By most measures, the U.S. economy is in solid shape. Despite the fact that 2022’s first half saw negative growth, the year’s second half is expected to improve because to a healthy labor market and resilient consumers.

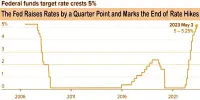

The fourth quarter’s growth in the gross domestic product, a measure of the health of the economy overall, exceeded expectations, and as inflation continues to drop, the Federal Reserve is largely anticipated to announce a more gradual rate hike at its policy meeting next week.

However, other areas of the economy, including those related to housing, manufacturing, and corporate profitability, have shown symptoms of slowing down, and a new wave of layoffs has heightened concerns that a recession is still imminent.

“There’s no scarcity of economists with strong opinions,” said Tomas Philipson, a professor of public policy studies at the University of Chicago and former acting chair of the White House Council of Economic Advisers. “There’s a lot of scarcity of economists with the right opinion.”

A ‘rolling recession’ may already be underway

Rather than an abrupt contraction Americans need to brace for, a “rolling recession” is already in progress, according to Sung Won Sohn, professor of finance and economics at Loyola Marymount University and chief economist at SS Economics. “This means some parts of the economy take turns suffering rather than simultaneously.”

In fact, the worst may even be over, he said.

The economy and financial markets have seen a significant amount of the response to the Fed’s actions. Consumers refinanced their homes in anticipation of higher rates, and businesses reduced supplies and eliminated employees in some regions.

“It is time to think about an exit strategy,” Sohn said.

“Expectations about a recession have been pretty inaccurate,” added Yiming Ma, an assistant finance professor at Columbia University Business School.

“This cycle has proven so many of our traditional theories wrong,” Ma said.

In fact, this could be the soft landing Fed officials have been aiming for after aggressively raising interest rates to tame inflation, she added.

What this means for consumers

But regardless of the state of the economy, many Americans are struggling to make ends meet due to exorbitant pricing for basic goods like eggs. The majority have used up their savings and are now relying on credit cards.

Several reports show financial well-being is deteriorating overall.

“For consumers, there’s a lot of uncertainty,” Philipson said. For now, the focus should be on sustaining income and avoiding high-interest debt, he added.

“Don’t plan any major future expenses,” he said. “No one knows where this economy is going.”

How to prepare your finances for a rolling recession

Every household will suffer a rolling recession to a different extent, depending on their industry, income, savings, and job security, even if the effects of inflation are being felt everywhere.

Still, there are a few ways to prepare that are universal, according to Larry Harris, the Fred V. Keenan Chair in Finance at the University of Southern California Marshall School of Business and a former chief economist of the Securities and Exchange Commission.

Here’s his advice:

Streamline your spending. “If they expect they will be forced to cut back, the sooner they do it, the better off they’ll be,” Harris said. That may mean cutting a few expenses now that you just want and really don’t need, such as the subscription services that you signed up for during the Covid pandemic. If you don’t use it, lose it.

Avoid variable-rate debts. Most credit cards have a variable annual percentage rate, which means there’s a direct connection to the Fed’s benchmark, so anyone who carries a balance has seen their interest charges jump with each move by the Fed. Homeowners with adjustable-rate mortgages or home equity lines of credit, which are pegged to the prime rate, have also been affected.

Stash extra cash in Series I bonds. These inflation-protected assets, backed by the federal government, are nearly risk-free and are currently paying 6.89% annual interest on new purchases through this April, down from the 9.62% yearly rate offered from May through October last year.

Although there are purchase limits and you can’t tap the money for at least one year, you’ll score a much better return than a savings account or a one-year certificate of deposit. Even if rates on online savings accounts, money market accounts, and CDs have increased, inflation still outpaces these returns.