Executive Summery

Bangladesh is one of the largest Muslims counties of the world. The people of this country are deeply committed and devoted to Islam. Islami bank Bangladesh limited was established in March 1983. the philosophy of Islami bank is to establish an egalitarian society based on the principles of social justice and equity. It is committed to conduct all banking and investment activities on the basis of interest free profit loss sharing system.

There are 03 (Three) Investment Modes like, Bai Mechanism, Ijarah mechanism & Shariah mechanism. There are different types of schemes IBBL offer for different types of people like Household Durable Scheme, Housing Investment Scheme. Real State investment modes, transport investment modes, car investment scheme, smells business investment scheme, agriculture, implements scheme, micro industries scheme.

Every commercial bank or Islamic commercial bank of our country has a division named investment veing which is related with banks core functional activities. The internship report titled “Evaluation of investment modes of Islami Bank Bangladesh Limited”.

In the banking world IBBL is performing well as it has acquired the assets and human resources of higher quality. IBBL will be more effective in our economy by adopting modern financial technology by extending activities in human & social welfare. IBBL is operating in a three sector banking system, such as formal, non formal and voluntary sector. General Banking and investment modes on the basis of interest free profit loss sharing system.

INTRODUCTION

Banking plays an important role in the economy of any country. In Bangladesh Muslim constituted more than 80% of its population. These people possess strong faith on Allah and they want to lead their lives as per the constructions given in the holy Quran and the way shown by the prophet Hazrat Muhammad (Sm). But no Islamic banking system was developed here up to 1983 The Traditional banking is fully based on interest it is commonly meant as commercial banks. But interest is absolutely prohibited by Islam. As a result the people of Bangladesh have been experiencing such a non-Islamic and prohibited banking system against their normal values and faith.

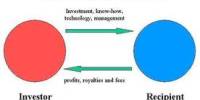

In the Islamic banking system the bank receives no interest. In this case IB receives its entire deposits from the investment of the clients on the basis of profit-sharing places it to the actual entrepreneurs on the basis of the profit sharing. So, it is clear that in case of the traditional banking systems, a fixed percentage of interest, irrespective of income earned is paid to the depositors.

Bangladesh is one of the largest Muslim countries in the world. The people of this country are deeply committed to Islamic way of life as enshrined in the holy Qur’an and the Sunnah. Naturally, it remains a deep cru in their hearts to fashion and design their economic lives in accordance with the precepts of Islam. The establishment of Islami Bank Bangladesh Limited on March 13, 1983, is the true reflection of this inner urge of its people, which started functioning with erect from March 30, 1983. This bank is the first of its kind in South-East Asia. It is committed to conduct all banking and investment activities on the basis of interest fee profit-loss sharing system. In doing so, it has unveiled a new horizon and ushered in a new silver lining of hope towards materializing a long cherished dream of the people of Bangladesh for doing their banking transactions in line with what is prescribed by Islam. With the active co-operation and participation of Islamic development bank (IDB) and some other Islamic banks, financial institutions, government bodies and eminent personalities of the middle east and the gulf countries, Islami Bank Bangladesh Limited has by now earned the unique position of a leading private commercial bank in Bangladesh.

Objective of the study

The main objective of the study is to gather practical knowledge regarding investment modes of Islami Bank Bangladesh Limited. This practical orientation gives us a chance to coordinate our theoretical knowledge with the practical experience. The following are the specific objectives.

To find out the overall pictures of investment modes of Islami Bank Bangladesh Limited.

To evaluate the investment modes of Islami Bank Bangladesh Limited.

To identify the problems related to investment faced by Islami Bank Bangladesh Limited.

To identify strength and weakness of investment modes in overall Banking System.

To know the Shariah Based investment modes opportunity in future.

To understand the prevailing mechanism of modes of finance of Islami bank.

To study the performance of modes of finance of Islami bank.

To highlight the characteristics of modes of finance of Islami bank.

To highlight the major problem of modes of finance facing by Islami bank.

To understand the basic difference in relation to conventional bank.

Islamic Banking

Islamic banking has been defined in a number of ways. The definition of Islamic bank, as approved by the General Secretariat of the OIC, is stated in the following manner.“An Islamic bank is a financial institution whose status, rules and procedures expressly state its commitment to the principle of Islamic Shariah and to the banning of the receipt and payment of interest on any of its operations”(Ali & Sarkar 1995, pp.20-25).

As per GUIDELINES FOR ISLAMIC BANKING issued by Bangladesh Bank in November 2009 “Islamic Bank” means such a banking company or an Islamic bank branches of a banking company licensed by Bangladesh Bank, which follows the Islamic Shariah in all its principles & modes of operations & avoids receiving & paying of interest at all levels.

There are seven Islamic Bank in Bangladesh:

1.Islami Bank Bangladesh Limited-1983

2.Al Baraka Bank Limited/ICB-1987

3.Al Arafa Islami Bank Limited-1995

4. Social Investment Bank Limited-1995

5.Shahjalal Islami Bank Limited-2001

6.EXIM Islami Bank Limited-2003

7. First Security Islamic Bank Limited-2006

Historical Background of Islami Bank Bangladesh Limited

Islami Bank Bangladesh Limited (IBBL) is considered the first interest free bank in Southeast Asia. It was incorporated on 13-03-1983 as a Public Company with limited liability under the companies Act 1913. The bank began operations on March 30, 1983.

Islami Bank Bangladesh Limited is a joint venture multinational Bank with 63.92% of equity being contributed by the Islamic Development Bank and financial institutions like-Al-Rajhi Company for Currency Exchange and Commerce, Saudi Arabia, Kuwait Finance House, Kuwait, Jordan Islamic Bank, Jordan, Islamic Investment and Exchange Corporation, Qatar, Bahrain Islamic Bank, Bahrain, Islamic Banking SysteInternational Holding S. A., Luxembourg, Dubai Islamic Bank, Dubai, Public Institution for Social Security, Kuwait Ministry of Awqaf and Islamic Affairs, Kuwait and Ministry of Justice, Department of Minors Affairs, Kuwait. In addition, two eminent personalities of Saudi Arabia namely, Fouad Abdul Hameed Al-Khateeb and Ahmed Salah Jamjoom are also the sponsors of IBBL. The total number of branches as of December 2001 stood at 121. The authorized capital of the bank is Tk. 500 million and subscribed capital is Tk. 160 million.

Features of Islami Bank Bangladesh Limited

The bank is committed to all its activities as per Islami Shariah. IBBL through its steady progress and continuous success has earned the reputation of being one of the leading private sector banks of the country. The distinguishing features of IBBL are as follow:

• All its activities are conducted on interest-free banking system according to Islamic shariah.

• Establishment of participatory banking instead of banking on debtor-creditor relationship.

• Investment is made through different investment modes permitted under Islami shariah investment income of the bank is shared with the Mudaraba depositors according to a ratio to ensure a reasonable fair rate of return on their depositors.

• Its aims are to introduce a welfare oriented banking system and also establish equity and justice in the field of economic activities.

• It extends socio economic and financial services to the poor, helpless and low income group of the people for their economic up liftmen particularly in the rural areas.

• It plays a vital role in human resource development and employment generation particularly for the unemployed youths.

• It extends co-operation to the poor, the helpless and the low income group for their economic development.

Functions of Islami Bank Bangladesh Limited

The operation of Islamic bank Bangladesh limited can be divided into three major categories: functions of Islami Bank Bangladesh Ltd. are as under:

General Banking

a. Mobilization of deposits.

b. Receipts and payment of cash.

c. Handling transfer transaction.

d. Operations of clearing house.

e. Maintenance of accounts with Bangladesh Bank and other bank.

f. Collection of cheque and bill.

g. Issue and payment of D.D, T.T and P.O.

h. Executing customers standing instructions.

i. Maintenance of safe deposit lockers.

j. Maintenance of internal accounts of the bank.

Foreign Exchange Business

Foreign Exchange business plays a vital role in providing substantial revenue in the bank income pool. Like all modern banks IBBL operates in the area of the foreign Exchange business. IBBL performs the following tasks:

a. Opening letter of credit (LC) against commission for importing industrial, agricultural and other permissible items under shariah and import policy.

b. Opening letter of credit on the principle of Mudaraba sale, on the principle of Musharaka sale and under wage earner scheme.

c. Handing of export/import document.

d. Negotiation of export/import document when discrepancy occurs.

e. Financing in import under MPI (Mudaraba Post Import).

f. Financing to export on profit or loss sharing.

g. Handling inward and outward remittance.

Others activities

The IBBL performs the following task for the welfare of the society:

Income generating scheme for the unemployed youth of the nation.

Monorom sale center for marketing homemade garments, handicrafts and other items.

Education scheme for assisting poor scholar student to case and help them to continue their study.

Health scheme for fulfillment of health needs of rural people.

Islamic bank hospital was established to extend first hand modern and contemporary medical service to the people on non profit business.

Humanitarian assistance is being provided to the poor, families affected by river erosion and for marriage of poor girls.

Energy relief operations are provided to the people affected by natural calamities. Assistance to mosque for construction, repair and renovation.

Investment Modes of IBBL

Investment is the action of deploying funds with the intention and expectation that they will earn a return for their owners of a fund can deploy it through real investment modes or financial investment. When resources are spent to purchase fixed and current assets for use in a production process for trading purpose, then it can be termed as real investment modes. For example, deposit of money with a bank, purchase of Mudarabah Savings Bond or share of a company. Financial investments ultimately takes form of real investment modes as it is meant for so. Since hoarding is condemned by Islam and a 2.5 percent annual tax (Zakat) is imposed on savings, the owner of a fund, if he is unable to make real investment, has no option but to invest his savings as a financial investment.

Modes of finance followed by Islami bank are exercised under three principles.

1. Bai- (Buy & Selling) Mechanism

2. Sharing (Profit & Loss) Mechanism

3. Ownership Sharing Mechanism Modes of finance under three principles can be presented by using chart as follows-

BAI- MURABAHA

Meaning:

The terms ‘Bai- Murabaha’ have derived from Arabic words Bai and Ribhun. The word Bai means purchase and sale and the words Ribhun means an agreed upon profit. Bai-Murabaha means sale on agreed upon profit.

Definition:

Bai-Murabaha may be defined as a contract between a Buyer and a seller under which the seller sells certain specific goods p0ermissible under Islamic Shariah and the Law of the land to the Buyer at a cost plus agreed profit payable on cash or on any fixed future date in lump- sum or by installments. The profit marked-up may be fixed on lump sum or in percentage of the cost price of the goods. There are different types of Murabaha as given bellow:

Types of Murabaha:

In respect of dealing parties Bai-Murabaha may be of two types.

1. Ordinary Bai- Murabaha:

Ordinary Bai-Murabaha happens between the two parties, i.e., the buyer and the seller, where the seller as an ordinary trader purchases the goods from the market without depending on any order and promises to buy the same from him and sells those to a buyer for cost plus profit, then the sale is called ordinary Bai-Murabaha. In this case the seller undertakes full risks of his capital invested on the business with a view to earn profit out of selling the goods purchased for.

2. Bai-Murabaha on order and promise:

It occurs between the three parties- the buyer, the seller and the Bank – as an intermediary trader between the buyer and the seller, where the Bank upon receipt of order from the buyer with specification and a prior outstanding promise to buy the goods from the bank, purchases the ordered goods and sells those to the ordering buyer at a cost plus agreed profit, the sale is called ‘Bai- Murabaha on order or promise’, generally known as Murabaha. In this case, capital with profit is almost secured by promise.

This Murabaha upon order and promise is generally used by the Islami Banks, which undertakes the purchase of commodities according to the specification requested by the clients and sale on Bai- Murabaha to the one who order for the goods and promised to buy those for its cost price plus a marked-up profit agreed upon previously by the two parties, the Bank and the client.

Therefore, it is a sale of goods on profit by which ownership of the goods is transferred by the Bank to the client but the payment of the sale price (cost plus profit) by the client is deferred for a fixed period.

To make it more clear, it may be noted here that Islamic Bank is financier to the client not in the sense that the bank finances the purchase of goods by the clients as conventional Bank does, rather it is a financier by deferring the receipt of sale price of the goods sold by the Bank to the client. There is a chance for happening of a loan and earning of interest under the wrong practice of Bai-Murabaha.

Therefore, to make a true practice of Bai-Murabaha, purchase of goods by the Bank should be for and on behalf of the Bank and the payment of price of goods by the Bank must be made for and on behalf of the Bank. But on any way, the payment of price of goods is turned into a payment for and on behalf of the client or it is paid to the client any profit on it will be Reba (Interest that is allowed in traditional baking system but not allowed in the Islami Banking system because Islam prohibits all kind of interest.

Steps of Bai-Murabaha Practiced by Islami Bank:

First Step:

Submission of proposal: The client’s sends a proposal with the specifications of the commodity for purchasing through the Bank and requests to make him known the date and method of payment of price, etc.

The Bank sends a quotation valid for a certain period mentioning the cost of the goods plus profit of the bank.

Second step:

Signing a promise to purchase: The client promises to buy the commodity from the bank on Bai-Murabaha basis (for the cost of the commodity plus the agreed upon profit)

The Bank studies the request and determines the securities with terms and conditions for approval.

Third step:

The first sale contract: The bank informs the client of its approval of purchasing the commodity. The bank may pay the price immediately pr as per the agreement.

The seller expresses its approval to the sale and sends the invoice.

Fourth step:

Signing of a Murabaha Sale Contract: The two parties (the bank and clients) sign the Bai-Murabaha sale contract according to the agreement of the promise to purchase.

Fifth Step

Delivery and Receipt of the commodity:

The Bank authorizes the client or his nominee to receive the commodity

The seller sends the commodity to the place of delivery agreed upon.

The client undertakes the receipt of the commodity in its capacity as legal representative and notifies the bank of the execution of the proxy

BAI-MUAJJAL (Deferred sale)

Meaning:

The terms “Bai” and “Muajja” have been derived from Arabic words ‘Bai’ and ‘Ajal’. The word Bai means purchase and sale and the word ‘Ajal’ means a fixed time or a fixed period. “Bai-Muajjal” means sale for which payment is made at a future fixed date or within a fixed period. In short, it is a sale on Credit.

Definition:

The Bai-Muajjal may be defined as a contract between a Buyer and a Seller under which the seller sells certain specific goods (permissible under Shariah and law of the country), to the Buyer at an agreed fixed price payable at a certain fixed future date in lump sum or within a fixed period by fixed installments. The seller may also sell the goods purchased by him as per order and specification of the buyer.

Bai-Muajjal is treated as a contract between the bank and the client under which the bank sells to the client certain specific goods, purchased as per order and specification of the client at an agreed price payable with in a fixed future date in lump sum or by fixed installments.

Thus it is a credit sale of goods by which ownership of the goods is transferred by the bank to the client but the payment of sale price by the client is deferred for a fixed period.

It may be noted here that in case of Bai- Muajjal and Bai-Murabaha, the Islamic bank is a financier to the client not in the sense that the bank finances the purchase of goods by the client, rather it is a financier by deferring the receipt of the sale price of goods, it sells to the client. If the bank does not purchase the goods or does not make any purchase agreement with seller but only makes payment of any goods directly purchased and received by the client from the seller under Bai-Muajjal / Bai-Murabaha agreement, that will be a remittance/ payment of the amount on behalf of the client, which shall be nothing but a loan to the client and any profit on this amount shall be nothing but interest.

There are some important features of Bai- Muajjal as given bellow:

Important Features:

It is permissible for the Client to offer an order to purchase by the bank particular goods deciding its specification and committing himself to by the same from the bank on Bai-Muajjal I.e. deferred payment sale at fixed price.

It is permissible to make the promise binding upon the Client to purchase from the bank, i.e. he is to either satisfy the promise or to indemnify the damages caused by breaking the promise without excuses.

It is permissible to take cash/ collateral security to Guarantee the implementation of the promise or to indemnify the damages.

It is also permissible to document the debt resulting form Bai-Muajjal by a Guarantor, or a mortgage or both like any other debt. Mortgage/ Guarantee/ Cash security may be obtained prior to the signing of the Agreement or at the time of signing the Agreement.

Stock and availability of goods is a basic condition for signing a Bai- Muajjal Agreement. Therefore, the Bank must purchase the goods as per specification of the client to acquire ownership of the same before signing the Bai-Muajjal Agreement with the Client.

After purchase of goods the bank must bear the risk of goods until those are actually delivered to the Client.

The Bank must deliver the specified goods to the Client on specified date and at specified place of delivery as per contract.

BAI- SALAM

Meaning:

The terms “Bai” and “Salam” have been derived from Arabic words. The words “Bai” means “sale and purchase” and the word “Salam” means “Advance”. “Bai-Salam” means advance sale and purchase.

Definition:

It is a sale in which an advance payment is made by the buyer, but the delivery is delayed to an agreed date. In the Bai-Salam, a financial transaction happens in advance in cash as a price of commodity whose delivery will be in a future date. It means deferred is the commodity sold (debt in kind) and price of the commodity described is to be aid immediately in advance.

The Bai-Salam sales serve the interests of both parties:

1. The seller- gets in advance the money he wants in exchange of his obligation to deliver the commodity later. He benefit from the Salam sale by covering his financial needs whether they are personal expenses for productive activity.

2. The purchaser-heretic is the financing bank. The bank gets the commodity it is planning to trade on in the time it decides. Because the commodity becomes the liability of the seller who meet his obligation. The bank will also benefit from the cheap prices for usually salam sale is cheaper than a cash sale. This way the bank will be secured against the fluctuations of prices.

The bank can sell on parallel salam commodity in the same kind as it has previously purchased on first salam without making one contract depend on the other. The bank also has the option of waiting to receive the commodity and then sell it for cash or deferred payment.

Important feature:

Bai-Salam is a mode of finance allowed by Islamic Shariah in which commodity or product can be sold without having the said commodity or product either in existence or physical possession of the seller. If the commodity are ready for sale Bai-Salam is not allowed in Shariah. Then the sale may be done either in Bai-Murabaha or Bai-Muajjal mode of finance.

Practical Steps of the Salam Sale:

1.Cash sale or sale on Credit- The Bank pays the price in the contract meeting so that the seller makes use of it and covers his financial needs. The seller abides the delivery of the commodity on the specific due date.

2.Delivery and receipt of the commodity on the specific due Date: The bank there is several options at the disposal of the bank to choose one of them.

a) The bank receives the commodity on the specific due date, and either for cash or on credit.

b) The bank can authorize the seller to sell the commodity on its behalf as against fees (or without fees).

c) Direct the seller to deliver the commodity to a third part (the Buyer) according to pervious promise of purchase, that is at an emphatic demand of purchase.

3. The sale Contract: The bank agrees to sell the commodity for cash or a deferred price higher than the salam purchase price. The buyer agrees to purchase and to pay the price according to the agreement.

Rules of Bai-Salam

1. Commodity Should be Known: It is a condition that the commodity should be known Ignorance about the commodity leads to dispute which invalidates the contract.

2. Monitoring By Specification: It is a condition that the commodity can be monitored by specification to the maximum possible degree, only negligible variation is tolerated If the commodity cannot Be monitored by specification salam is impermissible, because of ignorance that leads to dispute.

3. Availability of Goods for Delivery: It is a condition that the commodity is possible to deliver when it is due. That is the probability of its existence at the time of delivery is deemed to be high, if the contrary is the case, salam, is impermissible.

4.Salam n the Whole to be Possessed Partly: It is permissible to draw a salam sale contract on one whole thing but to be possessed at different times in specific parts.

5. Commodity a Liability Debt on the Seller: It is a condition that the commodity is a liability debt, The seller is obliged to deliver the commodity when it is due, according to the specification stipulated in the contract without abiding as to whether it is the product of his factory or the produce of his private firm or from others.

6. Salam on Existing Goods: Salam sale is impermissible on existing commodities because damage and deterioration cannot be assured before delivery on the due date. Delivery may become impossible, anything which is risky and elevator.

7. Salam on Land and Real Estates salam: Is impermissible on Land lots and real estates because the description or the real estate entails the location. If the location is determined then it is specified, which contradicts what the jurists agreed upon, that salam is a liability debt.

8. Salam on Special Item: Salam is permissible on a commodity of a specific locality if it is assured that it is almost always available in that locality and it rarely becomes unavailable.

9.Advance Payment: It is a condition that the purchase price in salam is specified and advanced to the seller at the contract meeting.

10. Date of Delivery Known: It is a condition in salam sale that the due date is known to avoid ignorance which leads to dispute.

Rule of Mudharabah:

1. Capital Must be Specific: It is a condition in Mudharabah that capital must be specific or its return to owner, so its amount must be known at the contract, and because the uncertainty about the amount of capital necessarily leads to uncertainty about the amount of profit, which represents an increment to capital.

2.Capital Must be in Currency: it is a condition that capital must be a currency in circulation. However, It can be merchandise only in condition that it is evaluated at the contract and the agreed upon value becomes the capital of Mudharabah.

3.Capital Not a Liability debt on Mudarib: It is a condition that in capital must not be a liability debt on the Mudharib, because the Mudharib is a trustee and in respect to the debt, it is a guarantor who can only be absolved after payment.

4.Mixing of Private Capital Permissible: It is permissible for a mudharib to mix its private capital with the capital of the Mudharabah, thus it becomes a partner, as well, and its disposal of capital on the basis of Mudharabah is permissible.

5.Delivery of Capital to Mudarib: It is a condition that the capital of Mudharabah must be delivered to the mudharib because not delivering it imposes constrictions on the withhold it imposes constrictions on the mudharib and restricts its power disposal. Some of the jurists permit the capital owner to withhold capital and release it gradually according to the needs of the mudharib since Mudharabah adjudges unrestricted disposal but not deliver.

6. Imposition of Restriction on Mudarib: It is permissible to impose restrictions on the mudharib if the restriction is beneficial and dose not constitute a constriction on the agent to attain the profit required and is not counterproductive to the purpose of the Mudharaba if the mudharib violates the restriction contravenes the beneficial condition, it becomes a usurper and guarantees capital to the capital owner.

7.Hiring Helping Hands By Mudarib: It is permissible for the Mudharib to hire assistance in difficult work, which it is unable to do by itself. Recourse shall be made to prevailing custom to determine that.

8.Disposal of the Mudharib: The disposal of the Mudharib is confined to what is conducive to the Mudharabah. It must lend or donate nothing of the Mudharabah capital It is also not allowed to purchase, for Mudharabah with more than its capital, nor is it allowed to go into partnership with others using the Mudharabah capital. All of the above is permissible if the capital owner consents and authorizes the agent to use its discretion.

9. No Security or Guarantee Except Negligence: No security on the Mudharib shall be stated in the Mudharabah contract except in case of negligence or trespass because the mudharib is a trustee on what is in its hold, capital is judged as a deposit. It is permissible to take a surety mortgage from the mudharib to guarantee the payment in case of negligence or trespass or violation of conditions, but it is impermissible to take that as a guarantee to capital or profit, because it is impermissible for the Mudharib to guarantee Capital nor profit.

10. Profit Sharing as per Agreed Ratio: It is a condition that profit should be specific because it the subject of the contract and being unknown abrogates the contract. The contraction parties should stipulate in the contract the profit shares (in percentage) for each one. It is impermissible to stipulate a lump sum as profit to either party so as not to lead to the termination of profit by one of them. Profit in Mudharabah is distributed according tto the agreement of the two contraction parties. They may agree on specific rations, be more or less.

Rules For Permanent Musharakah:

1. Capital Should be Specific: It is a condition that the capital of the company is specific, existent and under disposal. It is invalid to establish a company on non-existent fund of debt, for the purpose of profit,2. Share of Equity: It is not a condition that partners have equal shares in capital, though variation in shares is permissible. It is subject to agreement.

3.Nature of Capital: It is a condition that the capital of the company is money and valuables. Some of the jurists permit participating with merchandise on condition it is evaluated in the contract and the value agreed upon becomes the capital of the company.

4.Active Participation of Partners: It is impermissible to impose conditions forbidding one of the partners from work, because the company is build on and each partner implicitly permits and gives power of attorney to the other partner to dispose of and work wit capital but it is permissible for one partner to singly work in the company by mandate of other partners.

5.No Security for Profit: A partner is a trustee on the funds in his hand from the company and he guarantees only in case of trespass or negligence and it is permissible to take a mortgage or a guarantee against trespass and negligence but it is impermissible to take security or profit or capital.

6. Ratio of Profit Prefixed: It is a condition that profit for each partner must be known to avoid uncertainty and it must be a prorate ratio to all partners and must not be a lump sum, because this contravene the requirement of partnership.

7. Variation in Share of Profit Permissible: In Principe, profit must be divided among partners in ratios proportionate to their shares in capital but some of the jurists permit variation in profit shares whereupon it is determined by agreement for one of the partners may be more dexterous and more diligent and may not agree to parity ,so variation in profit becomes necessary.

8. Not a binding contract: In principle, partnership is a permissible and not a binding contract, so it is admissible for any partner to rescind the contract whenever it wishes provided that this occurs with the knowledge of the other partner or partners, because rescinding the contract without the knowledge of other partners prejudices their interests. Some of the jurists are of the view that the partnership contract is binding up to the liquidation of capital or the accomplishment of the job accepted at the contract.

Definition of diminishing Musharakah:

Diminishing Musharaka is an intention from the very beginning not to stay in and continue the partnership up to the liquidation of the company. The Islamic bank can give the other partner the right to purchase portion of the bank on the ownership [the form for full payment at a time or by installment basis as per agreement with the partners (the client).

The bank gradually can relinquish share to the partner, in exchange the partner pays the price to the bank periodically during a reasonable period to be agreed upon. after the discharge, the bank withdraws it claims from the firm and it becomes the property of the partner. Decreasing partnership is a mode innovated by the Islamic banks. It differs from the partnership. Those are mentioned below.

Steps of diminishing partnership

1. Participation in capital: The bank-tenders part of the capital required to the project In its capacity as a participant and agrees with the customer partner on a specific method of selling its share in capital gradually.

2. The partner-tenders part of the capital required to the project and be a trustee in what is in its hands of the bank funds.

3. 2. Results of the projects: The purpose of the work in the project is the growth of capital. The results of the project may be positive or negative.

4. 3. The distribution of the wealth accrued from the projects: In the event of loss each partner bears its share in the loss in a ratio proportionate to its share in capital. In case of earning profits, are detonated between the two partners (the bank and the customer) in accordance with the agreement. The shares the sale must be concluded as a separate deal with no connection to the contract of the company.

5. 4.The Bank sells its Share In Capital: The Bank- expresses its readiness, its readiness, in accordance with the agreement, to sell a specific percentage of its share in capital.

The partner- pays the price of that percentage of capital to the bank and the ownership is transferred to the partner.

6. This process continues up to the end of the partnership of the bank in the project and that’s by gradually transferring the ownership of the project customer/partner. In this way the bank has its principal returned plus the profit earned during the partnership advice versa.

In the first Conference of the Islamic Banks in Dubai, the conferees studied the topic of partnership ending with ownership (decreasing partnership) and they decided that this mode can be applied in one of the following (ways) forms.

The First Form: The Bank agrees with the customer on the share of capital and the conditions of partnership. The Conference has decided that the bank should sell its shares to the customer after the completion of the partnership and in an independent contract where the customer has the same provision.

7. The Second Form. The band agrees with the customer in participating in the total or partial capital of a firm of prospective earning son the basis of the agreement with the right to relating the remainder of the income for the purpose of paying the principal of what the bank has contributed.

8. The Third Form. The shares of each partner (the bank and the partner) in the company are determined as stocks co comprising the total value of the asset (real estate) Each partner, (the bank and the customer) gets its share of the earnings accrued from the real property, If the partner so wishes it can each year purchase a cretin number of the shares owned by the Bank, The shares possessed by the bank shall be decreasing until the partner becomes the sole owner of the real property.

9. Rules for diminishing Musharakah.

10. In addition to all the legal rules that apply to the permanent partnership which also apply to the decreasing partnership, the following matters must the observed.

1.Participation and Sharing profit and Loss: It is a condition in the decreasing partnership that it shall not be a mere loan financing operation, but there must be real determination to participate and all the parties shall share profit or loss during the period of the partnership.

11. 2.Bank’s Ownership and Right to Management: It is a condition that the bank must completely own its, share in the partnership and must have its complete right in management and disposal. In case the bank authorizes its partner to perform the work, the bank shall have the right of supervision and follow up.

12. 3.Redeeming Bank’s Share of Capital: It is impermissible to including the contract of decreasing partnership a condition that adjudges the partner to return to the bank the total of its shares in capital in assertions in addition to profits accruing from that share, because of resemblance to RIBA ( usury).

13. 4.Bank’s Promise to Sell It Share to the Partner: It is permissible for thee bank to offer a promise to sell its shares in the company to the partner if the partner pays the value of the shares. The sale must be concluded as a separate deal with no connection to the contract of the company.

Hire purchase Under Shirkatul Melk

Meaning and Definition:

Hire purchase Under Shirkatul Melk is a special type of contract which has been developed through practice. Actually, it is a synthesis of three contracts:

1. Shirkat

2. Ijarah and

3. Sale

There may be defined as follows:

Shirkatul Melk:

Shirkatul means partnership Shirkatul Melk means share in ownership. When two or more persons supply equity, purchase an asset, own the same jointly, and share the benefit as per agreement and bear the loss in proportion to their respective equity, the contract is called Shirkatul Melk contract.

Ijarah

The term Ijarah has been derived from the Arabic words ‘Air’ and ‘Uirat’ which means consideration, return, wages or rent. This is really the exchange value or consideration, return, wages, rent of service of an asset. Ijarah has been defined as a contract between two parties, the Hiree and Hirer where the Hirer enjoys or reaps a specific service or benefit against a specified consideration or rent from the asset owned by the Hiree, it is a hire agreement under which a certain assert is hired out by the Hiree to a Hirer against fixed rent or rentals for a specified period.

Element of Ijarah:

a. According to the majority of Fuqaha, there are three general and six detailed elements of Ijarah.

• The wording: this includes offer and acceptance.

• Contracting parties: this includes a Hiree, the owner of the property, and a Hirer, the party that benefits from the use of the property.

• Subject matter of the contract: this includes the rent and the benefit.

b. The Hiree: the individual or organization hires/rents out the property of service is called the Hiree.

c. The Hirer: the individual of organization hires / takes the hire of the property or service against the consideration, rent/ wages/ remuneration is called the Hirer.

d. The benefit / asset: the benefit, which is hired/, rented out is called the benefit.

e. The rent: the consideration either in monetary terms or in kinds fixing quantity of goods/money to be paid against the benefit of the asset or service of the asset is called the rent.

Sale

This is a sale contract between a buyer and a seller under which the ownership of certain goods or asset is transferred by seller to the buyer against agreed upon price paid / to be paid by the buyer.

Thus, in Hire Purchase Under Shirkatul Melk made both the bank and the client supply equity in equal or unequal proportion for purchase of an asset like land, building, machinery, transport etc. Purchase the asset with that equity money, own the same jointly, share the benefit as per agreement and bear the loss in proportion to their respective equity. The share part or portion of the asset owned by the bank is hired out to the client partner for a fixed rent per unit of time for a fixed period. Lastly the bank sells and transfers the ownership of it’s share/ part/ portion to the client against payment of price fixed for that part either gradually part by part or in limp sum with in the hire period or after the expiring of the hire agreement.

Stages of Hire Purchase Under Shirkatul Melk:

Thus Hire Purchase Under Shirkatul Melk agreement has got three stages:

• Purchase under joint ownership

• Hire and

• Sale and transfer of ownership to the other partner Hirer.

Important features:

1. In case of HPSM transaction the asset/ property involved is jointly purchased by the Hiree (Bank) and the Hirer (Client) the Hiree and the Hirer become co-owner of the asset under transaction in proportion to their respective equity participation.

2. In HSPM agreement, the exact ownership of both the Hiree and Hirer must be recognized.

3. Under this agreement, the Hirer becomes the owner of the benefit of the asset but not of the asset itself, in accordance with the specific provisions of the contract, which entitles the Hiree, is entitled fore the rentals.

4. As the ownership of hired portion of the asset lies with the Hiree and rent is paid by the Hirer against the specific benefit, the rent is not considered as price or part of price of the asset.

5. In the HPSM agreement the Hiree does not sell or the Hirer does not purchase the asset but the Hiree promise to sell the asset to the Hirer part by part only.

6. The promise to transfer legal title by the Hiree and undertakings given by the Hirer to purchase ownership of the hired asset upon payment part by part as per stipulations are effected only when it is actually done by a separate sale contract.

7. As soon as any part of Hiree’s ownership of the asset is transferred to the Hirer that becomes the property of the Hirer and hire contract for that share/part and entitlement for rent there of lapses.

8.In HPSM, the shirkatul melk contract is effected from the day the equity of both partied deposited and the asset is purchased and continues up to the day on which the full title of Hiree is transferred to the Hirer.

9. Effectiveness of the sale contract depends on the actual sale and transfer of ownership of the asset by the Hiree to the Hirer.

10. Under this agreement the bank acts as a partner, as a Hiree and at last as a seller; on the other hand the client acts as a partner, as a Hirer and lastly as a purchaser.

Rules:

1. It is a condition that the subject of the contract and the asset should be known comprehensively.

2. It is a condition that the asset to be hired must not be a fungible one which can not be used mire than once or in other words the asset must be a non-fungible one which can be utilized more than once or the service of which can be separated from the asset itself.

it is a condition that the subject of the contract must actually and legally be attainable.

3. It is a condition that the Hirer shall ensure that he will make use of the asset as per provisions of the Agreement.

4. It is a condition that the Hirer shall ensure that he will make use of the asset as per provision of the agreement.

5. The hire contract is permissible only when the asset and the benefit derived from it is with in the category as per Islamic Shariah.

6. In a hire contract, the period of hire and the rental to be paid per unit of time be clearly stated.

7. Everything that is suitable to be co considered a price, in a sale, can be suitable to be

considered as rental in a hire contract.

8. It is permissible to advance, defer or install the rental in accordance with the agreement.

9. It is permissible to make the Hirer to bear the cost of ordinary routine maintenance, because this cost is normally known and can be considered as part of the rental.

10. If the hired asset is damaged or destructed by the act of Allah and if the Hiree offers a substitute with the same specifications agreed upon in the hire contract the contract does not terminate.

In the process of applying Islamic modes of finance some basic characteristics have emerged.

The alternative risk sharing modes offered by Islami banks in lieu of interest are characterized by flexibility. Banks, in conditions of free market, can choose the most suitable formula set the suitable profit, margin or profit sharing percentages (according to type of activity, location clientele, pricing constraints etc.) design specific disbursement or repayment conditions to go with the formula etc. thus thee actual socioeconomic cost of providing goods or services to the community is better reflected in Islamic financing. This has its implications for rational resource allocation for the while community. Thee banking system can be made to act as a more potent resource allocater than the traditional one if the state so chooses in centrally managed or directed economics. More specifically the variety of modes used enables Islami banking to offer more effectively their services to the society in these areas.

Taxes and other fiscal resources:

Banks ‘knows better’ the profit margin realized by their partners. They may be asked to deduct taxes on behalf of the taxing authority at the source. This would certainly boost tax collection. A similar effect may happen when banks (in their capacity as co-financiers) pay customs duties, excise duties etc. directly to the state on behalf of the ‘Musharaka’ operations- there by lessening possibility of tax evasion.

Adaptability to fiscal and monetary regimes by the state:

Islami banks can only trade in assets. If these are regulated then Islami banks can only extend finance to the available volume. Excess liquidity cannot go to finance speculative activities, as the banks do not stand to gain from financing these activities through overdraft arrangements. Islami bank cannot offer normal overdraft.

Equally if price controls are enforced, Islami bank can help enforce observance either when purchasing raw materials or selling the products.

This can work more effectively if the whole system is Islamic since the breachers of the systems will be penalized by not having any finances extended to them. Compliance would be greater. An incomes and prices policy becomes more feasible to contemplate if the state machinery can have such an effective tool to check an unruly business community.

Development:

Because of their readiness to share labor Islami bank is an institutional standing than traditional banks in assisting development of their communities. This is especially so, for small industrial and agricultural sectors that are basically cutoff from normal commercial financing.

Resource Mobilization:

Islami bank’s trading activities and modes avail them of higher profit margins especially if they were efficient in turning over their activities at a higher rate. This enables them to offer higher profits for their investment account holders and enables them, there fore, to draw more of the public savings into investment accounts.

Inflation:

Islami banking investments are given for financing specific operations in terms of types of activities, duration and value. Thus there is a direct trade off between money going out of the bank and goods and services coming into the banks holds (by way of participation or sales contract). As such, Islamic finance cannot go to hoarding or monopolistic or market cornering activities, these activities are prohibited.

Therefore, the Modes of finance of Islami Bank Bangladesh Limited work to lessen inflation in a very direct way.

FINANCING PLAN

Pursuant to the investment modes policy adopted by the bank, a 7-year perspective-financing plan from 1995-2002 has been drawn up and put into implementation. This plan aims at diversification of the investment port-folio by size, sector, geographical area, economic purpose and securities to bring in phases all sectors of the economy and all types of economic activities and different economic groups of the society with in the fold of Bank’s investment operations.

Recently another 5-year plan from 2003-2007 has been adopted by the bank keeping the same in view, side by side with commercial and industrial investment operations, many special financing schemes like rural development scheme, house-hold durable scheme, investment modes for doctors, transport investment scheme, small business investment scheme, small transport investment scheme, micro-enterprise investment scheme and real estate investment program, targeting different economic groups have been introduced by the bank as part of their financing plan.

IBBL opened 15 new Branches during the year2011 raising total number of Branches to 266 from 251 of the previous year. The Bank plans to gradually open more branches covering important commercial places both in urban and rural areas. For effective control, close supervision and proper monitoring of the total operations of the branches as well as to assist them in the development of business 12 Zonal offices are working all over the country. Now more than 175,000 ATM cardholders of the bank can use IBBL’s own 100 ATMs & 1035 ATMs of others’ across the country.

Out of total 266 Branches (including 30 SME/ Agriculture Branches), 82.23%, i.e., 219 are Urban Branches and 17.67%, i.e., 47 are Rural Branches. IBBL has the highest number rural branches among the first generation Private Banks. In 2012,the total brances of Islami Bank Bangladesh Limited are 276

Deposit Products:

Without multidimensional and diversified products, any financial institution especially a Bank can hardly prosper and compete with other banks effectively. With this idea, IBBL has so far introduced 18 deposit products. Historical trend of the deposit mobilization shows a clear direction of doubling its deposit base in every 5 (five) years of its operations during the last decades.

1.Al-wadeeah current account.

2.Mudaraba Savings Account.

3. Mudaraba Term-deposit Account.

4. Mudaraba Special Notice Account.

5. Mudaraba Hajj Savings Account.

6. Mudaraba Special Savings(pention) Account.

7. Mudaraba Savings Bond Scheme Account.

8. Mudaraba Foreign Currency Deposit (Savings) Account.

9. Mudaraba Monthly Profit Deposit Account.

10. Mudaraba Muhor Savings Account.

11. Mudaraba Waqf Cash Deposit Account.

12. Mudaraba NRB Savings Bond Account.

13. Mudaraba School Student Savings Account.

14. Mudaraba Farmers Savings Account.

Mobilization of Deposits:

The year 2011 was another successful year of mobilization of Deposit. Total Deposit stood at TK. 341,854 million as on 31st December 2011 as against Tk. 291,935 million of the preceding year registering a growth of Tk. 49,919 million, i.e. 17% growth as compared to the percentage of growth of Deposit in 2010 was 20%.

Weightage and Final Profit rates of Deposit Schemes:

SI. No. Particulars of Deposites Weightage 2011 2010

1 Mudaraba hajj saving :

a)Above 10 years term 1.35 10.06 9.60

b)Up to 10 years term 1.30 9.69 9.19

2 Mudaraba waqf cash deposit account 1.35 10.06 9.60

3 Mudaraba special saving (pention) scheme(MSS)

a)10 years term 1.30 9.69 9.19

b)5years term 1.10 8.20 7.80

4 Mudaraba muhor saving account

a)10 years term 1.30 9.69 9.19

b)5 years term 1.10 8.20 7.80

5 Mudaraba NRB saving bond

a)10 years term 1.35 10.06 9.60

b) 5 years term 1.25 9.32 8.85

6 Mudaraba perpetual bond 1.25 13.20 12.35

7 Mudaraba saving bond

a) 8 years term 1.25 10.00 8.85

b) 5 years term 1.10 9.10 7.85

8 Mudaraba monthly profit deposit schime

a) 5 years term 1.20 10.00 8.55

b) 3years term 1.00 9.00 8.21

9 Mudaraba term deposits

a)36 Months 1.00 9.00 8.21

b)24 Months 0.98 8.50 7.26

c)12 Months 0.96 8.00 6.80

d)06 Months 0.92 8.00 6.50

e)03Months 0.88 8.00 6.22

10 Mudaraba savings (including RDS) 0.75 5.60 5.30

11 Mudaraba SND 0.55 5.00 3.89

12 Mudaraba foreign currency deposit 0.75 1.53 1.79

Management:

Islami Bank Bangladesh Ltd. is being managed by a Board of Directors comprising foreigners and local. An Executive Committee is formed by the Board of Directors for efficient and smooth operation of the Bank. Besides, a Management Committee looks after the affairs of the Bank

Financial Highlights:

(IBBL Main Operation)

(in million Taka)

1 Paid-up Capital 10007.71 7413.12

2 Total Capita(Equity) 33716.73 28400.03

3 Capital Surplus /deficit 7960.24 5287.58

4 Total Assets(Excluding contra) 389192.12 330586.12

5 Total Deposits 341853.67 291934.60

6 Total Investments (Excluding investment in share / securities) 305840.56 263225.13

7 Total Contingent Liabilities and commitments 113420.93 113098.67

8 Investment Deposit Ratio 89.47% 90.17%

9 Preference of classified investment against total general investments 2.71% 1.77%

10 Profit after Tax & Provision 4841.45 4463.47

11 Amount of classified investment during current year 3636.69 (407.77)

12 Provision kept against classified investments 3054.00 1840.00

13 Provision surplus/deficit – –

14 Cost of fund 8.86% 8.65%

15 Profit earning assets 295962.73 256354.66

16 Non-Profit earning assets 93229.39 74231.46

17 Return on investments 10.87% 10.08%

18 Return on assets 1.35% 1.47%

19 Income from investments 32308.90 25224.42

20 Earning per share(taka) 4.84 4.46

21 Net income per share(taka) 4.84 4.46

22 Price earning ratio(times) 11.27 13.29

23 Net asset value (NAV) 27800.21 23494.26

24 Net asset value (NAV) per share 27.78 23.48

25 Net operating cash flow per share 16.38 3.33

26 Dividend yield per share 5.87% 4.38%

27 Dividend payout ratio 66.15% 58.13%

FINDINGS

Conventional Bank vs. Islami Bank

The modes of finance followed by Islami bank ensure the investment system that is permitted by Islamic Shariah. Islami bank’s modes of finance is mainly based on buying and selling practice, not based on interest. Its other modes of finances are based on sharing basis and hire purchase under sirkatul melk. On the other hand the modes of finance follows by conventional banks are based on interest, which is prohibited by Islam. In its attitude to interest Islam is un-ambiguous. The Quran prohibits interest in unequivocal terms. The difference between Conventional Bank & Islamic Bank are given below:

Conventional Bank Islamic Bank

Historically it is very old, institutionally 500 yrs old.

Is based on interest.

Sufficient legal frame-work is available.

Deals in money or papers.

Periodical adjustment is merely done, so repayment is in risk.

Is based on fixed return on both sides of the balance sheet.

Does not involve itself in trade and business.

High expenses for ICC to minimize Operational Risk.

Only bank bears the Credit Risk.

Customer service mind set is to be manufactured.

Conflicting to Islam.

Though practised 1400 yrs ago, institutionally 50 yrs only.

Is based on profit/loss or rent.

Appropriate legal frame- work is absent.

Deals in assets.

Deal-wise adjustment is a must, so default risk is low.

Is based on profit sharing on deposits side, and on profit on assets side.

Actively participates in trade, production & valid services through valid contracts.

Mental make-up prevents most of the Operational Risk.

Investment risk is shared by the depositors.

Customer service mentality is inherent and auto-generated.

Friendly to every religion.

Obstacles

The process of establishment of Modes of Finance by Islami Bank Bangladesh Limited in Bangladesh has not been without obstacles. Despite tremendous popular support IBBL in Bangladesh could not yet achieve the desired level of success. There are many reasons for this, but the direct ones are:

• Legal frame- work for Islami Bank

• Default by fund users and income loss on overdue investment

• Manpower for Islami Bank

• Government securities and Islamic Money Market

• Islam allows ‘trading’ but forbids ‘Riba’

Legal frame- work for Islami Bank

The absence of necessary legal framework is one constraining factor for Islami Bank. All the financial and commercial law of the country is interest oriented. Even the tax structure has a bias towards loan financing. Interest –cost on borrowed funds is exempted from taxed where as dividend paid on funds mobilized as equity is subject to tax at varying rates ranging up to 50%. Under IBBL the loan mechanics are required to be replaced by Shariah laws like Musharaka, Mudaraba, etc. Though the Banking Companies Act, 1991 has validated their mechanics it does not have comprehensive provisions to define the right and obligation of the parties to such transactions.

Default by fund users and income loss on overdue investment

The absence of special legal provisions for Islami Bank has given certain undue advantages to unscrupulous clients. They avail of bank facilities under Bai-Muajjal and Murabaha mechanics only to default causing income loss to the financier bank. Suitable legal provisions could have avoided this income loss on overdue investment modes.

Manpower for Islami Bank

Most importantly for smooth implementation and successful replication of modes of finance of Islami banking, a band of people is needed having a different type of knowledge, skill and orientation. Such people are needed for Islami bank as well as for link institutions. The people working in the Islami bank and in the link institutions will have to have diverse but complementary expertise and should have commitment for the cause.

Government securities and Islamic Money Market

All the governmental approved securities in Bangladesh are interest bearing. Naturally the Islami bank, which is committed to avoid interest, cannot invest the permissible part of their statutory liquidity reserve and overnight surpluses in those securities.

As a result they deposit their entire reserve in cash with Bangladesh Bank. Similarly, the overnight surpluses also remain un-invested. But the conventional banks of the country do not suffer from this limitation. They receive interest on part of their credit balance kept with Bangladesh Bank as SLR. Besides, they invest a part of their liquidity reserves in Govt. securities, which yield then around 8.5% per annum.

Conclusions:

Banks play a very vital role in the economic development of the country. The popularity of banks is increasing day be day which leads to increase competition as well. Currently 48 Scheduled Banks are operating in Bangladesh. All commercial banks are offering almost the same products and services are different from each other. So people choose their Bank according to their satisfaction and need. And they will prefer the bank of which service is easily accessible and understandable. In Islamic Banking, investment modes is going on with profit-loss sharing system. In this system, no fluctuation comes between growth of economy as well as growth of IBBL. In Islami banking system, it is possible to create balance between money supply and the production of goods. On the other hand, conventional banking system creates inflationary problem. In conventional banking system, investment does not ensure employment opportunity besides Islamic banking system interest rate always fluctuates and events unrest in economy. Besides Islami bank always helps economic growth. In Islami banking system the collection of invested money is easier that the conventional banking because Islami bank concerns with the purpose of investment not with only the invested money. I also think that there is bright future waiting for the Islami banking in Bangladesh and IBBL is in a position to go as a catalyst for this development in the banking sector in Bangladesh. Most of the people of our country have a bad impression about IBBL’s operations regarding indirect generation of interest; which means no difference between investments of IBBL loan/credit/advance of conventional banks for this reason. They are not too much interested with IBBL because majority of our people have proper knowledge about the activities of Islami Banking as well as its investment modes, They don’t know mark up is accepted Islamic Shariah, The bank is committed to run its all activities as per Islamic Shariah, IBBL Investments in this Important sector, ships of scrapping, rice, Pharmaceutical etc, IBBL investment modes in profitable sector and operate others function through its steady progress and continuous success has by now earned the reputation of being one of the leading private sector bank of the country.