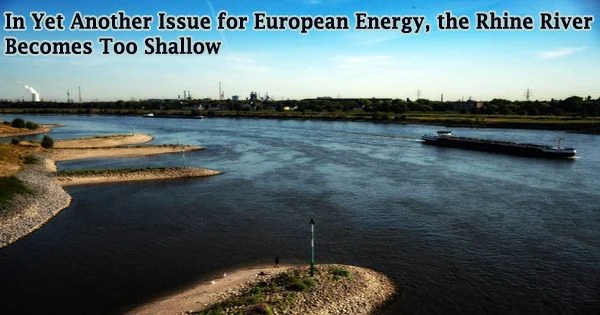

As the continent struggles with its greatest energy crisis in decades, the Rhine River reached a new low on Friday, significantly restricting the flow of essential supplies to portions of inland Europe.

According to German government data, a crucial water marker at Kaub, where the river is narrow and shallow, dropped below 40 centimeters (16 inches) on Friday and is likely to continue to decrease over the next few days. Many barges cannot afford to pass through the chokepoint at that depth.

Everything is transported down the Rhine, including grains, paper goods, chemicals, and fuels. With Europe already suffering from a shortage of energy supplies made worse by Russia’s conflict in Ukraine, it could not have happened at a worse moment. The cost-of-living situation is only getting worse as a result of climate change drying up Europe’s rivers.

Container company Contargo GmbH & Co. KG said Friday that a drop at Kaub to below 40 centimetres would prompt it to largely discontinue its barge business on the middle and upper Rhine. Some larger vessels are no longer able to pass that point, just west of Frankfurt, according to an official from the WSA, the German state waterways agency.

Companies have been taking steps to prepare. Chemicals maker BASF SE is using more rail to transport goods and has ordered shallow-water barges. Steelmaker Thyssenkrupp AG is using ships with lower drafts to keep its mill in the town of Duisburg supplied.

German utility EnBW Energie Baden-Wuerttemberg AG has enough coal to supply its power stations for the winter, even with disruption to shipments. Another power producer, Uniper SE, has warned that it may have to cut output at two key coal-fired power plants in Germany as it struggles to get fuel supplies along the river.

We’re expecting this situation to continue towards the end of the year.

Toril Bosoni

Truck company Hoyer GmbH hasn’t seen an increase in demand for its services due to the low water levels. Much of its business in the south of the country is on long-term contracts, a spokesman said.

If the disruption continues into September, there could be an increase in demand for trucks to move goods across Germany, according to Simonas Bartkus, head of marketing and communication at Girteka Logistics, the owner of Europe’s largest fleet of the vehicles. The company isn’t seeing any immediate impact on demand stemming from the Rhine.

Fuel Transport

When the water marker at Kaub falls to 40cm and below, it becomes uneconomical for many barges that haul commodities like diesel and coal to sail through that part of the river, a representative for Germany’s Federal Institute for Hydrology previously said. Low water levels restrict the volume of goods that can safely be carried.

The drop to 39 centimetres earlier means Kaub is at its lowest for the time of year since at least 1993, official figures show. By early Tuesday, that figure used to calculate draft is set to fall to 34 centimetres. The level isn’t the actual depth of the river.

The trade of 400,000 barrels a day of oil products could be disrupted along the river that stretches from the Amsterdam-Rotterdam-Antwerp region through Germany to Switzerland, according to Facts Global Energy.

Stockpiles of diesel and heating oil in independent storage in the ARA region are currently at their lowest seasonal level since at least 2008. A shallower river makes it harder to ship this important fuel into inland Europe when the water levels sharply dropped in late 2018, these inventories jumped above the seasonal norm.

The river crisis is especially concerning for landlocked countries in central and eastern Europe that normally get fuel via the Rhine, according to the International Energy Agency.

“We’re expecting this situation to continue towards the end of the year,” Toril Bosoni, head of the IEA’s oil market division.