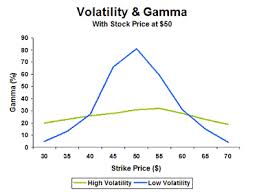

Major objective of this article is to discuss on Basics of Option Volatility. Here explain Option Volatility in financial point of view. Volatility is an element used when computing option pricing and is described as the measure of the actual magnitude and rate in the price change of the derivative. This refers to be able to both changes that raise and decrease. When volatility is high, the price of an option is high; when it’s low, the option’s quality will reflect it. Here explain two types of volatility: Historical Volatility and Implied Volatility.

Discuss on Basics of Option Volatility