, the issue “Loan disbursement and recovery system” has been undertaken as a comprehensive research topic, which will serve the BBA program. The research topic has been prepared as per the direction by the program supervisor.

OBJECTIVES OF THE STUDY

This report has been prepared through extensive discussion with employees of the bank and with the clients. While preparing this report, I had a great opportunity to have an in depth knowledge of all the banking activities practiced by the NCC Bank limited. It also helped me to acquire a fast hand perspective of a leading private bank in Bangladesh and the date of information concentrate within the period 2005 to 2009.

Primary objective:

The primary objective of this report is to prepare a report on “Loan Disbursement and Recovery System of National Credit Commerce Bank Limited” as the partial requirement of B.B.A program.

- To identify the pattern of the different types of loan system.

- Loan features and recovery system of some loan schemes with launching of some new scheme with special features.

- To evaluate the contribution of Scheme deposits in total collection of loan.

- To evaluate of the total collection of loan or provided in NCC then other bank

Secondary objectives:

The study was conducted to achieve the following secondary objectives-

- Ø To present an overview of National Credit & Commerce Bank Limited.

- Ø To appraise the principal activities of the Bank.

- Ø To appraise the financial performance.

- To identify the problems of NCC Bank Limited.

- Ø To suggest measures for the development of National Credit & Commerce Bank Limited.

SCOPE OF THE REPORT

This paper will cover the details of NCC Bank’s practices about various Loan Disbursement and recovery system of NCC Bank. Now a day’s loan disbursement is very much important for all banks because they are easily received profit from their customers. In this paper, I will try to focus on the various functions of Loan activities, its using business correspondence analysis of this sector as well as its role in our economy. It will also cover the total system of credit management procedures and performance of NCC Bank Ltd. The deterioration of loan quality will also affect the intermediation efficiency of the financial institutions and thus the economic growth process of the country. This establishes the fact that banks should provide increasing emphasis on various analytical tools and techniques for screening proposals and loan decision taking.

LIMITATIONS OF THE STUDY

Since the paper is concerned with the comparison of Loan department of The NCC Bank Limited with other private banks, different private commercial bands, such as, Eastern Bank Limited, United Commercial Bank Limited, Dhaka Bank Limited, HSBC, and Bank Asia Ltd etc are also deal with this loan sector. Basically all bank of their main target gain maximum profitability by providing loan to the customers. So a lot of information could not obtain because the banks were not interested to disclose their information, policy, and data to maintain their secrecy. I had to depend on the websites of the respective banks for much information. There are certain limitations regarding the studies that are summarized below:

- Field practice varies with the standard practice that also created problem.

- Time provided for conducting the study is another important constraint.

- The employees in The NCC Bank Limited are so much busy in their responsible fields.

- The total report like “Loan Disbursement and recovery system of the NCC bank Ltd” is vast and not possible to make it over a night. So it is the hard task to prove all the information on that necessary segment which might make report more resourceful and out standing. I couldn’t prepare the report as the best of my capability because much information could not gathered for the recourses of confidentially. During the Banking hour there were many customers who has to be served time offered per customer was not adequate to ask about their satisfactory and dissatisfactory level in connection with scheme related transactions which might have helped to focus in more detail.

- In case of performance analysis secondary data are used.

METHODOLOGY OF THE STUDY

National Credit &Commerce Bank Limited is one of the well-known private commercial bank in Bangladesh. Its public reporting system is appreciable. Data is managed in well manner. Data arrangement is logical that helps in easy application of analytical tool. Statistical tools and much graphical presentation are used for performance analysis.

Research Design:

Exploratory research has been conducted for gathering better information that will give a better understanding on various information in Loan sector, how to communicate customer and other bank employee, all are gathering knowledge about this sector of Loan. Both primary and secondary sources of data collection procedure have been used in the report. Primary data has been collected mainly through the writer’s observation of the approval process and monitoring techniques, informal interviews of executives, officers and employees of The NCC Bank Limited.

The Primary sources are follows:

Primary data are measurements observed and recorded as part of an original study. When the data required for a particular study can be found neither in the internal records of the enterprise, nor in published sources, may it become necessary to collect original data. For the completion of this report, the primary sources of data are-

v Face-to-face conversation with the respective officers and staffs of NCC Bank Limited.

v Informal conversation with the clients.

v Practical work exposures from the different desks of the departments of the Branch.

v Study of the relevant files as instructed as instructed by the officers concerned

v Experts’ opinion and comments,

The Secondary sources and data are follows:

The data, which has already been collected by others, such data are called Secondary data. For this internship report, the secondary data are collected from the below sources-

v Annual report of NCC Bank limited

v Unpublished data from the branch

v Banker’s training book

v Training materials available at the BIBM library,

v Various books articles, compilations etc. regarding marketing of financial products are informed below:

v Published of different products,

v Office circular and other published papers,

v Website of the NCC; www.nccbank.com.db

ORGANIZATIONAL PROFILE

INTRODUCTION

The prosperity of a country depends on its economic activities. Like any other sphere of modern socio-economic activities, banking is a powerful medium of bringing about socio-economic changes of a developing country. Without adequate banking facility agriculture, commerce and industry cannot flourish. A suitable developed banking system can provide the necessary boost for the economic growth of the country. Because banking system is linked with the whole economy.

National Credit and Commerce Bank Limited (NCCBL) is a private commercial bank. It is also contributing to the growth of our country’s economy. It is a progressive commercial bank in private sector. It creates new opportunities for its clients. It gives customized services and maintains harmonious banker-client relationship. It contributes towards formation of national capital, growth of savings and investment in trade, commerce and industrial sector.

HISTORICAL BACKGROUND

The National Credit and Commerce Bank Limited (NCCBL) started its operation in 25th November 1985 as a non-banking financial institution under the name of National Credit Limited (NCL). 26 businessmen sponsored it as a public limited company under the Companies Act 1913 with an authorized capital of taka 300 million. NCC Bank was incorporated as a banking company under the Companies Act 1994. In end 2001 it had 30 branches all over Bangladesh. It carries out all its banking activities through these branches among which 17 branches are authorized dealer of foreign exchange. The bank is listed in the Dhaka and Chittagong Stock Exchanges as a publicly quoted company for its general class of shares. The authorized capital of the bank is now taka 750 million. The Bank raised its paid up capital from Taka 195 million to Taka 390 million during the year through IPO of which sponsor directors/ shareholders equity stood at Taka 198 million. With the increase of paid up capital to Taka 390 million, the capital base of the Bank has become strong. NCC Bank is now positioned to best suit the financial needs of its customers and make them partners of progress.

MISSION

v Anticipating business solutions required by all our customers everywhere and innovatively supplying them beyond expectation

v Setting industry benchmarks of world class standard in delivering customer value through our comprehensive product range, customer service and all our activities

v Building an exciting team-based working environment that will attract, develop and retain employees of exceptional ability who help celebrate the success of our business, of our customers and of national development

v Maintaining the highest ethical standards and a community responsibility worthy of a leading corporate citizen

v Continuously improving productivity and profitability, and thereby enhancing shareholders value

VISION

To be in thee forefront of national development by providing all the customers inspirational strength, dependable support and the most comprehensive range of business solutions, through our team of professionals who work passionately to be outstanding in everything we do.

VALUES

Value Pillars of NCC Bank that are central to our core ideologies and that must always be reflected in everything we do:

v We are aggressive in business and self-driven.

v We empower people, create leaders and drive change.

v We treat people with respect and dignity.

v We are personally accountable for delivering on commitments to build high-trust relationship with customers and to ensure customer delight.

v We focus on managing risks and costs in order to be doubly profitable.

v We act in ways that reflect the highest standards of integrity

FUNCTIONS AND OPERATION

NCC Bank Limited opened its 65th branch with online facility at Progati Soroni, Badda on 26 January 2010. Vice Chairman of the Bank Lion M. Harunur Rashid MP formally inaugurated the branch as chief guest. Managing Director & CEO Mohammed Nurul Amin presided over the function. Mohammed Nurul Amin, Managing Director & CEO of the Bank in his speech citing various schemes and services of NCC Bank said that the bank would open more branches, SME Centers and branches of Brokerage House in different places of the country in this year. Stressing on social responsibility of the Bank, he said that Bank is not only a profit earning organization but also working for social welfare, which will continue in future.

The bank has by now a network of 17 branches strategically located in different cities. All the branches are functioning in computerized environment and integrated through Wide Area Network (WAN). This interconnected system is fictionalized with Oracle based software called Flora. The branches are full-fledged units and can provide all commercial and investment banking services ranging from small and medium enterprises to big business conglomerates and houses

MANAGEMENT OF NCCBL

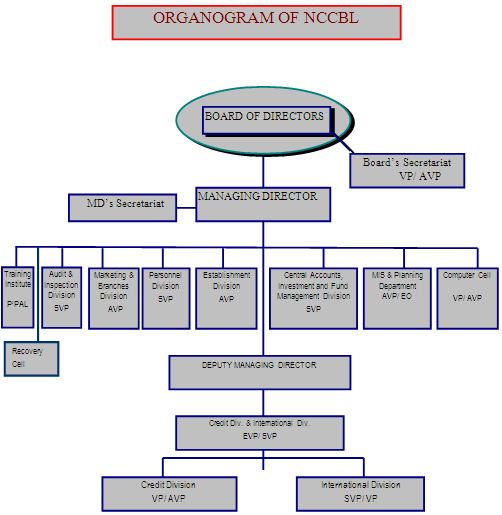

Management of NCCBL is professional and experienced. Top management and the policy formulation of the Bank is vested on the Board of Directors. The board of directors consists of 26 members headed by chairman. Most of the directors are owners of large business groups having high net worth. The executives and officers of the bank execute the policies and programs formulated by the board.

The Managing Director is the chief executive of the bank and he is assisted and supported by other qualified executives like Senior Executive Vice Presidents, Executive Vice President (EVP), Senior Vice President (SVP), Vice President (VP), Senior Assistant Vice Presidents and other officers and staffs. There are nine divisions in this Bank and one training institute

CORPORATE CULTURE

NCC Bank is one of the most disciplined Bank with a distinctive corporate culture. In this bank, it believes in shared meaning, shared understanding and shared sense making. The people of bank can see and understand events, activities, objects and situation in a distinctive way. They mould their manners and etiquette, character individually to suit the purpose of the Bank and the needs of the customers who are of paramount importance to them. The people in the Bank see themselves as a tight knit team/family that believes in working together for growth. The corporate culture they belong has not been imposed; it has rather been achieved through their corporate culture.

ACHIEVEMENT

Bank’s performance may be termed as satisfactory in respect of Deposit mobilization and profit earning. During the year under review the Bank could enhance quality of its assets and recovered it’s over dues from default borrowers. At the end of 2007, bank’s operating profit stood at tk. 178.02 crore as against tk. 127.00 corer of the year 2006.

The Authorized Capital of the Bank remained at tk. 2500.00 million during the year as before but Paid- up capital rose to tk. 1352.12 million as against tk. 1201.80 million of 2006. The reserved fund increased to tk. 1995.36 million during the year by registering 64.15% increase over last year’s tk. 1215.58 million.

Different Banking Sectors of NCC Bank Limited

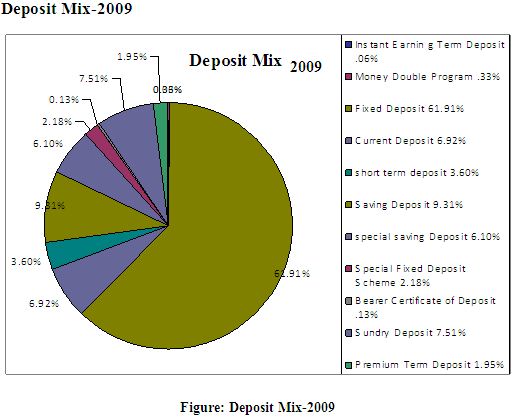

Deposit Scheme:

v NCC Bank Special Savings Scheme (SSS)

v Fixed Term Deposit (FDR)

v Short Term Deposit (STD)

v Savings Bank Account (SB A/C)

v Current Deposit Account (CD A/C)

v Current Deposits (CD)

v Premium Term Deposit (PTD)

v Instant Earning Term Deposit (IETD)

v Wage Earners Welfare Deposit Pension Scheme (WEWDPS)

v Money Double Program Deposit (MDP)

Foreign Exchange:

v Non Resident Foreign Currency Deposit Account (NFCD)

v Non Resident Taka (BDT Deposit) Account (NRTA)

v Resident Foreign Currency Deposit Account (RFCD)

v Foreign Currency Deposit Account

v Money Gram

v UAE Exchange

v Placid Express

v Arab National Bank (ANB)

v Dhaka Janata

v Habib Qatar

v Al Fardan

Money Transmission Products

v Payment Order / Security Deposit Receipt (SDR)

v Demand Draft

v Telegraphic Transfer

v Outstanding Bills for Collection (OBC)

v Travelers Cheque.

International Business Products

v Letter of Credit

v Back to Back Letter of Credit (BTB L/C)

v Buying and Selling of Foreign Exchange

v Foreign Demand Draft

v Foreign Telegraphic Transfer (FTT)

Foreign exchange Dept. of NCC bank:

NCC bank foreign exchange dept. plays a vital role to earn the bank’s maximum profit. The dept. is classified according to their activities. The foreign exchange dept. consists of three sections: –

- Import section,

- Export section,

- Foreign remittance section

IMPORT SECTION

Import of into Bangladesh is regulated by the Ministry of Commerce in terms of the import & export act 1950, with import policy orders issued periodically and public notices issued from time to time by the office of the Chief Controller of Import & Export (CCI&E). In terns of importers, exporters and indenters order 1981; no person can import goods into Bangladesh unless he is registered with the CCI&E. On the next step the importers applies to Bangladesh Bank through authorized dealers for import goods. In order to import a product from abroad, the importer needs to submit an application letter requesting for opening Letter of Credit (L.C) with the bank.

EXPORT SECTION

The export section of NCC bank of main branch is responsible for opening L/C negotiation of export documents, purchase of inland bill etc. As per Foreign Exchange Regulation Act, 1947, nobody can export by post and otherwise than by post any goods either directly or indirectly to any place outside Bangladesh, unless a declaration is furnished by the exporter to the collector of customer or to such other person as the Bangladesh Bank may specify in this behalf that foreign exchange representing the full export value of the goods has been or will be disposed by Bangladesh Bank.

The following documents are required to apply for registration of exports:

a) Trade License

b) Income clearance certificate,

c) Nationality certificate,

d) Bank solvency certificate,

e) Asset certificate,

f) Registration certificate,

g) Memorandum of association,

h) Rent receipt of business premises,

i) Certificate of incorporation,

REMITTANCE

Remittance is the best mediums to transfer funds from one place to another. This function eliminates the individual difficulties and the hazards in transformation of physica1 cash from one place to another.

To expend its network for distribution of remittance, the Bank has taken steps by entering in to an agreement with TMSS-a reputed NGO to use their 250 remote outlets under a join t venture of DFID & Bangladesh Bank called RPCF.

LOCAL REMITTANCE:

Transferring money among the country is called local remittance. In NCCBL, they provides following Local Remittance services:

- Pay Order

- Demand Draft

- Telegraphy/Telephone Transfer

FOREIGN REMITTANCE:

These remittance services are providing for exchange foreign currency. Those services are as follows:

Foreign Remittance

- Foreign Demand Draft

- Endorsement of US$ in passport

- Traveler’s Cheque

- Money Gram

- AFX

- Express Money

- Habib Exchange

CASH SECTION

CASH

Cash department is an important department of any bank. Cash amount is the main source of all banking activities. For that every day bank has to remain certain amount in cash in accordance with the rules and regulations of Bangladesh Bank. Cash section is a very sensitive organ of the branch and handle with extra care.

FUNCTIONS OF CASH SECTION

The cash department mainly performs the following functions:

1.Cash Receipt

2.Cash Payment.

CLEARING& BILLS SECTION

CLEARING

Local offices branch of NCC Bank receives different types of instruments, such as cheque, PO, DD etc. from its customers for collection. It also pays on behalf of its customers for those instruments that come to it through clearinghouse. When instruments of NCC Bank are sent for collection or received for payment through clearing house it is called Inter Bank Clearance or IBC.Clearing stands for mutual settlement of claims made in among member banks at an agreed time and place in respect of instruments drawn on each other.

TYPES OF CLEARING

There are two kinds of clearing:

- Inward Clearing

- Outward Clearing

Consumer Credit Scheme

This scheme is aimed to attract consumers from the middle and upper middle class population with limited income. The borrower should have saving or current deposit account with the bank. Minimum 25% of the purchase cost of the product is to be deposited be the borrower with the bank is equity before the disbursement of the loan. The rest 75% is to be kept as cash collateral (FDR, Shanchay Patra etc.) with the bank.

Loan amount is disbursed through a/c payee pay order/demand draft directly to the seller after submission of the indent, deposit of client equity and completion of documentation formalities.

Working Credit

Loans allowed to the manufacturing unit to meet their working capital requirement, irrespective of their size big, medium or large fall under the category.

Staff Loan

Bank official from senior officer and above is eligible for this loan. The maximum amount disbursed is TK. 50,000/- for a period of 2 years.

House Building Loan

This loan is provided against 100% cash collateral, besides; the land & building are also mortgaged with the bank Interest rate is 17% p.a.

Small Loan Scheme

NCCBL introduced three new small loan scheme are:

- House Renovation Loan

- Personal Loan

- Small Business Loan

House Repairing/Renovation Loan Scheme

This loan is offered for renovation and modernization of the house/building/flat which are acquired by inheritably or purchasing and other ways to make the properties liable and durable.

Interest rate is 16%

Personal Loan For Salaried Person

This loan is provided to fixed salaried persons in various organizations to meet any emergency cash needs at various events- treatment/operations of critical disease, matrimonial, maternity expenditure etc.

Interest rate is 17% p.a. and maximum credit ceiling is Tk1, 00,000/-

Small Business Loan Scheme

This loan is offered to the small and promising entrepreneurs to meet their capital requirement and enable them to operate and expand the business purposely.

Maximum credit ceiling is TK 5.00 lac with interest rate is 16% p.a.

Loan Against Imported Merchandise (Lim)

Advances allowed for retirement of shipping documents and release of goods imported through L/C taking effective control over the goods by pledge fall under this type of advance, when the importer failed to pay the amount payable to the exporter against import L/C, than NCCBL gives loan against imported merchandise to the importer. The importer will bear all the expenses i.e. the godown charge, insurance fees, etc. and the ownership of the goods is retaining to the bank.

Interest rate is 16%

LEASE FINANCE

To purchase any machinery, car etc for business purpose once can take this loan.

Requirements of the clients:

Party must have a CD a/c in the bank. Purchaser has to buy the product to the name of the bank.

Credit ceiling:

The party will finance 20% and the bank will finance rest of the amount.

Interest: Interest rate is 14%.

Repayment period:

Repayment period depends on loan amount. If the amount is big then it will take long time for repayment. If the amount is small then it will take short time.

Security: Bank will take collateral as security.

OTHER TYPES OF LOANS

Demand Loan

- Loan General

- Demand Loan Against Ship Breaking

- Payment Against Documents (PAD)

- Loan Against Imported Merchandise (LIM)

- Loan Against Trust Receipt (LTR)

- Forced Loan

- Packing Credit (PC)

- Secured Over Draft Against Cash Incentive

- Foreign Documentary Bills Purchased (FDBP)

- Local Documentary Bills Purchased (LDBP/IDBP)

- Inland Bill Purchased (IBP)

- Foreign Bill Purchase (FBP)

- Festival business loan

Loan (general)

NCCBL considers the loans, which are sanctioned for more than one year as loan (g). Under this facility, an enterprise of financed from the stating to its finishing, i.e. from installment to its production. NCCBL offers this facility only to big industries.

Loan against Imported Merchandise (LIM)

LIM is allowed for retirement of shipping documents and release of goods imported through L/C taking. When the importer failed to pay the amount payable to the exporter against import L/C, than NCCBL gives loan against imported merchandise to the importer. The importer will bear all the expenses i.e. the warehouse charge, insurance fees, etc. and the ownership of the goods is retaining to the bank. This is also a temporary advance connected with import, which is known as post import finance. Interest rate is 16%.

Loan against Trust Receipt (LTR)

Trust Receipt is a document, which creates the banker’s lien over the goods and practically amounts to hypothecation of the proceeds of sale in discharge of the lien. Loans against Trust Receipt to the clients are allowed when the documents covering an import shipment are given without payment. However, prior permission of Head Office must be obtained for such advances. The clients hold the goods or their sales proceeds until the loan allowed against the Trust Receipt is fully paid off. This is also a temporary investment connected with import and knows as post-import finance and falls under the category “Commercial Lending”. Interest rate is 16%.

Loan documentary Bill Purchase (LDBP)

The loan is made against documents representing sell of goods to local export oriented industries, which are deemed as exports and which are dominated in local currency/foreign currency. The bill of exchange is held as the primary security. The client submits the bill and the bank discounts it. This temporarily liability is adjustable from the proceeds off the bill. Current interest rate is 16%.

Inland Bill Purchase (IBP)

Payment that is made through purchase of inland bills/cheques to meet urgent requirement of the customer falls under this type of investment facility. This temporary investment is adjustable from the proceeds of bills/cheques purchased for collection. It falls under the category of “Commercial Lending”.

Loan Against Other Securities (Laos)

Loan against other securities is a 100% secured advance, which requires no sanction from the Head Officer. It is sanctioned by marketing lien of FDR, ICB Unit Certificate.

Interest rate is16%

Heir Purchase

Heir Purchase is a type of installment investment under which the Purchaser agrees to taka the goods on hire at a stated rental, which is inclusive of the repayment of principal as well as profit for adjustment of the investment within a specified period.

Foreign Bill Purchase (FBP)

Payment made to customer through Purchase of Foreign Currency Cheques/Drafts fall under this head. This temporary investment is adjustable from the proceeds of the cheque/draft. Foreign Exchange Department deals with Letter of credit (L/C) operation and foreign remittance. L/C operation divided into import operation, export operation and inland trade. NCC Bank offers two types of credit facilities to its customers. Such as:

v Funded Credit and

v Non Funded Credit

Funded Credit

The credit facility in which the fund of the Bank is directly invested is known as funded credit. Such as cash credit, secured overdraft etc.

Non-Funded Credit

The credits facilities in Bank’s funds are not directly invested are known as non funded credit such as –Letter Of Credit (L/C), Guarantee etc.

SME Loans

- Small Business Loan

- Consumer Finance Scheme

- Lease Finance

- Personal Loan

- House Repairing & Renovation loan

- Festival Business loan

- Festival Personal loan

- Car Loan Scheme

Consumer Credit Scheme

This scheme is aimed to attract consumers from the middle and upper middle class population with limited income. The borrower should have saving or current deposit account with the bank. Minimum 25% of the purchase cost of the product is to be deposited by the borrower with the bank i.e. equity before disbursement of the loan. The rest 75% is to be kept as cash collateral (FDR, Shanchay Patra etc.) with the bank. The purchased items are hypothecated with the bank. Loan amount is disbursed through pay order/demand draft directly to the seller after submission of the indent, deposit of client equity and completion of documentation formalities. The bank obtains post dated a/c payee cheque drawn in favor of the bank for the monthly installments covering the lending period from the borrower and the loan amount is adjusted on the due date of installments. N.A.

Working capital loan

Loans allowed to the manufacturing businesses to meet their working capital requirement. Loan facility starts from Tk. 1 lac up to Tk. 5 lac. Interest rate is 17% only.

House Repairing/Renovation Loan

This loan is offered for renovation and modernization of the house/building/flat. The genuine residential owners can avail this kind of loan. Loan facility starts from Tk. 1 lac upto Tk 5 lac. Loan can be repaid by monthly equal installments including interst within maximum 5 years. Interest rate is 17% only.

Small Business Loan

This loan is offered to the small and promising entrepreneurs to meet their capital requirement and enable them to operate and expand the business purposely. It is apporved against collateral and estimation of the revenue generation of the project for which the loan is sanctioned. The range of this type of loan is one to five lac taka. Loan repayment period is maximum 5 years.

Personal Loan

This loan is provided to salaried persons in various organizations to meet any emergency cash needs. Interest rate is 17% p.a. and loan facility starts from Tk 25000 and maximum credit ceiling is Tk 1 lac. Loan repayment period is maximum 5 years.

Car Loan

This loan is given on the basis of income of the customer.70% of the quotation is given as loan. Document of income and quotation of the car must be shown. Interest rate is 17%. Loan repayment period is maximum 5 year.

GENERAL PROCEDURE OF SANCTIONING LOAN:

The following procedure is applicable for giving advance to the customer. These are:

- Party’s application

- Filling form-A

- Collecting CIB report from Bangladesh Bank

- Processing loan proposal

- Project appraisal

- Head office approval

- Sanction letter

- Documentation

- Disbursement

A. Party’s application

At first borrower had to submit an application to the respective branch for loan. He/she has to clearly specify the reason for loan. After receiving the application from the borrower Bank officer verifies all the information carefully. He also checks the account maintains by the borrower with the Bank. If the official becomes satisfied then he gives form-A (prescribed application form of Bank) to the prospective borrower.

B. Filling Form –A

It is the prescribed form provides by the respective branch that contains information of the borrower. It contains- Name of the concern with its factory location, Official address and Telephone number, Details of past and present business, it achievement and failures, type of loan availed etc.

C. Collecting CIB Report from Bangladesh Bank

After receiving the application for advance, NCC Bank sends a letter to Bangladesh Bank for obtaining a report from there. This report is called CIB (Credit Information Bureau) report. NCC Bank generally seeks this report from the head office for all kinds of Investment. The purpose of this report is to being informed that whether the borrower has taken loan from any other Bank; if ‘yes’ then whether the party has any overdue amount or not.

D. Processing loan Proposal

After receiving CIB report, respective branch prepare an Investment proposal, which contains terms and conditions of Investment for approval of Head Office. Documents those are necessary for sending Investment proposal are Loan application, photograph of the borrower duly attested, personal information of borrower, CIB report, legal opinion, trade license, stock report, net worth calculation of business & individual, working capital assessment, financial statement, SME information and CRG.

NCC Bank prepares the proposal in a specific form. It contains following relevant information- Borrower, capital structure, address, Account opening date, introduced by type of business, particulars of previous sanctions, security (existing and proposed), components on the conduct of the account, Details of deposit, liabilities with other Banks, CIB report, Rated capacity of the project (item wise), Production/purchase during the period, Sales during the period, Earning received for the period.

DISBURSEMENT:

Finally respective officer disburses the loan after sanction and completion of all formalities. The officer writes cheque and provides it to the borrower. For this borrower has to open an account thorough which he/she can withdraw the money.

SOUND PRINCIPLES OF LOANS:

Sound principle of lending is obvious to avoid loan default tendency and risk elements to safeguard of public money as well as business of a bank. So, there must be a principle of advance and efforts should be made to make it a sound one for which in depth study must be made on the following points by this bank:

- When the loan is to be given

- Why the loan is to be given

- How the loan is to be given

- What may happen after disbursement of the loan

- Generally what happen (from past experience) after disbursement of the loan

- Is it hopeful that the borrower will repay the loan?

- Whether loan should be given only in private sector or also in government sector as well.

- Whether only secured loan will be extended or provision should be kept for clean loan also

- Whether only short term and mid term loan will be considered or long term will also be considered?

- Whom to be financed?

- Whether loan will be extended to trading sector only or industrial sector will also be considered.

Besides the above-mentioned decision, the managers must ensure materialization of following safe guards for proper use and timely realization of loans, commission. Interest etc and minimize the risk and hazards:

Safety of Fund:

Safety means the assurance of repayment of distributed loans. This depends mainly on integrity, business behavior, reputation, past experience in the particular line of business, financial solvency, quantum of own equity in business, capability to run business efficiently, capacity and willingness to repay the loan etc. of the loan.

Security:

It must be ensured that repayment of the loan is secured and for this purpose manager must retain security against loan to fall back upon incase of borrower’s default. The securities must possess required basic qualities such as possession, title deed, parches etc.

Liquidity:

The borrower should have liquid assets so that he can adjust liability on demand and as much as possible loan itself should be quasi liquid so that it can be realized on demand in case of need.

Purpose:

Purpose of a loan should be production, development and economic benefit oriented.

Profitability:

This is applicable both for bank and the borrower.

Diversification:

Diversification means to distribute the loan to a large number of borrowers rather to a small number of borrowers. This will increase the services of the bank and it will reduce the risk of loan recovery.

National Interest:

Nothing can be done legally if it jeopardizes national interest in any way.

Credit restriction imposed by Central Bank:

At the time of sanctioning loan, the commercial banks must have to follow the restrictions that are imposed by the Bangladesh Bank from time to time.

POLICY STATEMENTS OF BANGLADESH BANK

Bangladesh Bank has set out some policy statements about responsible use of credit which acts as a guideline for all the commercial banks in Bangladesh. These are the following:

Loan Deposit Ratio (LD):

The AD ratio should be 80%-85%. However, the Loan Deposit ratio of the bank should go up to 110%. The Loan Deposit ratio = Loan/ (Deposit +Capital +Funded Reserve)

The ratio will be fixed based on the bank’s capital, Bank’s reputation in the market and overall depth of the money market.

Wholesale Borrowing Guidelines (WBG):

The guideline should be set in absolute amount depending on bank’s borrowing capacity, historic market liquidity. The limit should be capped at the bank’s highest level of past borrowings. However, this limit can be increased based on the match-funding basis.

Commitments:

The commitments Guideline limits should not exceed 200% of the unused wholesale borrowing capacity of the last twelve months. The limit can be increased if there are natural limitations on customer discretion to draw against committed lines or a bank’s access to additional funds via realization of surplus statutory holdings.

Medium Term Funding Ratio (MTF):

The MTF of a bank should not be less than 30%. The ideal scenario should be 45%. Given, the overall scenario of current market, it will be suitable to move towards the MTF limit of 45% as we progress.

Maximum Cumulative Outflow:

MCO up to I month bucket should not exceed 20% of the balance sheet.

Liquidity Contingency Plan:

A liquidity contingency plan needs to be approved by the board. A contingency plan needs to be prepared keeping in mind that enough liquidity is available to meet the fund requirements in liquidity crisis situation. An annual review of the contingency planning should be made.

Local Regulatory Compliance:

There should be a firm policy on compliance to the Bangladesh Bank in respect of CRR, SLR, Capital adequacy etc.

FINANCIAL OBLIGATION OF LOAN SECTION

This includes those papers, which can be easily liquidated like FDR, BSP, Insurance Policy, share Debenture, ICB unit certificate etc. NCC bank allows 80% of the financial obligation is given as loan to the borrower remaining 20% of the instrument is treated as margin if the party fails to pay the interest. Interest on FDR against loan is = Interest bearing by FDR +405%. FDR must be on the same branch. Other than FDR the interest is 15%.

Supply Order and Work Order:

Generally, the bank grants Govt. and Semi-Govt. organization’s supply and work orders. Usually 10% of the supply order amount is deducted for Vat and tax and then 15% to 25% of the rest of the amount is allowed as loan.

The Procedures that is followed: –

a) Lien of the supply or work,

b) Registered Mortgage of land and property,

c) Power of attorney given to the bank by the authority to favour all the checks through the bank.

d) Interest is calculated in quarterly basis on the outstanding amount of liability at 15%.

e) 200% of the value of the loan amount is kept as immovable security,

f) 10%-25% of the received check amount is deposited to the sundry deposit a/c to adjust the loan,

g) Interest is calculated 75%to 90% of the rest of the amount of the check.

Consumer Financial Scheme (CFS):

Consumer credit is provided for the customer who wants to buy goods for their households. It is a special kind of credit scheme of NCC Bank.

Condition:

For getting loans, the customer has to provide 25% of the value of the goods by himself. Out of 75% of the value of the goods, bank provides loan at 17% interest rate where the actual amount of interest is 15% and the rest 2% includes charge for service (1%) and the provision for risk (1%). The whole amount is reimbursed on installment basis payable within the time limit of 24/36 months of which installment is payable on monthly basis.

Bank usually asks for a guarantor as personal security:

a) Consumed by himself,

b) A guarantor who is generally reputed govt. employee or any higher officer of the bank.

SELECTION OF BORROWER

Borrower selection is the most important step in lending. Borrower will be selected by considering the following:

a) Past Tract Record:

- i. Transaction record in bank,

- ii. Credit report,

- iii. Interview,

- iv. Market information,

- v. Financial statement (Balance sheet, Income statement etc.)

- vi. Report of (If more than Tk.10.00 Lac.)

b) Marginal Ability:

- i. Conceptual Skill and Harmful Skill (Analyzing, Planing, Organizing, Supervising, Controlling, Adapting etc.)

- ii. Operation Skill (Technical know how).

c) From the borrower analysis we get 3C’s and 3R’s:

1) Character: Trust and Confidence

2) Capital: Financial Solvency & Strength

3) Capability: Ability to manage, adjust &adopt

3R’s:

1) Reliability,

2) Resources,

3) Responsibility.

From the above analysis bank selects the right borrower.

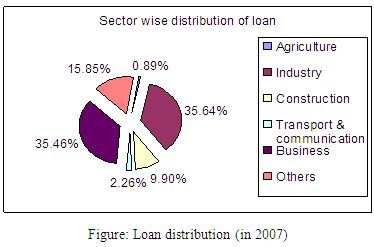

SECTOR WISE DISTRIBUTION OF LOAN

National Credit & Commerce Bank Ltd. complying the directives of Bangladesh Bank as per BRPD circular no. 17 dated 07.10.2003 has formulated their own credit policies indicating the area of lending which was duly approved by the board of directors. Bank provides loan to the following area:

- Agriculture & agro based ventures

- Trade & commerce

- Consumer financing

- Real estate & civil construction

- Industry

- Business

- Lease financing

- Housing Loan scheme

Loan disbursement position (2007-2008) at a glance

Now, Sector wise Exposure (2007) has been illustrated below:

Agricultural & Agro based ventures

Agriculture is the mainstay of Bangladesh economy being major contributor to the GDP. NCC bank keen to contribute towards the growth of economy in financing the agro based firm, specially poultry, fishery & hatchery. Financing also provided to export oriented shrimp culture and fish processing industries. As the sector is being looked after adequately by financial institutions and nationalized commercial bank still NCC bank provides a small amount of loan to this sector. In 2007, the bank sanctions only .89% of total loan amount.

Real estate & civil construction

In our society a reasonable number of small/big businessmen are related to the real estate and civil construction. NCC bank provides loan to this sector carefully only on selective basis. In 2007, 9.90% loan has been distributed to this sector.

Industry

Industry loan basically covers the following area.

– Working capital financing

– Capital financing in the form of term loans; and

– Financing of small & cottage industries.

The term loan financing for establishment of new industries is a specialized banking function. Bank follow a selective approach for term loan financing to small scale industries and export oriented or import substitute industries which will enjoy high degree of national economic priority. NCCBL set aside a large amount of money from budgetary allocation to finance in industry loan. In every year, bank provides the highest percentage of loan to this sector. In 2007, it sanctions 35.64% loan to this sector.

Business

A large section of our business community consists of small & medium business owners who are conducting their business with their own resources without availing much support from financial institutions. Such businessmen are generally sincere, honest and hard working but are often short of working capital not to mention the capital finance for expansion. NCC bank’s major concentration shall be under this sector under following categories:

– Small Business Loan

– Festival Small Business Loan

– Earnest Money Financing Scheme

– Financing of service concerns

– Financing of trading concerns

– Financing of manufacturing concerns

As businesses are major contributor to national GDP, so the second highest percentage of loan is given to this sector. In 2007, 35.46% loans are provided to different businesses.

Lease financing

NCC bank to keep its contribution to the growth of national GDP, accelerate the total economic development by infusing the fund in productive sector in more efficient and effective way; diversify its portfolio and satisfy the customer’s needs would go for lease finance for:

– Setting up of small and cottage industries/projects

– Transports (both road & marine)

– Medical equipments/ Lab equipment/ X-Ray machine etc.

– Construction equipment

-Other fixed assets of productive & service oriented ventures

Housing loan scheme

Construction of buildings is not progressing as expected because of scarcity of housing loans. Many people can purchase flat or construct hose if they are facilitated with the sanction of institutional loan. With a view to creating financial capability of the prospective clients in purchasing flats/ hoses and in constructing houses and with the objective of exploring a profitable investment area “NCC Bank Housing Loan” scheme has been introduced. The purposes of this scheme are:

ADVANCES

The prime asset of any financial institution consists of its loans and advances and other investments. These assets are created primarily out of funds received from the depositors, loans and some other liabilities. The depositors as well as the investors in the institution are interested in real /realizable value of the assets of the institutions. The creditors are interested, as they want to know the depth of risk on their deposits, while the equity holders desire to be acquainted with viability of their source of income. The management of the institution as well as their supervising authority i.e. the Central Bank, evaluate the assets of the institution keeping in view the aforesaid aspects. This evaluation at stipulated intervals is called “ Classification of Advances”. It is in fact, placing all loans and advances under pre-determined different heads/ classes based on the depth of risk each and every loan has been exposed to and to bring discipline in financial sector so far risk elements concerned in credit portfolio of banks.

CLASSIFICATION OF ADVANCES

At present loans and advances are classified under three heads according to degree of risk element involved these are-

- Sub-standard

- Doubtful

- Bad

Substandard:

A loan value of which is impaired by evidence that the borrower is unable to repay but where there is a reasonable prospect that the loan’s condition can be improved is considered as substandard.

Doubtful:

A loan is doubtful when its value is impaired by evidence that it is unlikely to be repaid in full but that special collection efforts might eventually result in partial recovery.

Bad:

A loan is considered as bad when it is very unlikely that the loan can be recovered. Good loans are classified as un-classified loans. Naturally depth of risk is more in doubtful or bad loans than unclassified ones.

RECOVERY

It is the duty of the recovery department of the Bank to recover the landed fund within the stipulated time and if the borrower fails to repay the money within the said period Bank will declare him as a defaulter and recover the fund by selling the securities given by the borrower or by freezing his account or make a suit against him

LEGAL FRAMEWORK FOR INVESTMENT RECOVERY

After being classified, Bank goes for loan recovery by legal action. Head Office appoints legal advisers and advises to the branch to file a suit against the defaulted loaner. NCC Bank generally suits files under the “Artha Rin Adalat 1990”.

EVALUATION OF INVESTMENT PROPOSALS

Financial Statement

Financial spreadsheet provides a quick method of assessing business trends and efficiency.

- Assess the borrower’s ability to repay

- Realistically show business tends

- Allow comparisons to be made within industry

Borrowers that provide Financial Statement are more likely to be good borrowers.

LENDING RISK ANALYSIS (LRA)

Lending Risk Analysis (LRA) is one of the new management and operational tools for improving the operational efficiency of all banks excepting the foreign banks initiated by “ Financial Sector Reform Project (FSRP)” in 1993. It focuses on internal changes to the lending process to improve the loan portfolio banks. According to FSRP international consultant, in a successful country (in terms of lending), all applications for credit are thoroughly analyzed to assess the risk that the bank will not fully recover the loan. Through the Lending Risk Analysis (LRA) the banking system will channel the scarce financial resources into those opportunities that will have maximum return. That is profitable enterprises will get fund and grow but loss making enterprises will be refused funding and will go out of business. Through the better practices of LRA all the banks will be benefited as well as the economy will grow and the people will be benefited.

The same FSRP international consultant further says, in Bangladesh, loan analysis in the NCBs typically covers only 25% of the potential risks that are analyzed by banks in the developed world (1993). Analysis skills are virtually non-existent in the NCBs. 905 of lending officers do not know how to analyze a set of accounts. So, the ultimate results of the lending process are- the country’s scarce financial resources are not applied effectively, loss making enterprises receive funding and stay in business and allowing them to loss even more, profitable enterprises are constrained by lack of funding, the tax payers are obliged to subsidies heavily the banking system, Bangladesh remain one of the poorest countries in the world.

Lending Risk Analysis (LRA) is simply a loan-processing manual. By going through this manual the lending bankers can assess the credit worthiness of their prospective borrowers. Therefore, LRA is such an instrument, which is definitely and directly related with lending information to analyze the borrower’s financial, marketing, managerial and organizational aspects subjectively and objectively. It also facilitates the analyst to know the security risk of the credit.

Lending Risk Analysis involves assessing the likelihood of repayment of loans to the bank as per agreement on the basis of analysis of certain risks. LRA, first of all, has divided the various risks into two groups namely, business risk and security risk.

CREDIT INFORMATION BUREAU (CIB)

Due to the irregular and insufficient flow of credit information into the Banking system the proportion of classified loan in relation to the total credit is very high. This proportion of classified loan generated bad influence in the Banking sector. In order to eliminate the bad culture and to equip the Banks with proper credit information for loan application processing, proposal for creation of Credit Information Bureau (CIB) was put forward by different comities and groups such as National Commission for Money,

Banking and Credit, 1986, the World Bank Report, 1987 and Financial Sectors Task Force Reports, 1990. In the backdrop of the above proposal Bangladesh Bank approved the CIB in 1992.

The main objectives of the CIB are to collect all shorts of information in respect of the borrowers (having outstanding balance of Tk. 10 lac and above) from the scheduled Banks, and other non Banking financial institutions and creation of computer database in order to feed back the same information to the Banks for quick processing of new loan applications, rescheduling etc. and preparation of various reports for MIS purposes to be used in Bangladesh Bank and Ministry concerned.

Investment monitoring implies that the checking of the pattern of use of the disbursed fund to ensure whether it is used for the right purpose or not. It includes a reporting system and communication arrangement between the borrower and the lending institution and within department, appraisal, disbursement, recoveries, follow-up etc.

NCC Bank officer checks on the following points:

- The borrower’s behavior of turnover.

- The information regarding the profitability, liquidity, cash flow situation and trend in sales in maintaining various rations.

- The review and classification of credit facilities starts at Investment Department of the branch with the branch manager and finally with Head Office Investment Division.

LOAN PRINCIPLES FOLLOWED BY NCCBL

The Principle of lending is a collection of certain accepted time tested standards, which ensure the proper use of loan fund in a profitable way and its timely recovery.

NCCBL follows the following five principles in its lending activity:

Safety

Safety should get the prior importance in the time of sanctioning the loan. At the time of maturity the borrower may not will or may unable to pay the loan amount. Therefore, in the time of sanctioning the loan adequate securities should be taken from the borrowers to recover the loan. Banker should not sacrifice safety for profitability.

NCC Bank Ltd. exercises the lending function only when it is safe and that the risk factor is adequately mitigated and covered. Safety depends upon:

- The security offered by the borrower; and

- The repaying capacity and willingness of the debtor to repay the loan with interest.

Liquidity

Banker should consider the liquidity of the loan in time of sanctioning it. Liquidity is necessary to meet the consumer need.

Security

Banker should be careful in the selection of security to maintain the safety of the loan. Banker should properly evaluate the proper value of the security. If the estimated value is less than or equal to loan amount, the loan should be given against such securities. The more the cash near item the good the security. In the time of valuing the security, the Banker should be more conservative.

Adequate Yield

As a commercial origination, Banker should consider the profitability. So banker should consider the interest rate when go for lending. Always Banker should fix such an interest rate for its lending which should be higher than its savings deposits interest rate. To ensure this profitability Banker should consider the prospect of the project.

Diversity

Banker should minimize the portfolio risk by putting its fund in the different fields. If Bank put its entire loan able fund in one sector it will increase the risk. Banker should distribute its loan able fund in different sectors. So if it faces any problem in any sector it can be covered by the profit of another sector.

DIVERSIFICATION OF RISKS

It is very risky for a bank to invest all its assets into a particular sector or a single borrower or to one particular region. If somehow the business of that sector or area or borrower collapses, the bank may fall in a critical situation. So it is better to invest in different sectors/borrowers and spread over the country. That’s why NCC Bank invests its fund in various sectors.

FOLLOWING STEPS ARE TAKEN AGAINST A DEFAULTER

- Reminder the party to repay the loan after validity dates

- Send final notice

- Send legal notice

- Eventually sue a case against the party

RECOVERY OF ADVANCE

A bank’s profitability and sustainability mostly depends on the recovery of its outstanding amount. Outstanding amount includes both principal and interest because, 80% of bank’s earnings comes from advances. A poor recovery rate indicates the weak condition of the banking operation and vice versa. But in the mid 80s, there started a loan defaulting culture, which is still in practice. As a result, banking sectors as well as the whole economy is facing a great threat from the defaulters. Money circulation has come down at its minimum level. If this cannot be checked, whole banking system of our country will collapse one day.

RECOVERY PROCEDURE

Recovery procedure is a lengthy one that requires efforts of the bank, society and legal institutions. It also takes time and money. Like other banks, NCC Bank follows four steps to recover the outstanding amount. These are-

1. Reminders to the clients

2. Creating social pressures

3. Sending legal notice and

4. Legal action

These four steps are described in detail below-

1. Reminder to the client is given through a formal communication channel. A letter is written and properly signed on the bank’s papers. This letter is issued several times to remind the honorable loaner to repay his/her outstanding portion.

- If the loan amount is not yet repaid after sending a series of letters, then social pressure is created on the client by persons referred while opening account in the bank.

- Legal notice is prepared and sent by NCC Bank when above two steps fails to recover the amount. It is a threat to the borrower.

- The last and final step of the recovery procedure is the help from the court. NCC Bank sincerely tries to avoid this kind of situation for its honorable clients but cannot help doing for its own sustainability.

STRATEGIES FOR RECOVERY

Recovery of loan can be made in the following 3 methods

- Persuasive

- Voluntarily

- Legally

1) Persuasive recovery

If the borrower didn’t paid the due amount of loan in time then the first step of bank is private communication with him. It creates a mental pressure on borrower to repay the loan amount. In this case bank can provide some advice to the borrower for repaying the loan.

2) Voluntarily recovery:

In this method, some steps are followed for recovering loan. This are-

- Building Task Force

- Arranging seminar

- Loan rescheduling policy

- Waiver of interest rat

3) Legal recovery:

When all steps fail to keep an account regular and the borrower does not pay the installments and interests then bank take necessary legal steps against the borrower for realization of its dues. In this case “Artha Rin Adalat Ain-2003” plays an important role for collecting the loan. Recovery procedure of NCC Bank is the ultimate combination of time, effort of money. It follows four procedural steps to recover the lending amount, which is joint effort of Bank, society and legal institutions, which are shown in Chart.

Loan Monitoring

Loan monitoring implies that the checking of the pattern of use of the disbursed fund to ensure whether it is used for the right purpose or not. It includes a reporting system and communication arrangement between the borrower and the lending institution.

The following steps are followed by respective officer.

a) Regular checking the balance of SB/CD/STD accounts of the borrower.

b) Regular communication with the defaulter customers and guarantors physically over telephone.

c) Issuance of letter to customers immediately after dishonor of cheque.

d) Issuance of legal notice to the defaulter customers and guarantors prior to classification of the loans.

e) Issuance of appreciation or greeting letter to the regular customers.

f) Periodical visit with the customers to maintain relationship and supervision of supplied articles.

Legal action to be taken after failings all possible efforts to recover the bank’s due.

LOAN SITUATION

While working at NCC Bank ltd, motijheel main branch, I have attained to a newer kind of experience. After the collection and analysis of data. I have got some findings. These findings are completely from my personal point of view. Those are given below:

- NCC Bank Limited has already achieved a high growth rate accompanied by an impressive profit growth rate in 2005-2009. The number of deposit and investment are also increasing rapidly.

- NCC Bank has an interactive corporate culture. The working environment is very friendly, interactive and informal. And there are no hidden barriers or boundaries while communication between the superior and the subordinate. This corporate culture provides as a great motivation factor to the employees.

- NCC Bank Limited has already established a favorable reputation in the banking industry of the country. It is one of the leading private sector commercial banks in Bangladesh. The bank has already shown a tremendous growth in the profits and deposits sector.

- They follow the traditional banking system in general banking department. The entire general banking procedure is not fully computerized.

- From the clients view introducer is one of the problems to open an account. It is general problem to all commercial bank.

- They face troubles with those clients who have not any knowledge in banking transactions and banking rules.

NCC Bank has own training Institution for its employees, so they don’t require to train them in other training Institutions.

Bank has no office assistance that’s why officer of Bank transfer papers and documents from one desk to another, it consumes time of officer and also clients.

NCC Bank has insufficiencies of Authorized Dealer Branch in respect of the total foreign exchange business. Bank has only six branches, which have AD licenses. As a result it total foreign exchange business is very small in respect of total market.

RATIO ANALYSIS

In 2007, Bangladesh economy suffered a serious blow in the year due to two consecutive devastating floods and ravaging cyclone, Sidor. The GDP had decrease to 6.5%. Inflation soared to double digit in this year. This up ward trend of inflation is due to the price of staple foods. But despite this various setbacks in the economy, bank’s performance may be termed as satisfactory in respect of deposit mobilization and profit earning. During the year bank enhanced quality of its assets and recovered over dues from default borrowers.

The growth of profit, Return on total assets, Return on equity, Earning per share and price-earning ratio, debt equity ratio, debt service coverage ratio over the last 6 years is appended on several charts below:

OPERATING PROFIT

By subtracting the operating expenses from operating revenue we get operating profit.

Operating profit = Operating Revenue – Operating Expenses

Operating profit is increasing every year due to expand in operation. Operating profit has increased almost 65% in last five years, which is a very good indication of the bank’s operational performance.

REGRESSION ANALYSIS: SOURCES OF PROFIT

Like every other business, Banks are profit oriented and profit is the central point on which the entire business activity rotates. Every bank has some source from which the profit came and bank continuously invest in new sectors or widen its area of operation to increase its profitability. Every year NCC bank earns a huge amount of profit from different loans & advances. But the profitability of each sources are not same. Different sources contribute differently to the profit. The aim of regression analysis is to find a causal relationship between variables. That is how the independent variables cause the dependant variables to change. The independent variables are sources of profit and dependent variable is profit after tax. By doing regression analysis I might also be able to predict the future level of profit by setting an earning target of a particular source. The common sources of profit are given below.

- Commission fee

- Brokerage fee

- Exchange fee

- Incidental charge

- Service charge

- Interest income

Commission Fee

Bank earn commission fee from issuing PO, DD, locker service, online service, account disclose etc. The regression equation is y = -265,554,232.89 + 2.8788X. The best-fit line for commission fee is upward sloping which indicates commission fee will increase continuously. The line also depicts that if commission fee increases 1 million profit will increase by 2.8788 million. So, future level of profit can be easily estimated by a given level of commission fee.

Year | Commission (X) | Profit after tax (Y) |

2003 | 141673861 | 79123761 |

2004 | 164070807 | 285156148 |

2005 | 226478385 | 352082173 |

2006 | 248353446 | 479219807 |

2007 | 331182016 | 677176546 |

Source: From annual report

Brokerage Fee

Being member of Dhaka Stock Exchange the Bank participated in the day to day trading & and earned a sizeable income. For this reason bank devoloped “ Brokerage House” for interested trader and customer. Bank earns a greater amount from this source in last five years. The regression equation is Y= 247490400.18 + 5.924X. The best fit line for this fee is much steeper and of course upward sloping. It indicates that if brokerage fee increases by 1 million profits will increase 5.92 million.

Year | Brokerage Fee | Profit after tax(Y) |

2003 | 573040 | 79123761 |

2004 | 4297859 | 285156148 |

2005 | 8757822 | 352082173 |

2006 | 15495893 | 479219807 |

2007 | 78113932 | 677176546 |

Source: From annual report

Foreign Exchange Fee

Foreign exchange is also an important source of income. The procedure of foreign exchange is same as share market. That is bank buy dollars at low price and when the value of dollar increase then bank sells it. The difference between selling and buying price is the profit for bank. The regression equation is Y = -319061935.03 + 3.154X. From the graph, we can see that best-fit line is quite flatter. It says if foreign exchange fee increase by 1 million profits will increase by 3.15 million.

Year | Foreign Exchange (X) | Profit after tax (Y) |

2003 | 136828675 | 79123761 |

2004 | 179199789 | 285156148 |

2005 | 259917222 | 352082173 |

2006 | 225182073 | 479219807 |

2007 | 298557859 | 677176546 |

Source: From annual report

Incidental Charge

Incidental charges are directly charged on account holders as fixed charge once in a year. The regression equation is Y = 207295336.16 +37.41X. The graph shows that there is strong positive relationship of incidental charge to profit. So the best-fit line is very steeper. The line says that 1 million increases in incidental charge will contribute 37.41 million increases in profit.

Year | Incidental Charge (X) | Profit after tax (Y) |

2003 | 930707 | 79123761 |

2004 | 3649951 | 285156148 |

2005 | 1672857 | 352082173 |

2006 | 3025469 | 479219807 |

2007 | 13074858 | 677176546 |

Service Charge

Service charge is charged twice in a year directly on account holders account. Service charge is also charged in time of providing different services to clients. The regression equation is Y = 214035999.26 + 11.64X. The best-fit line for this source depicts that 1 unit change in the source will cause 11.64 unit changes in total profit.

Year | Service Charge (X) | Profit after tax (Y) |

2003 | 2118942 | 79123761 |

2004 | 6130225 | 285156148 |

2005 | 8726013 | 352082173 |

2006 | 9302863 | 479219807 |

2007 | 42704783 | 677176546 |

Source: From Annual Report

Interest income

The major source of income of bank is interest income. Bank collects deposits from the money holders and invests the accumulated saving in the form of credit and other financial services to the clients. At one hand the bank pays interest to the depositors and on the other hand it earns interest at a higher rate from the borrowers. The difference or spread of interest rate is the profit for the bank. The equation is Y= 88379548.86+. 651

It means that if interest income increase by 1 million then profit will increase .651 million change in profit.

| Year | Interest income (X) | Profit after tax (Y) |

2003 | 419879656 | 79123761 |

2004 | 435573302 | 285156148 |

2005 | 608628966 | 352082173 |

2006 | 964985936 | 479219807 |

2007 | 1123357012 | 677176546 |

Source: From annual report

So, from regression analysis it is shown that profit after tax is highly dependent on the sources of profitability. If one source decreases then profit will decrease at a double rate. Among all sources profit is highly sensitive to the change in commission & interest rate.

SWOT ANALYSIS

Every business organization is required to judge the performance from the aspects of its strength, weakness, opportunity and threat.

Strength:

- The Bank provides quality service to the clients compared to its other contemporary competitors.

- Experienced bankers and corporate personnel have formed the management of the Bank, which formulates business strategies.

- Some services of the Bank are automated which attracts large number of clients.

- The Bank will very recently introduce online banking which will enable it to automate all of its operations. At present, several banking functions are performed by computers. The Bank is also a member of SWIFT (Society for Worldwide Inter Bank Financial Telecommunication) Alliance Access which enables the Bank to exchange critical financial messages swiftly and cost effectively.

- The bank has earned customer loyalty as organizational loyalty.

- National Credit and Commerce Bank Limited has already achieved a goodwill among the clients that helps it to retain valuable clients

Weakness:

- The bank does not go for rural banking. But rural people are bankable which NCCBL gets from the activities of the NGOs.

- The portfolio of Bank is not that much diversified because it inverts major portion of its fund on Government securities.

- The Bank lacks aggressive advertising and promotional activities to get a broad geographical coverage.

- The bank has only a few ATM booths but not in mention able places. So, the scope of the use of ATM card is limited.

Opportunity:

- The Bank can introduce more innovative and modern customer services to better survive in the competition.

- They can also offer micro credit business for individual and small business.

- The bank can diversify its portfolio by introducing new sector.

- Many branches can be opened to reach the Bank’s services in remote locations.

- The Bank can recruit experienced, efficient and knowledgeable workforce as it offers attractive compensation package and good working environment.

Threat:

- The common attitude of Bangladeshi clients to default.

- Multinational banks with various attractive means of providing commercial banking services can take the Bank’s lucrative clients away.

- Local competitors can also capture a huge market share by offering similar products and services provided by the Bank.

- The most thinking threats of the bank come from the competitors. The bank has a chance to lose its market share to the competitors if it does not take necessary action.

- Bangladesh Bank sometimes require private Commercial Banks (PCBs) to be abide by such rules and regulations which is not suitable for every commercial banks.

FINDINGS

Followings are the positive and negative findings of “Loan Disbursement And Recovery System of NCC bank Limited”.

- The unit which is involved in procurement is skilled.

- The division system is small.

- Many times customers face problem.

- Customer services charges are not found reasonable.

- Banking system are one-line function can customers collect money from nearer places.

- NCC has sixty-four branches for which customers are provided with quick service.

- NCC provide customer remittance in ten minutes

- Most of the customers are not aware about the loan system because of lacking of advertisement.

- NCC is online but sometimes system failure for long time that is one of the major problems of cash transaction system.

- The expansion process of the bank has little match with the modern pace of globalization.

RECOMMENDATIONS

The banking sector in Bangladesh is now quite competitive. The private commercial banks that are currently operating in Bangladesh offering different products but there are few basic differences among them in terms of structure and performance. Thus, the competitions among them are increasing day by day. So, based on my experience & knowledge to progress in future, NCC bank must adopt some policy, which will help the bank to capture a large number of clients in the market.

- NCC Bank could give more attention to advertisement and promotion of products, which is helpful to collect more deposits and increase investments scope. Bank could use various media for advertisement like TV, News Paper, Internet and Billboard.

- Though the bank recently inaugurated the online baking system but still they maintain voucher for each transaction, which spend a lot of time. This should be avoided.

- The portfolio of Bank is not that much diversified because it invests a major portion of its fund on Government securities. So, Bank should invest in diversified sector to minimize risks.

- The credit proposal evaluation process is lengthy. Therefore sometimes-valuable clients are lost. So, loan proposal processing should be completed in a very short time.

- The bank has only a few ATM booths but not in mention able places. So, the scope of use of ATM card is limited. So, Bank could spread the Booth all around the country to retain their existing customer.

- The number of branch branches of NCC Bank are not sufficient as compared to other private banks. So, Bank should setup new branches to meet the demand of clients.

- A philosophy of working culture must prevail for the interest of customer & bank itself.