Executive Summery

Prime Bank Limited is a fast growing private sector bank and it is already at the top slot in terms of quality service to the customers’ adding the value to the shareholders. As an internship placement, I chose Motijheel branch so that I can learn various activities in one place since Motijheel branch is the central branch of Prime Bank Limited. It controls the whole activities of all branches and thus it deals more activities than any other branch. I have joined on lllh February2010 and my two weeks internship period will be finished in 25′ February 2010. As the internship program requirement, internee student must have to submit a report working on the organization. To fulfill that requirement I have prepared a report on the practical experience whatever 1 gained at the time of •working in PEL. To analyze the Internal Marketing Strategies or Employee Satisfaction of Prime Bank Limited, I have prepared questionnaire to collect information which is a combination of open and close ended questions to collect information. My sample size is 20 who belong to the Executive Management Level, Mid Level and Junior Level of the hierarchy of the organization, In addition, we should know “Job satisfaction has been defined as a pleasurable emotional state resulting from the appraisal of one’s job, an affective reaction to one’s job, and an attitude towards one’s job “. Job satisfaction describes how content an individual is with his or her job. I have limited my investigation around three areas, namely, Physical Work Environment, Superior-Subordinate Communication, Benefits receiving from the organization. Job satisfaction describes how content an individual is with his or her job, Job satisfaction is a very important attribute which is frequently measured by organizations, The happier people are within their job, the more satisfied they are said to be. To keep the employees satisfied the organization has to adopt internal marketing strategies.

Definition of Home Management and Housing

Three are many definition of home management some simple, other a little elaborate in the simplest terms, home management is defined as the mental process of Utilizing the available resource to achieve what you want in life.

Goal of Home Management

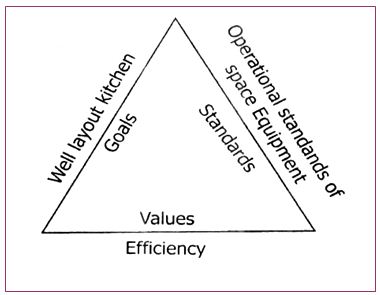

A goal is more specific and tangible and hence can be easily defined and understood. Goal is an objective or purpose to be attained and toward the achievement of which the policies and procedures of a programme are fashioned using family housing as a selected area, we can illustrate the concepts of value goal and standard as follows-

if the goals are fulfilled, then you reality the value values and you derive the ultimate value satisfaction.

History of Home Management:

Home management as an art has probably existed as long as there have been homes to be managed. Its beginning therefore, are lost in the mists of Prehistoric times. Early records of Peoples were little concerned with home activities. Only here and there can one glimpse family practice in the management of resources there is no real information’s available as to how home management developed before it became a field of study. It must have been passed on from generation to generation with modifications of current practices in each generation values and goals underlying practices were perhaps handed down intact than the practice themselves. Such were the indications of a veiy small study of this question.

Objective of the bank:

The objectives of the Prime Bank Limited are specific and targeted to its vision and to position itself in the mindset of the people as a bank with difference. The objectives of the Prime Bank Limited are as follows:

- To mobilize the savings and channeling it out as loan or advance as the company approve.

- To establish, maintain, carry on, transact and undertake all kinds of investment and financial business including underwriting, managing and

- Distributing the issue of stocks, debentures, and other securities.

- To finance the international trade both in import and export.

- To carry on the foreign exchange business, including buying and selling of foreign currency, traveler’s cheques issuing, international credit card issuance etc.

- To develop the standard of living of the limited income group by providing Consumer Credit.

- To finance the industry, trade and commerce in both the conventional way and by offering customer friendly credit service.

- To encourage the new entrepreneurs for investment and thus to develop the country’s industry sector and contribute to the economic development.

History of PBL

The Prime Bank Limited being Banking Company has been registered under the Companies Act 1994 with its Registered Office at 119-120 Motijheel C/A, Dhaka-1000.

The Bank operates as a Scheduled Bank under a Banking license issued by Bangladesh Bank, the Central Bank of the country. Prime Bank Ltd. was created and commencement of business started on 17th April 1995.

To fulfill the demand as well as to improve the commercial banking service in our country, The Prime Bank Limited is scheduled bank that was incorporated under the Companies Act 1994, started its operation on April 17, 1995 with a target to play the vital role on the socio-economic development of the country. It availed its registration as a banking company under the Banking Company Act 1993 from the Bangladesh Bank dated February 12, 1995. The started to make profit from the inception year. It was made possible for its management and the leadership of the first Managing Director Mr. Lutfur Rahman Sharker, Ex -Governor, Bangladesh Bank.

Aiming at offering commercial banking service to the customers’ door around the country, the Prime bank limited established 70 branches up-to this year. This organization achieved customers’ confidence immediately after its establishment in domestic and international markets.

Ownership Status

There are about 49 banks in Bangladesh among some of the banks are state on, some of the banks specialist and the others are private ltd. Prime Bank Ltd is on of the private Ltd banks in our country. According to the definition of private Ltd company the ownership of the company depend on the number of partners at the partners are the shareholders of the company and they the owner of the company. So the share holder of prime Bank are the owner of the Bank.

Organogram of PBL

Departments of Prime Bank Limited

If the jobs are not organized considering their interrelationship and are not allocated in a particular department it would be very difficult to control the system effectively. If the departments are not fitted for the particular works there would be haphazard situation and the performance of a particular department would not be measured. Prime Bank Limited has does this work very well. There are:

Human Resources Division Financial and Administration Division General banking department

- Accounts opening section

- Cash section

- Remittance section

- Bills and clearing section

- Accounts section Foreign exchange department

- Import section

- Export section

- Foreign remittance section

- Marketing

- Personal Relation Department

- Merchant Banking and Investment Banking

- Treasury Division

- International Division

- Computer and Information Technology Department

- Credit Division

- Corporate Affairs Division

- Card Division

- Board Audit Cell

- Monitoring and Inspection Division

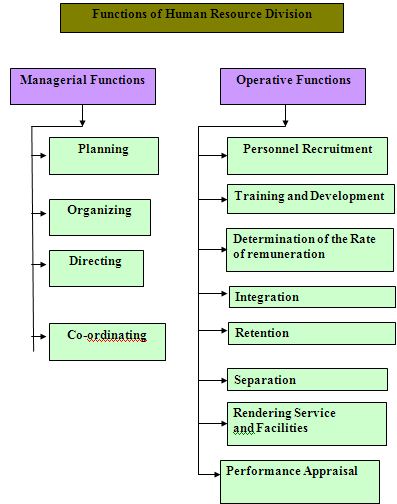

Human Resource Division of Organization

Human resource management is related with recruitment, selection, remuneration, security, labour, relations and different employees services,.”

HRM activities:

HRM is made of form activities (1) Staffing (2) Training and Development (3) Motivation (4) Maintenance

Other Activities of PBL

PRODUCTS and Services

Prime Bank Limited launched several financial products and services since its inception. Among them is Contributory Savings Scheme, Monthly Benefit Deposit Scheme. All of these have received wide acceptance among the people.

Other Activities of PBL

- Retail Banking

- SME Lending

- Corporate Credit

- Islamic Banking

- Credit Card

- Custodial Service

- International Trade Management

- Cash Management

- Institutional Banking

- Treasury

- Foreign Exchange Business

- Merchant Banking

- New Products & Services

- Online Branch Banking

- Information Technology in Banking Operation

Principal Activities of Prime Bank Ltd:

The principal activities of the Bank are banking and related businesses. The banking businesses include deposits taking, extending credit to corporate organization, retail and small & medium enterprises, trade financing, project financing, lease & hire purchase financing, issuance of local & international credit cards etc.

Rational of Present internship

Internship program is a pre-requisite for acquiring M.Sc Degree in college of Home Economic “Practical orientation in organizations” is arranged to have practical exposure. It is an opportunity for the students to know about real life situation through an internship program this report has been prepared by analyzing the practical experience which I gainted while working in Prime Bank Limited motijheel Branch, Dhaka.

Overview of the 14 days internship

I started my internship program on the 11th February 2010 in the beginning of internship have gone to the bank at 9.30 am and I met in charge of internship programme. She was very polite and gentle.

11th February in the first day I have been asked to fill up some bio data of some applicants in different post. In the first day I complete the assigned job very sincerely.

After finishing my duty I met the head the HR Division and after taking permission I go back to home. In the second day I after in the office and feel very easy and comfortable again met supervisor and she give me some task to do. And have also done my duty very sincerely. Sometimes I worked about internal marketing. Some of the officer help in the job because they are very helpful. I learn from then about internal marketing. Step by step I have done my work with the full co-ordination of the employee of Prime Bank.

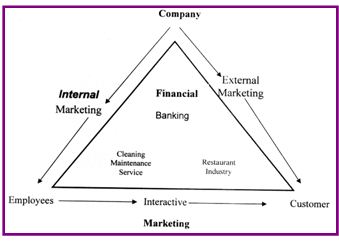

What is Internal Marketing?

Internal Marketing is marketing by service firm to train and effectively motivate its customer-contact employees and all the supporting service people to work as a team to provide customer satisfaction.

Internal marketing is an important ‘implementation’ tool. It aids communication and helps the organization to overcome any resistance to change. It informs and involves all staff in new initiatives and strategies.

While most companies allocate resources to understanding and communicating, with their external customers, few make the same investment in time, energy, and money in communicating with their internal customers—their employees. Internal communications is traditionally viewed as the sole province of the Human Resources department, but it’s essential to recognize the importance of marketing to internal customers.

Methodology

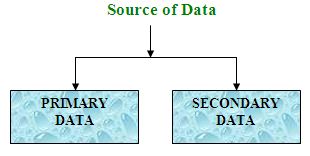

Both the primary and the secondary form of information were used to prepare this report. The details of these are highlighted below:

Source of the data collection

1. Primary Source

- Surveying through questionnaires

- Face-to-face conversation with the respective officers and staffs Practical work exposures from the different desks of the bank.

2. Secondary Source:

The organization part of the report is mainly based on Secondary data. These data were gathered from

- Annual report of the company.

- Web site of the company

- Internet

- Publications of the company, different type of books etc.

FINDINGS

To analyze the Internal Marketing Strategies or Employee Satisfaction of Prime Bank Limited, I have prepared questionnaire to collect information. My sample size is 20 who belong to the Executive Management Level, Mid Level and Junior Level of the hierarchy of the organization.

Job satisfaction has been defined as a pleasurable emotional state resulting from the appraisal of one’s job, an affective reaction to one’s job, and an attitude towards one’s job. Job satisfaction describes how content an individual is with his or her job. Job satisfaction is a very important attribute which is frequently measured by organizations. The happier people are within their job, the more satisfied they are said to be. To keep the employees satisfied the organization has to adopt internal marketing strategies.

To analyze the topic I have focused on Motijheel Branch. I have concentrated my investigation around the following areas.

- Superior-Subordinate Communication

- Facilities offered

- Physical Work Environment

- Motivational Factors

- Job switching trend

- Impact of Gender issues in internal marketing

From the executive level of management I have taken two respondents: designations of both employees are AVP. There are five respondents who are PO and three Officers from the mid level management of the hierarchy working in the various departments. And finally from the junior level there are two SO, two MTO, one JO, and five AO.

- AVP- Assistant Vice President

- SO- Senior Officer

- MTO- Management Trainee Officer

- JO- Junior Officer

- AO- Assistant Officer

- PO- Principal Officer

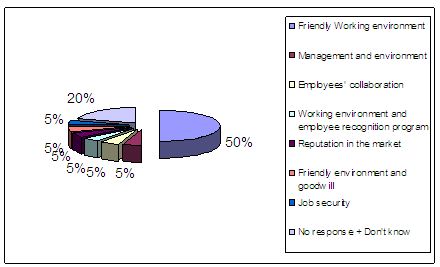

| Motives to being with the company | Responses | % |

| Friendly Working environment | 10 | 50% |

| Management and environment | 1 | 5% |

| Employees’ collaboration | 1 | 5% |

| Working environment and employee recognition program | 1 | 5% |

| Reputation in the market | 1 | 5% |

| Friendly environment and goodwill | 1 | 5% |

| Job security | 1 | 5% |

| No response + Don’t know | 3+1 | 20% |

The respondents were asked why they are staying with PBL. 50% of respondents said just because of friendly working environment. 5% responded because of management and environment, 5% said employees’ collaboration is the foremost reason. Working environment and employee recognition program is one of the motives to 5% respondents. Out of 20 respondents, 2 respondents held that friendly environment and reputation of PBL motivates them staying in the organization. 5% respondents said that PBL ensures better job security, that’s why they are being with them. Out of 20 respondents, 3 respondents that mean 15% didn’t answer this question and remaining 5% said they don’t know why they are staying with PBL, it indicates that they are confused.

Motivational Factors:

The organization provides various Benefits to the employees that can be counted as Motivational Factors. These are various non-wage compensations provided to employees in addition to their normal wages or salaries. There are various types of benefits provided by the employer like housing benefit, insurance benefits, retirement benefits, profit sharing, fringe benefits, perk benefit, year ending function stuff picnic, training and other specialized benefits. Benefits are an established and integral part of the total compensation package. In order to have a sound benefits program there are certain basic considerations.

Overall satisfaction regarding Employees Benefit Package:

4 | 3 | 2 | 1 |

Very satisfied | Satisfied | Dissatisfied | Very Dissatisfied |

2 | 11 | 3 | 4 |

Percentage (%) Analysis

4 | 3 | 2 | 1 |

Very satisfied | Satisfied | Dissatisfied | Very Dissatisfied |

10% | 55% | 15% | 20% |

Employee Benefits Programs:

Employee benefits constitute an indirect form of compensation intended to improve the quality of the work lives and the personal lives of employees. Since employees expect a full benefits package, the motivational value of these benefits depends on how the benefits program is designed and communicated.

Retirement Program

Retirement program is an important part of life for many individuals, requiring sufficient and careful preparation. In convincing job applicants, particularly older ones, employers usually emphasize the retirement benefits that can be expected after a certain number of years of employment.

1 to 6 scale point (1 being most important and 6 being least important)

| Scale | 1 | 2 | 3 | 4 | 5 | 6 | N/A |

| Responses | 7 | 2 | 2 | 3 | 2 | 3 | 1 |

| Percentage | 35% | 10% | 10% | 15% | 10% | l5% | 5% |

PEL arranged for retirement benefit for every employee. The above analysis showed that 35%+10%=45% believe that retirement program is vital part of employee benefit package. 10% think that it is moderately important, 15%+10%+15%^40% said that it is less important, and remaining 5% said that it is not applicable for them because of their probationary period.

One of the oldest and most popular employee benefits is life insurance which provides death benefits to beneficiaries and may also provide accidental death benefits.

Perk Benefits

The term perks is often used colloquially to refer to those benefits of a more discretionary nature. Often, perks are given to employees who are doing notably well and/or have seniority. Common perks are company cars, hotel stays, free refreshments, leisure activities on work time (golf, etc.), stationary, allowances for lunch etc.

1 to 6 scale point (1 being most important and 6 being least important)

| Scale | 1 | 2 | 3 | 4 | 5 | 6 | No response | N/A |

| Responses | 2 | 5 | 1 | 3 | 3 | 2 | 3 | 1 |

| Percentages | 10% | 25% | 5% | 15% | 15% | 10% | 15% | 5% |

Employee Recognition Program:

Employee recognition program is a non-financial, praising and verbal recognition supposed to provide by the superior for doing good performance. Employee recognition program is a verbal content which positively influence job satisfaction of employees.

| Scale | 1 | 2 | 3 | 4 | 5 | 6 |

| Responses | 7 | 2 | 6 | 1 | 3 | 1 |

| Percentages | 35% | 10% | 30% | 5% | 15% | 5% |

In the analysis 35%+10%=45% respondents responded that employee recognition program is an important tool in the organization to motivate employee. Respondents said PBL arranges employee recognition program but not in large extent. They recommended arranging this sort of program in large extent so that employees will be motivated to achieve their goals.

- Most of the employees think that the salary of Prime Bank Ltd. is low that don’t match with their salary expectation.

- The employees are given religious festival bonus on both Eid. The non-Muslims are also given bonus on Eid regardless of Puja.

Facilities offered or expected:

Housing Benefits

Housing Benefit is designed to help employees pay the rent for the home they live in. Employees might be provided loan for their house building.

Physical Work Environment:

Before analyze we should know what does comfortable Work Environment mean. By the word comfortable I meant whether Prime Bank provides suitable physical layout like well furnished with desk, light, AC, fan, spaces between the sections etc.

Comfortable Environment of the worksplace:

4 | 3 | 2 | 1 |

Strongly Agree | Agree | Disagree | Strongly Disagree |

8 | 10 | 2 | 0 |

Percentage (%) Analysis

Strongly Agree | Agree | Disagree | Strongly Disagree |

40% | 50% | 10% | 0% |

Superior-Subordinate Communication:

Superior-subordinate relationship has an important influence on job satisfaction in the workplace. The way in which subordinate’s perceive a supervisor’s behavior can positively or negatively influence job satisfaction. Individuals who dislike and think negatively about their supervisor are less willing to communicate or have motivation to work where as individuals who like and think positively of their supervisor are more likely to communicate and are satisfied with their job and work environment. The relationship of a subordinate with their supervisor is a very important aspect in the workplace. Therefore, a supervisor who uses nonverbal immediacy, friendliness, and open communication lines is more willing to receive positive feedback and high job satisfaction from a subordinate where as a supervisor who is antisocial, unfriendly, and unwilling to communicate will naturally receive negative feedback and very low job satisfaction from their subordinate’s in the workplace.

“Management listens to employees”

1 | 2 | 3 | 4 |

Strongly Agree | Agree | Disagree | Strongly Disagree |

3 | 9 | 5 | 3 |

DISCUSSION

v As companies empower staff to build stronger customer relationship, internal marketing underpins the drive for greater involvement, commitment, and understanding.

v Constant organizational change can loosen the ties between employer and employee. Internal marketing can bring the parties together with shared goals and values.

v Internal marketing helps the process of knowledge development by building understanding and commitment to personal development.

Job satisfaction has been defined as a pleasurable emotional state resulting from the appraisal of one’s job, an affective reaction to one’s job, and an attitude towards one’s job. Job satisfaction describes how content an individual is with his or her job. Job satisfaction is a very important attribute which is frequently measured by organizations. The happier people are within their job, the more satisfied they are said to be. To keep the employees satisfied the organization has to adopt internal marketing strategies.

LIMITATION

The major limitations of this study are:

- Ø Sufficient records, publications were not available as per my requirement;

- Ø There were some restrictions to have access to the information confidential by concern authority;

- Ø Information is, not-processed through computer;

- Ø Non-cooperative behavior of some officials of the bank;

- Ø 14 days are very short time to prepare this type of report.

RECOMMENDATION

Areas of the company that need improvement

It was tried to know the employee suggestion and comments to enhance the performance of the Bank. Most of the employees expressed that they have voices in major decision making. Employees feel dissatisfied in the areas of employee benefit program. From the analysis and findings part we have seen the largest parts of the employees are not happy with the benefit package and they recommended it should be improved. There are some additional areas wherein employees suggested developing. Respondents said Credit and Foreign Exchange Department, job description, job rotation of the employees, Marketing area, IT Department, ‘Management attitude’, Training, Salary and benefit packages etc areas need improvement according to respondents’ recommendation. We got broad areas as they suggested improving those are as follows:

For Employees;

- Respondents recommended Salary and benefit packages should sound and management should ensure well-communication of benefit package to the employees.

- Transportation facility is needed for the employees

- 90% of the female respondents responded that Day Care facility for their children should be introduced in the bank.

- Increase of maternity leave

- Paternity leave

- 35% of the female respondents responded that Prayer room for the Female should be seperated in the bank.

- Job descriptions, job rotation of the employee are diagnosed as problem area and it must be advanced.

- Training section should be developed.

- Respondents of PEL recommended arranging employee recognition program in large extent so that employees will be motivated to achieve their goals.

- Management of PEL is less serious about providing benefits and supporting employees to make decisions. Employees of PBL suggested a sound benefit package for its all employees.

- Since medical benefit and house building benefit is an important tool to motivate employees, PBL should provide these benefits to all employees including junior level employees.

- Life insurance plays a significant role to motivate employees in the organization, PBL doesn’t offer it. Employees suggested arranging life insurance benefits to the employees.

- For the overall banking;

- Respondents suggested Credit and Foreign Exchange Department needs improvement without mentioning any particular problem and solution to that problem.

- Responded suggested Marketing area needs to focus on customer services in a broader range.

- IT Department needs improvement.

- Area which was pointed that is ‘Management attitude’ but again without mentioning any specific problem to that

SWOT Analysis of Prime Bank Limited;

SWOT is an acronym for the internal strength and weakness of a firm and the environmental Opportunity and Threat facing that firm. So if we consider Prime Bank as a business firm and analyze the its strength, weakness, opportunity and threats the scenario will be as follows :

Strength

- Energetic as well as smart team work

- Good Management Corporation, with each other

- Usage of faster pc bank software

- Membership With SWIFT

- Good banker-customer relations

- Strong Financial Position

- Online Banking Service

- Strong position in CAMEL rating.

- Huge business area

- Excellent monitoring and supervision.

Weakness

- Lack of proper motivation, training and job rotation

- Lack of experienced employees in junior level management

- Lack of own ATM services

- Tendency to leave the bank in quest of flexible environment.

Opportunity

- Expanded market

- Growth of sales volume

- Change in political environment

- Launching own ATM card services

Threats

- Different services of FCB’S (phone banking/ home ban king)

- Daily basis interest on deposit offered by HSBC

- Entrance of new PCB’s

CONCLUSION

Prime Bank has created a new horizon of its own in the banking arena of Bangladesh in terms of service to the customers and value addition for its shareholders. PBL is the fastest growing private sector bank and the bank is enjoying remarkable success with significant growth in every sphere of its activities. The bank made satisfactory progress in all areas of business operation up to 2010.The bank has closed the year 2010 with a number of achievements. The bank further expanded and consolidated its customer base in both of its corporate business and retail banking. The bank’s capital adequacy ratio is always well above the stipulated requirement of 8%.

The bank has a network of 71 branches. And the branches are strategically located as the network is considered as the backbone of strength to outreach customers. PBL aims to continuously update and develop its product line and range of service to cater to the needs of retail & corporate customers. To achieve this goal, effort have been directed in three main areas-

- Design and introduction of new products and services.

- Shaping and developing the system to face new challenges and emerging needs of the market.

- Full implementation and utilization of the Bank’s excellence program which aims to provide quality service to customers.

In 2007 & previous years the bank consolidated its position and retained its product line and financial services aimed at various target groups. In short, in a challenging market conditions, the bank continued to provide more innovative products and better service to retain the market share.