Introduction:

Al-Arafah Islami Bank Ltd is a banking company incorporated in the People’s Republic of Bangladesh with limited liability. Islamic ideology encourages us to succeed in life. With the achieving of objective pursuing the way directed by Allah and the path shown by His Rasul (SM), Al-Arafah Islami Bank Ltd was established (registered) as a private limited company on 18 June 1995. The inaugural ceremony took on 27 September 1995. The authorized capital of the Bank is Tk. 2500.00 million and the paid-up capital is Tk. 1153.18 million as on 31.12.2007. Renowned Islamic Scholars and pious businessmen of the country are the sponsors of the Bank. 100% of paid up capital is being owned by indigenous shareholders.

The bank is committed to contribute significantly to the national economy. It has made a position contribution towards the socio-economic development of the country with 53 branches of which 17 is AD throughout the country.

Background:

Bank and financial institution play an important role in financial inter mediation and thereby contribute to the overall growth in the economy. At present the financial system in Bangladesh consists of the central bank, nationalized commercial/specialized banks, private banks, foreign banks and other non-bank financial institution. This report is based on one commercial Bank that is the Al-Arafah Islami Bank Ltd.

Objectives of the Study:

The first objective of preparing this report is to fulfill the partial requirements of the BBA program. In this report, I have attempted to give on overview of Al-Arafah Islami Bank Limited in general. Also in the major part, I have shown the practical approach of Foreign Exchange. Some following objectives of the report are as shown.

To gain or achieve the practical Idea of banking System of AIBL.

To explain the general banking activities of AIBL.

To identify the problems of AIBL prevailing in its banking system

To suggest some possible recommendations to overcome the problems.

Methodology of the study:

This report is based on exploratory research. Because, to make SWOT analysis, Findings, Ratio analysis I required to investigate on various sources.

In order to make the report more meaningful and presentable two sources of data and information have been used widely

‘’The primary sources’’ which are as follows

- Face-to-face conversation with the Executives and officers of Bank.

- Informal conversation with the client.

- Practical work exposures from the different desks of the various departments of the Branch covered.

- Relevant file study as provided by the officer’s concerned.

‘’The Secondary Sources’’ of data and information are:

- Annual Report of Al-Arafah Islami Bank Ltd.

- Periodicals published by Bangladesh Bank.

- Various books, articles, compilations etc. Regarding general banking functions.

Data Collection Method:

Scope of the report:

The scope of the organizational part covers the organizational structure, background, and objectives, functional, departmental and Business performance of AIBL as a whole and the main part covers foreign exchange department of AIBL.

Importance of the study

To identify the problem of AIBL.

To achieve practical knowledge of banking side of AIBL.

To observe interrelated activities of foreign exchange department of AIBL.

To gain practical knowledge about over all banking system & especially foreign exchange sector.

Limitations:

Objective of the practical orientation program is to have practical exposure for the students. My tenure was for twelve weeks only, which was somehow not sufficient. After working whole day in the office it way very much difficult, it not impossible to study again the

Theoretical aspects of banking. On the other hand to prepare my internship report I have faced some limitations as follows.

It is a common tendency of any departments to keep back their departmental data and information.

Unavailability to required published documents.

Profile of AIBL:

History of Al-Arafah Islami Bank:

Islam provides us a complete lifestyle. Main objective of Islamic lifestyle is to be successful both in our mortal and immortal life. Therefore in every aspect of our life we should follow the doctrine of Al-Quran and lifestyle of Hazrat Mohammad (Sm) for our supreme success. Al-Arafah Islami Bank started its journey in 1995 with the principles in mind and to introduce a modern banking system based on Al-Quran and Sunnah.

A group of 13 dedicated and noted Islamic personalities of Bangladesh are the member of board of Directors of the Bank. They are also noted for their acumen. Al-Arafah Islami Bank Ltd. has 68 branches and a total of 1432 employees. Its authorized capital is Taka 2800 million and the paid-up capital is BDT 1748.18 millions.

Vision of AIBL:

Wisdom of the directors, Islamic bankers and the wish of Almighty Allah make Al-Arafah Islami Bank Ltd most modern and a leading banking our country.

Mission of AIBL:

Achieving the satisfaction of Almighty Allah both here and hereafter.

Proliferation of Shariah Based Banking practices.

Quality financial services adopting the latest technology

Goal of the Bank:

The motto of the Al-Arafah Islami Bank Ltd is to explore a new horizon of innovative modern banking creating an automated and computerized environment providing one stop service and prepare itself to face the new

Hierarchy of Al-Arafah Islami Bank:

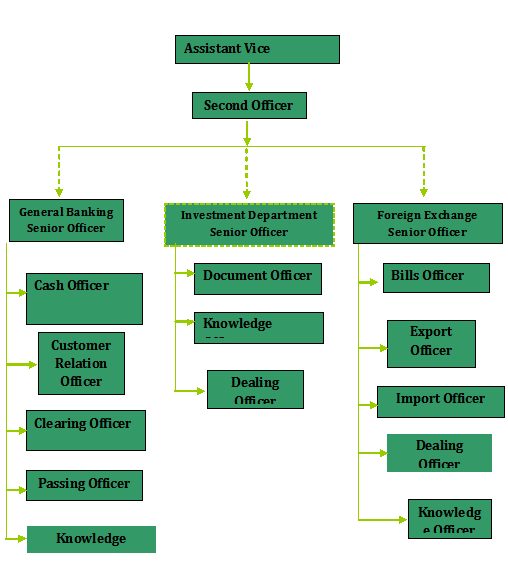

Fig Management Hierarchy of Islampur Branch of Al-Arafah Islami Bank:

Management System of AIBL:

A fourteen member Board of Directors are responsible for the strategic planning and overall policy guidelines of the bank. Further, there is an Executive Committee of the board of dispose of urgent business proposals. The executive Committee is assembled by nine members. Besides, there is a tree member Audit Committee in the board to oversee compliance of major regulatory and operational issues. There is an another eight member of Shariah Council to accelerate, monitor, control, supervise and maintain the modes of Islamic Banking System. Key issues are managed by a Management Committee headed by the CEO and Managing Director to facilitate rapid decisions.

The board’s Role:

The fatwa and Shariah Supervision Board oversee the application of different aspects of Shariah in the bank. It also ensures that all the transactions are in strict compliance with the right of contradict (Fatwa) any violating procedures, if they are found. The Board of Directors is obligated to obey the fatwas, irrespective of whether a unanimous or a majority consensus secured the decision (Clause of the Bank’s Memorandum & Articles of Association).

Management Structure:

A fourteen member Board of Directors are responsible for the strategic planning and overall policy guidelines of the bank. Further, there is an Executive Committee of the board of dispose of urgent business proposals. The executive Committee is assembled by nine members. Besides, there is a

Board of Directors:

There are 14 members for the bank’s Board of Directors. Among them 11 represents as the sponsors and general public, 1 senior official as Company Secretary and another one as the Shareholder Director. Managing Director is the ex-official Director of the Board.

AIBL’s Library:

The AIBL’s library houses a vast collection of more than 4000 books on Islamic Fiqh, law, economy, banking and Shariah. The library was primarily established with the aim of serving the Fatwa & Shariah Supervisions Board’s research team and the AIBL staff.

Thefacility is also accessible to the bank’s customers, researchers and the students of higher education.

Shariah Supervisors:

The clauses of the Bank’s Memorandum & Articles of Association requires the board of Directors to appoint a Shariah Supervisor, responsible for monitoring all the bank’s transactional procedures and assuring Shariah compliance. In current, there are six supervisors of Fatwa & Supervision Board.

Supervision Board and to the Chairman of the Board of Directors. The position also calls for participation in the Bank’s Training Programs.

Shariah Auditing:

The supervisory function forms a part of the Shariah Supervision procedures, its main task being to check Shariah compliance under the guidance of the Shariah Supervisors.

The Auditors continuously review the bank’s transactional procedures to ensure adherence to the framework crated by the Fatwa & Shariah Supervision Board. The Shariah Auditors submit periodic reports to the Shariah Supervisors so as to monitor and maintain Shariah compliance.

Branches:

Al-Arafah Islami Bank has a strong network of branches to cover all the imperative investments, trade and commerce of the country. It has broadly established 53 branches to cover the banking line through out the country. Of them only 17 are AD branches. Almost all the branches are equipped with computers, ABABIL software and

professionally component manpower in addition to facilitate the customer service with modern facilities and logistics.

Corporate Culture:

Al-Arafah Islami bank is one of the most disciplines banks with a distinctive corporate culture based on Islami Shariah. Here they believe shared meaning, shared understanding and shared sense making. The people in this bank can see and understand events, activities, objects and situation in a distinctive way. They mould their manners and etiquette, character individually to suit the purpose of the bank. The people of the bank see themselves as a tight knit team because they believe in working together for growth.

Social Responsibilities of AIBL:

Al-Arafah Islami Bank Foundation:

Financial Highlights of the company:

(In million taka) |

| Particulars | 2006 | 2007 | 2008 |

Authorized Capital | 2500.00 | 2500.00 | 2500.00 |

Paid up Capital | 854.20 | 1153.18 | 1383.81 |

Reserve Fund | 835.98 | 1091.95 | 905.33 |

Shareholders Equity | 1690.18 | 2037.50 | 2705.74 |

Deposit | 16775.34 | 23009.13 | 29690.12 |

Investment | 17423.19 | 22906.37 | 29723.79 |

Import | 1882.14 | 27042.72 | 32685.13 |

Export | 914.27 | 12714.91 | 20176.64 |

Total Income | 2172.48 | 2172.48 | 4387.26 |

Total Expenditure | 1202.71 | 2199.43 | 2859.16 |

Profit before Tax | 855.47 | 756.18 | 1528.09 |

Profit after Tax | 470.02 | 347.31 | 668.24 |

Income Tax | 385.45 | 235.53 | 590.66 |

Total Assets | 21368.17 | 30182.32 | 39158.44 |

Fixed Assets | 215.11 | 334.48 | 396.76 |

Earning per share (Taka) | 550.24 | 30.12 | 48.29 |

Dividend per share | 35% | 20% | 30% |

No. of Shareholders | 4487 | 12013 | 10664 |

Number of Employees | 912 | 1033 | 1080 |

Number of Branches | 46 | 46 | 50 |

Manpower per Branch | 20 | 23 |

Features of AIBL:

- All activities of the bank are conducted according to Islamic shariah.

- The banks investment policy follows different modes approved by Islamic shareah based on Quaran & Sunnah.

- The bank is committed towards establishing welfare oriented banking system, economic upliftment of the law- income group of people, create employment opportunities.

- According to the needs and demands of the society and the country as a whole the bank invests money to different halal business.

Authorized and Paid Up Capital:

The Bank Company Act 1991 which amended in March 2003 includes a provision of raising the capital to a new level of TK.100 Crore for the commercial banks within March 2005. In compliance with the new provision, the bank has raised its capital from TK.41.56 crore in the year 2002 to

Deposits:

The total deposit of the bank was TK.26, 685,444,177 at 31st December 2009, of which bank deposit was 3,676,315,890 taka. At the same time in the last year 2008, the amount of total deposits was 23,009,128,287 million taka.

Mode of liability purchase of AIBL:

At the end of the year 2009, the amount of investment of the bank was Tk.17423.19 million in comparison to tk.11474.41 million of the last year 2008. The amount of investment has increased 5948.78 million taka within this period, which is around 5184%. The bank extends investments to the clients under the following modes of investment under Islamic Shariah:

Grameen & Small Investment Scheme:

An Investment product ‘’Grameen and Small Investment’’ is in operation. The objective of this project is to introduce Shariah based banking system in rural and village area, creating employment through financing to low income group build up savings attitude improvement of living standard of rural low income mass people, creating opportunity to carry out Islamic lifestyle by way of alleviating poverty and at the same time to make other financially established by investing in small introduced in two branches of AIBL i.e. Gallai, Comilla and Ruposhpur, Srimongol. There is a plan to expand this project gradually in other rural branches.

Within the scope of Grameen and Small Investment scheme, investment has been made in the following sectors:

- Fisheries

- Poultry Rearing

- Cattle Rearing

- Vegetables business

- Tailoring business

- Cultivation of Betle leaf

- Work of Bamboo and Cane

- Cultivation of Principle

Corporate Information:

Name of the Company: Al-Arafah Islami Bank Ltd.

Legal Identity: A public limited company registered in Bangladesh on 18th June 1995, under the companies Act 1994 and enlisted in Dhaka Stock Exchange Ltd. & Chittagong Stock Exchange Ltd

Nature of Business: Commercial Banking based on Al-Quran & Sunnah

Registered Office: Head Office

PeoplesInsuranceBuilding (6th – 9th Floor)

36, Dilkusha Commercial Area Dhaka-1100 Bangladesh

SWIFT Code: ALAR BD IS (means Branch Code)

E-Mail: aibl@al-arafahbank.com

Webpage: www.al-arafahbank.com

Auditors: Hoda Vasi Chowdhury

Chartered Accountants

BMTC Bhaban, Level-8

7-9, Kawran bazaar, Dhaka-1100

Siful Shamsul Alam

Chartered Accountants

ParamountHeights, Level-6 (Box Culvert Road)

65, 2/1 Purana Paltan Dhaka-1100

Activities of AIBL:

Bank is nothing but an intermediary between lender (surplus unit) and borrower (deficit unit). Savings and deposits are the main strength of the banks to provide loan. And the interest earned from the difference borrowing and lending is the major portion of banks income. Banks also earns from variety of operation. Branch banking includes four operational divisions in Al-Arafah Islami Bank Limited. They are:

- General Banking

- Accounts Division

- Loan And Advance

- Foreign Exchange

Cash section:

The most vital and important section of the branch is Cash Department. It deals all kinds of cash transactions. This department starts with the day with cash in vault. Each day some cash that is opening cash balance are transferred to the cash officers from the cash vault. Opening cash balance is adjusted by cash receipts and payments. This figure is called closing balance. This balance is added to the vault. This is the final cash balance figure for the bank at the end of any particular day. There is an important clause and duty practiced by the branch is to refund the principal amount that exceeds more than Tk. 1 cr. at the principal branch of the bank.

Books that are maintained by the cash section:

Vault register

Cash receipt register

Accounts opening section:

Account opening section is an important factor for banks because customer is the main source of bank. Selection of customer is another important factor. Bank’s success and failure are largely depends on their customers satisfaction. If customer is not good then it may create fraud and other problems by their accounts with bank and thus destroy the goodwill of banks. Therefore banks must be conscious in selecting its customers. For this reason Al-Arafah Islami Bank Ltd. keep key information system.

Account Opening Process:

Recently, Bangladesh Bank has been declared, designed and enforced a unique format of forms for every banks. These formats hold the important document in a same manner and process respectively for different kind of accounts. Al-Arafah Islami Bank Ltd is not different from this practice.

- Applications must submit required documents.

- Applications must sign specimen signature sheet and give mandate.

- Introducer’s signature and accounts number verified by legal officer

- Filling and signing up KYC form or Know Your Customer form.

- Filling and signing up Owner Information Form.

- Authorized officer accepts the applications

- Minimum balance is deposited where only cash is acceptable.

Information collected to open Account:

Accounts opening information that is collected by the Al-Arafah Islami Bank Ltd. varies for each type of account. Those are given below:

Individual:

Name

Present and permanent address

Date of Birth and Age

Nationality

Tax information number

Passport or other certificate photocopy

Partnership Firm:

Need all the required information along the individual accounts

Copy of partnership deeds

Mandate from the partners is essential-indicating who will operate the accounts

Copy of Resolution of the Board of Directors

open an account to take services from the bank. Without opening an account, one cannot enjoy variety of services from the bank. Thus, the banking usually begins through the opening of the account with the bank.

Bank accounts are mainly of three (3) types:

1 Current Deposit Account

2 Saving Bank Account

3 Fixed or Time Deposit

1. Current Deposit Account:

A current account is a running and active account, which may be operated upon any number of times during a working day. It is purely demand deposit account because the bank is bound to pay the amount to the accountholder on demand at any time within the banking hour.

There is no restriction on the number and the amount of withdrawals from a current account. Generally the minimum amount to be deposited initially is tk.1000/- for opening a current account.

2. Saving Bank Account:

A saving account is meant for the people of the lower and middle classes who wish to save a part of their incomes to meet their future need and intend to earn an income from their savings, it encourages savings of non-trading persons, institutions, society and clubs etc. The deposits are mostly small amounts. Frequently withdrawals are not allowed.

a. AIBL Special Savings Scheme

b.AIBL Regular Deposit Program

c. Mudaraba Lakhopoti Savings Scheme

d.Mudaraba Millionaire Savings Scheme

e. Mudaraba Katipoti Savings Scheme

AIBL Special Savings Scheme:

This scheme is well known in the market as a well named Deposit Pension Scheme in other banks. If a client deposit an amount of fixed on the monthly basis often a few years i.e. 5 and 10 years he gets amount at a time. The bank offers approx 12% interest for this scheme particulars of which as follows:

SL NO | Amount to be Deported | Total Amount After 5 Years | Total Amount After 5 Years | Rate of Interest |

01 | 500.00 | 40,500.00 | 1,14,000.00 | 11% |

02 | 1000.00 | 81,000.00 | 2,28,000.00 | 12% |

03 | 2000.00 | 1,62,000.00 | 4,56,000.00 | -do- |

04 | 5000.00 | Cumulative Basic | -do- |

AIBL Regular Deposit Program:

RDP is a special services plan that follows to save a monthly basic and get a handsome amount at maturity. RDP account gives you the convenience of saving regularly in time with cherished dream RDP in the right solution

Monthly Deposit Amount and Receivable after 3/5 Years:

SL NO | Installment Amount | Matured Value 3 Years | Matured Value 5 Years |

01 | 500.00 | 20,900.00 | 38,000.00 |

02 | 1,000.00 | 41,800.00 | 76,000.00 |

03 | 2,000.00 | 83,600.00 | 1,52,000.00 |

04 | 2,500.00 | 1,04,500.00 | 1,90,000.00 |

05 | 5,000.00 | 2,09,000.00 | 3,80,000.00 |

06 | 10,000.00 | 4,18,000.00 | 7,60,000.00 |

Mudaraba Lakhopoti Savings Scheme:

In this scheme if a parson Deposit an amount for a period of 3 Years, 5 Years, 8 Years, and 12 Years he will get interest for the Deposit on the monthly basis in the following rate:

| Year of Account | Monthly Installment Amount | Total Taka |

3 Years | 2,375.00 | 1,00,000.00 |

5 Years | 1,275.00 | 1,00,000.00 |

8 Years | 670.00 | 1,00,000.00 |

10 Years | 460.00 | 1,00.000.00 |

12 Years | 335.00 | 1,00,000.00 |

Mudaraba Millionaire Savings Scheme:

Year of Account | Monthly Installment Amount | Total Taka |

3 Years | 23,950.00 | 10.00 Lac |

4 Years | 16,950.00 | 10.00 Lac |

5 Years | 12,750.00 | 10.00 Lac |

6 Years | 9,950.00 | 10.00 Lac |

7 Years | 8,000.00 | 10.00 Lac |

10 Years | 4,600.00 | 10.00 Lac |

12 Years | 3,345.00 | 10.00 Lac |

15 Years | 2,170.00 | 10.00 Lac |

20 Years | 1,150.00 | 10.00 Lac |

Remittance of Fund Section:

Sending money from one place to another through some charges is called Remittance. To pay or receive money of customers in the form of Remittance from one place to another, from one person to another inside and outside the national boundary is an earning source of every bank. Islampur Branch of Al-Arafah Islami Bank operates both the foreign and local remittance to serve its customers. In addition, this service is an important part of country’s payment system. Through this service, people can transfer their funds from one country to another country very quickly.

Foreign remittance:

Foreign remittance is to send money of customers from one place to another, from one person to another person outside the national boundary. Through Islampur Branch of Al-Arafah Islami Bank, it can able to serve the customers by receiving and paying their incoming foreign remittance in the form of local currency. Foreign remittance is received by the bank via some internationally authorized agents. There are two medium of agents for foreign remittance at Islampur Branch of Al-Arafah Islami Bank. Those are given below:

Moneygram

Eldorado

Local remittance:

Sending money of customers in the form of remittance from one place to another, from one person to another inside and outside the national boundary is another earning source of every bank. Islampur Branch of Al-Arafah Islami Bank operates the local and foreign remittance to serve the customers. In addition, this is the important part of country’s payment system. Through this service people can transfer their funds from one place to another very quickly. There are several techniques for collecting local and foreign remittance. Those are given below:

The main instruments used by AIBL Principle Branch for remittance of funds.

- Pay order/ Bankers Cheek

- Demand Draft

- Telegraphic Transfer

Charges for Pay Order are shown in below as a Chart:

Amount of P.O | Commission | VAT | Total | |||

1-100000 | 20 | 3 | 23 | |||

100001-500000 | 30 | 4 | 34 | |||

500001-10000000 | 50 | 8 | 58 | |||

Fixed Deposit Section:

Fixed deposit is one which is repayable after the expiry of a predetermined of a predetermined period fixed by him. The period varies from 3 months, 6 month, 1 year and 3 year. These deposits are not repayable on demand but they are withdrawing able subject to a period of notice. Hence it is a popularly know as ‘’Time Deposit’’ or ‘’Time Liabilities’’ Normally the money on a fixed deposit is not repayable before the expiry of a fixed period.

Cash Section:

The cash section of any branch plays very significant role in general banking department because it deals with most liquid assets. The principle branch has an equipped cash section with modern electronic machinery with fully computerized environment and gives one stop counter service. This section

Account Division:

Account department is a department with which cash and every department is related. It records the profit and loss A/C and statement of assets and liabilities by applying ‘’Golden Rules’’ of book-keeping i.e. GAAP. The functions of it are theoretical based. AIBL Principle Branch records its accounts daily, weekly, and monthly every record.

General Account:

The account that is to be maintained with H/O of AIBL for the purpose of settlement of inter-branch transactions General A/C is an important one which has to be maintained by each branch of AIBL.

Indeed general A/C is a record of originating and responding transactions among inter-branches of the same bank. All types of assets and liabilities of one branch with another one are settled through this account. Branch can know how much liable with H/O the branch is. The debit and credit balance shows assets and liabilities of the respective branch.

Following are the journal entries under AIBL general account:

- OBC paid by original branch (AIBL Principle Office) to responding branch (say, AIBL Islampur) through Inter-Branch Credit Advice.

- For original branch (Principle Branch)

Party’s A/C———————Dr.

AIBL General A/C—————–Cr.

- For responding branch (Islampur)

AIBL General A/C————Dr

Party’s A/C————————-Cr.

- O/W (outward) clearing chaques lodged through IBDA (Inter-branch debit advice).

- For original branch (Principle Branch)

AIBL General A/C—————Dr.

Part’s A/C—————————–Cr.

- For responding branch (Islampur)

Other Bank A/C —————–Dr.

AIBL General A/C———————Cr.

- Inward clearing chaques paid by original branch (AIBL Principle Office) to responding branch (say AIBL Islampur) through IBCA (Inter-branch credit advice)

- TT (Telegraphic Transfer)

- For original branch (Principle Branch)

Party’s A/C———————Dr.

AIBL General A/C—————–Cr.

- For responding branch (Islampur)

AIBL General A/C—————-Dr.

Party’s A/C—————————–Cr.

- TT (Telex transfer) original by AIBL (Principle Branch) to other branch of AIBL when party is not A/C holder (through IBCA).

- For original branch (Islampur Branch)

Party’s A/C————————-Dr.

AIBL General A/C———————Cr.

- For responding branch (Islampur)

AIBL General A/C—————–Dr.

Party’s A/C——————————Cr.

- Cash received from AIBL Principle office (through IBCA)

- For original branch (Principle office)

Cash A/C —————————-Dr.

AIBL General A/C———————Cr.

- For responding branch (principle office)

AIBL General A/C—————–Dr.

Party’s A/C (Principle Branch) ——-Cr.

Credit Department:

One of the core functions of commercial banks is to create the claim against individual borrower or real the purpose of sanctioning credit bank grants loan in the form of different securities. By the primary security we mean the financial claim of holder against the real sector of economy. In banking the sector the financial claim of bank against issuer called investors, borrowers and difficult units. This core function of a bank is performed by the credit.

Findings & Analysis:

Quantitative Data Analysis:

Ratio Analysis:

Ratio analysis is an analytical tool that can be applied to a bank’s financial statements so that management and the public can identify the most critical problems inside each bank and develop ways to deal with those problems. Some selected ratios are analyzed here to give an insight about Al-Arafah Islami Bank Ltd. For limited information some are analyzed very briefly.

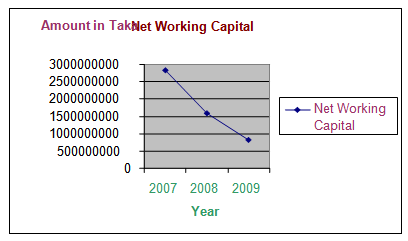

Net Working Capital:

Net Working Capital = Current Assets – Current Liabilities

Year | 2007 | 2008 | 2009 |

Net Working Capital | 2814774702 | 1596114316 | 829797471 |

Interpretation:

From the above graphical representation we can observed that the trend of working capital was very much unfavorable from the year of 2007 to 2009. The bank is losing liquidity of the working capital constantly up to 2009. So AIBL can not able to overcome the liquidity problem in the year of 2009.

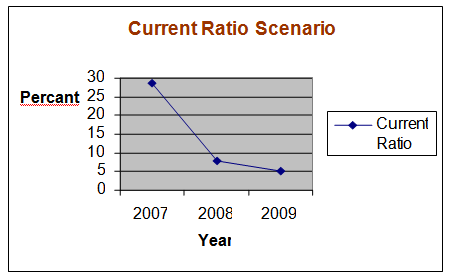

Current Ratio:

It is the best known liquidity measure of business firm. Current ratio indicates the ability of business firm to meet its short term financial obligations. This ratio is determined as follows:

Current Ratio = Current Assets / Current Liabilities

Year | 2007 | 2008 | 2009 |

Current Ratio | 28.522 | 7.715 | 5.22 |

Interpretation:

From the above graphical representation we can see that the trend of current ratio was very much unfavorable from the year of 2004 to 2006. As a result, the bank is losing liquidity to meet its short term financial obligations over the year. So, AIBL should take necessary steps to overcome the liquidity problem as soon as possible.

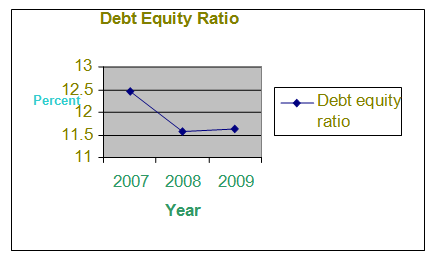

Debt to Equity Ratio:

Debt to equity Ratio indicates the level to which debt financing is used relative to equity financing. This ratio is determined as follows:

Debt to Equity Ratio = Total debt / Shareholder’s Equity

Year | 2007 | 2008 | 2009 |

Percent | 12.45 | 11.57 | 11.64 |

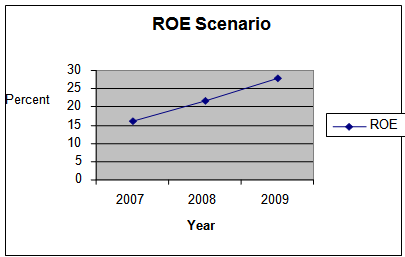

Return on Equity (ROE):

Return on equity measure the total earnings from shareholders equity.

Return on Equity (ROE) = Total Return/ Total Equity

| Year | 2007 | 2008 | 2009 |

| ROE | 16.17 | 21.55 | 27.81 |

Interpretation:

Here, we can find that AIBL was started with low ROE of 16.17% in the year 2007, but it was continuously increasing up to 2009, which is a good sign for AIBL. As the proposed net income was increased more then dividend and paid up capital. So the return on equity ratio of AIBL is well increasing.

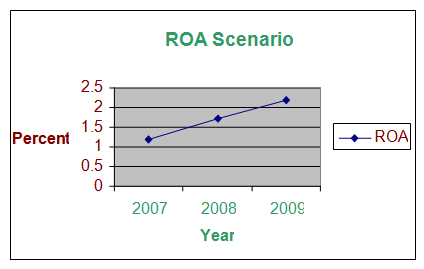

Return on Assets (ROA):

Return on asset measures the overall effectiveness in generating profits with available assets; earning power of invested fund. This ratio is used frequently for assessing the performance of fund. So it is important to evaluate how assets are contribution to generate profit. It has been calculated in the following way:

Return on Assets = Total Return/ Total Assets

Year | 2007 | 2008 | 2009 |

Percent | 1.20 | 1.71 | 2.20 |

- Few number of Exporter and Importer:

The number of exporter and importer who operate through this bank is not enough to achieve the goal. If the bank wants to increase their total foreign business then they should increase total export, import and remittance. So they need increase exporter and importer.

Lack of efficient employees:

They have not sufficient efficient employees to operate foreign exchange department in the bank. So they should increase efficient employees in this department.

- Number of Branches are not enough:

The bank is operated through 53 numbers of branches that are very few. So little number of branches is a barrier to improve foreign business

- Very few Branch level meeting is held:

Staff meetings and departmental meetings at the branch level does not held or very few which is very essential to develop service quality as well as problem solving. But this practice is very few. So It may create major problem in future.

- Lack of modern PC and comprehensive banking software:

PC Bank is not modern and comprehensive banking software. It does not provide adequate support on providing the services. It is not user friendly and management should consider replacing the PC Bank system by a more comprehensive banking system.

SWOT Analysis:

Strength of AIBL:

- All activities of the bank are conducted according to Islamic shariah where profit is the legal alternative to interest.

- Using up to date software in foreign exchange department that will reduce time and labor of employee.

- Skilled manpower and efficient employees are being involved in busy foreign section to meet the client’s satisfaction.

- The total deposit of the bank was TK.16775.33 million at 31st December 2009. At the same time in the last year 2008, the amount of total deposits was 11643.66 million taka. In this area the growth rate is 44.07%. So deposit is a good strength of AIBL.

Weakness of AIBL:

- They have a very few number of branches and foreign exchange department. This is a great weakness. If they can not recover this weakness, they will not increase earnings from foreign exchange sector.

- They can not open sufficient number of L/C in a month. Because they have not enough exporter and importer. This is another great weakness for foreign exchange department.

- AIBL is one of a new generation bank. Upon established of these banks total number of bank stands in our more than 53. In addition to that a huge number of financial institution working besides commercial Banks of our country. As such their business is becoming more and more vital weakness of AIBL because our financial market is not expanding in comparison with the establishment of new banks.

- In another weakness of the new generations banks are branch network which are very smaller in number through they are spreading very sharply. But this weakness will be come-up in the span of time and the authority is very serious to solve this weakness.

- Risk Management system is not strong. The bank has already exposed to a variety of risks the most important of which are credit risk, market risk and liquidity risk.

Opportunity of AIBL:

- Favorable business climate for commercial banks in the country in comparison with other business.

- High finding cost for lending is great opportunity for the bank. Due to lack of poor performance of NCB’s in our country though they are grabbing an huge deposits from the market, PCB’s are fulfilling the high demand of the financial marketing lending money towards deficit sources in

- High rate of interest. So PCB’s are making well done in regards of lending and besides deposit collection from the market. Govt. Banks are not able to fulfill market demand and this opportunity is taking by the PCBs.

- Another mentionable opportunity of the PCB’s is high grades of services in regards of customer service. Besides the NCB’s service is very poor and so much traditional. As a result of which it has easily achieved public respond easily creating their positive approach day by day.

- Another opportunity is the establishment of new banks is very vital point. Any body or organization cannot easily establish a commercial collecting paid-up capital and govt. is fully retracted in regards of giving permission to commercial bank in the country. Moreover, in our country there are no closing rules for commercial banks. As a result of which as an existing commercial banks AIBL have a great opportunity and potential for its favorable business opportunity.

Threat of AIBL:

- A few numbers of branches and foreign exchange department: this is a threat for Al-Arafah Islami Bank Ltd. Because they cannot increase their earnings by existing branches and foreign exchange department.

- Recovery of loan: This is a threat for Al-Arafah Islami Bank Ltd because the financial market strength of our country is not so strong. As such to recover the lending money is a great threat. Because in our country’s business chain like other countries is dependable each other. So, if the monetary flow faces any obstacle it hampers the running of full chains. As a result recovery face a great threat for commercial banks and AIBL is not out of this threat.

- Classified Loan: Another major obstacle for banks is its classified loan. Through this picture is not new for this particular bank it is exists to all commercial banks throughout the world. But in our country this bad culture created by the NCBs and its impacts comes to the PCBs also. But over viewing the bank’s performance we found that it is still in safe side in comparison with others but in should be careful to overcome this threat.

- Electronic Banking: It is the order of the day to deliver prompt service to the customers taking assistance of modern facilities. We have recognized this and taken all possible steps to introduce technology-based Banking service to the customers. It is a greatest threat for AIBL.

- Social Responsibility: We recognize that Bank’s are not mere profit earning institutions rather they have great responsibility towards the society in which they are operating. In this respect, I am happy that our Bank has been able to make its presence felt in the national level. A number of seminars have been arranged under its auspices on the topics of economic and social aspects which provided a way of looking at the picture from different perspectives.

Conclusion:

Islami bank is now reality in Bangladesh. It is functioning efficiently, smoothly and satisfactorily despite facing various internal and external threats. The economics of the country may be geared towards Islamic Principles and Teachings in order to realize the full potential of Islamic Banks in the long run. However, in the short run, Islamic banks can take a number of concrete steps to facilitate the Islamic Banking in Bangladesh.

This report gives a clear idea about the activities, function and operational strategies of Al-Arafah Islami bank Limited. AIBL started their journey in 1995 with the said principles of mind and to introduce a modern banking system based on Al-Quran and Sunnah. During these 20 years of its operation, the bank has been widely acclaimed by the business community from small business persons to conglomerates for forward looking outlook and innovative financial solutions. The Islampur Branch of Al-Arafah Islami bank conducts general banking activities. As perform the full of the foreign exchange activities by it own. The fund of bank strongly depends on deposits and it has a big influence through the number and the amount of deposit. The bank has to give huge concentration on better customer service and satisfaction.