When a voluntary association of firms is formed to achieve common goals and to enjoy the monopoly advantages, that sort of initiative is called a business combination. A major disadvantage is business combination brings a monopoly in the market, which may be harmful to society. Combinations lead to the concentration of wealth in a few hands. Monopolists try to gain special favor from the government through political corruption and pose a danger to democracy.

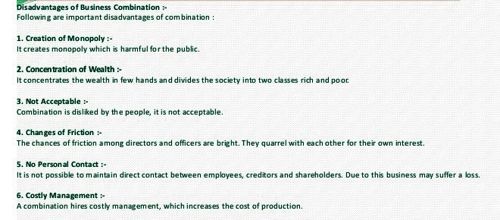

Following are the disadvantages of the business combination

(1) Business combination brings monopoly in the market, which may be harmful to society. Monopolies might restrict output, create artificial scarcities, charge high prices, and produce low-quality goods. All these affect consumer interests.

(2) Combined firms may become too large which leads to problems in coordination and control. Supervision might become difficult resulting in a poor quality of products, wastage, corruption, etc.

(3) The identity of the old company finishes. Combinations are quite huge in size with a substantial investment of resources. In case a combination collapses, it results in substantial losses for all those connected with it.

(4) In large combined firms, decisions are delayed because of various levels of authority. The organization would not able to utilize opportunities in the marketplace.

(5) Goodwill of old companies decrease. In small firms, the owner would personally know each employee. Since he has direct contact he can solve the problems of employees in the initial stages. In a large firm, the owners and employees do not have personal contact. Employee grievances may not be known and it might lead to strikes, lockouts, etc.

(6) Combined firms might try to wipe out competition and prevent the entry of new firms. They would aim to control the market. The consumers would be denied the freedom to choose from products of different manufacturers.

(7) Management of the company becomes difficult. Combined firms might witness conflicts of power, differences of opinion, politics, etc which may destabilize the organization.

(8) Business combination may result in over-capitalization. The firm might be using capital more than what is required. This would result in high costs and poor returns to shareholders.

(9) Combined firms might bribe politicians to frame policies in their favor. They might also motivate the political class to act against their competitors.

(10) Combined firms would not concentrate on improving quality or on innovation. It is because they have an assured market. Spending on research and development would be considered to be wasteful by them.