In order to decide how they can affect an organization internally as well as externally, managerial finance can be characterized as the process of gauging finance techniques. It is the branch of finance that is concerned with the implementation of finance techniques by management. Sound monetary administration makes esteem and hierarchical nimbleness through the allotment of scant assets among contending business openings. Managerial finance has two essential targets which are:

- Improving financial techniques to contribute to the organization’s growth;

- Implementing financial changes to avoid or reduce losses.

Managerial finance varies from the technical approach, which is basically concerned only with calculation and whether money has been allocated to the right categories. It is interdisciplinary, drawing from both corporate finance and managerial accounting. Managerial finance assists with business dynamics as it straightforwardly impacts benefits, misfortunes, income, and income age in an association. It adds to an organization’s general development fundamentally.

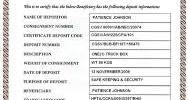

(Example of Managerial Finance)

The goal of the management approach is to evaluate the importance of facts, figures, and numbers. Managerial finance explores how to develop financial strategies where modifications can be made to help prevent losses and strengthen the bottom line. The contrast between an administrative and a specialized methodology can be found in the inquiries one may pose of yearly reports. The worry of a specialized methodology is essentially estimation.

Managerial finance helps to execute corporate plans and to track their success in relation to achieving a company’s goals. If budgets are handled correctly, money is generated and the finite resources of an organization are properly distributed. Managerial finance’s four main fundamentals are:

Capital structure: organizations or associations utilize administrative money as an essential business capacity to decide three factors that impact business tasks which are:

- Which capital type is best suited for funding endeavor equity, debt, or both;

- Amount of capital required;

- Event or time when the capital will be required.

An organization’s capital structure is vital to its development and can be purchased either by equity shares or other financial instruments, such as cash and bonds.

Cash flow: The essential target of the money the executives work is to guarantee that an association has sufficient assets to meet the organization’s monetary commitments. For a firm to run easily and beat benefits, it is fundamental that the income is continuous. Company activities may be stalled in the event of a cash shortfall, and this may negatively affect the organization’s reputation. It is therefore essential that financial obligations are fulfilled within the period stated.

Plan and forecast: To execute planning strategies, organizations rely on managerial finance. These strategies are used to predict:

- Monthly, quarterly and yearly budgets;

- Expected revenue generation;

- Future expenses;

- Expected profits.

Financial management experts must be prepared for extraordinary incidents when devising plans. If the above parameters do not achieve the expected results, it is appropriate to adjust the strategies to suit the current situation.

Financial reporting: Financial reporting is a pivotal part of an administrative account, as it essentially adds to the business dynamic. Associations depend on monetary reports for exact and point by point data about the current circumstance of the association. These reports must be easy to understand and should represent vividly how business processes and functioning are influenced by a specific parameter.

Actually, managerial finance and corporate finance are two unique methodologies; be that as it may, they cooperate as two of the main components in administrative bookkeeping. An administrative account is additionally keen on deciding the most ideal approach to utilize the cash to improve future occasions to bring in cash and limit the effect of monetary stuns. It carefully analyzes businesses by division and goods, as opposed to looking at the business as a whole. Output needs to be assessed by top-level managers. By looking at individual divisions, managerial finance helps them do so, assessing their efficacy and productivity in helping a business raise returns. It lets the senior-level managers make decisions about how a company is organized and whether its organization is functioning to maximally support the company.

Information Sources: