Executive Summary

Internship program is the pre-requisite for the graduation in BBA. Classroom discussion alone cannot make a student perfect in handling the real business situation; therefore, it is an opportunity for the students to know about the real life situation through this program. A report has to be built for the university and organization requirement. The topic of the report is “General Activities: A study on local of DBL, Bangladesh”. The main purpose of the report becomes very clear from the topic of the report. The report discusses about the different credit facilities, Deposit facilities, monitoring and performance.

This report is broadly categorized in five different parts. In part one introduction, purpose, objective, scope, limitation and methodology of the study is discussed. The main objectives of the report are identifying the General Activities and their overall performance in the last few years. Part two narrates the company profile including Dhaka Bank’s history, their philosophy, mission and strategy, activities and performances.

DHAKA BANK LIMITED was incorporated as a public Limited Company on 6th April 1995 under the company act. 1994 and started it’s commercial operation on June 05, 1995 as a private sector bank. The Philosophy of the bank is “EXCELENCE IN BANKING”. This is the bank’s commitment and guiding principle. Outside regular activities Dhaka Bank also takes part in different community services and environmental management programs.

Part three forces on the General activities. It includes services of banking sector, different loan categories, and credit analysis, loan review and handling problem loans. Who can apply for the loan and how can get loan. Mention different services and describe those. And also mention deposit system and define those deposits.

Part four of the report discussed financial performance and financial statement. That helps to analysis to find out actual position of the bank and also how better performances from before.

Part five of the report identifying some problem discussed some recommendation. That help to bank perform better than before.

Part five of the report mentions conclusion, appendix and reference.

At the end a very qualified and dedicated group of officers and staffs are working in the Dhaka Bank, Local Office and are always trying to provide the best service to the clients. They always monitor the activities in different sectors and their position. Their credit approval and monitoring process and its performance increased very rapidly and still trying their best to improve more and more.

So, within a very short period they earned the respect and acceptance from the customers and now it is one of the leading private commercial bank of the country.

Historical Perspective

Dhaka Bank Limited is the leading Private Sector Bank in Bangladesh offering full range of Personal, Corporate, International Trade, Foreign Exchange, Lease Finance and Capital Market Services. Dhaka Bank Limited is the preferred choice in Banking for Friendly and Personalized Services, cutting edge Technology, tailored solutions for Business needs, Global reach in Trade and Commerce and high yield on Investments, assuring Excellence in Banking Services.

Dhaka Bank Limited (DBL) is a Scheduled Bank that was incorporated as a public limited company on April 06, 1995 under the Companies Act, 1994. The Bank started its commercial operation as a Private Sector Bank on July 05, 1995 with a target to play the vital role on the socio-economic development of the country. Aiming at offering Commercial Banking Service to the Customers’ door around the country, the Dhaka Bank limited (DBL) established 50 branches up-to last year. This organization achieved Customers’ confidence immediately after its establishment.

Within this short time the bank has been successful in positioning itself as progressive and dynamic financial institution in the country. This is now widely acclaimed by the business community, from small entrepreneur to big merchant and conglomerates, including top rated corporate and foreign investors, for modern and innovative ideas and financial solution.

The Authorized Capital of the Dhaka Bank Limited (DBL) was Tk.1000 Million and Paid up Capital of Tk.100 million. The Bank raised its authorized capital at 6000 million and Paid up Capital raised at Tk.2, 128 Million as on 31 December 2009. The Total Equity with shareholder’s equity (Capital and Reserves) of the

Bank as on 31 December, 2009 stood at Tk.5, 634 Million. The Capital Adequacy Ratio is 17% as on December 31, 2009, which exceed the Stipulated Requirements for the Banks in Bangladesh.

Mission

To be the premier financial institution in the country providing high quality products and services backed by latest technology and a team of highly motivated personnel to deliver Excellence in Banking.

Vision

At Dhaka Bank, we draw our inspiration from the distant stars. Our team is committed to assure a standard that makes every banking transaction a pleasurable experience. Our endeavour is to offer you razor sharp sparkle through accuracy, reliability, timely delivery, cutting edge technology, and tailored solution for business needs, global reach in trade and commerce and high yield on your investments.

Goal

Our people, products and processes are aligned to meet the demand of our discerning customers. Our goal is to achieve a distinction like the luminaries in the sky. Our prime objective is to deliver a quality that demonstrates a true reflection of our vision – Excellence in Banking

Objectives of Dhaka Bank Limited

- Be one of the best banks in Bangladesh.

- Achieve excellence in customer service next to none and superior to all competitors

- Cater to all differentiated segments of retails and wholesales customers.

- Be a high quality distributor of product and services.

- Use state-of the art technology in all spheres of banking.

Values of Dhaka Bank Limited

- Customer focus

- Integrity

- Team work

- Respect for individual

- Quality

- Responsible citizenship

Workforce

Dhaka Bank Limited (DBL) recognizes that a productive and motivated Work Force is a prerequisite to leadership with its Customers, its Shareholders and in the Market it serves. DBL treats every Employee with dignity and respect in a supportive environment of trust and openness where people of different backgrounds can reach their full potential.

The Bank’s Human Resources Policy emphasize on providing Job Satisfaction, Growth Opportunities, and due recognition of superior performance. Realizing this Dhaka Bank limited (DBL) has placed the utmost importance on continuous development of its Human Resources, identify the strength and weakness of the employee to assess the individual training needs, they are sent for training for self-development.

Total number of employees stood at 924 as on December 31, 2009.

Management System

Since its journey as Commercial Bank in 1995 Dhaka Bank Limited (DBL) has been laying great emphasis on the use of improved Technology. It has gone to Online Operation System since 2003. And the new Banking Software FLEXCUBE is newly installed. As a result the Bank will able to give the services of international standards

Correspondent Relationship

The Bank established correspondent relationships with a number of Foreign Banks, namely American Express Bank, Bank of Tokyo, Standard Chartered Bank, Mashreq Bank, Hong Kong Shanghai Banking Corporation, CITI Bank NA-New York and AB Bank Ltd. The Bank is maintaining Foreign Exchange Accounts in New York, Tokyo, Calcutta, and London. The Bank has set up Letter of Credit on behalf of its valued Customers using its Correspondents as advising and reimbursing Banks. The Bank maintains a need based Correspondent Relationship Policy, which is gradually expanding.

Departments of DBL

If the Jobs are not organized considering their interrelationship and are not allocated in a Particular Department it would be very difficult to control the system effectively. If the any Departments are not fitted for the Particular Works there would be Haphazard Situation and the Performance of a Particular Department would not be measured. Dhaka Bank Limited (DBL) has does this work very well. Different Departments of Dhaka Bank Limited (DBL) are as follows:

q Human Resources Division

q Personal Banking Division

q Treasury Division

q Operations Division

q Computer and Information Technology Division

q Credit Division

q Finance & Accounts Division

q Financial Institution Division

q Audit & Risk Management Division

Existing Branches:

Dhaka Bank limited has 48 conventional Branches and 2 Islamic Banking Branches. Among total of 50 Branches, 27 Branches are located in DhakaCity, 6 Branches are located in Chittagong. The other 17 Branches are located in Sylhet(3), Narsingdi, Narayangonj(2), Sirajgonj Gazipur, Konabari, Bogra, Rajshahi, Cox’s Bazar, Noakhali, Fini, Rangpur, Satkhira , Syedpur, each. The registered office (Head Office) of Dhaka Bank Limited is at Biman Bhaban, 100 Motijheel C/A, Dhaka-1000.

Growth of the Bank

The Dhaka Bank Limited (DBL) is one of the most successful Private Sector Commercial Bank in our country, though it started its operation only nine years back. It has achieved the trust of the general people and made reasonable contribution to the Economy of the country by helping the people investing allowing Credit Facility.

Capital & Reserve

Dhaka Bank Limited (DBL) commences its operation with an Authorized Capital of Tk.1000.00 Million with Paid up Capital of Tk.100.00 Million. The Paid up Capital of the Bank amounted to Tk.1,228 Million as on December 31, 2005, 1,289 Million as on December 31, 2006 Tk.1,547 Million on 2007,Tk.1,934 in 2008 and Tk. 2,128 Million on 2009.

Deposits:

The deposit base of the bank continued to register a steady growth and stood at taka 60,918 million excluding call as of 31 December 2009 compared to taka 56,986 million of the previous year register a 7 percent growth. The growth was supported by branch network and high standard products and service along with competitive interest rate provided to customers. The customer group of the bank was individuals, corporation, NBFI, government bodies etc, network and high standard products and service provided to customers. The customer group of the bank was individuals, corporation, NBFI, government bodies, and autonomous bodies etc.

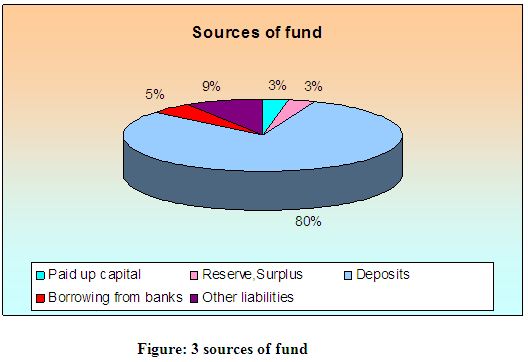

The cost free and low cost deposits comprised of 28 present of the deposits. Fixed deposits remained the main component of deposits contributing about 70 percent of the total deposits. Average cost of deposits was 8.68 in 2009 as against 9.40 in 2008. Deposit mix of the bank as of 31 December 2009 was as follow

| Type of deposit | Taka in million | Percent of total deposit |

| Current account and other depositsSavings deposits Short Term Deposits Term deposits DPS/MDS & Gft Cheques Bills payable | 5,5525,881 3,319 41,795 2,219 2,151 | 910 5

69 4 3 |

| Total | 60918 | 100 |

Capital

Dhaka bank limited commenced its operation on July 05, 1995 as a private sector bank with an authorized capital of 1000 million and paid up capital of 100 million. The bank raises its authorized capital from 1000 million to 2,650 million in 2005 and 6000 million in 2009.

The paid up capital of the bank amounted to 2,128 million as of 31 December 2009 paid up capital increased by taka 373 million during the year by transferring 20 percent of pre tax profit as per companies act 1991.the total shareholders’ equity ,capital and reserve of the bank as at the end of December 2009 stood at taka 4,966 million including sponsor capital of taka 1,113 million .the bank also made general provision of taka 625 million as per rate given by Bangladesh bank against the unclassified loans and advances, which will be treated as supplementary capital as per Bangladesh bank directives. The strong growth in equity will help the bank to expand its business.

Income and reserve

- Interest income increased by 4 percent from taka 7,171 million in 2008 to taka 7466 million in 2009.

- Income from investments increased by 38 percent from taka 664 million in 2008 to taka 920 million in 2009 mainly due to the purchase of five and ten years government bonds at higher rate of interest for SLR purposes.

- Commission and exchange earnings decreased by 2 percent from taka 1,077 million in 2008 to taka 1,061 million in 2009.

- Net interest income increased by 5 percent from taka 1,957 million in 2008 to taka 2,059 million in 2009 mainly due to increase of interest income from both advances and investments.

Expenses

- Interest expense increased by 3 percent from 5,213 million in 2008 to taka 5,406 million in 2009. This rise in interest expense is mainly attributable to the overall increase in deposit rates in market.

- Salary and allowance increase by taka 70 million mainly due to the revised pay scale effect from july 2009, recruitment of new staffs, annual Increment etc.

- Other overhead expenses increased by taka 27 million mainly because of lease rental for fixed assets, increase of advertisement in electronic and print media for business development, opening of some new branches, printing stationary, online communication charges, insurance, office rent, repair and maintenance, direct sales agents remuneration, contractual agency charges etc.

- Earning base in assets of the bank was 88percent in 2009 compared to 89 percent in 2008. The ratio indicates efficient utilization of resources to earn revenues.

Operating and net profit:

Dhaka bank limited registered an operating profit of 2,810 million compared to taka 2,533 million in 2008 making a growth of 10 percent. After all provision including general provisions on unclassified loans, profit before tax stood at taka 2,135 million provision for tax for the year 2009 amounted to taka 1,863 million in 2008. The net profit of the bank as of 31 December 2009 stood at taka 959 million compared to previous years taka 838 million making growth of 14 percent. Earning per share was taka 45.09 in 2009 compared to taka 39.42 in 2008 as per BAS-33.

Products/Services offered by Dhaka Bank Limited

Dhaka Bank offers the following checking accounts to the customers:

q Checking Accounts

1. Current Account

The Client can enjoy maximum flexibility and convenience when he/she opens a current account with Dhaka Bank. This is none bearing account.

2. Savings Account

The savings account allows the client to have interest income on his/her deposit whilst the account can use for other transaction purpose. DBL offers a competitive interest rate (4.00%) on the account on a daily basis provided that the balance of the account is minimum Tk. 10,00,000.00 at the end of business that day. Interest is applied to the account on half-yearly rests.

3. Short Term Deposit Account

DBL Short Term Deposit Account is a unique blend of flexibility and high return on public deposit. The client can use this account like a current account whilst s/he earns interest on the account when the stipulated minimum balance is maintained in the account. DBL offers very competitive interest rate (4.50%) and the interest is calculated on a daily product basis.

4. Excel Account

Excel account is first of its kind in Bangladesh. A unique blend of all the flexibilities of a current account and provision for interest on daily balance, excel account also offers an overdraft facility to meet client’s urgent cash need.

Description / Nature of the Job

Description/Nature of the Job

From the very first day to last day at Dhaka Bank I worked in General Banking department. So I gather a healthy knowledge about general banking department. I have worked on how to handle clients, received clients documents and issued cheque book, Know Your Customer (KYC), How to open an account, received and delivered letter etc. Sometimes I got opportunity to work other departments also. Now I am describing the activity of different departments that I worked during my internship period in the following:

E-Cash ATM Card

Dhaka Bank E-cash ATM card enables clients to withdraw cash and do a variety of banking transaction like make balance enquiry, account statement and pay BTTB telephone bills 24 hours a day. E-cash ATMs are conveniently located covering major shopping centers, business and residential areas in Dhaka.

3.2 Phone Banking

Dhaka Bank Phone Banking service allows clients to conduct a variety of transactions by simply making a phone call from anywhere. They can enquire about the balance in their accounts, check transaction details or request for account statement by fax or mail. Client also can talk with the officer to discuss their loan requirement or other transaction details. Non-customer may also avail the service to obtain general information and enquire about DBL products and services.

Online Banking

Convenience is the key feature of DBL service. DBL’s aim is to provide every customer easy access to his/her account from any branch and ultimately from anywhere. Cash withdrawal or deposit or any type of personal banking transaction can be performed using the any branch office.

Internet & SMS Banking

Dhaka Bank has recently landed its mark in modern banking arena by introducing Internet and SMS banking to add to its wide range of other banking products.

Through the Internet banking an account holder can access account information any time from anywhere, transfer funds, request for cheque books and account statement, enquire interest and foreign currency rates and many more. Through the SMS banking an account holder can make cheque status enquiry, balance inquiry, make utility bill payment and many more.

Dhaka Bank Credit Card

Dhaka Bank Ltd. brings everyday Credit Card in the shortest possible time. DBL recognize that clients need card every day. That is why it has develop processes to guarantee delivery of their card in just 5 days when they apply for a fully secured card; for an unsecured card it will be ready in just 15 days.

Foreign Exchange Department

Once of the largest business carried out by the commercial bank is foreign trading. The trade among various counties falls for close link between the patties dealing in trade. The situation calls for expertise in the field of foreign exchange operation. Mainly transactions with overseas countries are respects of import, export and foreign remittance come under the preview of foreign transactions, and International trade demands a flow of goods from seller to buyer and of payment form buyer to seller. In this case the bank plays a vital roe to bridge between the buyer and seller.

Foreign Exchange Department of any Bank is one of the most important department s of all departments. This department handles various types of activities by three separation sections:”

a. Import Section

b. Export Section

c. Foreign Remittance Section

Import Section

The function of the import section can be described under the following heads.

- L/C Opening

- L/C Transmitting

- Negotiating

- Lodgment

- Retirement

- Import Financer

Export Section

- Letter of Credit

- Bill of Exchange

- Invoice

- Insurance

- Bill of Lading

- Certificate of Origin

- Negotiating Documents with Discrepancies

- Checklist for Export Forms

- Procedure on Receipt of LC from Issuing Bank

Foreign Remittance

According to Foreign Exchange Regulation Act, 1947 the commercial banks or any other authorized dealer who has Bangladesh Bank authorization can do foreign exchange. According to this Act Travelers cheque, drafts are included in Foreign exchange.

Commercial Banks provides its customers the facility of Foreign Demand Draft, Travelers Cheque, and Endorsement in the passport and Telegraph Transfer. A customer is permitted to endorse maximum3000 US dollar per year for countries other than SAARC Countries and 1000 dollar for SAARC countries. If SAARC countries are to be visited by road then per year 500 dollar can be endorsed per passport. A t time cash can not be endorsed over 500 dollar.

General Banking

►►Current Account:

You can enjoy maximum flexibility and convenience when you open a Current account with us. This account offers you:

Any number of transactions a day

No minimum balance fee

Statement of account at your desired frequency

Free cheque book

Any branch banking facility

Phone banking

Statement by Fax on demand

E-Cash 24 Hour banking

►►Savings Account:

The Savings account allows you to have interest income on your deposit whilst the account can be used for your transaction purposes. You can draw a maximum number of two cheques per week; exceeding this number will forfeit the interest for the month.

We offer a competitive interest rate on the account. Also there is no requirement for a minimum balance to be maintained in the account to be eligible for the interest. Interest is applied to the account on half-yearly rests.

►►Savings Account also offer:

No minimum balance fee

Statement of account at your desired frequency

Free cheque book

Any branch banking facility

Phone banking

Statement by Fax on demand

E-Cash 24 Hour banking

►►Short term Deposit Account:

Short Term Deposit Account is a unique blend of flexibility and high return on the deposit. can use this account like a current account whilst earn interest on the account when the stipulated minimum balance is maintained in the account.

DBL offer a very competitive interest rate and the interest is calculated on a daily product basis. In addition to these you will also enjoy:

No limit to the number of withdrawals

No minimum balance fee

Statement of account at your desired frequency

Free cheque book

Any branch banking facility

Phone banking

Statement by Fax on demand

E-Cash 24 Hour banking

►►Fixed Deposit account:

can open Fixed Deposit accounts for 3 months, 6 months, 1 year or for longer term. We offer competitive interest rates. You can place your deposit under lien with us and take a loan, buy shares or open an overdraft account to meet your cash requirements. Interest rates on deposits vary from time to time. Please contact our branches for the latest rates.

Corporate Banking

►►Securitization of Assets

A powerful and effective means of generating funds for a certain category of institutions, Securitization of Assets is still in its infancy in The need however for such a service is great and there is a lot of support from multilateral financial institutions, such as the World Bank and the Asian Development Bank, for such activities to be developed further in this country.

Dhaka Bank intends to take up this challenge and play a significant role in ensuring that Securitization of Assets becomes a normal part of the range of financial instruments available for organizations who can count on a steady, but piecemeal, flow of revenue and want to translate this stream into cash resources with which to carry out further lending activities to new customers. Some practical issues still need to be settled such as those concerning pricing, or the legal framework, but it is expected that, as Dhaka Bank and other institutions pursue more such securitization activities these will be resolved.

►►Finance & Advisory Services

Given the needs of its large and varied base of corporate clients Dhaka Bank will be positioning itself to provide investment banking advisory services. These could cover whole spectrum of activities such as Guidance on means of raising finance from the local Stock markets, Mergers and Acquisitions, Valuations, Reconstructions of Distressed companies and other expert knowledge based advice. By this means Dhaka Bank hopes to play the role of strategic counselor to blue-chip Bangladesh companies and then move from the level of advice to possible implementation of solutions to complex financing problems that may arise from time to time. This would be an extra service that would complement the normal financing activities that Dhaka Bank already offers to corporate business houses.

►►Syndication of Funds

There has been a surge in the number of syndication deals closed in the last few years. 2004 was an exceptionally good year for syndicated deals for the local commercial banks also for the foreign banks. The total number of syndications in 2004 exceeded 10 totaling over Tk. 10 billion. This rise in the number of syndications can be primarily attributed to the prudential lending guidelines of the Bangladesh Bank. A commercial bank may provide funded facilities up to a maximum of 25% of its equity. Due to this reason, projects with sizeable costs need to approach more than one bank for their debt requirements and therefore the demand for syndications exist. Credit risk diversification has led many international companies to introduce credit derivatives that are actively being traded. Securitzation of assets is one such credit risk derivative that allows financial institutions to diversify their portfolios.

At Dhaka Bank Limited, the Syndications and Structured Finance unit was setup on October 30, 2004. This unit successfully closed two syndicated deals in the first and second quarters of 2004. The Syndications and Structured Finance team as a business unit soon followed up by closing another deal totaling Tk 2.10 billion for a large local corporate. The year (2004) being the first full year of operation for the team ended on a high note as we were able to close three syndicated deals as the Lead Bank, two deals as the Co-Arranger and several other deals as a participant.

►►Retail Banking

Amongst Private Sector banks, Dhaka Bank has already made its mark in the retail banking segment. The promotions like “Baishakhi Offer”, a strategic tie up with Electra International Limited, distributor of Samsung brand products, and “Freeze the Summer Campaign” a strategic tie-up with Esquire Electronics Limited, distributor of Sharp/General Brand electrical appliances saw Dhaka Bank to experience more than a reasonable growth on the Retail Banking business in 2004.

In the year 2007, Dhaka Bank Ltd. has signed MOU with 8 (eight) renowned car dealers namely: Haq’s Bay, Car House Ltd., The Sylhet Car, Car Port, Legend Car, Nippon Auto Trading, M/s. Kabir Enterprise and Capital Motors. The MOU empowers car buyers to avail DBL Car Loan at a reduced rate of 15%. This MOU will be valid for two years. Dhaka Bank will continue the MOU signing campaign with other renowned car dealers in and around Dhaka and Chittagong.

Dhaka Bank also launched the operations of VISA Card and has replaced all its VANIK

►►Card holders with VISA Cards.

Dhaka Bank has also offered a special promotion for Eid regarding interest charging on each purchase of items while using the DBL VISA Card. No interest will be applicable for any purchase made during the two Eid months.

►► Deposit Double

Deposit Double is a time specified deposit scheme for individual clients where the deposited money will be doubled in 6 years. The key differentiators of the product will be:

- Amount of deposit – The minimum deposit will be BDT 50,000.00 (either singly or jointly). The client will have the option of depositing any amount in multiples of BDT 10,000 subject to a maximum of Tk 20,00,000 in a single name and Tk 35,00,000 in joint name

- Tenure of the scheme – The tenure of the scheme will be 6 years.

- Premature encashment – If any client chooses to withdraw the deposit before the tenure, then s/he will only be entitled to prevailing interest rate on savings account in addition to the initial deposit. However, withdrawal of the deposited amount before one year will not earn any interest to the depositor(s).

- OD Facility against Deposit – Clients will have the option of taking advance upto 90% of the initial deposited amount. The lending rate will be tied up with the interest rate offered on the deposit.

| Product Features | |

| Deposited Amount | Min Tk 50,000 (singly or jointly) with multiples of Tk 10,000 Max Tk 20,00,000 (in single name) Tk 35,00,000 (in joint name) |

| Initial Deposit date | Any day of the month |

| Tenure | 6 years |

- Govt. Charges – The matured value is subject to taxes and other Govt. levies during the tenure of the deposit.

Restrictions and client eligibility

- Loans are restricted to Bangladeshi nationals falling in the categories mentioned below. The minimum age for any borrower is 25 years and the maximum age is 52 years with a minimum verified Gross Family Monthly Income of BDT 45,000.

| Salaried employees |

| ||||||

| Professionals |

| ||||||

| Businessmen |

|

| Loan amount limits under the program | Type of Loan | Minimum loan amount | Maximum loan amount |

| Car | Not specified | Tk 20,00,000 |

Dhaka Bank Car Loan EMI Schedule | ||||||

All Reconditioned Cars including Indian & Chinese Cars | All Reconditioned Cars Except Indian & Chinese Cars | |||||

Loan Amt | 12 M | 24 M | 36 M | 48 M | 60 M | 72 M |

1,00,000 | 9,073 | 4,896 | 3,516 | 2,834 | 2,432 | 2,169 |

2,00,000 | 18,146 | 9,793 | 7,031 | 5,668 | 4,864 | 4,338 |

3,00,000 | 27,219 | 14,689 | 10,547 | 8,502 | 7,295 | 6,508 |

4,00,000 | 36,292 | 19,585 | 14,063 | 11,336 | 9,727 | 8,677 |

5,00,000 | 45,365 | 24,482 | 17,579 | 14,170 | 12,159 | 10,846 |

6,00,000 | 54,439 | 29,378 | 21,094 | 17,004 | 14,591 | 13,015 |

7,00,000 | 63,512 | 34,274 | 24,610 | 19,838 | 17,023 | 15,184 |

8,00,000 | 72,585 | 39,170 | 28,126 | 22,672 | 19,454 | 17,353 |

9,00,000 | 81,658 | 44,067 | 31,641 | 25,506 | 21,886 | 19,523 |

10,00,000 | 90,731 | 48,963 | 35,157 | 28,340 | 24,318 | 21,692 |

11,00,000 | 99,804 | 53,859 | 38,673 | 31,174 | 26,750 | 23,861 |

12,00,000 | 1,08,877 | 58,756 | 42,188 | 34,008 | 29,182 | 26,030 |

13,00,000 | 1,17,950 | 63,652 | 45,704 | 36,842 | 31,613 | 28,199 |

14,00,000 | 1,27,023 | 68,548 | 49,220 | 39,676 | 34,045 | 30,369 |

15,00,000 | 1,36,096 | 73,445 | 52,736 | 42,510 | 36,477 | 32,538 |

16,00,000 | 1,45,169 | 78,341 | 56,251 | 45,344 | 38,909 | 34,707 |

17,00,000 | 1,54,242 | 83,237 | 59,767 | 48,178 | 41,341 | 36,876 |

18,00,000 | 1,63,316 | 88,134 | 63,283 | 51,013 | 43,773 | 39,045 |

19,00,000 | 1,72,389 | 93,030 | 66,798 | 53,847 | 46,204 | 41,215 |

20,00,000 | 1,81,462 | 97,926 | 70,314 | 56,681 | 48,636 | 43,384 |

►►Vacation Loan

Like the Car Loan, Vacation Loan of Dhaka Bank Limited is a term financing facility to individuals to aid them in their pursuit of spending a vacation in the country or abroad. The facility becomes affordable to the clients as the repayment is done through fixed installment s commonly known as EMI (equal monthly installment) across the facility period. Depending on the size and purpose of the loan, the number of installments varies from 12 to 48 months.

Targeted Market

The target market for personal loan mainly comprises of the following categories –

- Salaried employees of institutions in the Dhaka, Chittagong , Sylhet markets and where Dhaka Bank operates.

- Professionals who are self employed and have at-least 3 years of independent practice in the area of profession.

- Businessmen who are permanent residents of cities where Dhaka Bank operates with at least 3 years of continued operation in the line of business.

Restrictions and client eligibility

Loans are restricted to Bangladeshi nationals falling in the categories mentioned below The minimum age for any borrower will be 25 years and the maximum age 52 years with a minimum verified Gross Family Monthly Income of BDT 10,000.

| Salaried employees |

| ||||||

| Professionals |

| ||||||

| Businessmen |

|

| Loan amount limits under the program | Type of Loan | Minimum loan amount | Maximum loan amount |

| Vacation | BDT 25,000 | BDT 5,00,000 |

| Amount | EMI in months | |||

| 12 | 24 | 36 | 48 | |

| 25,000 | 2,292 | 1,249 | – | – |

| 50,000 | 4,584 | 2,497 | – | – |

| 75,000 | 6,876 | 3,745 | – | – |

| 1,00,000 | 9,168 | 4,993 | 3,616 | – |

| 1,50,000 | 13,752 | 7,489 | 5,423 | – |

| 2,00,000 | 18,336 | 9,985 | 7,231 | – |

| 3,00,000 | 27,504 | 14,978 | 10,846 | – |

| 4,00,000 | 36,672 | 19,970 | 14,461 | 11,750 |

| 5,00,000 | 45,840 | 24,963 | 18,077 | 14,688 |

►►Home Loan

The product is a term financing facility to individuals to aid them in their purchases of apartment or house or construction of house. The facility will become affordable to the clients as the repayment is done through fixed installment as commonly known as EMI (equal monthly installment) across the facility period. Depending on the size of the loan, the maximum period of the loan would be 180 months (15 years).

Targeted Market

The target market for Home Loan will be mainly focused in Dhaka and Chittagong . However, strong recommendation from branches operating in other areas will also be facilitated with the major concentration on the following category –

- Salaried employees of institutions with minimum 3 years continuous service

- Self-employed Professionals who are self employed and have at-least 5 years of independent practice in the area of profession. (Example: Doctors, Dentists, Engineers, Chartered Accountants, Architects who are members of their professional institutes.)

- Businessmen who are permanent residents of Dhaka, Narayangonj, Chittagong and Sylhet with at least 5 years of continued operation in the line of business.

Restrictions and client eligibility

- Loans are restricted to Bangladeshi nationals falling in the categories mentioned below: The minimum age for any borrower will be 21 years with a maximum age 50 years (at the time of application). The minimum verified Gross Family Monthly Income of the applicant should be BDT 40,000.00.

The family income will include only the income of the applicant and spouse. - The maximum permitted Equal Monthly Installment (EMI) paid by the borrower should be no more than the 33% of the Family Monthly Disposable Income (FMDI) of the borrower per month.

- In calculating FMDI, we propose to use the following industry standard formula:

Proven income of obligor PLUS proven income of spouse (if the spouse is working) LESS current monthly loan obligations (if any), other monthly fixed obligations (rent, children’s education, monthly food expenses, etc).

Loan amount limits under the program | Minimum loan amount | Maximum loan amount |

BDT 500,000 | BDT 3,500,000 |

- The maximum loan tenor for different amount of loan is proposed to be as following

Loan Amount | 5 lac to less tan 10 lac | 10 Lac to 35 lac |

Max Tenure | 5 yrs | 10-15yrs (negotiable)* |

- * The tenor will be decided at the discretion of the management.

►►Any Purpose Loan

Its time to do a few things you really wanted to.

Introducing “Any Purpose Loan” from Dhaka Bank Limited. Now you can get loan up to Tk. 500,000* to spend it any way you choose to. Just walk into any of Dhaka Bank Ltd. branches and walk out loaded.

►►Retail Banking

Amongst Private Sector banks, Dhaka Bank has already made its mark in the retail banking segment. The promotions like “Baishakhi Offer”, a strategic tie up with Electra International Limited, distributor of Samsung brand products, and “Freeze the Summer Campaign” a strategic tie-up with Esquire Electronics Limited, distributor of Sharp/General Brand electrical appliances saw Dhaka Bank to experience more than a reasonable growth on the Retail Banking business in 2004.

In the year 2007, Dhaka Bank Ltd. has signed MOU with 8 (eight) renowned car dealers namely: Haq’s Bay, Car House Ltd., The Sylhet Car, Car Port, Legend Car, Nippon Auto Trading, M/s. Kabir Enterprise and Capital Motors. The MOU empowers car buyers to avail DBL Car Loan at a reduced rate of 15%. This MOU will be valid for two years. Dhaka Bank will continue the MOU signing campaign with other renowned car dealers in and around Dhaka and Chittagong.

Dhaka Bank also launched the operations of VISA Card and has replaced all its VANIK Card holders with VISA Cards.

Dhaka Bank has also offered a special promotion for Eid regarding interest charging on each purchase of items while using the DBL VISA Card. No interest will be applicable for any purchase made during the two Eid months.

►►Islamic Banking

Dhaka Bank Limited offers Shariah based Islamic Banking Services to its clients. The bank opened its First Islamic Banking Branch on July 02,2003 at Motijheel Commercial Area, Dhaka. The second Islamic Banking branch of the bank commenced its operation at Agrabad Commercial Area, Chittagong on May 22, 2004.Dhaka Bank Limited is a provider of on line banking services and any of its client may avail Islamic Banking services through any of the branches of the bank across the country.

Dhaka Bank Islamic Banking Branches offer fully Shariah based, Interest free, Profit-Loss Sharing Banking Services. Dhaka Bank Shariah Council is closely monitoring its activities. Besides, Dhaka Bank is an active member of Islamic Banking Consultative Forum, Dhaka and Central Shariah Board of Bangladesh.

►►Capital Market Services

Capital Market Operation besides investment in Treasury Bills, Prize Bonds and other Government Securities constitute the investment basket of Dhaka Bank Limited.

Interest rate cut on bank deposits and government savings instruments has contributed to significant surge on the stock markets in the second half of 2004, which creates opportunities for the Bank in terms of capital market operations. The Bank is a member of Dhaka Stock Exchange Limited and Chittagong Stock Exchange Limited. The investment portfolio of the Bank made up of Government Securities and Shares and Debentures of different listed companies stood at Tk. 3,078 million as of December 31, 2004 indexing a 50% increase over Tk. 2,046 million in the previous year. Income from investment stood at Tk. 146 million in 2004 registering a 10% growth over the previous year.

►►SME

INTEREST & EXPERIENCE IN SME FINANCING – DHAKA BANK LIMITED

Since inception, the Dhaka Bank has held socio-economic development in high esteem and was among the first to recognize the potentials of SMEs.

Dhaka Bank’s Involvement:

Recognizing the SME segment’s value additions and employment generation capabilities quite early, the Bank has pioneered SME financing in Bangladesh in 2003, focusing on stimulating the manufacturing sector and actively promoting trading and service businesses.

| Product | Cash Credit |

| Eligibility | All SME businesses where the Key personnel have 2 years experience in the line of business. |

Satisfactory credit reportMethod of Appraisal The clients business experience, expertise, business volumes and monthly cash flow are used in the assessment process.Margins (indicative) The quality of receivables would be of importance in fixing margins up to which working capital is made available.Tenor Maximum 12 months (renewable)Pricing Risk based pricing strategy, in line with the market rates.Security Primary:

• Charge on the inventory and receivables.

• Charge on other current assets

• Personal guarantee of proprietor /partners/ directors.

• Charge on fixed assets.

Secondary:

• Collateral security on a case-to-case basis.Interest Fixed Rate, typically for 12 months.Review Facility terms & pricing are both reviewed at least annuallyProcessing fee Processing fee of 1% is generally charged on small loans. Actual fee charged is determined on a case-to-case basis.

| Product | Overdraft |

| Eligibility | All SME businesses where the Key personnel have 2 years experience in the line of business. |

Satisfactory credit reportMethod of Appraisal The clients business experience, expertise, business volumes and monthly cash flow are used in the assessment process.Margins (indicative) The quality of receivables would be of importance in fixing margins up to which working capital is made available.Tenor Maximum 12 months (renewable)Pricing Risk based pricing strategy, in line with the market rates.Security Primary:

• Charge on the inventory and receivables.

• Charge on other current assets

• Personal guarantee of proprietor /partners/ directors.

• Charge on fixed assets.

Secondary:

• Collateral security on a case-to-case basis.Interest Fixed Rate, typically for 12 months.Review Facility terms & pricing are both reviewed at least annuallyProcessing fee Processing fee of 1% is generally charged on small loans. Actual fee charged is determined on a case-to-case basis

SWOT ANALYSIS:

Strengths of Dhaka Bank Limited (DBL)

- Dhaka Bank Limited (DBL) is newly established Commercial Bank in the Banking Sector but it builds strong reputation in short time.

- The Financial Condition of DBL is very strong. It’s Loan and Deposit Quality is better than most other Private Commercial Banks in Bangladesh.

- DBL has strong network throughout the country and provide quality services to every level of Customers.

- DBL’s Correspondents Relationship with more than 200 International and Local Banks created Global Accessibility and Relationship with People.

- Installation and use of highly sophisticated, automated System (For example, FLEXCUBE) enables Dhaka Bank Limited (DBL) to have on time communication with all Branches reduces excessive paper-works waste of time for Valued Customer Transaction.

- ATM Cards of DBL give the Customers 24-hours Banking Facilities from his/her Accounts.

- Phone Banking of DBL gives the Customers, opportunity to make Enquiries and Service Request over the Telephone.

- Cash Advance from Credit Cards of DBL attracts more Customers to interact with the Bank.

Weaknesses of Dhaka Bank Limited

- One of the greatest weaknesses for Dhaka Bank Limited (DBL) is the Shortage of Manpower in every Division. During the Working Hours of the Bank, the Employees have to be fatigued and cannot provide proper attention that type of Services, which create dissatisfaction of the Customers.

- Higher Service Charge in some areas of Banking Operations than that of the Nationalized Commercial Banks discourage the Customers for opening and maintaining Accounts with DBL.

- Growth in Assets of a Bank depends on hoe fast its Deposits grow. But in the Deposit side DBL is facing some problems from its Competitors. Because the Competitors are giving a Higher Interest Rate in Deposits without any reason, which could be deteriorated its Position than before. Because of this a lot of Depositors are leaving the Bank.

- There is a very little practice for increasing Motivation in the Employees by the Management of Dhaka Bank Limited (DBL), which discourages them to provide the best Service to the Customers. This is another Weakness of the Bank.

Opportunities of Dhaka Bank Limited

- The greatest Opportunity for Dhaka Bank Limited (DBL) lies in the increase of standard of living of a certain mass of the Population as well as their acceptance of the Nation of Consumer Financing and Short Term Lending.

- The Credit Facility offered by Dhaka Bank Limited (DBL) attracted Security and Status conscious Businessmen and as well as Service holders with Higher Income Group.

Threats of Dhaka Bank Limited (DBL)

- The emergence of several Private and Foreign Banks with in the post few years offering similar Service with less or free charge for the facilities can be a major Threat of Dhaka Bank Limited (DBL).

- The Central Bank exercise strict control over all Banking Activities in Local Banks like Dhaka Bank Limited (DBL). Sometimes the restrictions impose barrier in the Normal Operations and Policies of the Bank.

- Revival Banks easily copy the Product offering of Dhaka Bank Limited (DBL). Therefore the Bank is in continuous of Product Innovation to gain Temporary Advantage over its Competitors. This is another Treat of the Bank.

- Sometime Political Loans are the Threat for the Banking Service.

5-YEAR FINANCIAL HIGHLIGHTS

Figure in Million

| 2005 | 2006 | 2007 | 2008 | 2009 | Growth % |

| Income Statement | ||||||

| Interest Income | 2897 | 4342 | 5636 | 7171 | 7466 | 4 |

| Interest Expense | 2149 | 3380 | 4049 | 5214 | 5407 | 4 |

| Net Interest Income | 748 | 962 | 1587 | 1958 | 2060 | 5 |

| Non Interest Income | 739 | 1110 | 1582 | 1929 | 2175 | 13 |

| Non Interest Expense | 594 | 889 | 1159 | 1353 | 1424 | 5 |

| Net Non Interest Income | 145 | 221 | 423 | 576 | 751 | 30 |

| Profit Before Tax & Provision | 893 | 1183 | 2010 | 2533 | 2810 | 11 |

| Provision for Loans & Assets | 125 | 233 | 479 | 669 | 675 | 1 |

| Provision for Tax (including Deferred Tax ) | 305 | 370 | 827 | 1025 | 1176 | 15 |

| Profit After Tax | 463 | 580 | 704 | 839 | 959 | 14 |

Balance Sheet Authorize Capital

2650

2650

6000

6000

6000

–

Paid up Capital

1228

1289

1547

1934

2128

10

Reserve Funds & Other Reserve

988

1262

1578

2065

2838

37

Shareholders’ Equity (Capital & Reserve)

2216

2551

3125

4000

4966

24

Deposits (Base& Bank excluding Call)

28439

41554

48731

56986

60918

7

Loans & Advances

23372

34049

39972

49698

52910

6

Investments

3926

5378

5972

7239

8660

20

Fixed Assets

122

217

291

387

424

10

Total Assets (excluding off-balance sheet items)

33072

47594

57443

71137

77767

9

Foreign Exchange Business Import Business

30213

46277

49496

65737

46160

(30)

Export Business

13505

23268

31081

39038

33305

(15)

Guarantee Business

6099

6473

6523

7887

6462

(18)

Inward Foreign Remittance

3377

16764

10609

11834

9786

(17)

Capital Measures Core Capital (Tier 1)

2216

2551

3126

3964

4634

17

Supplementary Capital(Tier 2)

237

373

554

844

1000

18

Tier 1 Capital Ratio

9.94

8.23

8.80

9.77

9.30

(5)

Tier 2 Capital Ratio

1.06

1.2

1.56

2.08

2.01

(3)

Total Eligible Capital

2453

2924

3680

4808

5634

17

Total Capital Ratio

11.00

9.43

10.36

11.84

11.31

(4)

Credit Quality Volume of Non-performing loans

351

554

1258

1908

2946

54

% of N/Ls to Total Loans & Advances

1.51

1.64

3.15

3.84

5.57

45

Provision for unclassified Loans

236

372

465

620

625

1

Provision for Classified Loans

103

172

439

825

1488

80

Share Information Number of Shares Outstanding

12.28

12.89

15.47

19.34

21.28

10

Earning per Share (Taka)

43.99

45.00

46.06

39.42

45.09

4

Book value per Share (Taka)

180

198

202

207

233

13

Market Price per Share (Taka)

469

466

706

361

484

34

Price Equity Ratio (Times)

10.66

10.32

15.33

9.15

10.72

29

Price Equity Ratio (Times)

2.60

2.35

3.49

1.74

2.07

19

Dividend per Share: Cash Dividend (%)

20

10

–

15

–

–

Bonus Share

1:20

1:5

1:4

1:1

1:4

–

Operating Performance Ratio Net Interest Margin

3.43

3.77

4.54

4.60

4.56

(1)

Credit/ Deposit Ratio

82.18

81.94

82.03

87.21

86.85

(0)

Current Ratio (Times)

1.33

1.24

1.38

1.28

2.10

64

Return on Equity (ROE) %

20.89

22.74

22.53

20.97

19.32

(8)

Return on Assets (ROA) %

1.40

1.22

1.23

1.18

1.29

9

Cost of Deposit (%)

8.13

9.15

8.97

9.40

8.68

(8)

Cost/ Income ratio in operating Business

75.44

78.14

72.15

72.16

70.85

(2)

Other Information Number of Branches

29

37

41

45

50

11

Number of CMS Unit

1

2

4

5

6

20

Number of SME Banking Center

–

–

–

3

6

100

Number of Employees

688

786

842

898

924

3

Number of Shareholders

3,677

4,187

5,340

8,198

10,530

28

Number of Foreign Correspondents/Banks

406

350

350

350

350

–

Highlights on the overall activities of the Bank

SL | Particulars | 2009 | 2008 | Change in % |

1 | Paid up Capital | 2,127,678,163 | 1,934,252,875 | 10 |

2 | Total Capital | 5,799,765,059 | 4,808,212,249 | 21 |

3 | Capital surplus / (deficit) | 652,185,034 | 748,363,332 | (13) |

4 | Total Assets | 77,767,413,094 | 71,136,842,020 | 9 |

5 | Total Deposits | 60,918,374,023 | 56,985,924,645 | 7 |

6 | Total Loans and Advances | 52,909,814,017 | 49,697,705,621 | 6 |

7 | Total Contingent Liabilities and Commitments | 25,059,631,616 | 25,960,666,127 | (3) |

8 | Credit Deposit Ratio (%) | 86.85 | 87.21 | (0) |

9 | Percentage of classified loans against total loans and advances | 5.57 | 3.84 | 45 |

10 | Profit after tax and provision | 959,372,816 | 838,764,573 | 14 |

11 | Amount of classified loans during the year | 2,946,138,271 | 1,908,258,498 | 54 |

12 | Provisions kept against classified loans | 1,488,012,719 | 825,217,000 | 80 |

13 | Provision surplus / (deficit) | – | – | – |

14 | Cost of fund [deposit cost & overhead cost] (%) | 10.94 | 11.53 | (5) |

15 | Interest earning Assets | 68,102,685,664 | 62,635,781,661 | 9 |

16 | Non-interest earning Assets | 9,664,727,430 | 8,501,060,359 | 14 |

17 | Return on Investment (ROI) | 11.58 | 9.18 | 26 |

18 | Return on Assets (ROA) | 1.29 | 1.18 | 9 |

19 | Incomes from Investments | 920,155,479 | 664,473,023 | 38 |

20 | Earning per Share (Taka) | 45.09 | 39.42 | 14 |

21 | Net Income per Share (Taka) | 45.09 | 39.42 | 14 |

22 | Price Earning Ratio (Times) | 10.72 | 8.31 | 29 |

The list of Dhaka Bank’s CSR activities

CSR Activities in the Year 2009 | Expenditure incurred against CSR activities |

| Donation to Prime Minister’s Relief Fund for bereaved family members of the Army Officers martyred during the recent carnage at BDR Head Quarter, Peelkhan a, Dhaka on March 10,2009 | 25 Lac |

| Donation to Prime Minister’s Relief Fund f or bereaved family members of Two Army Officers martyred during the carnage at BDR Head Quarter, Peelkhana, Dhaka on April 1, 2009. | 9.60 Lac |

| Donation to BIRDEM Hospital in 2009. | 24 Lac |

| Donation to Center for Women & Child Health Hospital in 2009. | 24 Lac |

| Contribution to Bangladesh Tennis Federation (BTF) as sponsorship of 23rd Bangladesh International Junior Tennis Championships 2009. | 5 Lac |

| Financial assistance for Shahidbagh Jame Mosque, Dhaka. | 50 Lac |

| Financial assistance for Kapasatia Jame Mosque, Hossainpur, Kishoregonj. | 20 Lac |

| Donation to Bangladesh Hockey Federation for sponsorship of Jawharlal Nehru Cup Hockey Tournament. | 10 Lac |

| Donation for the Aila Cyclone Victims | 10 Lac |

| Donate 2 units of Ambulances to be used by the Highway Police. | 48.86 Lac |

| Donation of to the Players and Officials of National Hockey Team for winning 3rd AHP Cup Tournament held in Singapore. |

2 Lac

Donation to Bangladesh Athletic Federation Sponsorship of 25th National Junior Athletic Championships 2009.

8 Lac

Sponsorship of Air Ticket an International player to participate in International Chess Tournament to be held in Hungary.

0.80 Lac

Donation to Bangladesh Olympic Association for sponsorship of BOA Sports Development lottery 2009.

10 Lac

Discussion of Results

Summary Statistics

- Ø A statistical summary of income level:

| Statistics | ||

| Income Level | ||

| N | Valid | 50 |

| Missing | 0 | |

| Mean | 31400.00 | |

| Std. Error of Mean | 1486.607 | |

| Median | 40000.00 | |

| Mode | 17500 | |

| Std. Deviation | 12874.393 | |

| Variance | 165,749,995.1 | |

| Skewness | -.131 | |

| Std. Error of Skewness | .277 | |

| Kurtosis | -1.961 | |

| Std. Error of Kurtosis | .548 | |

| Range | 27500 | |

| Minimum | 17500 | |

| Maximum | 45000 | |

From the above statistical summary, we can see that the average income level of the respondents is BDT. 31,400. Respondents have a maximum income level of BDT. 45,000 and a minimum income level of BDT. 17,500.

The statistical summary shows that majority of the respondents have an income level of BDT. 17,500 which are also regarded as the mode of the income level of the respondents.

The median of the income level of the respondents is BDT. 40,000.

In order to measure the variability of the income level, range, variance, and standard deviation can be taken into consideration.

The range, which measures the spread of the data, is found out to be BDT. 27,500.

The difference between the mean and an observed value is called the deviation from the mean. Variance is the mean squared deviation from the mean. The variance of the income level of the respondents is very large in our case which goes to make sure that the data points are not clustered around the mean but rather are scattered.

The standard deviation of the income level of our respondents is BDT.12, 874.

In addition to measures of variability, skewness and kurtosis can be used. In our case, skewness is -.131 which means that our data points are negatively skewed.

The kurtosis value is -1.961 which indicates that the distribution is flatter than a normal ditibution.

- A statistical summary of the age of the respondents:

| Statistics | ||

| Age | ||

| N | Valid | 50 |

| Missing | 0 | |

| Mean | 32.64 | |

| Std. Error of Mean | .730 | |

| Median | 37.00 | |

| Mode | 37 | |

| Std. Deviation | 6.326 | |

| Variance | 40.017 | |

| Skewness | -.635 | |

| Std. Error of Skewness | .277 | |

| Kurtosis | -.846 | |

| Std. Error of Kurtosis | .548 | |

| Range | 19 | |

| Minimum | 21 | |

| Maximum | 40 | |

From the above statistical summary of the age of the respondents, we can see that the average age of the respondents is 32.64 years. Respondents are of different age levels but the maximum age level of the respondents is 40 and a minimum age level of 21.

The statistical summary shows that majority of the respondents are of the age 37 which can also regarded as the mode of the income level of the respondents.

The median age of the respondents is also 37.

In order to measure the variability of the income level, range, variance, and standard deviation can be taken into consideration.

The range, which measures the spread of the data, is found out to be 19.

The difference between the mean and an observed value is called the deviation from the mean. Variance is the mean squared deviation from the mean. The variance of the age level of the respondents is 40.017 years which goes to make sure that the data points are clustered around the mean and are not scattered.

The standard deviation of the age level of our respondents is 6.326.

In addition to measures of variability, skewness and kurtosis can be used. In our case, skewness is -.635 which means that our data points are negatively skewed.

The kurtosis value is -.846 which indicates that the distribution is flatter than a normal distribution.

Regression Analysis

Here a multiple regression model has been used to provide estimates of the effect of each variable in combination with other variables in this model. The dependent variable Y is overall performance of Dhaka Bank as being perceived by the clients. The independent variables are customer satisfaction, technological advantage, Environment of the bank, and Employee efficiency.

Here

Dependent variable, Y=Overall Performance (OP)

Independent variable,

X1= Customer satisfaction (CS)

X2= Technological advantage (TA)

X3= Bank Environment (BE)

X4= Employee efficiency (EE)

These variables (X1-X4) were identified as the predictors of overall performance of Dhaka Bank as being evaluated by the clients.

As such the model turned out the following way:

Y = b0 + b1X1 + b2X2 + b3X3 + b4X4

Here, Y= Overall performance of Dhaka Bank being evaluated by clients.

b0 = constant

b1 = regression co-efficient associated with independent variable X1

b2 = regression co-efficient associated with independent variable X2

b3 = regression co-efficient associated with independent variable X3

b4 = regression co-efficient associated with independent variable X4

Model SummaryModelRR SquareAdjusted R SquareStd. Error of the Estimate1.977a.955.951.24319

| a. Predictors: (Constant), EE, TA, CS, BE |

From the Model summary we can find the overall relationship between the independent and dependent variables. The model summary table shows that the R square has a value of .977 which means that the variables which we have considered would represent 97.7 % of the dependant variable. The other 2.3 % can be represented by other extraneous variables.

R square indicates the explanatory power of the independent variable. It indicates how much the independent variables can explain the dependent variable and how much they can influence the dependent variable altogether. Here the R square is .977 and it means 97.7% variation in the dependent variable is caused by the independent variables. As such we can say that the independent variables can explain the dependent variable altogether as well as they can influence the dependent variable to change. If some of the independent variable changes than the dependent variable will also change and so the dependent variable is dependent on the independent variables very much.

So from this regression analysis we can say that the independent variables have the explanatory power and they can influence the evaluation of clients on overall performance of Dhaka Bank by more than 97%.

R shows the correlation between the dependent and independent variables. It summarizes the strength of association between the dependant and the independent variable. It is an index used to determine whether a linear or straight line relationship exists between the variables. It indicates the degree to which variation in one variable is related to the variation in another variable.

And in this case we can say that the correlation between the independent variables and the dependent variable is stronger because it is .977 and very much closer to 1 and that the relationship is positive.

CoefficientsaModelUnstandardized CoefficientsStandardized CoefficientstSig.BStd. ErrorBeta1(Constant).597.233 .938.014CS.931.171.8525.433.000TA-.273.134-.213-2.035.048BE.418.172.4893.143.030EE.503.170.3952.962.005a. Dependent Variable: QSP

From the above table the resulting model was:

Y = .597 +.931X1 -.273X2 + .418X3 + .503X4

Beta Value (Individual Significance Level)

By the beta value we can find the individual independent values significance level. If the significance level is more than 5%, then the independent values don’t have any impact on the dependent value but group wise they have influence over the dependent value. If the beta value is less than 5% then the independent value has impact on the dependent variable which is attitude in this case.

From the coefficient table, we can see that the beta coefficient of X1 which is customer satisfaction of Dhaka Bank is .931 which shows a positive relationship between overall performance of DBL and satisfaction of customers towards the bank. It means that people have a positive attitude towards the bank and they are satisfied with the current overall performance of the bank.

And the significance level shows that the value is 0.000 which is less than 0.005 and thus it shows that there is relationship between overall performance of the bank and customer satisfaction.

From the coefficient table, it can be seen that the beta coefficient of X2 which is technological advantage in DBL -.273 which means that there is negative relationship between overall performance of DBL and technological advantage in the bank. It means that people have a negative impression of the technological advancement in the bank as ATM booths of the bank are not available in all areas which is particularly causing people to have a negative attitude towards the bank.

From the significance level, we can see that the value is 0.048 which is much less than 0.05 and thus it can be strongly said that there is relationship between overall performance of the bank as being perceived by the customers and technological advantage in the bank but the relationship is negative.

From the coefficient table, we can see that the beta coefficient of X3 which is environment of the bank .418 which shows a positive relationship between the bank environment and the overall performance of the bank. It means that people have a positive attitude towards the environment of the bank as the employees are quite helpful in the bank and customers can get their work done very quickly and don’t have to stand in long queue for a long time..

And from the significance level, it can be seen that the value is 0.030 which is very much less than 0.005 and thus it shows that there is relationship between bank environment and its overall performance.

From the coefficient table, it can be seen that the beta coefficient of X4 which is efficiency of the employees in the bank is .503 which means that there is relationship between employees’ efficiency in the bank and its overall performance. It means that people do believe that the employees in the bank are very efficient and helpful as well which helps the customers to get their work done without having to face any major problems and difficulties.

From the significance level, we can see that the value is 0.005 which is less than 0.05 and thus it can be strongly said that there is relationship between employees’ efficiency and the bank’s overall performance.

We would again do another regression analysis where our dependant variable would be quality service & products as previously, we did our regression taking overall performance of the bank as our dependant variable.

The independent variables would be the same as before as we want to see how the independent variables relate with our new dependant variable. We would try to see whether we get similar sort of result as we had got earlier or whether there is drastic change in our findings. These would help us to be able to get a more depth analysis and we would be able to draw a valid and dependable relationship between the dependant and the independent variables.

Here

Dependent variable, Y=Quality service & products (QSP)

Independent variable,

X1= Customer Satisfaction (CS)

X2= Technological advantage (TA)

X3= Bank Environment (BE)

X4= Employee Efficiency (EE)

These variables (X1-X4) were identified as the predictors of quality service & products of Dhaka Bank Ltd.

As such the model turned out the following way:

Y = b0 + b1X1 + b2X2 + b3X3 + b4X4

Here, Y= Quality service & products

b0 = constant

b1 = regression co-efficient associated with independent variable X1

b2 = regression co-efficient associated with independent variable X2

b3 = regression co-efficient associated with independent variable X3

b4 = regression co-efficient associated with independent variable X4

| Model Summary | |||||

| Model | R | R Square | Adjusted R Square | Std. Error of the Estimate | |

| 1 | .982a | .963 | .960 | .22788 | |

| a. Predictors: (Constant), EE, TA, CS, BE | |||||

From the Model summary we can find the overall relationship between the independent and dependent variables. The model summary table shows that the R square has a value of .982 which means that the variables which we have considered would represent 98.2 % of the dependant variable. The other 1.8 % can be represented by other extraneous variables.

Here the R square is .982 and it means 98.2% variation in the dependent variable is caused by the independent variables. As such we can say that the independent variables can explain the dependent variable altogether as well as they can influence the dependent variable to change. If some of the independent variable changes than the dependent variable will also change and so the dependent variable is dependent on the independent variables very much.

So from this regression analysis we can say that the independent variables have the explanatory power and they can influence the expectation of shoppers by more than 98%.

R shows the correlation between the dependent and independent variables. It summarizes the strength of association between the dependant and the independent variable. It is an index used to determine whether a linear or straight line relationship exists between the variables. It indicates the degree to which variation in one variable is related to the variation in another variable.

And in this case we can say that the correlation between the independent variables and the dependent variable is very good because it is .982 which is much closer to 1 and that the relationship is positive.

| Coefficientsa | ||||||

| Model | Unstandardized Coefficients | Standardized Coefficients | t | Sig. | ||

| B | Std. Error | Beta | ||||

| 1 | (Constant) | .205 | .218 | .938 | .003 | |

| CS | 1.187 | .161 | 1.047 | 7.389 | .000 | |

| TA | -.277 | .126 | -.209 | -2.206 | .033 | |

| BE | .408 | .182 | .379 | 2.243 | .030 | |

| EE | .333 | .159 | -.252 | -2.090 | .042 | |

| a. Dependent Variable: QSP | ||||||

From the above table the resulting model was:

Y = .205 +1.187X1 -.277X2 + .408X3 + .333X4

From the coefficient table, we can see that the beta coefficient of X1 which is customer satisfaction of Dhaka Bank is 1.187 which shows a positive relationship between quality service & products of DBL and satisfaction of customers towards the bank. It means that people have a positive attitude towards the quality of products & services which DBL is currently offering.

And the significance level shows that the value is 0.000 which is less than 0.005 and thus it shows that there is relationship between quality of products and services of the bank and customer satisfaction.

From the coefficient table, it can be seen that the beta coefficient of X2 which is technological advantage in DBL -.277 which means that there is negative relationship between quality of services and products of DBL and technological advantage in the bank. It means that people have a negative impression on the technological advancement in the bank as ATM booths of the bank are not available in all areas which is particularly causing people to have a negative attitude on the quality of services or products of the bank as far as technological advantage is concerned.

From the significance level, we can see that the value is 0.033 which is much less than 0.05 and thus it can be strongly said that there is relationship between quality of products and services of the bank as being perceived by the customers and technological advantage in the bank but the relationship is negative.

From the coefficient table, we can see that the beta coefficient of X3 which is environment of the bank .408 which shows a positive relationship between the bank environment and quality of products and services of the bank. It means that people have a positive attitude towards the environment of the bank as the employees are quite helpful in the bank and customers can get their work done very quickly and don’t have to stand in long queue for a long time.

And from the significance level, it can be seen that the value is 0.030 which is very much less than 0.005 and thus it shows that there is relationship between bank environment and the quality of its products and services.

From the coefficient table, it can be seen that the beta coefficient of X4 which is efficiency of the employees in the bank is .333 which means that there is relationship between employees’ efficiency in the bank and quality of bank’s products and services. It means that people do believe that the employees in the bank are very efficient and helpful as well which helps the customers to get their work done without having had to face any major problems and difficulties.

From the significance level, we can see that the value is 0.005 which is less than 0.05 and thus it can be strongly said that there is relationship between employees’ efficiency and the bank’s overall performance.

Summary

Internship program is the pre-requisite for the graduation in BBA. Classroom discussion alone cannot make a student perfect in handling the real business situation; therefore, it is an opportunity for the students to know about the real life situation through this program. A report has to be built for the university and organization requirement. The topic of the report is “General Activities: A study on local of DBL, Bangladesh”. The main purpose of the report becomes very clear from the topic of the report. The report discusses about the different credit facilities, Deposit facilities, monitoring and performance.

This report is broadly categorized in five different parts. In part one introduction, purpose, objective, scope, limitation and methodology of the study is discussed. The main objectives of the report are identifying the General Activities and their overall performance in the last few years. Part two narrates the company profile including Dhaka Bank’s history, their philosophy, mission and strategy, activities and performances.

DHAKA BANK LIMITED was incorporated as a public Limited Company on 6th April 1995 under the company act. 1994 and started it’s commercial operation on June 05, 1995 as a private sector bank. The Philosophy of the bank is “EXCELENCE IN BANKING”. This is the bank’s commitment and guiding principle. Outside regular activities Dhaka Bank also takes part in different community services and environmental management programs.

Part three forces on the General activities. It includes services of banking sector, different loan categories, and credit analysis, loan review and handling problem loans. Who can apply for the loan and how can get loan. Mention different services and describe those. And also mention deposit system and define those deposits.

Part four of the report discussed financial performance and financial statement. That helps to analysis to find out actual position of the bank and also how better performances from before.

Part five of the report identifying some problem discussed some recommendation. That help to bank perform better than before.

Part five of the report mentions conclusion, appendix and reference.

At the end a very qualified and dedicated group of officers and staffs are working in the Dhaka Bank, Local Office and are always trying to provide the best service to the clients. They always monitor the activities in different sectors and their position. Their credit approval and monitoring process and its performance increased very rapidly and still trying their best to improve more and more.

So, within a very short period they earned the respect and acceptance from the customers and now it is one of the leading private commercial bank of the country

Recommendations

- Need to extend Branch Network and more New Branch to be opened in other Cities and Towns of Bangladesh to reach out the Potential Customers.

- Adequate measures are to be taken to reduce System failure.

- DBL needs to reduce their charge which they take in providing locker services from their clients.

- Check Book delivery time needs to be quickened and Dhaka Bank Limited (DBL) needs to be liberal in issuing Counter Check of Customers required amount.

- Dhaka Bank Limited (DBL) needs to advertise through various Media about Credit Cards, ATM Cards, Tele Banking and its other Products and Services.

- Apart from Advertising in Media, the Bank can take some steps for Personal Selling. Staffs/Officers can be hired or Internees can be used for this purpose.

- The Brochures of the Products and Services of the Bank can be mailed or Circulated by the Internees to the Potential Customers and Internees can give brief Idea to the Customers about the Products and Services of Dhaka Bank Limited (DBL).

- The Brochures of the Products and Services of the Bank can be mailed with the welcome letters along with the Statements of the Customers via courier. No extra cost will be incurred in this.

- Like Standard Chartered Bank, who arranged Money Link, Phone Link Nights to promote its Products and Services via Press and Public Exposures, Dhaka Bank Limited (DBL) can arrange Party, Meetings and Press Conferences to create Quality Image for the Bank.

- For Cash Withdrawals and Deposits more ATM can be installed in major cities and towns across the Country through which Customers can easily get access to their Accounts.

- As the Competitors offering a Higher Interest Rate on Deposits and Lower Charges in Loans, Dhaka Bank Limited (DBL) should think about it and if possible then maintain the Interest Rate and Bank Charges as similar as to its Competitors.

- As other Private Commercial Banks like Prime Bank Limited (PBL) offering a more relaxed Individual Loan, so in order to compete the Market Dhaka Bank Limited (DBL) should make their personal Loan more relaxed than other Competitors.

- Dhaka Bank Limited (DBL) should practice a Participant Marginal Process because in this all the Employees get chance for Participating in Problem Recognition and Problem Solving and thi9s will make the Employees feel better which will work as a Motivation Weapon. Also Award System should be activated depending on the Performance Appraisal of the Employees.

Conclusion

Notwithstanding some limitations Dhaka Bank Ltd. is doing better and holding good percentages of market share in banking sector. DBL, the new generation bank in Bangladesh came into being in 1995 under the entrepreneurship of prominent businessmen in the country. Established with the objective of bringing about a qualitative change in the sphere of banking and financial management, the bank today serves its customers spread across 50 branches within Bangladesh.

DBL provides services tailored to the specific needs of the customers in the area of trade, comers and industry, besides the domestic network. While services like Credit Cards, ATMs and SWIFT payment systems are already in place, the bank plans to introduce Real Time Online Integrated Banking System with all modern delivery channels in the future.

DBL has earned recognition at the national and international level. The bank achieve three awards in 2009 fiscal year those are Certificate of Merit from ICAB, Best bank Award, CSR Award. DBL is also committed to corporate social responsibility towards the community. The bank is also concern on the practice of the best modern human resource management where training and development is a concern with organizational activity aimed at bettering the performance of individual and groups in organizational setting. So, if the Bank can remove all of its present problems, it will be able to gain its goal & will reach to its vision.