A mortgage recast, also referred to as repayment or repayment of the loan, is when the borrower repays only part of the entire amount of the unpaid principal resulting in a reduced balance of the loan, and the financial institution then recalculates the monthly repayment of the mortgage loan depending on the remaining date, the outstanding principal amount and the interest rate. It is a component of certain kinds of mortgages where staying regularly scheduled installments are recalculated dependent on another amortization plan. As such, the financing cost and the credit term continue as before; notwithstanding, the regularly scheduled installments will be lower, following the decline in the chief sum. Some mortgages have a planned recast date, the date when a new amortization schedule will be determined by the lender depending on the remaining principal balance and duration of the mortgage.

Mortgage recasting is an approach to decrease the premium costs without shortening the credit term, where remaining installments are determined dependent on another amortization plan, and is ideal for individuals who as of late got a huge amount of cash and need to lessen their home loan costs. If the borrower has a large sum of money, then in the form of a mortgage, such money can be lent to the lender to minimize the outstanding balance of the loan as well as to decrease the interest burden and the monthly principal burden of such loans. Accordingly, if an individual’s primary goal is to lessen regularly scheduled installments as opposed to taking care of their advance quicker, at that point a recast could be thought of. In any case, not all credits are qualified for reworking, and a portion of the banks may charge an expense for the assistance.

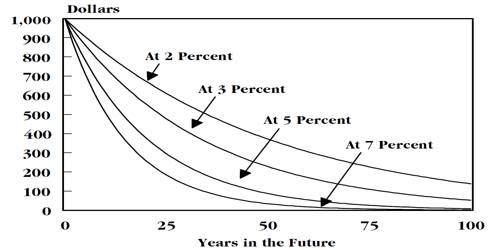

The principal advantage of recasting a mortgage for the homeowner is the ability to minimize monthly payments. As part of the loan contract, negative amortization loans or option adjustable-rate mortgages (option ARM) often have a mortgage recast clause. The aggregate sum of interest payable by the borrower to the loan specialist after mortgage recasting will clearly be lower when contrasted with the sum that the borrower would have paid without doing as such. In the interest measurement of the principal outstanding, this is attributed to the time value of the money factor current. Suppose if a person holds a 30-year mortgage with an S200,000 principal balance at a 5 percent interest rate, they will pay $1,200 per month. In such a scenario, spending about $50,000 on recasting will help them save monthly payments of around $300 per month and principal payments of about $35,000.

The mortgage recasting deals with the fundamental guideline of account. There are a few components due to which interest is charged by the bank, which incorporates time factor just as a danger factor. Sometimes, if additional principal payments are made, a mortgage lender will actually decrease the term of a loan, but will retain the same fixed monthly amount due simply by increasing the principal amount and reducing the interest portion of the payment. Individuals regularly choose renegotiating to get a lower loan cost which is beyond the realm of imagination with reevaluating or to move from a flexible rate home loan to a fixed-rate contract. Recasting is also desirable when a person takes out a low-interest, fixed-rate mortgage and wants lower monthly payments.

A mortgage recast doesn’t include acknowledged checks and proceeds for the first home loan. Then again, renegotiating a home loan implies taking care of the current credit and supplanting it with another one. Taking into account the various elements such as interest rate, time span, and an unpaid sum of borrowing, the idea of the time value of money work, etc. Specific amortization schedules for repayment of loans usually exist, which require equivalent monthly payment or payment of principal and interest as per the predefined pace.

Types of Mortgages that can be Recast –

- Negative amortization loans: Mortgage recasting can be composed into the advance terms and is related with a negative amortization advance. A contrarily amortizing advance has an installment structure that takes into account a planned installment that is not exactly the advance’s advantage charge. Therefore, over time, the principal owed rises as the amount of deferred interest is added to the principal balance. As the principal sum rises over time, negative mortgages for amortization cause the loan to be recast at some stage in order to pay off before the expected term. This may kick in, for instance, if the chief equilibrium of the credit arrives at a set cutoff through negative amortization.

- Home equity loans: Home equity loans allow borrowers, where the value of the property determines the loan amount, to use their home equity as collateral. Property holders searching for an approach to bring down their month-to-month contract installments without changing their financing cost or advance terms can consider a mortgage recast. However, after the original draw duration expires depending on the remaining loan balance, home equity lines of credit (HELOCs) will immediately be recast.

- High-balance loans: Conventional loans are conventional mortgage loans that are guaranteed by Fannie Mae and Freddie Mac and that are not secured by the government. The loan amount reaches the conforming loan limits in the case of high-balance loans. On traditional loans, conforming to Freddie Mac and Fannie Mae loans, recasts are permitted.

- Option Adjustable-Rate Mortgages (Option ARM): These mortgages give borrowers alternatives that incorporate paying the entirety of the head and premium or paying just probably the premium. While the options available with an ARM option allow for greater payment flexibility, it is easy for the borrower to end up with more long-term debt than before. These mortgages give borrowers alternatives that incorporate paying the entirety of the head and premium or paying just probably the premium.

However, if the principal repayment is greater than the outstanding amount owed on a particular installment, the outstanding balance amount shall be recalculated on the basis of the financial concepts, taking into account the present value of the balance of the amount of the loan discounted at the interest rate. The financing cost stays as before if there should be an occurrence of reworking similarly as the mortgage length. In the event that the loan fee is especially high, reworking is a terrible alternative. As contributed funds are caught up in the home equity, the mortgage recast also decreases overall liquidity. Borrowers seeking the capital may either need to sell their homes or use funding for home equity.

Information Sources: