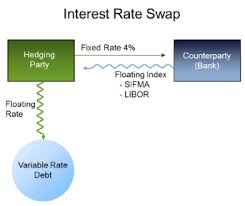

Interest rate swap is an agreement between two parties where one is foreseeable future interest payments can be exchanged for another specified primary amount. Interest rate swap often exchange a set payment for the floating payment that is linked to an interest rate. A company may typically use rate swaps to reduce or manage exposure to fluctuations in rates of interest or to get marginally lower rate than it might have been able to obtain without swap.

Interest Rate Swap