1.1 Introduction

Generally by the word “Bank” we can easily understand that the financial institution dealing with money. But there are different types of banks like Central Banks, Commercial Banks, Savings Banks, Investment Banks, Industrial Banks, Shilpa Bank, and Co-operative Banks etc. But when we use the term “Bank” without any prefix, or restriction, it refers to the Commercial banks. Commercial banks are the primary contributors to the economy of a country. So we can say Commercial banks are a profit-making institution that collects the deposits from the surplus unit of the society and then lend the deposits collected to the deficit unit of the society. So the people of the society and the government are very much dependent on the commercial banks as the financial intermediary. As banks are profit-earning concern they collect deposit at the lowest possible cost and provide loans and advances at higher rate. The difference between two is the profit for them.

Banking sector is expanding its hand in different financial events every day. At the same time the banking process faster, easier and the banking arena is becoming wider. As the demand for better service increases day by day, they are coming with different innovative ideas & products. In order to survive in the competitive field of the banking sector, all banking organizations are looking for better service opportunities to provide their fellow clients. As a result it has become essential for every person to have some idea on the bank and banking procedure.

Internship program is essential for every Business Administration student. In other words it is mandatory for the student of any professional degree. It helps them to get acquainted with the real life situation.

1.2 Rationale of the study

Internship Report prepared as a requirement for the completion of the BBA program of the student of Stamford University Bangladesh. The primary goal of internship is to provide an on the job exposure to the student and an opportunity for translation of theoretical concepts in real life situation. Students are placed in enterprises, organizations, financial institutions, research institutions as well as development projects. The program covers a period of 12 weeks of organizational attachment.

After the completion of four-year academic BBA program I, Md. Forhad Munsi, student of Stamford University-Bangladesh was placed in EXIM Bank Bangladesh Limited for the Internship Program. As a requirement for the completion of the program I need to submit a report, which includes “Financial Risk Analysis of EXIM Bank Limited”. This report contains on Product and Services of Export Import bank of Bangladesh Limited, Automation in Export Import Bank of Bangladesh Limited, Asset and Liability Management of Export Import Bank of Bangladesh Limited, Internal Control and Compliance of Export Import Bank of Bangladesh Limited, Credit Card of Export Import Bank of Bangladesh Limited, Credit Ratings of Export Import Bank of Bangladesh Limited, Financial Overview of Export Import Bank of Bangladesh Limited.

1.3 Objectives of the Study:

The general objective of the study is to analyze the status and dynamic of various function indicators and to find out the pattern and magnitude of relationship that exists among different parameters of EXIM Bank. The main object of the study is to measure the financial risk of EXIM Bank Ltd. The specific objective of the study are listed below-

• Measure the credit risk.

• Measure the liquidity risk.

• Measure the market risk.

• Measure the interest risk.

• Measure the capital risk.

1.4 Scope of the report:

As I was sent to the EXIM Bank, Malibagh Branch, the scope of the study is only limited to this Branch. The report covers its overall department wise function, structure and performance. The report covers “Financial Risk Analysis of EXIM Bank Limited”. This report gives a narrative overview of the Export Import Bank of Bangladesh Limited and its operation in Bangladesh as of early 1999. Any development of the bank thereafter is thus out of the scope of the report. This report also elaborates the internship project, which was of building a model for the performance analysis of Export Import Bank of Bangladesh Limited. This report does explain the methodology of model development and illustrates the model and tries to extract the theoretical lessons from the exercise. However, since the financial information is classified and sensitive in nature, so that I tried to construct this report with the help of available information

1.5 Limitation of the study:

Although I have obtained wholehearted cooperation from employee of EXIM Bank but they were extremely busy. So they were not able to give me much time, as they and I would like. Besides, total duration of internship is not sufficient to give me more than a superficial idea of the functioning of the various departments. I was rotated through on the way of my study. I have faced the following problems, which may be termed as the Limitation/short coming of the study. These are as follows:

1. It was very different to collect the information form various personnel for the job constrain.

2. Bank policy was not disclosing some data and information for obvious reasons.

3. Due to time limitation many of the aspects could not be discussed in the present report.

4. Since the bank personals where very busy, they could provide me little time.

5. Another significant problem faced during the preparation of this report was the contradictory explanation of a single subject by different employee.

6. Because of the limitation of information some assumption was made. So there may be some personal mistake in the report.

7. The time 2 months only, which is insufficient to know all activities of the branch are prepare the report.

8. The sufficiency of information was not adequately available. Moreover, the sources were hazardous and in-discipline. Therefore the providence of insufficient information came out as a constraint.

9. Almost all the personnel were apparently too busy to assist us with their valuable support.

10. Short internship was not able to provide us with adequate time to impose more databases sophistic to the formulation of this report.

11. During the internship, in many part of our enquiry, our performance was hindered by some sort of inexperience of some of the personnel of the bank due to lack of orientation to the procedure of such interns.

12. There was no remuneration for our internship that demoralizes our motivation to keep consistency in our extensive study.

13. Sometimes we had to face unexpected conduct on the part of some of the personnel that was supposed to be a little bit more cordial.

It was difficult for the branch officials to spare adequate time and informational inputs for the report.

Bank officials, for security reasons, declined the request for providing information in some crucial issues.

It was hard for me to gather the data in such a short period of time.

1.6 Methodology of the research work

There are two types of sources of methodology. One is primary and another is secondary sources while conducting the study both primary and secondary information were explored. But hardly any primary information could be found. In the absence of primary information the majority of the study has been based on secondary information. For the procurement of data, we had to take support of some specific methods as follows:

Then we went for the answers in the analytical point of view, which provides the mitigation of our requirements.

1 Interviewing:

Some times we went for personal interviews of some of the personnel who are treated as specialist in respective assignments. They assisted us with primary and secondary information and otherwise showed us clues for where about of our requirements.

2 Computer Sections:

For several years annual report of various schemes this section of EXIM Bank Head Office is a big source.

While conducting the study both primary and secondary information were explored. But hardly any primary information could be found. In the absence of primary information the majority of the study has been based on secondary information. For the procurement of data, we had to take support of some specific methods as follows:

Using both of the two sources has collected data.

1.6.1 The “Primary sources’ are as follows:

1 Face to face conversation with the bank officer and staffs.

2 File study of different section

3 Different section of deskwork.

4 During my practical orientation I worked in General Banking, Learned from there.

5 Face-to-face conversation with the respective officers and stuffs of the branch and head office.

6 Face-to-face conversation with clients visited the branch.

7 Practical work experience in the different desk of the department of the branch covered.

8 Relevant field study as provided by the officer concern.

1.6.2 The “Secondary Sources” of data and the information are:

1 Website of the EXIM Bank Ltd.

2 Various book articles regarding general banking functions, Foreign exchange operations and credit policies.

3 Different procedure manual published by EXIM Bank Ltd.

4 Different circular sent by head office or EXIM Bank Ltd. and Bangladesh Bank.

5 Annual report of Export Import Bank of Bangladesh Limited

6 Different Publications & journals regarding banking activities & policies

7 Right Share Offer Document of Export Import Bank of Bangladesh Limited

8 Different types of vouchers.

9 Export Import Bank of Bangladesh Limited Website

10 Books

2.1 Overview of EXIM Bank Ltd.:

Export Import Bank of Bangladesh Limited is a public listed scheduled bank categorized in private sector and established under the ambit of Bank Companies Act,1991 and incorporated as a public limited company under the Companies Act, 1994 on June 02. The Bank started commercial banking operations effective from August 03, 1999. The Bank converted its Banking Operations into Islamic Banking based on Islamic Shariah from traditional banking operation in July 01, 2004 after obtaining approval from Bangladesh Bank.

The span of time the Bank has been widely acclaimed by the business community, from small entrepreneurs to large traders and industrial conglomerates, including the top rated corporate borrowers for forward- looking business outlook and innovative financing solutions. With a few of the Company’s activities and program on the basis of Islamic Shariah, within this period of time it has been able to create an image of responsibility for itself and has earned significant reputation in the country’s banking sector. Within an operative period as eight years, the bank has arrived at a strong financial and business position by expanding its market share compared to its contemporaries and to some extent to the 2nd even 1st generation banks of private sector. In edition, the Bank has also made a significant contribution to the national economy under the prudent leadership and untiring support of the member of the Board of Directors, who are leading business personalities and reputed industrialists of the country.

As a matter of policy, the Bank conducts its business on the principles of Mudaraba, Murabaha, Bai-Muazzal and hire purchase transaction approved by Bangladesh Bank. The Bank is one of the interest-free Shariah-based Banks in the country and its modus-operandi is substantially different from those of other commercial banks.

2.2 Mission of Export Import Bank of Bangladesh Limited:

Export Import Bank of Bangladesh Limited mission statement states:

1 To be the most caring and customer friendly and service oriented bank.

2 To create a technology based most efficient banking environment for our customer.

3 To ensure ethics and transparency in all levels.

4 To ensure sustainable growth and establish full value of the honorable shareholders.

5 To add effective contribution to the national economy.

6 Provide high quality financial services in export and import trade.

7 Become trusted repository of customers’ money and their financial advisor.

8 Display team spirit and professionalism.

9 Create sound capital base.

10 Enhance shareholders wealth.

2.3 Vision of the Export Import bank of Bangladesh limited:

The gist of their vision is “Together Towards Tomorrow”. Export Import Bank of Bangladesh Limited, as the name implies, is not a type of Bank in some countries on the globe, but is the first of its kind in Bangladesh. It believes in togetherness with its customers, in its march on the road to growth and progress with services.

• Provides the greatest return to the stakeholders by the stakeholders by achieving sound profitable growth.

• Be perceived by the customers and employees as the best whenever it operates.

2.4 Organizational Development of the EXIM Bank:

In the 1450s and 1960s a new integrated type of training originated was known as organizational development. Organizational development is an intervention strategy that uses group processes to focus on the whole culture of an organization in order to bring about planned change, it seeks to change belief attitudes, values structure and practices so that organization can better adapt to technology and live with the fast pace of change.

The general objective of organization development is to change all parts of the organization in order to make humanly responsive, more effective, and more capable of self-renewal.

The organizational development process does not preclude the use of conventional training method, which is useful for some purpose. The management of EXIM Bank is also concern about the training for its development. They believe that if the employees will be trained enough they would contribute more for the development of the banking business that is why; they send some employee in every batch

2.5 Management Structure:

Mr. Kazi Masihur Rahman Mr. Ekramul Hoque

(Managing Director) (Additional Managing Director)

Mr. Md. Sirajul Islam Bhuiyan Dr. Mohammed Haider Ali Miah Deputy Managing Director Deputy Managing Director

Mr. Karimuzzaman Mr. Sirajul Haque Miah

Executive Vice-President Executive Vice-President

Mr. Md. Fazlur Rahaman Mr. Khondoker Rumy Ehsanul Haq Mr. Fazal Akhter

Executive Vice-President Executive Vice-President Executive Vice-President

Mr. Mamun Mahmood Mr.Mohammad Alamgir Mr. Md. Zakaria Faruq

Executive Vice-President Executive Vice-President Executive Vice-President

2.6 Board of Directories:

Late Shahjahan Kabir Md. Nazrul Islam Mazumder

Founder Chairman Chairman

Alamgir Kabir, FCA Kazi Masihur Rahman

Former Advisor Managing Director

2.7 Shariah Board:

The Board of directors has formed a Shariah Supervisory Board for the Bank. Their duty is to monitor all the Bank’s transactional procedures, & assuring its Shariah compliancy. This Board consists of the following members headed by its Chairman:

The tasks of the Shariah supervisor in summary is replying to queries of the Bank’s administration, staff members, shareholders, depositors, & customers, follow up with the Sharia auditors and provide them with guidance, submitting reports & remarks to the Fatwa & Sharia Supervision Board and the administration, participating in the Bank’s training programs, participating in the supervision over the AlIqtisad AlIslami magazine, & handling the duty of being the General Secretary of the Board.

2.7.1 Members of Shariah Council

Professor Moulana Mohammad Salah Uddin

Mohammad Sadequl Islam

H.M. Shahidul Islam Barakaty

Mr. A.S.M. Fakhrul Ahsan

Hafez Moulana Mufti Mohammad Khair Ullah

Moulana Mufti Mohammad Nur Hafez Quari Uddin

Mr. Md. Nazrul Islam Mazumder

Mr. A.K.M Nurul Fazal Bulbul

Mr. Md. Abdul Mannan

Mr. Zubayer Kabir

Mr. Abdullah Al-Zahir Sawpan

Mr. Kazi Masihur Rahman

2.7.2 Shariah Auditing

This is the civil supervisory aspect that shapes the Bank’s main feature. Its existence is part of the Sharia Supervision procedures. One of it’s main task is to check the Sharia compliancy in the Bank’s transactional procedures in accordance to the Fatwas issued in that regard, under the guidance of the Sharia Supervisor.

The Sharia auditor is assigned the task of revising the Bank’s transactional procedures throughout the year to check the extent to which the staff members and the different departments have abided by the regulations, advices, and Fatwas issued by the Fatwa & Sharia Supervision Board, forums, & banking conferences. As well as, assuring that all the contracts that states a right for the Bank or an obligation on the Bank is certified by the Fatwa & Sharia Supervision Board.

Moreover, the Sharia Auditing submits periodic reports to the Sharia Supervisor in order to be proposed to the Fatwa & Sharia Supervision Board to state what it finds appropriate in that regard.

2.7.3 Banking with shariah principles

Export Import Bank of Bangladesh Limited is the 1st bank in Bangladesh who has converted all of its operations of conventional banking into shariah-based banking since July/2004. We offer banking services for Muslims and non-Muslims alike allowing our customers choice and flexibility in their savings and investments. Our products are approved by our Shariah Board comprising of veteran Muslim scholars of our country who are expert in all matters of Islamic finance.

The process by which Noriba’s investments are designed and executed allows the Bank to offer a combination of Sharia compliance and capital markets expertise that is unique throughout the world.

Noriba is committed to the strict adherence to the requirements of the Sharia as a result of the Bank’s sole focus on Sharia-compliant investments and the full supervision of its financial products and transactions by the Noriba Sharia Board.

Noriba experts specifically design each of the Bank’s investment vehicles with the approval of the Noriba Sharia Board. Once the given product or transaction has been arranged, the Noriba Sharia Board carefully screens it for compliance before giving final approval for its implementation. This control mechanism guarantees that all aspects of Noriba’s final products and banking transactions are in adherence with the guidelines of the Sharia.

2.8 Corporate Information

Registered Name : Export Import Bank of Bangladesh Limited.

Registered Head Office : “SYMPHONY”

Plot No. SE (F), Road No. 142

Gulshan Avenue, Dhaka- 1212, Bangladesh

PABX: 880-2-988 9363, FAX: 880-2-988 9358

Website: www.eximbankbd.com

SWIFT: EXBDDH

E-mail: eximho@bdonline.com

Date of Incorporation : June 02, 1999.

Inauguration of 1st Branch : August 03, 1999.

Chairman : Mr. Md. Nazrul Islam Mazumder

Advisor : Mr. Alamgir Kabir, FCA

Managing Director : Kazi Masiiur Rahman (Managing Director)

Secretary : Mr. Mohammed Mubarak Hussein.

Auditor : Hoda Vasi Chowdhury & Co.

Chartered Accountants

BTMC Bhaban (8th level)

7-9, Karwan Bazar, Dhaka-1215

Essence : Local Bank Global Network

Authorized Capital : Taka 3500 million. (Year 2006)

Paid up Capital : Taka 2142.20 million (end of December. 2007).

Number of Branches : 35.

Reserve fund : Taka 3111.68 million, including paid up capital (end of December 2006) Phone: 9566764, 955382, 9561604.

Telex: 642527 Eximbo bj

Fax: 880-2-9556988

Credit Rating

Long term : A (adequate Safety)

Short term : ST-2 (High Grade)

Notification of Reporting : May 26, 2009

2.9 Special Feature of the Bank

1) Though EXIM Bank is engaged in conventional commercial banking it also consider the inherent desire of the religious Muslims, and has launched Islami Banking system and inaugurates two Islami Banking Branches in the year-2002 and one Branch in 2003. The Islami Banking Branches perform their activities under the guidance and supervision of a body called “SHARIAH COUNCIL”.

2) It is the pioneer in introducing and launching different customer friendly deposit schemes to tap the savings of the people for channeling the same to the productive sectors of the economy.

3) For uplifting the standard of living of the limited income group of the population the bank has introduced monthly saving scheme and educational saving scheme to encourage the common and fixed income group of people.

4) The Bank is committed to continuous research and development so as to keep pace with modern banking.

5) The operations of the Bank are computerized oriented to ensure prompt and efficient services to the customers.

6) The Bank has introduced camera surveillance system (CCTV) to strengthen the security services inside the Bank premises.

7) The Bank has introduced customer relations management system to assess the needs of various customers and resolve any problem on the spot.

8) The Bank has also currently provided Online Banking facility to the bank clients and charge yearly only Tk 1200 for this.

2.10 Organizational Structure of EXIM Bank:

The development of on organization depends on the management style of their organizations the same the development if the bank is being occurred only for the good management team. Management of the EXIM Bank controlling of all the resources of the organization. To achieve the ultimate objective of making EXIM Bank the finest banking of the country, the workforce will be futuristic in outlook, professional in attitude and honest in reputation.

The board of directors wants to repose in the management all executive powers to run this service industry administration and credit portfolio independently without any undue influence from outside. The board formulates policy and gives policy directives to the management. Transparency and accountability are strictly ensured at all leaves of the bank. Bank operate with integrity, competence and farsightedness abiding by all the principals and provisions laid down in the bank company act 1991, 1994 and the guidelines of Bangladesh Bank. The bank is committed to pursue a straight forward, upright legitimate banking business, never be tempted by the abnormal prospect of large returns to do any thing. It will only do what may be done under the national policy.

2.11 Corporate Culture

This bank is one of the most disciplined Banks with a distinctive corporate culture. Here we believe in shared meaning, shared understanding and shared sense making. Our people can see and understand events, objects and situation in a distinctive way. They mould their manners and etiquette, character individually to suit the purpose of the Bank and the needs of the customers who are of paramount importance to us. The people in the Bank see themselves as a tight knit team that believes in working together for growth. The corporate culture they belong has not been imposed; it has rather been achieved through their corporate conduct. The Bank achievement has been possible because of the able leadership; dedicated and committed services provided by all levels of management and staff which all possible because of a good and quality full corporate culture.

2.12 Social Commitment

The purpose of the banking business is, obviously, to earn profit, but the promoters and the equity holders of EXIM bank are aware of their commitment to the society to which they belong. A chunk of the profit is kept aside and/or spent for socio-economic development through trustee and in patronization of art; culture and sports of the country and the bank want to make a substantive contribution to the society where we operate, to the extent of our separable resources.

2.13 Branch information: 44 branches in Bangladesh upto September 2009

2.14 Business Functions

The Bank operates through its Head Office at Dhaka and 44 branches in Bangladesh. At Dhaka (Motijheel Branch), Panthapath Branch (Dhaka), Dhanmondi Branch (Dhaka), Mawna Chowrashta Branch, Agrabad Branch (Chittagong), Khatungonj Branch (Chittagong), Gazipur Chowrashta Branch (Gazipur), Imamgonj Branch (Dhaka), Gulshan Branch (Dhaka), Sonaimuri Branch (Noakhali), Sylhet Branch ((Sylhet), Nawabpur Branch (Dhaka), Jessore Branch, Asulia Branch, Malibagh Branch, Narayangonj Branch (Narayangonj), Shimrail Branch (Dhaka), Islami Banking Branch (Motijheel Dhaka), Eskaton Branch (Dhaka), Islami Banking Branch (Uttara, Dhaka), Laksham Branch (Comilla), Mirpur Br. (Dhaka), Jubilee Road Br. (Chittagong) & Elephant Road Br. (Elephant Road Dhaka).Rangpur Branch(Rongpur), Bashundhara Branch(Badda), Moulvibazar, Branch, (Moulvibazar),Fenchugonj,Branch(Fenchugonj,Sylhet), Savar Bazar Branch (Savar, Dhaka), Karwan Bazar Branch(Karwan Bazar, Dhaka),Comilla Branch(Monoharpur Comilla). The Bank also carries out international business through a Global Network of Foreign Correspondent Banks.

2.15 Slogan of the EXIM Bank “Local Bank Global Network”:

The word EXIM implies the meaning of its operation. Thought it is a new type of banking in Bangladesh, it is familiar with so many countries in the world such as export import bank of United States, export import bank of Japan, despite it is local bank it has a spread of its operation in the whole world through foreign banking. To achieve the desired goal, it has intention to pursuit of excellence at all stages with a climate of continuous improvement. Because it believes, the line of excellence is never ending. It also believes that its strategic plans and business networking will strengthen its competitive environment. Its motto is to provide quality services to the customers all over the world the slogan of the bank “Local bank global network”. It is completely adjustable with its operation.

2.16 Customer Services and Automation:

“To error human and forgiveness divines” a proverb, the bank believes but the customers will not accept. Because for a service they pay for they want it 100% defect free. So improvement of the customer service should always be their motto altered expectations of the customer have shifted the focus from resource base productivity.

To operate in the globalize environment, the banks future plan is to equip all the units of the bank with the modern technology, such as online computer network telex, fax, e-mail etc. for the service of the customer round the clock, it has a plan to install ATMs suitable places in Dhaka and other cities of the country.

3.1 Product varieties:

3.1.1 Deposit products:

Al-Wadiah Current Deposit (MSB, MSTD, RFCD, NFCD)

Mudaraba Savings Deposit

Mudaraba Short Term Deposit

Mudaraba Term Deposit

• One Month

• Three Months

• Six Months

• Twelve Months

• Twenty Four Months

• Thirty Six Months

Mudaraba Savings Scheme

• Monthly Savings Scheme(Money Grower)

• Monthly Income Scheme(Steady Money)

• More than Double the deposit in 6 years (Super Savings)

• More than triple the Deposit in 10 years (Multiplus Savings)

• Mudaraba Hajj Deposit

3.1.2 Investment products:

• Corporate finance

• Commercial finance

• Industrial finance

• Project finance

• Lease finance

• Syndicate finance

• Hire purchase finance

• Real estate finance

Mudaraba monthly savings scheme schedule:

The accumulated amount may be more or less of following.

Term | Monthly Installment | |||

500/- | 1,000/- | 2,000/- | 5,000/- | |

5 yrs. | 39,041/- | 78,082/- | 1,56,164/- | 3,90,411/- |

8 yrs. | 74,202/- | 1,48,404/- | 2,96,809/- | 7,42,024/- |

10 yrs. | 1,05,095/- | 2,10,190/- | 4,20,380/- | 10,50,952/- |

12 yrs. | 1,44,461/- | 2,88,923/- | 5,77,847/- | 14,44,618/- |

Table: 3.1

Mudaraba super savings scheme schedule:

• Some examples are given in the table below. Any amount can be deposited in multiples of Tk. 5,000.00.

Deposit | Payable (approximately) at maturity |

5,000.00 | 10,002.00 |

10,000.00 | 20,004.00 |

20,000.00 | 40,008.00 |

50,000.00 | 1,00,020.00 |

1,00,000.00 | 2,00,040.00 |

2,00,000.00 | 4,00,081.00 |

5,00,000.00 | 10,00,203.00 |

Table: 3.2

Mudaraba Multiplus Savings Scheme:

• Some examples are given in the table below. Any amount can be deposited in multiples of Tk. 5,000.00.

Deposited Amount | Amount payable approximately after maturity |

5,000.00 | 15,879.00 |

10,000.00 | 31,758.00 |

50,000.00 | 1,58,793.00 |

1,00,000.00 | 3,17,587.00 |

Table: 3.3

3.1.3 VISA Islamic Card: By the grace of Almighty Allah, Exim Bank Ltd has started commercial operation of fully Shariah based VISA Islamic Card (Local, International & Dual Currency) under the principle of Bai-Murabaha. This is the first Islamic electronic product for any Islamic bank in Bangladesh.

The main features of the card are-

• Lowest profit rate in the card market

• Simple profit rate

• No hidden charge

• Dual currency facility and

Instant card message service in mobil

3.1.4 Remittance:

• From UK through Exim Exchange Company (UK) Ltd.

• Cilenco Fast Cash.

• Western Union Money Transfer.

• ELDDORADO Money Transfer

3.1.5 L/C (Import & Export) Products:

Our Bank is posed to extend L/C facilities to its importers / exporters through establishment of correspondent relations and Nostro Accounts with leading banks all over the world.

3.1.6 Other products:

Grameen Phoney Bill Deposit:

Consumers can deposit their Telephone bill of Grameen Phone in all the branches except Motijheel.

Electricity Bill Deposit:

Palli Buddut somity of Gazipur can deposit their electricity bill to Gazipur branch

3.1.7 Loan and advance:

EXIM bank serves the and beyond the national boarder of the country through their unique services. It sometimes meets the optimum needs of the people by providing loans. Against providing loan the bank takes a high interest example, 13%. Besides this the bank serves the country best through their short term and long term lending process. Sometimes this bank provide loan to the government with relaxed conditions and contact.

3.1.8 ATM Network:

We have already floated tender in the national dailies to setup a network of 50 ATMs and 300 POS machines. The job of ATM interfacing with the Core Banking Software is going on. Inshallah, by the end of this year, at least 10 ATMs will come under our own ATM network.

4.1 Risk Analysis of EXIM Bank Ltd.:

Risk analysis has been a crucial term for banking sector throughout world. Risk means the probability or chance of loss in terms finance, operation and reputation. Therefore, banks are to give high importance on this issue.

The financial risk concerned with the five core factors. These factors are as follows:

• Credit risk

• Liquidity risk

• Market risk

• Interest risk

• Capital risk

The success of a company heavily depends on the five factors. If the company can measure the risk easily and tactfully, and can take suitable decision in the future the company must exist in the market in the long run. To measure properly the associated risk with the finance, there must be some finance experts, economy analyst for avoiding the risk.

4.2 Credit Ratings:

Despite all the challenges in maintaining balance between the financial indicators, EXIM bank maintained good fundamentals. Credit Rating Information and Services Limited (CRISL), well reputed rating agency of the country, reaffirmed the rating of EXIM Bank as ‘A’ (Adequately Safety) for Long Term and ‘ST-2’ (High Grade) for Short Term based on good financials and operational efficiency for the year under review.

4.3 Information Regarding Deposit, Asset, Investment:

4.3.1 Deposit: Deposit is one of the principal sources of fund for investment of commercial banks and investment deposit is the main stream of revenue in banking business. The total deposit of the bank stood at Tk. 57,586.99 million as on 31 December 2008 against Tk. 41,546.57 million of the previous year which is an increase of Tk. 16,040.42 million with a growth rate of 38.61 % which is remarkable achievement for the bank. The present strategy is to increase the deposit base through maintaining competitive rates of portfolio and having low cost fund.

4.3.2 Investment (General):

Total amount of investment of the bank stood at Tk. 53,637.68 million as on December 31, 2008 as against Tk. 40,195.24 million as on December 31, 2007 showing an increase of Tk. 13,442.44 million with growth rate of 33.44 %. Investments are the core assets of a bank. The bank gives emphasis to acquire quality assets and does appropriate Investment risk analysis while approving commercial and trade investment to clients.

4.3.3 Investment (Shares & Bonds):

The size of the investments portfolio in 2008 is Tk. 2894.02 million while it was Tk. 2457.72 million in 2007. The portfolio comprises of Bangladesh Government Islamic Investment Bond, Islami Bank Mudaraba Perpetual Bond and Share of other Companies.

4.3.4 Asset:

As on 31 December 2008, the bank had total asset BDT 68446.46 million which is around 33% gro0wth rate compared to the previous year where the asset was BDT 51503.03 in 2007.

4.4 Credit Risk:

Credit risk is the risk of loss due to a debtor’s non-payment of a loan or other line of credit (either the principal or interest (coupon) or both): The probability that some of a bank’s assets, especially its loans, will decline in value and perhaps become worthless is known as credit risk. Because banks hold little owners capital relative to the aggregate value of their assets, only a relatively small percentage of total loans needs to turn bad in order to push any bank to the brink of failure. The following are four of the most widely used indicators of bank credit risk:

1 The ratio of nonperforming assets to total loans and leases.

2 The ratio if net charge-offs of loans to total loans and leases.

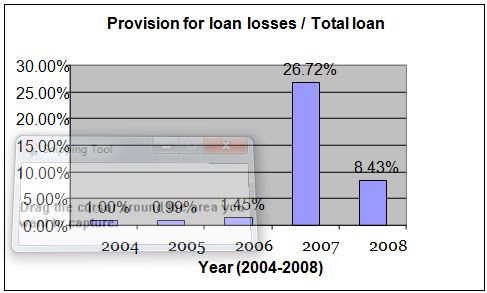

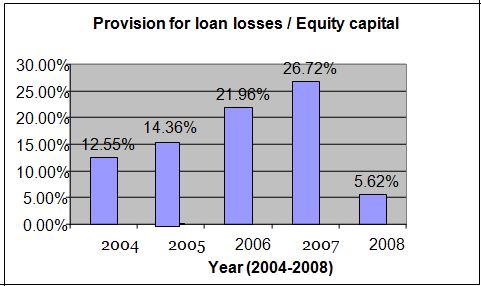

3 The ratio of the annual provision for loan losses to total loans and leases or to total equity capital.

4 The ratio of allowance for loan losses to total loans and leases or to total equity capital.

If we look at below we can easily understand the how credit risk was during the year from 2003 to 2007

Table: 4.1 (Credit Risk Data)

| Year |

|

|

| 2004 | 0.995% | 12.546% |

| 2005 | 0.99% | 14.36% |

| 2006 | 1.45% | 21.96% |

| 2007 | 26.72% | 25.32% |

| 2008 | 8.43% | 5.62% |

Calculation in appendix F1

4.4.1 Credit Risk Analysis:

We know there are various methods to measure credit risk. Here we use two methods:

1. Provision for loan losses/

Total loans

2. Provision for loan losses/Equity capital

Figure: 4.4.1.1(Provision of loan / total loan)

In 2004 Provision for loan losses/ Total loan = .995%

In 2005 the percentage is .99% here the risk is increase slightly. But in 2006 the percentage 1.45 and 2004 26.72 %. In 2006 to 2008 the credit risk increase highly that means the FI take more risky project in hand but in 2008 the percentage again down ward slope and the percentage is 8.43.

So, in fine we can say that the credit risk of EXIM bank highly volatile that means the credit risk of the bank increase and decrease through out year 2004 to 2008.

Figure: 4.4.1.2 (Provision for loan losses / Equity capital)

Measured by = Provision for loan losses/Equity capital

From the above calculation we can say that in 2004 the percentage is 12.54% and in 2005 the percentage is.1436%. So the bank faces more credit risk in 2004 than 2005. Because from the equation we say that if provision for loan loss lower than equity capital than the credit risk decrease and if provision for loan losses higher than equity capital than the bank face more credit risk.

In 2006 the percentage is 21.96% 2005 25.32% and 2006 5.62%. So the credit risk is very higher than 2004 and 2005. In 2007 and 2008 the risk is more stable and again in 2008 the risk decrease highly.

4.5 Liquidity Risk:

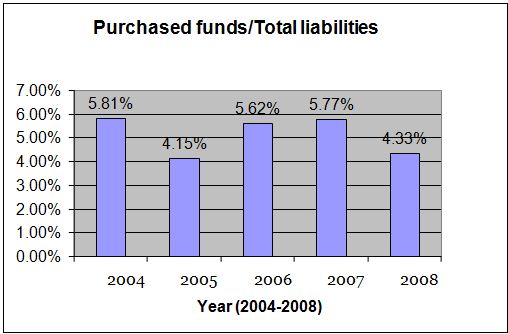

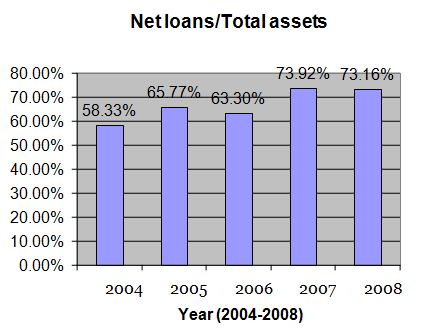

Bankers are also very concerned about the danger of not having sufficient cash and Borrowing capacity to meet deposit withdrawals net long demand and other cash needs. Faced with liquidity risk, a bank may be forced to borrow emergency funds at excessive cost to cover its immediate cash needs, reducing its earnings. Very few banks ever actually run out of cash because of the ease with which liquid funds can be borrowed from other banks. In fact, so rare is such an event that when a small Montana bank in the early 1980s had to refuse to cash checks for a few hours due to a temporary “cash-out,” there was a federal investigation of the incident. Somewhat more common is a shortage of liquidity due to unexpectedly heavy deposit withdrawals, which forces a bank to borrow funds at an elevated interest rate-higher than the interest rate other banks, are paying for similar borrowings. A significant decline in a bank’ liquidity position often forces it to pay higher interest rates to attract negotiable money market CDs (which are sold in million-dollar units and therefore are largely unprotected by deposit insurance). One useful measure of liquidity risk exposure is the ratio of: Purchased funds (including Eurodollars, federal funds, security RPs, large CDs, and commercial paper) to total assets. Heavier use of purchased funds increases the chances of a liquidity crunch in the event deposit withdrawals rise or loan quality declines. Other indication of a banks exposure to liquidity risk includes the ratios of:

1. Purchased funds to total assets

2. Net loan to total assets.

3. Cash and due-from deposit balance held at other banks to total assets.

4. Cash assets and government securities to total assets.

Table: 4.2 (Liquidity Risk Data)

| Year | Purchased funds/Total Assets | Net loans/Total Assets | Cash and due from banks/ Total Assets | Cash and government securities/ Total Assets |

| 2004 | 5.52% | 58.33% | 14.67% | 14.39% |

| 2005 | 4.15% | 65.77% | 10.15% | 16.13% |

| 2006 | 5.39% | 63.30% | 10.16% | 16.17% |

| 2007 | 5.44% | 73.92% | 9.93% | 11.12% |

| 2008 | 4.08% | 73.16% | 13.74% | 12.80% |

Calculation in appendix F2

4.5.1 Liquidity Risk Analysis:

We know there are various methods to measure liquidity risk. Here we use four methods:

1. Purchased funds/Total assets

2. Net loans/Total assets

3. Cash and due from bank/Total assets

4. Cash and government securities/Total assets

Figure: 4.5.1.1 (Purchased fund/ total liabilities)

In 2001,

Purchased funds/Total assets

From the above calculation we can see that in 2004 the percentage of liquidity risk according to their purchased fund against their total assets is 5.52% & in 2004 this percentage is decrease, which is 4.15%. So the banks face more liquidity risk in 2001 than 2005. But in 2006 & 2007 the percentage of liquidity risk again increase respectively 5.39%, 5.44%.

It means if the purchased of funds is increase against its total assets than the liquidity risk is higher. Than the bank face more liquidity risk. In 2008 we see that the percentage of liquidity risk being lower than the part four years. So we can say that the percentage of liquidity risk is fluctuating over the five years (2004-2008). It is highly fluctuate over the five years, which is not a good shine for any reputed organization.

Figure: 4.5.1.2 (Net loans/ total asset s)

Liquidity risk measured by,

Net loans/Total assets

From the above calculation we can say that in 2004 the percentage of liquidity risk accordingly to their net loans against their total assets is 58.33% & in 2005 this percentage is increase, which is 65.99% than in 2006 it is slightly decrease with 63.30%. But in 2007 the liquidity risk is again increase slightly decrease in 2008, which is respectively 73.92%, 73.16%. It means if the net loan is increase against its total assets than the liquidity risk is higher. So the banks face more liquidity risk.

The liquidity risk of the bank based on net loans is almost stable in 2005 & 2006, & by increasing slightly in 2007 & 2008.

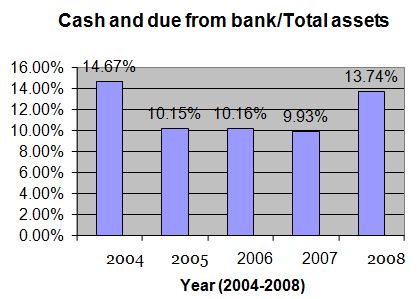

Figure: 4.5.1.3 (Cash and due from bank/ total assets)

Liquidity risk measured by, Cash and due from bank/Total assets

From the above calculation we can say that in 2004 the percentage of liquidity risk according to their cash and due from banks against their total assets is 14.67% & IN 2005 this percentage is decrease, which is 10.15%. In 2006 it is slightly increase by 10.16% & than again decrease in 2006 by 9.93%. But in 2008 it is increase by 13.74% which is closest to the year 2004.It means if the cash and due from banks is increase against its total assets than the liquidity risk is higher.

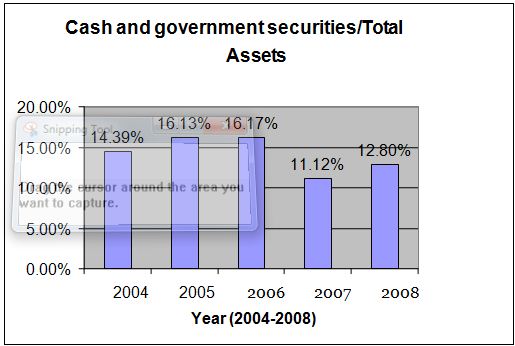

Figure: 4.5.1.4 (Cash and government securities/Total assets)

Liquidity risk measured by,

Cash and government securities/Total assets

From the above calculation we can say that in 2004 the percentage of liquidity risk according to their cash and government securities against its total assets is 14.39% & in 2005 & 2006 this percentage is increased by 16.13%, 16.19%. But in 2007 it is decreased by 11.12% and in 2008 it is increased by 12.80%. it means is the cash and government securities is increase against its total assets than the liquidity risk is higher.

4.6 Market Risk:

Market risk is the risk that values of assets and liabilities or revenues will be adversely affected by changes in market conditions such as market movements. This risk is inherent in the financial instruments associated with our operations and/or activities including loans, deposits, securities, short-term borrowings, long-term debt, trading account assets and liabilities, and derivatives. Market-sensitive assets and liabilities are generated through loans and deposits associated with our traditional banking business, our customer and proprietary trading operations, our ALM process, credit risk mitigation activities, and mortgage banking activities. Our traditional banking loan and deposit products are no trading positions and are reported at amortized cost for assets or the amount owed for liabilities (historical cost). While the accounting rules require a historical cost view of traditional banking assets and liabilities, these positions are still subject to changes in economic value based on varying market conditions. Interest rate risk is the effect of changes in the economic value of our loans and deposits, as well as our other interest rate sensitive instruments, and is reflected in the levels of future income and expense produced by these positions versus levels that would be generated by current levels of interest rates. We seek to mitigate interest rate risk as part of the ALM process. We seek to mitigate trading risk within our prescribed risk appetite using hedging techniques. Trading positions are reported at estimated market value with changes reflected in income. Trading positions are subject to various risk factors, which include exposures to interest rates and foreign exchange rates, as well as mortgage, equity market, commodity and issuer credit risk factors. We seek to mitigate these risk exposures by utilizing a variety of financial instruments. The following discusses the key risk components along with respective risk mitigation techniques. Volatile changes in interest rates have created have for manager of bank asset portfolios, particularly for those responsible for bank investments in government bonds and other marketable securities. When interest rates catapulted to record levels a few years ago, the market value of bank-held bonds plummeted, forcing many banking firms to accept substantial losses on any securities that had to be sold- a potent example of what financial analysts call market risk. If interest rates increase, the market value of –income securities (such as bonds) and fixed-rate loans will fall. A bank faced with the need to sell these assets in a rising-rate market will take losses. Falling interest rates, in contrast will increase the value of fixed-income securities and fixed-rate loans, resulting in capital gains when they are sold. Among the most important indication of market risk in banking are:

1. The ratio of a bank’s book-value assets to the estimated market values those same assets.

2. The ratio of fixed-rate loans and securities to floating-rate, loans and securities and of fixed-rate liabilities to floating-rate liabilities.

3. The ratio of book-value equity capital to the market value of a bank’s equity capital.

Table: 4.3 (Market Risk Data)

| Year | Book value of equity/ Market value of equity | Book value of assets/ Market value of assets |

2004 | 42.94% | 0.416% |

2005 | 45.91% | 0.975% |

2006 | 41.94% | 0.499% |

2007 | 44.83% | 0.619% |

2008 | 45.95% | 0.49% |

Calculation in appendix F3,

4.6.1 Market Risk Analysis:

We know there are various methods to measure market risk. Here we use two methods:

1. Book value of assets/Market value of assets

2. Book value of equity/ Market value of equity

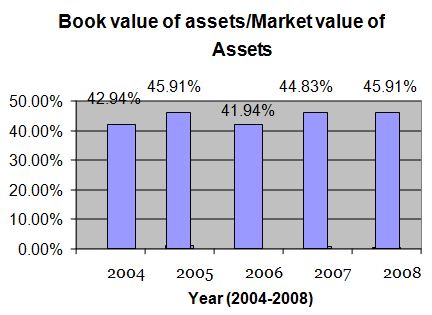

Figure: 4.6.1.1 (Book value of assets/Market value of Assets)

From the above calculation we can say that in 2004 the bank have no market risk. In 2005 the percentage of market risk is 45.91% according to their book value of assets the market value of assets. But in 2006 the marketris terribly increase by 41.94%.

It means the book value of the assets is more than the market value of the assets. In 2007 & 2008 the market risk is decrease respectively by 44.83%, 45.91%.

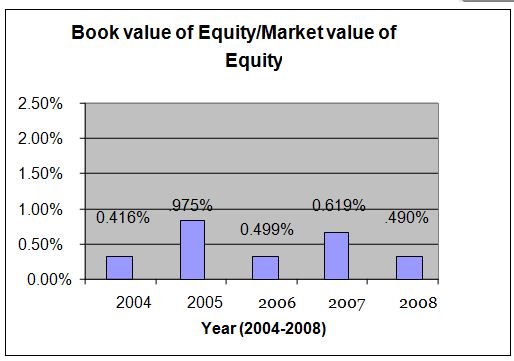

Figure: 4.6.1.2 (Book value of Equity/Market value of Equity)

Measured by,

Book value of equity/Market value of equity

According to book value of equity against the market value of equity in 2003 there is .416% market risk. In 2004 it is 0.975% & in 2005 again there is .499% market risk. And in 2006 the market risk is .619% which is less than the market risk of 2004. In 2007 the market risk of the bank is increasing slightly then the year 2006 by .490%.

4.7 Interest Rate Risk:

Interest rate risk represents exposures we have to instruments whose values vary with the level of interest rates. These instruments include, but are not limited to, loans, debt securities, certain trading-related assets and liabilities, deposits, borrowings and derivative instruments. We seek to mitigate risks associated with the exposures in a variety of ways that typically involve taking offsetting positions in cash or derivative markets. The cash and derivative instruments allow us to seek to mitigate risks by reducing the effect of movements in the level of interest rates changes in the shape of the yield curve as well as changes in interest rate volatility. Hedging instruments used to mitigate these risks include related derivatives such as options, futures, forwards and swaps. Movements in market interest rates can also have potent effects on a bank’s margin of revenues over operating costs. For example, rising interest rates can lower a bank’s margin of profit if the structure of the institution’s assets and liabilities is such that interest expenses on borrowed money increase more rapidly than interest revenues on loans and security investments. However, if the bank has an excess of flexible-rate assets (especially loans) over flexible-rate liabilities (especially rate-sensitive CDs and money market borrowings), falling interest rates will erode the bank’s profit margin. In this case, asset revenue will drop faster than borrowing costs.

The impact of changing interest rates on a bank’s margin of profit is usually called interest rate risk. Among the most widely used measures of bank interest-rate risk exposures are:

1. The ratio of interest-sensitive assets to interest liabilities when interest-sensitive assets exceed interest-sensitive liabilities in a particular maturity range, a bank is a vulnerable to losses from falling interest rates. In contrast, when rate-sensitive liabilities exceed rate-sensitive assets in volume, losses are likely to be incurred if market interest rates rise.

2. The ratio of uninsured deposits to total deposits, where uninsured deposits are usually government and corporate deposits that exceed the amount covered by insurance and are usually so highly sensitive to changing interest rates that they will be withdrawn if yields offered by competitors rise even slightly higher.

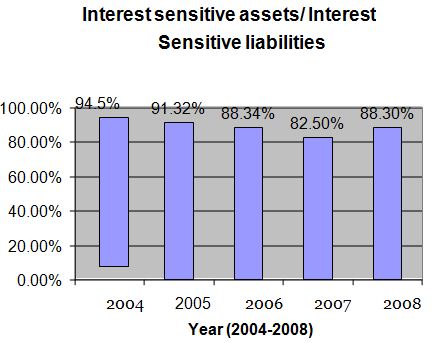

Table: 4.4 (Interest Risk Data)

| Year | Interest sensitive assets /Interest sensitive liabilities |

| 2004 | 94.5% |

| 2005 | 91.32% |

| 2006 | 88.34% |

| 2007 | 82.50% |

| 2008 | 88.30% |

Calculation in appendix F4

4.7.1 Interest Risk Analysis:

Figure: 4.7.1.1(Interest sensitive assets/ Interest Sensitive liabilities)

In 2004 here is no interest risk. In 2005 t is 91.32 percent which is very high. It means there is more interest sensitive liabilities than the interest sensitive assets. But in 2006 t is decreasing by 88.34% and 2006 by 82.50%.

In 2008 he interest risk again increases by 88.30%.

4.8 Capital Risk:

Probability of the value of the bank assets declining below the level of its total liabilities. The probability of the bank’s long run survival.

These are given below:

1 Stock price/Earning per share

2 Equity capital/Total assets

3 Purchased funds/Total liabilities

4 Equity capital/Risk assets

Table: 5 (Capital Risk Data)

| Year | Stock price/Earning per share | Equity capital/ Total assets | Purchased funds/Total liabilities | Equity capital/Risk assets |

| 2004 | 100% | 50.68% | 5.81% | 80.61% |

| 2005 | 100% | 4.84% | 4.15% | 5.55% |

| 2006 | 100% | 4.18% | 5.62% | 5.37% |

| 2007 | 100% | 5.74% | 5.77% | 6.87% |

| 2008 | 100% | 4.33% | 4.33% | 51.50% |

Calculation in appendix F5

4.8.1 Capital Risk Analysis:

We know there are various methods to measure capital risk. Here we use four methods:

1. Stock price/Earning per share

2. Equity capital/Total assets

3. Purchased funds/Total liabilities

4. Equity capital/Risk assets

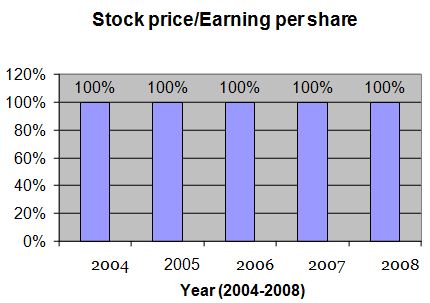

Here, Figure: 4.8.1.1 (Stock price/Earning per share)

Stock price/Earning per share

There is 100% capital risk through the year 2003 to 2007.

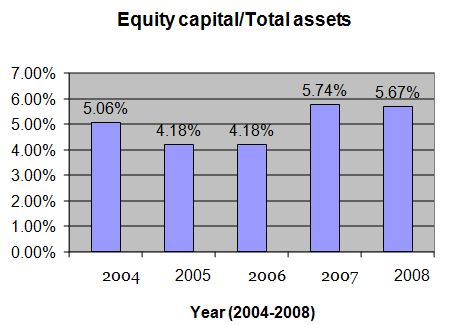

Figure: 4.8.1.2 (Equity capital/Total assets)

Measured by,

Equity capital/Total assets

From the above calculation we can say that in 2004 he capital risk of the bank is 5.06% than 2005 & 2006 it is decrease by 4.18% and this risk is stable for the two year (2005 & 2006).In 2007 the percentage of capital risk is increasing by 5.74%. It means the amount of equity capital is more than the total assets. In 2008 the risk of capital is slight decrease by 5.67%.

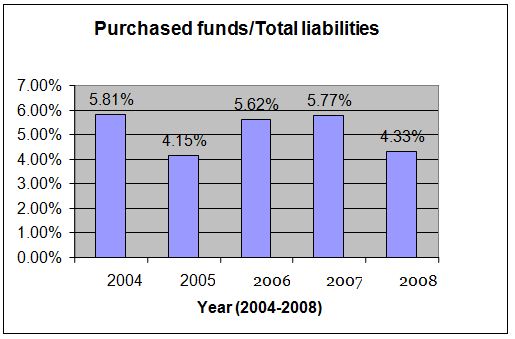

Figure: 4.8.1.3 (Purchased funds/Total liabilities)

Measured by, Purchased funds/Total liabilities

From the above calculation we can say that in 2004 the capital risk of the bank is 5.81% and in 2005 it is decreases but in 2006 it is increases. In 2007 the percentage of capital risk is increasing by 5.77%. It means the amount of purchased funds is more than the total liabilities. In 2008 the risk of capital is slightly decrease by 4.33%.

Measured by, Equity capital/Risk assets : From the above calculation we can say that in 2004 the percentage of capital risk accordingly to their equity capital against their risk assets is 0.69% & in 2005 this percentage is increase, which is 5.55% than in 2006 it is slightly decrease with 5.37%. But in 2007 the capital risk is again increase 6.87%. In 2008 the risk of capital is more increases by 51.50%.

SWOT analysis is the detailed study of an organization’s exposure and potential in perspective of its strength, weakness, opportunity and threat.

5.1 Strengths:

Export Import Bank of Bangladesh Limited main strength is their member of the Board of Directors, who is leading business personalities and reputed industrialists of the country.

They have their own training center.

Better working environment, which promotes team spirit, creativity, & performance capabilities of its employees.

Skilled, creative & committed manpower.

They are commanding position in Import and Export business.

Compare to other two banks this bank better position in investment.

The bank’s Return on Asset more than other two banks.

The bank’s Return on Equity is more comparing to other two banks.

Liquidity position is good.

Credit Rating Information & Services Ltd., a joint venture credit rating company rated Export Import Bank of Bangladesh Limited. as ‘A’ (Adequate Safety) in the long-term on the basis of its strong fundamentals, superior asset quality, good profitability, average growth rate, reasonable capital adequacy and comfortable liquidity. This indicates the positive perception of the market to the Bank. Short Term ST-2 (High Grade)

Excellent working environment.

5.2 Weaknesses:

Export Import Bank of Bangladesh Limited has not introduced online banking system which has an increasing public demand now a-days.

Lots of works are done manually.

They do not have their own Card facilities like Debit/Credit/ATM Card.

There is no separate customer care department, which can work solely with customer care and for continuous improvement of services.

The bank couldn’t use it’s full of capacity to give loan. Although Advance to Deposit ratio increased over 5 years it is very much below the standard. This indicates its excess idle fund & inefficiency in fund management..

Shortage of manpower in every division. So during the working hour the employees can’t provide proper attention to the customer that enhances customer dissatisfaction.

Shortage of spaces.

Most of the branch does not have any car parking facility.

There is no clear indication and encouragement for complaining and suggestion from the customers. Employees are also not properly instructed how to handle complains regarding their service failure.

There are two major categorized employees one group who are from different banks or joined through competitive exams, the other group who joined here from different references. There is a big difference in term of attitude, manner, working style, and behavior between the two groups, which has bad impact to the service. Branch management also loves to ignore the problem.

In selecting people for providing services to the customers, the employees’ personality, manners, attitudes and acceptability are not properly examined.

Only few branches have spacious car parking facility, which discourage some customers to deal with Export Import Bank of Bangladesh Limited.

5.3 Opportunities:

Export Import Bank of Bangladesh Limited has a lot of growth opportunities in the consumer banking, money market operations & also export-based industries due to global economic recovery.

It does not foresee exciting any of its business lines since it maintains balanced portfolio & it is well-positioned to increase out-thrust into diversified interests.

They have a big opportunity if they provide online Banking system.

They do not look forward to increase their product or service basket.

5.4 Threats:

The major challenge of Export Import Bank of Bangladesh Limited is there are already many financial institutions sharing the same size of the pie. As a result there is intense competition for generating business. Furthermore, due to the dual effect of competition & reduced rates (to the benefit of the borrower) they will find it challenging to bring their cost of fund to an acceptable level & yet maintain our high level of quality assets in our books & ensure our NPA(Non Performing Assets) is at an acceptable level.

The emergence of several private & foreign banks within the post few years offering similar or more services with less or free charge for the facilities can be a major threat for the bank.

Overburden with regulations & frequent changes of policies create problems in adapting clients & complying with rules, which adversely affect the business.

5.5 Initiatives taken to overcome weaknesses & threats:

Export Import Bank of Bangladesh Limited is working on to introduce card facility.

They will introduce an efficient customer care service very soon.

They are working to become fully automated bank.

Emphasis on high cost deposits, i.e., increasing the ratio of time to transaction deposits to achieve a higher cost of fund.

Implement segregation of duties between credit approval, sales & processes.

Closely monitor problem portfolio.

Survey customer opinions on services & compare with industry benchmark.

Rationalize communication cost. Use e-mail for internal communication.

Eliminate unnecessary processes, registers. Recycle paper, re-use envelops.

Define Work Standards & monitor performance.

The Bank tries to provide the products & services best in quality & price in order to achieve highest customer satisfaction & to face competitors positively.

5.6 Findings:

It can be shown from the report that the report mainly concerned with the five types of financial risks of a bank. The risks should be tightly handled by the bank to improve their service system and to gain more profit. Without any proper maintenance of risks the bank may fall down. Besides this the bank has got high Credit Rating in long term and short term than the previous year. In 2009 the bank earned ‘A’ in long term and ST-2 in short term. Among deposit, asset, investment there is remarkable improvements in all the sectors. As shown in asset there is huge improvement in 2008 (around 33%) compared to the previous year 2007. The financial risk is the most unfavorable for any organization. The risk is the uncertain future situation or probability or chance that cause for loss. The situation of risk is fluctuated in their respective area and the risk can be controllable by the best performance. EXIM Bank is one of the leading commercial bank o0f Bangladesh. It has huge opportunity to improve its services and can expand the range of service. There are some weaknesses and threats for the bank which must be tackled tactfully. The bank is technologically advanced and going to introduce ATM service and expanding branches.

6.1 Recommendation

The recommendations given below are not decisions; rather they are only suggestions to improve the customer’s service in order to fulfill the customer’s satisfaction so that customers give more preference to EXIM bank of Bangladesh limited. The recommendations are given below:

• Enlarge customers in different sectors:

They have to increase their Letter of Credit (LC) customer. Banks take margin against opening LC. They charge the margin on the customer according to their relationship with that bank. In the competitive market, EXIM bank should charge a lower rate of margin over the customer to increase the customer and maintain a long term relationship with the customer. If the margin is going high, customers can switch to the other commercial banks. They have to increase their confident level on foreign exchange business and have to acquire their customer for foreign exchange business.

• Give more training and development to increase the efficiency level of the employee:

Every company should establish an efficient customer care service. Because with this they can stay touched with the customer and customer can get immediate help of their problem. To establish that the specific company should have to have an efficient employee group. They can arrange more training and can undertake more and more development course to make their employee more effective and efficient. Their human resource planning may adopt open performance appraisal system instead of closed on. Lack of motivation level is too poor, because of this a huge number of employees switch over to other commercial banks.

• Commence new creation and services:

EXIM Bank already has the online banking services. But they don’t have own ATM booth. Their consumers withdraw cash by using the others banks booth. They have to introduce their own credit card service. So they face few hassles to withdraw money. To overcome this problem they should have to set their own ATM booth. They have to introduce ATM booth in some important places of country. Because it is safe and also less time consuming in transaction. They should have to introduce the Small business entrepreneur (SME) Banking system. They have to increase the number of branches in different important places. They have to create new ventures. Some of the new creation does not exist in the bank right now, such as marriage loan and car loan. EXIM bank should innovate some ventures like this in order to capture customers.

• Increase loans and advances in the prospective sectors:

EXIM bank should increase the loans and advances in the prospective field. Some of the services, they provides such as Export Import Bank of Bangladesh Limited can introduce more flexible education loan for the students who are interested in higher education in home and abroad. Because in our country there are so many meritorious students who don’t have enough money for the continuation of higher education. Export Import Bank of Bangladesh Limited can also introduce vacation loan for the people who needs money to enjoy there vacation. They also need money at the time of there vacation to visit different places. Export Import Bank of Bangladesh Limited can also introduce agricultural loan for farmer and for those people who wants to build there carrier in agriculture sector. Agriculture is now a growing sector in our country. Many people want to come in this sector but sometimes they don’t have enough capital to start the business. They can help them by provide loan.

• Upgrade the existing system by using the latest software programs:

They are using different type of software for their daily activities. Because with their manual work process in different area increase faults and it is time consuming. Maximum soft wares’ they are using is back dated. So they have to install the updated version of this software to do the work more efficiently and effectively.

• Increase the promotional activities and develop the R & D:

They have to focus on their promotional activities. Today promotion is one of the main weapon of attracting new customer. Many people don’t have any idea about their new product and services. Research and development department need to be established to find out the present flaws and upcoming threats and opportunities as well as inventing new an easy way to provide better service.

Besides the above, it may conclude the following suggestions & recommendations:

. Those are given n below:

• The bank has no library for its employees. The operational manual of the bank is backdated. It should replaced by a new and timely manual.

• Bank should be innovative and diversified its services. The bank provides any unique service, which can attract new branch provides only conventional services. Even it have failed to create diversify in its type of deposits.

• The decoration of local office is not too much attractive. The customer’s attitude toward the Bank will be more highly if they decorate more in attractive way.

• The office layout should be designed in a way so that, there is no chance of confusing customer. The cash receive section will be totally separated from the cash paying section.

6.2 Conclusion

EXIM Bank is one of the third generation banking service providers, but they need employees to provide prompt service. From the practical implementation of customer dealing procedure during the whole period of my practical orientation in EXIM bank limited I have reached a firm and concrete conclusion in a very confident way. Performance of EXIM Bank Limited during the last five years has proved that with strong desire and will power on achieving whatever target they may have. In this report I find that only in credit risk sector is highly up and downs but other financial risk are not highly ups and down so it can be said that they are effective and efficient in operating and taking the right decision in case of finance. Almost all the leading banks in our country have various extra facilities in offer for the customers in comparison with EXIM Bank but EXIM has succeeded in achieving more customers than many other competitors. This has been possible only because of strong customer relation and excellent customer service. Though there are some drawbacks in implementing Credit facilities in EXIM Bank Limited as per manual, it can be overcome through involvement of more financial expert In the decision making process and utilizing the tolls to judge integrity of the customers, Finally it can be argued that though the results achieved so far are not satisfactory, Credit Financing is a modern scientific technique for enhancing EXIM Bank’s strength and there lies the opportunities to make it more effective in the future for their own benefit.