The report deals with the mobile money services and that widens the financial and the ecosystem in terms of theoretical and financial point of view and the practical use. The study allows learning about the importance of modern techniques and models used to make it more efficient. The study will help to learn the practical procedures followed by the leading organizations. Moreover the study will help to know that the daily work has become easier through technology and it also helps the ecosystem to grow.

Objective of the study:

Broad objective:

To know over all about the Company of Robi Axiata Limited and also the Mobile Money services that it provides which widens the financial and its ecosystem.

Specific objectives:

a. To focus on the Mobile Money services both globally and in Bangladesh

b. To focus the financial involvement on Mobile money services in Robi Axiata Limited

c. To focus on the development of ecosystem by Mobile Money services.

Methodology:

Source of Information:

a. Primary: The primary information is collected through face to face interview, observation, and by doing daily works during the Internship period.

b. Secondary: The secondary information collected from website, office magazine, Journals, books and some other relevant sources. Both primary and secondary data sources were used to generate this report. Primary data sources are informal discussion with employees who were directly involved in such activities and observation while working in different desks. The secondary data sources are different published reports, manuals, price updates and different publications of “Robi”.I searched for options and found out alternate materials that provided me with information, such as the portals, websites special edition magazines online or journals. I have practical experience of the flow of mobile money system and a somewhat idea about how the financial transactions are done.

Background of the Company:

The history of telecommunication in business is one of the great stories of technological progress ever accomplished. It is now possible for an average person in a proper way with another in any part of the world. Telecommunication play an increasingly important role in the world economy and the worldwide telecommunication industry’s revenue was estimated to be $3.85 Trillian in 2008. The service revenue of the global telecommunications industry was estimated to be $1.7 Trillian in 2008.

Mobile phone has become an indispensable part of people’s everyday life. The telecom revolution and its relentless evolution together have made it possible in developing countries like Bangladesh. Very much like the nurture of the technology, the telecom industry in our country is also changing very rapidly. This is how at its saturation and thus, the subscribers base is increasing at a decreasing rate.

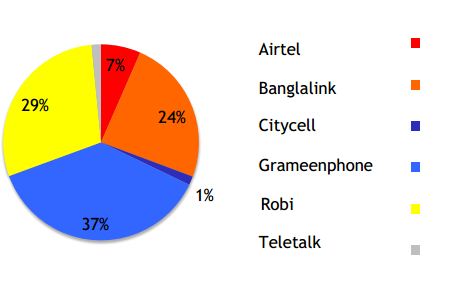

Through the first telecom company in Bangladesh, Citycell, was introduced in the 1990s, the device did not become so pervasive until 1997, the year when the largest telecom of the country, GrameenPhone (GP) hit the market with its GSM technology. Since then the industry grew at such an incredible rate in just a decade that anyone can hardly imagine. Now there are a number of players battling so hard for their respective market share and the consumers as well as the economy are benefitted tremendously from this fierce competition. The mobile phone operators serving the Bangladeshi population includes:

- Robi (Axiata Group Berhad and NTT DoCoMo INC)

- GrameenPhone (Telenor & Grameen Telecom Corporation)

- Banglalink (Orascom Telecom Holding S.A.E)

- Airtel (Bharti Airtel & Warid Telecom International)

- Teletalk (BTCL)

- Citycell ( Singtel, Pacific Group and Far East Telecom)

Review of Robi Axiata Limited

In order to get on with the rhyme of the modern world, infra-structural development of the telecommunication sector should get the priority. As a consequence, ROBI Axiata LTD one of the pioneers not only in the telecommunications private sector of Bangladesh, but also a dynamic and leading countrywide GSM communication solution provider. It is a joint venture company between Axiata Group Berhad, Malaysia and NTT DOCOMO INC, Japan. With a mission to meet the communication needs of the people of Bangladesh, Robi Axiata Ltd. formerly known as Telecom Malaysia International (Bangladesh), commenced its operation in 997 under the brand name Aktel. Later, on 28th March, 2010 the company started its new journey under the new brand name “ROBI”.

By serving the urban dwellers and rural people simultaneously, ROBI is going to fulfill the country’s vision to make communication a basic necessity and with the reach at all levels of the society. Sharing ROBI’s experience and expertise with the people of Bangladesh will not only assist in the development of the telecom infrastructure in the country but most importantly the people will remain connected and closer with each other.

Robi is truly a people oriented brand of Bangladesh. Robi believes to be ahead with innovation and creativity. The company is providing the telecommunication services to support national telecommunication policy for a higher rate of telecommunications ration and coverage in Bangladesh. Robi is committed to provide warm, friendly approachable service to its valued customers as well as mass society. Robi services its subscribers with the philosophy of the excellence with the limited interconnection.

Introduction

Mobile Financial Services (MFS) is an approach to offering financial services that combines banking with mobile wireless networks which enables users to execute banking transactions, mostly by means of a mobile device. This means the ability to make deposits, withdraw, and to send or receive funds from a mobile account. Often these services are enabled by the use of Bank appointed agents that allow mobile account holders to transact at independent agent locations or bank branches. MFS is still new in Bangladesh (the industry just turned three) and this report aims to capture its early development of the ecosystem.

Access to formal financial services can help households to better plan and manage their lives. MFS offers the opportunity to build another channel beyond the bank branch and ATM network to enable millions to have easier access to the formal banking system. Bangladesh Bank aims to build a commercially viable, competitive and safe MFS market.

Bangladesh’s financial architecture started developing within public sector institutions established at the time of Bangladesh’s independence. Over the last thirty years several new generations of private banks have entered and today make up about one –half of banking assets. Bangladesh has been a global leader in financial inclusion, building some of the original and still largest microfinance institutions (MFIs). In addition to 4 state owned commercial banks and 610 licensed MFIs, Bangladesh’s financial sector consists of 30 domestic commercial banks, 9 foreign banks, 4 government owned specialized (developed) banks, and 30 non-bank finance institutions.

Following several years of deliberations and ad hoc permissions on MFS, the Department of currency Management and Payment systems of Bangladesh Bank issued “guidelines on Mobile Financial Services (MFS) for the Banks on September 2011.

Market Development of MFS in Bangladesh

The second half of 2011 marked an important turning point in MFS for Bangladesh. Earlier ad hoc permissions from Bangladesh Bank were replaced with a set of guidelines providing the regulatory certainty critical to promote market development. Providers have responded positively several banks establishing active deployments. The three largest of these were launched in 2011 and early 2012. By the end of the next two years the early expansion came from BRAC Bank/bKash and DBBL that have the largest numbers of registered customers and agents. These two players have

signed several MNO partners respectively.

The deployment that focuses on establishing mobile accounts and basic P2P services have grown the fastest so far. Earlier licenses offered to banks and their MNO partners solely for inward foreign remittance shave not grown much- a pattern consistent with international experiences.

The MFS market in Bangladesh is now at a moderate stage of development as the MFS providers are seeking to stabilize their technology, build out agent networks and acquire new customers. This involves a complex, sequenced set of activities that includes: (1) finding and training agents, (2) marketing to bring attention to the service, (3) acquiring customers using know your customer (KYC) forms and account opening processes while at the same time helping new customers to begin to transact. The deployments that are most active today are seeking to expand their customer bases as well as offering products different from the basic ones. The mobile money industry is led by bKAsh and the industry has seen a threefold growth in number of registered subscribers in the last one year. It is hoped that other providers entering the market might also grow and provide more alternatives and competition. It is still early and much more will be learned about MFS in Bangladesh over the coming year.

Finding on the MFS Market Structure

The MFS guidelines and the honest broker role taken on by Bangladesh Bank have been instrumental in the recent growth of this sector. After several years of uncertainty, the firm move by Bangladesh Bank to establish MFS guidelines provided a positive signal that is enabling market growth. Bangladesh Bank has also been proactive in bridging differences between commercials banks and MNOs, and this honest broker role has been instrumental to the recent rapid growth of BRAC Bank and Dutch-Bangla Bank in this sector.

Bank and MNOs share the view that the potential for MFS lies initially with P2P, small merchant payments and mobile top ups. Interviews and surveys with banks and MNOs presents a consistent picture that the expectations are for small payments to be the early drivers of MFS. At the same time it’s also seen the benefits of safekeeping of funds. Importantly, banks and MNOs don’t expect large volumes of inward foreign remittances to be received over MFS.

They recognize that mobile accounts will need to have more usability before clients will want to receive inward foreign remittances into a mobile account. Deployments focusing on establishing mobile accounts and

driving small domestic payments are the priority. BRAC Bank/bKash and Dutch Bangla Bank are early leaders in the market. Both DBBL and BRAC Bank/bKash launched in 2011 and have moved to activate agent networks in nearly all districts. Both have opened millions of mobile accounts and their transaction volumes since launch

are higher than others so far. Both DBBL and BRAC Bank/bKash rely primarily on making contacts with MNOs for the use of USSD channels.

The more recent launch of Bank Asia’s program is notable. Bank Asia is a more recent entrant and has a different approach. It offers an MNO independent technology, but is limited to those with Smartphones which have higher computing capability and can use existing data services provided by MNOs with no need for a special contract with any MNO.

Mobile Money Services widen Financial Inclusion:

The mobile banking system has given the industry a scope to widen its financial enclosure. The MMU 2013 Mobile Financial Services State of the Industry Report has highlighted that an increasing number of providers are overcoming operational challenges to create solid distribution networks and a large base of active customers. Today, 13 services each have more than 1 million active mobile money accounts and those services that have created solid foundations are moving forward with new products such as bulk payments and merchant payments. The augmented

number of mobile money users and access points demonstrates the important role of mobile financial services in driving financial inclusion in developing countries.

Ecosystem Development:

As mobile money becomes a conventional product for a growing number of operators, competition is also increasing. At the end of 2013, 52 markets had two or more mobile money services compared to 40 in 2012. In June 2013, transactions involving external companies using mobile money as a platform to receive and make payments drove the growth in mobile money globally, representing 29 per cent of the total value of transactions. These transactions are also growing much faster than airtime top-ups and on-net transfers. In June 2013, 53,000 dealers were accepting

payments via mobile money and 16,000 organizations use mobile money as a payment platform for accepting bill payments or making salary payments.

The State of Mobile Money Access

Using a mobile phone makes it more convenient to conduct payments and make transfers, mobile money users still need to be able to easily cash-in and cash-out from their mobile wallet, and these cash-in and cash-out (CICO) activities have to be supported by a physical network of distribution points.

How far are mobile money agents reaching?

To facilitate deposits and withdrawals from accounts, the mobile money industry has been relying on large networks of agents. First, let’s consider the reach of these agents. In comparison between 2013 and 2014, the number of mobile money agent outlets grew quickly at an annualized growth rate of 23.35%, reaching 257561 in June 2014 January. However, there are certain proportion of agents who are inactive and the telecommunication company and the banks are working very hard pushing the agents to be active by providing striking incentives and location of the dealings.

What are the trends in mobile money distribution?

As the industry matures, new distribution trends are emerging which contribute to improving accessibility of mobile money services. One of these trends is agent sharing. Traditionally, every mobile money provider builds and manages its own network of mobile money agents, although in some cases agents can service multiple deployments in one market. In 2013, we began to see agentsharing models becoming formalized, with service providers recruiting and managing agents that other companies use to deliver their own mobile money services. Examples of this model already exist in Nepal, Nigeria, and Zambia. This emerging trend highlights an interesting alternative for operators seeking to manage their cost structure.

The State of Mobile Money Revenues – is there really any money in mobile money?

Initially, mobile network operators (MNOs) introduced mobile money initiatives to reduce the costs of distributing airtime and customer churn, though recently it has started to see an increase in MNOs revenues from mobile money transactions. Potential growth of mobile money deployments is widely accepted, but there has been a lot of debate surrounding profitability. Whilst mobile money deployments have made significant inroads in developing countries only a few MNOs have reported double digit contributions to their overall revenue.

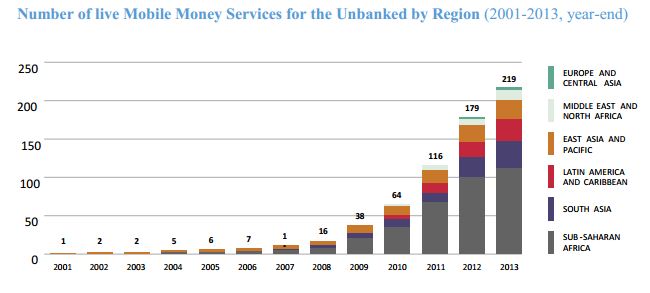

Number of mobile money services:

The mobile industry reached a milestone at the end of quarter 3, surpassing 200 mobile money deployments at the end of 2013, there were 219 services live in 84 countries, compared to 179 services in 75 countries at the end of 2012 (see figure 1). The deployment tracker has also identified 113 mobile money services that are planning to launch.

In 2013, mobile money was rolled out in nine new markets: Bolivia, Brazil, Egypt, Ethiopia, Guyana, Jamaica, Tajikistan, Togo, and Vietnam, regulatory reforms that are enabling mobile money services are contributing to the growth of the industry in terms of number of deployments. With a year-on-year increase (YOY) of just 22%, the growth of mobile money services is now slowing down. This deceleration in the number of new launches between 2012 and 2013 is true across all regions although there are significant variations.

Mobile Money for the Unbanked:

Mobile money represents a tremendous opportunity for social impact through enabling customers to access services which can help them to manage their daily lives and improve their livelihoods. It also represents an important commercial opportunity, and as such many of our members have built mobile money into their core strategy for achieving future revenue growth.

Growing & Expanding Services

With 219 services in 84 countries at the end of 2013, mobile money is now available in most developing and emerging markets. The industry continues to grow and expand outside of SubSaharan Africa, with 19 service launches planned in Latin America for 2014.The number of active mobile money accounts is growing fast, in June 2013 there were over 60 million compared to just 37 million in June 2012. A total of 13 mobile money services have now reached scale, with over 1 million active users.

Financial Inclusion:

With an increasing number of services reaching scale, the mobile money industry is extending access to financial services beyond the reach of traditional financial institutions in many developing countries. At the end of 2013, nine markets had more mobile money accounts than bank accounts, compared to just four in 2012.

The development of other mobile financial services including mobile insurance, credit and savings services will enable a deepening of financial inclusion by offering services beyond money transfer and payment. In 2013 there were a total of 123 mobile insurance, credit and savings services, 27 of which were launched this year.

Ecosystem development & interoperability:

An increasing number of mobile money providers are recognizing ecosystem development opportunities as competition within the mobile money industry grows. As mobile money becomes an increasingly mature and mainstream service, with 52 markets now having 2 or more services, opportunities to foster interoperability are highlighted.

Mobile money services have been used successfully in a number of markets to address the issue of payment and billing scale. In June 2013, there were 53 thousand merchants accepting payments via mobile money, and 16 thousand organizations using mobile money as a payment platform for accepting bill payment or making bulk payments such as salary payments. Given these developments in the mobile money ecosystem it is not surprising that transactions involving external companies have driven growth in the sector, representing 29 per cent of the total value transacted in June 2013.

MFS in Perspective of Bangladesh:

In Bangladesh 22% of adults use mobile money and less than 10% of the population (165mn) so far have encountered any formal banking facility. Nearly 48% of MFS users live in urban areas while 32 per cent reside in rural areas and 20 per cent in semi-urban neighborhoods, according to a study. Less than 20 per cent of the users are women, according, titled ‘Mobile Financial Services Consumer Insights’.85% of mobile money users transact through OTC instead of using their own wallets. However, this shows that most of the mobile banking base are yet to understand the proper use of their mobile wallets.

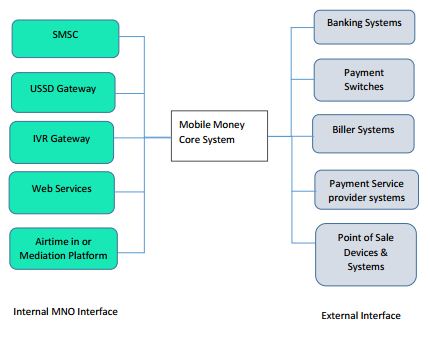

The Mobile Money Interface:

There are basically two interfaces in the mobile money core system. It is important to know how it works and the divisions of MFS in active mode. Below is a chart of the system works.

The Functional layer:

The transactional Functionality of mobile money systems must support three types of activities:

1. Customer Activities: these may be performed by a customer or a business, but they have an impact on the customer’s mobile money account.

2. Agent activities: agent perform two distinct functions, serving customers and administering their business.

3. Operator activities: performed by the MNO offering the service

Mature services and vendors agree that it is preferable to launch a new mobile money service with a limited suit of functionality. This makes it easier for both customers and agent assistants to understand the service, why it’s needed, and especially how to use it. Additionally functionality can then be rolled out in a structured fashion over time depending on how the service evolves.

MNO Activities:

Operators administering the service at the MNO have a range of tasks to perform. A key financial transaction is converting cash into e-money (and vice versa) as cash is deposited into (or withdraw from) an underlying bank account. This is called “bank reconciliation”. Other examples include transferring funds between mobile money accounts, making agent commission payments, and allocating funds to an agent account. All financial transactions, including bank reconciliation should be performed using a “maker/checker” procedure (common in conventional banking systems) in which one person creates the transaction and another approves it. Mobile money services generally requires this, so vendors need to support this feature.

Fraud and Risks:

The growing popularity of Mobile Financial Services has created different challenges but exciting opportunities. One of the key challenges in MFS is how to manage the inherent risks particularly, the risk of fraud. Mobile Financial Services face similar risks to those seen in the payments and other financial services sectors. The risks become more complex because, mobile financial services target the retail market. With millions of users accessing services, it is important for stakeholders to understand the risks that they face and therefore to better prepare for such risks.

After all, the risks and fraud result in the loss of money to someone.It is important for an organization to have a clear understanding of risks and fraud in order to establish measures that mitigate against the risks otherwise the credibility of services will be affected. It is evident that mobile money-related fraud is increasingly becoming important. Over the past few years, several serious cases of fraud have been reported that have raised concerns within the industry. As mobile payments begin to scale in many markets and new products are introduced, there is growing need to address fraud conclusively. There can be five core types of fraud, they are:

1. Customer driven fraud

2. Agent driven fraud

3. Business partner driven fraud

4. System administration fraud

5. Mobile financial service provider fraud

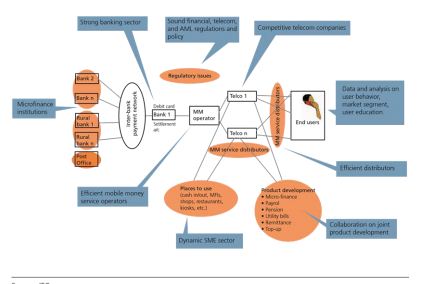

The Development of Ecosystem:

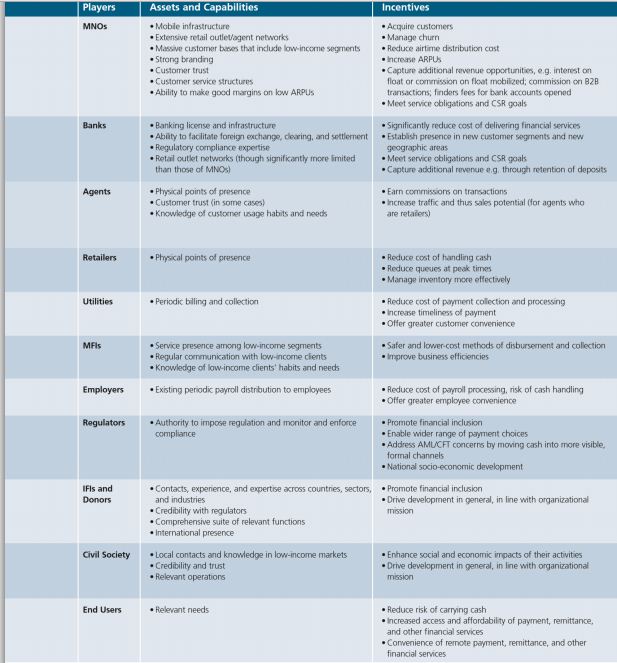

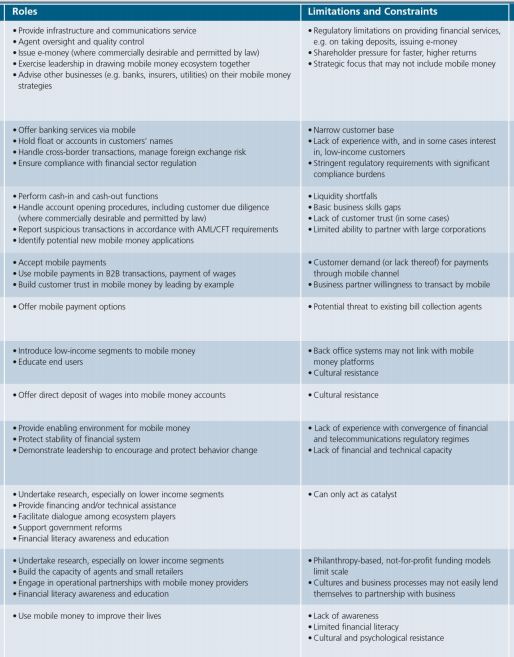

The mobile money has vastly supported the economic community producing goods and services for the customers that adds value to the ecosystem. Mobile money ecosystems span a wide range of different players, including mobile network operators, banks, airtime sales agents, retailers, utility companies, employers, regulators, international financial institutions and donors, and even civil society organizations.

Mobile money has significant implications for economic activity across the board. First, it reduces the cost and risk inherent in dealing with cash. Second, and perhaps more significantly, it facilitates the flow of money from one party to another using a communications infrastructure that already connects billions of customers around the world. The need and opportunity for mobile money are shared by businesses and their customers. In particular industries, such as telecommunications, software, and even retail, it offers the chance to develop whole new business lines. For customers, the advantages of mobile money include affordability, security, and convenience. The mobile channel may open access to financial services and other markets to many, mostly low-income, customers who are currently excluded altogether.

It is mobile money’s ability to facilitate financial sector inclusion that gives it its enormous potential for development impact. Given access, financial services can help poor people forge their own paths out of poverty in two primary ways. First, they enable one to obtain through savings or credit sums of money large enough to invest in income generation and asset creation (for example, through enterprise, housing, education etc. Second, they help reduce vulnerability to unexpected events such as accident, illness, theft, or drought.

Many mobile network operators (MNOs) are playing leadership roles within their mobile money ecosystems. What gives MNOs the impetus and ability for leadership in developing mobile money ecosystems is their reach across customers in all income segments. In Bangladesh, about one tenth of the population has bank accounts while more than one third has mobile phones. As a result, MNOs are able to provide not only the infrastructure and a large pool of potential users for mobile money. Their advice is especially critical for companies seeking to use the mobile channel to reach out to new customers beyond their traditional markets.MNOs’ networks of sales agents and retail

outlets, where customers can sign up for service, purchase phones and accessories, and top-up their pre-paid airtime accounts, give them their reach geographically and across income segments.

These agents and retail outlets form the backbone of any mobile money ecosystem.In theory, the mobile money argument is strong for banks as well as MNOs. Mobile banking is up to 50% cheaper than offering financial services through traditional channels, and the unmet need is enormous.

Advantages and Disadvantages of Mobile Banking

Advantages:

- It utilizes the mobile connectivity of telecom operators and therefore does not require an internet connection.

- With mobile banking, users of mobile phones can perform several financial functions conveniently and securely from their mobile.

- You can check your account balance, review recent transaction, transfer funds, pay bills, locate ATMs, deposit cheques, manage investments, etc.

- Mobile banking is available round the clock 24/7/365, it is easy and convenient and an ideal choice for accessing financial services for most mobile phone owners in the rural areas.

- Mobile banking is said to be even more secure than online/internet banking.

Disadvantages:

• Mobile banking users are at risk of receiving fake SMS messages and scams.

• The loss of a person’s mobile device often means that criminals can gain access to your mobile banking PIN and other sensitive information.

• Modern mobile devices like Smartphone and tablets are better suited for mobile banking than old models of mobile phones and devices.

• Regular users of mobile banking over time can accumulate significant charges from their banks.

Mobile Financial Services in the Context of Robi Axiata Limited, Bangladesh:

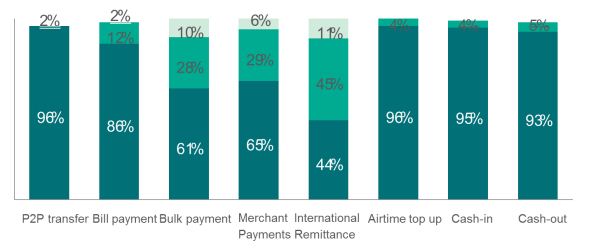

Robi is the Bangladesh brand for the Axiata group out of Malaysia. Robi is the third largest provider with 20% market share. Robi started its mobile money services 1st with Dutch Bangla Bank (DBBL) in 2011 and later with many existing Banks especially BRAC Bank/bKash is its highest players. Digital transactions include the aggregate of P2P transfers, bill payments, merchant payments, and other digital transactions the platform enables. Cash-based transactions are the average of total cash-in and cash-out transactions. For example, a round-trip P2P transaction which requires cash-in and cash-out from agents. The product offerings of Robi Digital Services are, P2P transfer, Bill Payments, Bulk Payments, Merchant payments, International Remittance, Airtime top up, Cash in and Cash out

- Do not offer the product in June 2013 and are not planning to launch it within the next 12 months (top in chart)

- Do not offer the product in June 2013 but are planning to launch it within the next 12 months (middle portion)

- Offer the product in June 2013(the last part)

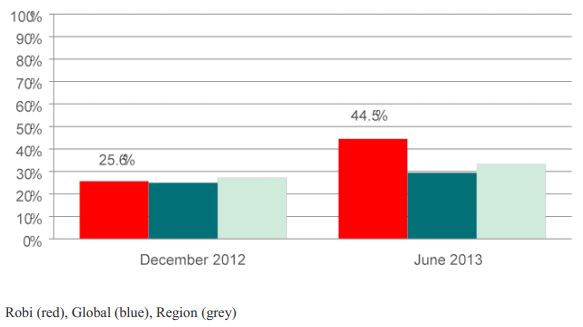

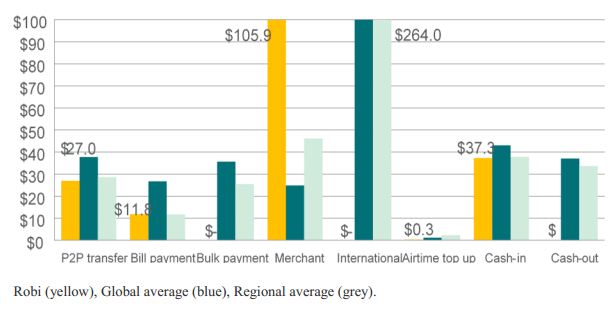

The challenge of Robi is to keep a track on the active registered accounts. This is because a thousands of accounts are opened per day and the agents miss out registering those accounts and the customers most of the time skip fulfilling the legal formalities what so ever. The below chart shows the active registered accounts compared to the global and the Bangladesh region

The progress was only possible because Robi hires qualified agents interviewing the applicants. The agents are given trainings and knowledge about the products and the feature of it, so that they can satisfy the customers and fulfill all the formalities that are necessary to open an account and make transactions. Robi Digital Services team track the progress report and brings out the solution if the agents face any problems from the customer end. The Digital Services team go for a monthly visit into different cities for upgrading the day to day transaction system. The KYC center provides them all the requirements of the customers and the team upgrades themselves according to the customers need.

This chart shows the average number of transactions per active customer (using 30 days customer accounts for wallet-based services and the number of unregistered users who have transacted during the month for OTC services) per month by product in June 2013.

It shows that the Merchants payments, Cash-in, and the P2P transaction are domination the product offerings in Robi Axiata Limited. Maintaining with the global standards, Robi is competing in a tremendous manner. However, the P2P transfer and the Airtime top up is dominating the worldwide market of Mobile Banking. A chart is shown below in respect of value (right) and volume (left) of the product offerings worldwide.

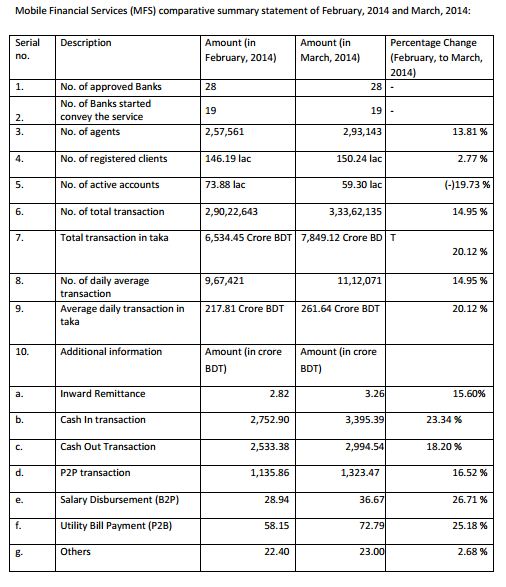

Payment Systems Department

The chart shows the changes/ increase in the Mobile Financial Services for a very short time. This indicates the Mobile Money culture is habituated to this region and the booming industry is showing a positive indications in the financial sector as well as the development of the ecosystem. The purpose of showing the changes for a short period is that the increase in different sector is identified. The sectors which needs to improve can also be identified and can take corrective actions without spending a lot of time as the result is reviewed in a short time.

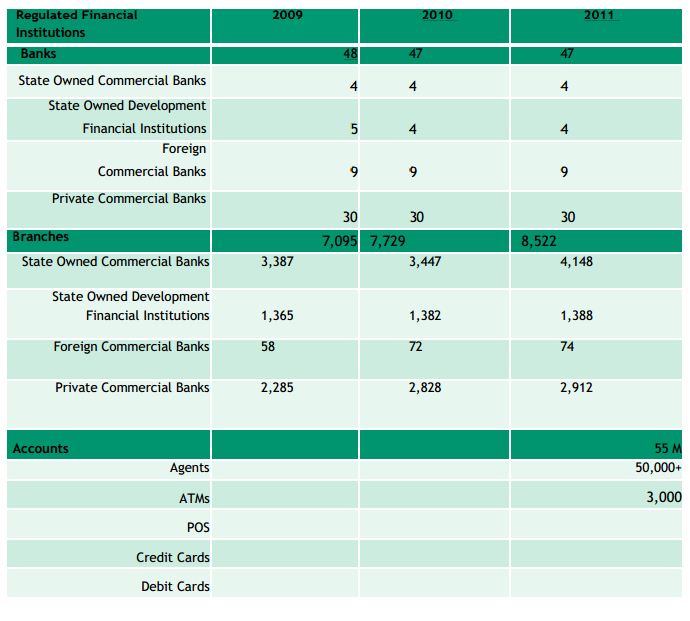

The Financial Sector Snapshot:

As the table shows that Bangladesh has widen its financial sectors with every sector possible. The branches of the Banks and the number of agents and ATM’s increases widely from year to year. The comparison of the private, commercial and the foreign owned banks statements are shown in the table to get a clear view of how each banks are progressing. The number of ATMs are shown to get a view that the increasing amount of transactions are the result of available greater amount of ATMs. Thus the economic condition of the country is booming and the customers are habituated and feel free to use Mobile Financial Services for instant and safe money. The increasing amount of branches, ATMs, and the Banks shows that the future of the Mobile Financial Services to the leading business as it provides a time consuming transactions and easy cash dealings for the customers. Thus Mobile financial Services will be the largest “Services Oriented” products that will serve the large amount of customers.

The Financial Snapshot:

The chart shows that Robi Axiata Limited has secured its position in the second after Grameen Phone and Banglalink is on a close competition with Robi Axiata Limited. In recent days all the existing telecommunication company is focusing on providing their customers with instant mobile money services. The banking sectors are also in collaboration and coming up with new offers and terms providing the customers easy and secured mobile financial services.

However, there is always a risk of theft and challenge to secure the data information of the customers. The banks and the telecommunication companies now a days are very strict about collecting information of the customers. The national IDs, birth certificate and the business trade license cards etc. are important to submit to the banks and the telecommunication company to secure the customers money and to avoid theft. The KYC (Know your customer) center helps the customers to get their own password and pin for each transaction they make. The Telco’s are

putting much effort to secure and encourage people to use mobile banking as they provide sufficient and easy way to reach money to the customers.

Conclusion:

Bangladesh began its Mobile Financial Services (MFS) journey in 2011. The primary goal of MFS is financial inclusion- reaching the unbanked population with appropriate financial services. At the broadest level, MFS constitutes offering financial services that include, but not limited to, funds transfer, saving products, insurance products, paying fees of various forms (utility, education etc.).

However, in the initial stages of the market development, funds transfer services have been the most common form of MFS in Bangladesh.

The report includes the several forms of MFS and how the Banks and the telecommunication companies are coming up with more attractive and easy ways to serve their customers. It also shows who are the customers, what type of transactions do they conduct and in what amount, what factors influence their choice and how they view MFS. The main context of this report is on Robi compared it to other Telco’s. The Banks play a big role in proving the MFS to the customers.

Mobile Financial Services (MFS) is a rapidly growing market segment in Bangladesh. New regulatory guidelines, strategy shifts among the key MFS providers, increased awareness among the public, have all contributed to significant growth of the market. For example, Bangladesh reached 10 million registered customers mark in the early November 2013, and by the end of December, the number has experienced a 30% growth. The rapidly increasing of the MFS has created a mass attention in the market and the companies are coming up with new strategies, scopes

to work and serve customers with MFS.

While preparing this report it has been experienced that the mobile money services are quite popular among the low income people compared to the high earners. As a result the rural and urban areas are also covered experiencing the MFS. Hence the economy shows a positive indicator and that the Mobile Financial services will bring a great opportunity in the economy and its customers.