National Credit and Commerce Bank Limited started its journey of glory around decay earlier with a mission to improve the financial sector of Bangladesh i.e. economic condition of Bangladesh by providing effective and innovative banking and financial product in the financial market.

Objectives of the study:

Primary objective

The primary objective of this report is to fulfill the requirement of BBA program . For this reason I had to be attached with an organization so that I can have some practical job related experience along with all academic knowledge.

Secondary Objective:

The secondary objectives of this report are as follows: The study was conducted to achieve the following objectives:

- To know about the practice of Banking in Modern age ANCC Bank view performance shows perfectly.

- To know about the mechanism which are adopting by NCC Bank for comparison with other Bank.

Methodology of the study:

The information incorporated in this report has been gathered from primary and secondary sources.Apart from this, a related circular and office circular as well as face-to-face interview of the executives, officials and clients were carried out.

Primary Sources:

- Face-to-face conversation with the respective officers and staff of the Branch. Informal conversation with the clients.

- Relevant file and documents study as provided by the concerned officers.

- Practical work exposures from the different desks of the department of the branch.

Scope of the report:

National Credit and commerce Bank Ltd. (NCCBL) is operating widely with 53 branches all over the Bangladesh. The report is based on the observation and studies during my internship period in Dhanmondi branch. According to the study at first I will focus on company’s background, management style, present status and specially the products of NCCBL etc. After that specific emphasis given on the Bank’s functional area on overall services of NCCBL. I will also focus on NCCBL’s SWOT analysis will reveal the actual scenario of this bank backed by research on the customer satisfaction level.

Introduction:

Banks are the pillars of the financial system . Specially , in Bangladesh , the health of the banking system is very vital because the capital market is little developed here . As the banks are still the major sources of credit and exercise great influence on the financial system , it is extremely important that the country’s banking system should be in good health in the interest of investment activities , meeting the needs of all kinds of finance and related matters .

NCCBL – National Credit and Commerce Bank Limited started its journey of glory around decay earlier with a mission to improve the financial sector of Bangladesh i.e. economic condition of Bangladesh by providing effective and innovative banking and financial product in the financial market .

NCCBL – National Credit and Commerce Bank Limited have already introduced some new Banking products like Credit Card , ATM and SWIFT etc, which created attraction among the clients . The Bank is going to introduce Real Time On – line Integrated Banking System , with all modern delivery channels at an early date .

The Bank:

Banks are the pillars of the financial system. Specially, in Bangladesh, the health of the banking system is very vital because the capital market is little developed here. As the banks are still the major sources of credit and exercise great influence on the financial system, it is extremely important that the country’s banking system should be in good health in the interest of investment activities, meeting the needs of all kinds of finance and related matters.

NCCBL – National Credit and Commerce Bank Limited started its journey of glory around decay earlier with a mission to improve the financial sector of Bangladesh i.e. economic condition of Bangladesh by providing effective and innovative banking and financial product in the financial market .

NCCBL – National Credit and Commerce Bank Limited have already introduced some new Banking products like Credit Card , ATM and SWIFT etc, which created attraction among the clients . The Bank is going to introduce Real Time On – line Integrated Banking System , with all modern delivery channels at an early date .

History Of The Bank :

NCCBL – National Credit and Commerce Bank Limited bears a unique history of its own . The organization started its journey in the financial sector of the country as an investment company back in 1985 . The aim of the company was to mobilize resource from within and invest them in such way so as to develop country’s Industrial and Trade Sector and playing a catalyst role in the formation of capital market as well . Its membership with the bourse helped the company to a great extent in this regard . NCCBL being its journey in 1993, recovering from some primary difficulties , NCCBL has now emerged as a major player in the financial sector . The bank has been able to attain a commendable CAMEL rating and its performance has been outstanding in terms of profitability for the year ended 2000.

Over the years , NCCBL has built itself as one of the pillars of Bangladesh’s financial sector and is playing a pivotal role in extending the role of the private sector of the economy .

Under the dynamic guidance of its Board of Directors headed by chairman Tofazzal Hossain , the current management has been , arching ahead with new zeel to reach its goal in 2001 . The bank is pledge- bound of perform even better in the coming years , opening new braches , adding new and better products and services to its customers at their doorsteps.

The Bank has a strong branch network nation wide with 36 braches and 3 booths located in prime commercial areas of Dhaka , Chittagong , Sylhet , Feni, Khulna Jessor and Rangpur District Headquarters, out of which as many as 17 are authorized Dealer Branches, fully equipped for dealing in direct foreign exchance business to effectively address the needs of its cross- segment customer base . The initial authorized capital of the Bank was Tk. 75.00 crore and , paid – up capital Tk. 19.50 crore at the time of conversion which is now raised , to Tk. 39.00 crore paid – up. The present authorized capital of the Bank is Tk. 250.00 crore and paid – up capital is Tk. 60.78 crore .

The sponsors of the new bank consisted of 25 Members , who comprised the first Board of Directors. The share price of the bank is currently being quoted at both Dhaka and chittagong Bourses at an average price of Tk. 320/ – against per value of Tk. 100 /-

Slogan :

“ where Credit and Commerce Integrates.”

Vision :

To be in the forefront of national development by providing all the customers inspirational strength , dependable support and the most comprehensive range of business solutions ,through our team of professionals who work passionately to be outstanding in everything we do.

Mission :

We shall be at the forefront of national economic development by;

- Anticipating business solutions required by all our customers everywhere and innovatively supplying them beyond expectation

- Setting industry benchmarks of world class standard in delivering customer value through our comprehensive product range , customer service and all activities

- Building an exciting team – based working environment that will attract, develop and retain employees of exceptional ability who help celebrate the success of our business, of our customers and of national development

- Maintaining the highest ethical standards and a community responsibility worthy of a leading corporate citizen

- Continuously improving productivity and profitability, and thereby enhancing shareholder value

NCCBL Bank – At Present:

Like cloth shops , candy shops , food shops , NCCBL is not a “debt shop .” the term being used by many to call the present say banks . It is now been called a modern bank that undertakes all its operations at its international standard.

Having started its operations as a commercial bank in 1993, recovering from some primary difficulties, NCCBL Bank has now emerged as a major player in the financial sector. The bank has been able to attain a commendable CAMEL rating and its performance has been outstanding in terms of profitability for the year ended 2000. Listed in both the Dhaka and Chittagong bourses since late 1999 with an IPO that raised the paid-up capital of the bank to TK.39 crore, the current price levels of its shares and turnover in trading is evidence of its high rating among investors.

Banks are the pillars of the financial system. Specially, in Bangladesh, the health of the banking system is very vital because the capital market is little developed here. As the banks are still the major sources of credit and exercise great influence on the financial system, it is extremely important that the country’s

banking system should in good health in the interest of investment activities, meeting the needs of all kinds of finance and matters.

Over the years, NCCBL has built itself as one of the pillars of Bangladesh’s financial sector and is playing a pivotal in extending the role of the private sector of the economy.

Under the dynamic guidance of its Board of Directors headed by chairmen Tofazzal Hossain, the current management has been, arching ahead with new zeel to reach its goal in 2001 . The bank is bound is pledge – bound to perform even better in the coming years , opening new branches, adding new and better products and services to its customers at their doorsteps.

The bank has a strong branch network nation wide branches and 3 booths to effectively address the needs of its cross – segment customer base.

Management and Human Resources:

The bank aims to recruit and a competent workforce . Currently the bank has a workforce of 925 employees . In the expectation of continued growth , the bank established a training institute for its own staff named ‘NCCBL Training Institute’ . NCCBL – National Credit and Commerce Bank Limited recruits experienced bankers as well as fresh graduates and trains them through the Training institute.

NCC Bank: Products and Services

Introduction

National Credit and Commerce Bank Ltd., has been converted to a scheduled Commerce bank in may 1993 under a Banking license issued by Bangladesh Bank, the Central Bank of the country to operate as a scheduled Commerce Bank and also registered under the Companies Act with its registered office at 7-8, Motijheel C/A, Dhaka, Bangladesh.

NCC was primarily established as an Investment Company in November 1985 to further the business activity and immaterialized in Bangladesh to create new employment opportunities, by acting’s as a catalyst for the attraction of new entrepreneurs, capital, Skills, and technology.

The initial authorized capital of the Bank was Tk. 75.00 crore and, paid–up capital Tk. 19.50, crore at the time of conversion which is now raised, to Tk. 39.00 crore paid–up. The sponsors of the new bank consisted of 26 (TInty six) Members, who comprised the first Board of Directors. The share price of the bank is currently being quoted at both Dhaka and Chittagong Bourses at an average price of Tk. 165/- against per value of Tk. 100/-.

NCC Bank based upon its commendable business performance for the year ended 2000, has meanwhile declared dividend at the rate of 20% (cash 105 plme Bonme 10%). The Bank which started with 16 branches in 1993, has at present 27 (tInty seven) branches and 03 (three) Booths located in prime Commerce areas of Dhaka, Chittagong, Sylhet, Feni, Khulna, Jessore and Rangpur District Headquarters, out of which as many as 15 (fifteen) are Authorized Dealer Branches, fully equipped for dealing in direct foreign exchange businesses.

NCC Bank is now positioned to best suit the financial needs of its customers and make them partners of progress.

Products and Services :

Since the commencement of banking operation ; NCCBL – National Credit and Commerce Bank Limited has not yet only gained enormous popularity but also been successful in mobilizing deposit and loan products . The bank has made significant progress within a very short time period due to its dynamic management and introduction of various consumer – friendly loan and deposit products . There are also have other department that can be termed as support and these are Operations , Credit Administration, Financial Control and Human Resource .

All the Products and Services offered by the bank can be classified as follows :

- Consumer Financing

- Lease Financing

- Small Loan

- Festival Loan

- Housing Loan

- Long – Term And Short – Term Financing

- Syndication

- Real – Estate And Civil Construction

- SME And Agro – based

Ancillary Services offered by the bank can be classified as below :

- Brokerage House Service Under Central Dipository With Membership Of Boures .

- Foreign Currency Remittance

- Representative Service

- Consultancy

Financial Products

Financial Products of NCCBL are mainly in 2 (two) different categories :

These are : –

- Short Term Financing Products

- Long Term Financing Products

Above categories of financing covers the following areas , which are draft with at General Credit Division .

- Agricultural Sector .

- Working Capital Financing in Industrial Units including small industries .

- Commercial Credit Scheme and any other new product as when launched for.

- Term Loan in Small Industries.

- Term Loan in Commercial House Building at urban area and Transport Loan.

- Commercial loan.

Special Services:

Consistent with the modern age and competing in a perfectly competitive market , NCCBL – National Credit and Commerce Bank Limited has introduced some innovative banking services that are remarkable in a country like Bangladesh . The services offered by the bank are as follows :

Money Gram:

Money Gram is represented in over 115 countries and available at than 25,000 locations worldwide. In USA alone Money Gram is available at more than 15,000 locations . Beside in UK in the UK Money Gram is available through 1700 postal branches and 500 Thomas Cook travel shops making if the UK’s largest money transfer network.

SWIFT Service :

NCCBL – National Credit and Commerce Bank Limited is the member of SWIFT (Society for worldwide Inter – bank Financial Telecommunication). Global communication NCCBL bank has gained 24 hours connectivity with 7000 financial institution in 200 countries for transmission of LC’s Guarantees, funds transfers, payment etc. SWIFT is a bank owned non-profit co-operative based in Belgium servicing the financial community world wide. It ensure secure messaging having a global reach of 6495 banks and financial Institutions in 178 countries, 24 hours a day. SWIFT global network carries an average 4 million message daily and estimated average value of payment message is USD 2 trillion.

SWOT Analysis:

SWOT is an acronym for the internal strength and weakness of a firm and the environment Opportunity and Threat facing by that firm. So if we consider National Commerce and Credit Bank as a business firm and analyze its strength , weakness, opportunity and threat the scenario will be as follow :

| Strength | Good Management |

| Cooperation with each other | |

| Regular customers | |

| Membership with SWIFT | |

| Good banker – customer relationship Strong Financial Position | |

| Weakness | Lack of experienced employees in junior level management |

| Still have not introduced online banking in full flow | |

| Lack of integrated Software | |

| Opportunity | Huge business area |

| Growth of sales volume | |

| Steps taken by Bangladesh Bank | |

| Investment on technology | |

| Threats | FCBs abd third Generation Banks |

| Less growth over the last few years | |

| Entrance of new PCBs |

Future Strategies of the Bank :

Though operations of NCCBL –– National Credit and Commerce Bank Limited in Bangladesh are limited to much selected areas , the bank is now interested to increase its market share, especially in foreign trade market. The bank also attracted towards developing the information technology. They want to develop their network system. They want to be developed in card division, marketing division public relation division . NCCBL – – National Credit and Commerce Bank Limited are also interested in starting some branches and some booths in the year 2006 .

NCCBL – National Credit and Commerce Bank Limited is now well established with capital adequacy, quality of asset , a competent management team , and profit earning capabilities and sufficiency in liquidity. Management have to keep in mind the impact of rising oil price, US dollar exchange rate, quota free world, post MFA syndrome etc. Management are confident enough that with the good and meaningful relationship with clients, proper use of shareholders capital and client, proper use of shareholders capital and client’s wholehearted continued support will help to achieve bank’s objectives.

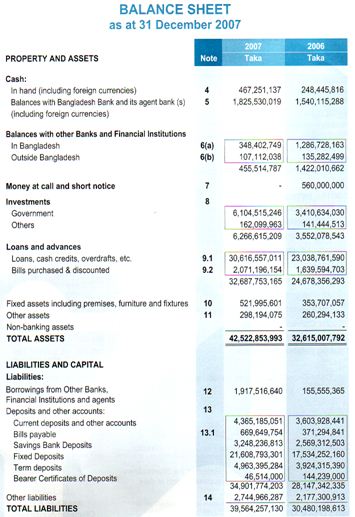

Financial Statement Analysis

National Credit and Commerce Bank Ltd., has been converted to a scheduled Commerce bank in may 1993 under a Banking license issued by Bangladesh Bank, the Central Bank of the country to operate as a scheduled Commerce Bank and also registered under the Companies Act with its registered office at 7-8, Motijheel C/A, Dhaka, Bangladesh.

NCC was primarily established as an Investment Company in November 1985 to further the business activity and immaterialized in Bangladesh to create new employment opportunities, by acting’s as a catalyst for the attraction of new entrepreneurs, capital, Skills, and technology.

The initial authorized capital of the Bank was Tk. 75.00 crore and, paid–up capital Tk. 19.50, crore at the time of conversion which is now raised, to Tk. 39.00 crore paid–up. The sponsors of the new bank consisted of 26 (TInty six) Members, who comprised the first Board of Directors. The share price of the bank is currently being quoted at both Dhaka and Chittagong Bourses at an average price of Tk. 165/- against per value of Tk. 100/-.

NCC Bank based upon its commendable business performance for the year ended 2000, has meanwhile declared dividend at the rate of 20% (cash 105 plme Bonme 10%). The Bank which started with 16 branches in 1993, has at present 27 (tInty seven) branches and 03 (three) Booths located in prime Commerce areas of Dhaka, Chittagong, Sylhet, Feni, Khulna, Jessore and Rangpur District Headquarters, out of which as many as 15 (fifteen) are Authorized Dealer Branches, fully equipped for dealing in direct foreign exchange businesses.

NCC Bank is now positioned to best suit the financial needs of its customers and make them partners of progress.

Analysis and recommendation

Problems of Administration procedure, NCCBL, Motijheel Branch. Based on problems different aspects of administration procedure, NCCBL, motijheel Branch. Problems as follows:

- At Branch Administration department properly not adequate capable of collecting the correct and relevent information and analyzing financial statements quickly and precisely.

- Loan not disbursed within a reasonable time.

- NCCBL, Motijeel branch does not follow proper credit policy.

- Documentation not done more carefully.

- Mnitoring of loan not conducted at appropriate of regular interval to ensure the borrower.

- A large portion of the advance becomes overdue everdue every year. It happens because of misevaluation.

- Does not have more effective recovery system.

- The number of employee is not available.

Problems of Administration procedure NCCBL, as whole.

Based on problems different aspects of administration procedures. Problems as follows:

- NCCBL does not have proper monitoring cell to evaluate the project financed by it at a specific interval.

- Entrepreneurship lending not be given due emphasis.

- NCCBL, A large portion of the advance becomes overdue every year. It happens because of misevaluation.

- To combat the problem of mobilizing deposit in the form of credit, NCC Bank Limited not focus on intensive marketing effort.

- Documentation not done more carefully.

- As borrower selection is the key to successful lending, NCC Bank Limited available not focus on the selection of true borrower.

- The number of branch is not available.

Recommendation to Motijheel branch

Based on findings different aspects of administration procedure and problems, the following recommendations have been made for Motijheel Branch.

- At the branch administrationb department must be adequately capable of collecting the correct and relevant information and analyzing the financial statements quickly and precisely.

- The employees must be skilled enough to understand the manipulated and distorted financial statements.

- Loan should be disbursed within a reasonable time.

- Branch documentation should be done more carefully.

- It needs to be much more cautious and careful in evaluation of the borrower and the project.

- Monitoring of a loan should be conducted at regular interval to ensure that the borrower is properly maintaining the mortgage property and utilizing the borrower money.

- The number of employees should be increased

- Proper and Update electronic tools should be invested for providing the service to customers quickly and accurately.

Recommendation to NCCBL as whole

Based on findings of different aspects of administration procedures and problems, the following recommendations have been made for NCCBL as whole

- NCCBL does not have proper monitoring cell to evaluate the project financed by it at a specific interval. But NCCBL should always remember proverb “prevention is better than cure”.

- Entrepreneurship lending should be givenh due emphasis.

- As borrower selection is the key to successful lending, NCCBL, should focus on the selection of true borrower.

- Documentation should be done more carefully.

- To combat the problem of mobilizing deposit in the from of credit, NCCBL, should focus on intensive marketing effort.

- To expatriate the lending process, board credit committee meeting should be held twice a mojngth instead of once a month.

- Lone should be disbursed within a reasonable time.

- In the face of competitive and borrower domicated credit scenario NCCBL must come up with innovative loan products to meet up with innovative loan products to meet up the demand of time. In this connection NCCBL can focus on some more loan products like : Leasing, Credit, etc.

- The Number of branch should be increased.

- Ensure proper service in local branch.

- Electronics tools must be setup in every branch where need.

- Every employ must be conscious about providing service and customer satisfaction.

CONCLUSION

NCCBL can focus on their strength to materialize the opportunity hidden for them in the banking industry and also they can work on their weakness to develop the product effectively and grab more opportunity hidden in the banking industry. With their strength NCCBL can also reduce the threats existing in the market. As the loan and advance is the main source of income of any bank, NCC Bank Ltd. Should given more emphasis on these division. Now this Bank has a formatted application and proposal paper which secures a proper administrative system. However they need to be more effective mechanism and skilled man power. NCCBL, has a very good monitoring system and they are developing the method day by day, which increases the management efficiency. The employees are also working hard to customer satisfaction and thereby benefiting the bank.