Chapter 1: Introduction

1.1 Background

In today’s dynamic world, every human activity is getting influenced by technological advancements. The highest impact of technology can be observed in the area of business. Doing business has become really complicated, with a wide array of tasks to be fulfilled. The core business activities did not, however, change. A firm still needs to produce goods and or services, and it also has to market the goods and or services. These activities had their boundaries and limitations, previously. But today, the possibilities seem infinite. Today’s effective business strategy may get obsolete tomorrow. This phenomenon is most obviously detected in the area of marketing.

Marketing in the year 2003 is very much different from what it was even ten years ago. Marketing activities of a firm mainly consists of the decisions regarding its four P’s—Product, Price, Place and Promotion. If we take a closer look, we can see that products have changed a lot, aligned with the changing demographic profiles of us human-beings, as well as due to different emergent and modified human needs. Previously we needed television sets for entertainment. But nowadays DVD player, surround sound system, etc. accessories are also being demanded alongside. Thus we see millions of product offerings from the manufacturers, each having its own target market. Whenever the topic of targeting comes forward, customization also comes into attention. Mass marketing is losing its appeal and effectiveness in a really fast pace.

Targeting, segmentation, customization and Niche Marketing are today’s marketing jargons. Thus firms are customizing their product offering according to the specific needs of the niche’s. Similarly, the other three marketing activities are also being aligned with this Niche concept.

The Hong Kong and Shanghai Banking Corporation, Bangladesh (HSBC) is also trying to practice such a niche marketing policy. Recently they have launched an e-mail marketing campaign. The market segment consists of the existing 35,000 clients of HSBC. However, all 35,000 customers are not being targeted for this campaign. Understandably, the customers who have access to e-mail are targeted. The overall campaign has been divided into a number of steps. Successful completion of all the steps will mean the beginning of a new era of marketing in our country. This campaign and all of its details are being managed by a software solution, named Amacis Visibility.

1.2 Objectives of the Research:

The objectives of this research are:

v To implement a new mean of marketing

v To update the customer database of HSBC Bangladesh

v To judge the effectiveness of an e-mail marketing campaign

v To inform existing customers about new product offerings, in a cost effective manner

1.3 Significance of the Study

This study is very important for the marketing department of HSBC Bangladesh. Our country is still lagging behind most other Asian nations in terms of adaptation of information technology. Though many professionals of our country are provided with e-mail addresses from their organizations, many do not use them. This is a challenging venture for HSBC. The campaign cost is quite high. If the first campaign fails to raise the desired rate of response, HSBC Bangladesh will think twice before launching such campaigns. If the customers get comfortable with e-mail correspondence, they can be directly informed about all changes in policies and products. Currently, if there is a change in policy, each and every customer needs to be informed via postal services. This becomes very costly, because HSBC uses privatized courier services for such purposes. If every customer used an e-mail address, they could be informed through incurring almost zero cost.

1.4 Expected Findings (Hypotheses):

It is expected that the following things will be found from the research:

v About fifty percent customers of HSBC has an e-mail address

v About fifty percent of these customers regularly check their e-mail accounts

v Fifty percent customers of HSBC are comfortable with electronic correspondence

v Ten percent customers of HSBC respond to promotional offers sent via e-mail

v Impact in sales and customer satisfaction levels due to the introduction of e-mail marketing

v What percentage of customers click on the hyperlinks included with the e-mail messages

The marketing department of HSBC believes that at least 50% of the customers will have their own e-mail addresses. They also believe that around 60 to 70 percent of the customers will accept e-mail correspondence as a viable option. They are also expecting a 30 to 40 percent response rate.

1.5 Methodology

In this research, two types of data had been used. The primary data was collected from the customers through telephone interviews. As a rule of thumb, the following sequence of approach was used:

1. Cell Phone (if any)

2. Office Phone (if any)

3. Home Phone (if any)

If a person could not reached after making three phone calls, his e-mail address field had to be marked as “N/A” or “Not Available”. However, there were some exceptional cases. Some customers could be reached at the third phone call, and they would request the researcher to call back at a later time or date. These customers were called back. This way some customer’s were called even four to five times. On average, the research team approached one thousand customers in a week. Any customer belonging to one week’s thousand list was not called after the week ended. This rule decreased the consistency of the study, but it was required, because after 1,000 entries were collected, the researcher had to close their fields by inputting data into the database.

The data collection was affected by a number of variables, e.g. number of phones used in interviewing, time used per phone call, number of persons making phone calls, etc. The population was 35,000 customers of HSBC. Secondary data here was the previously compiled database, which had e-mail addresses of some customers, as well as their phone numbers, occupation, address etc. This data aided the researchers in tracing the customers and getting the e-mail addresses from them.

1.6 Limitations of the Study

The limitations of the study are:

v Time: It is quite impossible to contact 35,000 customers within a time frame as short as three months. Thus the researcher could not reach all customers within the allotted time, which questions the validity of the research findings.

v Chittagong Branch: HSBC has one branch in Chittagong branch, which has a lot of customers itself. These customers could not be reached by the researcher, who was working in Dhaka.

v Lack of facilities: Some essential facilities like land phone lines, updated secondary data, etc. were not readily available; during the data collection phase. Many HSBC customers have changed their phones, occupation and home address. These changes have not been reflected on the existing database, which was used in data collection.

v Unwillingness of the Customers: Some customers were not willing to disclose personal information over telephone. No alternative means of collection could be used, which forced the percentage of e-mail addresses to be lesser than it actually is. Some customers also declined to be contacted via e-mail address.

v Phone Problems: A percentage of customers could not be reached due to certain factors like continually engaged phone lines, unavailability in all the phone numbers provided, etc. Some people kept their cell phones off, and others asked the researcher to call back later. Mobile phone network problems also hampered the study. The researcher was provided with Citycell mobile phone; which has a serious connectivity problem with Grameen Phone cells. This factor also hampered the data collection.

1.7 Budget for the Study

(a) Financial Budget:

HSBC recruited three interns for this research. Each received Taka 4,500 as salary per month, for three months. The other cost components were telephone bills, printing costs, PC usage costs, etc. The approximate budget was:

| Researchers Remuneration (Total) | 4500×3×3= | 40,500 |

| Telephone Bills | 3500×3×3= | 31,500 |

| Other Costs | 1000×3×3= | 9000 |

Total Cost 81,000

(b) Time Budget:

The whole project took three months to complete. After the successful collection of 10,000 e-mail addresses, the first series of e-mails were forwarded to the customers. After that, the outcomes of the campaign were closely analyzed. However, data collection continued up to the end of the three month period.

Chapter 2: A Brief Overview of the Banking and Finance Sector of Bangladesh

2.1 Bangladesh Bank: The Regulatory Body

The Bangladesh Bank is the country’s central bank and is responsible for issuing and maintaining the value of the currency. It oversees the banking system and implements the government’s financial and monetary policies. With the exception of foreign banks, Bangladesh’s banking system was government-owned until 1982. The government is increasingly allowing more private commercial and investment banks to increase competition. Of the 52 licensed banks in June 2001, four were nationalized commercial banks, five were specialized banks, 30 were private commercial banks, and 13 were foreign banks. Other financial institutions, such as the Industrial Promotion and Development Company of Bangladesh, take an active part in financing industrial projects. The functions and responsibilities of the Bangladesh Bank are not clearly defined, and it lacks autonomy in such core areas as the licensing of new banks, monetary and exchange rate policies, and supervision of the nationalized commercial banks, which together account for over 50% of both total deposits and lending. Although major policy reforms have been undertaken during the past few years, including deregulation of interest rates, strengthening of standards of loan classification and provisioning, and elimination of the Bangladesh Bank’s control over most financial transactions, the financial sector continues to be underdeveloped and inefficient.

There are two bourses in Bangladesh: the Dhaka Stock Exchange (DSE) and the Chittagong Stock Exchange (CSE). The Securities and Exchange Commission (SEC) is the market watchdog but has been criticized for weak governance. Allegations of insider trading continue to affect investor confidence. There are less than 250 listed companies and turnover and liquidity are low. A stock market bubble was created by manipulation of the stock markets in July-November 1996 and the DSE all-share index peaked at 3,600 in November 1996. The index has been trading in a range of 540-670 in the last few years. The ratio of market capitalization to GDP is now less than

3% and is small compared to other countries in the region. Automated online real-time screen-based trading was launched in 1998. The DSE-20 price index, which lists the largest companies, was launched in January 2001.

2.2 Industry Analysis

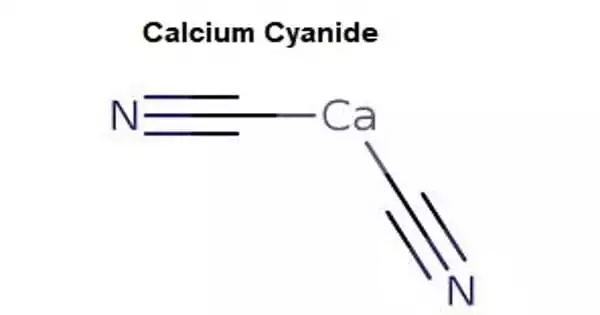

According to Hill, “An Industry can be defined as a group of companies offering products or services that are close substitutes for each other.” Close substitutes here refers to products or services that satisfy the same basic consumer needs. In order to understand an entity’s business, one needs to take a closer look at the industry where the entity is operating. Here, the banking industry of Bangladesh will be analyzed through the usage of two models, namely Porter’s Five Forces Model and the Industry Life Cycle Model.

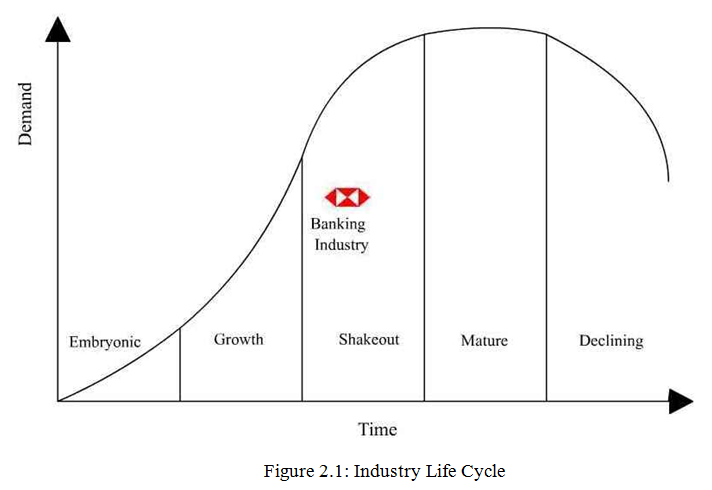

2.3 The Industry Life Cycle Model

The industry life cycle model is a useful tool for analyzing the effects of an industry’s evolution on competitive forces. Using this model, we can identify five industry environments, each linked to a distinct stage of an industry’s evolution. The stages are:

- Embryonic Industry Environment

- Growth Industry Environment

- Shakeout Industry Environment

- Mature Industry Environment

- Declining Industry Environmen

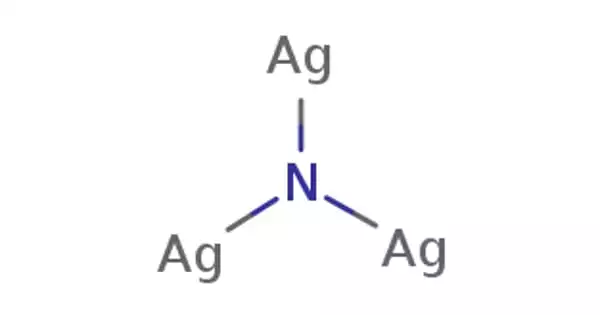

It is very important for a business entity to have a clear idea regarding the industry life cycle. Each stage of the life cycle requires unique and differentiated strategy formulation. If we analyze all the characteristics of the life cycle model, we can see that the banking industry of Bangladesh is in its growth stage. However, the shakeout stage does not seem too far a reality. Some of the characteristics of the shakeout stage are already evident.

In the growth stage, the demand for the industry’s product begins to take off. It is quite evident that the demand for banking services in Bangladesh has increased gradually, throughout the years. The increasing number of banks and their differentiated offerings bolsters this fact. Rivalry among the competing banks is getting intense, day by day. However, the rivalry among competitors in a typical growth industry is low. High rivalry begins at the shakeout stage. However, many authors do not distinguish between these two stages. The justification of low rivalry among companies is that all of them keep themselves indulged in market share building. As demand is ample and supply is comparatively low, anyone can enter the market and get their share of the profit. Banks in our country passed through that stage, and now the market is shrinking day by day. The growth rate has fallen, and slowly the demand is approaching the saturation point. Most banks have prepared themselves for the intense competition which is the core characteristic of the shakeout stage. It is expected that interest rates and service charges for the different banking services will sharply decline in the coming years.

2.4 Porter’s Five Forces Model

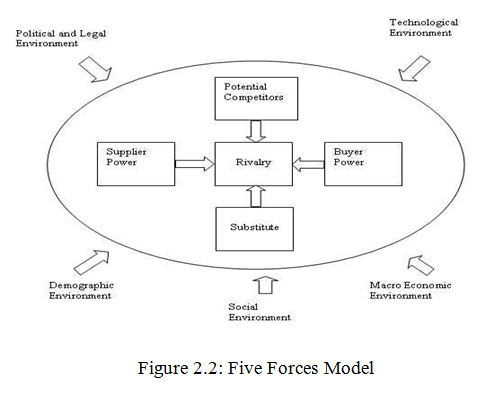

The model focuses on five forces that shape competition within an industry:

Figure 2.2: Five Forces Model

- The Risk of New Entry by Potential Competitors

- The Degree of Rivalry Among Established Companies Within an Industry

- The Bargaining Power of Buyers

- The Bargaining Power of Suppliers

- The Threat of Substitute Products

Porter argues that the stronger each of these forces is, the more limited is the ability of established companies to raise prices and earn greater profits. Thus, a strong competitive force can be regarded as a threat since it depresses profit. Similarly, a weak competitive force can be viewed as an opportunity, for it allows a company to earn greater profits.

2.4.1 Potential Competitors

Potential competitors are companies that are not currently competing in an industry but have the capability to do so if they choose. The banking industry in our country is still in its growth stage. So the threat of potential entrants is quite high. Usually the existing companies try to deter potential competitors by setting certain entry barriers. Barriers to entry are factors that make it costly for companies to enter an industry. The common barriers to entry are Brand Loyalty, Absolute Cost Advantage, Economies of Scale and Government Regulations. In Bangladesh, the question of Brand Loyalty is somewhat evident in the banking industry. A person who is a loyal customer of a local or government owned bank usually does not opt for an account in a multinational bank, whatever lucrative the benefits seem. This creates barriers for new entrants. No bank enjoys an absolute cost advantage, due to the fragmented nature of the industry. “Fragmented” industry and its attributes will be discussed in the following section. Most of the government banks and some local banks enjoy scale of economy; due to the fact that they have been doing business for quite a long time, and they have branches all over the country. The multinational banks are also on the process of achieving scale of economy. The increasing number of branches supports this statement. Government regulation is quite supportive towards the formation and operation of new banks. So this factor is not a significant entry barrier in this sector.

2.4.2 Rivalry Among Established Companies

The second of Porter’s five competitive forces is the extent of rivalry among established companies within an industry. If this rivalry is weak, companies have an opportunity to raise prices and earn greater profits. If rivalry is weak, companies have an opportunity to raise prices and earn greater profits. The extent of rivalry among established companies within an industry is largely a function of three factors:

a) The industry’s competitive structure

b) Demand conditions

c) The height of exit barriers in the industry

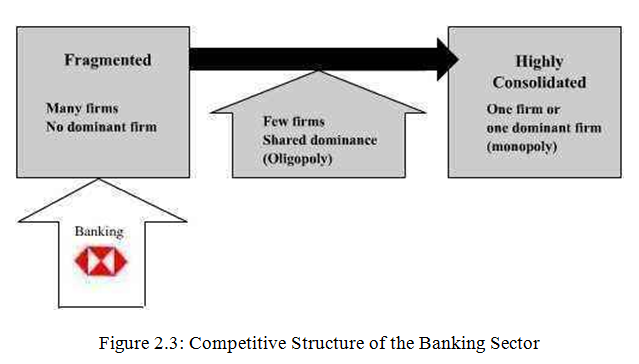

a) The Competitive Structure

Competitive structure refers to the number and size distribution of companies in an industry. Structures vary from fragmented to consolidated and have different implications for rivalry. A fragmented industry contains a large number of small or medium-sized companies, none of which is in a position to dominate the industry. A consolidated industry may be dominated by a small number of large companies (oligopoly) or in extreme cases, by just one company (a monopoly). In many countries, banking is a consolidated industry, with a few major players in the market. But in our country, the industry is very much consolidated, as a whole.

The prime characteristics of a fragmented industry are low entry barriers and identical product offering from the firms. Such is the case in our banking industry. Banks operate with pre-fixed and unanimously agreed interest rates, and their offerings are somewhat identical. The only way to differentiate product offerings from those of the competitors is to lower prices. Such phenomenon occurs as new entrants flood into a booming fragmented industry. This also creates excess capacity. A vicious price war is usually followed by the situation of excess capacity. It can be expected that our banking industry will experience severe price cuts in the following years. As a whole, a fragmented industry increases competition, and it also depresses overall industrial profitability.

b) Demand Conditions:

An industry’s demand conditions are another determinant of the intensity of rivalry among established companies. Growing demand from either new customers or additional purchases by existing customers tends to moderate competition by providing greater room for expansion. Growing demand tends to reduce the rivalry because all companies can sell more without taking market share away from other companies. In the case of banking, the demand has been growing at a satisfactory rate, throughout the last decade. However, it is not certain whether the trend will sustain or not.

c) Exit Barriers

Exit barriers are economic, strategic and emotional factors that keep companies in an industry even when returns are low. If exit barriers are high, companies can become locked into an unprofitable industry in which overall demand is static or declining. The common exit barriers are:

i. Investment in plant and equipment that have no alternative uses and cannot be sold off.

ii. High fixed costs of exit

iii. Emotional attachments to an industry

iv. Economic dependence on the industry

In order to keep up-to-date with today’s complicated banking practices, a bank needs to invest on computers, software, secured vaults, security systems and different other controlling and monitoring measures. Most of these assets are customized, and therefore serves the purposes of the intended organization, only. This customization nullifies the resell value of these assets.

High fixed costs of exit can appear in the form of employee severance payments, and also in the form of government penalties, etc

Many local banks of our country have become part of our everyday lives. They had been their since our ancestors were born. Thus many people, both within the government and the mass have emotional attachments with these banks. This acts as a serious exit barrier for these banks. So, in spite of being highly inefficient and loss bearing, some banks are still operating.

Some banks are so big that shutting any of them will give a serious blow to our foreign and domestic trade. Such an occurrence can impact the whole economy.

2.4.3 Buyer and Supplier Defined

In a typical industry, the buyers are the customers that avail the offerings from the incumbent firms. On the other hand, suppliers are the firms that provide raw materials for the producers. Using their raw materials, the firms produce goods and sell it to the customers. This is a typical buyer-seller scenario. However, the banking industry is a bit different from a typical industry. The two major functions of a bank are providing money depositing facilities and loan facilities. When a person takes a loan from a bank, he is a buyer. However, when he deposits his money to the same bank, he becomes the supplier. Thus the same individual can become the buyer and seller, simultaneously. The directors of a bank are also suppliers for that particular bank.

2.4.4 The Bargaining Power of Buyers

Bargaining power of the buyer can be viewed as a competitive threat when they are in a position to demand lower prices from the company or when they are in a position to demand better service that can increase operating costs. On the other hand, when buyers are weak, a company can raise its prices and earn greater profits. For the banking industry buyer means customers who take loan from the banks. The bargaining power of the buyers depends on the following factors:

a) Number of Loan Applicants:

There are more than 50 banks in our banking sector including multinational and nationalized banks. There are not enough original business loan applicants in our country. Investment opportunities are not growing as well; for lots of other factors. So, banks are setting with their idle money for giving loans; mostly in the form of personal credits. As a result, competition for doing business is increasing day by day among established companies.

b) Switching Cost:

Switching cost is very low in banking industry. Every bank is giving the similar types of loan at similar interest rate. So, an individual who wants to take loan from banks can switch easily to other banks if he or she doesn’t like the terms and conditions. Customers of HSBC bank are switching to other banks because of low interest rate and lots of other reasons. Lower switching cost makes the industry more competitive.

c) Threat of Backward Integration:

In banking industry, there is always a chance for threat of backward integrations. Big multinational companies or corporations can give threats to the commercial banks that they will arrange their funds by forming another bank where the cost of fund is low compared to other banks. For this reason, giant customers of this industry always possess more power than their banks. However, the individual non-corporate clients do not possess this type of bargaining power.

2.4.5 The Bargaining Power of Suppliers

Bargaining power of suppliers can be viewed as a threat when the suppliers are capable of forcing up the price that a company must pay for its inputs or reduce the quality of the inputs they supply, thereby depressing the company’s profitability. On the other hand, if suppliers are weak, this gives the company the opportunity to force down prices and demand higher input quality. For the bank the main supplier of fund is the depositor. Bank also gets its funds from the directors. So, the strength of the suppliers depends on the following factors:

a) Number of Supplier:

Bargaining power of the fund suppliers is low in banking industry because there are lots of individual savings in the economy but banks don’t have too many opportunities for investment.

b) Threat of Forward Integration:

Sometimes suppliers of funds can give threat to the bank as well. Corporations or big multinational companies can give threat to the private bank that they will form another bank for depositing their money. They will not supply any fund to other banks. We all know that bank makes money by investing other’s money. So, this can lead to a higher competition in procurement of fund.

2.4.6 The Threat of Substitute Products

The final force in Porter’s model is the threat of substitute products. Substitute products are those of industries that serve consumer needs in a way that is similar to those being served by the industry being analyzed. Loans, the major banking product, have some substitutes. All informal sources and channels of financing are treated as viable substitutes. Some wealthy individuals, whom are often usurers as well, lend out money at a very high interest rates. These loans do not often require securities, and also do not require any special conditions, e.g. age, certain service time, set monthly income, etc. which makes them a very lucrative option. However, most of these activities are illegal, and therefore bears high risk. For this reason, most people tend to avoid these channels. Thus it appears that the threat of substitute products is not that much prevalent in the banking sector of Bangladesh, till date.

2.5 Role of Macroeconomic Environment

The banking industry is not a self-contained entity. It is embedded in a wider macro environment—the broader economic, technological, social, demographic and political environment. Changes in the macroenvironment can have a direct impact on the banking sector, improving or deteriorating the profitability of the sector, permanently or temporarily.

2.5.1 The Macroeconomic Environment

The state of the macroeconomic environment determines the general health and well-being of the economy. This in turn affects a company’s ability to earn an adequate rate of return. The four most important factors in the macroeconomy are:

a) The growth rate of the economy

b) Interest rates

c) Currency exchange rates

d) Inflation rates

If the growth rate of the economy is high, consumer expenditure increases, which helps most businesses. However, the growth rate of our economy is moderate, which provides moderate opportunities for the banks to expand their operations and earn higher profits.

Interest rate is very significant for the banking industry. At the moment, interest rate is quite high in our country, compared to neighboring countries. Most personal loans bear an interest rate of at least 12 to 14% and above. This high interest rate is increasing the short term profitability of the industry, but in the long run, it is also acting as a hindrance towards building a better customer base.

Movement in currency exchange rates has a direct impact on the competitiveness of a company’s product, especially in the global market place. Providing “Trade Services”, e.g. processing export-import documents, maintaining export and import formalities, etc. is a major business of the country’s banks. Thus the exchange rates of the major currencies, e.g. dollar; euro, pound sterling, etc. have a direct impact on the banking industry.

Inflation can destabilize the economy, producing slower economic growth, higher interest rates, and volatile currency movements. Throughout the last decade, the inflation rate has come under control in our country, making its detrimental effects less significant. Thus the banking industry is not experiencing that much of difficulties due to inflation.

2.5.2 The Technological Environment:

Technological changes can act as a barrier to entry in an industry. Previously, the usage of computers and electronic databases were unknown to most people of our country. But the scenario has changed a lot in the last 8 to 10 years. After the elimination of duties on computers and accessories, the price of personal computers fell sharply. This created a boom in the computer industry. Most households in Dhaka now have at least one personal computer. Nowadays, people expect swift, hassle free service from the banks. Even the old and nationalized banks are realizing this fact. Installing all the modern banking equipments and computer systems can result in high fixed costs. Thus technological environment acts as a serious hindrance for entrepreneurs to setup their own banks, in our country.

2.5.3 The Social Environment

As with technological change, social change creates opportunities and threats. Due to changes in cultural values and education, people trust the banks more than ever. Previously, bank loans were perceived as a mean of getting bankrupt—through paying excessive interests. But today’s 4 years installment personal loans are gaining popularity. Borrowers are still paying interests, but they are not being compelled to live with the loan burden for 10 to 15 years—it’s all over within a brief time frame. All these factors are contributing positively towards the banking industry.

2.5.4 The Demographic Environment

Currently, individuals are getting established at a younger age. These individuals are the prime targets of many of the banking services like credit cards, personal loans, etc. Being younger in age, these individuals tend to spend more in luxury items, and they need to take loans in order to fulfill their desires. Realizing this opportunity, the banks cleverly brought out different loan schemes. This change in demographic environment has proven to be a great opportunity for the banks operating in Bangladesh.

2.5.5 The Political and Legal Environment

The political and legal environment of Bangladesh has never been impressive. This volatile environment creates a lot of difficulties for banks. Due to lack of law enforcement, the percentage of defaulted business loans had been historically high in our country. American Express Bank was compelled to shut down their corporate banking due to high number of defaulted loans. They simply got fed up while dealing with such troublesome customers. It is easy to recover loan money from small customers than from big businessmen—who are generally favored by the corrupt law enforcement agents of our country. This has become a very frustrating scenario for both the banks and for those people who genuinely need money for doing business. Neither party can fully trust the other. Unwanted strikes, hartals and political unrest have harmed the business of the banks as well. If the political and legal environment does not improve significantly, the banking industry’s performance will definitely be below par, in future.

2.6 The Concept of Strategic Groups Within Industries

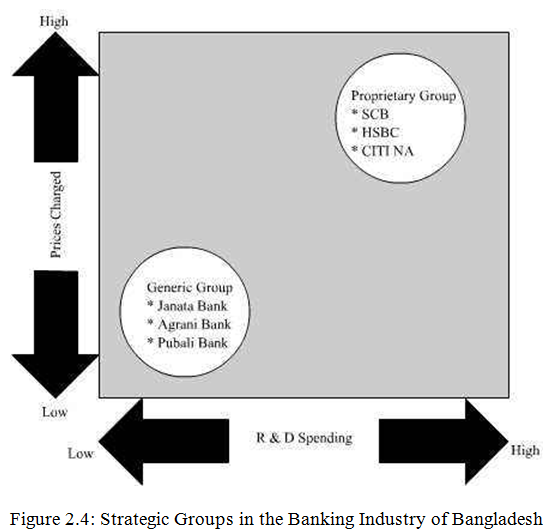

All firms within a certain industry do not act similarly, in most cases. They differ in terms of distribution channels, served market segments, product quality, technological leadership, customer service, pricing policy, advertising policy and promotions. As a result of these differences within most industries, it is possible to observe groups of companies in which each member follows the same basic strategy as other companies in the group but follows a different strategy than that of companies in other groups. These groups of companies are known as strategic groups.

2.6.1 Proprietary Group and Generic Group

There can be two types of strategic groups in a particular industry. One group spends a lot of resources in research and development. They bring out new products and services in order to attract customers. In the banking industry, the multinational banks like HSBC, Standard Chartered and also a few local banks like Eastern Bank, Dhaka Bank, etc. follow such a strategy.

This group is called the Proprietary Group. Banks that belong to this group pursue a high-risk/high-return strategy. The prices charged by these banks for their services are generally higher, which is apparent from the diagram shown above. They bear high risk, because their high R&D spending may bear no fruit. There is no guarantee that heavily researched and pre-tested products will do well in the market. What a bank believes to be a premium service might appeal the least to the customers. However, when a product does become popular, it usually brings a lot of fortune for the firm, mainly due to the premium price attached with it. These banks also devote a lot of resources in adopting new technology. That is why we see banks like HSBC to be fully equipped with the latest banking software as well as with the finest and fastest PCs, teller machines, vaults and security systems.

On the other hand, there are a number of banks who adopt a strategy which is totally different from what is adopted by the banks of the proprietary group. These banks belong to the generic group. The name suggests that, these banks will be generic in nature. They believe in providing no frills, traditional banking services. They are reluctant in spending high amounts in research and development. They are often the followers of what other banks adopt after doing research. They almost never equip themselves with the latest technologies. They use five years old technology, which is cheaper, yet functional. Understandably, the price charged by these banks is quite lower than the same of the proprietary banks. Their target market is totally different. While the minimum average account balance in HSBC bank is 50,000 Taka, one can maintain a zero balance and still have his account active in a generic bank.

2.6.2 Implications of Strategic Groups

Strategic groups help in defining the true competitive picture of an industry. Though belonging to the same industry, all banks do not compete against each other, directly. For this reason, HSBC does not have to position itself against the government banks.

2.6.3 Mobility Barriers within Strategic Groups

There are mobility barriers within the strategic groups. That is, a bank belonging to the generic group cannot just move itself up to the proprietary group, overnight. There are high mobility barriers in the banking industry of Bangladesh. This means, banks within a given group are protected to a greater extent from the threat of entry by banks based in other strategic groups.

E-mail marketing campaign on HSBC

Chapter 3: The Hongkong and Shanghai Banking Corporation (HSBC)

3.1 An Overview of HSBC Group

Headquartered in London, HSBC Holdings plc is one of the world’s largest banking and financial services organizations, with major consumer, commercial and investment banking and insurance businesses. The HSBC Group evolved from The Hongkong and Shanghai Banking Corporation Limited (Hongkong Bank), which was founded in Hong Kong with offices in Shanghai and London and an agency in San Francisco. The HSBC Group international network comprises more than 5,500 offices in 81 countries and territories, operating under well-established names in the Asia-Pacific region, Europe, the Americas, the Middle East and Africa. With primary listings on the London and Hong Kong stock exchanges, shares in HSBC Holdings plc are held by some 160,000 shareholders in more than 90 countries and territories. In the United States, investors are offered a sponsored American Depository Receipt program. Through a global network linked by advanced technology, the Group provides a comprehensive range of financial services: personal, corporate, investment and private banking; trade services; cash management; treasury and capital markets services; insurance; consumer and business insurance; pension and investment fund management; trustee services; and securities and custody services, The HSBC family is comprised of over 130,000 employees representing 81 countries and territories Following are the principal members of the Group,

| COMMERCIAL BANKING | INVESTMENT BANKING | OTHER FINANCIAL SERVICES |

| Banco HSBC |

BamerindusHSBC Asset

ManagementForward TrustBritish BankHSBC Equator BankHSBC financial

InstitutionFirst DirectHSBC Investment

BankHSBC GibbsHang Seng BankHSBC Investment

Bank AsiaHSBC Global payment and Cash ManagementHongkong BankHSBC Private BankingHSBC InsuranceHongkong Bank of

AustraliaHSBC SecuritiesHSBC MarketsHongkong Bank of

CanadaTrinkaus &BurkhardtHSBC Trade ServicesHongkong Bank of

Malaysia HSBC Bank of Roberts Marine Midland Bank Midland Bank

However, many of the members have changed their name into HSBC, The Hongkong and Shanghai Banking Corporation Limited to introduce the whole group under one brand name.

3.2 Key Developments of HSBC Group

Founded in 1865 in Hong Kong, this Group expanded primarily through offices established in Hongkong Bank’s name until the mid-1950s when it began to create or acquire subsidiaries. This strategy culminated in 1992 with one of the largest bank acquisitions in history when HSBC Holdings acquired Midland Bank, which was founded in the UK in 1938. The following are some key developments in the Group’s growth since 1959.

1959: Hongkong Bank acquires The British Bank of Middle East (formally the Imperial Bank of Persia) and The Mercantile Bank (originally the Chartered Mercantile Bank of India, London and China), which is subsequently integrated into Hongkong Bank.

1960: Wayfoong Finance, a Hongkong Bank hire purchase and personal finance subsidiary, is established.

1965: Hongkong Bank acquires a majority shareholding in Heng Seng Bank, now the second largest bank incorporated in Hongkong

1967:Midland Bank purchases a one-third share in the parent of London merchant bank Samuel Montagu.

1971: The Cyprus Popular Bank Limited (now Laiki Bank) becomes an associated company of the Group.1972: Hongkong Bank forms a merchant banking subsidiary, Wardley(now called HSBC Investment Bank Asia ), and an insurance subsidiary, Carlingford (now HSBC Insurance).Midland Bank acquires a share-holding in UBAF Bank (now known as Arab Commercial Bank).

1973: Samuel Montagu becomes a wholly owned subsidiary of Midland.

1978:The Saudi British Bank is established under local control to take over The British Bank of the Middle East’s branches in Saudi Arab.

1979:Hongkong Bank acquires 51% of New York State’s Marine Midland Bank Antony Gibbs becomes a wholly owned subsidiary. Midland acquires a controlling interest in leading German private bank Trinkaus & Borkhardt.

1980:Hongkong Bank of Canada is established in Vancourver. The Group acquires a controlling interest in Equator Holdings.

1981: Egyptian British Bank is formed, with the Group holding a 40% interest.

1983: Marine Midland Bank acquires Carroll McEntee & McGinly (now HSBC securities (USA) Inc), a New York based primary dealer in US Government securities. The Cyprus Popular Bank becomes an associated company of the Group.

1986: Hongkong Bank established Hongkong Bank of Australia, and acquires James Capel, a leading London based international securities company.

1987:Hongkong Bank acquires the remaining shares of Marine Midland and a 14.9% Equity interest in Midland Bank.

1988: Strategy alliance is entered into between Hongkong Bank and California-based Wells Fargo Bank. Midland Bank launches First Direct, the UK’s first 24-hour organization’s telephone banking service.

1989:A strategic alliance is entered into between The HongKong and Shanghai Banking Corporation and California – based wells Fargo Bank. Midland Bank launches First Direct, the UK’s first 24-hour organization’s telephone banking Service.

1991: HSBC Holding is established; its shares are listed on the London and Hong Kong stock exchanges.

1992: HSBC Holdings purchases the remaining equity in Midland Bank. HSBC Investment Banking is formed.

1993:The HSBC Group’s Head Office moves to London. Forward Trust, a Midland subsidiary, acquires Swan National Leasing, established the UK’s third largest vehicle contract hire company.

1994:Hongkong Bank is the first foreign bank to incorporate locally in Malaysia, forming Hongkong Bank Malaysia Berhad.

1995:Wells Fargo & Co. and HSBC Holding establish Wells Fargo HSBC Trade Bank in California to provide customers of both companies with trade finance and international banking service.

1997:Marine Midland Bank acquires First Federal Savings and Loan Association of Rochester in New York.

1999: Shares in HSBC Holdings begin on a third stock exchange, New York. HSBC Holdings acquires Republic New York Corporation (now integrated with HSBC USA Inc.) and its sister company Safra Republic Holdings S.A. (now HSBC Republic Holdings (Luxembourg) S.A.).Midland Bank acquires a 70% interest in Mid-Med Bank p.l.c. (now called HSBC Bank Malta p.l.c.), Malta’s largest commercial bank.

2000:HSBC and Merrill Lynch form a joint venture to launch the first international online banking and investment service company. HSBC reaches an agreement in principle to acquire 75% of the issued shares of Bangkok Metropolitan Bank, the eight largest banks in Thailand. HSBC acquires Credit Commercial de France (CCF) a major French banking group. Share as in HSBC holdings are listed on the organization’s stock exchange, in Paris.

2001:Agreement is reached for HSBC to acquire Barclay’s Bank’s branches and fund Management Company in Greece. CCF is chosen by the French Government to acquire Banque Hervet, a regional bank in France. HSBC Finance (Brunei) Berhad signs an agreement to acquire IRB Finance Berhad, a Finance company in Brunei.

2002:The Hongkong HSBC’s joint venture with Merrill Lynch to provide online investment and banking services to ‘mass affluent’ investors is integrated into the HSBC Group and continues to operate as Merrill Lynch HSBC. HSBC acquires the corporate banking and trade finance business of State Street Bank and Trust Company’s Global Trade Banking Australia business; Benkar Tuketici Finansmani ve Kart Hizmetleri A.S., a leading provider of consumer finance in Turkey; and Grupo Financiero Bital S.A. de C.V., one of Mexico’s largest financial services groups. HBSC purchases a 10% interest in Ping An Insurance Company of China Limited, the second largest life insurance operation in China; and agrees to acquire Household International, Inc., a leading US consumer finance company operating in 46 states.

2003: CCF agrees to increase its stake in French private bank Banque Eurofin SA to 71.21%, and to acquire a further two branches of Banque Worms in France, bringing the total number purchased to 13. HSBC acquires Keppel Insurance Pte Ltd, a provider of life insurance and Islamic insurance in Singapore; and increases its shareholding from 60% to 100% in Equator Holdings Limited.

3.3 Global Coverage of HSBC

HSBC is truly the World’s Local Bank, in a number of ways. The global presence of HSBC makes it really large banking institution. The following table clearly shows that the brand HSBC can be found in every nook and corner of the third planet of the solar system:

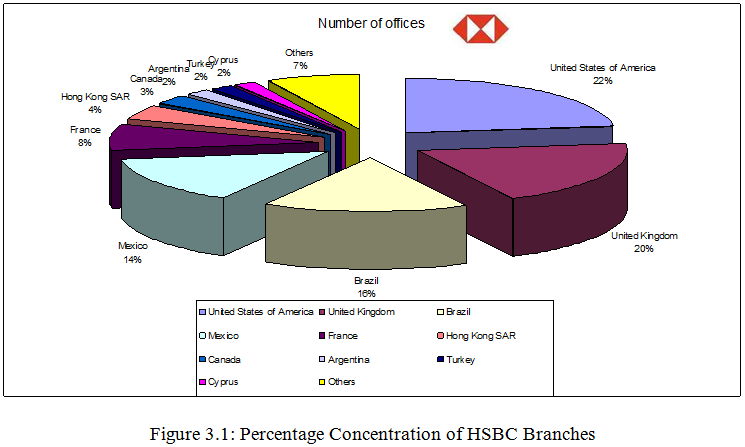

The following figure shows the percentage distribution of HSBC branches, around the globe.

USA, UK, Brazil. Mexico, France, Hong Kong, Canada, Argentina, Turkey and Cyprus jointly host 93% of the total number of HSBC branches. Bangladesh’s share is only a meager 0.051%.

3.4 Vision Statement of HSBC

“We Aim To Satisfy The Organization’s Customers With High Quality Service That Reflects The Organization’s Global Image As The Premier International Bank”

3.5 Objectives of HSBC

HSBC’s objectives are to provide innovative products supported by quality delivery of systems and excellence customer services, to train and motivate staffs and to exercise community responsibility. By combining regional strengths with group network HSBC’s aim is to be the bank of choice and one of the leading banks in its principle markets. HSBC’s goal is to achieve sustained earnings growth and to continue to enhance shareholders value.

Chapter 4: HSBC Bangladesh

4.1 HSBC in Bangladesh

HSBC Bangladesh started its operation on 17 December 1996 in Dhaka with a vision to satisfy its customers with high quality service that reflects its global image as the premier International Bank. In 1999 it has opened one Branch in Chittagong and two Booths in Gulshan and Motijheel. Recently, another Branch has started operating from 2 March 2003 in Dhanmondi. All of these offices were inaugurated by Mr. David G. Eldon Chairman HSBC Asia Pacific, during his visit in February 1999 and March 2003. HSBC Bangladesh also has an Offshore Banking Unit, which provides banking services for foreign companies based in the Export Processing Zones in Dhaka and Chittagong. HSBC Bangladesh also introduced the ATM and telephone banking facilities for personal Banking business.

4.2 Mission of HSBC Bangladesh

- We aim to become one of the leading Banks in Bangladesh by our prudence fair and quality of operations.

- We intend to meet the needs of our clients and enhance our profitability by creating corporate culture.

- We aim to ensure our competitive advantages by upgrading banking technology and information system

- We provided high quality financial services to strengthen the well being and success of individual, industries and business communities

- We believe in strong capitalization.

- We maintain high standard of corporate and business ethics.

- We extend highest quality of services, which attracts the customers to choose us first.

- We create wealth for the shareholders.

- We maintain congenial atmosphere for which people are proud and eager to work with HSBC Bank.

- We believe in disciplined growth strategy.

- We encourage various term investments to investors to buy our stock.

- We intend to plat more important in the economic development of Bangladesh and its financial relation with the rest of the world by interlining both domestic and international operations.

4.3 Organizational Structure of HSBC Bangladesh

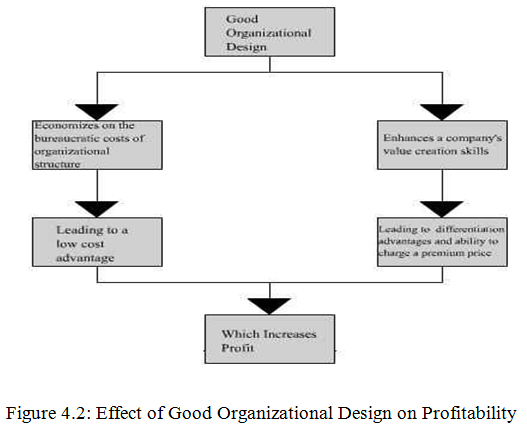

4.3.1Importance of Organizational Design

Organizational design means selecting the combination of organizational structure and control systems that lets a company pursue its strategy most effectively—that lets it create and sustain a competitive advantage. The primary role of organizational structure is twofold:

(1) To coordinate the activities of employees so that they work together most effectively to implement a strategy that increases competitive advantage.

(2) To motivate employees and provide them with the incentives to achieve superior efficiency, quality, innovation, or customer responsiveness.

Good organizational design increases profitability of a firm, as it can be seen from the figure. Thus a well planned organizational structure is crucial for a firm.

The organizational structure of HSBC Bangladesh has been created, keeping these factors in mind. The structure can be analyzed in terms of differentiation.

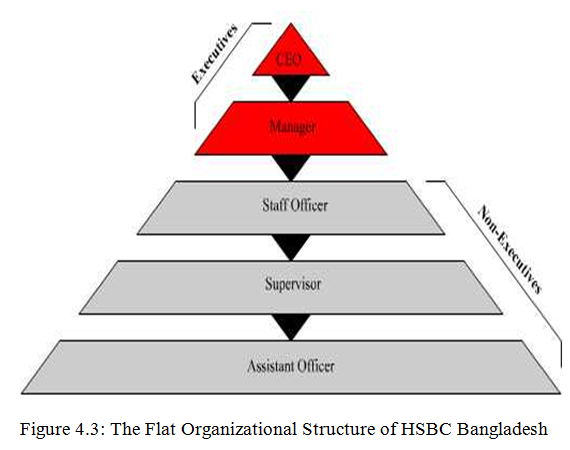

4.3.2 Vertical Differentiation in the Organizational Structure

The aim of vertical differentiation is to specify the reporting relationships that link people, tasks, and functions at all levels of a company. This means that management chooses the appropriate number of hierarchical levels and the correct span of control for implementing a company’s strategy most effectively. The organizational hierarchy establishes the authority structure from the top to the bottom of the organization. The span of control is defined as the number of subordinates a manager directly manages. The basic choice is whether to select a flat structure, with few hierarchical levels and thus a relatively wide span of control, or a tall structure, with many levels and thus a relatively narrow span of control.

HSBC bank Bangladesh has a flat structure, with only five levels in the management. The top most level is the CEO (Chief Executive Officer) level. The CEO, Mr. David J. Griffiths is the head of the organization. The next top position is Manager. The “Managers” of HSBC can be compared to the departmental heads of other organizations that are doing business in Bangladesh. The head of human resources is the HR Manager in HSBC. In other organizations, entry level employees are termed as “Executives”, which is a mistake. By definition, executives should be the topmost employees of an organization. In HSBC, CEO and the managers are called executive level employees.

The managers report to the CEO. The managers have three levels of non-executive employees reporting to them. When a person first joins HSBC, in most cases, he or she joins as an Assistant Officer. Only in extremely rare cases, where the applicant has ample job experience, a person might join as a Supervisor or Staff Officer. Supervisors and Assistant Officers are required to follow a predefined dress code. The dress code is relaxed for staff officers, the managers and the CEO. They may or may not wear the assigned dresses.

The flat structure of HSBC helps in keeping the bureaucratic costs low. Tall structure results in the following problems, which leads to bureaucratic costs:

1. Too many middle managers

2. Motivational problem

3. Coordination problem

4. Information distortion

HSBC is free from these problems.

4.3.3 Horizontal Differentiation in the Organizational Structure

Whereas vertical differentiation concerns the division of authority, horizontal differentiation focuses on the division and grouping of tasks to meet the objectives of the business.

HSBC Bangladesh uses the most popular and common structure, the functional structure. Functional structures group people on the basis of their common expertise and experience or because they use the same resources.

Functional structures have several advantages. First if people who perform similar tasks are grouped together, they can learn from one another and become better—more specialized and productive at what they do.

Second, they can monitor each other to make sure that all are performing their tasks effectively and not shirking their responsibilities. As a result the process becomes more efficient, reducing manufacturing costs and increasing operational flexibility.

A third important advantage of functional structures is that they give managers greater control of organizational activities. In HSBC, every department has reports to the CEO, COO or a manger of a particular department. Five departments report to the COO (Chief Operating Officer), who is the second most powerful individual at HSBC. The five departments are:

a) Financial Control Department (FCD)

b) Administration Department (ADM)

c) Hongkong Universal Banking (HUB)

f) Information Technology Department (IT)

g) Network Service Center (NSC)

The manager, corporate banking, is responsible for the following three departments:

a) Trade Services (HTV)

b) Payment & Cash Management (PCM)

c) Institutional Banking (IB)

All the branch managers report to the manager, Personal Financial Services (PFS). The sales team also reports to him. The sales team consists of MSO (Mobile Sales Officers) and call center representatives.

The other four departments report to the CEO. These are:

1. Marketing and Public Relations (GPA)

2. Human Resource and Training Department (HR)

3. Treasury (TRSY)

4. Credit and Risk Management (CRM)

5. Internal Control (MIC)

These departments are called the “Small” departments, due to smaller workforce.

All the departments follow the previously mentioned flat structure. That is, there are managers, supervisors, staff officers and assistant officers in almost all the departments. Corporate banking and PFS—these two departments have their own workforce. There are certain divisions within some departments, as well, e.g. HTV is divided into HTV Import and HTV Export.

4.4 Functions of the Major Departments

4.4.1 Information Technology (IT)

This department relates to all other departments in order to provide technical services. This department’s job is to plan, negotiate and purchase maintenance of IT, communications, PABX, security system etc.

Operations:

• Maintains communication media and security system.

• Provides technical support to LAN communication system.

• Maintains database

• Submit off-line batch run report

• Does trouble shooting

• Develop in-house software.

4.4.2 Hongkong Universal Banking (HUB)

This department is responsible for all offline branch run report. The HUB officer is responsible for coordination with Technical service department to ensure the system is used and understood to HUB’s full potential and is available to end user for maximum available time. It ensures department operations in accordance with group statement and procedure.

Operations:

• Assists HUB operations operated by other staffs.

• Execute trouble shooting

• Generate reports

• Controls HUB access

• Assists audit programs

4.4.3 Administration Department

Like that of any other organizations, the Admin department of HSBC makes sure that the organizations moves on with all its departments and staffs operating according to all the rules and regulations of the company. It also prevents any bottlenecks within the work process and ensures smooth functioning. The admin department has two divisions – General Administration and Business Support Services.

The general admin division is pretty much similar to the admin departments of other companies that ensure discipline and regulatory concerns. The business support services provide supports to the departments during employee leaves and sudden terminations so that the department can function without problems.

4.4.4 Network Service Centre

This department can be described as the ‘Power House’ of HSBC Bangladesh. NSC does the back office job for the bank. The main four jobs that are performed by NSC are Clearing, Scanning of signature cards, issuing checkbooks and sending & receiving Remittances. NSC looks after the clearing process of HSBC and makes necessary contact with the central bank for maintaining account flows. All the customer signatures are scanned in this department and are entered into the system. NSC also issues checkbook for new and old accounts based on requisition from various branches. ‘Remittance’ is a banking term, which means ‘Transfer of funds through banks’. When a bank remits on behalf of its customers, it is termed as outward remittance. On the other hand, when the bank receives the remittance on behalf of the bank, it is inward remittance. The following are the methods that NSC used to remit money for customers: Telegraphic Transfer (TT), Demand Draft (DD) & Cashier’s Order.

HSBC is nationally on-line. Anyone having account in any branch in Bangladesh can transact in any branch of HSBC Bangladesh. NSC facilitates this network-service. Any type of information about the customers are loaded or composed in the system through NSC.

Operations:

• Facilitates the network service.

• Updates the information system.

• Generate the Phone Banking PIN and the ATM PIN.

4.4.5 Financial Control Department

FCD is responsible for the preparation of the Annual Operating Plan (AOP), monitoring treasury risk limits, profit exposure and maintaining strong liquidity. FCD is the key member of the Asset Liabilities Committee (ALCO), which deals with how efficiently the bank’s assets and liabilities are managed.

Operations:

• Annual Planning.

• Analysis of the reports.

• Scrutinizing daily functional statement.

• Checking the accounts and giving necessary feedbacks.

• Monitoring risks and profits.

• Analysis of the transactions.

• Maintains bills and vouchers.

4.4.6 Treasury Department

This department deals with the cash management. As continuous cash transaction goes on and there is a limit of keeping money in the bank-volt this department should be sincere about the availability of money when needed. Moreover foreign exchange rates are also monitored by this department.

Operations:

• Monitor the call money rate.

• Monitor the foreign exchange rate.

• Confirm the availability of money.

• Cash management through participating in call money market.

• Fulfill the requirements of Bangladesh Bank.

4.4.7 Human Resources & Training Department (HRD)

The functions of Human Resources Department are strategic planning and policy formulation for compensation, recruitment, promotion, training, development and appraisal. This department also contributes to employees’ performance by providing standard of training.

Operations:

• To assist the top level decision making process on compensation, promotion, training,

development and appraisal.

• Communicate with all external and internal entities.

• Monitor leave, payroll, increments and allowances etc.

• Maintains financial flows related to HRD.

• Plan and arrange the development training programs for the employees.

• Ensure the standard of the group.

• Help to ensure the cost effectiveness.

• Provide full logistics supports to all departments for quality services.

• Deals with intra and inter communication for administrative issues

• Ensures value actability.

• Plan for development of the company.

• Facilitates admin officers’ job

• Develop plans for support services.

• Ensures security of the company

• Conduct the performance evaluation.

• Execute recruitment arrangements.

4.4.8 Internal Control

Internal Service Officer is responsible for ensuring quality. Through fulfilling audit requirements it maintains the local and group compliance.

Operations:

• Ensures the standard and services

• Ensures operational responsibilities

• Ensures group requirements.

4.4.9 Marketing Department

This department is responsible for increasing public awareness of the Bank’s name, products and services, image etc. HSBC is giving more importance on marketing its products and services through advertising in newspapers, billboards, banner and publishing leaflets, newsletter etc

Operations:

• Coming up with innovative and different promotional approaches.

• Conducting, Coordinating and organizing media activities.

4.4.10 Corporate Banking or Institutional Banking (CIBM)

This department deals with all types of banking with the institution or organization rather than personal financial services.

Operations:

• Market risk analysis regarding assistant liability

• Analysis of credit risk.

• Implementation and feedback of strategic decision

• Follow-up and facilitate documentation in corporate customer relationship.

• Assists the treasury department.

• Collect information from different organizations and maintain liaison with them.

• To monitor the corporate accounts on daily basis.

4.4.11 Trade Services (HTV)

This department maintains a close relationship with corporate banking, credit operations and personal banking for marketing selling trade services to the existing and targeted customers. This department handles all trade related businesses of the bank.

Operations:

• Deals with amendment and bills.

• Maintains customer relation and banking

• Maintains export and import formalities.

• Checks vouchers

• Process export-import documents.

• Ensure quality services for the customers.

4.4.12 Securities Department

This department facilitates the development of money market and investment activities of bank. This department explores the FI (Financial Institution) market; identify customers and FI related issues. Maintain close relation with the foreign exchange issues. The prime duty of this department is to make sure that the bank complies with BB (Bangladesh Bank), SEC (Stock Exchange Commission), DSE (Dhaka Stock Exchange), CSE (Chittagong Stock Exchange) and client reporting requirements.

Operations:

• Complies with financial institutions’ requirement.

• Monitor feedback and supervise operation in the financial markets.

• Make liaison with different level.

• Prepare the plan of activities for different department in the financial market.

• Facilitate the transfer of share certificate.

• Maintain documents related to share market.

4.4.13 Credit Management

This department coordinates the lending facilities. This is also a member of ALCO. This department is responsible for all necessary documents and securities related to corporate and personal lending.

Operations:

• Prepare and supervise credit approval

• Coordinates documents of Group and Bangladesh Bank

• Ensure customer credit documents and necessary papers.

• Analyses the financial statements of the customers and analyses the data to identify

possible risk.

• Conducts stock statements

• Deals with insurance documents

• Calculate and Analyze the profitability

There are two separate departments under Credit management: PFS credit which deals with individual lending and CMB credit which deals with the Commercial lending.

4.4.14 Personal Financial Services (PFS)

This department supervises the Customer Service Department (CSD), ATM (Automated Teller Machine) center & Product Development department.

Operations:

CSD

- Provides support for the customers, through phone or face to face

- Handles requests of changing of address and phone numbers

- Answers customer queries regarding products and services

ATM

- Ensures the trouble free operation of all the ATM centers

- Disburses money to the ATM centers

PFS Product

- Conducts research on new product possibilities

- Designs new products

- Designs product brochures

- Test markets products, internally

4.5 Business Principal and Values

The HSBC Group is committed to five Core Business Principles:

- Outstanding Customer Service;

- Effective and efficient operations;

- Strong Capital and Liquidity;

- Conservative lending policy;

- Strict expense disciplines;

Through loyal and committed employees who make lasting customer relationships and international teamwork easier to achieve these principles.

To conform to these principles the Group has defined value as:

• Valuing people (Applicable to both our customers and staff employees)

Staff: ensure amicable work environment foster trust among colleagues allow fairness to prevail at all times demonstrate sincerity and sense of belongingness ensure respectful environment.

Customer: make sure importance is assigned to each customer courteous behavior to be provided at all times to ensure that no tangible discrimination occurs.

- Quality First (Customer focused):

- provision of services that would be labeled as “value for money”

- provision for effective and efficient service

- priorities of customer satisfaction

- ensure commitments are met

- courage to apologies for mistakes rather than attempting to camouflage

- avoid complacency

- •Professionalism (Staff focused): Ensure staffs are thoroughly aware of respective responsibilities.

- Ensure job descriptions are executed properly

- Address areas where improvement may be necessary expeditiously

- Advocate team spirit

• Profit Driven (Internally focused):

Focus on augmenting/enduring profitability of the bank through a combination of:

1. selection of quality accounts

2. mitigation of avoidable expenses

3. remaining within compliance parameters (both local and Group)

- Innovative:

- quick to acclimatize/adapt to changes in test/demand/environment

- remain proactive

- remain flexible

- Integrity:

- Ensure moral uprightness and honesty among the staff

- Ensure soundness and wholeness in the job

To conform to the stated Group principles and above definition of value HSBC also operates according to certain Key Business Values (KBV). Those are:

• The highest personal standards of integrity at all levels;

• Commitment to truth and fair dealing;

• Hand-on management at all levels;

• Openly esteemed commitment to quality and competence;

• A minimum of bureaucracy;

• Fast decision and implementation;

• Putting the Group’s interest ahead of the individual’s;

• The appropriate delegation of authority with accountability;

• Fair and objective employer;

• A merit approach to recruitment/ selection/ promotion;

• A commitment to complying with the spirit and letter of all laws and regulations wherever we conduct our business;

• The promotion of good environmental practice and sustainable development and commitment to the welfare and development of each local community.

HSBC’s reputation is founded on adherence to these principles and values. All actions taken by a member or staff member on behalf of a Group company should conform to them.

4.6 Products and Services Provided

4.6.1 Corporate Credit

HSBC offers the convenient and flexible form of short-term financing for routine operating expenses and overheads of the company.

Import and Export Loans

Loans against import are available when the company purchases under Documentary Credit or Documentary Collections terms.

Pre-shipment finance is available to meet the working capital requirements. Advances are granted upon production of a buyer’s contract or export DC.

DP / DA Purchase

A cash advance is made when a company exports goods to a buyer through Documentary Collections, either on a Documents against Acceptance (DA) or Documents against Payments (DP) basis.

Long-term Loans

HSBC can customize a Term Loan to finance the fixed assets that the business needs (such as land, new premises, equipment and machinery). It may be a green-field project or an expansion of an existing plant that may be financed at competitive floating rate of interest.

Guarantees and Bonds

HSBC in Bangladesh issues a full range of Performance Guarantees, Advance Payment Guarantees, Financial Guarantees and Bid bonds for supporting the underlying business of the customers.

4.6.2 Trade Services

Export Services:

• Pre-shipment Finance

To assist the cash-flow when companies are manufacturing or packing the goods, HSBC can arrange pre-shipment finance facilities. A Packing Credit (PC) can be offered which will enable the company to purchase raw materials or other related expenses that may require to process and export.

• Post- shipment Finance

If the documents, after checking, are found to contain no discrepancies, HSBC can consider negotiating and paying the company the discounted value of the invoice. No facilities are required, and funds will typically be advanced on the same day if documents are presented before noon.

• Documentary Credit (DC) Advising

Electronic export DC Advising is a new and alternative way to receive a full copy of the Export Documentary Credits (DCs), amendments and export transaction advices via email. The service brings direct benefits to the business at no extra cost.

In this increasingly competitive environment, the Electronic DC advising services will help by offering:

– Enhanced Accuracy in the Preparation of Documents

– Convenience

– Reduced Courier Expenses

Import Services:

• Import bills

HSBC provides incoming documents against imports from Bangladesh that are processed for a fee by the Bank.

• Import Loans

HSBC provides the loans granted to importers to pay for their imports into Bangladesh.

• Shipping Guarantees

HSBC provides a guarantee issued to shipping companies to allow release of goods prior to arrival of import documents.

4.6.3 Payment and Cash Management

• Account management services

HSBC’s Global Payments and Cash Management services provide domestic and regional transaction solutions to blue-chip companies throughout the world. Services include a comprehensive range of traditional account and transaction services, augmented by HSBC’s liquidity and financial management techniques and delivered via our global electronic banking system, Hexagon.

HSBC’s commitment to service excellence, reputation for stability and understanding of the region has repeatedly been recognized through citations by major business publications. With the local expertise in Bangladesh, HSBC is well versed in local practices and regulations affecting the management of cash on a domestic and regional basis.

• Payment and collection

Country-wide Payments:

Most corporate treasurers cannot afford to spend time worrying about routine payments. HSBC in Bangladesh has the technology to put you in better control of routine operations and has been successfully handling payment requirements throughout the nation for its corporate clients. It provides the benefits, which include:

Country-wide Collection:

As receivable management is crucial to the financial cycle, HSBC has developed products to efficiently manage the requirements and reduce cost. The services and benefits include:

This payment and cash collection service provides the customer the following benefits:

– Reduction in payment time.

-Cost reduction through efficient fund management.

-Detailed MIS on cash collection and payment, resulting in better management.

-Reconciliation done through Hexagon.

-Centralization of control of all your cash and instruments.

-Network coverage of almost 200 locations nation-wide.

-Quicker cash collection in a central account, resulting in greater earnings.

• Hexagon cheque writer

The latest addition in the Payments and Cash Management services is Hexagon Cheque Writer. It is a cheque writer product which is also a built-in module of Hexagon, global electronic banking. It is designed to facilitate the corporate customers for preparing, printing and updating the PC ledger (ledger maintained in cheque writer). Services and benefits include:

Preparation of cheques through Hexagon Cheque Writer.

Reconciliation of cheques at the Hexagon ledger.

Advice along with cheque leaves.

No further installation required since it is built in our Hexagon module.

Recurrent payments can be stored and printed.

Convenience of in-house cheque printing.

4.6.4 Personal Financial Services

Banking Across the Country

The organization’s computer system provides the customer the opportunity to make transaction between accounts at different branches. No matter where the organization’s account is held the customer can withdraw money from any HSBC branch or ATM in Bangladesh.

Money Savings Schemes

HSBC offers both local and foreign currency current accounts and local currency savings accounts for its customers to save money.

Investment Schemes:

Both local and foreign currency time deposit schemes are offered by HSBC for its individual customers.

Personal Loan Schemes

HSBC offers Personal Installment Loan (PIL), Personal Secured Loan (PSL), Personal Installment Credit (PSC), Home Loan and Car Loan.

More details on these products are provided in the appendix.

Car Loan

Under the car loan scheme HSBC offers a loan up to 70% of the car value. Cash security or personal guarantee is not required for the loan. Cars can also be insured at discounted rates.

Education Loan

HSBC’s education loan can help the customer accomplish the desire for higher studies. Cash security or personal guarantee is not required.

Support Services

To make the products more attractive HSBC offers free ATM cards and ATB pins to its customers with its products. The benefits of ATM card are described under the description of ATM centre in the project part and the features and facilities provided by ATB are given below:

To avoid the long queues at the branch HSBC offers the Phone-banking service, doing the banking is just a phone call away. The futures of phone banking are,

• Private and Secure: Phone-banking is designed for total privacy. To ensure the confidentiality of the transactions, the account can be activated only by keying in both the Phone-banking Number (PBN) and the Personal Identification Number (PIN). User can also change the PIN as often as he or she like for added security.

• Fast and Easy: Simple-to-follow instructions, will guide the user all the way through multiple transactions. For added convenience HSBC has developed a Quick Search function to speed the various transactions.

• Comprehensive: The Phone-banking service allows the user to perform a wide range of transactions, from fund transfers to term deposit placements.

The facilities of phone banking are,

- Check balances on the primary and linked accounts

- Transfer funds between one’s own accounts

- Hear the details of the last five transactions

- Order a statement

- Order a chequebook

- Pay bills to pre-designated third parties in local currency

- Report a lost or stolen ATM card

- Open or renew a time deposit

- Enquire about foreign exchange rates

4.7 Pricing Information

A quick guide to personal banking charges

A quick guide to personal banking charges is intended to give a clear picture of the fees HSBC charges for their most commonly used services. HSBC hopes that the simple tables will help the customers manage their money more effectively. The sections on specific account types should be read in conjunction with the section entitled “general services—all accounts”.

The charges in this guide were correct at the time of printing (July 2002) but remain subject to change. These changes are applicable only to the accounts maintained in Bangladesh with The Hongkong and Shanghai Banking Corporation Limited, which reserves the right to introduce charges not included in this guide. For charges that are not mentioned in this guide, please refer to the relevant promotional material.

Payment of foreign currency notes is subject to availability. The charges for remittances do not include any charges that may be imposed by other banks.

General services—all accounts

| Item | Charge |

| General Services | |

| To issue a Bangladesh Bank Cheque | Tk. 250 |

| To issue a foreign currency Demand Draft drawn on Bangladesh Bank | USD 10 or equivalent |

| Processing of Student Remittance Application Customer | Tk. 5,000 per student per annum |

| Application to Bangladesh Bank under 18A/18B of FER Act | Tk. 1,500 |

| 50% Salary Remittance for foreigners | Tk. 2,000 per year + each individual remittance fees |

| Cashiers Order (Pay Order) | |

| To issue a Cashier’s Order | Tk. 300 |

| Cancellation of Cashier’s Order | Tk. 250 |

| Standing instructions | |

| To Set up, amend or suppress Payment(s) instruction | Tk. 500 per annum |

| Each standing instruction returned as a result of | |

insufficient fundTk. 300Transaction ChargeThe bank reserves the right to levy a charge on transactions conducted

| ATM Cards | ||

| Local ATM Cards | ||

| ATM Card | Free | |

| Annual Fee | Free | |

| Replacement fee for lost or damaged card | Free | |

| Foreign currency ATM cards | ||

| Annual fee | Tk. 500 per year | |

| Replacement fee for lost or damaged cards | Free | |

| Phonebanking | Free | |

| Request for Banker’s reports | ||

| Credit/Solvency report/Certificate | ||

| Each report provided to local banks by mail/facsimile | Tk. 500 | |

| Each report provided to overseas banks by mail | Tk. 1000 | |

| Each report provided to overseas banks by Facsimile/Telex | Tk. 2000 | |

| Each supplementary copy | Tk. 300 | |

| Certificate of balance/solvency | ||

| To certify the balance/solvency of each account for current year | Tk. 500 if needed the same day | |

Tk. 300 if needed the next day

| Duplicate advice/statement | |

| Up to 1 year | Tk. 500 |

| More Than 1 year | Tk. 1000 |

Deposit accounts/services

| Item | Charge | |

| Savings & Current accounts | ||

| * Relationship fee | Tk. 250 per quarter for average relationship less than Tk. 50,000 for a quarter | |

(3 monthly basis)* (Relationship is all accounts under one customer ID. i.e. Loans, FCY and Taka accounts)Account closureClosing of accountsTaka AccountsTk. 300Foreign Currency A/CUSD 10/GBPSClosing of unsatisfactory accountsImproperly conducted account closed by the Bank or a an account closed within three months of its openingTk. 500 or USD 12 or GBP 10Personalized cheque book

Specially printed cheque book

Issuance of counter chequeFree

At actuals

Tk. 200Returned ChequeEach clearing cheque returned due to insufficient fundTk. 500Each clearing cheque returned due to other reasonsTk. 200Stop payment orderTo stop payment on each or a series of cheque(s) in sequential order issued by the account holderTk. 200To cancel each stop payment orderTk. 100Time DepositsMinimum balance

Tk. 100,000

USD 1,000

GBP 1,000

EURO 1,000* Interest is calculated daily for savings accounts and payable half yearly at the Bank’s prevailing interest rate.* Overdraft interest is calculated daily and charged quarterly at the Bank’s prevailing interest rate

Payment services

| Item | Charge |

| Foreign currency services | |

| Notes deposits/withdrawals (customer) | |

| Deposit of encashment of foreign currency notes Up to $ 5000 or equivalent | 0.25% or minimum USD 4 |

| above $ 5000 | 0.5% of full amount |

| Encashment certificates | Tk. 300 |

| Sale of foreign currency notes | 1% min Tk. 100 |

| Endorsement Charge | Tk. 250 |

| Cheque Collection | |

| Domestic | |

| Outward cheque collection local currency Up to Tk. 100,000 | Tk. 200 plus postage and other bank charges |

| Above Tk. 100,000 | 0.20% min. Tk. 300 max. Tk. 1,500 plus postage and other bank charges |

| Outward cheque collection FCY | 0.10% min. Tk. 300 plus postage and other bank charges |

| Inward cheque collection FCY | TK. 300 + postage |

| Cheque collection return LCY | Tk. 200 |

| Cheque collection return FCY | USD 5 |

| Domestic cheque purchased | 1% min. Tk. 250 Plus other bank/post/telex charges |

| Overseas | |

| Outward cheque collection FCY | 0.15% min. Tk. 400 plus courier charges |

| Inward cheque collection FCY | USD 25 |

| Foreign currency cheque return charges | |