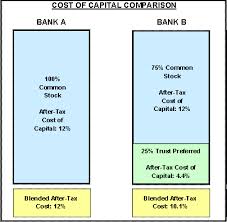

Primary purpose of this presentation is to discuss on Cost of Capital. To evaluate the rate of return required because of the market suppliers of capital to attract their funds towards the firm. To analysis the Cost of Capital here Used to decide whether a proposed corporate investment increase or decrease the firm’s investment price. Here also explain Investments that are expected to increase: NPV>0 or IRR>Cost of Capital. Finally briefly explain on Cost of long-term debt, Cost of Preferred stock , Cost of Common Stock and Cost of Retained Earnings with theoretical examples.

Lecture on Cost of Capital