The Gross Margin Ratio is a profitability ratio, also known as the gross profit margin ratio, that compares a company’s gross margin to net sales. It illustrates how much profit a business earns after the Cost of Goods Sold (COGS) is paid off. Generally, it is determined as the selling cost of a thing, less the expense of products sold (for example creation or procurement costs, excluding roundabout fixed costs like office costs, lease, or authoritative expenses). The proportion demonstrates the level of every dollar of income that the organization holds as a gross benefit.

Gross Margin is often used with Gross Profit interchangeably, but the words are distinct. The higher the gross profit, the more money a corporation holds on each revenue dollar, which it can then use to fund other expenses or meet debt obligations. The figure for net sales is actually gross income, less profits, allowances, and discounts. In other words, the gross profit ratio is basically the rate markup on the stock from its expense. This is the unadulterated benefit from the offer of stock that can go to paying working costs.

Example of Gross Margin Ratio

The Formula for Gross Margin Ratio is:

Gross Margin Ratio = (Revenue – COGS) / Total Revenue

Where:

COGS = Cost of goods sold

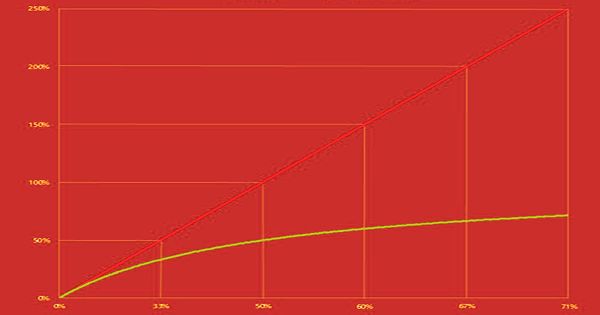

The goal of margins is “to assess the value of incremental sales and to direct the decision on pricing and promotion.” The gross margin ratio is frequently confused with the profit margin ratio, but the two ratios are entirely different. For instance, if the proportion is determined to be 20% that implies for each dollar of income created $0.20 is held while $0.80 is ascribed to the expense of products sold. The rest of the sum can be utilized to take care of general and authoritative costs, intrigue costs, obligations, lease, overhead, and so on.

The gross margin reflects the portion of any dollar of sales maintained as gross profit by the company. In its estimate, this ratio only takes into account the cost of the products sold, so it calculates the profitability of inventory sales. On the other hand, the gross margin ratio takes into account other expenditures. It is possible to express gross margin as a percentage or in overall financial terms. If the latter, it may be reported for a company on a per-unit basis or on a per-period basis. The ratio quantifies how gainfully an organization can sell its stock. A higher proportion is more ideal.

To calculate how their manufacturing costs contribute to their sales, businesses use gross margin. For a producer, higher gross margins represent higher efficiency in converting raw materials into profits. If retailers can get a major buying discount from the manufacturer or wholesaler when they buy their inventory, their profit margin would be higher because their prices are down. Larger gross margins are commonly viewed as ideal for most organizations, except for rebate retailers who rather depend on operational effectiveness and key financing to stay serious with lower edges. Increasing products (selling merchandise at a more exorbitant cost) would bring about a higher proportion. Notwithstanding, this must be done seriously in any case, the merchandise would be too costly, and less clients would buy from the organization.

It is also possible to use gross profit margins to calculate company productivity or to compare two firms with different market capitalizations. A low gross margin ratio does not inherently mean a business that is poorly performing. Rather than comparing them across industries, it is important to compare the ratios between companies in the same industry. A business with a high gross profit ratio means the company would have enough funds to pay wages, utilities, and rent for operating expenses. Net overall revenue is the first of the three significant benefit proportions. The other two are working net revenue, which demonstrates how operationally productive an organization’s administration is, and net revenue, which uncovers the organization’s main concern benefit in the wake of taking away the entirety of its costs, including charges and intrigue installments.

In certain sectors, such as apparel, for example, profit margins are estimated to be close to the 40 percent level, so before they are resold, the products need to be purchased from manufacturers at a certain cost. In other sectors, such as software product growth, the gross profit margin will in certain cases be higher than 80%. Because the gross margin ratio simply calculates the income from the selling of products, the amount of revenue that can be used to finance other areas of the company is often calculated.

Information Sources: