Main purpose of this report is to analysis General Banking of the Al Arafah Islami Bank Limited. Report overall about banking system according to banker’s point of view. Here also observe the general banking operation of Al Arafah Islami Bank and their services review the techniques used by the bank to make it lucrative. Finally evaluate of the present performance of the bank regarding general banking and draw SWOT analysis.

Objective Of the Report

- To get practical exposure to corporate culture

- To understand the system and methodology adopted for conducting day to day banking by AIBL

- To get an overall idea about banking system according to banker’s point of view

- To observe the general banking operation of AIBL and their services review the techniques used by the bank to make it lucrative.

- To evaluate of the present performance of the bank regarding general banking.

Methodologies of the Report

During the time of prepare this report I was able to gather the necessary information and data in both of two sources.

Sources are

- Primary and

- Secondary

These are shown elaborately

Primary Sources of data:

- Face to face conversation with the bank officers & staffs.

- Worked with every employee.

- Conversation with the clients.

Secondary Sources of data:

- Manual of the Al-Arafah Islami Bank Ltd.

- Files and documents of the branch.

- Annual reports of Al-Arafah Islami Bank Ltd.

- Different papers of Al-Arafah Islami Bank.

- Bangladesh Bank Guidelines.

- Different reference books of the library, journals, websites.

History of AIBL

Islamic ideology encourages us to successed in life here & hereafter. To achieve this success we must follow the way dictated by the HOLY QURAN and the path shown by Rasul (SM). With this goal in view Al-Arafah Islami Bank Ltd was established (registered) as a public limited company on 18 june 1995.The inaugural ceremony took place on 27 September 1995.The authorized capital of the Bank is TK.2500.00 million and the paid up capital TK.1153 million. Some very renowned Islamic personalities and pious businessmen of the country are the sponsors of the bank. The total paid up capital was invested locally.

The Bank is committed to contribute significantly in the national economy. It has made a positive contribution towards the socio economic development of the country by opening 78 branches on which 21 authorized dealer (AD) throughout the country.

The equity of the bank stood at TK.2037 million Crore as on 31 December 2008,the manpower are 1033 and number of shareholders are12013.

The Bank conducts its business on the principales of Musaraka, Bai muazzal,and hire purchase transactions approved by Bangladesh Bank. Naturally, its modes and operations are substantially different from those of other conventional commercial Bank. There is a shariah council in the Banks who maintains constant vigilance to ensure that the activities of the bank are being conducted on the percepts of Islam. The Shariah council consists of prominent Ulema, reputed, Bankers, renowned lawyers and eminent Economist.

Vision

- To be a pioneer in Islami Banking in Bangladesh and contribute significantly to the growth of the national economy.

Mission

- Achieving the satisfaction of Almighty Allah both here & hereafter.

- Proliferation of Shariah Based Banking practices.

- Quality financial services adopting the latest technology.

- Fast and efficient customer service.

- Maintaining high standard of business ethics.

- Balanced growth.

- Steady & competitive return on shareholders’ equity.

- Innovative banking at a competitive price.

- Attract and retain quality human resources.

- Extending competitive compensation packages to the employees.

- Firm commitment to the growth of national economy.

- Involving more in Micro and SME financing.

Corporate Culture

The bank has a friendly work environment which is not usual in other commercial banks. However the efficiency of the employees & strict corporate protocol is not present in the bank .The people in the bank see themselves as a tight knit team/family that believes in working together for growth. The Corporate culture has developed has not been imposed; it has rather been achieved through their Corporate conduct.

Corporate Objectives of AIBL

- All the activities of AIBL are conducted on interest-free system according to Islamic shariah.

- Investment is made through different modes permitted under Islamic Shariah.

- Investment-income of the bank is shared with the Mudaraba depositors according to a ratio to ensure a reasonably fair rate of return on their deposits.

- Its aims are to introduce a welfare-Oriented Banking system and also to established equity and justice in the field of all economic activities.

- Its extends co-operation to the poor, helpless and low-income group of the people for their economic enlistment particularly in the rural areas.

- It plays a vital role in human resources development and employment-generation, particularly for the unemployed youths.

- Its aim is to achieve balanced growth and development of the country through investment operations, particularly in the less development areas.

STAFF WELFARE PROJECT

The Bank always kept a careful eye on the economic security and benefit of its staffs & officers. The Bank operates a contributory provident fund, a social security & benevolent fund and a gratuity fund for its employees. In the year 2007 TK. 7.5 lac was paid to wife of late Mr.Shahidul Islam ,AVP & former branch manager of joydevpur Branch from bank’s social security & benevolent fund. Till now a total of TK.30 lac has been paid from the fund to the families of late officers & staffs of the bank.

Prevention of money laundering

Money laundering risk is defined as the loss of reputation and expenses incurred as penalty for being negligent in prevention of money laundering. For mitigating the risk the Bank has a Central Compliance Unit (CCU) at Head Office. The unit reviews the anti money laundering activities of the bank on regular basis .The bank has a designated chief Anti Money Laundering Compliance Officers (CAMLCO)at Head Office and Branch Anti Money Laundering Compliance Officers(BAMLCO)at branches.The Compliance Officers review the suspicious Transaction (STR) and records them properly.Manuals for prevention of money laundering have been established and Transaction profile has been introduced . Training has been continuously given to all the category of officers and executives for developing awareness and skill for identifying suspicious activities.The bank submits the suspicious Transactions Report (STR),Cash Transaction Reports (CTR) and other periodical reports to Bangladesh bank on time.

Human Resource of AIBL

Human resource is our prime asset. It is neither the machine nor the technology alone, but the invaluable mix of man –machine interface that makes technology work. We strongly believe while the capacity of machine is limited ,the potential of human being is unlimited .The qualities of loyalty to the company and to the customers, tenacity to learn more and the commitment to perform characterize our human resource. Our employees with outstanding quality are rewarded in the Bank.

The Human Resource Division of Head Office is responsible for fixing principles and policies concerning personnel and certain areas of administration .The division is responsible for employee relation, staffing succession, planning ,training, employee benefits, compensation and their social security. The salary and compensation package for all levels of our employees was reviewed and revised last year to be competitive with all local private sector Banks and financial institutions in the country .It is targeted to attract and retain good performers in the Bank.

We recruited 480 fresh entrants and 15 experienced Bankers during the year 2010 though a transparent recruitment process to fulfill the manpower requirement in the Bank. The Bank also sent 9 employees to BIBM, 07 employees abroad, 25 employees to Bangladesh Bank for training in different fields to upgrade themselves with the latest techniques of modern banking. we have 1,711 staff in the Bank of whom 73 are executives,1339 are officers and 299 other staffs as on December 31st 2010.

| SL .NO. | Designation Category | Number |

| 1 | Executives | 73 |

| 2 | Officers | 1,339 |

| 3 | Others | 299 |

| Total | 1,711 |

The Bank plans to rationalize per –Branch employee by equitable Manpower distribution of human resource amongst the existing and future branches. As a part of social commitments Bank accommodated 279 students from different renowned universities for doing internship program in our Bank during the year 2010. The Bank has recruited experienced new manpower to strengthen its large scale operations. Total manpower employed in the Bank including Managing Director is 1,711 at 31st December 2010; which was 1,296 at the end of the last year.

R&D and Training

The Bank gives utmost importance for making continuous investment in Research and Development (R&D) and Training to achieve operational efficiency in the competitive global banking scenario. The Bank’s human resource policy is to recruit and build up quality manpower having skill and professional expertise. In implementation of the human resource development strategy, the Bank established its own Training Institute at the Head Office with the vision to build up professionals with technical, human and conceptual skills. The Institute is focused to ensure a formal platform where employees can exchange their ideas, update their knowledge base, and open up their eyes to the complexities of banking world. The Bank always acknowledged the valuable contribution made by its employees for the continuous superb achievement every year. The improvement in cost income ratio and better per employee performance indicate the efficiency, productivity of the employee. The Bank created a sense of community among the employees by encouraging communication with each other in the Management Committee Meeting and across the department and the divisions. This discussion helped the employee to learn each other’s jobs and roles and develop an understanding about the Bank as a whole.

In 2010 total number of 1808 trainees were trained at training Academy through 44 training courses /workshop consisting of 223 working days. A total 7091 executives/officials have trained on different subject through 8 out reach and 615 “In-house training at Branches”. The numbers of officials trained in 2010 is 5 times of the total manpower of the Bank; That is, in this year each official has attended in an average of 5 training programs. In these programs training sessions were conducted by resources persons from Bangladesh Bank, BIBM and many other government and private Bank and financial institutions besides Bank’s own speakrs. As a general member of Bangladesh Institute of Bank Management (BIBM) 9 Officers and executives have got training from that institution on different courses in this year. At the same time, some other 25 officers and executives of the Bank have been trained in several training institutes including Bangladesh Bank Training Academy and others.

Moreover, 7 executives of the Bank participated in training courses in India, Nepal, Singapore and Malaysia in the year of 2010.

Internal Control and Compliance

Operational loss may arise from error and fraud due to lack of internal control and compliance. Management through Internal Control and Compliance Division (ICCD) controls operational activities of the Bank . Bank has established separate Internal Audit &Inspection Department, Audit Monitoring Department and Regulatory Compliance Department under ICCD. Audit Monitoring Department is ensuring the compliance of Audit &Inspection Reports while Regulatory Compliance Department is ensuring the compliance of Regulatory Rules and Regulations. The Audit Committee of the Board subsequently reviews the reports of the Internal Control and Compliance Division .ICCD independently reports the Internal Control System and Financial Health of the Board of Directors.

Appointment of Statutory Auditor

In the 15th Annual General Meeting of the Bank M/S Hoda Vasi Chowdhury & Co.and M/S ACNABIN Chartered Accountants were appointed External Auditors of the Bank for a term till conclusion of the 16th Annual General Meeting . As per Bangladesh Bank Rule M/S Hoda Vasi Chowdhury & Co. Chartered Accountants will be retired and M/S ACNABIN Chartered Accountants are eligible for another terms. The Board has approved M/S Masih Muhit Haque &Co.and M/S ACNABIN Chartered Accountants for re-appointment as External Auditors by the shareholders till the 17th Annual General Meeting.

Information Technology of AIBL

Al-Arafah Islami Bank Ltd. With he vision of becoming the leading Bank in the country both in service and technical aspects have taken bold steps o fulfill the requirements of the mass .Banking sector is going through massive change with the advent of new technologies as well as new ways and norms of banking .with

information technology becoming the tool of almost every trade ,IT Division at Al-Arafah Islami Bank took the challenge of giving the best possible service to its users and customers alike. AIBL’s pledge to adhere with the principles of Islamic Norms and ethics and combine them with today’s technology threw a great challenge to the IT division. It has been a while now that AIBL is providing True Centralized online payment services to its customers in all it’s branches

with 78 online branches AIBL is committed to provide online facilities at any new branch that is added to the banks existing network . To keep pace with the growing customer needs as well as new technologies AIBL has taken a number of steps to facilitate clients while improving the existing services and adding on new services . The bank is striving hard towards the goal of changing from brick to click bank while taking banking services to the people who are not yet under the banking umbrella.

IT Division of the bank works day and night with its partners finding ways to reduce costs without compromising with customer experience. By this time Bank can proudly announce that it is the part of Bangladesh Bank’s recently launched Automated clearing House (BACH) and its Electronic Fund Transfer Network (BEFTN).AIBL’s It division

has worked in tandem with Bangladesh Bank’s personnel to make the project successful and were among the first banks to successfully implement and comply to requirements provided by the Central Bank. With Allah Almighty’s grace AIBL’s IT Division has rose to the occasion and extended it’s all out co –operation to the central Bank in implementing the new projects under the DIGITAL Bangladesh theme. Clearing is now completely automated along with Electronic Fund Transfer.

Under the guidance of the Central Bank AIBL has provided CIB information as data with minimum error to the Central Bank. The project is under way and IT Division is extending full support to CIB Cell of Bangladesh Bank. Bangladesh Bank coming up with guidelines for Internet and mobile fund transfer the Bank is ready to take the challenge and provide its customers the best possible experience of technology combined with safe and secure Banking.

Al-Arafah renews its pledge to combine the latest technology available with cream of bankers to provide. Customers with an experience of hassle free banking where a customer can pay his /her utility bill even at dead of the night. Though AIBL have attained a lot in terms of respect from the banking industry and customers alike in terms of its ventures with technology its management is pledge bound to mix the latest trends in technologies with banking to provide the ultimate experience to it customers.

Shariah Board of AIBL

Shariah Council of AIBL Consists of 5 members specialized in Fiqhal Muamalat (Islamic Commercial Law) according to guidelines given by the Bangladesh Bank to ensure whether all banking operations are transacted in accordance with Islami Shariah i.e. Qur’an, Sunnah, Ijma, and Iztihad.

In the year 2007 the Shariah Council has complied various decisions taken by the council on different matters at different times under the caption “Islami Banking Shariah Nitimala (1995-2006) and prepared a Shariah Manual and published which is first of its kind in Bangladesh. Shariah Council advices everybody concerned to comply with Shariah requirements and render all out efforts to increase the standard of service rendered to the clients.

On-line Banking

AIBL Started Providing On-line general banking services to the clients from 23 May 2008 through a network of all branches in the country using satellite based Communication links. This bank is a member of the Society for Worldwide Inter bank Financial Telecommunications (SWIFT).All of the Authorized Dealer Branches has SWIFT connectivity. The bank will introduce a few more products for the client, such as, SME banking , Tele-banking, Internet Banking etc in near future. To present the overall picture of the bank to the Depositors, Shareholders, and Investment Clients and Well wishers in home and abroad transparently bank has designed a Web site as WWW.al-arafahbank.com.

SME Banking

As SME has emerged as a thrust sector, Al-Arafah Islami Bank Ltd. also considers it important to extend and enhance finance for the same. Keeping this idea in the forefront, the bank has prepared an integrated policies, methods and procedures for SME investment.

Foreign Remittance

This bank is authorized dealer to deal in foreign exchange business. As an authorized dealer, a bank must provide some services to the clients regarding foreign exchange and this department provides these services.

The basic function of this department are outward and inward remittance of foreign exchange from one country to another country. In the process of providing this remittance service, it sells and buys foreign currency. The conversion of one currency into another takes place an agreed rate of exchange ,which the banker quotes ,one for buying and another for selling . In such transactions the foreign currencies are like an other commodities offered for sales and purchase,the cost (convention value) being paid by the buyer in home currency , the legal tender .

Remittance Procedures Of Foreign Currency

There are two types of remittance:

- Inward remittance

- Outward remittance.

Inward Foreign Remittance

Inward remittance covers purchase of foreign currency in the form of foreign T.T.,D.D., and bills, T.C. etc. sent from abroad favoring a beneficiary in Bangladesh .purchase of foreign exchange is to be reported to Exchange control Department of Bangladesh bank on Form-C.

Outward Foreign Remittance

Outward remittance covers sales of foreign currency through issuing foreign T.T. Drafts, Travelers Check etc. as well as sell of foreign exchange under L/C and against import bills retired.

Working of this department

- Issuance of TC, Cash Dollar/Pound

- Issuance of FDD, FTT & purchasing, payment of the same .

- Passport endorsement.

- Encashment certificate-

- F/C Account opening & filling.

- Opening of Export FC retention Quota A/C &maintain.

- Maintenance of ledger of Cash Dollar, FC Deposit A/C & TC .

- Maintain FBC register & follow up FBC.

- Opening of Student file & Maintain.

- Preparation of all related statement, Voucher & posting.

- Preparation of Weekly, Monthly, Yearly Statement for Bangladesh Bank return timely.

- Attending all related correspondence to other Bank or Institutions.

Position in the Stock Market

Bank’s Share sustained a steady strong position since its induction at Dhaka Stock Exchange & Chittagong Stock Exchange in 1998.In Dhaka Stock Exchange the face value of taka 10 of our share was traded at taka 110.00 highest in 2010. The Market trend of our bank’s share in Dhaka Stock Exchange between January 2010 to December 2010 is stated in the list:

SHARE PRICE LIST

| Month | Opening | High | Low | Closing |

| January | 52.23 | 59.30 | 50.20 | 58.88 |

| February | 58.50 | 61.40 | 52.00 | 52.60 |

| March | 51.88 | 54.50 | 48.10 | 54.15 |

| April | 54.73 | 75.40 | 53.33 | 72.85 |

| May | 73.00 | 100.00 | 56.30 | 87.00 |

| June | 86.70 | 96.00 | 81.00 | 93.80 |

| July | 94.10 | 104.90 | 91.60 | 98.20 |

| August | 99.20 | 102.90 | 92.60 | 98.70 |

| September | 101.90 | 110.00 | 100.10 | 109.70 |

| October | 66.40 | 72.60 | 63.00 | 64.40 |

| November | 69.00 | 77.90 | 64.00 | 71.50 |

| December | 72.30 | 73.50 | 54.00 | 66.88 |

Capital Market Services

Al-Arafah Islami Bank Ltd. (AIBL) is a corporate member of Dhaka Stock Exchange Ltd. & Chittagong Stock Exchange Ltd. Membership Number of Dhaka Stock Exchange is 234 and Membership Number of Chittagong Stock Exchange is 139.After obtaining stock broker and stock dealer registration certificates from Securities and Exchange Commission it started share trading from 15th January 2009. Its functions includes:

- Share trading services in DSE,

- Margin facility through bai-muazzal system,

- Full services Depository participant services and

- Discretionary account services.

Pledges and Commitments of the sponsor Directors of AIBL

Whenever a new institution comes into existence, the sponsors claim that it would be an institution with a difference. If a new institution does not have any novelty, why it should at all be brought into existence?

The sponsors of Al-Arafa Islami Bank Ltd in conformity with the tradition claim that it would be a bank with a difference. In what respect? Let us try to substantiate our claim.

The sponsors and promoters of Al-Arafa Islami Bank Ltd made a few firm pledges and commitments in the name of Allah. Such categorical commitments have never been made by the promoters of any bank in Bangladesh or anywhere in the subcontinent, to their knowledge.

Let us have a look at some of these commitments, titled “Agreements, Pledges and Commitments of the Promoters, Sponsors and Directors Of Al-Arafa Islami Bank Ltd”

Objective of the Sponsors

We declare that Al-arafa Islami Bank has not been set up with the objectives of economic welfare and financial benefit of the sponsors and promoters on this world,on the economy, we are desirous of our welfare in the next world and Nazat in Akhirat which could be achieved more by rendering credit services by the sponsors and bankers to others than any service to themselves.

Motivating Sprit of Qurbani

We are determined to rise above Nafsaniyyat of self-service and have come forward imbued with the spirit of Quarbani and sacrifice and to build up a model credit institution in which selfish, nafsaniyyat shall not be cultured on the mere pretext of majority view of the sponsors.

Inspiration for Qurbani of Nafsaniyyat or self-interest

The Promoters and sponsors of Al Arafa Islami Bank are imbued with the spirit of sacrifices and Quarbani of the family of Hazrat Ibrahim (A.),and which was rekindled by our beloved prophet Muhammad(S.) and Sahaba-I- keram and thereafter by the Sufi saints who made supreme sacrifices and Qurbani for preaching of Deen of Allah to all corners of the world,particularly to this region.

Clean Banking is “Ibadat”

We agree to conduct the clean banking under patronization of the government,and firmly believe that the association with this bank would be nothing but ‘Ibadat’and that we shall act accordingly.

Environment of Al-Arafah Islami Bank

AIBL shall bear the mark of sunnah of our Prophet Muhammad (S.) of our faith and conviction, our values and attitudes towards life and that the entire environment of the bank shall in conformity with Sunnah.

Sunnah of Keeping Deposit as “Amanat”

We firmly and solemnly pledge and promise to hold the deposits and other fund at our disposal as ‘Amanat’ and sacred trust keeping in mind the Sunnah of our beloved Prophet Muhammad (S.) who would hold the money and materials deposited with him even by the infidels in great trust for which he earned the title of ‘Al-Ameen’.

Groping and Lobbing

We shall not indulge in grouping and lobbying most particularly, in financial matters and banking business for the personal interest of anybody.

Responsibility to depositors

We are conscious that the deposit of our clients might be more than90% of the disposable loans and credit and we shall put priority on their interest over that of shareholders or directors.

Employment Policy

We agree that all recruitment be made on merit and rules. All employees after employment must confirm to Faradh and Wajib with in the time determined, but not exceeding two years.

Freedom from Nepotism and Districtism

We are totally committed not to indulge overtly or covertly in any kind of nepotism or favoritism due to relationship, friendship, acquaintance, regionalism, districtism or locally as regards to loan facilities or employment or any other aspect directly or indirectly.

Bases of Conscience of Directors

We do hear by promise and pledge that in addition to the laws, regulations in force in the country, we shall be bound to and abide by the dictates of our conscience based on faith and trust on Allah and expectation of Shafayat from our beloved prophet Hazrat Muhammad(S.)

Special Features of Al-Arafah Islami Bank Ltd.:

- All activities of the bank are conducted according to Islamic Shariah where profit is the legal alternative to interest.

- The bank’s investment policy follows different modes approved by Islamic Shariah based on the Qur’an & Sunnah.

- The bank is committed towards establishing welfare oriented banking system, economic upliftment of the low –income group of people, create employment opportunities.

- According to the need and demand of the society and the country as a whole the bank invests money to different ‘Halal’ business. The bank participates in different activities aiming at creating jobs, implementing development projects of the government and creating infrastructure.

- The bank is committed to establish an economic system resulting in social justice and equitable distribution of wealth. It is committed to bring about changes in the underdeveloped rural areas for ensuring balanced socio economic development of the country through micro credit program and financing of SME’s as well.

- According to Mudaraba system, the depositors are the partners of the investment income of the bank. About 70% of the investment income is distributed among the Mudaraba depositors.

- To render improved services to the clients imbued with Islamic spirit of brotherhood, peace and fraternity and by developing an institutional cohesion.

- The bank is contributing to economic and philanthropic activities. AIBL English Medium Madrasah and AIBL library patronize by the Bank are two such examples.

Performance Analysis of AIBL.

AIBL at a Glance

Here is a sum of Performance of AIBL

Figure in Million TK.

| SI.NO | Particulars | 2007 | 2008 | 2009 | 2010 |

| 01. | Authorized Capital | 1000.00 | 2500.00 | 2500.00 | 5000.00 |

| 02. | Paid-up Capital | 677.94 | 854.20 | 1153.18 | 4,677.28 |

| 03. | Reserve Fund | 488.96 | 542.22 | 835.98 | 1091.95 |

| 04. | Deposits | 11643.66 | 16775.33 | 23009.13 | 52,973.97 |

| 05. | Investment | 11474.41 | 17423.19 | 22906.37 | 53,582.96 |

| 06. | Import | 9337.49 | 12631.60 | 18821.40 | 27042.72 |

| 07. | Export | 3639.34 | 4932.90 | 9142.70 | 12714.91 |

| 08. | Profit before Tax and Provision | 348.89 | 548.20 | 969.77 | 756.18 |

| 09. | Profit after Tax and Provision | 154.76 | 262.90 | 470.02 | 347.31 |

| 10. | Total Assets | 12874.61 | 15336.89 | 21368.16 | 30182.32 |

| 11. | Earnings Per Share | 26.36 | 38.78 | 55.02 | 30.12 |

| 12. | Dividend | Bonus 15.50% | Bonus 26% | Bonus 35% | Bonus 20% |

| 13. | Number of Employees | 1,033 | 1,080 | 1,296 | 1711 |

| 14. | Number of Branches | 46 | 50 | 60 | 78 |

| 15. | Number of Shareholders | 12,013 | 10,664 | 11,382 | 49,386 |

Capital of AL–Arafah Islami Bank Ltd.

The Bank Company Act, 1991, which amended in the march2003, includes a provision of raising the capital to anew level of taka100 crore for the commercial banks within march2005. In compliance with the new provision, the bank has raised its capital from Tk41.58 crore in the year 2002 to TK.85.56 crore in 2003 by issuing a right share against each of the existing shares in the year 2003 and declared16% bonus dividend from the profit of the year2003. The bank again declared15.50% bonus dividend from the profit2004.As a result, the paid up capital of the bank stood at Tk.67.79 crore as at 31st December 2005.

Bank declared26.00% bonus dividend for theyear2005. As a result the paid up capital of the Bank stood at TK.85.42 crore as at31st December2006.In this fund bank experience a growth rate64.18%.

Reserve Fund

The total reserve fund has stood at TK.1,746.42 million in the current year against TK. 1,223.18 million at 31st December 2009. In this account , the bank experienced a growth of 42.78%. The Bangladesh Bank has fixed the ratio of capital adequacy against Risk- weighted Assets at 9% or TK. 2000 million whichever is higher.

Capital Adequacy

According to BRPD Circular the bank will have to maintain TK. 4,000.00 million Capital & Statutory Reserve by August 2011. In compliance with the new provision, the bank has raised its Capital & Reserve from TK. 4,065.96 million in The Year 2010 to TK. 10,512.81 million in 2010 by declaring 30% stock dividend out of the profit of the year 2009 and issuing right share worth TK. 2,338.64. The paid up capital of the bank has stood at TK. 4,677.28 million at 31st December 2010.

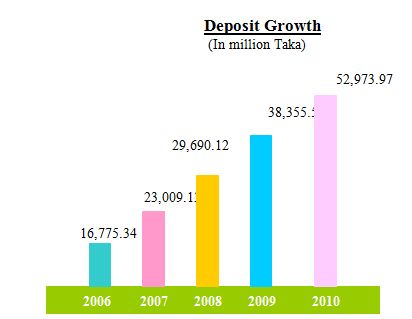

Deposits

The total deposit of the bank was Tk.52,973.97 million at 31st December 2010 as against TK. 38,355.50 million at 31st December 2009 recording a growth of 38.11%of which TK. 115.05 million was bank deposit and TK. 52,858.92 million was general deposit. The present strategy is to increase the deposit base through maintaining competitive profit rates and having low cost of funds to ensure a better spread with an average return on investment. The mix deposit of the bank on December 31,2010 was as follows:

Investment

The investment of the bank has stood at TK. 53,582.96 million as on 31st December 2010 as against TK. 36,134.08(Net off PR) million in the previous year showing an increase by 48.29% The investment portfolio of the bank is well diversified and covers a broad spectrum of business and industries including readymade garments, textile, edible oil, ship scraping, steel & engineering, chemicals, pharmaceuticals, cement, telecommunication, construction, health care, real estate, education, transport and investment under consumer schemes. We have geared up efforts to improve the recovery rate of disbursed investment and also taken adequate measures for converting the classified investment into performing assets. As a result, classified investment of the bank could be kept at a low level far below the national average. It is 1.14% in our bank as on 31 December 2010. The bank gives top- most priority to the creation of quality assets and does appropriate risk grading while approving commercial, trade and project investment to different clients.

Sectorwise Investment 2010

| Sectors | Taka in million |

| a) Agriculture, Fishing and Forestry b) Industry c) Construction d) Water Works & Sanitary Services e) Transport & Communication f) Storage g) Trade Finance h) Miscellaneous | 685.40 14,277.03 2,512.86 102.27 1,535.76 17.99 32,786.47 4,786.02 |

| Total(including Profit Receivable) | 56,703.80 |

| Less Unearned Profit on Investment | 3,120.84 |

| Total | 53,582.96 |

Foreign Trade

At the end of 2010, the total Foreign Exchange Portfolio (Import, Export & Remittances) was TK. 92,408.40 Million showing a growth of 52.86% of this Bank in compare with the corresponding year. The total export of the Bank was TK. 23,546.10 million in 2009, which was increased by 36.08% to TK. 32,042.40 in 2010. Similarly, the amount of import has increased from TK. 34,074.80 million in 2009 to TK. 55,934.10 million in 2010 experiencing a growth of 64.15%.

The Inward foreign remittance business of the Bank recorded a tremendous growth rate of 56.48% from TK. 2,832.28 million to TK. 4,431.90 million in comparison with last year due to starting live dealing by Treasury & delivery of quality services to the clients.

Income

Investment Income

The investment income was TK. 4,143.30 million during the year 2010 which registered a growth of 3.47% over the previous year. Investment income is 55.08% of the total income of TK. 7,522.25 million.

Income from other than investment

The bank has earned TK. 3,378.95 million from sources other than investment like commission income, exchange income, locker rent etc. in the current year which is 44.92% of the total income. It indicates 159.70% growth over the year 2009.

Expenditure

Profit paid to Depositors

The bank has paid the depositors TK. 3,133.69 million which is 75.63% of the investment income and 70.23% of the total expenditure for the year 2010. It indicates 17.48% growth over the year 2009.

Administrative and other expenses

The administrative and other expenses were TK. 1,328.61 million during the year showing 46.25% growth over the year 2009. It is 29.77% of the total expenditure.

Operating Profit

The bank earned Operating profit of Tk.3,059.95 million during the year 2010.The pre-tax profit of the Bank during the year 2009 was TK. 1,729.83 million and thus the Bank attained positive growth of 76.89% in respect of operating profit. The provision for income tax for the year amounted to TK. 873.01 million and divisible profit available for appropriation amounted of TK.1,819.05 million.

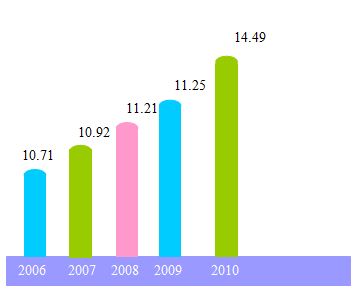

Capital Adequacy Ratio

| (a) Core Capital (Tier-1) | TK. In million |

| Paid up Capital Statutory Reserve Retained Earnings Minority interest in subsidiaries | 4,677.28 1,681.82 1,274.86 1,948.89 |

| Total Core Capital | 9,582.85 |

| (b) Supplementary Capital (Tier-2)

| |

| Provision for Unclassified Investment Exchange Equalization Fund Assets Revaluation Reserve

| 897.66 – 32.30 |

| Total Supplementary Capital | 929.96 |

| Total Capital (a+b) | 10,512.81 |

| (c) Capital Adequacy Ratio | 14.49% |

Operating Performance Ratio (Figure in million)

| Particulars | 2009 | 2010 | Growth% |

| Net Profit Margin% | 4.11 | 1.82 | (99.56) |

| Credit/Deposit Ratio | 94.2 | 93.43 | (0.83) |

| Return on Equity(ROE)% | 24.10 | 18.83 | (21.88) |

| Return on Assets(ROA)% | 1.77 | 2.45 | 38.61 |

| Cost of fund % | 11.08 | 9.72 | (12.27) |

| Cost/Income ratio operating business (%) | 67.40 | 59.32 | (11.99) |

Share Information (Figure in million)

| Particulars | 2009 | 2010 | Growth% |

| Number of Shares Outstanding | 17,959,536 | 467,727,936 | 2,500.00 |

| Earning Per Share(Taka) | 2.00 | 4.14 | 107.00 |

| Book value per Share(Taka) | 19.82 | 16.47 | (16.89) |

| Market price per Share(Taka) | 53.63 | 66.88 | 24.72 |

| Price Earning Ratio(Times) | 11.23 | 13.24 | 17.90 |

| Price Equity Ratio(Times) | 2.71 | 4.06 | 50.06 |

Theoritical Aspects of General Banking

General Banking

General banking department is the heart of every banking work. It does the most important and basic work of the banks .General banking is the Starting point of the banking Operation that starts on account opening and end on account closing . All other department are linked with this department .It provides day –to-day services to the customer. Every day it receives deposits from the customers and meets their demand for cash by honoring cheques. It opens new accounts ,remit fund, issue bank drafts and pay orders, collected outward and inward bills and so on .General banking is also known as retail banking .

Account Opening

Banker customer relationship is established through opening an account on obtaining introductory reference and introduction. If there is any lapse in this regard bank may suffer loss subsequently. Bank shall not get protection under section 131&131(a) of Negotiable Instruments Act 1981 for negligence and will be guilty of conversion in case of collection of a cheque instrument having defective title if the account is not opened without proper introduction & inquiry. There are many kinds of account and schemes maintain by the Al Arafah Islami Bank Limited to their customers required.

Current Account

Deposit in Current account in Islami Bank is accepted under the principle of Al -Wadia. It means that the bank receives money in current account as Al- Amana (on trust) .As such:

- The depositor can deposit any amount in this account

- The depositor can withdraw any amount by cheque

- No profit is allowed in this account

- The depositor shall also not bear any loss

- Cheques , bills etc collected in this account against commission

- excise and incidental charge realize from this A/C as per rule .

Saving, & term deposit

Deposit in saving, shorts notice & term deposit accounts are accepted on the Mudaraba Principle of Islami Sharia. Under the above principle the client is the Shaheb- Al-mal and the bank is Mudareb. As per contract the bank is authorized to invest Mudaradba funds at joint risk of the client and the bank. The clients can not interfere/participate in the management of the fund. Any profit resulting from the investment of the Mudaraba Fund is distributed between the client and the bank as per principle of distribution of profit announced by the bank as at the beginning of the year or as per contract. Loss is to be borne by Shaheb Al-Mal after adjustment of the same from equity and the bank does not get any remuneration for the management of fund.

Short Notice Deposit (SND)

Bank accepts such kind of deposit, which is withdrawal at notice of seven to Twenty nine days, and thirty days and over with profit. The account is maintained like that of a Mudaraba savings account.

Sundry & other deposits

Sundry & other deposits are also treated to be accept under Al-Wadia Principle.Al Arafa Islami Bank Limited do maintain various term deposit account and deposit schem

Hajj account deposit

Hajj deposits at monthly installment for any period from 1(one) year to 20(twenty) years are accepted under the above scheme to enable the account holder to perform Hajj

One Time Hajj deposit

For once time a certain amount of money can be deposited from 1(one) year to 25(twenty-five) years under the one time Hajj scheme to perform Hajj at the maturity period.

Installment Term Deposit (ITD)

According to Mudaraba rules this deposit is accepted. The main attraction is its profit is calculated on daily deposited amount. Under this scheme a form has to be filled. One parson can have more than one ITD account in same branch Its sustain for:

The schemes of Mudaraba Milliner Deposit Scheme (MMDS) accounts are:

| Name of Scheme | Maturity Periods | Monthly Installment | Receivable Amount |

| MMDS | 3 years | 23950.00 | 10.00(Lac) |

| 4 years | 16950.00 | 10.00(Lac) | |

| 5 years | 12750.00 | 10.00(Lac) | |

| 6 years | 9950.00 | 10.00(Lac) | |

| 7 years | 8000.00 | 10.00(Lac) | |

| 10 years | 4600.00 | 10.00(Lac) | |

| 12 years | 3345.00 | 10.00(Lac) | |

| 15 years | 2170.00 | 10.00(Lac) | |

| 20 years | 1150.00 | 10.00(Lac) |

Mudaraba Lakhopoti Deposit Scheme (MLDS) account are

| Name of Scheme | Maturity Periods | Monthly Installment | Receivable Amount |

| MLDS | 3 years | 2375.00 | 1.00(Lac) |

| 5 years | 1275.00 | 1.00(Lac) | |

| 8years | 670.00 | 1.00(Lac) | |

| 10 years | 460.00 | 1.00(Lac) | |

| 12 years | 335.00 | 1.00(Lac) |

Mudaraba Term Deposit (MTDR)

Multiple of 1.00 Lac & over in multiples of that are accepted for 3or 5 years and the bank give profit of Tk.969for each month on per Lac and rest amount are adjusted with deposit. There are several type of deposit is known as Mudaraba Term Deposit

They have also Mudaraba Kotipoti Deposit Scheme and Mudaraba Double Deposit Scheme of various periodic.

Savings Investment deposit

Deposit under the scheme is accepted by monthly installment and after expiry of the term, double amount of such savings in given as investment in feasible sectors by the bank as per choice of the depositors without any collateral security. Any one by saving under the scheme can take business venture on utilizing the amount saved under the scheme as well as availing ban investment.

Savings Bond Deposit

Under this scheme the bank has introduced saving bonds for Tk.10,000/-,Tk.100.000/- for 3,5 and 8 years. After the completion of the tenure the deposited money may increase by 1.5 even two times, Insha-Allaha

Fixed Deposit A/C

Every conventional bank there is a fixed deposit section but in the Islami bank like Al-Arafah calls this fixed deposit Mudaraba term deposit (MTDR).In this type of deposit a large or small amount of money can depositor in the bank for which a comparatively high rate of interest , is offered to depositor for the period of 3 months, 6 months, 1 year, 3 years, 4 years, 5 years with the condition the client can not withdrew the amount before maturity but can drew the profit rate on the profit rate on the basis of saving deposit rate .After the term of which the account was opened the MTDR gets its maturity .Paying the principle amount plus profit less tax fulfills the client .

Bank Remittance

When money is sending from one place to another place for the customer is another important service of banks . In addition, this service is an important part of country’s payment system .For this service, people ,especially business persons can transfer funds from one place to another place very quickly. There are four

Kinds of techniques for remitting money from one place to another place. These are :

- Demand Draft (DD)

- Telegraphic Transfer (TT)

- Telephone Transfer (TT)

- Pay Order (PO)

Telegraphic and Telephone Transfer (TT) are almost the same ,both are them are known as TT in short.

Demand Draft

This is an instrument through which customer’s money is remitted to another person /firm/organization in outstation (Outside the clearing house area ) from a branch of one bank to an outstation branch of the same bank or to a branch of another bank (with prior arrangement between that bank with the issuing branch).

TT

This is a mode of transfer /remittance of customer’s money from a branch of one bank to another branch of the same bank or to a branch of another bank (with prior arrangement between that bank with the TT issuing branch) through telephonic message. The issuing branch used to send the message of such remittance /transfer to the drawer/ payee branch through telephone adding certain code number or test number on the basis of text key apparatus developed by the concerned bank for its different branches.

Pay Order

Pay order gives the payee the right to claim payment from the issuing bank. It is payment from issuing branch only. Within the clearinghouse area of issuing branch, payment is made through clearing.

Clearing Department

Receiving cheques/instruments

Bank received cheques/instruments for clearing/collection. Cheqes received from customer Which are Drawn on other bank situated on the same locality (clearing house) and happen to be member of clearing house are treated as clearing cheque.

Clearing House

Inter branch cheques and instruments drawn on the branches which are situated in the same locality when received for collection is treated under this mechanism.

Process of inward clearing:

After receiving cheques from the local office of AIBL, those cheques are directly send to the computer section for checking the balance of those specific accounts from which money should be collected. If the required balance available there then amount is debited from that account and the cheque is honored. But incase if the require balance is not available the authorize officer of clearing department immediately informs to the head of the customer service or he tries to connect the account holder. If the account holder does not deposit the required balance immediately the cheque is dishonored. Finally the authorized officer gives all the entry of those cheques in inward clearing register.

The format of the register book is given below:

| SL# | Bank Name | Branch Name | Cheque No. | Amount | Drawn on | Remarks |

After giving the entries, a credit advice is sending to the local office of Al-Arafah Islami Bank Limited.

Process of outward clearing:

For outward clearing cheques, the bearer of the cheques must have an account in V.I.P. Road branch of AIBL. After the submission of the cheques, authorized officer gives the entries in software, which is provided by Bangladesh bank. The name of the software is Nikash. After giving all the entries are printed and are enclosed with the cheques. Then all the cheques with the enclosed sheets are sent to the local office of AIBL for the collection of money. The local office sends it to clearing house.

Collection Cheqes Outward

Out-station collection cheques are to be accepted from the customers and local banks only.

Collection Cheqes Inward

Cheqeues/ instruments received for collection from upcountry branches/other banks are known as Inward cheques for collection.

Transfer of cheques

Cheques and instruments drawn on the branch and also deposited in the same branch for credit of customer’s account are called transfer of cheque/ instruments.

Cash Department

Cash Department that is the most Vital and sensitive of the branch deals with all kind of transaction in cash .All Cash receipts and payments are made through this department .This department start the day with cash in vault .This cash amount is called opening cash balance. All the day, a bank makes some cash payment and takes some cash receipts .Net figure of these cash receipts and payment is added to the opening cash balance .The figure is called closing balance .This closing balance is then added to the vault, and this is the final cash balance figure for the bank at the end of any particular day.

General Banking procedure of AIBL

- Account Opening Department.

- Mudaraba Deposit section or FDR Department.

- Remittance Department.

- Cheque clearing Department.

- Cash Department.

Various Types Of Deposit Account Of AIBL

AIBL Bank offers following types of deposit account :

- Mudaraba Current Deposit Account (CD)

- Mudaraba Savings Deposit Account (MSD)

- Mudaraba Term Deposit Receipt Account (MTDR)

- Short Notice Deposit Account (SND)

- Installment Term Deposit (ITD)

- Mudaraba Hazz Account

- Mudaraba Pension Scheme

- Mudaraba Lakhpoti Scheme

- Mudaraba milliner Scheme

- Mudaraba Kotipoti Scheme

- Mudaraba Double Deposit Scheme.

Different Types of Account Holders

Anyone can open an account with the banker if he is not incapable of entering into a valid contract and the banker is satisfied of his bonafide and is willing to enter into the business relations with him. There are certain types of accounts in regard to which the banker should take note of the relative laws and exercise pre-cautions in order to safeguard its interest. Some types are:

- A/c opened by minors

- Joint (two or more persons)

- Firms

- Co-operative societies

- Government

- Public bodies

- Agents

- Executors

- Administrators

- Trustees

- Liquidators

- Receivers

- Non- Resident

Different types of Account Opening Section

- Individual Account

- In join name

- Proprietorship

- Partnership

- Limited Company

Accounts opening Steps

Application’s part-

- The application must find out an introduce who has a SB/CD account in the specific branch of the bank. The introducer must have satisfactory transaction as well as healthy balance.

- The applicant must fill up the accounts opening application form properly .The introducer must introduce him by signing his name and mentioning his account number.

- He must also put his name and signature in the specimen signature card (SS card) and must fill the cheque book requisition from.

- The application must submit money two passport size photographs, which will have to be attested by the introduce in backside.

Opening process of personal Banking service of AIBL

Current Deposit Account

Individual

- Genuine & acceptable introduction

- Attested photograph of the account operator’s /A/c holder’s

- Attested photograph of the nominee

- Certificate from the Chairman/ Commissioner/Voter ID/photocopy of passport

- Verification of introducer’s signature

- Admittance of the signature(s) of opener/operator’s A/c

- Transaction Profile

- Obtain KYC

- Declaration/Undertaking

Joint Account

- All item for individual account holder as stated above

- Two or more persons can open an account

- Authorized person can operate the account

- Authority is automatically revoked by death, insanity or bankruptcy

- Stoppage of payment by any one of the account holders

- Special instruction regarding operation of the A/c in any of the following forms:

By any of the joint account holder singly

- By either or survivor singly

- By either singly

- By any two or more joint account holding jointly

- By all the survivors jointly

Accounts mandate-regarding drawing ,survivorship, power to overdraw and other matter , i.e. for withdrawal of goods kept for safe custody, separate mandate from surviving persons, closing of debit a/c , stopping operation of a/c after instantly of any person, obtain receipt made by survivors and representatives of deceased persons

Role of survivorship incase of joint –account by husband and wife:

If the account is opened for convenience of husband, then the balance cannot be claimed by the widow but to be sent to the estate of the deceased person. But , if the account is opened for the provision for wife, then the widow can claim the balance in full.

Sole Proprietorship

In case of opening an account by a sole-proprietor of a firm, he /she should sign the account opening form and furnish his specimen signature showing his representative character.

- All items for individual account holder as stated above.

- Valid trade license or attested photocopy thereof issued by the competent authority

- Membership certificate from local business association/Chamber of Commerce .

Partnership Firm

A banker should not open an account in the name of a partnership unless one or more of the partners apply to him to do so . Except where the partner, making an application for the opening of an account in the firm’s name, is deprived of the power, which fact is known to the banker , there can be no legal objection to a banker opening an account in the name of the firm at request. Failure, however, to make proper enquiries by referring to the partnership agreement or any other record in writing which may be available before opening of account on behalf of a firm in a partner’s name may lead a banker in trouble.

- All items for individual account holder as stated above.

- Valid trade license or attested photocopy thereof issued by the competent authority

- Tow or more person can form a partnership firm by partnership deed .(Registered notarized)

- Clear mandate for operating the a/c from the partners regarding name of the persons to draw cheques and borrow money, to overdraw, to mortgage or to sell properties owned by the firm.

In case of insolvency of the firm: Operation should be stopped after receiving notice of insolvency of the firm.

Insolvency of the partner: If the balance is in debit , the a/c must be closed and the debt should be proved to the receiver. If the a/c is in credit the other partners may continue the account. Any cheque previously drawn by the partners may be paid on the confirmation of the partners.

May be allowed to continue the same but the bank should take fresh mandate from other partner but if the account is in debit then the account must be closed to determine the liability of the deceased’s estate.

Private Limited Company

A company registered under the Companies Act, 1913 has a legal entity apart from its shareholder. Private company means a company which by its articles:

- Restricts the right to transfer the shares if any ;

- Limits the number of its members 2 to 50

Prohibits any invitation to the public to subscribe for the shares , if any or debentures of the company.

When a current account is to be opened for a private limited company the banker will have to obtain the following requirements:

- All terms for individual account holder as stated above

- Copy of memorandum and articles of association duly certified by the Secretary/ Director of the company

Certificate of incorporation

- Certified copy of resolution of the board of Directors regarding opening of a/c, the execution of papers and conduct of the account.

- List of Directors under the signature of the Chairman.

- Copies of latest financial statement/ Transaction profile.

Public Limited Company

Any seven or more persons associated for any lawful purpose, any subscribing their names to a memorandum of association and otherwise complying with the requirements of the Act (13a) in respect of registration, from an incorporated company. When an account is to be opened in the name of a Public limited Company the following formalities are to be observed:

- All terms for individual account holder as stated above

- Certificate copies of memorandum and article of association are to be submitted

Certificate of incorporation

- Certified copy of commencement of business for inspection and in case of a newly floated company

- List of Directors under the signature of the Chairman to be furnished

- Certified copy of a resolution of the Board or Directors regarding opening of the bank a/c execution of the papers and conduct of the account to be furnished.

Trust Account

A trustee is a person entrusted with the work of the management of a property under a trust created by the owner thereof for the benefit of another or of another and the owner section 3 of the Trust Act 1882 defines “trust”& a trustee as, “A trust is an obligation annexed to the ownership of property and arising out of confidence reposed in and accepted by the owner, or declared and accepted by the owner or declared and accepted by him, for the benefit or another or of another and the owner, the persons who reposes or declares the confidence is called the trustee.”

- All terms for individual account holder as stated above.

- Trustee is a person entrusted with the work of a management of a property under a trust deed.

- Discharges his duties as per trust deed.

- Attested photo is required.

Savings Account

Personal, partnership, and club, school, madrasa etc financial institution can open this type of account.

- One passport Two stamp size-attached photograph duly signed by the acceptable introducer of the bank.

- Regulation copy to operate the account

- Nominee

- Photograph of the nominee.

- Photocopy of passport/voter identity/commissioner certificate

- Photocopy of Trade License.

Short Notice Deposit (SND)

Bank accepts such kind of deposit, which is withdrawal at notice of seven to Twenty nine days, and thirty days and over with profit. The account is maintained like that of a Mudaraba savings account.

Mudaraba Savings A/C

- Nationality certificate from Ward Commissioner/ UP Chairman or passport (photocopy) of every signatories of the A/c or voter ID

- KYC form for individual

- Introduction of any current account /Savings account holder

- Two copies attested photographs of a/c operators

- One copy attested photograph of nominee.

Mudaraba Special Savings (Pension) MSS A/c

- KYC From for individual

- Introduction of any current account / Savings account holder.

- Two copies attested photographs of a/c operators.

Fixed Deposit Account (MTDR A/C)

- Fill up the from including – (A). Amount, (B). Maturity, (C).Rate of profit,(D). Favoring.

- Specimen signature in the from and SS card.

- Special instruction in SS card (if any)

- Entry in receipt.

- Payment through pay slip or A/c.

Encashment before maturity:

- Maturity in 3 months, but in enchased it then no profit will be given ; no service charge or excise duty will be deducted.

- In enchased before maturity period 6 months or others profit will be given to nearest slab and excise duty will be deduct.

- 80% loan as line can be given in MTDR.

MTDR Opening Procedure:

- The application must fill up the MTDR from properly and must size in the specified portion.

- The maturity date of the MTDR and profit rate will be specially mentioned on the MTDR from.

- Name of the person who will collect the money after maturity will be maintained.

- Nominees must be mentioned.

- Branch manager’s authorization oblication.

Different Deposit

Monthly profit Based Term Deposit

Under the above scheme, deposits of TK.1.00 Lac, 1.10 Lac, 1.20 Lac, 1.25 Lac and multiple thereof are accepted for a term of 5(five) years and the bank gave profit thereon Tk.969 per month per Lac and proportionately on the rest amount of deposit under the category during the year under review. The aforesaid rate shall, however, be adjustable at the close of calendar year on finalization of accounts.

Marriage Savings Deposits and Investment Scheme:

Fixed monthly installment for a particular period is to be deposited to defray the expenses of marriage and the bank allows double of Saving or Tk.30,000/= which is higher as investment to procure ornaments, furniture, fixture, etc. repayable in 24 monthly installment without any collateral security.

Savings Bond Deposit

Under this scheme the bank has introduced saving bonds for Tk.10,000/-,Tk.100.000/- for 3,5 and 8 years. After the completion of the tenure the deposited money may increase by 1.5 even two times, Insha-Allaha

General practice for All types of A/C

Closing of an Account

- Whenever a customer approaches for closing an account, he may be requested to submit an application mentioning the reason of closure of a/c alongwith the unused leaves of cheque book and pass book (if any) issued to him.

- On receipt of the application, it should invariably be brought to the notice of the manager who will personally see the matter.

- On being satisfied of the reason of closure. Manager will pass an order to that end.

- If an account is closed closing charge shall have to be realized.

- The closing balance after recovery of incidental charges shall be paid through an unused cheque/pay order.

Beside of the above procedure account may close by following matter:

- Death of constituent

- Disbursement from deceased account.

- Prohibitory orders from court.

- Freeze of account

- Blocked account

- Bank rights to closed an account.

Transfer of an Account

Account can transfer from one branch to another branch of a bank. This is applicable to all sorts of account except MTDR or FDR. In transferring account, the following formalities are to be maintained.

- An application from contain the following matters is to be submitted.

- Reason

- Name of the branch where the account is to be transferred.

- Date of the effect

- Signature in the application should be same as that in SS card.

- Permission of the manager is needed.

- The account holder has to surrender the cheque book. Latter on the bank will destroy this in the party. And this destruction should be clearly mentioned in the application including the serial number of the remainder pages of the cheque book.

- Bank will give the account statement before transferring it interest will also be applicable here. This profit will also be applicable here. This profit will be calculated, but is not written in IBCA(Inter Bank Credit Advice ) in the cumulated amount. Even if the bank wants to mention it in the IBCA, it may be mention separately as the interest amount.

Function of the Clearing Department

Cheques clearing section of Al-Arafah Islami Bank Ltd. receives cheque, demand drafts and pay orders their clients. Upon the receipt of the instrument the cheque clearing section examines:

- Whether the paying bank within Dhaka

- Whether the paying bank outside Dhaka

- Whether the paying bank of their own branch.

The paying Bank within Dhaka city:

The cheques clearing section of Al-Arafah Islami Bank Ltd, Motijheel Cor. Branch sends Inter Branch Debit Advice (IBDA) to the head office on the receiving day of the instruments. The main branch takes those instruments to the clearinghouse on the following day. If the instruments are dishonored, Head Office of Al-Arafah Islami Bank Ltd. sends IBDA to the Al-Arafah Islami Bank Ltd, Dhanmondi branch.

The paying Bank of their Own Branch:

The cheque clearing section of Al-Arafah Islami Bank Ltd, Motijheel Cor. Branch sends outward bills for collection (OBC) to the concerned paying branch to get Inter Branch Credit Advice (IBCA) from the paying branch. If the paying branch dishonors the instrument, the paying branch returns it to the Al-Arafah Islami Bank Ltd,Motijheel Cor. branch describing why the instrument is dishonored.

Dishonor of cheque

A banker cans dishonor the cheque for following reason:

- Insufficient fund

- Payment Stopped by drawer.

- Alteration required drawer signature

- Effect not clearing in cheque

- Exceed arrangement in cheque

- Full cover not received

- Payee’s endorsement irregular

- Drawer signature different and required

- Cheque is post date

- Crossed cheque must be presented through a bank

- Clrrong stump required cancellation

- Cheque crossed “Accounts payee only”

- Collecting bank’s discharge irregular

Remittance and Order Section

Telegraphic Transfer (TT)

Telegraphic Transfer is by far the quickest method of transferring funds form one place to another. Some times, the remitter of the funds requires the money to be available to the payee immediately. In that case the banker is requested by the remitter to remit the funds telegraphically. It is an instruction conveyed by telegraph/telex/telephone to the drawer branch for paying certain amount of money to a specified person.

Accounting entries for issuance of TT

Debit……………..Cash/Remitter’s A/c

Credit ……………IBGA

Credit…………….Commission

Credit ……………Telex/Telephone Charges A/c

Accounting entries for payment of TT

Debit ………………IBGA A/c

Credit ………………TT Payable A/c

Debit ……………….TT Payable A/c

Credit ………………Client’s A/c

Pay Order (PO)

Payment order is meant for making payment of the banker’s own or of the customers dues locally and not for effecting any remittance to an out station. In a sense, the payment order is used for making a remittance to the local creditors.

Issuance & Payment of PO

- F-19 form should be filled properly

- Total amount should be deposited through cheque/cash.

Commission to be realized as per bank’s circular

- Printed payment order leaf should be filled in as per F-19 and signed by two authorized officers.

- Entry should be given in B-22 register under supervision of authorized official .

- The instrument should be handed over to the purchaser.

PO are required to be discharged by the beneficiary where applicable on revenue stamp of appropriate value against in cash or through account.

Remarks: No Test is required for PO

Accounting entries for issuance of PO

Dr …………………..Cash/Party’s A/c

Cr …………………..PO A/c

Cr …………………..Commission A/c

Accounting entries for payment of PO

Dr …………………..PO A/c

Cr …………………..Cash/Party’s A/c

Demand Draft (DD)

According to Section (A) of the negotiable instruments Act, a demand draft is “an order to pay money drawn by one office of the bank upon other office of the same bank for a sum of money payable to order on demand.”

The followings are essential features of a demand draft issued by the bank:

- It is a negotiable instrument

- It is drawn by one office of a bank upon another office of the same bank.

- It is payable on demand.

- Its payment is to be made to the person whose name is mentioned in the instrument or according to order. In other words, it can not be made payable to the bearer.

FINDINGS

At the end of the GENERAL BANKING of AIBL ‘’ the following information are found:

- AIBL follows the strong overview guidelines to through out the general banking assuming greater priority in view of the changes in the scenario of the banking practices due to liberalization, deregulatory measures and globalization of business and financial transactions.

- In compliance with the decision of Bangladesh Bank circular, Al-Arafah Islami Bank Limited has prepared risk profile in line with the guidelines and framework provided by Bangladesh Bank to customize in their existing framework to better manage the general banking to suit the new changes.

- AIBL has a great number of reliable clients to invest their fund and will be back in time.

- AIBL follows the most liberal process of disbursement process, which made the clients, inspires to take advance and help them to pay in time.

- They have interest free banking. They only receive profit of the goods.

- It has a lowest profit rate comparatively to other commercial bank, which is affordable for the clients.

- The have a significant role in social and financial development by investing like, masque, madrasa, grameen and small enterprise.

- Last but not least they have a Saria Council of credit management which follow the rules of Sunnah in implicating the credit disbursement according to islami sharia that save them from the affect of interest.

RECOMMENDATION

Problems:

The respondent Bank employees face the following Problems in rendering customer services:

- Some customers do not understand form.

- Refusing to provide introducer or photo for opening accounts.

- Cheques, deposit slips are not to be written properly.

- Some customers are not interested or not able to write D.D., T.T., pay order voucher.

- Misbehavior of some customer.

- Lack of education and of adequate knowledge of general banking peoples in our country are not interested in involving Bank activities.

- Failure of the electricity created problems to be done properly.

- The telephone network of our country will have not been expended developed.

Recommendation for solution:

- The Bank personnel should help the customers to understand the form.

- Bank employees should be more diplomatic for acquiring information of the customers.

- A bank employee requires more patients for the misbehavior of customer.

- To provide proper education to the customer concerning general banking services.

- Government should take necessary measures for development of electricity.

- Government and Private sector should give adequate knowledge for the development of a decent banking culture in the country.

- Management information System should immediately be developed.

- Making correspondence with the customers.

- Making good behavior with the customers.

- Call centre can be established for receiving complains and suggestions.

- Telephone network should be developed.

- All the tasks should be equally distributed to all the employees.

- The charge of PO, DD, TT etc can be exempted in the case of AIBL customers.

- Fund transfer, payment of utility bill, balance inquiry etc can be done through internet.

- AIBL can join to the western union money transfer. As a result, Money transfer from anywhere in the World to Bangladesh in minutes and money transfer between Bangladesh and any other part of the globe is safer and faster than ever before.

- AIBL can introduce debit card. So, people will feel more comfortable to expend money.

- When a customer opens a new account then a cheque book can be delivered at that time in name of welcome account with containing 5 pages.

- It is observed that bank executives have little idea about their customer behavior, attempts should be taken to bring customers orientation in banking management.

Conclusion

General Banking development performs the core functions of the bank, operated the day-to-day transactions, all other department is linked with these departments. They take the deposit from the customers and meet their demand for cash honoring their cheques. The department is very rush and the employees here are too upgrade to their duty.

After comparing the interviews, it has been seen that the customers are more or less satisfied with the overall services of customer service and the behavior of employees. They also have some complains which make them unsatisfied in some cases. From the survey I have noticed that the customers prefer prompt service, want to avoid more formalities for issuing D.D, T.T, P.O, opening account etc. So AIBL should try heart & soul to please those customers in a smart & trusting way.

The AL-ARAFAH ISLAMI BANK . has been put on the top of all the commercial Banks in the Central Banks CAMEL rating (Published in Financial Express on July 2003).

I have also noticed that AIBL has a better position for providing General Banking Services comparing with other private sector Banks. There is a word in business sector

“A company must diminish from the market when it cease to serve its customer.” So it is necessary to provide quality of services to make customer satisfied. Thus, an organization can achieve its goal successfully.