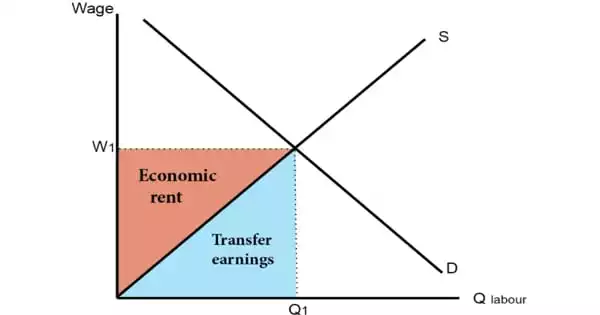

Economic rent is defined as money earned in excess of what is economically or socially necessary. In economics, economic rent is any payment made to an owner or factor of production that exceeds the costs of bringing that factor into production (in the context of a market transaction). This can happen, for example, when a buyer attempting to obtain an exclusive good or service makes an offer before hearing what a seller considers an acceptable price. It can be found in a variety of contexts, such as labor markets, real estate, and monopolies.

Economic rent is defined in classical economics as any payment (including imputed value) or benefits received for non-produced inputs such as location (land) and assets formed by establishing official privilege over natural opportunities (e.g., patents). Economic rent includes income gained by labor or state beneficiaries of other “contrived” (assuming the market is natural and not the result of state and social contrivance) exclusivities, such as labor guilds and unofficial corruption, in the moral economy of neoclassical economics.

Formula

Economic Rent = Agreed Price – Free Market Price

According to the formula, the value of economic rent can be calculated by subtracting the free market price from the agreed-upon price of the factor of production. The agreed-upon price is the price reached between the buyer and the producer. Furthermore, the free-market price is the amount paid by the producer in the normal market.

Overview

Economic rent is opposed to producer surplus or normal profit in the moral economy of the economics tradition in general, both of which are theorized to involve productive human action. Economic rent is also unaffected by opportunity cost, in contrast to economic profit, where opportunity cost is a critical component. Economic rent is defined as unearned revenue, whereas economic profit is a more specific term that refers to surplus income earned by selecting between risk-adjusted alternatives. Economic rent, unlike economic profit, cannot theoretically be eliminated by competition because any actions taken by the recipient of the income, such as improving the object to be rented, will change the total income to contract rent. Nonetheless, total income is comprised of economic profit (earned) plus economic rent (unearned).

Economic rent may be derived from the legal ownership of a patent in the case of a manufactured commodity (a politically enforced right to the use of a process or ingredient). For education and occupational licensing, the number of permits and licenses is collectively controlled by knowledge, performance, and ethical standards, as well as the cost of permits and licenses, regardless of the competence and willingness of those who wish to compete solely on price in the area being licensed.

In the case of labor, the existence of mass education, labor laws, state social reproduction supports, democracy, guilds, and labor unions can generate economic rent (e.g., higher pay for some workers, where collective action creates a scarcity of such workers, as opposed to an ideal condition where labor competes with other factors of production on price alone). Most other forms of production, including agriculture and extraction, are subject to economic rent due to scarcity (uneven distribution) of natural resources (e.g., land, oil, or minerals).

When economic rent is privatized, the person who receives it is referred to as a rentier.

Economic rent is distinct from other forms of unearned and passive income, such as contract rent. This distinction has significant implications for government revenue and tax policy. Governments can collect a portion of economic rent for the purpose of public finance as long as there is sufficient accounting profit. In the case of resources such as minerals and oil and gas, for example, a government can collect economic rent in the form of royalties or extraction fees.