General banking activities of United Commercial Bank

Modern Banking presents an extensive variety of economic services – particularly credit, funds, and payment services and carries out the widest array of economic tasks of any business firm in the financial system which is a result improvement. Earning a good image of honesty to pact with money of the shareholders is the vital characteristic of banking process.

Introduction

Bank is a financial institution which deals with money. Not all banks are the same. There are different types of banks: co-operative banks, savings banks, investment banks and central banks. Because of its transitional role, banking system occupies a vital place in a country’s economy. It confirms distribution and re-allocation of assets and keeps up the motion of economic activities. As monetary intermediaries, banks stand between investors who invest capital and debtors who demand capital. It assembles asset for both the public and private sectors, and provides inventive answers to meet the requirements of entrepreneurs and government agencies. Thus the banking segment plays a key role in the evolution of Bangladesh’s economy. After the independence of Bangladesh in 1971, six state owned commercialized banks were composed, two state owned banks that specialized in lending to the agriculture and industry, three foreign banks including standard chartered bank. The banking industry has faced momentous expansions from 1980’s.

Private Banks has entered in banking industry, Micro finance banks grew rapidly, which has provided assistance to meet the needs of poor citizens. Foreign trading is a large business which is run by commercial banks. Foreign trade means the exchange of capitals and services across the border. Expertise is provided by commercial banks. Foreign trade requires a flow of goods from seller to buyer and payment from buyer to seller. Here, bank plays as a conciliator between the buyer and seller.

Objective of the Report

General objective:

- General objective is to prepare and submit a report on the topic “General Banking”.

- To get idea about the relationship between real life learning and theoretical learning of UCB ltd.

Specific objective:

- To apply hypothetical knowledge in real-world field.

- To observe the purposes of general banking.

- Getting idea about how commercial bank works.

- To understand entire branch banking procedures.

- To gain practical experience that will help us in our practical life.

- To understand how other departments of the branch function.

- To know the strength and weakness of the bank.

- To understand in which sector the bank is working with proper efficiency.

- To find out the problems of the bank and suggesting the way to solve the problems.

- To analyze the current performance and making future predictions.

Concept of Bank

The financial institution which deals with money and money worth instruments is called Bank. A bank is a financial in-between option that accepts deposits and channels those deposits into lending activities. They do it either directly or through capital markets. In 1901, Justice Holmes wrote, in an Irish case (Re Shields Estate): “The real business of the banker is to obtain deposits of money which he may use for his own profit by lending it out again.”. “Banking means the accepting, for the purpose of lending or investment, of deposits of money from the public, repayable on demand or otherwise, and withdrawal by cheque, draft, order or otherwise” – According to Section 5(b) of Banking Regulation Act, 1949. “The few who understand the system will either be so interested in its profits or be so dependent upon its favors that there will be no opposition from that class, while on the other hand, the great body of people, mentally incapable of comprehending the tremendous advantage that capital derives from the system, will bear its burdens without complaint, and perhaps without even suspecting that the system is inimical to their interests.” The Rothschild brothers of London writing to associates in New York, 1863.

Brief History of Banking System in Bangladesh

The name bank derives from the Italian word banco which means “desk/bench”. This word used during the Renaissance by Jewish Florentine bankers, who used to make their transactions above a desk covered by a green tablecloth in ancient times. If we talk about history of banking in Bangladesh, the banking system at independence consisted of two branch offices. One was former State Bank of Pakistan and another consisted of seventeen large commercial banks, two of which were controlled by Bangladeshi interests and three by foreigners except Pakistanies. There were fourteen smaller commercial banks. Virtually all banking services were concentrated in urban areas. The newly independent government immediately designated the Dhaka branch of the State Bank of Pakistan as the central bank and renamed it the Bangladesh Bank. The responsibility of Bangladesh bank was

- regulating currency,

- controlling credit,

- monetary policy,

- administering exchange control and

- the official foreign exchange reserves.

Then the Bangladesh government initially nationalized the whole conjugal banking system and proceeded to rearrange and rename the different banks. Foreign-owned banks were permitted to continue doing business in Bangladesh. The insurance business was also nationalized and became a source of potential investment funds.

Historical Background of United Commercial Bank Limited (UCBL)

United Commercial Bank Limited was built-in as a public limited company under the Companies Act. 1994. UCBL’s rules and regulations were established under of Bangladesh bank and the Bank companies’ Act 1991, on the 3rd June 1983, The founder chairman and the leader of that time during the leadership of Late Mr. Shahjahan Kabir.

He was founder chairman, who had a long dream of floating a commercial bank which would contribute to the socio-economic development of our country. He had a long experience as a good banker.

To get the dream done few highly qualified and successful entrepreneurs joined the chairman. With proper hardworking, intelligence and talent each and every entrepreneurs proved themselves in different field of business in the journey of UCBL. According to the process Mr. Nazrul Islam Mazumder became next chairman after passing Mr. Shahjahan Kabir the founder of UCBL.

Government contributed to United Commercial bank Limited along with some selfmotivated and hardworking entrepreneurs and distinguished industrialists of the country.

It was formed as a public company in Bangladesh on the 26th June, 1983 under the company Act 1994 and listed in Dhaka Stock Exchange limited on the 30th November, 1986 and Chittagong Stock Exchange Limited on the 15th November, 1995.

Overview of United Commercial Bank Limited

Alike other banking institutions United Commercial Bank does not produce any tangible product but it offers a variety of money related services to its customers. However, United Commercial Bank started as a small Bank in mid 1983 and established itself as one of the largest first generation banks in Bangladesh. It distinguishes itself from other private banks by its personalized services, innovative practices and effective management system. Also a huge networking system of 148 branches made it easier to success.

The Bank has its in different and diverse segments of banking like Retail Banking, SME Banking, Corporate Banking, Off-shore Banking, and Remittance etc. United Commercial Bank has lengthened its arena by diversion among different segments of banking like:

Retail Banking: Retail Banking is a mass-market banking where customers use all banking services from local branches of larger commercial banks. Services include personal loans, opening and checking different account, issuing debit or credit card etc.

SME Banking: Small and medium enterprise banking works for creating jobs for low income people. They help increasing economic growth, social stability, and they contribute to the development of a dynamic private sector. Bank also assess and monitor business loans, managing business financing risks, pricing products and working for further development of SME.

Corporate Banking: Corporate banking, also known as business banking, refers to the aspect of banking that deals with corporate customers. It is also the source of regular write-downs for loans that have sourced. Its Corporate banking service consists of simple business of issuing loans to more complex matters, such as helping minimize taxes paid by overseas subsidiaries, managing changes in foreign exchange rates or working out the details of financing packages necessary for the construction of a new office, plant or other facility.

The Bank also provides its clients with both incoming and outgoing remittance services. Thus the expatriates find an easy way to send money through proper channel. The Bank, aiming to play a leading role in the economic activities of the country, is firmly engaged in the development of trade, commerce and industry by investing in network expansion and new technology adoption to have competitive advantage.

Risk Management and decision making of UCBL:

It’s natural that there will be risk in all the main business areas of the bank. Proper risk management is one of the core foundations of banking. As a commercial bank, UCBL adds full significance to direct business risk to ensure prolonging performance and expansion. Appropriate and effective risk management is its main point of importance. A broad range of risk issue is covered up by the bank. Foreign exchange risk, internal control and compliance risk and credit risk, asset liability management, laundering risk these are the five main banking areas to be covered but the risk management section of the bank. Protecting the bank’s assets, financial supplies, market status and productivity Investment Schemes are the standard goal of risk management section. The bank took following steps to make this effective:

- Foreign Exchange Risk

The possible alteration in earning occurrence due to alteration in market prices is explained as foreign exchange risk. All possessions that are available to foreign investors are openly influenced by the market (e.g. Justice, country union, personal assets, manufacturing etc). A major role is also played by foreign exchange rates in deciding which finance government arrears, which purchases equities in companies and exactly change and manipulates the financial scenario.

The jobs of treasury functions are critical because of high risk market. UCBL has separated the front and back office per Bangladesh bank guidelines to operate treasury functions properly. Front office autonomously carries out the transactions and the back office is in charge of confirming of the contracts and passing of their entries in books of accounts. All foreign exchange transactions are valued again at Market-to-Market rate as directed by Bangladesh Bank and all accounts are signed again on month to month basis.

- Credit Risk Management

The chance that the borrower or country party is will not be successful to meet their responsibilities according to the agreement terms is considered as credit risk. This failure happens when the country party is unwilling to accept their responsibilities or their financial situation is weak. If the bank deals with or lends to corporate, individuals, other banks or financial institutions, this risk arises then. To carry out marketing responsibilities and credit product assessment, to maintain strong relationship with customers and finding out new business possibilities, the bank formed a detached credit division since its inspection. safety of the planned credit capacity, manufacturing investigation, customer’s chronological performance, includes borrower risk analysis, financial statement analysis, market status of the borrower and safety of the planned credit capacity are the functions of credit risk management. Lending decisions which are made by UCBL are based on appraisal statement prepared by assessment squad.

- Internal Control and Compliance Risk Management

A serious part of bank administration and base of the safe and sound function of banking institution is internal control and compliance (ICC). A strong internal control and compliance system is needed to make sure that the bank will meet its aims and objectives, will achieve long term productivity targets and uphold dependable fiscal and supervisory reporting. Because of insufficient well-built internal control and compliance culture, error may arise and operational loss may happen. Useful internal control and compliance is needed to make sure that the bank complies with laws and regulations as well as rules, preparations, internal rules and actions, and reduces the threat of unpredicted losses and harms to the banks status. To make this effective, the bank has formed an ICC division which is leaded by senior executives. Audit & Inspection Department, Compliance Department and Monitoring Department are the three separated departments of ICC. An internal control and compliance policy was also developed by the bank which was approved by the board of directors.

Cyclic and unique audits are commenced by the audit and inspection team. the fiscal reporting prices, the method of internal control, the procedure of auditing and the bank’s compliance method with rules, guidelines and code of conduct etc are reviewed by the audit committee.

- Prevention of Money Laundering

A main risk to the fiscal services community is money laundering. It is important for the administration of banks and other monetary instructions to view the impediment of money laundering as a part of their risk management plans. UCBL’s administration is completely alert that the fiscal structure cannot be used as way of illegal actions. To make sure it stays like this, co-operation and co-ordination among related parties are required.

Chief Anti Money Laundering Compliance Officer (CAMLCO) at head office and compliance officers at branches has been appointed by the bank to evaluate the transactions of the accounts to recognize mistrustful transaction.

- Asset Management

An almost common and acknowledged approach to risk management is asset or liability management. From the time when assets and productivity are closely associated, the asset or liabilities of UCBL are being supervised by the bank so that nonstop productivity can be guaranteed and the bank can uphold and enlarge its assets resources. Unbiased decisions are made by the assets/liability management committee for the financial movement of the bank. It is ALCO’s aim to direct and utilize the resources, recognize balance sheet matters which are similar to balance sheet gaps, interest rate gaps. Liquidity eventuality preparation and implementation of liability pricing policy for the bank are also reviewed by ALCO.

General Banking:

Everyday transaction of banking system is the main operation which is handled by general banking sector. It has to meet the customers demand for cash and to receive investment from them. It opens new accounts, forwards customer’s money from one place to another through issuing bank draft, pay order, endorsement, collects all bills like local cheque collection, inward and outward bills collection for customers. General banking is also known as Retail Banking. In UCBL, Mirpur Road Branch, departments under general banking section are:

1) Account opening section

2) Cash section

3) Deposit section

4) Remittance section

5) Accounts section

6) Clearing section

7) Other Customer Service section

Account Opening Section

Responsibility of the customer service starts with opening of new account in the name of new customer. This is the starting point of the client bank relationship. By opening an account, the bank bridge it’s customer to avail the facilities provided by the bank. This is one of the most important sections of a branch, because by opening accounts bank mobilizes funds for investment. Many rules and regulations are followed and various documents are taken while opening an account. UCBL has several types of deposit accounts for its customers.

Current Account:

This type of account is opened by both individuals and business concerns. Frequent transactions (deposits as well as withdrawal) are allowed in this type of account. It is purely a demand deposit account. Some Important Points of current accounts are as follows-

- Minimum opening deposit of TK.1000/- is required;

- No withdrawal limit.

- No interest is given upon the deposited money;

- Minimum Tk.1000/= balance always must be maintained.

Savings Account:

Individuals for savings purposes open this type of account. This deposit is primarily for smallscale savers. Based on deposited amount Interest is given here. Interest on this account is calculated and accrued monthly and credited to the account half yearly. Important Points of savings accounts are:

- Minimum opening deposit of Tk.1000/= is required;

- Minimum Tk. 500/= balance must always maintain.

- Withdrawal amount should not be more than 1/4th of the total balance at a time

- Withdrawal limit is twice in a month.

- If withdrawal amount exceeds 1/4th of the total balance at a time no interest is given upon the deposited money for that month.

Special Notice Deposit (SND) FORMER STD Account

Any individual or corporate body can open Special Notice Deposit Account, which is an interest bearing deposit account, for a short period of time. However, 7 days of notice is required if the customer wishes to withdraw money from this account. Interest rate on SND accounts will be varied based on the amount and not on the customer or tenure. Interest is calculated based on daily minimum product and paid two times in a year.

Call Deposit

When the money market is tight such deposits attract higher rate of interst and then to be treated as banker’s borrowings as call loans. Sometime the banker secures funds from the money markets usually from other bankers against receipt to meet his purely tepmorary shortage of funds. These debts are repayable immediately at call.

Formalities for Opening an Account:

For opening the account, the first hand requirements:

- Application on the prescribed form

- Introduction of the applicant

- Specimen signature

- Two copies of passport size recent photograph with attested by the introducer.

At first customer service desk want to know whether the customer has introducer to open the account or not? If yes then give him/her a printed Account opening Form along with Specimen Signature Card, Customer Transaction Profile Form and Information form on Money Laundering. After that, request customer to fill up the form duly and submit the form with required documents.

Steps taken at the Time of Opening the Account

Before opening of a current or saving account, the following formalities must be completed.

- Inform customer of the essential conditions under which the account will be operated (e.g. charges, minimum balances etc.).

- Receive completed appropriate account opening form and other required documents including two recent photographs for each signatory.

- Obtain identification of client, verify signature of introducer.

- Have all documentation approved/ initiated and cancels blank spaces on signature card.

- Take approval of General Banking In-Charge / Manager.

- Allocate account number and have initial deposit slip prepared and deliver to cashier.

- Must be 18+ and with sound mind.

Documents Required:

- Personal Account (Individual/Joint):

- Two Copies of Passport size photographs of the applicant attested by the Introducer and one copy passport size photograph of the Nominee attested by the applicant.

- Copy of passport/National Identity Card/ Voter ID Card

- Details of occupation/employment and sources of wealth or income

- Joint Declaration Form (For joint a/c only).

- Employee’s Certificate (in case of service holder).

- Partnership Account

- Introduction of the account.

- Two photographs of the signatories duly attested by the introducer.

- Partnership letter duly signed by all partners (Sign should be similar as stated in Partnership Deed).

- Partnership Deed duly certified by Notary public.

- Registration (If any).

- Updated Trade license

- Limited Company

- Introduction of the account.

- Two photographs of the signatories duly attested by the Introducer.

- Valid copy of Trade License.

- Board resolution of opening A/C duly certified by the Chairman/Managing Director.

- Certificate of Incorporation.

- Certificate of Commencement (In case of Public limited company).

- Certified (joint stock) true copy of the Memorandum and Article of Association of the Company duly attested by Chairman or Managing Director.

- List of directors along with designation & specimen signature.

- Latest certified copy of Form – xii (to be certified by register of joint stock companies) (In case of Directorship change).

- Rubber Stamp (Seal with designation of each person)

- Certificate of registration (In case of Insurance Company – Obtained from department of Insurance from the Peoples Republic of BD).

- Proprietorship Account

- Introduction of the account.

- Two photographs of the signatories duly attested by the introducer.

- Valid copy of Trade License.

- Rubber stamp.

- TIN number certificate.

- Identity (Copy of passport).

- Permission letter from DC/ Magistrate (in case of newspaper)

- Club / Societies Account

- Introduction of the account.

- Two photographs of the Signatories duly attested by the introducer.

- Board Resolution for Opening A/C duly certified by President/ Secretary.

- List of Existing Managing Committee.

- Registration (if any).

- Rubber Stamp.

- Permission letter from Bureau of N.G.O. (In case of N.G.O. A/C).

Account closing procedure:

To close account, a customer has to provide a written application. After submitting the application he has to submit the final cheque to withdraw full amount from his account. Bank charge will be deducted and after submitting unused cheque books,his “account opening” form will be rubber stamped and identified as closed then.

Issuance of new Cheque Book

A customer needs a cheque book to open account,especially for savings account and current account holders.Thus he can withdraw money whenever needed. A cheque book requisition slip is prepared and signed by the client, a new book is issued after that. The number of pages in the cheque book will differ according to the customer’s request and the type of his account. Every single page of the cheque book will be signed by authorized party of the bank. On the cover of the cheque book, account holders name will be written. Current,savings,CC and SND etc account holders will get cheque book. If the account holder is of 12 age and below, his legal guardian will get the cheque book of 10/20 leaves.

Issuance of Deposit Slip

If a customer decides to deposit money, he has to collect a deposit slip from the customer service department of the bank.

Department of cash payment

A banks cash sector expresses the liquidity strength of the bank. As it has to deal with money, it is also susceptible. This department does the most vital work, which is, contributing to the earnings of bank along with providing customer satisfaction with their superior and quick services. UCB mirpur branch has a well outfitted and decked out cash department which has online computer system and an electronic counted machine. Cash payments can be made very quickly as it takes a few seconds to see the account balance. The transaction which involves cash is called cash transaction. Cash transaction involves:

- Cash payment

- Cash receipt

Process of cash payment:

Cash payment in this counter is made to customers with a valid cheque. Customer has to place the cheque on the counter to get payment. Payment procedures are given below:

- The cheque leaf is checked to see if it is worded in the right way. Branch seal, Date, total amount to be withdrawn (in figure and word) and signature of the drawer is covered in the cheque leaf. It is also checked whether the “bearer” word is crossed away or the cheque is in the name of any establishment. From cheque holder, a receiver signature is also taken on the back of the cheque and the denominations of notes are also written there.

- Signature confirmation is done by matching signature with the sample, giving confirmation of the verifier and confirmation seal.

- Account is debited and the cheque is cancelled by the officer. Then it is posted in the computer system and transaction number and posting stamp is attached on the cheque.

- Cash payment officer takes the cheque.

- A “cash paid” stamp is attached on the cheque, and then this entry is taken in the cash payment register.

- Entry is posted in the debit drawer account and notes the transaction number on the top of the cheque.

Cash receipt procedure:

- First it is checked whether the deposit slip is properly filled up with every details needed.(e.g. account number, amount in figure and word, depositors sign

- Cash receiving officer takes the cash, counts them twice and matches with the deposit slip and also writes down the value of notes at the back of the cheque.

- The cash receiving officer also writes down the amount in figure and words in front side of the cheque.

- A signature of cash receiving officer and “cash received” stamp is attached on the front side of the cheque.

- It is added in the record book and a scroll number is written in the cheque.

- The system credits and places the deposit slip in the concerned account.

- Depositor gets a counter folio as a receipt. System balances the cash by getting one combined cash debit voucher posting.

Local Remittance

As it is very risky to carry cash money, that is why by using banking channel, money can be transferred from one place to another. This movement of cash money through online banking system is called remittance. While providing service to the customers, remittance of funds is one of the most vital features of the commercial banks.

Remittance types:

- Between banks in the different centers.

- Between banks and central bank in the same country

- Between banks and non banks customer

- Between banks in the same country

For remittance funds, UCBL uses instruments given below:

- Payment order (PO)

- Demand Draft (DD)

- Telegraphic Transfer (TT)

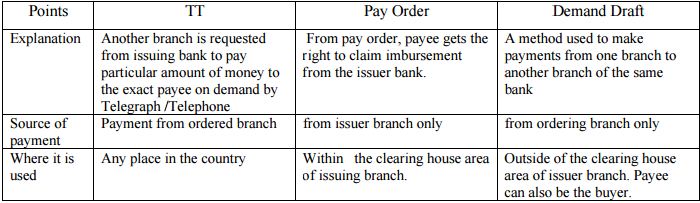

The main three types of local remittances are given below:

Other Services

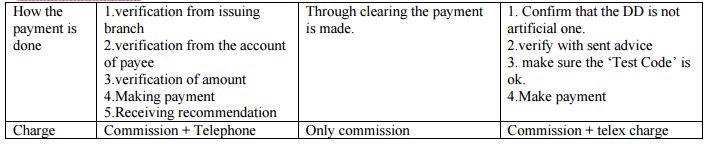

Credit card

Credit card facilities are provided by UCBL through wide network of UCB and Dutch Bangla Bank ATM booths. Withdrawal charges are:

- 150tk for 5000tk

- 300tk for more than 5000tk.

Cash withdrawal can be made through all VISA marked ATM booths all over the country.

Facilities of getting a UCBL credit card:

- Providing credit card for ladies – first time in Bangladesh.

- Choice of colors in standard (Silver) products.

- Higher coverage is accepted internationally in POS workstations and ATMs.

- Reward point for spending leads to win attractive prizes.

- Latest and best quality product at lowest annual fee in the market.

Inquiry through SMS for Credit Card

Credit card transactions can be done through SMS in UCBL. The charge deducted is 115tk with vat. It is one more mentionable additional service of UCBL.

Schedule of Charges for Credit Card

Note: 15% VAT will be deducted along with all other charges.

Performance of UCBL

With an opening paid up capital of TK. 35.50 millions, UCBL started its journey on 1983. Its objective is to provide superior customer service with delight and contentment. Prolonging complete business growth by ensuring efficiency, good asset quality, regulatory compliance, dependable productivity, good domination and of course mixture of skill and specialized talents are its vision. The formal initiation of UCBL happened in 27 June of the same year. The bank set record indeed in terms of advance, deposit and expansion of business through its nonstop diversification during the year of 2014. And now, when the operating performance is measured among all of the private commercial banks in Bangladesh, UCBL stands among one of the best banks.

Dhaka stock exchange enlisted UCBL on 1986 and Chittagong stock exchange did it on 1995. Foreign banking license was given to UCBL on 9th June, 2010. It is UCBL’s pride that it has 48 branches and 115ATM throughout the country.

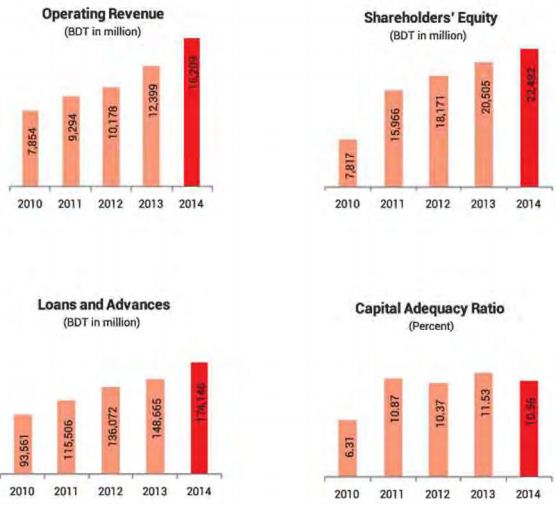

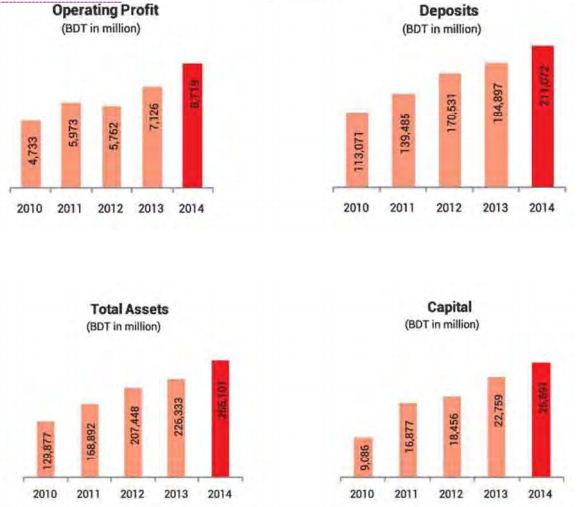

Financial Summary of five years

If business profitability and volume are measured, UCBL made significant growth in previous 5 years. Almost 105% of total assets of the bank increased and loans and advance of the bank grew by 86% during these years. During this period, the productivity of the Bank amplified by more than 87% and net revenue after tax by 70.56% in accordance with the increased volume of business.

SWOT Analysis

SWOT mean strength, weakness, opportunity and threat. The detailed study of an organization’s coverage and prospective in perception of its potency, flaws, chances and risks is called SWOT analysis. It is needed to make the current way of performance and also predict the outlook to develop their performance compared to opponents. The organization can learn about their current situation in the market with the help of this tool.

It also plays an important role in making modification in the planned administration of the organization. The SOWT of UCBL is given here in brief:

Strength of UCBL

- A very experienced administration group operates the United Commercial Bank Limited. The top managing executives of the bank is the main strength for UCBL .Because they have all worked in reputed banks and their years of banking knowledge, proficiency, and capability will continue to help towards more development of the bank. UCBL has already set up a complimentary status in the banking business of the country. As it is one of the top private sector commercial banks in Bangladesh, It has shown a marvelous expansion in the profits and deposits sector.

- The bank has 148 branches all over the country to provide better service to the customers. Every branch is located in a comfortable, convenient and secure place so that customer’s feels safe and secure while doing transactions. It creates a positive mindset among the customers which helps the bank to get more customers.

- An elevated increase rate with a remarkable revenue increase rate has already been attained by UCBL.

- The management of UCBL has created a very friendly, interactive and informal culture inside the bank. And, there are no concealed obstacles or limitations while corresponding between the low level employees and the high level employees. By working in this type of environment, employees feel more motivated and encouraged to work.

- UCBL is one of the top banks which give quality service to the customers.

- UCBL has various types of products and services to offer, so the customers can choose the best products according to their needs.

- The bank has a fully operational and fast online service all across the country.

Weakness of UCBL

The main important thing is that the bank has no clear mission statement and strategic plan. The bank does not have any long-term strategies whether it wants to focus on retail banking or become a corporate bank. The path of the future should be determined now with a well-built practical strategy.

- The bank has an insufficient work force. As it has a weak recruitment policy, it has failed to provide more human resource and as a result it has failed to provide efficient customer service.

- The profit rate UCBL is provided is not sufficient compared to other banks. So when it comes to making investments, customers feel less interested to invest in UCBL.

- Some of the job in UCBL has no path for promotion. So people feel less motivated to work in those positions. This weakness of UCBL is creating a group of unsatisfied employees.

- When it comes to marketing, UCBL has to give more emphasis on that.

Opportunity for UCBL

- UCBL has to develop their business overview to diminish the business risk. The management can think about options of starting merchant banking or diversify into leasing and insurance sector.

- The movement in the secondary financial market straightly impacts on the primary financial market. National monetary movements are governed by the investment in the secondary market. The business of the bank is controlled by the activity in the national financial system.

- In the recent time, a great number of private banks coming into the market. In this competitive atmosphere UCBL must develop its product line to improve its prolonging spirited benefit. They can introduce the ATM to participate with the local and the foreign bank in that product line. They can initiate credit card and debit card system to attract their potential customers.

- In addition, Special corporate scheme can be introduced for the corporate level customers or customers with a high income. They can also initiate various schemes for service holders. The schemes for the service holders must be created according to their type of profession, level of earning etc.

- The country’s increasing population is learning to adopt consumer finance. Opportunity in retail banking lies here. The average people in our country are of middle class. Various types of retail lending products have immense appeal to this class. So a wide variety of retail lending products has a very large and easily pregnable market.

Threats for UCBL

- There is an increase in the growth of new multinational banks and upcoming foreign, private banks. It poses massive threats to UCBL. If it happens, UCBL has to develop their current marketing strategy or create new strategy to prevail successfully in the banking business.

- The default risks of all terms of loan have to be minimizing in order to sustain in the financial market. Because default risk leads the organization towards to bankrupt. UCBL has to remain vigilant about this problem so that proactive strategies are taken to minimize this problem if not elimination.

- The payment scale for middle to lower employees must be reconsidered or the good and efficient employees will look for employment somewhere else. If it happens, it will greatly affect the management of the bank.

- The economy of Bangladesh is not stable. The variation of economic situation may affect the banking business.