Growth in the United States dropped significantly during the first three months of the year as interest rate hikes and inflation took grip of an economy that is widely predicted to weaken even further.

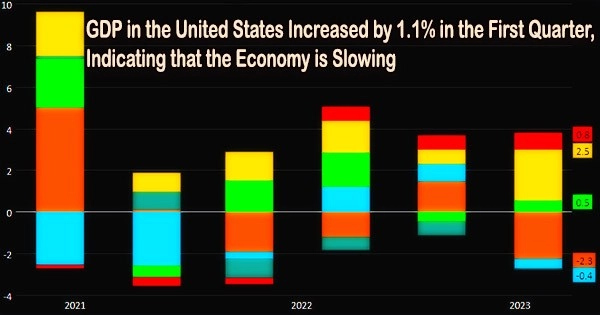

The Commerce Department said Thursday (April 27, 2023) that gross domestic product, a measure of all goods and services generated during the period, increased at an annualized rate of 1.1% in the first quarter. Economists surveyed by Dow Jones had been expecting growth of 2%.

The growth rate followed a fourth quarter in which GDP climbed 2.6%, part of a year that saw a 2.1% increase.

The report also showed that the personal consumption expenditures price index, an inflation measure that the Federal Reserve follows closely, increased 4.2%, ahead of the 3.7% estimate. Stripping out food and energy, core PCE rose 4.9%, compared to the previous increase of 4.4%.

Stocks were solidly higher following the report while Treasury yields spiked.

“People were still spending even despite higher prices, even despite higher inflation and a big drag that we had from inventories,” Citigroup economist Veronica Clark said. “Overall, I think it’s a relatively inflationary report, even though the headline GDP number a bit softer. All of those signs that demand is still strong and prices are still rising were very much present today.”

Like most other Wall Street forecasters, Citi expects the economy eventually to tip into recession, though Clark said the timing is uncertain.

“We would have expected to see some more slowing at this point, though you’re definitely getting signs that you’re on the margin,” she said. “So it doesn’t look like we’re going to be immediately slowing into a recession. And I think this Q1 data definitely helps to confirm that, especially since consumption is still so strong.”

The U.S. economy is likely at an inflection point as consumer spending has softened in recent months. The backward nature of the GDP report is possibly misleading for markets as we know consumers were still spending in January but since March, have pulled back as consumers are getting more pessimistic about the future.

Jeffrey Roach

The slowdown in growth came due to a decline in private inventory investment and a deceleration in nonresidential fixed investment, the report said. The inventory slowdown took 2.26 percentage points off the headline number.

Consumer spending as measured by personal consumption expenditures increased 3.7% and exports were up 4.8%. Gross private domestic investment tumbled 12.5%.

“The U.S. economy is likely at an inflection point as consumer spending has softened in recent months,” said Jeffrey Roach, chief economist at LPL Financial. “The backward nature of the GDP report is possibly misleading for markets as we know consumers were still spending in January but since March, have pulled back as consumers are getting more pessimistic about the future.”

In other economic news Thursday, jobless claims totaled 230,000 for the week ended April 22, a decline of 16,000 and below the estimate for 249,000.

The GDP report comes as the Federal Reserve attempts to tame an economy beleaguered by inflation, which has reached its highest level in more than 40 years.

In a policy tightening regime that began in March 2022, the central bank has raised its benchmark interest rate by 4.75 percentage points, taking it to the highest level in nearly 16 years. Though inflation has pulled back some from its peak around 9% in June 2022, it remains well above the Fed’s 2% goal. Policymakers all say inflation is still too high and will require elevated interest rates.

At the same time, growth has been hampered by problems in the banking sector, which are expected to spread to the rest of the economy. The Fed’s rate hike cycle, along with a projected credit constraint, are expected to tip the economy into recession later this year.

Consumers, on the other hand, have remained resilient, and it is believed that extra savings and purchasing power would be used to keep the economic recession short and shallow. A strong jobs market, with an unemployment rate at 3.5%, also is expected to underpin growth.