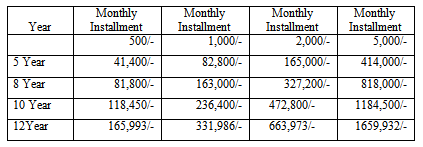

Monthly Installment deposit:

The savings amount is to be deposited within the 10th of every month. In

case of holidays the deposit amount is to be made on the following day.

The deposits may also be made in advance.

The depositor can have a separate account in the bank from which a

standing instruction can be given to transfer the monthly deposit in the

scheme’s account. .

In case the depositor fails to make the monthly Insta1ln;1ent in time, 5% on overdue installment amount will be charged. The charge will be added with the following month(s) installment and the lowest charge will be Tk. 10/

Withdrawal:

· Generally, withdrawal is not advised before a 5-year term, but if it is withdrawn before the above term, interest will be paid at savings rate. However, . no interest will be paid if the deposit is withdrawn within 1 year of opening the account.

· In case the depositor wishes to withdraw between the 5,8,10 and 12 year period then full interest will be paid for a completed term and savings rate will applicable for the fractional period.

Loan Advantage:

After three years of savings in this scheme the depositor (if an adult) is eligible for a loan up to 80% of his deposited amount. In that case, interest rates on the loan will be applicable as per prevailing rate at that time.

Reasons for Disqualification from this Scheme:

· If the depositor fails to pay 3 installments in a row, he will be disqualified from this scheme and interest will be applicable as mentioned in the withdrawal clause.

· If the depositor fails to pay 5 installments in a row after completion of 5-year term, the Bank reserves the right to close the account and interest will be paid as mentioned in the withdrawal clause.

· case of death of the depositor the scheme will cease to function. The amount will be handed over to the nominee of the deceased depositor. In case of absence of the nominee, the bank will hand over the accumulated amount to the successor of the deceased.

Rules:

· A form has to be filled at the time of opening the account. No introduction

is needed but attested photographs are advised.

· The depositor can select any of the installment amounts, which cannot be

subsequently changed.

· In case of minors, the guardians may open and supervise the account in

his favour.

· A single person can open more than one account for saving under several

installment rates.

· The accumulated deposit (with interest) will be returned within one

month of completion of a term.

· The depositor should notify the bank immediately on any change of

address.

· The government tax will be deducted from the interest accumulated in

this scheme.

· If necessary, at the request of the depositor, the scheme can be transferred

to a different branch of the same Bank.

· The Bank reserves the right to change the rules and regulations of the

scheme as and when deemed necessary.

Super Savings Scheme:

Savings help to build up capital and capital is the prime source of business investments in a country. Investment takes the country towards industrialization, which eventually creates wealth. That is why savings are treated as the very foundation of development. ‘ To create more awareness and motivate people to save, DHAKA BANK offers “Super Savings Scheme” .

Terms and Conditions of DHAKA BANK Ltd. :

1. Any individual company, educational institution, government organization

NGO, trust society etc. may invest their savings under this scheme.

2. The deposit can be made in Multiples of Tk. 10,000.

3. The period of deposit is for six years.

4. Any customer can open more than one account in a branch in his/her name or in

joint names. A deposit receipt will be issued at the time opening the account.

5. If the deposit is withdrawn before six years term, then savings interest rate +1% will be applied before payment is made. However, no interest will be paid if the deposit is withdrawn within the 1st year.

6. A depositor can avail loan up to 80% of the deposited amount under this scheme.

7. In case of death of the depositor, before the term, the deposit (with interest at savings rate +1 %) will be given to the nominee. In the absence of nominee, the legal heirs/successors will be paid on production of succession certificate.

8. In case of issuing a duplicate deposit the rules of issuing duplicate receipt of term

Deposit will be applicable.

Some examples are given in the table below. Any amount can be deposited in multiples of Tk. 10,000.00

Deposit | Term | Payable at Maturity | Payable Amount |

10,000/- | 6 Year | Double | 20,000/- |

20,000/- | 6 Year | Double | 40,000/- |

50,000/- | 6 Year | Double | 100,000/- |

100,000/- | 6 Year | Double | 200,000/- |

200,000/- | 6 Year | Double | 400,000/- |

500,000/- | 6 Year | Double | 10,00,000/- |

MONTHLY INCOME SCHEMES (MIS) :

A monthly income scheme that really makes good sense is a sure investment for a steady return.

HIGHLIGHTS OF THE SCHEME

Minimum deposit Tk. 25,000/

Higher monthly income for higher deposit.

The Scheme is for a 5- Year period.

Monthly income will be credited to the depositor’s account on the 5th of each month.

Deposit Amount | Income |

Tk. 25,000/- | Tk. 250/- |

Tk. 50,000/- | Tk. 500/- |

Tk. 100,000/- | Tk. 1000/- |

Tk.200,000/- | Tk.2,000/- |

Tk.500,000/- | Tk.5,000/- |

Tk.10,00,000/- | Tk.10,000/- |

Objectives of the Schemes:

An account is to be opened by filling up a form. The Bank will provide to the customer a deposit receipt after opening the account. This receipt is non-transferable. If the deposit is withdrawn before a 5-year term, savings interest rate will be applicable and paid to the depositor. However, no interest will be paid if the deposit is withdrawn within 1 year of opening the account and Monthly income paid to the customer will be adjusted from the principal amount.

A depositor can avail loan up to 80% of the deposited amount under this scheme. In this case, interest will be charged against the loan as per Bank’s prevailing rate. During the tenure of the loan, the Monthly Income will be credited to the loan account until liquidation of the loan amount inclusive of interest. Steady money-Make your money work for you-Slogan.

SMART SAVER:

What is Smart Saver?

Smart saver is a high return investment plan, which helps a customer and builds up a sizeable amount in a period of 5 years. This scheme offers a customer to buy Smart Saver term Deposit 5 times the invested amount. Smart is a 5-year term deposit scheme.

How does it work?

Smart Saver is available unit wise. One unit of smart saver is Tk. 25000.00. For purchasing 1 (one) unit smart saver a customer has to invest Tk. 5000.00 as down payment and the Bank will provide loan for Tk. 20000.00. The loan is repayable monthly in equal installment of Tk. 490 for a period of 5 years. At the end of the 5 year period, the Smart Saver Term Deposit will be en-cashed and the customer will be paid

Tk. 45000.00

Flexible Repayment Schedule:

Customer also has the option to repay in 12, 24, 36, 48 & 60 monthly installments.

Maximum investment:

400 units i.e. Tk. 10000000.00 in single/joint names.

Terms and Conditions:

1. One unit of Smart Saver Term Deposit is Tk. 25000.00

2. During the tenure of the loan the Term Deposit will be kept in the Bank as

security.

3. customer will have to open an account and monthly installment of loan

will be debited from the account commencing from 30 days after opening

loan account.

4. Within the first year if the customer fails to repay 3 consecutive instaI1ments, only the principal amount of Smart Saver Term Deposit will be en-cashed and the loan will be liquidated inclusive of accrued interest and balance paid to the customer. After completion of one year, savings rate will be added to the principal amount of Smart Saver Term Deposit. In both cases closing charge will be Tk. 500.00.

5. For missed installment on due date, customer will be charged Tk. 25.00 per

unit per month.

6. In the event of death of the customer, the bank shall be entitled to encash the

Term Deposit and adjust the due first before any refund is made to the

nominees / successors.

7. The bank reserves the right to amend the rules and rates as and when

deemed necessary.

Calculation of the scheme is given below :

Unit | 1 Unit | 2 Unit | 10 Unit | 50 Unit | 100Unit | 200 Unit | 300 Unit | 400 Unit |

| Smart Saver Term Deposit Down Payment (20%) | 250005000 | 50000010000 | 2500050000 | 1250000250000 | 2500000500000 | 5000001000000 | 7500001500000 | 10000002000000 |

| Bank Loan(80%) | 20000 | 400000 | 200000 | 1000000 | 2000000 | 4000000 | 6000000 | 8000000 |

| Monthly Installment | 490 | 980 | 4900 | 24500 | 49000 | 98000 | 147000 | 196000 |

| Customers are Paid (after 5 Years) | 45000 | 90000 | 450000 | 2250000 | 4500000 | 9000000 | 13500000 | 18000000 |

SECTION B PART TWO BRANCH BANKING AND OPERATION OF DHAKA BANK LTD.

Foreign Exchange:

Foreign exchange can simply be defined as a process of conversion of one currency into another. A well-known author of some popular books on foreign exchange, Dr. Paul Einzig tells that foreign exchange means “a system or process of conversion of one national currency into another and of transferring money from one country into another”. In ordinary sense “Foreign Exchange” means Foreign Currency, which refers to the rate of exchange the price of one unit of foreign exchange in terms of another currency. But in its complete sense, foreign exchange means the mechanism or the media used and the rate at which these media are exchanged with another.

Foreign Exchange department is divided into two parts, the first one is the Export Department .and the second part is the Import Department.

Export Department:

When any organization wants to export any product to another country than that particular organization usually opens an Export Letter of Credit (L/ C) from this department.

Foreign Exchange Operation (Export Financing) :

Exporter means any person lawfully exporting goods from Bangladesh to any other country in the world. After shipment the exporter has to tender the documents to the Bank within the stipulated period for the negotiation of the documents drawn under a Letter of Credit. If required, finance the duty drawback and cash compensatory support claims of the exporter.

Export credit means any credit provided by an institution to an exporter in the form of packing credit or post shipment credit.

Packing credit means any loan or advance granted or any other credit provided by an institution to an exporter for financing the purchase, processing or packing of goods on the basis of Letter of Credit (L/ C).

Post-shipment means any loan or advance granted or any other credit provided by an institution to an exporter of goods from Bangladesh from the date of realization of the credit after shipment of the goods to the date of extending the credit after shipment of the goods to the date of realization of the export proceeds and includes any loan or advance granted to an exporter in consideration of on the security of any duty drawback or any cash payment by way of incentive.

Incentives are as follows:

Export Finance:

Interest Rate.

Incremental Incentive on Interest for Interest Based Bank.

Extent of Export Credit.

Credit to First Time Applications.

Back-to-Back Letter of Credit.

Substitute Benefit:

Exporter will get this benefit only for export oriented local

weaving/Knitting manufacturer.

Duty Draw Back:

An Exporter of manufactured products is entitled to draw back the value of the customer’s duties; sales tax etc. already paid on the importation of raw materials used in the production or manufacture of the export products.

Export Credit Guarantee Scheme.

Confessional Rate of Import Duty.

Income Tax Rebate.

Retention Quota.

Traveling Facilities.

Export Formalities:

Procedure for Registration of Exporter.

Books and Register/Ledger Required for Export.

Export L/ C Checking and Advising.

Formalities of Back-to-Back L/C Opening.

Accounting of Back-to-Back L/ C.

B.B Bill Checking/Lodgment.

Mechanism of Acceptance.

Pre-shipment Financing.

Export Document Checking and N negotiation/ Collection Basis.

Calculation of Offering Sheer for Fund Disbursement System.

Proceeds Realization Correspondence.

Formalities of Back-to-Back Payment System.

Substitute Benefit Realization/ Collection System.

EXP From Reporting of Bangladesh Bank.

Disposal of EXP Forms.

Disputes and Settlement of Export Claim.

For obtaining export registration certificate from CCI & E, the following documents re required:

Application Form.

Nationality Certificate.

Partnership Deed (Registered).

Memorandum and Article of Association and Incorporation Certificate.

Bank Certificate.

Valid Trade License.

Copy of Rent Receipt of the Business Firm.

Checking and Advising of Export Letter of Credit. :

On receipt of Export letter of Credit, it is to be recorded in the Bank’s inward register and then the signature of a Bank and finally it is to be forwarded to the beneficiary under forwarding schedule.

Processing and Opening of Back-to-Back Letter of Credit:

An exporter desired to have an Import LIC limit under Back-to-Back arrangement. In that case the following papers & documents are required:

Full Particulars of Bank Account. Balance Sheet.

Statement of Assets & Liability. Trade License.

Valid Bonded Warehouse License. Membership Certificate.

Income Tax Declaration. Memorandum of Articles. Partnership Deed.

Resolution.

Photographs of All Directors.

On receipt of above documents and papers the Back-to-Back Letter of Credit opening section will prepare a credit report. Branch must obtain sanction from Head Office for Opening Back to Back LIC.

Sometimes Back-to-Back Letter of Credit may be opened without Head Office’s consent because of valued clients of the Bank. In that case an officer of Foreign Exchange Department will send a Post to the Head Office for opening Back-to-Back Letter of Credit.

Exporters prepare the documents and submit the same to the Bank for negotiation.

Preparation of Export Documents:

Bill of Exchange or Draft. Commercial Invoice. Bill of Lading. Inspection Certificate. Packing List.

Export License. Shipment Advice. Certificate of Origin. Weight Certificate.

EXP Form.

Courier Receipt.

Export Documents Checking:

General Verification:

L/C Register or Not.

Exporter submitted Documents before Expiry Date of the Credit. Shortage of Documents etc.

Particular Examination:

Each and every document should be verified with the L/ C.

Cross Examination:

Verified one document with another.

On receipt of documents it must be checked properly and then a proposal sheet would be prepared as per Bank’s format indicating the full particulars of shipment and discrepancies under the signature of authorized person and should be placed to

Manager for disposal instruction or sanction. .

Sanction of Pre-shipment:

The party is to apply to the Bank. On receipt of the application of pre-shipment, section will start scrutiny of the application.

Types of pre-shipment, whether clean/pledge/hypothecation of goods. Whether the investment is within Bangladesh Bank credit restriction.

Whether the security offered is acceptable.

What is the purpose of the investment.

Whether the goods specified for finance is eligible for export under export control rule.

How the PSI A/ C will be adjusted.

Whether the item is traditional or non-traditional.

Disbursement:

Execution of Documents:

Execution of the charge documents.

Lien mark on Master Letter of Credit (L/C).

Import Department:

When any organization wants to import any product from other country than the particular organization usually opens an import Letter of Credit (L/C) from this department.

Foreign Exchange Operation (Import Financing) :

Import Goods by Letter of Credit:

A Letter of Credit is a conditional Bank undertaking of Payment. In other words Letter of Credit is a letter from the importer Banker to the exporter that the bills if drawn as per terms and conditions are complied with will be honored on presentation.

Following papers are to be submitted by the importer before opening the Letter of Credit:

Trade License.

Import Registration Certificate.

Income Tax Declaration with TIN. Membership Certificate.

Memorandum of Articles (in case of Ltd. Co.).

Registered Deed (in case of Partnership firm). Resolution.

Photographs.

V AT Registration.

Bank will supply. the following papers I documents before opening of the Letter of Credit:

Letter of Credit (L/C) application. . LCAP.

IMP.

1M Form.

Charge Documents.

Guarantee Form.

The above papers / documents must be completed duly filled and signed by the party and the signature verified.

Checking of Documents:

Before Lodgment, the documents must be checked with Letter of Credit (L/C) file. Check-up as under:

* Invoice.

* Bill of Lading.

* Draft.

* Bank Forwarding Date.

Invoice:

The amount of invoice to be filled with that of draft.

The invoice is shown by the beneficiary and is signed

by him.

Description of goods in the invoice and bill of lading

are to be identical.

Bill of Lading:

Full set of on board and freight prepaid in case of CFR value duly signed

by the shipping company.

Correct descriptions of goods are given as per invoice and bill of lading. o Shipment date is given as per Letter of Credit.

Bill of Lading not caused, if so the acceptance of importer is required.

Other Documents:

Certificate of Origin, Packing List, Inspection Certificate, Health Certificate and Shipment Advice etc. must be relevant to the Letter of Credit (L/C).

Maintain the Register:

Give serial number of the Documents according to the entry in the relevant bill register. Full particulars of the entire document are recorded including the details of shipment, merchandise and amount etc. The import bills register must be marked with the notion PAID showing the date of payment when the documents are retired by the importer against payment.

Application of Rate : B.C Selling Rate.

Exchange control from: IMP and TM Form.

Endorsement of LCAF : Document must be kept under lock and key of the bank under

the custody of a responsible officer.

Reporting :

After completion of the above procedure the relevant exchange control form (for bill value IMP and for F.C.C, 1M form) prescribed by the Bangladesh Bank Exchange Control Department vide Schedule.

Import on Deferred Payment Basis:

Import of heavy machinery, plants, ships, capital goods etc. may be necessary on deferred payment terms because the importer of the consignee may fail to make full payment of the bill on receipt due to heavy involvement in the outlay of funds Moreover here is the possibility of payment of installments spread over the period of usance/ deferred time.

Letter of Credit for import on deferred payment basis can be opened in respect of capital machineries under SEM/WES for up to 360 days deferred payment terms and in respect of raw an~ packing material imports under the Back to Back Letter of Credit (L/ C) arrangement for up to 180 days credit terms by export oriented ready made Garments/Specialized Textile/Hosiery units operating under the bonded warehouse system.

It has been decided that for import of industrial raw materials under SEM, WES by industrial consumers as per their pass book entitlements, Letter of Credit may be opened on deferred payment terms for a period of up to 90 days subject to the conditions that:

I) If the price includes interest on sight FOB price, the interest rate should not be

above LIBOR for the relative period and

II) The payment date must be within original validity of the relative LCA for remittance in case the LCA has been registered with the Bangladesh Bank. However if the entire fund is arranged by the Authorized Dealers under the Wage Earner’s Scheme without recourse to Bangladesh Bank, the due date of payment should not be beyond six months from the date of opening of import Letter of Credit L/ C or 90 days from the date of Bill of Lading, whichever is earlier.

The requirement of advance deposit of foreign exchange covers before opening Letter of Credit for import of admissible items under SEM/WES on deferred payment basis may be decided by the Authorized Dealers on the basis of banker-customer relationship keeping in view their responsibility for making payment on due date subject to compliance with the minimum margin requirements for import of such commodities prescribed by the Banking Control Department of Bangladesh Bank from time to time.

Head Office of Authorized Dealers will submit to the Exchange Control Department of Bangladesh Bank Head Office, a consolidated monthly statement showing position of outstanding and fresh Letter of Credit (L/ C) opened on deferred payment terms under SEM/WES, in respect of all their Authorized Dealer Branches. The statement pertaining to a month should be furnished to Bangladesh Bank by the 15th day of the following month.

Lodgment of the Documents:

Documents must be lodged within 7 (seven) days and examine the same whether documents are in order or not. The exporter of Bangladesh follows the whole procedure. Necessary papers that the exporter sends with the shipment are:

Commercial Invoice.

Packing List.

Bill of Lading.

Certificate of Original Goods.

Weight and Measurement List.

Other Paper that The Importer Asked for.

Kinds of Bill Documents:

At Sight.

Collection.

Cash/Loan.

Usance/Deferred.

Application of Rate:

The foreign currency would be converted at the rate ruling on the date of Lodgment (B.C Selling Rate) or at the rate if forward exchange booked or at the rate prescribed by Bangladesh Bank. The rate and the equivalent Bangladesh Taka should be recorded on the bill Register. Two officials must check the conversion.

Exchange Control Forms:

IMP /TM (Import Form & Traveling Miscellaneous Form) must be filled in and duly signed by the importer in all respect at the time of Lodgment.

Noting on The Letter of Credit File:

As soon as documents are ledged the utilized amount is to be noted on the Back-to-Back L/C copy or on the printed format of the Letter of Credit (L/C).

Security of the Documents:

Documents must be kept under lock and key of the Bank under the custody of a responsible officer.

Limitation of the Importers :

Importer is to be advised on the date of lodgment of documents with full particulars of shipment to retire the documents against payment or to dispose the import documents as per arrangement, if any.

Dishonour of Documents:

If the documents are found discrepant by the bank on checking a telex/cable message is to be sent to the negotiating bank/ collecting bank on the date of receipt of documents. In the meantime the discrepancies are also to be referred to the drawee for their acceptance. The reply of the importer is to reach the bank within 72 hours in case of non-acceptance. The dishonour is to be communicated to the negotiating bank within reasonable time. Unusual delay in communication of dishonour is not acceptable to the negotiating bank and the issuing bank forfeits its right to claim the refund.

Disposal of LCA :

Exchange control copy of LCA, if fully utilised or when the balance is too small is submitted to the Bangladesh Bank, exchange control department alongwith IMP /TM and schedule.

Retirement (At sight bills) of WES (cash) :

The importer must retire all the importer bills immediately after receipt of documents.

Retirement procedure for Deferred Payment of Usance Bills:

When the draft is returned by the drawee (importer) after being du1y accepted by him. The following procedures are to be maintained:

The maturity date is to be worked out and noted in bill register and also in due date diary. The due date diary may be maintained by the dealing officer and the manager or in charge of foreign exchange department.

The Foreign Correspondent shou1d be advised the due date of maturity and be authorized to debit the wrong account or to claim reimbursement on due date as per Letter of Credit (L/ C).

All the documents are delivered to the importer except accepted Bill of Exchange/ draft.

ACU Letter of Credit L/C) :

This type of L/C is the same as Case L/C. Reimbursement must be made on ACU NOCTRO A/ C countries. Reimbursement authority shou1d be sent on the same day as the Letter of Credit (L/ C) is sent.

Letter of Credit (L/C) :

Letter of Credit (L/ C) is the most important thing for doing any sort of foreign business. There is no guaranteed relation between Importer and Exporter. As a resu1t they use a media to secure their goods and currency. So exporters and importers use their respective banks as a media and Letter of Credit (L/ C) is a legal obligation between the exporter and importer. The importer can open a Letter of Credit (L/C) of 100% or take the margin of 25%, 15%. The margin actually depends on the relationship between the customer and bank. To open. Letter of Credit (L/C) the importers submit the invoice/indenture. It is necessary to fill up the following forms:

LCF form.

Application and agreement for confirmed irrevocable without resources to drawer’s Letter of Credit (L/C).

Letter of Credit (LI C) Authorisation Form.

Form of IMP (Importer) and EXP (Exporter).

Among the above forms the LCF forms are sent to Bangladesh Bank for authorisation of fund. When Bangladesh Bank registers the form, the Bank prepares two copies of the form; one of which is sent to the exporter and another to the advising Bank. This advising Bank is the Bank where the Importer maintains his account. This advising Bank can be the negotiating Bank and reimbursing Bank. After the completion of shipment the negotiating Bank helps the exporter to get the clearance easily.

Therefore the Bank negotiates with the advisory Bank on behalf of the exporter and makes payments to the exporter by collecting the money from the advisory Bank.

Parties to a Letter of Credit :

As per the terms and conditions of the Letter of Credit (L/ C) the seller is required to be routed through some intermediary banks in order to get his claim. So we see that there are a number of parties involved in a Letter of Credit (L/C). The involved parties in a Letter of Credit (L/ C) are as under:

Importer/Buyer. Exporter/Seller/Beneficiary .

Opening/ Issuing Bank. Advising/Notifying Bank

Confirming Bank (for add confirming L/C). Exporter Bank (i.e. negotiating Bank). Reimbursing Bank or Paying Bank.

Classification of Letter of Credit (I/C) :

· Revocable Letter of Credit (L/C).

· Irrevocable Letter of Credit (LI C).

· Confirmed Letter of Credit (L/C).

· Transferred Letter of Credit (L/C).

· Divisible Letter of Credit (L/C).

· Revolving Letter of Credit (L/C).

· Restricted Letter of Credit (L/q.

· Red Clause Letter of Credit (L/C).

· Green Clause Letter of Credit (L/ C).

· Back-to-Back Letter of Credit (I.,I C).

· With Recourse Letter of Credit (L/C).

· Without Recourse Letter of Credit (LI C).

Revocable Credit:

As per Article No.8 (a) a revocable credit is a credit, which can be amended or cancelled by the issuing bank at any time without prior notification to the seller since it offers little security to the seller.

Irrevocable Credit:

As per Article No. 9 an irrevocable credit constitutes a definite undertaking of the issuing bank. A credit cannot be amended or cancelled without the agreement of all parties. It gives the seller greater assurance of payment. An irrevocable credit can be either confirmed or unconfirmed depending on the desire of the seller.

Confirmed Irrevocable Letter of Credit (UC):

As per Article No. 10 of UCPDC when an issuing bank authorises or requests another bank to confirm its irrevocable credit and the latter has added its confirmation, such confirmation constitutes a definite undertaking of the confirming bank in addition to that of the issuing bank. These types of Letter of Credits (L/C) are called Confirmed Irrevocable Letter of Credit (LI C).

A confirmed credit gives double assurance to the seller of making payment first by opening bank and the second by confirming bank and, it cannot be amended or cancelled without the agreement of the issuing bank, the confirming bank and the beneficiary .

The Recourse to Drawee or without Recourse to Drawer:

These terms are very much related with the Bill of Exchange, which are to be drawn under the strength of LI C. The recourse means in case the drawee of the bill fails to honour it, the banker as the holder of the bill can claim the amount back from the drawer.

In order to avoid such liability, the exporter may ask the importer to arrange credit without recourse to the drawer. In this case the issuing bank will have recourse to the drawee only, if the drawee fails to honour the bill and the liability of the drawer ends as soon as the bill is negotiated.

Transferable Credit:

A transferable credit is one that can be transferred by the original beneficiary to one or more subsequent beneficiaries. The original beneficiary acts as the middleman and does not supply the goods himself. The 2nd beneficiary is one who acts as actual supplier and to whom the credit is transferred in full or in part.

As per Article No. 48 of UCPDC 500 a transferable credit is a credit under which the beneficiary has the right to request the bank called upon to effect payment or acceptance or any bank entitled to effect negotiation to make the credit available in whole or in part to one or more parties.

A transferable credit can be transferred once only. Fractions of a transferable credit can be transferred separately, provided partial shipments are not prohibited.

The credit to be transferred only under the terms and conditions specified in the original credit with exception of the amount of the credit, if any unit prices stated therein, and of the period of validity or period for shipment, any or all of which may be reduced or curtailed.

Procedure for Transferable Letter of Credit (UC) :

The original beneficiary when requests the banker in writing to effect transfer of the Letter of Credit (LI C) to the second beneficiary, the signature of the original beneficiary on the letter of request must be verified by his banker. The Letter of Credit (L/C) can be transferred only on the terms and conditions specified in the original credit.

A transferable credit can be transferred once only. Fractions of transferable credit can be transferred separately. The aggregate of such transfers will be treated as only one transfer. The aggregate of such transfers must not exceed the original value of LIe. When transfers are made in part, it should be verified that the original Letter of Credit (L/C) permits part shipment.

While transferring a credit, bank may hold the original at their custody. Each and every transfer must be noted on the back of the original one. All the transfers are to be noted in the Letter of Credit (L/C) register. Bank chargelcommission is to be realized on the 1st beneficiary unless otherwise specified.

Each transferable Letter of Credit (L/C) is subject to UCPDC, ICC publication No. 500, and 1993 revision.

Revolving Credit:

The revolving credit is one, which provides for restoring the credit to the original amount after it has been utilised. A credit revolving as to time because automatically reinstated or available on utilisation at.specified intervals of time within a given overall period of validity. It revolves in relation to time. In this case the issuing bank will have to consider for factors in addition to the other factors.

Generated rate and maintain the growth of the special business such as Import and Export trades.

Anticipatory Letter of Credit (Red. Clause and Green Clause L/C):

The anticipatory credits make provisions for pre-shipment payment (at least the part amount) to the beneficiary in anticipation of his effecting the shipment as per L/ C conditions. As the clause of the credit, authorises the negotiating bank to provide pre-shipment advance to the beneficiary for procurement of the goods is printed/ typed in red ink to draw attention to the unique nature of the credit, this type of Letter of Credit (L/C) is known as Red Clause L/e. The ‘Green Clause’ (printed or typed in green ink) is an extension of the ‘Red Clause’ in that it authorises the negotiation bank to grant advance to the beneficiary for storage facilities at the port in addition to the earlier stated pre-shipment advances.

Back-to-Back Letter of Credit (L/C)

Back-to-Back Letter of Credit (L/C) is a type of Import L/C either inland or abroad, which open against lien on valid export L/C.

In our country in export of garments, this method of finance is widely used and is very well known to the manufacturers of garments. Bangladeshi exporters had received an irrevocable Letter of Credit (Lj C) for supply of readymade shirts, from an American Bank. For manufacture of the ordered shirts the exporter does not have the required raw materials. To execute the order he has to import raw materials from Korea. Then the Bangladeshi exporter will have to open an import Letter of Credit (Lj C) favoring the Korean supplier of fabrics and accessories. The Letter of Credit (Lj C) is opened by the Bangladesh Bank lien against the American Bank’s Letter of Credit (Lj C) under bonded warehouse system.

Restricted Letter of Credit (L/C) :

When the negotiation is restricted to the Letter of Credit (L/ C) advising bank only against adding confirmation to the credit. This type of Letter of Credit (L/ C) is called restricted L/C.

The Letter of Credit (L/C) application must be completed / filled in and signed by the authorized person of the importer giving the following particulars:

· Full name and address of the supplier or beneficiary and importer.

· Brief description of the goods.

· L/C value of US$,… etc. (CFR value) which must not exceed the LCA value.

· The unit price, quantity, quality of the goods.

· Origin of the goods, port of loading and port of destination.

· Mode of shipment (Sea, Air, Truck or Rail etc.).

· Last date of shipment and negotiation time (must not be beyond 30 days from the

shipment date).

· Insurance cover note number and name of the company.

· Tenure of draft (i.e. sight/usance/deferred etc.).

· Mode of advising L/C (i.e. airmail/ full telex! short cable etc.).

· Opening of L/C under VCPDC publication No. 500 ICC revision 1993.

· Whether shipment! transshipment is allowed.

. Instruction to add confirmation.

. LCA number.

· Any other relevant information and instruction if and, must be mentioned in the Letter of

Credit (L/C) application form.

Examination of Letter of Credit (L/C) application form:

On receipt of Letter of Credit (L/C) application an officer of L/C section must check it very carefully by the following manner.

That the terms and conditions as stipulated in the L/C application are consistent with exchange control and import trade regulation and VCPDC 500.

That all the information mentioned in the above column has been furnished.

That the items to be imported are eligible according to the importer’s entitlement.

That the goods are not being imported or originated from South Africa or Israel.

If the goods are imported from any member countries of ACU. ,

That all the cutting! erasing! alteration if any, is authenticated by the authorized person. LCA/ License/ permit etc. are endorsed.

That the validity of the L/C must not exceed the validity of LCA.

L/C is opened within the validity period permitted in the License.

For Letter of Credit (L/C) limit following information are to be furnished by the

applicant.

The full particulars of bank account.

Types of business (Proprietorship, Partnership, Limited Co.) in case of Ltd. Co. balance sheet of last 3 (three) years and the names of directors.

Historical background.

Amount of time required.

Terms of payment- Whether the import documents would be retired against payment on receipt or against acceptance or whether post import finance is required in the form of MPI I L TR etc.

Goods to be imported

Security to be offered.

Re-payment schedule and source of fund.

Other liabilities of the customer with the bank.

Statements of Assets and Liabilities.

Account position (Balance).

Trade license and import registration number with renewal date.

On receipt of the above particulars, the import section of the bank will prepare credit report of the concerned importer. The report should be collected from the previous banker of the party also.

Preparation of Credit Report:

Bank prepares credit report in prescribed forms. Character, Capacity and Capital, are known as the three Cs of credit. Instead of the three Cs, some mention the three Rs i.e. reliability, responsibility and resources. To theses three Cs we may add two more Cs i.e. collateral and conditions.

How a banker should obtain necessary information regarding these fundamentals of credit? No doubt, the banker has to make inquiries from those of their customers and other people and verify the report by the banker. Sometimes information is gathered by deputy marketing officer or credit officer.

Position of Letter of Credit (L/C) :

Import section will see whether there is sufficient fund available in the account to cover the margin to be sanctioned, commission, postage, cable or telex charge etc. If it is found O.K, Letter of Credit (L/C) will be sanctioned.

In all cases the sanction must be informed to the importer for acceptance. On receiving confirmation from the client, the terms and conditions of the sanctioned are acceptable, the subsequent documentation! charge document are taken up.

Following: papers documents submitted by the importer before opening of the L/C :

Trade License (Valid).

Import Registration Certificates (Must be kept in the bank custody). Income tax declaration with TIN.

Membership Certificate.

Memorandum of (In case of partnership firm) understanding. Resolution.

Photo: one copy.

VAT Registration Certificate.

Bank will supply the following: papers I documents before of the L/C :

Letter of Credit (L/C) Application form. LCA Form.

IMP Form.

Charge Documents Paper.

Guarantee Form.

The above papers must be completed duly filled in and signed by the party and the signature verified by the bank.

Maintenance of Register :

The sanction must be recorded in the following registers.

Document Execution Registers. All the charge documents must be recorded in this register.

Limit register.

Liability Ledger.

Confidential Report of Beneficiary of Letter of Credit (L/C) :

According to exchange control regulations, bankers are required to obtain confidential report of the beneficiary of Letter of Credit (L/C) before opening the same, if the amount of Letter of

Credit (L/C) exceeds Tk. 5 lac. Bank can open Letter of Credit (L/C) below Tk. 5 lac without obtaining C.R.

Bankers can write, to their foreign correspondents to supply the C.R. But from practical experience, we can see that foreign correspondents of different countries do not supply the C.R. timely.

To overcome the above situation bankers can conduit reference book i.e. MUWN/ DUNN/ BRADSTREET/ Trade directories of various chambers of commerce of different countries of the world.

On receipt of C.R. from any source, the banker can accumulate the same in one master file.

LCA Re2istration :

Letter of Credit (L/C) authorization forms consists of six copies. 1st copy for exchange control purposes, 2nd copy for licensing authority, 3rd and 4th copies for the CCl & E, 5th copy for the registration unit and 6th copy is the office copy for the bank.

The procedure for registration of LCA form with the Bangladesh Bank is under.

All LCA forms should be registered with Bangladesh Bank, Registration Unit,

Exchange Control Department, Bangladesh Bank.

After filling up the relevant portions of the LCAFs and duly signed by the importer, they are forwarded to the registration unit of the Bangladesh Bank by the authorized dealers duly authenticated. The Bangladesh Bank registration unit subject to observation of usual drill registers the LCAFs. The officer in charge of the Bangladesh Bank unit will give the registration number on all the copies of LCA forms under his signature. Therefore, the same will be opened unless an LCA form which has been registered with the Bangladesh Bank.

After registration the original and duplicate copies of the Letter of Credit (L/C) authorization forms will be delivered to the authorized representative of the Banks from whom the same was received by the registration unit. 3rd and 4th copies of the form will be passed on to the concerned licensing office, 5th copy of the form will be retained in the record of the registration unit of the Bangladesh Bank.

The authorization dealers will not issue blank Letter of Credit (L/C) authorization form to their clients. The importer should sign the L/C authorization form in the presence of Bank officer. The A.D. should sign the LCA form and verify the importer signature. Authorized dealer shall keep it carefully.

The registration will remain valid for 11 months or 17 months. As the case may be

depending on the commercial and industrial machinery.

When Letter of Credit (L/C) has been opened against the exchange control copy of the LCA form, full particulars must be endorsed on the back of the copy under the stamp and signature of the, authorized dealer.

Letter of Credit (L/C) Numbering in The Register:

If the Letter of Credit (L/C) application and other formalities are found in order then put the serial number in the Letter of Credit (L/C) opening register. This Letter of Credit (L/C) number form on the appropriate blank space.

Enter in the Letter of Credit (L/C) opening register the following particulars:

Date, Letter of Credit (L/C) value (Foreign Currency) and Bangladesh Tk., Rate of Conversion, LCA No., CCI and E Registration No., Shipment Date, Expiry Date of the L/C, Commission, Postage and Telex etc. to be recovered.

Letter of Credit (L/C) Advising:

Letter of Credit (L/C) must be typed in the printed format of a bank, after typing, Letter of Credit (L/C) should again be checked up by two authorized signatories and would be dispatched under their full signature bearing their signature number.

Telex Letter of Credit (L/C) :

Any importer may desire the Letter of Credit (L/C) to be transmitted by Telex. In that case the whole Letter of Credit (L/C) is to be transmitted by Telex to the advising bank by the opening bank.

In the last paragraph of the above Telex Letter of Credit (L/C) must be mentioned that the Telex message is an operative and no airmail confirmation will follow. In ~hat case, reimbursement authority is to be sent to the reimbursing bank separately.

If the importer desires that the Letter of Credit (L/C) is to be advised by a short cable, short cable can be sent incorporating the principal terms of the Letter of Credit (L/C) as under.

Advice our irrevocable Letter of Credit (L/C) No……………….. Date. Favouring …….

(Beneficiary’s name and address).

Amount (Foreign currency). Merchandise to be imported.

Last date of shipment. Negotiation days.

Name of the Importer with address.

Test Number.

Air Mailing Details.

The airmail Letter of Credit (L/C) must state under “this is in confirmation of our cable dated”. This is necessary to eliminate the possibility of issuing two advises of dispatching the same letter of Credit (L/C) to the beneficiary by the foreign correspondent.

Add Confirmation:

Sometimes the beneficiary of the Letter of Credit (L/C) may ask for add confirmation to a Letter of Credit (LC) by an internationally reputed bank in the beneficiary’s country. The importer is to request his bank i.e. opening bank to do so in writing.

The opening bank advised the Letter of Credit (L/C) through their correspondent with whom they have prior arrangement of credit line. Instructions are issued in the following language.

“Please find your confirmation of the credit at beneficiary’s cost”. Adding confirmation Letter of Credit (UC) is the negotiation restricted to the bank that has added their confirmation to the credit.

Such undertaking can neither be amended nor cancelled without the agreement of the issuing bank, the confirming bank and the beneficiary.

Disposal of Letter of Credit (L/C) Copies and Filin2 :

Letter of Credit (L/C) is normally typed in the respective bank’s printed format in manifold (9 copies). The original L/C is sent to the advising bank for beneficiary and 2nd copy sent to the above bank at the same time for their own purposes, 3rd copy for importer, 4th copy for reimbursing bank, 5th and 6th office copy of the bank.

One copy for importer to be sent to them along with the memo of charges incurred by the opening bank for the L/C stating their account has been debited for the amount of Memo including that amount of margin.

Accountin2 Procedure for Letter of Credit (L/C) :

The following accounting system is followed I documentary credit. The register shall be posted immediately on receipt of approval from the manager to open a L/C. Foreign currency should not be purchased against L/C at the time of opening of L/C. If necessary, the importers may avail forward booking facilities from Head Office subject to formal approach by the branch.

Amendment:

Amendment of irrevocable Letter of Credit (L/C) is not permissible without the joint consent of all the parties involved in documentary credit operation.

Time Extension :

A written application from the opener of Letter of Credit (L/C) and signature of the opener to be verified.

A relevant license/ LCAI Permit of the loan! barter must remain valid up to that period the extension is sought. Increase in Letter of Credit (L/C) amount may be done provided the LCA covers the increase in amount.

Letter of Credit (L/C) amount can be decreased provided the relevant indent is amended accordingly and with the consent of the beneficiary.

Each and every clause of the L/C can be amended provided the parties involved in the L/C consents to it.

Procedure or Preparation and Dispatch:

Amendment is to be typed in the Bank’s printed format. The copies of the amendment must be dispatched to all concerned as done in dispatching the L/C. Amendment can be done either by cable/ telex or airmail.

Each and every amendment of L/C must be noted in the L/C file and copies of each amendment are kept in the L/C file chronologically (date wise).

Bank Change :

Amendment commission is to be realized from the party as per instruction of Bangladesh Bank F. C. circulars.

Accounting Procedure:

Dr. Party’s Account.

Cr. Commission Account.

Cr. P & T Account.

Liability:

If the amount of L/C increases, the liability voucher is to be passed as under:

Dr. Liability as per Contra (WES L/C) Cr. Assets as per Contra (WES L/C) Dr. Assets as per Contra (WES L/C) Cr. Liability per Contra (WES L/C)

A fresh liability is to be passed including the amount of increase on the date of amendment.

Other banks’ accounting is same as above in case of amendment.

Some are parts:

General Banking and Finance Operations of Dhaka Bank Ltd (Part 1)

General Banking and Finance Operations of Dhaka Bank Ltd (Part 2)

General Banking and Finance Operations of Dhaka Bank Ltd (Part 3)