The initial public offering (IPO) or stock market launch refers to the mechanism by which a private corporation’s shares are sold to the public in a new stock issue. A corporation is considered a private entity, usually with a limited number of investors, prior to an IPO (founders, friends, family, and business investors such as venture capitalists or angel investors). A privately owned corporation is turned into a public company by this process, colloquially known as floating or going public. Initial public offerings can be utilized to raise new value capital for organizations, to adapt the speculations of private investors, for example, organization originators or private value speculators, and to empower simple exchanging of an existing property or future capital raising by getting traded on an open market. As it usually entails equity premiums for existing private investors, the transition from a private to a public company may be an important period for private investors to fully understand the benefits from their investment. It also requires public buyers, meanwhile, to engage in the sale.

At the point when an organization experiences an IPO, the overall population can purchase shares and own a bit of the organization unexpectedly. An IPO is regularly alluded to as “going public” and the guaranteeing cycle is commonly driven by a venture bank. Both in absolute terms (total value as determined by the share price multiplied by the number of shares sold to the public) and as a proportion of the total share capital, the stock exchanges specify a minimum free float (i.e., the number of shares sold to the public divided by the total shares outstanding). Prior to the IPO, an organization has not many investors; this incorporates the originators, blessed messenger financial specialists, and financial speculators. Yet, during an IPO, the organization opens its offers available to be purchased to people in general.

Although there are many advantages to the IPO, significant costs are also involved, especially those related to the procedure, such as banking and legal fees, and the ongoing need to reveal significant and often sensitive details. The additional money collected is the greatest benefit of an IPO. The capital raised can be utilized to purchase extra property, plant, and equipment (PPE), fund research and development (R&D), grow or take care of existing obligations. Via an IPO, there is often an increased knowledge of a company, which usually creates a flood of potential new clients. When it comes to IPOs, there are various investor groups. This includes:

- Qualified Institutional Buyers (QIBs)

- Non-Institutional Investors (NIIs)

- Retail Individual Investors (RIIs)

Once a corporation enters a point in its development phase where it feels it is sufficiently mature for the rigors of the regulations of the Securities and Exchange Commission (SEC) along with the advantages and obligations to public shareholders, its interest in going public can begin to be publicized. What’s more, private speculators/establishing accomplices/investors can utilize an IPO as a leave system. A public contribution is perhaps the most well-known ways investors make a lot of cash. Private companies, however, can also apply for an IPO at different valuations with solid fundamentals and demonstrated profitability potential, depending on market competitiveness and their ability to meet listing criteria.

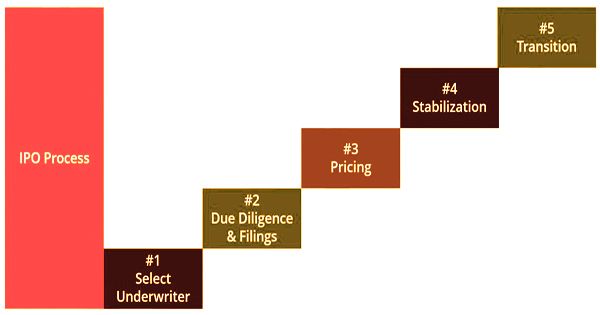

Steps in an Initial Public Offering (IPO): In an initial public offering, the first move is to employ an investment firm or bank to manage the IPO. Investment banks can either work with one boss, or one bank can work on its own. In different countries, IPO procedures are regulated by various rules. For a good IPO, preparation is important. The following 7 advance planning steps are proposed by one book:

- develop impressive management and professional team

- grow the company’s business with an eye to the public marketplace

- obtain audited financial statements using IPO-accepted accounting principles

- clean up the company’s act

- establish antitakeover defenses

- develop good corporate governance

- create insider bail-out opportunities and take advantage of IPO windows.

Investors associated with the IPO the supervisory crew, evaluators, bookkeepers, the endorsing banks, legal advisors, and Securities and Exchange Commission (SEC) specialists go to a gathering to talk about the contribution and decide the circumstance of the recording. During the entire underwriting process, identical meetings occur. Due diligence must be carried out on the business after the meeting to ensure that the registration statements are correct. Business due diligence, legal and IP due diligence, financial and tax due diligence are included throughout the activities.

An IPO is a major advance for an organization as it furnishes the organization with admittance to collecting a ton of cash. This gives the organization a more noteworthy capacity to develop and extend. Initial public offerings by and large include at least one speculation banks known as “underwriters”. The firm selling its shares, called the “issuer” enters into a contract to sell its shares to the public with a lead underwriter. Then, the underwriter approaches investors with offers to sell those shares. For the most part, the progress from private to public is a critical time for private financial specialists to trade out and acquire the profits they were anticipating. Private investors may clutch their offers in the public market or sell a bit or every one of them for gains.

The investment banks will assign shares to investors until the IPO is priced and the stock will begin trading on the market for the public to purchase and sell. Multinational IPOs in both the domestic market of the issuer and other regions may have several syndicates to deal with varying legal requirements. Then, the public market opens up a tremendous open door for a huge number of speculators to purchase partakes in the organization and contribute funding to an organization’s investors’ value. The public comprises of any individual or institutional financial specialist who is keen on putting resources into the organization.

While there are advantages to going public, there are also notable disadvantages to consider. It can take anywhere from six months to a year for an Initial Public Offering (IPO). The company’s management team is likely to concentrate on the IPO during this period, creating a risk for other parts of the company to suffer. In certain circumstances, when the IPO is definitely not a “hot” issue (undersubscribed), and where the salesman is the customer’s counsel, it is conceivable that the monetary impetuses of the guide and customer may not be adjusted. In the United States, public organizations are observed by the Securities and Exchange Commission (SEC).

There are two key ways in which you can assess the price of an IPO. The business either sets a price (“fixed price method”) with the aid of its lead managers or the price can be calculated by analyzing confidential investor demand data collected by the bookrunner (“book building”). Generally, the quantity of offers the organization sells and the cost for which offers sell are the producing factors for the organization’s new investors’ value esteem. Investors’ value actually speaks to shares claimed by financial specialists when it is both private and public, yet with an IPO the investors’ value increments essentially with money from the essential issuance.

The following example highlights a popular hypothesis in corporate finance as to why IPOs are underpriced:

Suppose that there are two groups of investors invested in an IPO insider and the rest of the market (outsiders). Insiders know the company’s true value and if it is overpriced, they can stay away. Insiders can buy the shares if the IPO is underpriced.

Outsiders do not grasp the company’s true worth but know that the insiders know. Outsiders will follow suit with the insider’s action with this information:

- If the IPO is underpriced, everyone would buy shares.

- If the IPO is overpriced, the insiders are not going to buy it. Knowing this, the outsiders would also not buy into the offering.

Along these lines, it is to the greatest advantage of the backer and its bank to undervalue the contribution. In such cases, the offers in retail class are offered to speculators based on a lottery. This is an electronic cycle that guarantees unprejudiced assignment of offers to speculators.

Information Sources: