Foreign exchange reserves are assets held by a central bank or monetary authority in various foreign currencies. It is also known as forex reserves or FX reserves, and it is cash and other reserve assets such as gold held by a central bank or other monetary authority that are primarily available to balance the country’s payments, influence the foreign exchange rate of its currency, and maintain market confidence. These reserves are used to support the value of the country’s currency, provide liquidity in times of economic crisis, and facilitate international trade and transactions.

Foreign exchange reserves typically include a range of foreign currencies, such as the US dollar, the euro, the Japanese yen, and the British pound, as well as gold and other international reserves.

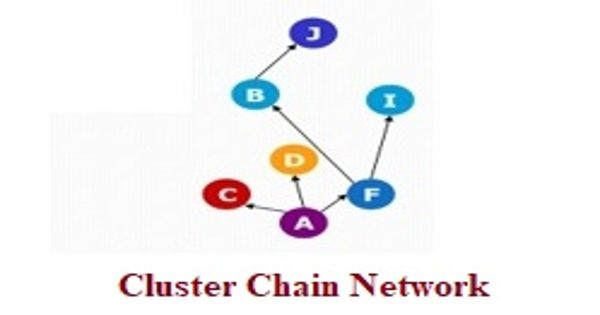

Foreign exchange reserves can include foreign currency deposits, government bonds denominated in foreign currencies, and other financial instruments denominated in foreign currencies. The reserves are typically held in major currencies such as the US dollar, euro, and Japanese yen. Reserves are held in one or more reserve currencies, which are currently primarily the US dollar and, to a lesser extent, the euro.

The size of a country’s foreign exchange reserves is often viewed as an indicator of its ability to meet external obligations and to stabilize its domestic currency in times of crisis. Central banks can use their foreign exchange reserves to intervene in currency markets to support their currency or to meet foreign obligations.

Foreign exchange reserves assets can include banknotes, bank deposits, and reserve currency government securities such as bonds and treasury bills. Some countries keep a portion of their reserves in gold, and SDRs are also considered reserve assets. Often, for convenience, the central bank of the reserve or other currency retains the cash or securities, and the “holdings” of the foreign country are tagged or otherwise identified as belonging to the other country without ever leaving the vault of that central bank. They may be physically relocated to their home country or another country from time to time.

The level of foreign exchange reserves is an important indicator of a country’s economic strength and ability to manage its currency. A high level of reserves can provide a buffer against economic shocks and help maintain confidence in the currency. However, excessive accumulation of reserves can also have negative effects, such as reducing the return on investment and tying up resources that could be used for domestic development.

Interest is typically not paid on foreign cash reserves or gold holdings, but the central bank does earn interest on government securities. The central bank, on the other hand, may profit from the depreciation of the foreign currency or suffer a loss from its appreciation. The central bank also incurs opportunity costs from holding reserve assets (particularly cash holdings), as well as storage, security, and other costs.