Organization Overview of Banglalink Digital Communications Limited

“Banglalink Digital Communications Limited” is the second largest company in the telecom sector of Bangladesh after Grameenphone. This operator has brought massive change in the telecom industry of Bangladesh. Before Banglaink’s emergence, the telecom industry was monopolized by Grameenphone and Grameenphone took the chance of being the only player in the market by skimming the market although Grameenphone was successful to provide good quality of service and yet the subscription price and the call & sms tariff was unjustifiably high. Although Banglalink started its operation back in 1989 which was formerly known as Sheba Telecom (Pvt.) Ltd., failed to compete with Grameenphone. It was a joint venture company of Bangladesh-Malaysia and was granted license to operate in the rural areas of 199 upazilas.

Upon obtaining GSM (Global System for Mobile) license in 1996 it expands its business to cellular mobile and radio telephone services. The scenario of the telecom industry changed all on a sudden when the Egypt based telecom giant Orascom Telecom Ltd. purchased the shares of TRI(Technology Resources Industry) in Sheba for US$25 million in July 2004. The Bangladeshi partner ISL(Integrated Services Ltd) did not know that TRI had sold their shares to Orascom.

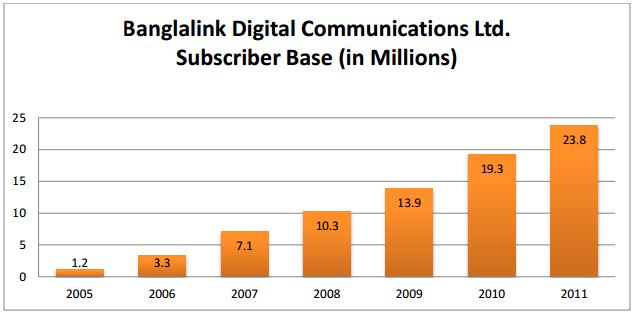

However, there was an agreement between TRI & ISL regarding the sale of shares and it was “if any party wants to sell their shares, the other party will get the chance to buy those first”. This is a very common law of finance and this kind of contract is done to avoid the dilution of the shareholders’ value. Therefore, when the deal between TRI and Orascom was revealed, ISL purchased the stocks back from Orascom as per the agreement. However, ISL did not see any hope in Sheba Telecom and failed to operate the business effectively and in September, 2004 they sold their 100% ownership to Orascom Telecom Holdings with 59,000 user base for $50 million. That’s how in the year 2005 Banglalink was born and it purchased a GSM license to operate cellular business in the country for 15 years. The beginning years were not easy for Banglalink. Grameenphone started their operation in 1997 and Banglalink made its entrance in the market after seven years of Grameenphone. Therefore, very logically Grameenphone was a well-established company when Banglalink started to build its cellular infra-structure in the country. By the time Banglalink entered, Grameenphone had taken the maximum advantage of the market. However, it did not take too much time for Banglalink to capture considerable market share of Grameenphone as it started its operation with a vision to make the telephony available to the mass at a lower price. Before Banglalink’s operation in the country, using a cellphone was luxury. Afterwards, it became a necessity and Banglalink’s vision to penetrate the market using lower cost worked in favor of them. Banglalink came up with innovative and low cost product & service offerings and the sales increased like wildfire and it became the fastest growing mobile operator of the country with a growth rate of 257%. This milestone was achieved with innovative and attractive products and services targeting the different market segments; aggressive improvement of network quality and dedicated customer care and effective communication that emotionally connected customers with Banglalink. Banglalink started with 59,000 customers when they purchased Sheba in February, 2005 and in December 2005 the customer base count showed 1.2 million. The customer base is growing exponentially every day and in March, 2014 the company has reported the current customer base is more than 29 million. The telecom industry is fully saturated with different mobile operators. To keep hold of the market position and match with changing wave strategically, Banglalink has changed its slogan to “notun kichu koro” or “start something new” in October, 2013. The slogan was backed by the launch of 3G (third generation) mobile network.

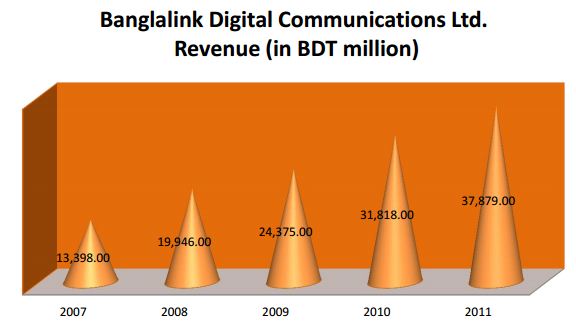

After Orascom’s takeover the revenue of the company has grown significantly every year. The organization has achieved milestones in terms of revenue every year, although maximum portion of revenue was re-invested in order to finance its network deployment project. In the year 2007 the revenue of the company was BDT 13,398 million and in the year 2011 the revenue was BDT 37,879 million. The revenue for each year from 2007 to 2011 is shown in a chart below:

Although Banglalink has experienced stable growth in the revenue every year, the average revenue per user (ARPU) has seen a declining trend. In the year 2009, the ARPU was $2.5 and the declined ARPU in the year 2010 & 2011 was $2.3 & $1.9 respectively. This is happening because of the high rivalry among the operators and also because of low switching cost. This must be alarming for Banglalink as while the customer base is increasing significantly, the ARPU is declining; which implies the existing customers are switching to other operators and to stop this Banglalink needs to focus more on retaining existing customer more than creating new customers.

Vision

The strategic market oriented vision of Banglalink is:

‘To understand people’s needs best and develop appropriate communication services to improve people’s lives and make it simple’.

All the strategies, goals and objectives of Banglalink is developed based on the vision of the company. The vision of Banglalink expresses the concern of the company for its customers and the dedicated people of Banglalink works persistently in order to provide a better customer experience and to make its customers happy and to bring changes in their lives it is expanding its business, establishing new networks and connecting people thus building breezes towards the achievement of its persuasive vision.

Mission

To achieve its vision Banglalink has also targeted a set of missions that will lead the organization to its vision. The missions of Banglalink are:

- Segmented approach in terms of products and services

- Delivering superior benefits in every phase of the customers’ experience (before, during and after sales)

- Creating optimum shareholder value

Their missions mainly comprise objectives for two sets of stakeholders: customers and shareholders. Banglalink tends to segment its market to figure out its potential customers.

Unlike Grameenphone its target market is people from all walks of life. It insists on providing economic products and services to the people while delivering them the best customer experience in the country and by providing this Banglalink will be able to serve the interest of the second group. In this way, the missions of Banglalink are linked and upon achieving these, the company can march towards its vision.

Values

Banglalink has built four core values from the very beginning of their journey. The organizational culture has developed based on the core values. The employees of Banglalink demonstrate these four core values which create the difference. The employees of Banglalink are innovative, straight forward, passionate and reliable.

Ownership Structure

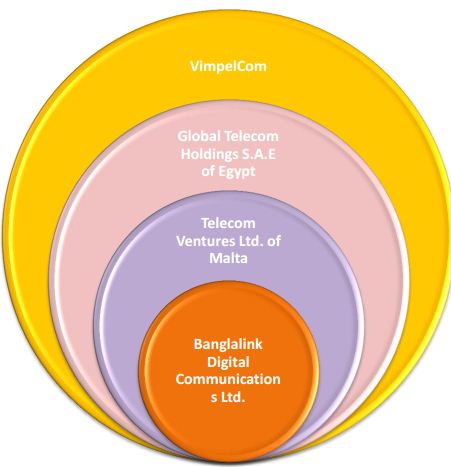

Telecom ventures Ltd. is currently operating its business in Bangladesh under the brand name Banglalink Digital Communications Ltd. Telecom Ventures Ltd. It is a Malta-based telecommunication company which was formerly known as Orascom Telecom Ventures Ltd. and now it is a fully owned subsidiary of Global Telecom Holding S.A.E. (former Orascom Telecom Holding S.A.E.). A business combination between VimpelCom of Russia and Wind Telecommunication of Italy took place in April 2011 and after this combination world’s sixth largest telecom operator VimpelCom now owns 51.92% voting shares of Global Telecom Holding S.A.E and therefore, VimpelCom is the ultimate parent company of Banglalink Digital Communications Ltd. Although VimpelCom is the ultimate owner of Banglalink, The structure of shareholders is shown below using an exhibit:

The ownership structure of VimpelCom is also very interesting. The parent company of Banglalink’s main competitor in Bangladesh is Telenor and very surprisingly Telenor has good amount of stake in VimpelCom. Altimo of Alpha Group has 56.2% economic rights and 47.9% voting rights in VimpelCom. Altimo is one of the Russia’s largest investment firms and it has its stake in oil and gas, commercial and investment banking, asset management, insurance, retail trade, telecommunications, water utilities and special situation investments. Their business portfolio includes many large corporations and they are successful in investing on diversified sectors to reduce business risk which is also popular as unsystematic risk. The other shareholder of VimpelCom is Telenor group of Norway. This Norwegian giant holds 33% economic rights and 43% voting rights in VimpelCom. This group has its fame in operating large telecom companies in 29 countries around the world. Therefore, in Bangladesh whether someone uses Grameenphone or Banglalink Telenor is being benefitted substantially. The rest 10.8% economic rights and 9.2% voting rights belong to the minor shareholders.

Products and Services Offered by Banglalink Digital Communications Ltd.

Products

Banglalink Digital Communications Ltd. has two brands in Bangladesh and they are popular as Banglalink and Icon. Both the brands provide similar services but the basic difference between the two brands is the user class. Banglalink products and services are available for everyone whereas icon products and services are provided to only the premium segment of market. Icon has established itself as a premium brand and in most of the cases the icon managers hunt its prospective customers.

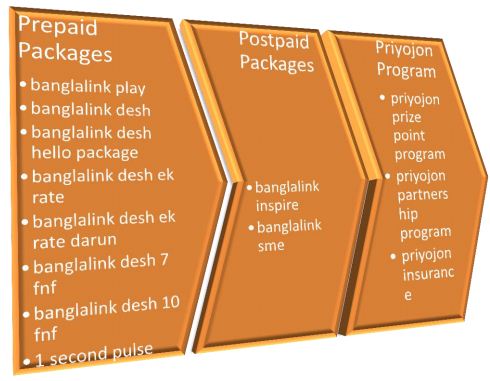

Banglalink’s Products: Banglalink offers three basic packages and program to its customers and the packages are Prepaid, Postpaid and Priyojon Program. These three packages are also customized based on the demand of market niches and therefore the actual product line is really lengthy. The product line of Banglalink has been depicted below:

Among three programs mentioned above prepaid and postpaid packages has its own sub-products and priyojon program is a loyalty program aiming to increase customer retention of Banglalink. Prepaid package has eight customized products and under postpaid package customers can enjoy two types of product.

Banglalink values its customers and to strengthen the bond of Banglalink with its customers Banglalink has come up with the priyojon loyalty program. The major objective of priyojon program is to get engaged more with its existing customer.

Banglalink believes that selling a new connection is not the end of its marketing rather it is the beginning of a customer’s journey with Banglalink and therefore the priyojon program is developed to make the customer satisfied, to provide them a positive customer experience and most importantly to make the customers feel how the brand cares for them. Priyojon program has been described very precisely in the following exhibit:

Icon’s Products: Icon is a premium telecom brand in Bangladesh. The package is designed only for those customers who have heavy usage pattern and most importantly for those who maintain a higher social status. This is brand is not promoted extensively as the brand wants to have very limited number of high value customers. Generally the minimum criteria to own the package are to expend 3500tk. per month. This package have carry forward facility of all monthly freebies such as Minutes, SMS, Data and ISD talk time for 1 month or bill cycle. For example, if a customer uses 2000 minutes out of 3000 in February, for March, s/he will have free minutes of 4000 (3000 regular + 1000 carried forward). The ICON users get extra facilities in different aspects. Such as there are discount offers in hotels, airways, resorts, restaurants’, mobile phones etc.

Priyojon Program Prize Point

- Based on the usage in every month a customer can earn priyojon prize points and with this prize points, the customer can get free talktime & sms, free data and physical gifts

Partnership Program

- Those who are registered under priyojon program can enjoy upto 50% discount on the purchase of fashion & lifestyle; food & beverage; electronics & home appliances; entertainment; hotel, tours & travel and daily needs items from more than 350 partners

Priyojon Insurance

- Using the prize points a customer can get free life insurance coverage upto BDT 1 million

Services

Banglalink provides 3G & Internet, VAS (value added services), international roaming, MFS (mobile financial services) to its customers. Among all the services that Banglalink caters, the stated are very important and sensitive in terms of revenue generation and those are explained very briefly.

3G & Internet: In October 2013, Banglalink was purchased a license from the government of Bangladsh in order to provide 3G services to its customers. 3g is third generation mobile telecomunication technology which provides faster internet services. Upon getting the license Banglalink has launched its 3G services in January, 2014 and currently the 3g service is available for the customers of Dhaka, Comilla, Chittagong, Barishal, Bogra, Khulna, Gazipur, Tangi, Munshiganj, Mymensingh, Narayanganj, Rajshahi, Rangpur, Sylhet,Tangail.

Sooner the coverage will spread to the whole country. To avail the 3G service customers do not need to change their connection, all they need is a 3G supported handset. With 3G connections customers can browse faster than before, they can go for video call and there is also mobile TV service available in the service. Day by day the organization is expanding its 3G range and now the company’s major capital expenditure is allocated for the deployment of 3G equipments. Besides 3G, the organization has been providing 2G internet services from the past decade.

International Roaming: To ensure banglalink’s customers stay connected anywhere in the world, Banglalink provides international roaming facility to its customers. Using international roaming option, if a customer goes outside Bangladesh, he/she can still use his/her banglalink connection. Wherever the customers go, they can have their banglalink connection active, as banglalink has roaming partners all over the world.

VAS: VAS stands for value added service which aims to ad value in a customers life by exploring multi-purpose usage of mobile phone. VAS is a very popular idea among the telecom companies and the companies are always looking for new usage of mobile phone that can make the life of people better so that in between the operators can figure out a good source of revenue.Like all other operators Banglalink has innovative value added services which are categorized into three measures and those are: information based serives, entertainment based services, call management services.

Information based VAS are: wikipediazero, facebook on ussd, krishi news, travel guide, bibaholink, jobs link, islamic service, banglalink krishibazaar, banglalink emergency, blood bank, healthlink, banglalink jigyasha, i´info, railway junction, yellow pages, sms (text, quotes & jokes …), international sms, namaz alert.

To enhance the power of knowledge Banglalink provides the wikipediazero service for free. Now, customers can visit m.wikipedia.org or zero.wikipedia.org for free and can know whatever they want to. In addition to this service if customers use their handset’s default facebook browser to only browse facebook they won’t be charged for data usage.

Entertainment based VAS are: banglalink local radio, priyo tune, bbc bangle, banglalink timer sms, friend finder, amar tune, song dedication, power menu, music station, voice portal, ring tones, logos, picture messages.

Call management VAS are: banglalink easy divert, voice message, call block, call me back, missed call alert, conference call.

Mobile Financial Services (MFS): Mobile financial services are a new but very promising trend to generate healthy cash for the telecom operators. It is a special form of VAS. VAS only provides general services whereas MFS aims to provide high quality of transaction service with the usage of mobile phone.

These days the mobile phones are not only mobile phone rather these are more like credit cards. Now, the cellphone users can pay their utility bills and other bills using their cellphone and they can transfer physical money using their connection. Mobile Financial Services were permitted in 2011 and within very shortest time period the services has achieved remarkable response from the users of the service. Overnight, the concept has become popular and the people are now transferring their fund anywhere in Bangladesh using Bkash, Ucash and other services very easily and it has reduced the transaction time and the hassles of a transaction. The MFS has become 83 million dollars market based on the only the fees collected from processing each transaction. Banglalink was the first to come up with M-wallet which was awarded in national and international level.

For processing every utility bill Banglalink gets Tk. 5 as the transaction processing cost. MFS is growing every day and new dimensions of the services are yet to be discovered; however the success of MFS largely depends on two factors: transaction security and transaction cost.

Banglalink’s Social Responsibility

From the inception of Banglalink, the company feels its obligation towards the environment and local culture of Bangladesh. Banglalink is committed to play its role as a responsible corporate house and it has spent huge money on its CSR activities. It has undertaken extensive CSR programs to bring positive changes in the society and to create a positive image of the organization among its stakeholders. Although sometimes it is debated that the CSR program is a part of its branding, the good part of this has been realized. The CSR activities of Banglalink have benefitted the environment and because of Banglalink’s promotion of our local culture, the national heritages of the country have been elevated successfully to the people in home and abroad. A few highlights of the CSR activities of Banglalink have been listed below:

From the beginning of Banglalink, it has been expanded its hands on cleaning world’s longest sea beach, Cox’s bazar. Under this project, 26 female workers clean the 3 km long beach 363 days a year in 2 shifts. In addition to that there is another team of 7 male workers who support to move all heavy dirt and rubbish from the beach. Banglalink has been truly making a difference in preventing environmental pollution at Cox’s bazar beach which shows the commitment of the organization towards environment.

Since 2009, to help underprivileged children, Banglalink has taken this special initiative to distribute blankets among the orphan children of many orphanages around the countrywhich are in great need for it during winter season. In 2013 Banglalink distributed 5,000 blankets among the destitute children of 101 orphanages across the country. The districts covered were- Dhaka, Chittagong, Khulna, Rajshahi, Rangpur, Barisal, Narayanganj, Mymensingh, and Tangail.

Since 2009, Banglalink took several initiatives to provide free services to hajj pilgrims at hajj camp where they gather to depart for hajj. This includes arranging air-conditioned busses for pilgrims, water distribution zone, phone counter for making free phone calls, free charging units etc.

Banglalink distributed free water and dates for the fasting people who got stranded at major traffic points of selected metro cities around iftar time during ramadan. This social activitu is been introduced from recent years. Banglalink also took initiative of arranging regular iftar and dinner in different orphanages around the country. In 2011, the company provided water and dates to almost 85,000 people and iftar and dinner for more than 12,000 orphans of 123 orphanages across the country.

Besides the above, to promote our local culture the organization has been patronizing “Lalon Utshob”, “ Boat Races”, “Boshonto Utshob”, “Shah Abdul Karim Loko Utshob”, “S M Sultan Utshob”, “Hason Raja Loko Utshob” and many mores in order to demonstrate their dedication for local culture and festivals.

Internship Experience

I was selected as an intern in December, 2013 to work in the treasury and cash management unit of accounting & finance department of Banglalink Digital Communications Ltd. I joined Banglalink on 22nd January, 2014 and my first day at Banglalink started with an orientation program which was conducted by HR team of Banglalink. The next day I got the chance to meet the people I worked with for four months. I had an internship agreement with Banglalink for three months and the agreement was extended for one more month. Like the interns of other departments my responsibilities were not project-based moreover, from the organization’s perspective I was employed as an intern to assist the people of treasury unit in their daily activities and to share their workload and from my perspective it was a great opportunity to gain firsthand experience on the financial activities of a company that is growing fast. Being a student of accounting & finance, I do feel really lucky to do my internship in the similar field and it has allowed me to detect the application of knowledge gained in the last four years. I was guided by well-educated & well-experienced people who have corporate expertise in dealing with financial activities. Treasury Senior Assistant Manager Qumrul Hasan Miron was my reporting supervisor and I have had his utmost guidance and assistance always, whenever I asked. During my employment, the best thing I figured out about Banglalink is its working environment. The organization has perhaps the best working environment among the privately owned corporations of Bangladesh. Everyone in Banglalink was so co-operative and I always had the support whenever I asked for it. In words, Banglalink is the best place to learn and I have exceled in different functions of treasury and I believe the experience gained from working in here will help me to advance my career and to put myself in a better position in future.

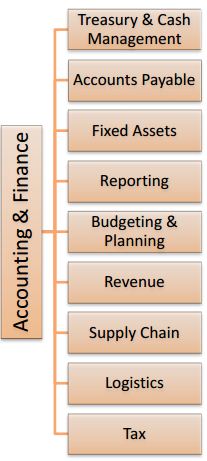

Accounting & Finance Department of Banglalink – at a glance

Accounting & Finance Department is probably the biggest functional department of Banglalink. Chief Financial Officer (CFO) is the head of the department. The people working in this department are highly experienced and they process the financial data and look after the financial matters of the company and based on the data provided by them the top management takes strategic decisions to run the organization. To ensure the effectiveness and efficiency of this department, it has been broken down to several functional units. Few major functional units of accounting & finance department are shown below:

I was assigned to work with the treasury and cash management unit and this specific unit is the most important unit of accounting & finance as it deals with the core financing activities of the company. The major responsibility of the treasury unit is to bring, utilize, monitor and repay the money from different financing sources, to figure out an optimum capital structure and to minimize the financing cost while maintaining a good relationship with financial stakeholders. In words, the treasury & cash management unit takes care of the money of the organization. The treasury & cash management unit uses the most-diversified financing activities in Bangladesh.

Activities Performed in Core Treasury

Core treasury unit of Banglalink keeps the track of fund through effective fund management process, remits money outside the country for different purposes, works for reporting required by government institutions like Bangladesh Bank, Board of Investments and most importantly monitor the short term loans and prepares the journal entries associated with working capital.

My activities were:

Downloading and sorting the bank statements: Preparing the fund positioning and fund movement report is very sensitive as well as important activity that core treasury performs every day. Everyday the fund positioning and fund movement report has to be circulated to the top management and across the treasury unit within the shortest possible time so that the decisions regarding fund can be undertaken effectively. Bank statements are the most important prerequisite of this process. Banglalink has its accounts in more than 20 banks and in every bank there are multiple accounts. Different banks account statements come in different form and the data in the bank statements is useless to input in the process until it is properly filtered and sorted. I used to download bank statements of Banglalink and sort and filter the data in the proper way to facilitate the fund positioning process.

Forecasting the interest expense: Interest expense forecasting is another major activity of the core treasury team so that the company is prepared to pay the interest against short term loans properly and to keep adequate fund available in the bank accounts to pay off the interest expense. The interest on short-term loans is paid either on maturity of the loan or at the quarter end. One of my prime responsibilities was to prepare a forecast of interest expense at the month-end for every week of the next three months. I used to prepare this report based on the past-trend of interest expense.

Preparing the bank instructions: The movements of or payment from the available fund is made by writing an instruction for the banks. A bank instruction is like an application addressed to designated personnel of a bank and all the details of the transaction is written in the body part. The bottom of the instruction is signed by the signatories of the organization. In most of the cases, it is required to get the bank instruction signed and stamped by two signatories upon receiving which the receiving bank clears the transaction. One of my responsibilities was to prepare the instruction for the payment to a roaming partner. A roaming partner is a foreign telecom operator the network of which has been used by a customer of Banglalink via IGW (international Gateway) as the customer wants to use the Banglalink connection in abroad. Therefore, in every month payment has to be made to the roaming partners in different countries and I used to prepare the bank instructions to remit money outside the country and the payment was made from the dollar account of the company since the roaming partners sends the invoice in a foreign currency.

Reviewing the journal entries: The core treasury team journalizes all short-term loan (STL) and long-term loan (LTL) related entries, FDR entries, remittance of money outside the country for the purpose of international roaming, technical fees, training fees, audit fees, membership & subscription fees and other payments in the oracle (ERP) system of the company and the hardcopies of the journal entries are filed to meet auditor queries. Since I did not have the access to the oracle system due to the company policy, my task was to review and verify the journal entries as per the instruction of my mentors to make sure the entries have been placed in the general ledger properly.

Preparing and arranging documents for reporting purpose: The government bodies like Bangladesh Bank (BB) and Board of Investment (BOI) holds the right to get the financial information regarding the company anytime they want and the queries of these regulatory institutions has to be met within the shortest period of time. The updated report of capital is submitted to Bangladesh Bank periodically. I used to assist them in this regard. For example, a query from Bangladesh Bank was to show them the utilization of three huge chunk of capital received from the shareholders along with providing necessary documents. My mentors provided me with the breakdown of the utilization and asked me to arrange the supporting documents like bank statements, LC/LCA copies, commercial invoices and so on.

Keeping track of FDR tax deduction certificates: Whenever treasury spots funds are staying idol for a period of time and there is a scope to earn interest income from the unutilized fund, upon receiving prior approval treasury invests the money and create a FDR. The moment interest is realized on the FDR, banks deducts 10% tax on the earned interest and sends a tax deduction certificate. My task was to get the tax certificates from the banks, review the certificates, documentation of those certificates and keeping a track of the certificates.

Updating Bloomberg Rate: The exchange rate of US dollar, Euro & British pound against taka is updated everyday from the website of Bloomberg and the rate is used to declare the corporate rate at the end of every month.

Activities Performed in Corporate Treasury

The main responsibility of corporate treasury unit of Banglalink is to allocate the funds for business activities and sourcing the funds from different financial institutions at a lower cost and maintaining a good liaison with financial institutions so that fund can be procured anytime at a lower cost. My basic responsibilities in this unit were:

Keeping track of Bangladesh Bank cheques: The treasury allocates the money to other departments and facilitates the vendor and non-vendor payment. There are times when payment has been made from an account which does not have sufficient money to meet the required payment amount; money is transferred from an account of another bank that has surplus balance through Bangladesh Bank cheque in the same day. In the clearing house of Bangladesh Bank this type of cheques are cleared twice a day. The transaction cost of BB cheque is Tk. 230.

My task was to keep the track of this type of fund transfer and to check the bank statements whether the transfer has been executed or not.

Keeping track of internal fund transfer: Funds are also transferred from one account to another account of the same bank for the similar reason Bangladesh Bank cheque is issued. As it is stated before, Banglalink has multiple bank accounts in the same bank and money is transferred from one to another whenever it is necessary. I used to keep the track of internal fund transfer as well.

Cross unit acitivities: At the end of each month the trackers of Bangladesh Bank cheques and internal fund transfer has to be provided to the cash management unit along with the bank instructions made to transfer funds. This was done to facilitate the month end bank reconciliation.

Activities Performed in Cash Management

The cash management team monitors the cash collection process and different bank accounts, prepares bank reconciliation statements at month end and monitors the cash collection process from e-commerce projects with PDB, WASA, Qubee and etc. My tasks in this department include:

Updating the point of POS system: The distributors sends their sales report to the cash management unit of Banglalink and the sales report is updated in the POS system everyday to get the cash collection from different sources like prepaid sales, postpaid sales, airtime revenue(I’top up) and many more headings. My task was to update the POS system from the collection report to get the accumulated cash collection.

Updating the collection report of international roaming: Just like Banglalink’s payment to its roaming partner, Banglalink also receives revenue from its roaming partners for using its network and a tracker of the collection from the roaming partners is maintained. I used to update the tracker of the collection from the roaming partner.

Updating the bank balance in centralized system: There is a centralized system of group treasury of VimpelCom which is also known as treasury management system and the closing balance of each bank account is updated in this system. I updated the closing bank balances of few accounts in that system.

Activities Performed in Trade Finance

The trade finance team plays a crucial part in procuring the capital goods of the company. Trade finance facilitates the financing activities of capital goods their main responsibility include preparing LC & LCA upon the request of Procurement unit and the dissolving LC & LCAs and the payments related with LC.

The only cross-unit activity that I had with this unit was:

Sorting the necessary LC and LCA documents: One of my basic responsibilities was to arrange and compile necessary documents required by regulatory institutions of government and it has been described previously. For the reporting purpose the LC and LCA documents as well as the other documents of trade finance were necessary and I had to sort out the relevant documents.

Moreover, I have learned the LC process from the mentors in trade finance unit during my internship period.

Session with Corporate Sales, Icon and Customer Care Department

The internship program of Banglalink is known as “Advanced Internship Program” and the internship program is distinct because the interns learn from working in many functional units.

All the interns are required to attend a one week session with the people from corporate sales, icon and customer care department to know sales process of the organization and how the customers are being served. The session with corporate sales was enthralling as we visited garments factories in Gazipur & Ashulia to monitor an ongoing promotion. Corporate sales team caters different organizations by providing them telecom service at a fixed rate per month and the corporate package is customized based on the need of the service-receiving organization. 5%-10% of Banglalink’s total revenue comes from the corporate sales. The session with icon entailed their working process followed by the session with customer care to know about how the customers are relentlessly served in order to create a satisfied customer.

Conclusion

Banglalink Digital Communications Ltd. is one of the leading multinational telecom companies in Bangladesh. I had the opportunity to work for this company during my internship program.

This internship program has helped me to explore new horizons of business environment. This report has provided insights on the treasury activities within the limited scope. The treasury functions are so vast and complex that one report is not enough to write everything about it. However, the fullest measure was taken to make this report fruitful and informative.

Although the financial analysis does not provide an outstanding image of the organization, the company has very good potential because it has got highly skilled people and they know better than anyone how to take this organization in a better position. I believe this company will keep on growing whatever the situation is.

Finally, I would say that this internship at Banglalink Digital Communications Ltd. has made my practical knowledge of Business Administration better and made my BBA education more complete and applied.