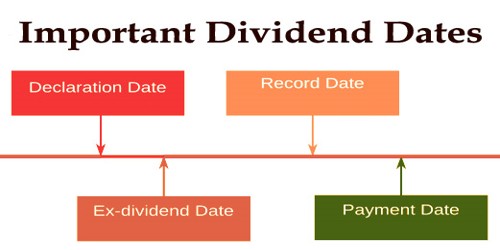

A dividend usually comes in the form of a transfer of cash that is paid to investors from the profits of the company. A business may opt to pass the value to shareholders by means of a dividend instead of reinvesting cash back into the company. There are 4 important dates: declaration date, record date, ex-dividend date, payment date.

Important Dividend Dates

Declaration Date: This is the date that a potential dividend is declared by the board of directors. This declaration provides information on the exact amount of the dividend, the date of registration, and the date on which the dividend will be paid (the date of payment).

For example: ABC Co. announced on xx/ xx /xxxx (declaration date) a dividend of $0.500 per share (dividend size) payable on xx/ xx /xxxx (payment date) to registered shareholders as of xx/ xx /xxxx (record date).

Ex-Dividend Date: This is the foremost important date for the shareholder; it tells who exactly catches the present dividend payment. The corporate doesn’t set the ex-dividend date the ex-dividend date is about by the exchange where the company’s stock is traded. Normally, the date precedes the record date by two or four days. The aim of setting this date is to make it possible to clear up the records relating to transfers of ownership of shares of stock before the record date. Purchasers of the shares are not entitled to a dividend on or after the ex-dividend date.

This date is decided by the exchange the stock is traded on and it’s supported the date of record (ex-dividend date = date of record minus days for settlement).

Record Date: In order to obtain a dividend, the record date, also known as the date of record, is the date from which the investor must be on the company’s books. The company calculates this date and it is used to decide the most relevant date for the ex-dividend date for a dividend paid stock. The ex-dividend date is before the record date because of the actual fact that there’s a settlement period for stock trades on exchanges. This can be not the date up to which we must buy shares to urge the dividend.

Payment Date: The date/day when the real dividend will be paid. Dividend payments can be mailed or transferred electronically to shareholder accounts. Today, for instance, is 00/00/0000 and we have 100 shares of a firm named XYZ. At 00/00/0000 (declaration date), the XYZ corporation declares its next dividend payment. XYZ declares that they’ll pay $1.10 dividend with a record date 00/00/0000 and payment date 00/00/0000. The ex-dividend date is 00/00/0000 (two days before the record date due to 2 days settlement time that’s needed for every transaction on the exchange to be fully processed).

This means that we will obtain a dividend payment of $110 (100 shares X $1.10 dividend per share) if we keep our shares until the ex-dividend date (in our case, 00.00.0000). We’ll still get the payout if we sell our shares on the ex-dividend day. If, for example, we sell our shares before the ex-dividend date, at 00.00.0000, we skip the payout.

Some firms pay dividends once a year. These dividend dates are announced once a year, respectively. Some businesses pay twice a year, once a quarter, or even each month. They will record their dates as many times as the payments of the dividend are.

Information Sources: