A foreign direct investment (FDI) is a speculation made by a firm or individual in one country into business intrigues situated in another country. Enduring premium separates FDI from unfamiliar portfolio speculations, where financial specialists latently hold protections from a far off nation (country). In general, FDI occurs when an investor develops foreign business operations or acquires foreign business assets within a foreign company. You may make a foreign direct investment by gaining a permanent interest or by exporting your business to a foreign country.

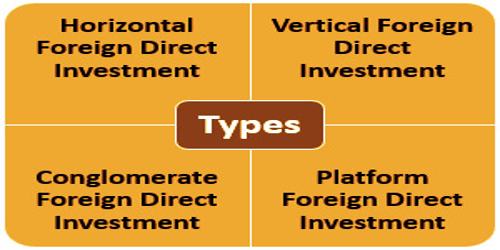

Typically, there are two main types of FDI: horizontal and vertical FDI.

- Horizontal: A horizontal direct investment refers to the investor developing the same form of business activity in a foreign country as it does in their home country, for example, a U.S. based cell phone company opening stores in China.

- Vertical: By going to a different stage of the supply chain, a vertical investment a company extends into a foreign market. As such, a firm leads various exercises abroad however these exercises are as yet identified with the fundamental business. Utilizing a similar model, McDonald’s could buy a huge scope ranch in Canada to deliver meat for their cafés.

However, two other forms of FDI have also been observed: conglomerate and platform FDI.

- Conglomerate: A conglomerate form of foreign direct investment is one where an organization or individual makes an overseas investment during a business that’s unrelated to its existing business in its home country. Since this type of investment includes joining an industry in which the investor has no prior experience, it frequently takes the form of a joint venture with an already established international business in the market.

- Platform: A platform may be a business expands into an overseas country but the output from the foreign operations is exported to a 3rd country. Often known as export site FDI. FDI platform typically operates within free-trade areas in low-cost locations. For example, if Ford purchased manufacturing plants in Ireland that were mainly intended to export cars to other EU countries.

Examples of foreign direct investment (FDI) include, but are not limited to, merger, acquisition, retail, distribution, logistics, and manufacturing. Foreign direct investment and the laws that regulate it can be critical to the growth strategy of a business.

Advantages of Foreign Direct Investment (FDI):

Foreign Direct Investment (FDI) provides incentives both to the investor and to the host country. These benefits motivate all parties to get involved and allow FDI to do so. Below are some of the benefits for businesses:

- Market diversification

- Tax incentives

- Lower labor costs

- Preferential tariffs

- Subsidies

The following are some of the benefits for the host country:

- Economic stimulation

- Development of human capital

- Increase in employment

- Access to management expertise, skills, and technology

For enterprises, most of these incentives are focused on cost-cutting and risk-reduction. The advantages are primarily economic for the host countries.

Disadvantages of Foreign Direct Investment (FDI):

Despite many benefits, there are still two main disadvantages to FDI, such as:

- Displacement of local businesses

- Profit repatriation

The passage of huge firms, for example, Walmart, may uproot nearby organizations. Walmart is regularly reprimanded for driving out neighborhood organizations that can’t rival its lower costs. On account of benefit bringing home, the essential concern is that organizations won’t reinvest benefits once more into the host nation. This prompts huge capital outpourings from the host nation. Subsequently, numerous nations have guidelines restricting unfamiliar direct speculation.

Information Sources: