CHAPTER ONE

Introduction:

In modern era business is very much complex because of even changing customer choice, preference, taste etc and for the technological and high competition. As globalization, the competition is spread over the world. So every organization should be maintaining international standard. Every company or firm wants to make their loyal customer group. Each firm would like to gain maximum profit through consumer’s satisfaction. Today each company has to face so much competition. To perform all marketing tasks marketer faces two types of environment, one is macro or external and another is micro or internal environment.

PRAN Group is the largest food and nutrition company of Bangladesh founded in 1981. It has obtained prestigious ISO 9001:2000, and being the largest exporter of processed agro products with compliance of HALAL & HACCP to more than 70 countries from Bangladesh. Also a popular company for juice in Bangladesh. “PRAN” is currently the most well known household name among the millions of people in Bangladesh and abroad also. Since its inception in 1981, PRAN Group has grown up in stature and became the largest fruit and vegetable processor in Bangladesh. It also has the distinction of achieving prestigious certificate like ISO 9001:2000, and being the largest exporter of processed agro products with compliance of HALAL & HACCP to more than 70 countries from Bangladesh. PRAN is the pioneer in Bangladesh to be involved in contract farming and procures raw material directly from the farmers and processes through state of the art machinery at our several factories into hygienically packed food and drinks products. The brand “PRAN” has established itself in every category of food and beverage industry and can boost a product range from Juices, Carbonated Drinks, Confectionery, Snacks, and Spices to even Dairy products.

Importance of the Study:

We know PRAN Group is a well known brand within Bangladesh. PRAN is a concept or a way to fight poverty and hunger in Bangladesh in the shortest possible time through employment generation. PRAN signifies investment in agro processing, creating demands for farm produce, which create jobs in rural areas also preventing urban migration. PRAN’s aim is to add value to agricultural produce. PRAN is in testimony to our convictions. It stands for: “PROGRAMME FOR RURAL ADVANCEMENT NATIONALLY.”

We do not see why we should remain poor given the gifts endowed by nature such as fertile soil, water, year round growing season, a river system for easy and cheap transportation and a hard working people who are farmers by tradition.

Bangladesh comparative advantage lies in creating a competitive edge in value added agricultural products. PRAN’s journey started in 1981. Today they have major investments in several corporate. They are the largest processors of fruits and vegetables in Bangladesh and fast moving into milk, confectionery, tee, aromatic & fine rice, peanuts, pulses, mustard & spices to name a few.

PRAN encourages contract farmers and helps them grow quality crops with increased yields and to obtain fair prices. In the stock market their performance has been just as rewarding with both PRAN Group publicly listed companies, Agricultural Marketing Co Ltd & Manipur Foundry Ltd achieving blue chip status. Supporting PRAN is helping the Bangladeshi farmer and indeed Bangladesh economy. Success of PRAN group is our success. Investing in PRAN is investing in our and Bangladesh future.

Objectives of the Study:

The broad objectives of this study are to find out financial system of PRAN group.

The specific objectives of this study are show below:

- To identify the present financial system of PRAN group in Bangladesh.

- To analysis the present problems in operating marketing function of PRAN group

- To analysis the opinion of the participants involving operating marketing function of PRAN group.

- SWOT analysis and future prospects of PRAN group.

- To prescribe appropriate recommendation and suggestion to overcome existing problems of PRAN Group.

Specially, the above objectives of this study are to know the way by which we can take best decision regarding its product, price, distribution, and promotional activities with the Marketing and Financial environment.

Methodology of the Study:

The population sampled for the study was limited to the PRAN Group where we were assigned to perform the study.

Data collections: In order to conduct the report, I have collected necessary information from two sources

1. Primary sources of information

2. Secondary sources of information

Primary sources of information

• Face to face conversation with the respective officers of PRAN Group

• Oral interview of the responsible

• Observation of department of PRAN Group

Secondary sources of information

• Annual report of PRAN Group

• A brief on staff of PRAN Group•

• Various document of the company•

• Website of PRAN Group.

Scope of Study:

The report is descriptive in nature. The study covers only various functional areas of Human resource Department. No attempt is to perform detailed analysis effectiveness of the department. The findings are strictly based on the information provided by respective personnel. The concentration is on the presentation of the facts as discovered.

Limitations of the Study

Term Paper program is a one kind of procedural program. There are involved various factors such as time/cost/information etc. So I have to face some problem to working this study. Mainly I have faced few problem these so much important of my study. The companies officer are not provided sufficient current information such as information on company existing market share, industries demands, sales volume of competitors, accurate financial statement, cash in flow statement, rough behaviors of some employees etc. When I have survey sample wholesalers, retailers and customers then they have not cooperation with me.

After also I have some personal limitations such as money problem, time problem, lack of available previous research materials due to insufficient knowledge about this research fields through above limitation are exist. I have tried my best to overcome these limitations in this study.

CHAPTER TWO

Overview of the Organization:

PRAN is currently the most well known household name among the millions of people in Bangladesh and abroad also. Since its inception in 1981, PRAN group has grown up stature and became the largest fruit and vegetable processor in Bangladesh. It has also the distinction of achieving prestigious certificate like ISO 9001:2000, and being the largest exporter of processed agro products with compliance of HALAL & HACCP to more than 70 countries from Bangladesh.

On retirement from Bangladesh Army in the year 1981, Major General Mr. Amjad Khan Chowdhury got involved with industrial entrepreneurship by assisting agriculture which covered manufacturing of tube well cast iron products, irrigation implements. He started Agricultural Marketing Company from 1985 based by commercial production and marketing of chinigura aromatic rice; collecting mango, pineapple, litchi and other fruits from the farmers. This company played significant role by gradual cultivation of mush rooms, tomato and various spices and subsequent exports to foreign markets. This group met success by marketing of olive and other indigenous fruits after collection, processing and preservation. In recent times PRAN group performed production and marketing by establishment of dairy, bakery and growing of various kinds of pulses, tea leaves. This group’s products are being exported to about 70 countries of the world including Middle East and Africa. In last two and half decades, more than 9000 workers have been employed in PRAN Group. Indirectly this group is devoted in upkeep of about more 40,000 families. In the year 2007, export earning stood at Tk.100 Cr. from Drinks, Snacks, Tomato products, Tea and Rice produced by PRAN Group. Today PRAN Group produces more 25 types of light industrial and plastic products including 170 food products. This group is on the top in the export of goods out of agricultural process. PRAN is life literally.

Factory Profile:

| Company Name | Pran Group12 R. K. Mission Road, Dhaka 1203, Bangladesh |

| Address (Headquarters) | Pran Center, 105, Progoti Sarani, Middle Badda, Dhaka1212, Bangladesh |

| Contract Number | Phone: 880-2-9563126880-2-7167412880-2-7167416 Fax: 880-2-9559415

|

| Establishment Year | 1981 |

| Registration Date | 2009/01/15 (Year/Month/Date) |

| Buyer / Seller in EC21 | Seller |

| Business Type | Manufacturer

|

| Employees total | Above 30,00 |

| Annual revenue | USD 100,000 – 500,000

|

Product:

JUICES SNACKS

CONFECTIONERY DAIRY

CARBONATED SOFT DRINKS HOUSEHOLD ITEMS

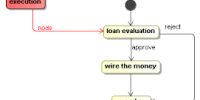

ORGANIZATIONAL ADMINISTRATIVE FLOW MODEL

Mission & Vision:

Mission: Defines the fundamental purpose of an organization or an enterprise, succinctly describing why it exists and what it does to achieve its vision. For example, the charity above might have a mission statement as “providing jobs for the homeless and unemployed” A mission statement is a brief description of a company’s fundamental purpose. It answers the question, “Why do we exist” The mission statement articulates the company’s purpose both for those in the organization and for the public.

The mission of PRAN group is to generate employment and earns dignity & self respect for our compatriots through profitable enterprises.

Vision: outlines what the organization wants to be, or how it wants the world in which it operates to be (an “idealized” view of the world). It is a long-term view and concentrates on the future. It can be emotiveand is a source of inspiration. For example, a charity working with the poor might have a vision statement which reads “A World without Poverty.”

PRAN group’s vision is to improving livelihood

CHAPTER THREE

The Present Financial Strategy of PRAN Group:

Cash Conversion Cycle:

The Cash Conversion Cycle (CCC) measures how long a firm will be deprived of cash if it increases its investment in resources in order to expand customer sales. It is thus a measure of the liquidity risk entailed by growth. However, shortening the CCC creates its own risks: while a firm could even achieve a negative CCC by collecting from customers before paying suppliers, a policy of strict collections and lax payments is not always sustainable.

Cash Cycle:

The length of time between the purchase of raw materials and the collection of account receivable generated in the sale of the final product. It is also called cash conversion cycle.

Cash cycle = Operating Cycle – Accounts Payable

Operating Cycle:

Definition

The average time between purchasing or acquiring inventory and receiving cash proceeds from its sale.

Formula to calculate operating cycle:

Operating Cycle = Inventory period+ Account Receivable period.

Operating Cycle Definition and Explanation:

The operating cycle is the number of days from cash to inventory to accounts receivable to cash. The operating cycle reveals how long cash is tied up in receivables and inventory.

A long operating cycle means that less cash is available to meet short term obligations.

Inventory Period: This consists of as follows:

1. Raw Materials

2. Packing Stuff

3. Store & Process

4. Work-In-Process

5. Finished Goo

Amount in taka | |

As at | |

30-jun-2012 | 30-jun-2011 |

Sales Volume of PRAN Group:

Year | Sales Volume (Tk.) |

2004-05 | 10,00,00,000 |

2005-06 | 12,00,00,000 |

2006-07 | 13,00,00,000 |

2007-08 | 16,00,00,000 |

2008-09 | 18,50,00,000 |

2009-10 | 21,50,00,000 |

2010-11 | 28,50,00,000 |

2011-12 | 35,70,00,000 |

Source: Official record, Annual report of PRAN 2011-2012

The information is presented in a diagram chart which is given below:

Account Receivable Period

Average receivables are equal to the sum of beginning receivables and ending receivables, divided by two. The number alone doesn’t provide much information. It must be compared to average receivable collection periods for other companies in the industry, as well as past collection periods, to find out if collection times are increasing or decreasing.

Formula:

Average receivables = (Beginning receivables + Ending receivables) / 2

Year Calculation Average receivables

Total Units (Sales):

Total units (sales) for the last eight years are given below:

Year | Total Units (Sales) |

2004-05 | 27500000 |

2005-06 | 30000000 |

2006-07 | 32000000 |

2007-08 | 35500000 |

2008-09 | 39500000 |

2009-10 | 43500000 |

2010-11 | 46000000 |

2011-12 | 51500000 |

Sources: Official Record, Annual Report of PRAN 2011-12

CHAPTER FOUR

Ratio Analysis:

Ratio Analysis, being the basic tool of the strategic analysis, is extremely important for an organization to carry out its business planning. Ratio Analysis is one of the basic tools of financial analysis. And it is a fact that financial analysis itself plays an important role in the progress of business strategic planning. Being the basic tool of the strategic analysis, ratio analysis plays a vital role and it is not possible to complete the analysis of a company’s strengths, weaknesses, opportunities and threats, without an analysis of its financial position.

Return on Assets:

ROA = EACS

Total Asset

Year 2011

ROA = 45490177

1172667837

= 3.88%

Year 2012

ROA = 52217607

1138318801

= 4.58%

Table: 1

YEARS | PRAN |

2012 | 4.58% |

2011 | 3.88% |

In the above from Table-1 & Graph-1 of ROA is showing that in year 2012, pran group is 4.58% where in year 2011 was 3.88%. I can say that pran is in the highest position from year 2011 to year 2012.

Return on Equity:

ROE = EACS

Total common stock equity

Year 2011

ROE= 45490177

401331039

= 11.33%

Year 2012

ROE = 52217607

426965832

= 12.23%

Table: 2

YEARS | PRAN |

2012 | 12.23% |

2011 | 11.33% |

In the above from Table-2 & Graph-2 of ROE is showing that in year 2012, pran group is 12.23% where in year 2011 was 11.33%. I can say that pran is in the highest position from year 2011 to year 2012.

Net Profit Ratio:

Net Profit Ratio = Net profit * 100

Sales

Year 2011

Net Profit Ratio = 45490177

1316345576

= 3.45%

Year 2012

Net Profit Ratio = 52217607

1479083463

= 3.53%

Table: 3

YEARS | PRAN |

2012 | 3.53% |

2011 | 3.45% |

In the above from Table-3 & Graph-3 of Net Profit Ratio is showing that in year 2012, pran group is 3.53% where in year 2011 was 3.45%. I can say that pran is in the highest position from year 2011 to year 2012.

Gross Profit Ratio:

Gross Profit Ratio = gross profit * 100

Sales

Year 2011

Gross Profit Ratio = 286842298

1316345576

= 21.80%

Year 2012

Gross Profit Ratio = 327732815

1479083463

= 22.16%

Table: 4

YEARS | PRAN |

2012 | 22.16% |

2011 | 21.80% |

In the above from Table-4 & Graph-4 of Gross Profit Ratio is showing that in year 2012, pran group is 22.16% where in year 2011 was 21.80%. I can say that pran is in the highest position from year 2011 to year 2012.

Liquidity

Current Ratio:

Current Ratio = Current asset

Current liability

Year 2011

Current Ratio = 756842149

591768482

= 1.28%

Year 2012

Current Ratio = 777882302

5704158

= 1.36%

Table: 5

YEARS | PRAN |

2012 | 1.36% |

2011 | 1.28% |

In the above from Table-5 & Graph-5 of Current Ratio is showing that in year 2012, pran group is 1.36% where in year 2011 was 1.28%. I can say that pran is in the highest position from year 2011 to year 2012.

Debt Management

Debt Ratio:

Debt Ratio = Total debt

Total asset

Year 2011

Debt Ratio = 742468482

1172667837

= 63.31%

Year 2012

Debt Ratio = 683440850

1138318801

= 60.03%

Table: 6

YEARS | PRAN |

2012 | 60.03% |

2011 | 63.31% |

In the above from Table-6 & Graph-6 of Debt Ratio is showing that in year 2012, pran group is 60.03% where in year 2011 was 63.31%. I can say that pran has the best dependency in year 2012 than year 2011.

Asset Turnover Ratio:

Asset Turnover Ratio = sales

Total asset

Year 2011

Asset Turnover Ratio = 1316345576

1172667837

= 1.12 times

Year 2012

Asset turnover Ratio = 1479083463

1138318801

= 1.30 times

Table: 7

YEARS | PRAN |

2012 | 1.30 times |

2011 | 1.12 times |

In the above from Table-7 & Graph-7 of Asset Turnover Ratio is showing that in year 2012, pran group is 1.30 times where in year 2011 was 1.12 times. I can say that pran is in the highest position from 2011 to 2012.

Equity Ratio:

Equity Ratio = Net profit after tax

Equity share capital

Year 2011

Equity Ratio = 45490177

80000000

= 56.86%

Year 2012

Equity Ratio = 52217607

80000000

= 65.27%

Table: 8 |

2012 | 65.27% |

2011 | 56.86% |

In the above from Table-8 & Graph-8 of Equity Ratio is showing that in year 2012, pran group is 65.27% where in year 2011 was 56.86%. I can say that pran is in the highest position from 2011 to 2012.

Inventory Turnover Ratio:

Inventory Turnover Ratio = Net sales

Average Inventory

Year 2011

Inventory Turnover Ratio = 1316345576

514774187

= 2.55 times

Year 2012

Inventory Turnover Ratio = 1479083463

534462767

= 2.77 times

Table: 9

YEARS | PRAN |

2012 | 2.77 times |

2011 | 2.55 times |

In the above from Table-9 & Graph-9 of Inventory Turnover Ratio is showing that in year 2012, pran group is 2.77 times where in year 2011 was 2.55 times. I can say that pran is in the highest position from year 2011 to year 2012.

CHAPTER FIVE

Findings

Return or Profitability:

- Return on Assets (ROA): The Return on Assets ratio is calculated from Appendix A-1 to A-2. The highest value of the ratio is 4.58% in year 2012 and lowest is 3.88% in year 2011. So, the performance of 2012 is so good than 2011.

- Return on Equity (ROE): The Return on Equity ratio is calculated from Appendix A-1 to A-2.The highest value of the ratio is 12.23% in year 2012 and lowest is 11.33% in year 2011. The performance of PRAN was good in last year.

- Net Profit Margin: The Net Profit Margin ratio is calculated from Appendix A-1 to A-2. It shows the net profitability of two years. In there, PRAN shows the best performance in year 2012. The highest value of the ratio is 3.53% in year 2012 and the worst value of PRAN was 3.45% in year 2011.

- Gross Profit Margin: The Gross profit margin ratio is calculated from Appendix A-1 to A-2. It shows the net profitability of two years. In there, PRAN shows the best performance in year 2012. The highest value of the ratio is 22.16% in year 2012 and the worst value of PRAN was 21.80% in year 2011.

Liquidity:

- Current Ratio: Current ratio is calculated from Appendix A-1 to A-2.PRAN is in the best position in year 2012 and the value is 1.36%. But the performance of year 2011 was poor than year 2012.

Debt Management:

- Debt Ratio: Debt ratio is calculated from Appendix A-1 to A-2. It shows PRAN has the more dependency in year 2012 which value is 60.03% and the value of year 2011 was 63.31%

Asset Turnover Ratio:

- Asset Turnover ratio is calculated from Appendix A-1 to A-2.PRAN is in the best position in year 2012 and the value is 1.30 times. The value of year 2011 was 1.12 times which is poor than year 2012.

Equity Ratio:

- Equity ratio is calculated from Appendix A-1 to A-2.PRAN is in the best position in year 2012 and the value is 65.27%. The value of year 2011 was 56.86% which is poor than year 2012.

Inventory Turnover Ratio:

- Inventory Turnover ratio is calculated from Appendix A-1 to A-2.PRAN is in the best position in year 2012 and the value is 2.77 times. The value of year 2011 was 2.55 times which is poor than year 2012.

CHAPTER SIX

6.1. CONCLUSION:

PRAN is one of the most popular brands in Bangladesh as well as in international market recently. Now the firm is facing various types of financial & marketing problems. In this paper some suggestions and recommendations have been given so that the firm can overcome those problems. I believe that the management of PRAN group is more experience as well as they are also thinking about those problems. I think management should be took care this problem.

So, through the observation of the activities and information collected from the interview of participant such as wholesalers, retailers, customers it can be said that this firm is being profitable conduct becomes the firm is not to strong on counter remarkable competition, workers dissatisfaction, and for sufficient demand in comparison with the manufactured goods. But the firm is not being able to perform its financial activities with efficiency. In this condition continues the firm will be endangered and undergo less in the long run. But it is possible to expand this firm to a greater extant, if it can make use of its present opportunities and facilities properly and it will be possible for it to earn more profit than it is earning now. Therefore, the firm will have to give importance to perform the financial activities efficiently.

Recommendation:

I think the following suggestion and recommendation ate seen feasible for the improvement of the existing PRAN Group. These are given in below:

a) Quality Ensures:

The firm should ensure quali

CONCLUSION:

PRAN is one of the most popular brands in Bangladesh as well as in international market recently. Now the firm is facing various types of financial & marketing problems. In this paper some suggestions and recommendations have been given so that the firm can overcome those problems. I believe that the management of PRAN group is more experience as well as they are also thinking about those problems. I think management should be took care this problem.

So, through the observation of the activities and information collected from the interview of participant such as wholesalers, retailers, customers it can be said that this firm is being profitable conduct becomes the firm is not to strong on counter remarkable competition, workers dissatisfaction, and for sufficient demand in comparison with the manufactured goods. But the firm is not being able to perform its financial activities with efficiency. In this condition continues the firm will be endangered and undergo less in the long run. But it is possible to expand this firm to a greater extant, if it can make use of its present opportunities and facilities properly and it will be possible for it to earn more profit than it is earning now. Therefore, the firm will have to give importance to perform the financial activities efficiently.

Recommendation:

I think the following suggestion and recommendation ate seen feasible for the improvement of the existing PRAN Group. These are given in below:

a) Quality Ensures:

The firm should ensure quality of PRAN product according to the consumer need and expectations. Quality of a product is of attributes that the consumer expects in a particular product. So quality should be select from consumer viewpoint.

b) Proper Policy: PRAN should follow the proper policy for their group and they also select right dividend policy.

c) Product Development:

The Company will make as ‘economic and quality product’ for large market share.

- It improves product quality and adds new product features and improved styling.

- It adds new models and flanker products (i.e. products of different sizes, flavors, and so forth that protect the main product).

- It enters new market segments.

- It increases its distribution coverage and enters new distribution channels.

- It shifts from product awareness advertising to product preference advertising.

- It lowers prices to attract the next layer of price sensitive buyers.

BIBLIOGRAPHY

Websites:

1) www.pranrflgroup.com

2) http://www.pranfoods.net/

3) http://www.slideshare.net/Mouri36/pran-group

4) http://www.marketwatch.com/investing/stock/pran/financials

5) http://www.scribd.com/doc/44303390/Annual-Report-Analysis

6) http://bhola.en.ec21.com/company_info.jsp