Executive Summary_____________________________

At present, Consumer Banking is one of the mounting core business units of any competitive bank since consumer banking deals with ample customers and lead generator of significant revenue. For futuristic banking product and services offered by consumer banking, consumer banking is getting momentum day by day. And all banks are trying to aggressively expand the consumer or retail banking division. Major spirit of consumer banking is the consumer deposit and lending product line, customer base, ancillary consumer banking products like debit card and credit card. As far as life style of people is concerned, consumer bank can play a widespread role since consumer banking deals with individuals’ complete life style as well as banking solution.

Beauty and spirit of consumer banking inspired me to decide Consumer Banking as my internship report topic. EBL is one of the fastest growing private commercial banks, which is aggressively moving forward in the arena of consumer banking by rendering super product and service range among huge customer base across the country. EBL already set up some landmarks by introducing ‘ real time online banking, Debit card, Internet Banking, kiosks and sales team for consumer banking.

In this report, four chapters have segregated total analysis. While chapter one demonstrates introduction, scope and limitation of the study, chapter two has shown the overview of EBL comprising history, vision, mission and core business units. Consumer banking scenario of the EBL has been demonstrated in chapter three. Finally finding and conclusion is drafted in chapter five of this report.

Introduction:

I completed this project in Eastern Bank Limited (EBL), one of the largest and reputed Private Commercial Bank in Bangladesh. During this time my instructor, Muhmud zubayer assistant professor Dept of business Administration, East West University assigned me. I was placed in the Head office of EBL, in the Consumer Finance Center. The primary activities carried out by this department include evaluation of the loan applications, preparing necessary documents for the loan’s approval, monitoring the loan after disbursement and ensuring its repayment. While working on this department I found that Consumer Banking at EBL is striving hard to grip the market. From year 2004 to 2005, their deposit growth is 53% and loan growth is 174%. However, to increase the volume is not only the target, they have broad planning for future in the consumer banking sector.

Scope of the study:

This internship report is based on the topic- Analysis of Consumer Credit Scheme – An Overview of Eastern Bank Ltd. During this period, I able to gather practical knowledge about the overall consumer financing procedure of EBL.

The first part of the report gives a synopsis of Eastern Bank Ltd and its operation. Most of the information of this part is gathered from internal source and web site.

Second part will give the overall scenario about the Consumer Banking & Consumer Finance Centre (CFC) and different sort of consumer loan offered by EBL with competitive interest rates.

Third part of the report will give a detailed static of the consumer banking performance in the last year. I have collected this information from the MIS (Management Information System) Dept. I greatly thanked to them in this regard.

And the last part of the report gives an analysis of the current condition of Consumer Banking at EBL with the Porter’s five forces of model.

Objective of the study:

The basic focus of this study is to give a general outlook about the consumer financing position at EBL. However the specific objectives of this report are:

General objective:

– To gain practical job experience and view the application of theoretical knowledge in practical life.

Project objective:

– To present an overview of the Consumer Finance Centre of EBL

– To provide the yearly consumer loan statistics and overall trend of consumer loan.

– To identify the ways to perk up the consumer banking position at EBL.

Methodology:

The first step of this report work was concerned with problem identification and deciding on the topic. This was achieved through consultation with the faculty advisor and the supervisor in EBL. Next the particular objectives of the project were set. Based on these objectives, the necessary data for completion of the project were identified. Next, those internal sources were identified who would be able to provide the necessary information.

After this, the data collection process began. Both primary and secondary sources of information were used for the purpose of this report. The primary sources of information were the concerned officials of EBL. Data were collected from them through face-to-face interview. The sources of secondary information were different publications, board memos and other reports of EBL.

After data collection was complete, the data was analyzed to find out their implications. Data Analysis was done mostly through table and statistical data comparison (frequency, relative frequency). Software like MS- Excel is used to analyze the data and come up with good findings.

Limitation:

• Lack of comprehension of the respondents was the major problem that created much confusion regarding verification of conceptual question.

• Limitation of time was one of the most important factors that languished the present study. Due to time limitation, many aspects could not be discussed in the present study. Due to time constraints, the sample size had to be restricted to 25 only.

• Confidentiality of data was another important barrier that was faced during the conduct of this study. Every organization has their own secrecy that is not revealed to others. While collecting data on EBL’s strategic plan, the personnel did not disclose enough information for the sake of confidentiality of the organization.

• Rush hours and business was another reason that acts as an obstacle while gathering data.

Chapter 2

O V E R V I E W OF E A S T E R N B A N K L I M I T E D

History and Background

The emergence of Eastern Bank Limited in the private sector is an important event in the banking industry of Bangladesh. Eastern Bank Limited started its business as a public limited company on August 8, 1992 with the primary objectives to carry on all kinds of banking business in and outside of Bangladesh and also with a view to safeguard the interest of the depositors of erstwhile BCCI (Bank of Credit and Commerce International (Overseas)) under the Reconstruction Scheme, 1992, framed by Bangladesh Bank.

In 1991, when BCCI had collapsed internationally, the operation of this bank had been closed Bangladesh. After a long discussion with the BCCI employees and taking into consideration the depositors’ interest, Bangladesh Bank then gave permission to form a bank named Eastern Bank Limited which would take over all the assets, cash and liabilities of erstwhile BCCI in Bangladesh, with effect from 16th August 1992. So, it can be said that EBL is a successor of BCCI.

EBL started its business as a scheduled bank with only four branches, which included Principal Branch, Dhaka; Motijheel Branch, Dhaka; Agrabad Branch, Chittagong and Khulna Branch. EBL started its business with a motto to grow as a leader in the banking arena of Bangladesh through better counseling and efficient service to clients. EBL resumed its operational activities initially with an authorized capital of Tk. 1000 million, divided into 10 million shares of Tk. 100 each and paid up capital of Tk. 310 million. The initial shareholders were the NCBs, various govt. agencies, and some of the depositors who had agreed to accept shares in the new bank in lieu of their deposits. The first Board of Directors of EBL constituted under govt. supervision, consisted of 7 directors from various business and professions. Eastern bank Limited was under govt. control until the end of 2000 and therefore, there were lots of deficiencies in the Bank’s management. In 2001, the board of directors brought in new professional management from various foreign banks who have been trying to modernize the bank ever since.

Eastern Bank Limited started the year 2004 with Paid-up Capital stood at Tk. 828 million but the authorized capital remained unchanged at Tk. 1000 million. The general public held 83.42% of its shares while institutional investors held the rest 16.58%. At present, EBL is one of the fastest growing commercial banks in the country & the largest capital based bank in Bangladesh. It has 23 branches (including 1 off-shore banking unit) scattered all over the major cities of the country in major business areas.

Vision:

To become the bank of choice by transforming the way we do business and developing a truly unique financial institution that delivers superior growth and financial performance and be the most recognizable brand in the financial services in Bangladesh.

Mission of EBL:

We will deliver service excellence to all our customers, both internal and external.

We will constantly challenge our systems, procedures and training to maintain a cohesive and professional team in order to achieve service excellence.

We will create an enabling environment and embrace a team based culture where people will excel. We will ensure to maximize shareholder’s value.

Major Achievements of EBL

Kiosk

EBL launched Kiosk in March 2006 and basically kiosk offers mini branch banking facility like 24-hour ATM facility, bills payment for customers, internet banking. Customer service desk serves in kiosk from 8p.m. till 10p.m. Some direct sales officers are also attached with kiosks to take care of business sourcing part.

Real time online banking

EBL is the pioneer Bank in laying foundation to the world class banking software in Bangladesh. No other private Banks in Bangladesh could implement foreign banking software with success in the past.

Flexcube@ is the Internet banking solution that delivers the Corporate, Consumer and Investment Banking products to bank’s customers over the Net. Our Internet Banking module is a secure, robust and extensible web banking solution. It is anchored on a reusable component framework that complies with industry standards. Conceived specifically to exploit the potential of the web, our new banking platform delivers a modular solution addressing Consumer, Corporate and Investment Banking. Customers will be able to transfer funds, inquire balance, request for chequebook, pay utility bills on-line etc.

Internet Banking

EBL made a milestone in the banking arena by introducing the internet banking for the first time in Bangladesh. Internet banking application addresses the needs of small, individual and corporate account holders of the bank. This application provides a comprehensive range of banking services that enable the customer to meet most of their banking requirements over the Net. Transactions that can be executed through net are Account Operations and Inquiries, Fund Transfers and Payments, Utility Bill Payment, Deposits, Loans, Inquiries and other services.

EBL Visa Electron Debit Card

EBL is the first bank in the country to introduce debit card. This is a new addition to banking services, so that our customers can have access to cash anytime and shop by swiping this card in all VISA POS (Point of Sales)

Core Business Units of EBL:

Consumer Banking

Corporate Banking

SME banking

Treasury

Consumer Banking

EBL Consumer Banking deals with the day-to-day financial wants of the consumer clients. Consumer banking products are designed keeping in mind the financial necessities and affordability of the clients. The new IT platform of EBL has enabled its Consumer Banking to offer world class and comprehensive range of financial products and services. These have been fashioned in a manner to fulfill the clients’ banking needs with dedicated Relationship Managers who are reaching out to the customers to make sure that the job is done in a systematic manner within the client’s time frame. And with Internet banking service, customers can now access the accounts and services at the click of 0mouse.

Corporate Banking

Corporate Banking is an integrated specialized area of the Bank, which addresses the diverse financial needs of Corporate Customers.

SME Banking

SME Banking is an integrated specialized area of the Bank which addresses the diverse financial needs of small and medium business houses.

Treasury

Treasury unit is a Core banking unit with its leading-edge technology and steadily growing volume of activity in the markets, EBL’s treasury unit and currency dealing desks have consolidated its position as a well-known and well established counterpart in the newly transformed Free Floating rate, dealing daily with a wide circle of both bank and non-bank customers all over Bangladesh. Our everyday business evolves around participation in Money Market & Foreign Exchange Market in a substantial volume.

Management Aspects:

Like any other business organization, the top management makes all the major decisions in EBL. The board of directors being at the highest level of organizational structure plays an important role in policy formulation. The board of directors is not directly concerned with the day-to-day operation of bank. They have delegated this duty to the management committee. The board mainly establishes the objectives and policies of the bank. There are three (3) committee of the board for different purposes:

1. Executive committee comprising of 7 members of the board;

2. Committee of the board for Administrative matter,

3. Committee to examine Bad Loan Cases.

The Chief Executive Officer (CEO), who is assisted by 3 Executive Vice Presidents (EVPs), looks after the day-to-day affairs of the Bank. Human Resource Department, MDs Secretariat and Audit and Compliance Department are under direct control of the CEO. The three EVPs are in charge of Operations, Credit and Corporate Banking respectively. They control the affairs of these departments through the managers who are in charge of various departments under these divisions.

Mid and lower level employees get the direction and instruction from the top executives about the duties and tasks they have to perform. Management of Eastern Bank Ltd. assumes that employees are members of the team, who actively participate in accomplishing the organization goal. The chief executive provides the guideline and broad direction to the managers and employees but delegates’ responsibility for determining how tasks and goals are to be accomplished.

Divisions:

All policy formulations and subsequent executions are done in the Head Office. It comprises of nine major divisions namely Corporate Banking Division, Credit Division, Consumer Banking Division, Trade Services Division, International Division, Finance and Accounts Division, Human Resources Division, Information Technology Division, and Audit and Compliance Division. Besides these main divisions, there is also an Administration Division, which looks after the Bank’s day–to-day operation

Business Network of EBL

EBL operates through a network of 22 branches around the country. 10 of those branches are located in Dhaka, 5 in Chittagong and 3 in Sylhet & rest in other 4 commercially important cities (Khulna, Bogra, Rajshahi & Jessore).

See in the next page –

Chapter 3

C O N S U M E R B A N K I N G A T

E A S T E R N B A N K L T D.

About Consumer Banking:

Consumer Banking at EBL is to serve individual customer throughout every stage of their life stage. Consumer banking is considered to the front officers of the bank, which interfaces with the customers.These activities are being carried out through the 22 branches. Previously these branches used to conduct all kind of business activities, including processing credit issue, conducting trade service, consumer service etc. But after the restructuring process, all these branches are now mainly focusing only on delivering service to individual and corporate customers and are therefore termed as “Sales & Services Centers”.

Consumer banking products are designed keeping in mind the financial necessities and affordability of the clients. The new IT platform of EBL has enabled its Consumer Banking to offer world class and comprehensive range of financial products and services. These have been fashioned in a manner to fulfill the clients’ banking needs with dedicated Relationship Managers who are reaching out to the customers to make sure that the job is done in a systematic manner within the clients time frame. However, EBL has decided to give more focus on consumer banking and is developing modern delivery channels like ATMs, tele-banking, internet banking, debit cards, etc. and many other new consumer products and services to meet specific financial demands of the customers as well as to make their life easy & convenient.

The broad functions of this division are:

Settlement of accounts

Building strong relationship with individual customers

Identifying individual needs of the customers and thus helping design products that will meet their needs.

Providing locker services

Providing ancillary services

Competitive Strength of Consumer Banking Division:

Competitive strengths are as follows:

Real time online banking

Debit Card

Internet Banking

Large branch network across Bangladesh (in all major cities)

Experienced consumer banking team with considerable exposure from global leaders in consumer banking

Smart Student

Student File: Eastern Bank has launched new services for the students who are going abroad by remitting the money for education purposes. Eastern Bank has introduced these services for the first time in Bangladesh.

This services has exceptional features:

Lower fees for file opening.

Interested student can apply for studies.

This service is available in Gulshan, Shantinagar Agrabad.

Real time online banking:

EBL is the pioneer Bank in laying foundation to the world class banking software in Bangladesh. No other private Banks in Bangladesh could implement foreign banking software with success in the past. EBL provides the following services to its clients through real time online banking:

Anywhere 24 hours X 7 days banking

Internet banking, Tele banking and ATM/POS

Significantly reduced time in banking transactions

Sophisticated Customer Information at the fingertips and can be provided anytime

Online Inter-branch Transfer

Any Branch Pay Order System

Digital Signature/Photo image while transacting

Display Customers Balance, Transactions, Statements online

Automatic Sweep in & out

Internet Banking:

EBL made a milestone in the banking arena by introducing the internet banking for the first time in Bangladesh. Internet banking application addresses the needs of small, individual and corporate account holders of the bank. This application provides a comprehensive range of banking services that enable the customer to meet most of their banking requirements over the Net.

Facilities of Internet Banking:

Account Operations and Inquiries

Fund Transfers and Payments

Utility Bill Payment

Deposits

Loans

Inquiries and other services

Session Summary

EBL Visa Electron Debit Card

EBL is the first bank in the country to introduce debit card. This is a new addition to banking services, so that our customers can have access to cash anytime and shop by swiping this card in all VISA POS (Point of Sales).

Market analysis shows the following viable deposit and loan market size for consumer clients. Only 20% of deposit market size and 14% of total consumer loan market size has been occupied. So still ample share of both consumer deposit and consumer loan market is remaining.

Main Elements of Business Strategy:

Designing product wise consumer budget and action plan:

All branches or sales & Service centers are provided product wise and month wise budget and action plan of different customer’s events. These are monitored and tracked regularly.

Introducing Contemporary product and Kiosk or booth:

Introducing contemporary product line for different target group like executives, housewives, students of private varsities which EBL is going to do soon will assure robust sales volume. Kiosk or mini booth (total 5 in 2005) will be set up in busy Dhaka areas and that will introduce a new model of banking in Bangladesh.

We will offer Internet Banking, ATM, and Bills Pay services plus loan and deposit account application sourcing at those kiosks.

Designing Hunting Team/ Direct Sales Team

EBL already has 150 commission pay based direct sales agents in its team whose only responsibility is sales.

At EBL we have also formed “hunter team” in each branch the members of which have clear focus on branch-based sales, while there are separate teams for services.

Training and Motivation for Direct Sales Team

Embrace Direct Sales and support Direct Sales. Know they hold the key to your growth

Two Customers Events per Month in the Branch Level

Currently we are ensuring minimum two customers events are conducted inside/outside branch per month going by the net relationship value (NRV) of the customers. We believe in the strength of micro marketing, which is a totally new concept in the banking industry of Bangladesh. So far already 60+ events have been held at EBL branches where some 25 customers attended at each event.

Aggressive Advertisement campaign and aggressive promotion all over the year

EBL has launched aggressive media campaign and street based visibility campaign this year. We are already on air every evening with a premier TV channel in Bangladesh; and have already launched a road based campaign for promoting our technology-based products.

One BRM per week

Currently we are holding one Business Review Meeting per week in consumer banking. This is a very helpful tool for fostering nicer and more effective communication and for tracking progress of business and projects. BRM also helping us to monitor actual time-to-market for our different products and services.

Another major element of our business strategy is to be innovative in the areas of product development and launching. We have very successfully launched EBL Auto Loan which is on time has been able to take the top position in Auto Loan market; and then we have launched EBL Jiban Dhara (Any Purpose Lifestyle Loan) which also, as a product, came out to be different form the existing other products in the market.

The main driver of our business strategy is to be different, to be able to differentiate ourselves form others not according to us, but according to the customers. That is the reason; EBL is planning to launch its ATM and Credit Card business in 2005 in a totally different format in this market.

Future Product Development Plan and promotion program:

We are planning to introduce the following new products for our consumer banking in 2005:

Children Deposit Plan (only for kids)

Evening banking for selected branches

Introducing Partially Secured Loan or EBL Money Maker Loan

EBL Jiban Dhara (Lifestyle Loan; already launched)

Islamic Banking

EBL Freedom Loan (loan for women’s executives and other solvent women)

EBL Homemaker Loan (loan for housewives)

EBL Travel Loan

Special deposit for private university students, and housewives

SMS banking through mobile phone

Credit Card (Visa and / or Amex)

15 ATMs – solely EBL’s ATMs, not under any consortium arrangement

Mall branding (week long visibility driven show at super market / mega mall floors)

Promotion is the vital marketing mix element that helps to occupy a place in the customers’ mind. We are thinking of launching the followings to give our brand equity a jolt:

Campaign for Private University Students: As we are aware that 52 private varsities are there in Bangladesh, the students of which go abroad regularly for higher studies. We want to launch “Student File” program for these students, which will give us good opportunity of fee and FX earnings. We want to offer them also savings account, debit card and Internet banking though normal channels plus kiosks.

Kids Day: We plan to celebrate kid’s day on a certain Friday, both in Dhaka and in Chittagong. Kids of English medium schools along with their guardians will be invited in the program. Drawing or game contest will take place. Top performers will be awarded with bank’s logo pasted school bags.

Mobile Loan Hut: Mobile sales booth or loan hut will be set up at Bashaudnara City, the largest mega mall in Dhaka.

Following is our desired mix of advertising/promotion sources:

| Key Area | Location | Proportion |

| Newspaper | Daily Star, Prothom Alo | 40% |

| Billboard | Shopping Mall, Busy Highway | 30% |

| Internet | Quiz contest at Bank website | 5% |

| Magazines | Fortnightly Bengali Magazines | 5% |

| Client’s evening every month | All valued Clients | 20% |

| Electronic media | Channel i news (EBL break) |

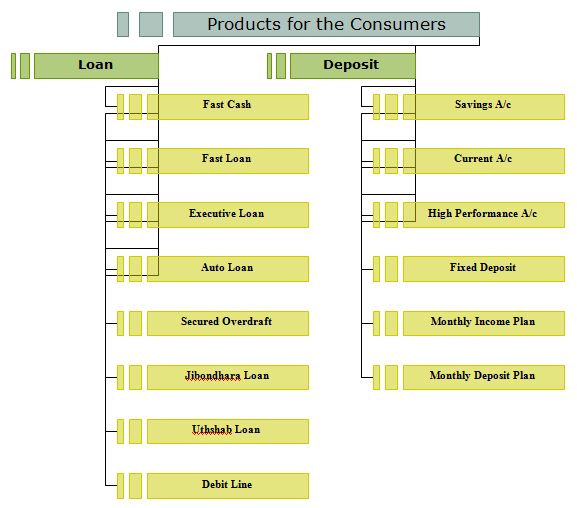

Products offered by EBL for the consumers:

EBL Consumer Banking

Eastern bank provide very productive consumer banking service. Eastern bank’s consumer banking based on several types of loan product & Deposit product. Their loan product is much more adoptable. So peoples are showing better response to purchase this loan product. We ask some question about consumer banking service of EBL to client of EBL what is their opinion most client answer is they are happy.

EBL Consumer Banking (Loan product) List

EBL Jibandhara loan.

EBL Home loan.

EBL fast loan.

Executive loan.

Auto loan.

Travel loan.

Personal loan.

EBL education finance pack.

EBL Jibandhara Loan

Loan Amount ranges from BDT 50,000 to BDT 1,000,000 ( or 12 times of gross salary, whichever is lower).

Repayment tenure of 12, 24, 36, 48 or 60 months.

Payment option available starting after

minimum 6 months of disbursement of loan.

Early full and final settlement allowed.

No security required.

No hidden charges.

Age: Minimum 22 years, Maximum 60 Years.

Professional Experience:

Salaried Executives: 1 year of experience

self employed Professionals: 2 years of experience.

Minimum monthly income:

Salaried Executives: minimum BDT 15,000 / month

Self employed Professionals: minimum BDT 20,000 / month.

EBL Home Loan

EBL introduces the most convenient & practical Home Loan that suits your all home financing needs. Let it be for apartment purchase, home construction, extension or renovation – EBL is here with the ultimate solution for you. With so many attractive features in it – the home you wanted to buy, or to extend the existing one or renovate the same is no longer a distant dream.

Loan amount BDT 500,000 – 75,00,000 or 50 times of applicant’s Gross Monthly Income, whichever is lower

Repayment tenure 3 years to 20 years.

Attractive Interest rates based on loan amount:

Loan Amount Interest Rate

BDT 5 Lac to 15 Lac 14.00%

BDT 15 Lac+ to 25 Lac 14.25%

BDT 25 Lac+ to 40 Lac 14.50%

BDT 40 Lac+ to 75 Lac 15.00%

Source: EBL website

Loan Take-over facility with attractive interest rate option (1% less than existing other Home Loan but not less than 13.5% per annum).

Processing fee – 1.25% of the loan amount for the fresh applicants and 0% for the take-over loans.

Loan up to 80% of the property value

Advance/Partial Prepayment – Anytime and any amount payment facility available, fee is 1% of the Advance/Partial Prepayment amount.

Additional Loan Top up facility available.

Bangladeshi citizen within age range 22 Years – 57 years.

Length of Service/Business:

Salaried Executives: Minimum 3 year of experience with 6 month permanent employment with present employer; Contractual Employees of Supranational Organizations, international development organizations & Donor agencies e.g. WHO, FAO, UNDP, CARE etc. will be eligible subject to 1. minimum length of service 5 years 2. contract renewed at least twice.

Professionals: Minimum 3 year of practice in the profession.

Businessman: Minimum 3 years of involvement in business.

Minimum Income for Individual :

BDT 25,000/- per month for Salaried Executives.

BDT 40,000/- per month for Self Employed and others.

BDT 50,000/- per month for Businessmen.

Joint Applicant – Spouse and immediate family members (father, mother, son, daughter, brother & sister)

Total Income for Principal and Joint Applicants:

BDT 30,000/- per month for Salaried Executives.

BDT 50,000/- per month for Self Employed, Businessmen and Others.

EBL Fast Loan

Revolving credit facility.

Pre-determined amount of credit from your current account.

Interest charged only for the amount you have drawn.

Interest charged on quarterly basis.

Repayment at anytime during the stipulated period.

Option of renewal at your request.

Any individual having an FD or other securities like Wage Earner’s Bond, ICB unit certificate etc is eligible to apply.

EBL executive Loan

Loan amount ranging from minimum BDT 50,000 to maximum BDT 1,000,000 or 6 times of gross salary, whichever is lower (in case of govt. officials, the loan amount starts from BDT 30,000).

Repayment tenure of 12,24 or 36 months.

Early full and final settlement allowed.

Any Salaried Executive can apply for the loan.

Age : Minimum 23 years, Maximum 60 Years.

Professional Experience:

5 years of experience with minimum 2 years of continous employment with curre3nt employer.

Minimum monthly income:

BDT Tk. 15,000 for Executives of any private organization

BDT Tk. 10,000 for government officials.

Loan Amount | No. of installments | |||

12 | 24 | 36 | ||

50,000 | 4,513 | 2,425 | 1,734 | |

100,000 | 9,026 | 4,849 | 3,467 | |

200,000 | 18,052 | 9,698 | 6,934 | |

300,000 | 27,078 | 14,546 | 10,400 | |

500,000 | 45,130 | 24,244 | 17,333 | |

750,000 | 67,694 | 36,365 | 25,999 | |

1,000,000 | 90,259 | 48,487 | 34,666 | |

*Conditions apply

Source: EBL website

EBL Auto loan

Loan amount ranges from BDT 350,000 to BDT 2,000,000 (upto 100% for brand new car and 70% for reconditional car).

Competitive interest rates.

Repayment tenure of 12,24,36,48 or 60 months.

You have the option of pre-paying your loan after a minimum of 6 months of loan disbursement.

Early full and final settlement allowed.

Age : Minimum 22 years, Maximum 60 Years.

Professional Experience:

Salaried Executives: 3 year of experience

Self employed Professional: 2 years practice.

Business: 2 years experience

Minimum monthly income:

Minimum monthly income: BDT Tk. 30,000/month.

Loan Amount | No. of installments | ||||

12 | 24 | 36 | 48 | 60 | |

350,000 | 31,426 | 16,805 | 11,963 | 9,565 | 8,144 |

500,000 | 44,894 | 24,007 | 17,089 | 13,664 | 11,635 |

750,000 | 67,341 | 36,010 | 25,634 | 20,495 | 17,452 |

1,000,000 | 89,788 | 48,013 | 34,178 | 27,327 | 23,269 |

1,500,000 | 134,681 | 72,020 | 51,267 | 40,990 | 34,903 |

2,000,000 | 179,575 | 96,026 | 68,356 | 54,653 | 46,537 |

* Conditions apply

** Customer will bear the insurance charge.

Source: EBL website

EBL Travel Loan

Do you want funds readily available to you whenever you desire to go on a vacation that you plan with family or friend? EBL’s TraveLoan is the answer to your questions

TraveLoan – Secured

Loan amount 90% of the security deposit (EBL FD).

Easy Monthly Installment Repayment – 12 months to 60 months.

Loan amount Tk. 50,000 – Tk. 500,000.

Processing fee – 1% of the loan amount or Tk. 2,000 whichever is higher.

Advance/Partial prepayment allowed.

Loan disbursement directly to Customer Account.

No personal guarantee required

50% processing fee waiver for EBL Dual Currency Credit Cardholder

50% Dual Currency Credit Card Issuance fee waiver for TraveLoan borrowers.

Travel Loan – Unsecured

Loan amount Tk. 50,000 – Tk. 500,000 or 10 times of gross monthly income, whichever is lower.

Loan amount Tk. 50,000 – Tk. 500,000.

Processing fee – 1% of the loan amount or Tk. 2,000 whichever is higher.

Advance/Partial prepayment allowed.

50% processing fee waiver for EBL Dual Currency Credit Cardholder.

50% Dual Currency Credit Card Issuance fee waiver for TraveLoan borrowers.

Disbursement

Secured

Directly to Customer Account with EBL.

Unsecured

Loan less than or equivalent to Tk. 200,000 to Customer Account with EBL.

Loan above Tk. 200,000 – air ticket fee (including co-traveler) to the travel agency through pay order from EBL; 80% of the remaining loan amount through TC/cash foreign currency endorsement from EBL and balance to Customer Account with EBL in cash.

Additional Supporting Documents

Valid Passport Copy (Mandatory)

Valid Visa of traveling country (for unsecured loan only)

Travel Quotation from travel agent (for unsecured loan only)

EBL Parse´Loan

There must have been many occasions when you have had some money and needed some more for some specific purpose. EBL Parseloan is the right Product for you, where you give some and we share the rest with you – making life simple for you.

Any purpose personal loan facility

Loan amount BDT 2,00,000 to BDT 10,00,000 or 12 times of Applicant’s Gross Monthly Income

EMI based loan repayment facility

Repayment Tenure – 12 months to 60 months

Available in two versons:

EBL Parseloan 30 – where you provide 30% of the applied loan amount in the form of EBL FD; for example, if you need Tk. 10 lac loan, then you need to provide BDT 3 lac as security.

EBL Parseloan 50 – where you provide 50% of the applied loan amount in the form of EBL FD; for example, if you need Tk. 10 lac loan, then you need to provide BDT 5 lac as security.

Loan facility for both fresh applications and take-over purpose

Attactive interest on security amount (FD) making the total loan cost minimal.

Attractive Loan Interest Rates:

Particulars | EBL Parseloan 50 | EBL Parseloan 30 |

Annual Interest Rate for Fresh Loan Applicants | 16.5% | 17.5% |

Annual Interest Rate for Take-over Loans | 16% | 17% |

Source: EBL website

Processing Fee:

Fresh Loans: 1% of the loan amount.

Take-over Loans: 0.25% of the loan amount.

Partial Pre-payment and early final settlement options available.

One Personal Guarantor required.

Salaried Executives: Minimum 1 year of service and BDT 15,000 monthly income.

Professionals/Self Employed: Minimum 1 year of experience and BDT 20,000 monthly income.

Businessmen: Minimum 2 years in business and BDT 20,000 monthly income.

EBL Education finance pack

Like planting seeds in fertile soil, giving children the best education now will help them grow to reach their full potential. Many families like yours choose to send children abroad for higher education because you believe this will cultivate your child’s unique skills and talents in a supportive and nurturing environment. And while the cost of this may seem daunting, the benefits will last a lifetime.

At EBL, we’ve developed the Education Finance Pack with three types of loan facilities so that you can select matching your need. Our Education Loan covers the entire cost of your child’s education to help you send your children for higher education abroad. So be it for home or abroad, for your child or for yourself – EBL Education Finance Pack is always beside you.

EduLoan Unsecured – Education Loan without Security Deposit

EMI based loan facility

Maximum loan amount BDT 10,00,000 or 10 times of Gross Monthly Income of the applicant

Loan amount up to 80% of the summation of admission fee, tuition fee, semester fee, other fees as stated by the educational institutions, living/lodging expenses and traveling expense. Total expense estimation needs to be submitted by the applicant with supporting documents.

- Processing fee – 1.5% of the Loan amount

- Repayment tenor : 12 – 60 months

- Advance / partial pre payment is allowed

- Interest Rate: 18%

- Student File services available

- Disbursement:

1. Study in Bangladesh: Initial admission fee & initial semester/tuition fee to be remitted directly to the institutions through Pay Order.

2. Study Abroad: Initial admission and initial semester/tuition to be remitted abroad through EBL Smart Student File. Payment for traveling expenses to be reimbursed through Pay Order favoring the travel agent.

EduLoan Secured – Education Loan with Security Deposit

- EMI based loan facility .

- Processing fee – 1% of the Loan amount or BDT 10,000, whichever is higher .

- Loan amount is 95% of the security deposit (EBL FD).

- Repayment tenor : 12 – 60 months.

- Advance / partial pre payment is allowed.

- Within same day processing.

- No personal guarantee required.

- Interest Rate: FD+3%

- Student File services available.

EduLine – Credit Facility against Security Deposit

- Loan amount is 95% of the security deposit.

- Advance / partial pre payment is allowed.

- Interest against utilization only.

- Within same day processing

- Processing fee – 1% of the Loan amount or Tk. 2,000, whichever is higher.

- No personal guarantee required.

- Interest Rate: FD+3%.

- Student File services available.

EBL Consumer Banking

Eastern bank provide very productive consumer banking service. Eastern bank’s consumer banking based on several types of loan product & Deposit product. Their deposit product is much enjoyable. So peoples are showing better response to deposit their valued money to EBL. Because EBL provided all interest is better then another commercial bank of Bangladesh. When we discuss some client why you deposit your money here? Their blooming face is the answer of better customer service. So they come here or deposit money here.

EBL Consumer Banking (Deposit Product) List

EBL Interesting account.

EBL Campus account.

EBL High performance account.

EBL Repeat.

EBL confidence.

EBL Interesting Account

Interest calculated on daily balance.

Interest is credited to your account every month.

Competitive interest rate.

Unlimited cash withdrawal.

Available in all EBL Branches.

No extra terms and conditions.

Minimum Age: 18 years.

Citizen of Bangladesh.

EBL Campus Account

EBL Campus – first time in Bangladesh a tailor made banking pack for students.

Campus Account : Under “EBL Campus”, yet another wonderful product that directly takes you into the rewarding world of general banking. It’s your very own, very special savings account with no hidden charges or restrictions, while giving you very attractive interest on daily balance, Plus a super-smart plastic in your wallet!

InterInterest calculated on the basis of daily balance.

Interest bearing deposit account.

No hidden charges or restrictions apply with regard to interest payment.

No standing in bank branch queues for withdrawal of money.

Leads you into the smart … modern world of electronic banking- ATMs, POS terminals, Kiosks etc.

You need to be a student.

Minimum age 18 years.

Valid identification document (generally student ID Card) required for opening the account.

EBL High Performance Account

EBL high performance account is committed to make a difference. You will see your money grow everyday. This account has the security and growth of a Savings account as well as the convenience of a current account-making things easier for you.

Interest calculated on a daily balance.

Minimum balance required: BDT 20,000.

Unlimited cash withdrawal.

Highest interest rate compared to other similar accounts.

Available in all branches of EBL.

No extra terms and conditions apply.

Interest is paid twice a year.

Minimum age: 18 years.

Citizen of Bangladesh.

EBL Repeat

Under this scheme, minimum principal amount is Tk. 100,000 (Taka One Lac Only). There is no maximum principal amount limit. Accounts in multiple of Tk. 100,000 (Taka One Lac Only) can be opened.

EBL repeat must be kept for a term of 1 year (12 Months)/ 2 Years (24 Months) / 3 years (36 Months).

EBL Repeat can be opened by EBL Account Holders only.

All payments, principal & interest, shall be paid to the above specified EBL Account only.

In case of premature closure, interest will be paid as per the following table:

| Product | No Interest | Interest Rate |

| EBL Repeat – 1 Year | In encashed before 3 Months on interest will be paid | If encashed after 3 months, interest will be as per prevailing savings account rate |

| EBL Repeat – 2 Years & 3 Years | If encashed before 6 months, no interest will be paid | If encashed after 6 months, interest will be as per prevailing saving account rate |

Source: EBL website

In case of early encashment for any of the above tenor, prepaid interest in FD rate will be adjusted from “EBL Repeat” principal amount.

Depositor has to pay income tax or any other tax the government may fix from time to time, as applicable.

A system-generated advice will be provided to the depositor which is non – transferable.

If there is any loan in the name of the depositor(s) with EBL, then EBL shall have the right to adjust the loan amount from the deposit, which has been deposited by the Account Holder under the scheme of EBL Repeat.

EBL Repeat Account Holders may take OD facility against EBL Repeat account (maximum 90% of the value).

Unless prior written notice is received by the Bank, the Bank will automatically renew the deposit for the same period on the maturity date at the prevailing rate of interest.

As per present deposit rate, EBL Repeat monthly interest are:

EBL Confidence

The name of the scheme is “EBL Confidence”

Any citizen of Bangladesh can open this account. This account can be opened in the name of an individual only.

Under the scheme account(s) can be opened for a period of 3 (36 Monthly Installments) / 5 (60 Monthly Installments) / 7 (84 monthly installments) / 10 (120 Monthly Installments) years in any denomination at multiple of Tk. 500.00 per month but not exceeding Tk. 20,000.00 per month.

Depositor can choose any denomination of deposit per month at the time of opening the scheme, which cannot be changed later on.

The rates of interest are: for 3 years: 9.00% per annum; for 5 years: 9.50% per annum; for 7 years: 10.00% per annum; for 10 years: 10.50% per annum.

Any benefit from EBL confidence mat come under purview of Income Tax of any other levy as decided by the government of Bangladesh.

Monthly installments will be automatically realized from the Customer’s Personal EVL account linked with EBL Confidence.

Deduction of the monthly installments will start from the day of opening EBL Confidence and all subsequent installments will be deducted on the same day of following months. Sufficing available/cleared fund must be kept in the linked account on or within next three days of due date to collect the deposits.

If sufficient balance (full value of installment) is not available in the corresponding account for realizing monthly installment in time, Account Holder will have to pay @ 2% on the installment arrear(s) as penalty.

In the event of failure to pay monthly installment(s) on or within next three days of the due date, it will be the sole responsibility of the EBL confidence Account Holder to settle the arrear installment(s) before or along with the next deposit due through a written instruction to EBL.

If any monthly installment remains unpaid for four consecutive months, the account will be closed automatically.

In case of premature closure of the account Tk. 300 (Taka three Hundred Only) will be charged as closing charge.

In case of premature closure, the following will be applicable;

1. Less than 1 year: self deposited amount without interest;

2. More than 1 year but less than 3 years: self deposited amount plus interest @ prevailing savings account interest rate;

3. More than 3 years but less than 5 years: matured value of 3 years plus interest @ prevailing savings account interest rate on self deposited amount for fraction period;

4. More than 5 years but less than 7 years: matured value of 5 years plus interest @ prevailing savings Account interest rate on self deposited amount for fraction period;

5. More than 7 years but less than 10 years: matured value of 7 years plus interest @ prevailing savings account interest rate on self deposited amount for fraction period.

If there is any loan in the name of the depositor with EBL, then EBL holds the right to adjust the loan amount from the deposit which has been deposited by the by the EBL confidence Account Holder for deposit under the scheme of EBL Confidence.

EBL Confidence depositor(s) can take 90% OD facility against deposited amount at bank’s prevailing lending rate after at least two years of this scheme.

These terms and conditions shall be governed by and construed in accordance with the laws of Bangladesh and the customer and the Bank is hereby irrevocably submit to the non-exclusive jurisdiction of the Courts of Bangladesh.

EBL reserved the right to change/alter/ratify the terms and conditions at any time without prior notice.

Maturity Value Table | ||||

Installment Amount | 3 years | 5 years | 7 years | 10 years |

Tk. 500 | Tk. 20,730 | Tk. 38,513 | Tk. 60,979 | Tk. 1,06,329 |

Tk. 1,000 | Tk. 41,461 | Tk. 77,027 | Tk. 1,21,958 | Tk. 2,12,659 |

Tk. 2,000 | Tk. 82,922 | Tk. 1,54,054 | Tk. 2,43,916 | Tk. 4,25,318 |

Tk. 5,000 | Tk. 2,07,306 | Tk. 3,85,136 | Tk. 6,09,791 | Tk. 10,63,297 |

Tk. 10,000 | Tk. 4,14,613 | Tk. 7,70,272 | Tk. 12,19,583 | Tk. 21,26,594 |

Tk. 20,000 | Tk. 8,29,227 | Tk. 15,40,545 | Tk. 24,39,166 | Tk. 42,53,188 |

Source: EBL website

EBL Cards product

In Bangladesh most of the bank providing card service EBL not laggard. EBL has three cards product

EBL simple credit card.

Life style card.

Cool card.

EBL card service based on qualified financial service to customer. EBL connect to largest ATM service network Q-cash. And all most all PSO station except EBL card. EBL card has no any hidden charges. EBL cool card and Life style card is a debit card. But it is like prepaid card any one can purchase this card with open account in bank, just reload ad use this card. Another commercial bank in Bangladesh takes huge charge for card service. But EBL debit card & credit has no yearly charges. In the life time of the card pay only one time its service charges. For enjoy this facilities or service peoples like EBL.

The main advantage of EBL Card’s

A global branded VISA Electron Debit Card tagged with Campus Accolunt maintained at EBL

Round the clock access to a large ATM network (over 85 Q-Cash & VISA ATMs within Bangladesh) and a larger network of POS terminals at different shops

Discount on purchases available from many retail outlets/shops

EBL Simple credit card

Welcome to EBL World of Credit Cards!

Introducing EBL SIMPLE Credit Cards. The first of its kind, a complete Credit Card with every benefit possible, and still offering you something extra. At work or leisure, experience the convenience of a Card that does everything with style and honesty.

When you become a member of EBL SIMPLE Card Services family, you become a part of an exclusive club – entitled to first class financial advice, priority treatment and a growing range of courtesy services.

We understand the value of your money. That is why we aim to give you the highest benefit at a minimum cost. Choose the card type that matches your requirement and experience the difference.

Features at a glance

One time Fee, Lifetime Free

Owning a Credit Card is a basic right of a Qualified Financial Services Consumer – and there is no strong reason to pay fee every year for that right.

At EBL, we have shown respect to this concept. To avail EBL Credit Card services, you need to pay the Issuance/Joining/Subscription/ Annual Fee only once. After that there is no annual fee for you as long as you transact at least 18 times in a whole year.

It is a lifetime Card. As per market standard, an average cardholder uses his/her card almost 24 times annually. So, without doing anything extra – you can have the free renewal option – for the following year.

EBL lifestyle Card

EBL Campus – fist time in Bangladesh a tailor made banking pack for students.

LifeStyle Card – Under “EBL Campus” it’s another brilliant offering- a solid, internationally branded prepaid card that suits the lifestyle of students. The best way to not only make a fashion statement, but also to control your spending all in style. Reload and use only when you need to.

And rest asured about the safety & security that the VISA logo vouches for!

A global branded VISA prepaid card

Reloadable

Round the clock access to large ATM network (over 85 Q-cash & VISA ATMs within Bangladesh) and a large network of POS terminals at different shops

Discount on purchases available from many retail shops/outlets

Having a bank account with EBL is not required

Minimum age: 18 years

EBL Campus Cool card

EBL Campus – fist time in Bangladesh a tailor made banking pack for students

Cool Card – Under “EBL Campus”, it’s another fantastic offering- the perfect vehicle for doing away with the hassles of carrying cash around. This VISA Electron Debit Card- specially designed for students- is not just a piece of super- smart plastic, it’s much more. It’s freedom,

ease, order, safety & style- all put together fashion!in a cool, cool

A global branded VISA Electron Debit Card tagged with Campus Accolunt maintained at EBL

Round the clock access to a large ATM network (over 85 Q-Cash & VISA ATMs within Bangladesh) and a larger network of POS terminals at different shops

Discount on purchases available from many retail outlets/shops

Cheaper than EBL VISA Election Debit Card (available for general customers)

You need to be a student

You need to have an EBL Campus Account opened with EBL

Minimum age: 18 years

EBL SME Banking

EBL has six comfortable SME products this very product much more comfort to small business proprietors because of its lower interest rate. SME holders easily can adobe to this loan. Below show EBL most popular SME product Agami. EBL another SME product is

EBL Uddag.

EBL Asha.

EBL Asha.

EBL Puje.

EBL shubidha.

EBL Mukti.

EBL Bannijoy.

In Bangladesh all most all banks provide SME banking service. They want to sale their SME product. But their objective is only maximizing business their business. But EBL also maximizing as well as they want to promote small business and industry sector. Because EBL believe that SME sector is a weapon of developing the economy.

EBL Agrim

Any legal business purpose, loan facility minimum BDT 200,000 – maximum BDT 950,000.

No collateral security required.

Loan tenure 1 month to 6 months.

Single shot payment at maturity but interest will be realized on monthly basis.

Partial payment and early payment allowed- no additional fee required

Any successful enterprise with minimum two years in same or relevant business can apply for the loan.

Business cash flow to support the proposed loan in one shot.

Business cash flow to support the proposed loan in one shot.

Necessary documents of business required.

Bank account in the name of the enterprise or entrepreneurs.

EBL IT Based Service

Internet Banking: EBL provide internet banking service. So a customer he can deposit or draw his money any branches in Bangladesh. EBL internet banking is completely different from others.

SMS Banking: EBL also introduce SMS banking by sending SMS customer can easily find his expected information without consume much time.

Phone Banking: EBL phone banking really better service then another local commercial bank always phone to customer.

Call Centre: EBL also provide call centre service customers are happy to get this sort service any time customer gets their account related information.

24-hour Cards Center: The EBL 24-hour Cards Center is equipped with a state-of-the-art system that ensures your queries being handled efficiently and promptly. For any card-related query or information, all you need to do is dial 9571760 or 9571775 Ext. 120/130.

SWIFT Service: By using SWIFT code EBL world wide transfer fund or received fun with in few minutes. The NRB are very happy for this service.

EBL in future introduce many 3rd generation services and some service is now pipeline near feature they introduce this service.

EBL provided service is very common many bank provide this service but EBL service is fulfill their needs so customers are happy and they come again and again. For EBL IT based better service.

Consumer Finance Centre:

Consumer Finance Center (CFC) is the centralized department for evaluating credit risk in consumer lending. The department is consist of a team of people to identify, analyze, measure and manage risk related to consumer credit.

Due to the asymmetric information and moral hazard, banks have to suffer a lot due to the bad loans and advances, which weakens the financial soundness of the bank. If the selection of borrower is correct, that is, the borrower is of good character, capital and capacity or of reliability, resourceful and responsible; the bank can easily get the return from the lending. CFC made this monitoring much more easier. LAP comes from 22 branches of EBL in CFC. Based on their detailed investigation and analysis higher authority approved or declined the loan applications. So that chance of bad loans lessens.

All unsecured retail loans will be processed, monitored and managed by the Consumer Finance Center. Each loan application after recommendation from Officer Lending Support will be approved/ declined by higher authority at Consumer Finance Center

Credit Approval Procedure:

Studying past track record: After getting an application for a loan, an EBL Official studies the past track record of the applicant. Generally the study includes,

Account balances and the past transactions.

Credit report from other banks.

Information of the Industry by studying market feasibility.

Financial statements (balance sheet, cash flow statement, and income statement). If the borrower is a sole- proprietor, then the single entry accounting treatment is converted to double entry system.

Report from Credit Information Bureau of Bangladesh Bank if the amount is more than TK.10 lac.

Borrower analysis: Borrower analysis is done from the angle of 3-C (character, capital, capacity) or 3-R (reliability, resourcefulness, responsibility). It follows that the bank forms a rational judgment about the integrity of the borrower, which should be undoubted. The human skill, conceptual skill, operational skill is qualitatively analyzed.

Business analysis: Business analysis is done from two angles-terms and conditions and collateral securities.

Monitoring Process in Consumer Banking:

Consumers are all individuals, professionals, housewives, doctors, and engineers, etc and high net worth individuals.

Monitoring of consumer Banking is one by “Sales and Service center.” They keep record of all the documents. If there is any exception, they monitor it and send it to the clients and request it to adjust it. Head Office credit risk management finally monitors all branches consumer banking by using Management Information System (MIS). Eastern Bank Limited give maximum emphasis on Consumer Banking.

Chapter 4

COMPARATIVE PRODUCT OF CONSUMER BANKING

Consumer Banking : Comparative Product Analysis

With Focus on:

Consumer Deposit and Loan Market Size

Strength of Principal Competitors

Comparative Analysis of Consumer Deposit

Comparative Analysis of Consumer lending

Consumer Deposits and Loans-Market Size:

Market analysis shows the following viable deposit and loan market size for consumer clients. Only 29% of deposit market size and 33% of total consumer loan market size has been occupied. So still ample share of both consumer deposit and consumer loan market is remaining.

Market analysis – 4 cities (Dhaka, Ctg, Khulna, Sylhet)

| Area | Volume |

| Total target urban household | 7.5 lacs |

| Avg. household size | 4.8 persons |

| Avg. income per household | Tk 175,000 monthly |

| Total target deposit customers – top end | 8 lacs |

| Total target deposit customers – Salaried | 18 lacs |

| Consumer deposit market size | Tk 21,000 crore |

| Total target consumer loan customers | 26 lacs |

| Consumer loan market size | Tk 16,000 crore |

| Current deposit volume –

| Tk 6,436 crore (30.64% of Tk 21,000 crore market) |

| Current loan outstanding | Tk 5,200 crore (33% of Tk 16,000 crore market) |

Market for consumer lending:

According to the statistics and market research papers available, the consumer lending market in Bangladesh has a size of BDT 160 billion whereas loan outstanding as of September 30, 2005 as per Scheduled Bank Statistics of Bangladesh Bank is around BDT 52 billion (Categorized under: Advances for professional services, Flat purchase, Consumer Goods, purchase through credit cards, educational expenses etc). This indicates that only 32% of the market has been realized by the financial institutions. So the remaining 68% of the market holds true potential for the loan giving institutions. We fear that too restrictive and stringent regulations at this embryonic stage of consumer financing will slow the market growth having adverse impact on the economy as a whole.

Market for consumer deposit:

According to the statistics and market research papers available, the consumer deposit market in Bangladesh has a size of BDT 210 billion whereas loan outstanding as of September 30, 2005 as per Scheduled Bank Statistics of Bangladesh Bank is around BDT 64 billion. This indicates that only 30% of the market has been realized by the financial institutions. So the remaining 70% of the market holds true potential for the deposit mobilizing institutions. Presently, all banks are trying to introduce new consumer deposit product comprising current, savings and monthly savings plan.

Strength of Principal Competitors in consumer business area

| Name of Competitor | Major Strength |

| Standard Chartered Bank |

|

| HSBC |

|

| Eastern Bank Ltd |

|

| BRAC BANK |

|

Comparative Analysis on Deposit Product:

Product Proposition:

Savings Account with ATM card facility

Parameter | SCB | HSBC | EBL | BRAC | Dhaka

| ||

| Name of Product | Savings | Access | Savings Plus | Savings | HPA | Savings | Savings |

| Initial Deposit | 2,00,000 | 20,000 | 5,00,000 | 50,000 | 20,000 | 5,000 | 1,000 |

| Cheque Book | Yes | N.A | Yes | Yes | Yes | Yes | Yes |

| Relationship Fee half yearly | N.A | N.A | N.A | N.A | Tk. 300 | Tk 300 | N.A |

| Balance Maintenance Fee | Tk 575 half yearly | N.A | Tk 300 quarterly | Tk 300 quarterly | N.A | N.A | N.A |

| Rate of Interest | 2.75% -3% | 2.75% to 3% | 4% | 3.75% | 7% | 5.50% | 6% |

| Interest accrual | Monthly | Monthly | Daily | Daily | Daily | Monthly | Monthly |

| Interest Application | Half yearly | Half yearly | Monthly | Half yearly | Half yearly | Half Yearly | Half Yearly |

| Valued Added Service | -Call Center -SMS Banking -E Statement -ATM | -Call Center -SMS Banking -E Statement -ATM | -ATM -Phone Banking -Monthly Statement | -ATM -Phone Banking | -ATM -Internet Banking | -ATM -SMS Banking | ATM |

| Debit Card/ATM Fee | TK 690 | TK 690 ATM card Tk 150 | N/A | N/A | TK 500 | TK 230 | TK 500 |

Product Proposition:

DPS: A monthly savings plan to continue for equal installment up to certain period of time which generates a big return after maturity.

Features | HSBC | HSBC | SCB | BRAC Bank | Dhaka Bank | EBL |

| Name of DPS | My Future | Smart Saver | Monthly Savings | DPS | DPS | MDP |

| Initial Deposit | Tk 10,000 | Tk 50,000 | 10,000 | No | No | No |

| Installment size | 5000 | 1000 | ||||

| Tenor | 1 Year, 2 Year and 3 Year | 3 Year | 3 year 5 year 10 year | 4 Year, 7 Year, 11 Year and 14 Year | 5 Year and 10 Year | 5 Year |

| Rate of Interest * | 6% | 4.75% | 6.50% | 8 % to 9.75% | 9.5% to 10% | 9% |

*Interest is monthly compounding

Product Proposition:

- Monthly Return on Fixed Deposit: A monthly savings plan to continue for equal installment up to certain period of time which generates a big return after maturity.

Parameter | BRAC Bank | Dhaka Bank | Prime Bank

| EBL |

| Name of the product | Abiram | Special Deposit Scheme- Income Unlimited | Monthly Benefit Scheme | MIP |

| Tenor | 1 year , 2 year and 3 year | 3 & 5 Year | 5 year | 3 year |

| Rate of Interest | 12.00% (1 Year) 11.50% (2 Year) 11.50% (3 Year) | 12% | 12% | 10% |

| Customers Monthly Returns for Tk 1 lac | Tk 900 (After Tax Deduction) -1 Year | Tk 900 (After Tax Deduction) | Tk 900 (After Tax Deduction) | Tk 750( after Tax Deduction) |

Comparative Analysis on Consumer Lending Product:

Personal life style loan without any security:

| Category | SCB | HSBC | EBL | BRAC |

| Product Name | Personal Loan | Personal Installment Loan | Jiban Dhara | Life Style Loan |

| Loan Amount | Minimum Tk 50k and Maximum Tk 10 lac or 12 times of gross monthly income which ever is lower | Minimum Tk 50k and Maximum Tk 10 lac or 10 times of gross monthly income whichever is lower | Minimum Tk 50k and Maximum Tk 10 lac or 12 times of gross monthly income which ever is lower | Minimum Tk 50k and Maximum Tk 10 lac or 15 times of gross monthly income whichever is lower |

| Minimum Monthly Income | Tk 12k (For Salaried Executives) Tk 50k (For Self Employed Professionals & Businessperson) | Tk 18k (For Salaried Executives) Tk 50k (For Self Employed Professionals/Business person) | Tk 15k (For Salaried Executives) Tk 20k (For Self Employed Professionals/Business person) | Tk 10k (For Salaried Executives) Tk 25k (For Self Employed Professionals & Business person) |

| Rate of Interest | 19% | 18% | 19% to 20% | 19.95% |

| Processing Fee | 1% | 1% | 1.50% | 2% |

| Target Customers | Self Employed Professionals, Business person & Salaried Executives | Self Employed Professionals, Business person & Salaried Executives | Self Employed Professionals, Business person & Salaried Executives | Salaried Executives, Self Employed Professionals & Businessperson |

CAR LOAN

Category | EBL | SCB | HSBC | BRAC |

| Loan Amount | Minimum Tk 3.5 lac and Maximum Tk 20 lac | Minimum Tk 3 lac and Maximum Tk 20 lac | Minimum Tk 1 lac and Maximum Tk 20 lac | Minimum Tk 3 lac and Maximum Tk 20 lac |

| Minimum Monthly Income | Tk 30,000

| Tk 25,000

| Tk 20,000 | Tk 20,000 |

| Tenor | 12 to 60 month | 12 to 60 months | 12 to 60 months | 12 to 60 months |

| Loan to Value | 70% to 75% | 70% to 75% | 70% to 75% | 100% |

| Rate of Interest | 17%

| 16.00% | 14.50% | 19% |

| Processing Fee | 1% to 1.5% | 1% | 1% | 2% |

Personal loan for salaried executive:

Category | EBL | SCB | HSBC | BRAC |

| Loan Amount | Minimum Tk 50k and Maximum Tk 10 lac or 12 times of gross monthly income whichever is lower | Minimum Tk 50k and Maximum Tk 10 lac or 12 times of gross monthly income which ever is lower | Minimum Tk 50k and Maximum Tk 10 lac or 10 times of gross monthly income whichever is lower | Minimum Tk 50k and Maximum Tk 10 lac or 15 times of gross monthly income whichever is lower |

| Minimum Monthly Income | Tk 12,000 (Govt Officials) Tk 15,000 (Private Organizations) | Tk 12,000

| Tk 18,000 | Tk 12,000 |

| Tenor | 12 to 60 month | 12 to 60 months | 12 to 60 months | 12 to 60 months |

| Rate of Interest | 16% to 18%

| 16.00% to 18.00% | 13.00% to 15.00% | 19.95% |

| Processing Fee | 1% to 1.5% | 1% | 1% | 2% |

| Guarantee Required | Yes (B & C Category) | Yes | No | No |

Chapter 5

F I N D I N G S & C O N C L U S I O N

Findings

Consumer Banking at EBL is the rising part which is striving hard and soul for grapping the market. It offering different new products for attracting the market, providing modern service to the customers, trying to create a brand image in the mind of the customers, making different campaign and promotion program.

Consumer Finance Centre (CFC) is the integrated centre for assessing the risk associated with personal lending. It is totally a new dept in CNB (Consumer Banking) team. Here loan applications are received from the branch and CFC made the total analysis procedure in a very systematic way.

Recently EBL launch a new product named the Debit Line, which is first time in Bangladesh. And the company asserts it as their major products. It offered totally a modern service, which is customers can overdrawn against their debit card if the have the debit line. It offers very competitive interest rate where there is high rate of interest for credit card in the market.

In last part of the report that is the analytical part we observed that there is a huge growth in the deposit and loan side in 2005 though they can not achieve the budget. In 2004 FUM was Tk.728.35 crore and at the end of 2005 it climbs up to Tk.1187.89 crore . 63% growth in consumer banking in 2005.

Recommendations

EBL should take new initiatives to upgrade the product line of consumer banking of brand image of consumer bank.

(1) EBL Should launch women’s banking to cater to banking serine for working women 4 house wife.

(2) FBL should launch priority banking to ensure better service for valued customers.

(3) Bank should entered especial focus in SME banking. Bank should give Bette 4 flexible credit facility to small of middle enterprise.

(4) EBL should arrange frequent tainting for uses team since they are involved in frequent customer calls and direct sales.

Conclusion:

This report serves the purpose of expressing my experience in EBL for three month probation period. As an young professionals i joined this renowned organization with fervor and enthusiasm. It is my great pleasure to have this experience which will guide me through my professional life. Working as an intern in the bank gives one first hand experience in consumer banking at EBL

For maintaining the personal lending, management maintains different techniques that as an internee I experienced directly. The success of consumer banking greatly depend on the sharp rules and regulations, maintaining the CNB team according to their goal and role, providing different modern products and services to the customers, being competitive in the market, providing some unique offer to the customer, creating a brand image , different promotional activity etcThe number of private commercial bank is increasing rapidly. The sector is expanding and it becomes competitive day by day. So consumer banking should provide more inimitable products and services with competitive interest rate to become the bank of choice.

![Internship report on National credit and commerce bank Ltd [ Part-3 ]](https://assignmentpoint.com/wp-content/uploads/2013/03/ncc-bank-200x100.jpg)