Introduction

In this free online accounting lesson we define a T-account, debit, credit and account balance. We then talk about double entry bookkeeping system and related double entry rules. After that we discuss general journals, ledgers and the posting process. Finally, we understand closing entries and their purpose. Accounting examples are provided for most learning objectives.

This part will be devoted to new techniques used by most accountants in the world. The technique is called a double-entry recording process. To understand it better we are introducing a T account.

Double-entry Accounting System

T account is an individual accounting record that shows information about increases and decreases in one balance sheet or income statement account. It is so called because it has a form of letter T.

On the top of the horizontal bar there is the account title. Account decreases and increases are placed on the either side of the vertical bar:

Account Title | |

Decreases & Increases | Increases & Decreases |

The left side of the T account is called Debit, and the right side is called Credit.

Debit is the left side of a T account.

Credit is the right side of a T account.

Often these two terms are abbreviated as Dr and Cr. It is common to say that an account has been debited when the amount is placed on the left side of an account, and credited if the amount is placed on the right side.

Account balance is the difference between the debit and the credit side of a T account.

Now we can define the double-entry system:

Double-entry recording system provides for the equality of total debits and total credits.

Double-entry accounting system and its rules

The double-entry rule can be helpful when we need to find a mistake in financial records. If total debits do not equal total credits, there must be a mistake. However, this system cannot ensure complete accuracy. For example, even if we do make sure debit balances equal credit ones, it is quite possible to choose a wrong account debit (credit) while making an entry.

Two important rules about double-entry recording system:

Assets = Claims (Liabilities and Owner’s Equity)

Total Debits = Total Credits

Effects of debits and credits on accounts

Let us see how debits and credits affect accounts. As it was said, debit is the left side and credit is the right side of an account. Increases and decreases are recorded differently for asset and claim accounts. Here is what we mean:

- Debit entries increase asset accounts, and decrease liability and equity accounts.

- Credit entries increase liability and equity accounts, and decrease asset accounts.

Illustration: Effects of debits and credits in T accounts

An easy way to remember these rules is to learn that increases are posted on the outsides (see plus signs above) and decreases are posted on the insides (see minus signs above). That rule holds true for asset as well as liability and equity accounts.

Illustration of applying double-entry accounting system

We will go to an illustration. A company, called Huske’s Consultants, started its operations on January 1, 2006 when the owner, Mrs. Huske, contributed cash into the business. All accounts had zero beginning balances. We will see how each transaction affects T accounts and the accounting equation. Transaction impacts on the financial statements will be shown in a horizontal statements model. All the events are numbered and their numbers are used as recording references. Recall that there are four types of accounting events:

- Asset source transactions

- Asset use transactions

- Asset exchange transactions

- Claims exchange transactions

Transaction type will be indicated for each accounting event. All transactions took place during 20X6.

Due to the space limitations, we will not show all the accounts while explaining a transaction. Only those accounts that are affected by a particular transaction will be shown in the accounting equation.

In the cash flow section of the horizontal model, OA, FA and IA stand for operating, financing and investing activities, respectively.

Analysis of cash contribution transaction

Event No. 1. Huske’s Consultants started operating on January 31 when the owner made $10,000 cash contribution. This accounting event acts to increase both assets (Cash) and equity (Contributed Capital). The increase in Cash is recorded as a debit and the increase in equity is recorded as a credit:

Illustration: Effect of a capital contribution in T accounts

Assets | = | Liabilities | + | Equity | |||

Cash |

|

|

| Contributed Capital | |||

Debit | Credit | ||||||

This is an asset source transaction:

Illustration: Effect of a capital contribution in the horizontal model

Assets | = | Liabilities | + | Equity | Rev. | – | Exp. | = | Net Inc. | Cash Flow | |

10,000 | = | n/a | + | 10,000 | n/a | – | n/a | = | n/a | 10,000 | FA |

Analysis of supplies purchase on account transaction

Event No. 2. On May 15, Huske’s Consultants purchased office supplies for $400 from a local supply company on account (i.e., agreed to pay for them on a later date). Purchasing supplies on account acts to increase assets (Supplies) and liabilities (Accounts Payable). The Supplies account is debited and the Accounts Payable account is credited:

Illustration: Effect of a supplies purchase in T accounts

Assets | = | Liabilities | + | Equity | |||

Supplies | Accounts Payable | ||||||

Debit | Credit | ||||||

This is an asset source transaction.

Illustration: Effect of a supplies purchase in the horizontal model

Assets | = | Liabilities | + | Equity | Rev. | – | Exp. | = | Net Inc. | Cash Flow | |

400 | = | 400 | + | n/a | n/a | – | n/a | = | n/a | n/a | |

Analysis of providing service on account transaction

Event No. 3. On May 20, 20X6 the company provided services on account (i.e., it will collect cash later) to Mandy Food Store. The client, Mr. Mandy’s business was billed for $2,600. The transaction acts to increase assets (Accounts Receivable) and equity (Consulting Revenue). The asset is debited and the equity account is credited:

Illustration: Effect of recording revenue in T accounts

Assets | = | Liabilities | + | Equity | |||

Accounts Receivable | Consulting Revenue | ||||||

Debit | Credit | ||||||

This is an asset source transaction.

Illustration: Effect of recording revenue in the horizontal model

Assets | = | Liabilities | + | Equity | Rev. | – | Exp. | = | Net Inc. | Cash Flow | |

2,600 | = | n/a | + | 2,600 | 2,600 | – | n/a | = | 2,600 | n/a | |

Analysis of paying cash for expenses transaction

Event No. 4. On April, 5 the company paid $600 cash for operating expenses. Expense recognition acts to decrease assets (Cash) and equity (Operating Expenses). Cash is credited and Operating Expense is debited:

Illustration: Effect of paying operating expenses in T accounts

Assets | = | Liabilities | + | Equity | |||

Cash | Operating Expense | ||||||

Credit | Debit | ||||||

An increase in expenses results in a decrease in equity. That’s why we showed expenses with a plus sign and equity underneath them with a minus sign.

This is an asset use transaction:

Illustration: Effect of paying operating expenses in the horizontal model

Assets | = | Liabilities | + | Equity | Rev. | – | Exp. | = | Net Inc. | Cash Flow | |

(600) | = | n/a | + | (600) | n/a | – | (600) | = | (600) | (600) | OA |

Analysis of taking a loan transaction

Event No. 5. On May 31, 20X6, due to liquidity problems, Huske’s Consultants decided to borrow $4,000 from Local Business Bank. The company issued a note that had a 1-year term and carried 7% annual interest rate. The transaction increases assets (Cash) and liabilities (Note Payable). The asset increase is recorded as a debit and the liability increase is recorded as a credit:

Illustration : Effect of taking a loan in T accounts

Assets | = | Liabilities | + | Equity | |||

Cash | Note Payable | ||||||

Debit | Credit | ||||||

This is an asset source transaction:

Illustration: Effect of taking a loan in the horizontal model

Assets | = | Liabilities | + | Equity | Rev. | – | Exp. | = | Net Inc. | Cash Flow | |

4,000 | = | 4,000 | + | n/a | n/a | – | n/a | = | n/a | 4,000 | FA |

Analysis of rent prepayment transaction

Event No. 6. On June 1, 20X6 Mrs. Huske realized that the business was growing and in this connection rented a larger office. $2,400 cash was paid in advance for a 1-year rent of the new lease. The transaction decreases one asset account (Cash) and increases another (Prepaid Rent). To increase the Prepaid Rent account it is debited and to decrease the Cash account it is credited:

Illustration: Effect of rent payment in T accounts

Assets | = | Claims | |||||

Prepaid Rent | + | Cash | |||||

Debit | Credit | ||||||

This is an asset exchange transaction.

Illustration: Effect of rent payment in the horizontal model

Assets | |||||||||||

Prepaid Rent | + | Cash | = | Claims | Rev. | – | Exp. | = | Net Inc. | Cash Flow | |

2,400 | + | (2,400) | = | n/a | n/a | – | n/a | = | n/a | (2,400) | OA |

Analysis of cash collection transaction

Event No. 7. On June 15, 20X6 Huske’s Consultants received $1,500 cash from Mandy Food Store for the provided services (see Event No. 3). Cash collection increases one asset account (Cash) and decreases the other (Accounts Receivable). Cash is debited Accounts Receivable are credited:

Illustration: Effect of cash collection in T accounts

Assets | = | Claims | |||||

Cash | + | Accounts Receivable | |||||

Debit | Credit | ||||||

This is an asset exchange transaction:

Illustration : Effect of cash collection in the horizontal model

Assets | |||||||||||

Cash | + | Accounts Receivable | = | Claims | Rev. | – | Exp. | = | Net Inc. | Cash Flow | |

1,500 | + | (1,500) | = | n/a | n/a | – | n/a | = | n/a | 1,500 | OA |

Analysis of cash advance receipt transaction

Event No. 8. On June 31, 20X6 Mrs. Huske signed up a contract with Mining Company to perform consulting services. Huske’s Consultants received an advance cash payment in amount of $3,600 for the one-year contract. The transaction acts to increase assets (Cash) and liabilities (Unearned Revenue). The asset is debited and the liability is credited:

Illustration: Effect of cash advance receipt in T accounts

Assets | = | Liabilities | + | Equity | |||

Cash | Unearned Revenue | ||||||

Debit | Credit | ||||||

This is an asset source transaction:

Illustration: Effect of cash advance receipt in the horizontal model

Assets | = | Liabilities | + | Equity | Rev. | – | Exp. | = | Net Inc. | Cash Flow | |

3,600 | = | 3,600 | + | n/a | n/a | – | n/a | = | n/a | 3,600 | OA |

4.3.9 Analysis of cash revenue transaction

Event No. 9. On June 31, 20X6 Huske’s Consultants represented Mr. Debret (a client) in the court, for what the company received $700 cash. The increase in assets (Cash) is recorded as a debit. The increase in equity (Consulting Services) is recorded as a credit:

Illustration: Effect of cash revenue in T accounts

Assets | = | Liabilities | + | Equity | |||

Cash | Consulting Revenue | ||||||

Debit | Credit | ||||||

This is an asset source transaction:

Illustration: Effect of cash revenue in the horizontal model

Assets | = | Liabilities | + | Equity | Rev. | – | Exp. | = | Net Inc. | Cash Flow | |

700 | = | n/a | + | 700 | 700 | – | n/a | = | 700 | 700 | OA |

Analysis of cash investment transaction

Event No. 10. On June 31, 20X6, Huske’s Consultants loaned Jak Building Company $3,000. Jak Building Company issued a 1-year, 8% note. The transaction acts to increase one asset (Notes Receivable) and decrease the other (Cash). An increase in Notes Receivable is recorded as a debit, and a decrease in Cash is recorded as a credit:

Illustration: Effect of cash investment in T accounts

Assets | = | Claims | |||||

Notes Receivable | + | Cash | |||||

Debit | Credit | ||||||

This is an asset exchange transaction:

Illustration: Effect of cash investment in the horizontal model

Assets | |||||||||||

Notes Receivable | + | Cash | = | Claims | Rev. | – | Exp. | = | Net Inc. | Cash Flow | |

3,000 | + | (3,000) | = | n/a | n/a | – | n/a | = | n/a | (3,000) | IA |

Analysis of furniture purchase transaction

Event No. 11. New furniture was required for the recently rented office (Event No. 6). On June 31, 20X6 Mrs. Huske paid $2,000 cash to purchase a new table and several chairs. The office equipment is expected to have a useful life of 2 years and a salvage value of $400. The purchase acts to increase one asset account (Office Equipment) and to decrease another (Cash). The Office Equipment account is debited and the Cash account is credited:

Illustration: Effect of furniture purchase in T accounts

Assets | = | Claims | |||||

Office Equipment | + | Cash | |||||

Debit | Credit | ||||||

This is an asset exchange transaction:

Illustration : Effect of furniture purchase in the horizontal model

Assets | |||||||||||

Office Equipment | + | Cash | = | Claims | Rev. | – | Exp. | = | Net Inc. | Cash Flow | |

2,000 | + | (2,000) | = | n/a | n/a | – | n/a | = | n/a | (2,000) | IA |

Analysis of cash payment on account transaction

Event No. 12. On August 14, 20X6, Huske’s Consultants paid the $400 owed to the local supply company (see Event No. 2). The cash payment acts to decrease assets (Cash) and liabilities (Accounts Payable). The decrease in assets is recorded as a credit, and the decrease in liabilities is recorded as a debit:

Illustration : Effect of cash payment on account in T accounts

Assets | = | Liabilities | + | Equity | |||

Cash | Accounts Payable | ||||||

Credit | Debit | ||||||

This is an asset use transaction:

Illustration: Effect of cash payment on account in the horizontal model

Assets | = | Liabilities | + | Equity | Rev. | – | Exp. | = | Net Inc. | Cash Flow | |

(400) | = | (400) | + | n/a | n/a | – | n/a | = | n/a | (400) | OA |

Analysis of cleaning services on account transaction

Event No. 13. On September 18, 20X6 Huske’s Consultants received $800 bill from SuperCleaners for cleaning the office. Mrs. Huske plans to pay the bill later. The event acts to increase liabilities and decrease equity. The increase in liabilities (Accounts Payable) is recorded as a credit, and the decrease in equity (Office Maintenance Expense) is recorded as a debit:

Illustration: Effect of cleaning services on account in T accounts

Assets | = | Liabilities | + | Equity | |||

Accounts Payable | Office Maintenance Expense | ||||||

Credit | Debit | ||||||

This is a claims exchange transaction:

Illustration: Effect of cleaning services on account in the horizontal model

Assets | = | Liabilities | + | Equity | Rev. | – | Exp. | = | Net Inc. | Cash Flow | |

n/a | = | 800 | + | (800) | n/a | – | (800) | = | (800) | n/a | |

Analysis of cash distribution transaction

Event No. 14. On November 31, 20X6 Huske’s Consultants distributed $300 in cash to the owner. The distribution acts to decrease assets and equity. The decrease in assets (Cash) is recorded as a credit, and the decrease in equity (Distribution) is recorded as a debit:

Illustration : Effect of cash distribution in T accounts

Assets | = | Liabilities | + | Equity | |||

Cash | Distribution | ||||||

Credit | Debit | ||||||

This is an asset use transaction:

Illustration: Effect of cash distribution in the horizontal model

Assets | = | Liabilities | + | Equity | Rev. | – | Exp. | = | Net Inc. | Cash Flow | |

(300) | = | n/a | + | (300) | n/a | – | n/a | = | n/a | (300) | FA |

Analysis of interest payable / expense adjusting entry

After we saw all transactions pertaining to the accounting period, we need to make adjusting entries. Recall that adjusting entries are those made at year end (or any other fiscal period) to adjust revenues or expenses.

Adjustment No. 1. On May 31 Huske’s Consultants borrowed $4,000 cash from the bank and agreed to return the money in a year and pay 7% annual interest (see Event No. 5). For the current accounting period, the interest expense amounted to $163 (i.e., $4,000 x 7% x [7 months / 12 months], rounded). The adjustment acts to increase liabilities and decrease equity. The increase in liabilities (Interest Payable) is recorded as a credit, and the decrease in equity (Interest Expense) is recorded as a debit:

Illustration: Effect of interest expense in T accounts

Assets | = | Liabilities | + | Equity | |||

Interest Payable | Interest Expense | ||||||

Credit | Debit [- Equity] | ||||||

This is a claims exchange transaction:

Illustration: Effect of interest expense in the horizontal model

Assets | = | Liabilities | + | Equity | Rev. | – | Exp. | = | Net Inc. | Cash Flow | |

n/a | = | 163 | + | (163) | n/a | – | (163) | = | (163) | n/a | |

Analysis of prepaid rent adjusting entry

Adjustment No. 2.On June 1 Huske’s Consultants prepaid rent for 12 months in amount of $2,000 (see Event No. 6). The rent expense to be recognized at the end of the period is calculated as follows: $2,000 x (7 months / 12 months) = $1,167 (rounded). Recognition of the rent expense acts to decrease assets and equity. The decrease in assets (Prepaid Rent) is recorded as a credit, and the decrease in equity (Rent Expense) is recorded as a debit:

Illustration: Effect of rent expense in T accounts

Assets | = | Liabilities | + | Equity | |||

Prepaid Rent | Rent Expense | ||||||

Credit | Debit | ||||||

This is an asset use transaction:

Illustration : Effect of rent expense in the horizontal model

Assets | = | Liabilities | + | Equity | Rev. | – | Exp. | = | Net Inc. | Cash Flow | |

(1,167) | = | n/a | + | (1,167) | n/a | – | (1,167) | = | (1,167) | n/a | |

Analysis of unearned / earned revenue adjusting entry

Adjustment No. 3. On June 31, Huske’s Consultants received $3,600 advance cash payment for services to be performed within a year after signing the contract (see Event No. 8). By December 31 the company had provided 10 months of service, so the amount to be recorded as revenue is $3,600 x (6 months / 12 months) = $1,800. This amount is transferred from liabilities (Unearned Revenue) to equity (Consulting Revenue). This revenue recognition acts to decrease liabilities and increase equity. The decrease in liabilities is recorded as a debit and the increase in equity is recorded as a credit:

Illustration: Effect of revenue recognition in T accounts

Assets | = | Liabilities | + | Equity | |||

Unearned Revenue | Consulting Revenue | ||||||

Debit | Credit | ||||||

This is a claims exchange transaction:

Illustration: Effect of revenue recognition in the horizontal model

Assets | = | Liabilities | + | Equity | Rev. | – | Exp. | = | Net Inc. | Cash Flow | |

n/a | = | (1,800) | + | 1,800 | 1,800 | – | n/a | = | 1,800 | n/a | |

Analysis of interest receivable / revenue adjusting entry

Adjustment No. 4. On July 31, Huske’s Consultants loaned $3,000 to Jak Building Company. In return, Huske’s Consultants received one-year, 8% note (see Event No.10). In this connection, Huske’s Consultants needs to record $100 (i.e., $3,000 x [5 months / 12 months]) as interest revenue. The adjustment acts to increase assets and equity. The increase in assets (Interest Receivable) is recorded as a debit, and the increase in equity (Interest Revenue) is recorded as a credit:

Illustration: Effect of interest revenue in T accounts

Assets | = | Liabilities | + | Equity | |||

Interest Receivable | Interest Revenue | ||||||

Debit | Credit | ||||||

This is an asset source transaction:

Illustration: Effect of interest revenue in the horizontal model

Assets | = | Liabilities | + | Equity | Rev. | – | Exp. | = | Net Inc. | Cash Flow | |

100 | = | n/a | + | 100 | 100 | – | n/a | = | 100 | n/a | |

Analysis of fixed assets depreciation adjusting entry

Adjustment No. 5. On June 31, office equipment costing $2,000 was purchased. The useful life of these assets is expected to be 2 years with a salvage value of $400. Huske’s Consultants has to recognize as an expense the office equipment cost used during 2006. The amount to be recorded is $800 (i.e., [$2,000 – $400] / 2 years). The adjustment acts to decrease assets and equity. The decrease in assets (Accumulated Depreciation) is recorded as a credit, and the decrease in equity (Depreciation Expense) is recorded as a credit:

Illustration: Effect of depreciation expense in T accounts

Assets | = | Liabilities | + | Equity | |||

Accumulated Depreciation | Depreciation Expense | ||||||

Credit | Debit | ||||||

This is an asset use transaction:

Illustration: Effect of depreciation expense in the horizontal model

Assets | = | Liabilities | + | Equity | Rev. | – | Exp. | = | Net Inc. | Cash Flow | |

(800) | = | n/a | + | (800) | n/a | – | (800) | = | (800) | n/a | |

Analysis of salaries payable / expense adjusting entry

Adjustment No. 6. At the end of the period, Huske’s Consultants accrued $600 salaries that will be paid off in the next accounting period (20X7). The adjustment acts to increase liabilities and decrease equity. The increase in liabilities (Salaries Payable) is recorded as a credit, and the decrease in equity (Salaries Expense) is as a debit:

Illustration: Effect of salaries expense in T accounts

Assets | = | Liabilities | + | Equity | |||

Salaries Payable | Salaries Expense | ||||||

Credit | Debit | ||||||

This is a claims exchange transaction:

Illustration: Effect of salaries expense in the horizontal model

Assets | = | Liabilities | + | Equity | Rev. | – | Exp. | = | Net Inc. | Cash Flow | |

n/a | = | 600 | + | (600) | n/a | – | (600) | = | (600) | n/a | |

Analysis of supplies expense adjusting entry

Adjustment No. 7. On May 15, Huske’s Consultants acquired supplies for $400. At the end of the accounting period $100 of supplies remained on hand. The difference ($300 = $400 – $100) was used during the year and should be expensed. The adjustment decreases assets and equity. The decrease in assets (Supplies) is recorded as a credit, and the decrease in equity (Supplies Expense) is recorded as a debit:

Illustration: Effect of supplies expense in T accounts

Assets | = | Liabilities | + | Equity | |||

Supplies | Supplies Expense | ||||||

Credit | Debit | ||||||

This is an asset use transaction:

Illustration: Effect of supplies expense in the horizontal model

Assets | = | Liabilities | + | Equity | Rev. | – | Exp. | = | Net Inc. | Cash Flow | |

(300) | = | n/a | + | (300) | n/a | – | (300) | = | (300) | n/a | |

Presentation of T accounts for the accounting period

We will transfer all the data to T accounts. Note that we meet the two requirements about the double-entry recording process:

Total Debits = Total Credits

Total Assets = Total Liabilities + Total Equity

If the two requirements are satisfied, we are sure that all amounts were posted. At the same time, we cannot say for sure whether the amounts were posted to correct accounts; the fact that debits equal credits does not imply correct accounts were affected by journal entries.

Illustration: Summary of all accounts with transactions

Assets | = | Liabilities | + | Equity | |||

Cash | Accounts Payable | Contributed Capital | |||||

(1) 10,000 (5) 4,000 | (4) 600 (6) 2,400 (10) 3,000 (11) 2,000 (12) 400 (14) 300 | (12) 400 | (2) 400 (13) 800 | (1) 10,000 | |||

| Bal. 10,000 | |||||||

| Bal. 800 | |||||||

Consulting Revenue | |||||||

Unearned Revenue | (3) 2,600 (9) 700 (A3) 1,800 | ||||||

(A3) 1,800 | (8) 3,600 | ||||||

Bal. 11,100 | Bal. 1,800 | ||||||

| Bal. 5,100 | |||||||

Accounts Receivable | Notes Payable | ||||||

(3) 2,600 | (7) 1,500 | (5) 4,000 | Interest Revenue | ||||

Bal. 1,100 | Bal. 4,000 | (A4) 100 | |||||

| Bal. 100 | |||||||

Supplies | Interest Payable | ||||||

(2) 400 | (A7) 300 | (A1) 163 | Operating Expense | ||||

Bal. 100 | Bal. 163 | (4) 600 | |||||

Bal. 600 | |||||||

Prepaid Rent | Salaries Payable | ||||||

(6) 2,400 | (A2) 1,167 | (A6) 600 | Salaries Expense | ||||

Bal. 1,233 | Bal. 600 | (A6) 600 | |||||

Bal. 600 | |||||||

Notes Receivable | |||||||

(10) 3,000 | Office Maint. Expense | ||||||

Bal. 3,000 | (13) 800 | ||||||

Bal. 800 | |||||||

Interest Receivable | |||||||

(A4) 100 | Interest Expense | ||||||

Bal. 100 | (A1) 163 | ||||||

Bal. 163 | |||||||

Office Equipment | |||||||

(11) 2,000 | Depreciation Expense | ||||||

Bal. 2,000 | (A5) 800 | ||||||

Bal. 800 | |||||||

Accum. Depreciation | |||||||

| (A5) 800 | Supplies Expense | ||||||

| Bal. 800 | (A7) 300 | ||||||

Bal. 300 | |||||||

Rent Expense | |||||||

(A2) 1,167 | |||||||

Bal 1,167 | |||||||

Distributions | |||||||

(14) 300 | |||||||

Bal. 300 | |||||||

Assets | = | Liabilities | + | Equity | |||

Assets | = | Claims | |||||

Summary of debit and credit effects on accounts

For your convenience we provide a table of account groups with indication of how they are increased or decreased:

Illustration : Summary of debit and credit impacts

Account | Debit | Credit |

| Assets | Increase | Decrease |

| Contra Assets | Decrease | Increase |

| Liabilities | Decrease | Increase |

| Equity | Decrease | Increase |

| Contributed Capital | Decrease | Increase |

| Revenue | Decrease | Increase |

| Expenses | Increase | Decrease |

| Distributions | Increase | Decrease |

Recording process steps

T accounts and double-entry system provide accountants with a sophisticated means of recordkeeping. Nevertheless, drawing T accounts is only one step in a sequence of steps accountants take from initiating a transaction to including it into the financial statements. In general, all the steps are as shown below:

Illustration: The accounting recording process

Analysis of source (business) documents

First, there should be a document showing that an accounting event took place. Such a document is usually called a source document:

Source document serves as a basis for an accounting entry. Source documents are what accountants use to record accounting transactions. Source documents are also called business documents.

Source documents vary. Some examples of source documents are invoices, material requisition forms, bank statements and credit memos.

Recording transactions in general journal

Second, source documents are the basis for recording transactions in a chronological order in a journal. Each company has what is called the general journal or the book of original entry:

General journal (book of original entry) contains records about all transactions of an entity. In particular, the journal includes such data as the event date, accounts involved, explanations and amount(s).

In addition to the general journal, an entity may have other journals that relate to specific areas, like a cash journal (includes information on cash transactions only) or a sales journal (includes information about sales only).

Let’s look at the general journal containing transactions from our illustration above:

Illustration: General Journal for Huske’s Consultants

Date | Account titles | Debit | Credit |

Jan 31 | Cash | 10,000 | |

| Contributed Capital | 10,000 | ||

May 15 | Supplies | 400 | |

| Accounts Payable | 400 | ||

May 20 | Accounts Receivable | 2,600 | |

| Consulting Revenue | 2,600 | ||

April 5 | Operating Expense | 600 | |

| Cash | 600 | ||

May 31 | Cash | 4,000 | |

| Notes Payable | 4,000 | ||

June 1 | Prepaid Rent | 2,400 | |

| Cash | 2,400 | ||

June 15 | Cash | 1,500 | |

| Accounts Receivable | 1,500 | ||

June 31 | Cash | 3,600 | |

| Unearned Revenue | 3,600 | ||

June 31 | Cash | 700 | |

| Consulting Revenue | 700 | ||

June 31 | Notes Receivable | 3,000 | |

| Cash | 3,000 | ||

June 31 | Office Equipment | 2,000 | |

| Cash | 2,000 | ||

Aug. 14 | Accounts Payable | 400 | |

| Cash | 400 | ||

Sept 18 | Office Maintenance Expense | 800 | |

| Accounts Payable | 800 | ||

Nov 31 | Distributions | 300 | |

| Cash | 300 | ||

Adjusting entries | |||

Dec 31 | Interest Expense | 163 | |

| Interest Payable | 163 | ||

Dec 31 | Rent Expense | 1,167 | |

| Prepaid Rent | 1,167 | ||

Dec 31 | Unearned Revenue | 1,800 | |

| Consulting Revenue | 1,800 | ||

Dec 31 | Interest Receivable | 100 | |

| Interest Revenue | 100 | ||

Dec 31 | Depreciation Expense | 800 | |

| Accumulated Depreciation | 800 | ||

Dec 31 | Salaries Expense | 600 | |

| Salaries Payable | 600 | ||

Dec 31 | Supplies Expense | 300 | |

| Supplies | 300 | ||

| Totals of debits and credits | 35,530 | 35,530 | |

In addition to adjusting entries, closing entries must be made at the end of an accounting period.

Closing entries are made to free up (to zero) the nominal (temporary) accounts so that they are prepared to be used in the next accounting period.

Nominal accounts are revenue, expense, and distribution accounts. All nominal accounts are closed to Retained Earnings.

The general journal with closing entries is presented below:

Illustration : Closing entries for Huske’s Consultants

Date | Account titles | Debit | Credit |

Closing entries | |||

Dec. 31 | Consulting Revenue | 5,100 | |

| Interest Revenue | 100 | ||

| Retained Earnings | 5,200 | ||

Dec. 31 | Retained Earnings | 4,430 | |

| Operating Expense | 600 | ||

| Office Maintenance Expense | 800 | ||

| Interest Expense | 163 | ||

| Rent Expense | 1,167 | ||

| Depreciation Expense | 800 | ||

| Salaries Expense | 600 | ||

| Supplies Expense | 300 | ||

Dec. 31 | Retained Earnings | 300 | |

| Distributions | 300 | ||

Posting of accounting information from journals to the ledger

Next, after complete transaction data are recorded, portions of the data are summarized and transferred to another journal, called the ledger:

The ledger is a collection of all accounts a business maintains in its accounting system. With the development of computerized accounting systems, ledgers are often in the form of electronic records (databases).

So, the ledger is where information about all accounts is kept. In order for the information to get to the ledger, it must be posted from journals.

Posting is the process of transferring the accounting information from journals to the ledger. For example, all information from a cash journal is posted to the ledger to update the cash account(s).

Sometimes information in journals is summarized into homogeneous groups before posting to the ledger. For instance, if there are a lot of cash payments for supplies during a period, such payments may be summarized to limit the number of records in the ledger. Note that only homogeneous transactions are usually summarized before posting.

After posting has been made, all debit and credit balances are compared to ensure they balance.

4.5.4 Preparing trial balances

When all entries are posted, a trial balance is prepared.

A trial balance is a list of all accounts with their balances at a point in time.

Trial balances can be prepared at any time (before or after adjusting or closing entries). However, it is considered a good practice to have a trial balance before preparing financial statements because a trial balance shows accounts with their balances. Such information greatly facilitates preparation of financial statements. An example of a trial balance before and after all closing entries is shown below:

Illustration : Before closing trial balance for Huske’s Consultants

| Account Titles | Debit | Credit |

| Cash | 11,100 | |

| Supplies | 100 | |

| Accounts Receivable | 1,100 | |

| Interest Receivable | 100 | |

| Prepaid Rent | 1,233 | |

| Notes Receivable | 3,000 | |

| Office Equipment | 2,000 | |

| Accumulated Depreciation | (800) | |

| Accounts Payable | (800) | |

| Salaries Payable | (600) | |

| Interest Payable | (163) | |

| Notes Payable | (4,000) | |

| Unearned Revenue | (1,800) | |

| Contributed Capital | (10,000) | |

| Distributions | 300 | |

| Consulting Revenue | (5,100) | |

| Interest Revenue | (100) | |

| Depreciation Expense | 800 | |

| Interest Expense | 163 | |

| Office Maint. Expense | 800 | |

| Operating Expense | 600 | |

| Rent Expense | 1,167 | |

| Salaries Expense | 600 | |

| Supplies Expense | 300 | |

| Grand Total | 23,363 | (23,363) |

Illustration: Post closing trial balance for Huske’s Consultants

| Account Titles | Debit | Credit |

| Cash | 11,100 | |

| Supplies | 100 | |

| Accounts Receivable | 1,100 | |

| Interest Receivable | 100 | |

| Prepaid Rent | 1,233 | |

| Notes Receivable | 3,000 | |

| Office Equipment | 2,000 | |

| Accumulated Depreciation | (800) | |

| Accounts Payable | (800) | |

| Salaries Payable | (600) | |

| Interest Payable | (163) | |

| Notes Payable | (4,000) | |

| Unearned Revenue | (1,800) | |

| Contributed Capital | (10,000) | |

| Retained Earnings | (470) | |

| Grand Total | 18,633 | (18,633) |

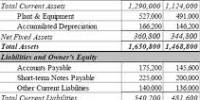

Preparing financial statements (conclusion only)

After the post closing trial balance is prepared and checked to ensure credit balances equal debit balances, financial statements are prepared. We are skipping preparation of financial statements here because we have seen how that is done before. Note that preparation of financial statements is the final step in the sequence that was started by analyzing source documents.