The purpose of this report is the fulfillment of Bachelor of Business Administration program’s requirement that involves three months internship program followed by preparation of this report. The topic of this report is “Market Segmentation: A Case study of Prime Bank Ltd.” With a view to establishing various aspects of this topic, the report has been divided into some chapters.The Introductory part starts with shedding some light on the organization’s background and business activities; it encompasses PBL’s activities in the country.The second part focuses the banking sectors of Bangladesh, which includes all some other banks and the activities of others bank.

The chapter 3 of this report is about the company profile of Prime Bank Ltd. The kind of banking it’s dealing, profit and loss of the bank and so on. Everything is included in this topic.The forth chapter of this report is dealing with the market segmentation of Prime Bank Ltd. Prime Bank has a huge variety of market segmentation with various products. I have tried to describe this segmentation in my report as I am a student of marketing. I mentioned different products of PBL which is offered to the different customers.And it is also dealing the most important topic for any organization, that is SWOT analysis. And the ending part of this report includes some strength and weakness of Prime Bank Ltd. and some recommendations based on the study and the sources of data I have collected.

Introduction:

Background of the report:

As a student of Bachelor of Business Administration (BBA) in Banking every student has to conduct a practical orientation in any organization for fulfilling the requirements of the 12 weeks Internship Program. The main purpose of the program is to expose the students to the real world situation. This report is done as a partial requirement of the internship program for the BBA students. This report is prepared for the internship program consisting of a major in depth study of the market segmentation: A Case Study of Prime Bank Limited.

Practical knowledge is fundamental for the application of theoretical intelligence. Bearing this in mind and internship program was being included in the BBA curriculum. The goal of this analysis is to expose the student in the organizational work situation and also to provide an opportunity for applying classroom learning in practice. There are some difference between theories and practice

Rationale of the study:

In order to fulfill the requirement of the Internship I have selected Prime Bank Limited. The Human Resource Division (HRD) of Prime Bank Limited placed me to its Banshee Branch. The overall topic of the report has been chosen by me .The topic of my report is “Market segmentation: A case study of Prime bank Ltd.”. I have done my internship in Prime Bank Limited, Banasree Branch. During this period I tried to get familiarize myself with the theoretical concept and practical process of customer service in Prime Bank Limited.

Objective of the Study:

General Objective: The general objective of this study is to evaluate the segment of Prime Bank Limited.

Specific Objectives: The specific objectives of this study are:

- To gain a brief idea about the market segmentation of Prime Bank Ltd.

- To offer standard banking services to the people.

- To know the basic facilities for particular segment.

- To improve and broaden the range of product and services.

Methodology

Sources of data:

Primary and secondary data has collected for intern report.

Primary Source:

Primary data has been collected from various clients. Even I have asked some of the employees of Prime Bank Ltd to collect the basic information about Prime Bank’s market segmentation. I have taken the help of some book also to get the brief idea about market segmentation.

Secondary sources:

Secondary data collected for research paper. It is collected secondary data for my research paper from:

- Annual reports of PBL

- Bank records/documents

- Journals of the Bank

- Different books, training papers, manuals etc. related to the topic.

- Website of the Bank

Limitations:

The one of the main limitations of the research paper was to conduct a small-scale survey.

Time period was the other limitation for collecting information, which was only three month long.

Insufficient supply of relevant books and journals.

The branch is too much busy branch as for this to operate the survey on the basis of questionnaire.

Deficiencies in data required for the study.

Field practice varies with the standard practice that also created problem.

Time provided for conducting the study is another important constraint.

The employees in Prime Bank Limited are so much busy in their responsible fields; they could hardly provide little time to discuss with them

Banking Sector in Bangladesh:

Definition of Bank:

“The bank is the life blood of modern economy”. A bank is an establishment, which trades in money, an establishment for deposit custody and issue of money and for granting loans and discounting bills and facilitating transmission of remittances from one place to another. (Imperial Dictionary)

“A commercial banker is a dealer in money in substitutes for money, such as checks or bill of exchange”. (New Encyclopedia Britannica)

“The financial institution which earn profit through acceptance of deposit extending credit, issuing notes and cheques, receiving and paying interest is called Bank”.(Notes &Notes writer)

‘Bank’ is an organization chartered by the state or federal government, principal Functions of which are:

- To receive demand deposits and pay customers cheques drawn against them.

- To receive time deposits and pay interest thereon.

- To discount notes, make loans and invest in govt. or other securities.

- To collect cheques, drafts, notes etc.

- To issue drafts and cashier’s cheques.

- To certify depositors cheques and

- When authorized by a chartering govt. it may act in a fiduciary capacity.

Definition of bank given by some authors:

- “The institution which accepts the checks of the persons from whom it collected money in current accounts is called banks”. (H. L. Hert)

- “A bank is an economic institution whose main aim is to earn profit through exchange of money and credit instrument”. (John Harry)

- “A bank is an institution the principal function of which is to collect the unutilized money of the people and to lend it to others”. (R. P. Kent)

- “Banks are the institutions whose debts are commonly accepted in settlement of the other people’s debt”. (Sayers)

- “Banks are a variety of firm for the safe keeping of money and for the granting and transfer of credit”. (Coulborn)

- “A bank may be a person or a firm or a company who deals with money like other business organization”. (Prof. T. Hardy)

- “Bank is a real financial institution which receives deposit from a group of people & lends it to other group of people”. (Bar Bari Block)

Objective of Bank:

Owners, clients and government’s point of view:

Objective of banking business- owner’s viewpoint:

- Good will: By spreading banking business.

- Raising efficiency: Efficient banking system is necessary for maximizing profit.

- Rendering services: It gives various services to public and government.

- Investment of capital: proper investment of owner’s share holder’s capital is also a major objective of a bank.

- Earning profits: It is main objective. Through transaction.

Objective of banking business- client’s point of view:

- Deposits: One of the banks main objectives is to accept its client’s deposits. To receive time deposits and pay interest thereon.

- Safety: Clients expect safety of their deposits from the bank. Providing safekeeping of its client’s monetary possessions and valuables is another one of banks essential objectives.

- Advice and consultation: Banks also give some advisory services to their clients.

- Representative and trustee: Banks also work as a Representative or as a trustee for their clients.

- Raising living standard: By providing interests against their deposits, banks help their clients to improve their living standard. Developing living status of people then consumption can be increase. In this reason industry and business can be developing.

- Economic development: It is an important objective of bank that can help

- Economic development of any country.

Objective of banking business- government’s point of view:

- Issue of notes and currencies: Bank plays the role of issuing notes, currency circulation and preservation as a medium of transaction.

- Capital formation: Banks encourage mass people to save. Small savings turns into capital. This capital is used in building industries and many development works.

- Money market control: Banks try to control money and credit market in order to bring stability in commodity price. Government tries to stabilize the money market through banks.

- Employment: As part of their primary macroeconomic objectives, they expect banks to provide employment for its people. Usually banking business requires many professionals. In this way it can reduce unemployment problem.

- Advice in financial matters: Another objective of a bank is to provide necessary data of the country and proper advice to the government. Since banks hire a lot of financial experts and advisors, it often seeks advice from banks to help them develop policies.

Historical background of the banking business in Bangladesh:

The territories which now constitute Bangladesh were integral part of Mughal Empire and thereafter British-India and then Pakistan. Hence we have the common historical background of banking and banking institutions as that of Pakistan and India. For the beginning of banking in the territory now comprised Bangladesh, we must go back to the Calcutta Agency Houses. These trading firms started their banking operations for the welfare of their constituents. The important among those Houses were Messer. Alexander &CO. Messer. Fargusson & Co. both the firms started the business of banking with other business, and both were the predecessors of the early joint stock Banks in the then India. The Bank of Hindustan was the earliest bank started under the direction of the British rule in British-India.

After the partition of British-India into Pakistan and India, the territories now form Bangladesh became integral part of Pakistan and was called East Pakistan. Immediately after partition, as aforesaid, in 1987, an Expert Committee was appointed to study the issue of banking in the then Pakistan. On the recommendation of the Expert Committee the Reserve Bank of India continued its function in Pakistan up to 30th September, 1948 and there after the State Bank of Pakistan, having been established on the 1st July, 1948 started functioning and assumed full control of banking and currency.

Beginning of Banking in Bangladesh:

After independence the Government of Peoples Republic of Bangladesh was formally to cover the charge of the administration of the territory now constitute Bangladesh. In an attempt to rehabilitate the war-devastated banking of Bangladesh, the government promulgated a law called Bangladesh Bank (temporary) order, 1971 (Acting President’s Order No.2 of 1971). By this order, the State Bank of Pakistan was declared to be deemed as offices, branches and assets of Bangladesh Bank. On that date there existed 14 scheduled banks with about 3042 branches all over the country.

On the 16th December, 1971, there existed the following 12 banks in Bangladesh, namely:-

- National Bank of Pakistan

- Bank of Bahwalpur Ltd

- Premier Bank Ltd.

- Habib Bank Ltd.

- Commerce Bank Ltd.

- United Bank Ltd.

- Union Bank Ltd.

- Muslim Commercial Bank Ltd.

- Standard Bank Ltd.

- Australasia Bank Ltd.

- Eastern Mercantile Bank Ltd.

- Eastern Banking Corporation Ltd.

Nationalization of Banks in Bangladesh:

Immediately after the Government of Bangladesh consolidated its authority, it decided to adopt socialist pattern of society as its goal. Hence in order to implement the above mentioned state policy; the Government of Bangladesh decides to nationalize all the banks of the country accordingly on the 26th March, 1972, Bangladesh Banks (Nationalization) Order, 1972(President order No. 26 of 1972) was promulgated.

The undertakings of existing banks specified in the 1st column of the table below stands transferred to and vested in, the new banks mentioned in the 2nd column of the said table:

Privatization of Banks in Bangladesh:

Until the early 1980’s the Government owned, controlled, and directed Bangladesh’s financial systems with the objective of allocating funds to priority sectors. In 1983 the

Government began to reform the financial sector interest rates on deposits were raised to provide a positive real return in deposits. Private Banks were allowed to enter, two NCBs were denationalized and another nationalized bank was converted into a limited liability company and partially privatized.

After the amendment in the nationalizing law, the Pubali Bank, the Uttara Bank and the Rupali Bank have been transferred to the private sector. These banks have now been re designated respectively as Pubali bank Ltd, Uttara Bank Ltd and the Rupali Bank Ltd. Further in order to accommodated private sector share in Bangladesh Shilpa Bank, suitable amendments have been made in the Bangladesh Shilpa Bank Order 1972 (presidents Order No. 129 of 1972). It is expected that the bank will formally get listed in the private sector in the near future.

Banking Operation in Bangladesh:

The basic operation of a bank as a financial institution is to collect deposit and give loan. Other than that, for the industrial and business as well as social and economic development bank also perform some other activities. The overall banking functions can be divided into two broad categories, such as-

–Micro operations

-Macro operations

1 Micro operations

The banking operations, which is directly related to clients.

- Receiving Deposits: Bank collects the scattered money from people and deposits those in different accounts, such as current, savings, fixed deposits account. As a result people become interested to save and bank gathers money for investment purpose.

- Paying Interest: Bank pays interest to the depositors for the deposited money.

- Extension of Credit and Receiving Interest: Bank grants short term, mid term, long term loan and collects interest from these loans.

- Creation of Credit Deposits: Before granting loan bank tells its clients to open an account (current or savings) in that particular bank and than deposits the loan amount on that account. In this way bank creates credit deposits account through credit extension.

- Creating Medium of Exchange: Bank Through checks, bill of exchange, bank drafts, pay order, creates a medium of exchange and perform the activities of financial transaction.

- Issuing Checks: Bank issue checks against current/savings accounts to facilitate payment. For example: bearer checks, cross checks, traveler checks etc.

- Formation of capital: This is an important function of banks. Banks gather the scattered deposits from the whole country and create capital for investment.

- Issuing Notes: Issuing different types of notes are one of the major functions of central bank.

- Circulation of Money: Commercial banks help in circulation of money issued by Central bank.

- Act as a Trustee: Bank often issues bank solvency certificate for its clients. Moreover it also works as a trustee for its clients.

2 Macro Operations:

The operations not limited between the clients and the bank, rather help for the overall development of country are the Macro Operation of bank:

- Investment of Capital: Bank invests the capital to different profitable industry and business in order to raise the productivity and mobility of capital.

- Role in the Economic Development: Banks invests money for the development of industry, business and trade, housing, transportation, communication.

- Transmission of Money: Banks send and receive money from one branch to another branch, even one country to another country through checks, bill of exchange, drafts etc.

- Safe custody of Money: By depositing clients money banks provide safety from theft burglary etc. By spreading the banking activities all over the country it helps to create a good and safe environment.

- Consultancy: Banks provide important and valuable advice to business organization, individuals or industry.

- Employment: Banks create employment opportunity by opening new branches all over the country.

- Controlling Money Market: The economy of the country mostly depend on the money market. Central bank with the help of the other commercial banks controls this money market.

- Credit control: Banks through loan expansion and reduction control the credit amount of the country.

- Industrial development: Industrial and commercial banks provide long term loans for the industrial development of the country.

- To set up relation: Banks try to create relationship between local and foreign business organization.

Company Profile Of Prime Bank Ltd.

Historical Background of Prime Bank Limited:

In the backdrop of economic liberalization and financial sector reforms, a group of highly successful local entrepreneurs conceived an idea of floating a commercial bank with a different outlook. For them it was competence, excellence and consistent delivery of reliable service with superior value products. Accordingly, Prime Bank Limited was created and commencement of business started on 17th April 1995.

Prime Bank Ltd. is operating as a scheduled bank under the banking license issued by Bangladesh Bank, the Central Bank of the country on April 17, 1995 through the opening of its Motijheel Branch at Adamjee Court Annex Building, Motijheel commercial area, Dhaka-1000. PBL was actually registered under the Companies Act of 1913 with its registered office at 5, Rajuk Avenue, Motijheel commercial area, Dhaka-1000 which was later shifted to Adamjee Court Annex Building, 119-120, Motijheel commercial area, Dhaka-1000.

As a fully licensed commercial bank, Prime Bank Limited has being managed by highly professional and dedicated team with long experience in banking. They constantly focus on understanding and anticipating customer needs. As the banking scenario undergoes changes so does the bank and it adjusts and repositions it self to the changed conditions.

In its 14th year of operation in 2009, Prime Bank has made substantial headway in terms of business growth, profitability and establishing its image as one of the leading private commercial banks. Its march towards reaching greater heights in operation continues with full vigor and enthusiasm.

Prime Bank has made significant progress within a very short period of its existence. The bank has been graded as a top class bank in the country through internationally accepted CAMEL Rating. The bank has already occupied an enviable position among its competitors after achieving success in all areas of business operations.

Commencement of Operation:

Prime Bank Ltd. started its operation on 17th April, 1995 with an authorized capital of Tk. 1000 million and paid up capital of Tk. 100 million by a group of highly successful entrepreneurs who are established in various fields of economic and business activities. PBL is a fully licensed scheduled commercial bank set up in private sector in pursuance of the Government of Bangladesh to liberalize banking and financial services.

Till now, the branch network of Prime Bank Ltd. increased to 84 branches in the last of the year 2010. Currently, there is no proposed branch. The commercial and investment services of PBL range from small enterprises to big business loans to all type of customers. Besides this, the bank actively participates in socio-economic development of priority sectors like agriculture, industry, housing, self-employment, etc. PBL is also a pioneer in providing consumer loans as well as financing the industries and transport sector through attractive leasing and higher purchase scheme.

Vision: Prime Bank Ltd.

To be the best Private Commercial Bank in Bangladesh in terms of efficiency, capital adequacy, asset quality, sound management, and profitability having strong liquidity.

Mission: Prime Bank Ltd.

To build Prime Bank limited into an efficient. Market driven, customer-focused institution with good corporate governance structure. Continuous improvement in Bank’s business policies, procedures and through integration of technology at all levels.

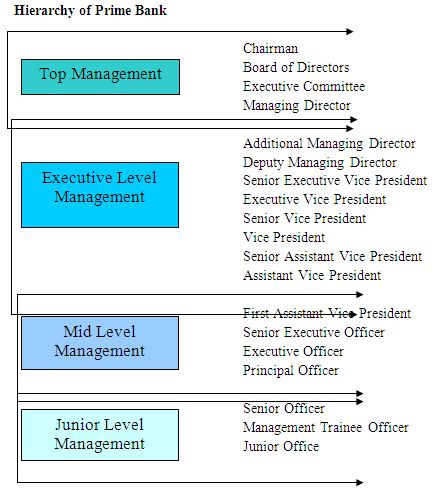

Prime Bank’s Organizational Structure

Prime Bank is listed with promoter shareholders’ collectively holding a 46% stake in the bank. One of the main reasons for the bank’s good financial condition is that the bank’s promoters, who have other business interests as well, have refrained from using the bank for insider lending. This is a huge issue for Bangladeshi private banks and together with somewhat lax supervision, is the single biggest factor for the poor financial condition of most private banks.

The bank had a rather large board (20 members in all) with representatives from all the major shareholders. Previously central bank norms prevented any one shareholder individually holding an equity stake of greater than 5% in the bank; this was the reason for the 20 directors sitting in the board. The central bank rules in this regard have undergone a slight change. Now the rules are that the individual holding has been enhanced to 10% and the size of the Board will now be restricted to 13 members, which should include at least two independent directors.

The bank’s board has a policy of rotating the Chairman’s position amongst various members; consequently the bank has a new Chairman every year. The executive management also appears a bit top-heavy (relative to the size of the bank) with one additional managing director besides the managing director, a Senior Executive Vice President, four Executive Vice Presidents and many Senior Vice Presidents. Prima-facie the rotating Chairman and the presence of effectively two managing directors may lead to some overlapping responsibilities and possible conflict; however this does not seem to have happened so far in the bank’s history and the bank continues to perform satisfactorily.

Market Segmentation

The division of a market into different homogeneous groups of consumers is known as market segmentation.

Rather than offer the same marketing mix to vastly different customers, market segmentation makes it possible for firms to tailor the marketing mix for specific target markets, thus better satisfying customer needs. Not all elements of the marketing mix are necessarily changed from one segment to the next.

For example, in some cases only the promotional campaigns would differ.

A market segment should be:

- Measurable

- Accessible by communication and distribution channels

- Different in its response to a marketing mix

- Durable (not changing too quickly)

- Substantial enough to be profitable

Various bases can segment a market, and industrial markets are segmented somewhat differently from consumer markets, as described below.

Consumer Market Segmentation

A basis for segmentation is a factor that varies among groups within a market, but that is

sought. consistent within groups. One can identify four primary bases on which to segment a consumer market:

1.Geographic segmentation

Geographic segmentation is based on regional variables such as region, climate, population density, and population growth rate.

2.Demographic segmentation:

Demographic segmentation is based on variables such as age, gender, ethnicity, education, occupation, income, and family status.

3.Psychographic segmentation:

Psychographic segmentation is based on variables such as values, attitudes, and lifestyle.

4.Behavirol segmentayion:

Behavirol segmentation is based on variables such as usage rate and patterns, price sensitivity, brand loyalty, and benefits

The optimal bases on which to segment the market depend on the particular situation and are determined by marketing research, market trends, and managerial judgment.

Business Market Segmentation

While many of the consumer market segmentation bases can be applied to businesses and organizations, the different nature of business markets often leads to segmentation on the following bases:

- Geographic segmentation – based on regional variables such as customer concentration, regional industrial growth rate, and international macroeconomic factors.

- Customer type – based on factors such as the size of the organization, its industry, position in the value chain, etc.

- Buyer behavior – based on factors such as loyalty to suppliers, usage patterns, and order size.

Profiling the Segments:

The identified market segments are summarized by profiles, often given a descriptive name. From these profiles, the attractiveness of each segment can be evaluated and a target market segment selected.

The Marketing Mix

(The 4 P’s of Marketing)

The major marketing management decisions can be classified in one of the following four categories:

Product

Price

Place (distribution)

Promotion

Product

The product is the physical product or service offered to the consumer. In the case of physical products, it also refers to any services or conveniences that are part of the offering.

Product decisions include aspects such as function, appearance, packaging, service, warranty, etc.

Price

Pricing decisions should take into account profit margins and the probable pricing response of competitors. Pricing includes the list price, but also discounts, financing, and other options such as leasing.

Place

Place (or placement) decisions are those associated with channels of distribution that serve as the means for getting the product to the target customers. The distribution system performs transactional, logistical, and facilitating functions.

Distribution decisions include market coverage, channel member selection, logistics, and levels of service.

Promotion

Promotion decisions are those related to communicating and selling to potential consumers. Since these costs can be large in proportion to the product price, a break-even analysis should be performed when making promotion decisions. It is useful to know the value of a customer in order to determine whether additional customers are worth the cost of acquiring them.

Promotion decisions involve advertising, public relations, media types, etc.

Geographic Segmentation:

- Country region

- City or metro size

- Density

- Climate

Demographic Segmentation:

- Age

- Gender

- Family Size

- Family life-style

- Income

- Occupation

- Education

- Religion

- Race

- Generation

- Nationality

Psychographic Segmentation

- Social Class

- Lifestyle

- Personality

Behavioral Segmentation

- Occupation

- Benefits

- User status

- Usage rate

- Loyalty rates

- Readiness stage

Segmentation in details

Income Level:

- Current Account

- Savings Account

- STD account

- Deposit Scheme

- Contributory Savings

- Short term deposit

- Lakhpoti deposit

- Demand Draft

Occupation

- Savings account

- Deposit Scheme

- Contributory

- Education savings

- Fixed deposit scheme

- Lakhpoti scheme

Lifestyle:

- Online banking

- Deposit scheme

- Fixed deposit scheme

- Mastercard

- Remittence

Social Class:

- Cheque

- Mastercard

Benefits:

- Deposit Scheme

- Contributory Savings scheme

- Double benefit scheme

- Pay order

User Status:

- Monthly benefit scheme

Nationality:

- Foreign Currency account

Personality:

- Master card

- TT

Religion:

- Islamic banking corporation

1. Current Account (segmentation on the basis of Income level)

Current account is purely a demand deposit account. There is no restriction on withdrawing money dorm the account. It is basically justified when funds are to be collected and money is to be paid at frequent interval. At present there are 840 current accounts in Satmasjid Road Branch of Prime Bank LTD. Some Important Points are as follows-

- There is no withdrawal limit.

- No interests given upon the deposited money;

- Minimum Tk.5000 balance must always maintain all the time;\

2. Savings Bank Account (segmentation on the basis of Income Level):

This deposit is primarily for small-scale savers. Hence, there is a restriction on withdrawals in a month. Heavy withdrawals are permitted only against prior notice. Some Important Points are as follows-

- Minimum opening deposit of Tk.2000 is required;

- Minimum Tk.1000 balance must always maintain all the time;

- Withdrawal amount should not be more than 1/4th of the total balance at a time and limit twice in a month.

- If withdrawal amount exceed 1/4th of the total balance at a time no interest is given upon the deposited money for that month.

3. Short Term Deposit Account (segmentation on the basis of income level):

A short-term deposit (STD) account is a running with amounts being paid into and drawn out of the account continuously. These accounts are called Demand Deposits or Demand Liabilities since the banker is under obligation to pay the money in such deposits on demand. Business Organization, Public Institution, and Corporate Bodies generally open these accounts. An individual person may open an STD account. It is an interest bearing deposit. Interest is a calculated on daily basis as per Banks Prescribed Rate and is credited to account on half yearly basis.

Current interest rate on STD account is presented in the following table:

| Particulars | Interest Rate |

| Below Tk. 4 core | 4.00% |

| Tk. 4 core and above but below Tk. 6 core | 5.00% |

| Tk. 6 core and above | 6.50% |

Table 4: Interest of STD Account

N.B. Senior Citizen will get 0.50% higher rate than usual.

ACCOUNT CLOSING:

It is a general right for every account holder to close his or her account at any time s/he find inconvenient to continue. But also has some formalities. The person needs to apply to the manager of the specific branch mentioning the reason for the account closing also the date when he would like to close his/her account with 100/- account closing charge.

- Deposit schemes (segmentation on the basis of income level):

Bank is the largest mobilize of surplus domestic savings. For poverty alleviation, we need self-employment, for self-employment, we need investment and for investment we need savings. In the other words, savings help capital formations and the capital formations help investments in the country. The investment in turn helps industrialization leading towards of wealth of the country. And the wealth finally takes the country on road to progress and prosperity. As such, savings is considered the very basis of prosperity of the country. The more the growth of savings, the more will his prosperity of the nation.

The savings rate in Bangladesh is one of the lowest in the world. In order to improve the savings rate, Financial Institutions responsible for mobilization of savings should offer attractive savings schemes so that’s the marginal propensity to save increases.

5. Contributory Savings Scheme (CCS)(segmentation on the basis of income level)

A person gets the opportunity to build up savings by contribution monthly installments and receives an attractive fixed amount at the end of a specified term in this Savings Scheme.

The Scheme is designed to help the fixed income group to save money and build up sizable funds with which they can go for some income generating venture to improve the quality of their life and/or meet any future financial obligations.

| Size of monthly deposit | After 5 years terminal value | Pension for next 5 years |

| 2,000 | 1,60,000 | 3,457 |

| 3,000 | 2,40,000 | 5,186 |

| 4,000 | 3,20,000 | 6,915 |

| 5,000 | 4,01,000 | 8,644 |

| 6,000 | 4,81,000 | 10,373 |

Some other features are mentioned below:

- The depositor is not allowed change the size of installment afterwards.

- A person can open more than one account for different size of installments in any branch of the bank.

- The specified amount on maturity at any slab shall be paid after one month from the date of deposit of the final installment.

- The installment shall be payable by 8th day (in case of holiday the next working day) of every month.

- Normally the depositor can not withdraw money before maturity except certain unavoidable reasons.

- When a depositor fails to deposit any installment, he/she will have to pay a fine @ 5% of the overdue amount payable at the time of depositing the next installment or maximum Tk. 500/-.

DEMAND DRAFT (DD) (segmentation on the basis of income level)

A demand draft is a written order of one branch upon another branch of the same bank, to pay a certain some of money to or to the order of a specified person. Drafts are not issued payable to bearer. In practice, drafts are not to be drawn between branches within the same city.

Process of DD Issue:

- Customer is supplied a DD form with a commission voucher and vat on banking service voucher.

- Customer fill up the form which includes the name of payee, amount of money to be sent, exchange, name of the drawer branch, signature and address of the drawer.

- The customer may pay in cash or by transferring the amount from his / her account (if any).

- After the money is paid and the form is scaled and signed accordingly it is given to the DD issuing desk.

- Upon the receiving the form concerned officer issues a DD on a particular block. The DD block has two parts, one for bank and another for customer.

- Bank’s part contains issuing date, drawer’s name, payee’s name, sum of the money and name of his drawee branch.

- Customer’s part contains issuing date, name of the payee, sum of the money and name of the drawee branch.

After furnishing all the required information entry is given in the DD Issue register and register and at the same time bank issue a DD confirmation slip addressing the drawee branch. This confirmation slip is entered into the DD advice issue register and a number is put on the confirmation slip from the same register. Later on the bank mails this slip to the drawee branch. At least two Grade -1 officer sign the DD block and amount is sealed on the DD with a special red seal to protect if from material alteration. The number of DD is put on the DD form. Next the customer is supplied with his/her part.

PAYMENT OF DD:

- When a DD is brought for payment, the branch check out the following matters: Whether the DD is drawn on them. Whether it is crossed or not . Whether it is properly signed by the authorized officer of the issuing branch.

- The branch then checks out whether the confirmation slip has arrived or not.

- If the confirmation has not arrived, the DD is given entry in the Ex-Advice register.

- Concerned officer writes down the date on which the DD was paid on the confirmation slip and sign on it.

- When the confirmation slip arrived before the DD, it is entered into the DD advice register and kept in a file. Later on, when the DD arrives the date is put on the confirmation slip and the above mentioned procedure is applied.

- When the situation of payment arises concerned officer checks out whether it is crossed or not.

- If it is crossed he should just transfer the amount to the account mentioned in the DD by crediting the account and debiting the issuing branch.

- If all the particulars are all right and the payee is genuine bank made the payment.

Payment

In respect of each Card Account Statement, the following stated therein shall be paid to Card Division at PBL’s Head Office within the Payment Due Date: a) at least the aggregate of the minimum payment(s) specified as such in the Card Account Statement; and b) the amount, if any, by which the Outstanding Balances stated therein exceeds the credit limit in relation to the Card Account(s) stated therein. b. If, Outstanding Balance stated in Card account Statement is not paid in full within the Payment Due Date stated therein, PBL may charge and debit the Card Account calculated on a daily basis, subject to a minimum monthly finance charge of 2.50% or such other sum as may be determined from time to time by PBL without notice. c. On the amount of each and every charge stated in that Card Account Statement as from the date when such charge was incurred or was posted to the Card Account, as PBL may elect, to the billing date stated in that Card Account Statement and On the entire Outstanding Balance from the billing date stated in that Card Account Statement until full payment of the Outstanding Balance is made. A charge in relation to any Card Transaction shall be deemed to have been incurred on the Card Account on the date when that Card Transaction was effected. d. If any amount required to be paid under Condition 7.1 hereof is not paid in full by the Payment Due Date stated therein, PBL may charge and debit the Card Account a late payment charge at such rate or amount as PBL may from time to time determine without notice. e. Any payment made by a Cardholder shall be applied in the following order:

| Priority | Payment applied for |

| 1st | Any over limit amount |

| 2nd | Any overdue amount |

| 3rd | Cash Advances |

| 4th | Service Charges |

| 5th | Fees |

| 6th | Purchases |

f. In respect of payment of Cardholder (Card Type-Gold/Silver International) to PBL, charges shall be made by Bankers’ draft payable in US$ or any other settlement mode acceptable to PBL. If PBL decides to accept payment tendered in some other currency, payment will not be credited in the Card Account. Charges incurred in any currency other than US$ will be converted into US$ at rates that will not be less favorable to Cardholder than the rate arrived at by use of an inter bank rate in existence within 24 hours that PBL or any authorized Agent processes the Charge plus 1% of the converted amount. An official rate will be used where required by law. Charges converted by common carriers shall be billed at rates used by such carriers and where submitted to PBL by such carriers in other than US$, shall be converted to US$ in accordance with foregoing procedures PBL may charge the Card Account for cost resulting for converting payments.

Islamic mode of operation (segmentation on the basis of religion)

Prime Bank Limited has started its operation as a Conventional Bank in April 1995. But pretty soon afterwards, within few months, the Bank has taken up the Challenge to start Islami Banking Operations. The Challenge is not so much as in operating Islamic Banking but in maintaining both the forms in Parallel. From its inception as an Islami Bank the bank has proven itself to be worthy of its slogan of ‘Bank with a Difference’, through successful operation of Islami Banking.

Prime Bank has started its Islami Banking operation through its first Branch being inaugurated at 19, Dilkusha C/A, Dhaka on 18 December 1995. Since then it has so far has established four more branches at different locations in the Country. Because of its popularity and management’s commitment toward social well being gradual expansion of Prime Bank’s Islami Banking operations is assured. Following are the salient features of Islamic Banking, as is practiced in Prime Bank Limited:

| 01. | All activities are conducted according to Islamic Shariah. |

| 02. | Interest free monetary operations. |

| 03. | Building partnership relation between the Bank and its customers. |

| 04. | Following Islamic principles in its investment portfolio. |

| 05. | While investing special consideration to social needs is given. |

| 06. | Through small and long term deposit schemes providing hope to the poor income group of the society. |

| 07. | Client service centric banking, through which making the clients feel special. |

| 08. | Conduct welfare activates etc. |

Online Branch Banking (segmentation on the basis of life style):

The bank has set up a Wide Area Network (WAN) across the country to provide online branch banking facility to its valued clients. Under the scheme, clients of any branch shall be able to do banking transaction at other branches of the bank.

Under this system a client will to be able to do following type of transactions:

- Cash withdrawal from his/her account at any branch of the bank irrespective of location.

- Cash deposit in his/her account at any branch of the Bank irrespective of location.

- Cash deposit in other’s account at any branch of the bank irrespective of location.

- Transfer of money from his/her account with any branch of the bank.

Monthly Benefit Deposit Scheme (MBDS)(segmentation on the basis of income level +user status)

This is a Deposit Scheme where the depositor gets monthly benefit out of his deposit. The scheme is designed for the benefit of the persons who intend to meet the monthly budget of their families from the income out of their deposit. Investment of fund of Trusts and Foundations, which award monthly scholarships / stipends to students etc.

N.B. Senior Citizens will get 0.50% higher rate of interest as permissible for all other deposits of our Bank. Monthly benefit shall be Tk. 930/- per Tk. 1, 00,000/- per mouth for Senior Citizens.

Educations Savings Scheme (ESS)(segmentation on the basis of occupation)

The educational expenses particularly the expenses for higher education are sharply increasing day by day in our country. Sometimes, the children are deprived of getting the desired level of education because of the inability of the parents to meet their educational

expenses. But the parents would not feel any differently to defray such expenses if a proper financial planning is made much ahead of time Moreover, we are receiving demands from the Islamic minded people of our country for an attractive Savings Scheme on the basis of Islamic Sariah so as to encourage them to save in Islamic way for education of their children. With this end in view, Prime Bank Limited has introduced a

Savings Scheme entitled “Education Savings Scheme” in accordance with the principles of Islamic Sariah i.e., on the basis of profit and loss sharing. The scheme provides a unique opportunity to the parents to make a future provision for the educational expenses of their children when they enter into Schools, Colleges and Universities out of the benefit of a small amount of savings with the Bank at an opportune moment.

The Procedure of opening double benefit deposit scheme:

1st step: Information needed of customer

2nd step: Documents should be attached are following

3rd step: The deposited amount –one can easily deposit it by cash, or by cheque,

or debiting his or her account having in this bank

4th step: Finding the customer ID NO.

Agency services:

Prime Bank provides a range of ancillary services. Customers can arrange for dividends to be sent to their bank and paid directly into their bank accounts. Customer may also authorize the bank to detach coupons from bearer bonds and present them for payment, purchase or sale or of stock exchange securities either directly or through the banks’ brokers

CASH (segmentation on the basis of Geographic segmentation):

The Prime Bank Limited has a heavy equipped cash section. Cash is received and disbursed in this section. The cash section consists of three junior officers.

Cash received:

Any person can deposit money by filling up the deposit slip or pay in slip and gives the form along with the money to the officer. The officer checks the A/C number, amount of taka both in words and in figure. Then the officer gives the entry to the receiving cash book and also writes the denomination of currency at the book of deposit slip. Then the officer sends the deposit slip counterfoil credit voucher and cash book for rechecking the particulars and for a second signature. After this second signature stamp “cash received” is given over the credit voucher. At the end of the day total of scroll book are entered in the cash book and total of the credit vouchers are found out and checked with the previous entries. The process is same for cash received the date of the next day.

Cash disbursing:

The PBL received various financial instruments for encashment. The common instrument handled by the branch is cheque, demand draft, pay orders, and debit cash vouchers etc. This instrument is hacked for apartment tenor. If the instrument is all right it is sent for posting by computer. After posting, signature is verified by the head. Then the cheque is sent for cancellation. After checking the A/C number, payee instruction and date the cancellation, officer cancels the cheque. There after the payment is done. The process is same for other financial instrument along with the clearing step. Bearer cheque is paid in cash cross cheque is balanced to the A/C.

Transaction Cash money:

At first the cash officer gives some money from the vault to the officer who makes payment to the clients and keeps a record of that amount. There are two teller desk from which the payment is being made. At the end of the payment period the balance must be adjusted with the records of the transaction. That is the received balance; the payment balance must be similar with the balance on the receiving and the payment register book

CHEQUE (segmentation on the basis of social class):

Chequebook issue has described below in terms of some cases observed in the bank.

Chequebook issue to the person except owner of the accounts:

It has been observed that a client that is owner of the account has wanted to draw a chequebook by another person from the bank then the authorization letter of the owner to draw this chequebook must have submitted by the bearer. In the authorization letter the bearer’s signature must have to be verified by the owner of the account.

Chequebook issue to the account holder:

When an existing account holder wants to draw a cheque book from the bank then he comes to the bank with the requisition slip which is already fixed in the cheque book that was delivered to him before this newly one. There is acquisition slip in every cheque book issued by the Prime Bank Limited.

It has been observed that if the owner of the account has wanted to draw a cheque book by a bearer then the bearer’s signature has appeared on the top left hand side (on the back of the requisition slip) on the requisition slip. And the bearer signature has been authenticated by the account holder by a signature, which has appeared on the bottom left hand side (on the back side of the requisition slip) just below the bearer’s signature.

When the chequebook is lost:

It has been observed that when an account holder has lost a chequebook, the holder of the account must have filled a indemnity bond which have been authorized by a guarantor. The guarantor must have to maintain an account in the Prime Bank Limited and the signature of the guarantor must have to appear on the indemnity bond.

Indemnity Bond:

Indemnity bond describes that if there is any loss or liability for the issuing of this new cheque book despite the old cheque book is lost; the guarantor will be liable for this loss or liability.

Process:

At first the requisition slip has to be filled by the account holder. On the requisition slip the main components are:

1) The name of Bank

2) The name of the branch

3) Date

4) CD/SB Account No

5) Containing no. of leaves

6) Name of the account

7) First serial no and last serial no of the leaf

8) Address of the account holder

9) Signature of the account holder

10) Signature of the authorized officer

Then these components have to be filled by the account holder, the authorized officer and the cheque book issued who are on the desk for giving services to the client. The desk man then gives entry in the “Cheque Book Issue Register”. The components on the register book are date of issue, cheque serial no, account no of the account holder

Remittance (segmentation on the basis of lifestyle):

Carrying cash money is troublesome and risky. That’s why money can be transferred from one place to another through banking channel. This is called remittance. Remittances of funds are one of the most important aspects of the Commercial Banks in rendering services to its customers.

Types of remittance:

- Between banks and non banks customer

- Between banks in the same country

- Between banks in the different centers.

- Between banks and central bank in the same country.

- Between central bank of different customers.

The main instruments:

- Payment order (PO)

- Demand Draft (DD)

- Telegraphic Transfer (TT)

Financial Position of Prime Bank at initial stage

| Particulars | 2006 | 2007 | 2008 | 2009 | 2010 |

| Authorized capital | 1000 | 1000 | 1000 | 1000 | 4000 |

| Paid up capital | 500 | 600 | 700 | 1000 | 1400 |

At the initial stage the authorized capital was 1000(Tk. In Million) and paid up capital was 500 (Tk. In .Million), Graph shows that paid up capital is increasing day by day.

Initial Advances of Prime bank

| Particulars | 2006 | 2007 | 2008 | 2009 | 2010 |

| Loan &Advances | 9074.94 | 12686.85 | 16492.22 | 23219.67 | 31916.11 |

Operating profit & Profit before Tax

| Particulars | 2006 | 2007 | 2008 | 2009 | 2010 |

| Operating Profit | 756.09 | 747.84 | 1001.41 | 1146.14 | 1520.34 |

| Profit Before Tax | 705.09 | 696.84 | 796.91 | 1064.24 | 1200.83 |

SWOT Analysis (PBL):

Strength

- The Bank has been graded as a top class Bank in the country through internationally accepted CAMELS rating.

- The banking has already occupied an enviable position among its competitions after achieving success in all areas of business operation.

- Better customer service, flexible loan, and business strategies over competitors.

- Able to achieve customer reliability.

Weakness

- Technologies used in Prime Bank are not advanced like other banks.

- All the branches are not operating online banking.

- Lack of ATM booth.

- Complicacy of maintaining manually accounts and papers.

Threat

- Day by day new upcoming banks are coming with many new services that are a threat for the bank. So increased number of new bank creates sever competition in Foreign Exchange banking.

- Competition will be tough to survive in market with lacking of new software.

Opportunities

- Prime Bank is the fast growing bank. There are huge opportunities to capture new market share.

- To attract new customers by enhancing its coverage over country.

- Promote its loan facilities and encourage customer to involve in export import business by flexible procedure

Conclusion:

‘A bank with a difference’- the perfect explanation of Prime Bank Limited. I am glad to think myself a part of Prime Bank Limited family during my internship program. The bank is different from its customer care, reliability, efficiency, capital adequacy, asset quality, sound management, excellent personnel etc. It provides me a wide range of scope to observe the different functions of bank through the cordial assistance of its members.

Prime bank limited is contributing greatly in the field of education in this way. The bank has a project in its consideration for university students; that is internship program. I think Prime Bank is the bank who makes available this opportunity most.

The market segmentation of Prime Bank ltd is so wide that it has able to capture a huge number of clients. By focusing on Geographic segmentation, demographic segmentation, Psychographic segmentation the has get the main success.

From any reputed organization the expectation of the clients is a wide options. Without a variety of options no organization can make a success. As prime bank has followed all these, it is now a successful bank.

Findings of the Study

Based on previous analysis and practical experience of 3 months internship program, the following things are observed during the research period:

- Customer Service is the core concern for the bank. A bank must satisfy its customer by providing best facilities and advantages and wide range of segmentation.

- Just because of the wide range of varity products, the bank can fulfill all customers’ need. Provide service at once when customer need.

- All branches of the bank are not under online banking system.

- It has very limited ATM facility.

- The bank is full of qualified employees, so they can fulfill the demand of the customers.

- Various accounts, various remittance, various scheme has give the customers a huge options to find what is right for them.

Recommendation

- Comparing with some other banks like DBBL, prime bank can increase its ATM booths.

- Prime Bank can expand some of their segments.

- They don’t have focused on the financially poor clients. So, they can introduce a new scheme or any new thing for comparatively poor people.

- Prime Bank Ltd. is now using only one software and that is “PC BANK”. But recently the bank is taking initiatives for installing new software named TEMONUS T24. It is very dedicated software. It has real time online banking, ATM facilities and E-banking and lot of more. It will be a great progress for the bank.

- Still all the branches of prime bank Limited are not introducing Online Banking. I think online banking is preferable to customer; it makes all the transactions easy. Very soon prime bank will operate on online.

- Prime bank has limitation of providing Education Loan; maximum students (who really need it) have no sufficient support to meet the terms and conditions to get this loan. So, conditions should be in favor of students.

- In case of Export L/Cs, the Government encourages the exporters by giving different facilities like tax-cuts. I think the bank should also think about such type of facilities to be given to the Exporters because Bangladeshi Exporters like Readymade garments Exporters are going to face a tuff situation in coming years from the exporters of other countries.

- Promotional activities should be done to expand the Foreign Exchange business so that customers can be informed.

- The bank should try to arrange more training programs for their officials. Quality training will help the officials to enrich them with more recent knowledge of International Trade Financing.

- Prime Bank should update its websites on regular basis.

- Prime Bank Ltd. is doing their Office work, vouching, accountings manually. But other banks are using many developed techniques and software. So the bank should adopt advanced technology

- Prime Bank should increase numbers of branches to cover a large number of clients base both in rural and urban areas.