This report targets to analyze the impact of monetary policy on the inflationary situation. Monetary Policy is described as the deliberate control associated with base money supply (M) and credit conditions in a few circumstances with a look at to realizing macro-economic policy objectives including price stability, GDP increase, maintaining high levels associated with production and economic increase, employment generation etc.

Introduction

Monetary Policy is defined as the deliberate control of base money supply (M) and credit conditions in certain circumstances with a view to realizing macro-economic policy objectives such as price stability, GDP growth, maintaining high levels of production and economic growth, employment generation etc. The monetary department (MPD) of Bangladesh Bank formulates monetary policy in the form of projected growth money (M2) as an intermediate target, consistent with projections for GDP growth and targeted limit for price inflation over each year. Reserve money is used as a main instrument for implementation of monetary policy.

This paper will try to indicate the impact of monetary policy on inflation situation.

Objectives of the paper:

With giving an overview of what the monetary policy really is and narrating how the central bank formulates the monetary policies and takes the necessary steps for its implementation in Bangladesh, this paper targets to analyze the impact of monetary policy on the inflationary situation.

Methodology:

The study depends on

- Extensive literature review of external sources on central banks on formulation and implementation of monetary policy for the country

- Publications of Bangladesh Bank

Scope of the paper:

- First of all, monetary policy is a deep sea to swim through. Though Bangladesh practices and implements a limited number of instruments, the mix is always complex to grab the main idea behind it. Extensive analysis of the mix is beyond the scope of the paper.

- Framing of indices of central bank policies is beyond the limit of this paper.

- Structured data is hard to collect from the departments of Bangladesh Bank, so complex calculations and data analysis is deliberately avoided.

Bangladesh Bank (BB):

The central bank of the country, was established as a corporate body by the Bangladesh Bank Order, 1972 (P.O. No. 127 of 1972) with effect from 16 December, 1971 by acquiring the liabilities and assets of erstwhile State bank of Pakistan in East Pakistan.

There is a cross departmental committee on monetary policy (MPD) headed by a deputy governor, which includes the officials of the core departments of the bank for monitoring of the money market and exchange rate operations in the short term.

Inflation:

In economics, inflation is the rise in the general level of prices of goods and services in an economy over a period of time. When the general price level rises, each unit of currency buys fewer goods and services. Consequently, inflation also reflects erosion in the purchasing power of money – a loss of real value in the internal medium of exchange and unit of account in the economy. A chief measure of price inflation is the inflation rate, the annualized percentage change in a general price index (normally the Consumer Price Index, CPI) over time.

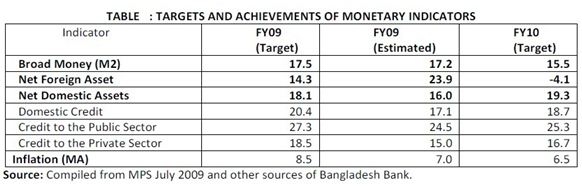

Bangladesh has been facing an upward trend in inflation over the last couple of years. Inflation expands the wealth of the asset owners while it reduces the net consumption of the poor as the prices of goods and services go up. If a poor wants to maintain the same level of food consumption, it reduces his or her other consumption, including health, education and investment. Such increments in price without corresponding rise in disposable income restrain the government’s goal of reduction of poverty. So, our government tries to control inflation but with little success. For example, the inflation overshot the target of 6.5% in FY2008 –09.

Sources of Inflation:

The factors that affect the movement of the prices upward in Bangladesh include:

- Increased prices of inputs

- Upward price movements in the country of origin

Anticipated upward pressure on prices of gas, fuel and power

- Undervalued exchange rate

- Continuous pile-up of remittances vis-à-vis decreasing import

- Increased non-development expenditure

- Lack of prudential management of liquidity

Monetary policy:

Monetary policy is the main macro-economic policy formulated and implemented by the central bank. Bangladesh Bank has the authority to increase or decrease the volume of money in the economy and therefore, is responsible for formulating and implementing the monetary policy for the country. The wheel of development moves by taking forces from this policy. The aim of monetary policy is to keep inflation low and steady. Though, in a developing country like Bangladesh, the effectiveness of monetary policies is always uncertain, but effectiveness of these policies is treated as signal for policy makers.

Monetary Policy and Inflation:

In a market oriented economy, central banks cannot control inflation directly. They have to use different instruments such as open market operation, legal reserve ratio, bank rate etc. Bangladesh Bank wants to stabilize the existing inflationary pressure by putting a break on money supply growth. The suggested tools to influence the growth of money stocks are:

- Restriction of broad money growth path

- Adjustment in cash reserve ratio (CRR)

- Statutory liquidity requirements (SLR)

- Restriction in the capital accounts

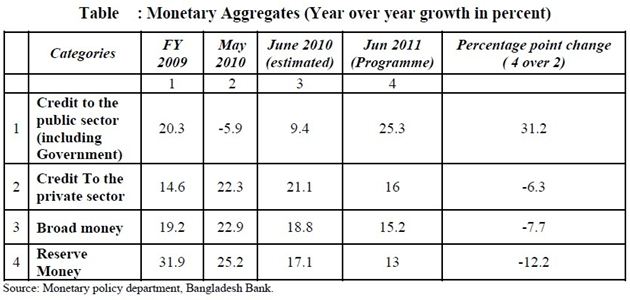

All the banks were required to maintain 5% of their total demand and time liabilities to Bangladesh Bank as CRR and no less than 18.5 percent as SLR. But BB has raised the CRR and SLR for scheduled banks by one half percentage point from May 2010 to restrain the expansion of monetary base.

BB plans to continue to support sufficient credit availability to agriculture, small and medium enterprises (SMEs), renewable energy and other productive sectors, but it also intends to strongly discourage lending expansion for wasteful consumption and unproductive speculative investment. It also has stated that workers’ remittance growth would settle down and import growth would increase at a moderate level to ease out the inflows driven appreciation pressure of taka and also the monetary expansion, resulting out of such pressures.

The policy target:

In the backdrop of market economy, it is necessary that the monetary policy framework be articulated for greater clarity and transparency benefitting both the policy makers as well as the stake holders. The leading central banks in the industrial world have increasingly adopted the unitary goal of fighting inflation. However, the following objectives are also kept in mind:

- The promotion of price stability

- GDP Growth

- Ensuring full or near full employment

- Supporting national and global economic and financial stability

Inflation target:

It is the general wisdom that the monetary policy tools are of immediate potency in controlling inflation. However, contemporary evidences imply that monetary policy cannot deal well with the inflationary impacts of external shocks such as the recent international price of oil and related energy products.

Many central banks, as a consequence, focus on the core inflation, which is typically constructed by subtracting the most volatile components from the Consumer Price Index (CPI). Hence, as a policy goal, core inflation may be a more credible target than CPI inflation.

It is quite relevant to set an indicative target band that will be realizable over the medium term. Inflation in Bangladesh has been moderate. The full CPI for the above period was about 6.77.

In a floating rate system, there is no question of a target band for the currency par value and hence the short term adjustments in the exchange rate system are necessary. In order to maintain export competitiveness, one has to keep an eye on the evolving pattern of sectorial productivity changes in the competitor countries. If inflation is allowed to slip, the subsequent depreciation in the par value of the currency will fuel further inflation.

Growth Target:

As long as Bangladesh remains within the National Strategy for Accelerated Poverty Reduction (NSAPR) – Poverty Reduction Growth Facility (PRGF) framework, the growth target is already built in there. The latter is based on the medium term macro-economic framework (MTMF). Hence, inflation targets must be based on level of investment and Balance of Payment (BOP). The major constraint here is the lack of timely data on macro-economic indicators.

Conduct of Monetary Policy:

Modern practices appear to be a rule based approach to the Conduct of Monetary Policy. John Taylor (1998) defines a monetary policy rule as a description of how the instruments of policy change in response to target economic variables. It routinely monitors the inflationary outlook by examining the evolving pattern of a broad index namely GDP Deflator and periodically decides to adjust the central bank rate or leave it unchanged. BB puts more emphasis on controlling inflation via the money multiplier, M2. The success of targeting broad money in controlling in inflation is premised on the long term equilibrium relationship between money and prices.

Instruments of monetary policy:

BB has moved from regulations and control based monetary instruments towards market based policy. Directed lending has been reduced to minimum level except agriculture sector.

The central bank has, in its disposal, a number of policy instruments. These can affect certain intermediate targets such a reserves, money supply, interest rates etc. The instruments of monetary policy are as follows:

- Bank Rate: The rediscount rate of discounting first class bills such as Treasury Bills. To check the credit operation (contractionary monetary policy), central banks increase bank rate. Borrowing becomes more expensive, hence demand for loans will be reduced.

- Open Market Operation: It refers to the buying or selling of securities and treasury bills by central bank in the open market so as far to influence the size of bank deposits. In times of inflation, BB will reduce the cash reserves of commercial banks by selling more treasury bills.

- Variation in Legal Reserve Requirement: It means cash and liquidity ratios or reserve-asset ratios. The central bank has the authority to vary the cash and liquidity ratios in times of inflation. For instance it could increase the cash and liquidity ratios in times of inflation and the policy is reverse in times of deflation.

- Selective Credit Control: The central bank may resort to credit rationing. It may prescribe absolute limits upto which specific sector of the economy may get credit from the banking system.

- Setting Marginal Requirements: Central bank may insist on marginal requirements. For instance, banks may be asked not to give loans exceeding 60% of the goods pledged on a particular good. It may instruct to set different interest rates to be charged on loans of different categories.

- Moral Suasion: It is sometimes called Jaw Bone Control. BB, in times of inflation, may persuade the commercial banks to restrict their lending policy.

Monetary Policy and macro-economic management:

Monetary policy is used for achieving the objectives of macro-economic management and for providing a sound macro-economic environment. It refers to the overall economic measurement of a country with the purpose of achieving a target growth rate of the economy while:

- Maintaining price stability

- Making progress towards poverty alleviation and employment generation

- Achieving balance of payments viability

As described above, the broad money M2 can be influenced indirectly by changes in the monetary policy instruments that target and monitor the reserve money via the money multiplier, M. The cash reserve requirement ratio, (CRR) and the statutory liquidity ratio (SLR) are effective means of announcing the monetary policy stance.

Anchor(s) of the Monetary Policy

Intermediate objectives (anchors) are important for monetary policy. They provide guidelines to policy-makers at times when ultimate objective (inflation or growth or both) responds with a lag. It also reduces the uncertainty and ensures transparency in policy making (Crockett, 2004) and (Lindsey and Wallach, 1989). In this context, three most popular approaches in a monetary policy regime are the following:

- Exchange rate targeting

- Monetary aggregate targeting

- Inflation targeting

Central bank independence and Inflation:

The studies on whether increased central bank independence lead to a lower inflation show that countries with legally more independent central banks tend to have lower inflation which in the long run is not at the expense of lower economic growth.

Consequences of the Monetary Policy:

Increase in the Average Interest Rate

According to the theory of liquidity preference espoused by the IMF, the interest rate rises when the central bank decreases the money supply. Since the average commercial lending rate in Bangladesh is almost close to 12.75% (FY 2010) and further raise may hamper the aggregate demand because the cost of borrowing would increase and firms spending on new factories and equipment would also reduce. This may also discourage them to hire more workers. Thus less hiring means lower employment.

Devaluation of BDT against U.S. Dollar

In FY 2008-2009 and FY 2009-2010, continuous depreciation of Bangladeshi taka was observed due to the negative growth in the export sector. On an average, in 2008-2009 taka was depreciated by -0.066 points and in 2009-2010 taka was depreciated by -0.046 points. That is why the weighted average exchange rate against the U.S. dollar was 69.006 taka (on average) in FY 2008-09 and 69.4410 taka (on average), with Tk.0.435 difference and .63 percentage change in a year. Thus this undervalued exchange rate favors the export sector at the cost of inflation. Because the devaluation of money creates excess demand of domestically produced goods and thus shortage of supply increases the market prices.

Credit squeeze to private sector due to monetary contraction

According to the MPS of FY2011, credit to the private sector will be squeezed by 28.25% at the end of FY 2011. Increase in govt. expenditure, mainly financed through borrowing, by 19.6 % to BDT 1321.7 billion will also result in crowding out of private sector. Thus unavailability of credit and unfavorable investment may hamper the growth generated by the private sector, thereby impacting on the overall GDP growth. As Bangladesh economy is in need of higher investment, the average increase in the interest rate from the existing rate may not only increase the capital inflow but also dampen the business confidence of the investors as they would face credit squeeze due to the MPS’s instruments.

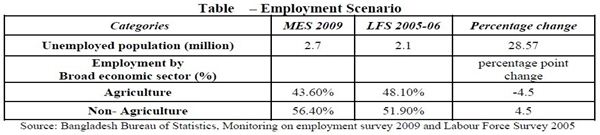

Impact on the Employment Generation

In recent year, the unemployed population in Bangladesh has increased by 28.57% and the shifting of employed population from agriculture to non-agriculture has also increased by 4.50%. Poverty reduction is not possible without employment generation. If the service and industry sector cannot increase labor absorption capacity, the monetary policy may fail to fulfill one of its dual objectives.

Impact on Agriculture

The credit disbursement rate of agriculture for the recently completed FY 2009-10 is 97% of the target which is satisfactory in terms of disbursed amount. The disbursement record shows mismatch in disbursement time which in turn force the agricultural growth to shrink, with lower contribution to GDP.

Impact on Industry

The contribution of the industrial sector in GDP was 29.95% in FY2009-10. The aim is to raise this contribution in GDP to 40% by 2021. In order to keep the RMG sector alive, availability of credit must be ensured. As this sector holds a huge number of labors, the government should also pay attention about the employment condition of the labor forces.

The availability of loan must be strictly ensured for the proper growth of SME sector by the local private and state-owned banks. NBFIs must also be encouraged for more contribution.

Impact on Power Sector

Bangladesh is facing severe power crisis in recent times. The per capita energy consumption is one of the lowest (165.32 kWh) in the world. Only 47% of the total population has access to electricity. Due to rental power plants with high per unit cost, the government has to bear huge cost per year for buying electricity from the private operators. The amount is almost BDT 5,000 crore per year.

The government may avoid huge subsidy by increasing the power tariff for the consumers. If the government provides the entire amount of extra payment, this might be resulted as higher budget deficit with higher borrowing for the government. On the other hand if the government decides to make higher the tariff level for avoiding higher subsidy, this might result with an inflationary pressure.

Conclusion:

As the ultimate goal of the macro-economic policy is to achieve optimal social welfare, instrument independence can ensure the requisite transparency, accountability and long term benefit in controlling inflation. An explicit declaration of inflation target can be instrumental.

In a fiscal dominant country Bangladesh, where the fiscal authority sets its budget independently of public sector liabilities fiscal policy can affect monetary policy in different ways: Firstly through the impact of government inter-temporal budget constraint on monetary policy, secondly through the effect of fiscal policy on a number of monetary variables, such as interest rates, interest spreads and exchange rates.

In the backdrop of easing inflationary pressure, the famous trade-off between growth and inflation may have taken a back seat for the moment. However, as global economic development continues to show signs of recovery, BB needs to be vigilant to maintain macroeconomic stability. The effectiveness of this monetary policy statement will largely depend on the capacity of BB to carry out its stated objectives and the effectiveness of related policy implementation. A pragmatic mix between fiscal and monetary policy can help us achieve that goal.