An embedded option is a financial security provision (typically in bonds) that gives a certain right to an issuer or holder of a security, but not an obligation to take certain acts at some point in the future. It is an inseparable component of another defense, which as a stand-alone entity cannot exist. The consideration of an embedded option can physically affect the estimation of that monetary security. Some basic sorts of securities with embedded options incorporate callable security, puttable security, convertible security, extendible security, replaceable security, and covered coasting rate note. If they are not mutually exclusive, a bond can have several embedded options. In reality, embedded options make investors susceptible to reinvestment risk and expose them to the likelihood of price appreciation being restricted.

Protections other than bonds that may have inserted choices incorporate senior value, convertible favored stock and interchangeable favored stock. The embedded options exist just as a part of monetary security, for example, a security or stock and can’t be isolated from it. An embedded option, usually associated with bonds, is a function that enables holders or issuers of financial securities to take specific action against each other in the future. The importance of a defense may be materially influenced by embedded options. Multiple embedded options can contain one protection. The lone limitation in such a case is that the choices can’t be totally unrelated. For example, a bond can’t accompany both call and put embedded options since the two alternatives are fundamentally unrelated.

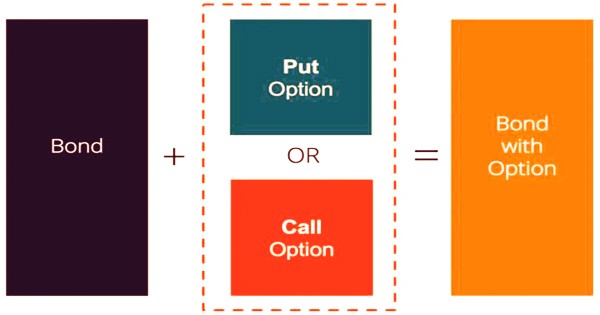

Embedded options are different from bare options that trade independently from their underlying securities. Compared to the valuation of their plain vanilla counterparts, the valuation of financial securities with embedded options is certainly a more sophisticated method. In the latter group, traders may buy and sell call and put options, which are essentially separate securities from the investments themselves. The valuation of securities with an embedded option is basically a combination of the valuation of plain vanilla bonds or stocks and the valuation of options.

The valuation of these securities blends bond- or equity-valuation with option pricing, as applicable. In comparison, embedded options are inexorably connected to the underlying security; they cannot, therefore, be purchased or sold separately. For financial markets, embedded options can be extremely advantageous. Such alternatives by and large furnish the two financial backers and organizations with a wide level of adaptability to build up the most fitting plan of monetary security to more readily suit the requirements of the elaborate gatherings. The complexity of the securities, on the other hand, makes their pricing less stable, which in turn can result in higher risk.

Embedded options give investors the power to redeem a security prematurely. It can be divided into two main categories: those that provide financial security issuers with rights, and those that provide financial security holders with rights. The options which grant the issuers of financial security rights contain the following provisions:

- Call provision: A bond issuer is entitled to redeem the bond before the maturity date. In general, callable bonds have higher coupon rates to compensate investors for the possible risk of a bond being repurchased early.

- Capped floating rate provision: The maximum interest rate that an issuer can pay to investors is defined by a bond with a capped floating rate clause.

The option price, as measured using Black Scholes, is then applied to or subtracted from the price of the ‘straight’ bond, depending on the form of option (i.e. as if it had no option) and this total is then the value of the bond. After the estimation of the security is resolved, different yield esteems, for example, respect development and the running yield, may then be determined. Options that deliver rights to the holders of a financial security come with the following provisions:

- Put provision: The bond holder has the right to claim early redemption of the principal sum of the bond. On fixed dates, the embedded put option is exercisable. Puttable bonds, unlike callable bonds, bear lower coupon rates to reimburse the issuers of the bonds.

- Convertible provision: At a fixed rate, the issuer of a bond has the right to turn the bond into common stock at some stage in the future. Additionally, preferred shares are also tied to a convertible clause.

- Exchangeable provision: A security holder (typically a bond or preferred stock) has the right to convert the security into the common shares of a company other than the issuer at a fixed rate and in the future at some point.

- Extendable provision: The issuer of a bond is entitled to extend the bond’s maturity date. There is uncommon use of this type of embedded alternative, and its primary application takes advantage of long periods of declining interest rates.

- Floored floating rate provision: The minimum interest rate that investors will earn from the issuer is stated in a bond with a floor floating rate clause.

In a trust indenture, embedded options on a bond are spelled out, which delineates the terms and conditions that must all be met by trustees, bond issuers and bondholders. It exposes investors to the danger of reinvestment as well as the potential for the appreciation of limited prices. If an investor or issuer exercises the embedded option, reinvestment risk manifests if the receiver of the transactional proceeds is barred from reinvesting them.

Information Sources: