The financial management rate of return (FMRR) is a unique, but highly complex real estate investing rate of return that some argue is a better reflection of real-world investment situations than both internal rate of return (IRR) and modified internal rate of return (MIRR).

The FMRR is similar to the internal rate of return and takes into account the length and risk of the investment. The FMRR specifies cash flows (inflows and outflows) at two distinct rates known as the safe rate and the reinvestment rate.

Nonetheless, despite its benefits, because of its complexity, it typically is not provided in real estate investment software, and otherwise requires a good conceptual understanding along with a financial hand-held calculator to compute which requires a series of steps that are neither quick nor easy. As a result, the financial management rate of return is not commonly used by real estate investors though it should be for several important reasons.

The financial management rate of return is based upon the notion which includes the following components common to real estate investing objectives and practice.

- Wealth maximization – real estate investors primarily seek to maximize their long-term wealth position, therefore the wealth investors can hope to accumulate by owning the real estate investment is vital.

- Cash flows after-tax – only cash flows after taxes are evaluated because real estate investors want to gauge the desirability of an investment based upon the amount they might collect after satisfying the IRS.

- Safe rate – a rate the investor can safely collect on funds invested in a highly liquid account (i.e., a checking or savings account) and withdrawn when needed without penalty to cover future financial obligations associated with the real estate investment property.

- Reinvestment rate – a rate the investor might expect to receive from some minimum amount of future funds not required to meet financial obligations of the property that are reasonably reinvested in average investments of intermediate duration and comparable risk.

- Similar risk – real estate investors want the opportunity to compare various investments that are somewhat comparable in duration and similar in risk.

Because the calculation of financial management rate of return is so complex, many real estate professionals and investors choose to use other metrics for real estate analysis. The benefit of using FMRR is that it allows investors to compare investment opportunities on par with one another.

Although the Internal Rate of Return (IRR) has long been a standard measure of return within the financial lexicon, a primary drawback is the value’s inability to account for time or a holding period. As such, it’s a weak indicator of liquidity, which plays a material role in determining the overall risk level of any given investment security or vehicle. For instance, when using just IRR, two funds may look alike based on their rates of return but one may take twice as long as the other to simply getting back to an original principal investment amount. Many analysts will supplement IRR or MIRR return measures with the payback period to assess the length of time required to recoup a principal investment sum.

Financial management rate of return (FMRR) addresses the length of investment term as well the risk issue associated with investment by specifying cash outflows and cash inflows at two different rates known as “safe rate” and “reinvestment rate”.

- Safe rate assumes that funds required to cover negative cash flows are earning interest at a rate easily attainable and can be withdrawn when needed at a moment’s notice (i.e., like from a day of deposit account). Thus, the name “safe” because the funds are highly liquid and safely available with minimal risk when you need them.

- Reinvestment rate reflects that the rate one might expect to receive if the positive cash flows were invested in a similar intermediate or long-term investment with comparable risk. Reinvestment rate is higher than a safe rate because it is not liquid (i.e., it concerns another investment) and thus higher-risk.

FMRR also makes an additional assumption not included with IRR and MIRR. That positive cash flows occurring immediately prior to negative cash flows will be used to cover that negative cash flow.

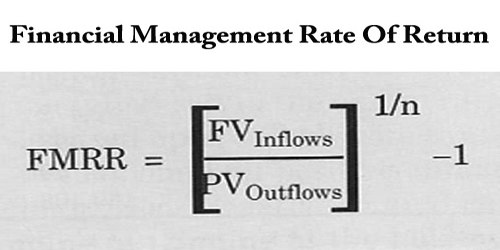

Calculating FMRR –

Since FMRR is a modified internal rate of return, there is no formulaic way to calculate it, rather it must be computed by iterations of trial and error, made easy by computer software. Before using such software, there are some important steps that must be undertaken to determine a safe rate and reinvestment rate (higher than the safe rate) to apply to all future cash flows over the course of a specific holding period.

FMRR (not unlike IRR) measures the future financial performance of investment real estate by equating the initial cash investment (year 0) along with all future annual cash flows estimated for the holding period (including sale proceeds) on an end-of-year basis.

CF0 cash investment

CF1 cash flow

CF2 cash flow

CF3 cash flow

CF4 cash flow

CF5 cash flow + cash proceeds (future sale)

In this case, the IRR would be the internal rate of return which results in the investment value being exactly equal to the discounted future benefits (i.e., cash flows and sales proceeds). In other words, IRR is the discount rate at which future cash flows are discounted back to year 0 to equal the initial cash investment and thus provide the yield.

The FMRR differs in that it specifies two different rates to make the calculation. A “safe rate” for discounting and a “reinvestment rate” for compounding.

Here’s how it works.

Positive cash flows are discounted back at the safe rate until all negative cash flows are removed (where possible). Negative cash flows that remain are then discounted back at the safe rate back to year 0. Then all the positive cash flows (where possible) are compounded forward at the reinvestment rate to the end of the holding period.

Okay, now let’s consider what the schema we illustrated above looks like after the FMRR adjustments. The result would be an amount for year 0 (investment) and for year 5 (referred to as the Accumulation of Wealth) along with zero amounts for all years in between.

CF0 investment

CF1 0

CF2 0

CF3 0

CF4 0

CF5 Accumulation of Wealth

Afterward, the internal rate of return computation is applied and the result is the financial management rate of return (FMRR).

The financial management rate of return (FMRR) model provides real estate investors with a better indication of the true capital requirements of the project as well as a long-term wealth position. So it really is a better real estate investment measure that should be included as part of any real estate analysis.

Information Sources: