When it comes to real estate, we can say that it takes a lot of foresight and capital investment to see a profit. Some of the best real estate investments generate a consistent monthly income while also increasing wealth through long-term asset appreciation. As a result, real estate investments are distinct from many other types of investments.

Real estate investing is the purchase of property for the purpose of generating income rather than living in it as a primary residence. In layman’s terms, it is any land, building, infrastructure, or other tangible property that is usually immovable but transferable.

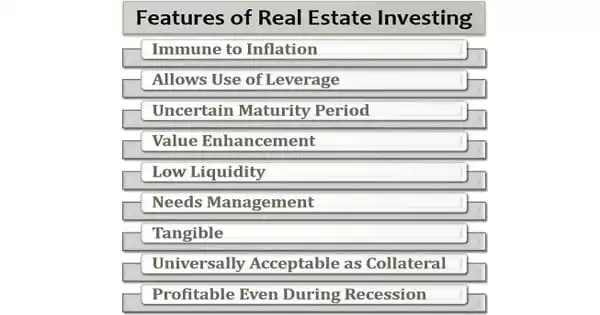

Features of Real Estate Investing –

Let us now understand the characteristics of real estate investment one by one:

- Tangible

Real estate, also known as property, is one of those investments that have a physical existence and can be touched and seen. A real estate investment, unlike other investments with fixed maturities, has no fixed maturity. If you see a good opportunity, you can sell it in a few days or keep it for decades. Many of the most profitable pieces of real estate in American cities have been held for decades, and some of the most profitable real estate in Europe has been held for centuries by the same trust or family.

- Allows Use of Leverage

Because of its physical existence, financial institutions are drawn to funding for real estate. Some markets, such as stocks and commodities, are regulated to ensure maximum transparency. Investors now have access to real-time market data and can make immediate changes to their portfolios.

- Value Enhancement

Investing in real estate can provide investors with a double benefit. On the one hand, real estate generates rental income, and on the other, its value increases over time.

Real estate operates in a very different manner. When an investor purchases a property, there is a risk that the seller is withholding information or is unaware of any problems. As a result, when purchasing real estate, research and inspections are critical. And, if you buy a property sight-unseen, such as at auction, be sure to factor in the higher risk when making an offer.

- Low Liquidity

Real estate is deemed illiquid because it cannot be easily sold without suffering a significant loss in value. One of the most important characteristics of real estate is that it is a capital asset. As a result, it cannot be bought and sold as frequently as stocks or equity.

When it comes to real estate investing, however, a lack of liquidity is a good thing. Real estate’s illiquidity contributes to its status as a stable, appreciating asset class for long-term investors.

- Needs Management

Real estate investment entails purchasing a physical asset and incurring maintenance costs. The investor must also manage the source of income that is generated. Every piece of real estate is unique in terms of location, physical structure, and financing.

As a result, investors can take advantage of a community’s local knowledge to acquire and manage a highly profitable portfolio of real estate investments. Because of the heterogeneity of real estate, the most successful investors have a team in each geographic area of their real estate investments.

- Universally Acceptable as Collateral

It is very common for banks and other financial institutions to finance properties by using them as collateral. Real estate investments can be volatile at times, shifting as cities and neighborhoods evolve. As a result, real estate is not a hands-off, static investment, but rather one that necessitates constant attention.

- Profitable Even During Recession

Real estate has long been regarded as one of the most secure investments. Because of the risks associated with real estate, investing in this asset class can be very profitable for savvy investors with a proven plan for success. They can be profitable or generate income even during a recession if done correctly. The most successful investors either manage their investments themselves or hire an expert team to locate, rehab, and manage real estate investments on their behalf.