A budget is an official statement of the estimated income and expenditure for a specific time period based on previous records and plans. A budget can be created by an individual, a group, a company, the government, a business, or anyone who needs to track his or her revenue and expenses. A static budget is one in which the income and expenditure of the relevant body are pre-determined for the upcoming period. Even if there is a fluctuation in the predetermined numbers, it remains static, i.e., the same.

The distinction between static and flexible budgets is based on their adaptability. A static budget, once created, cannot be changed regardless of changes in the assumed activity before the fixed period expires. A flexible budget, on the other hand, is free to be adjusted in response to changes at any point during the specified time period.

Differences between Static Budget and Flexible Budget

Following are the main differences between static and flexible budgets:

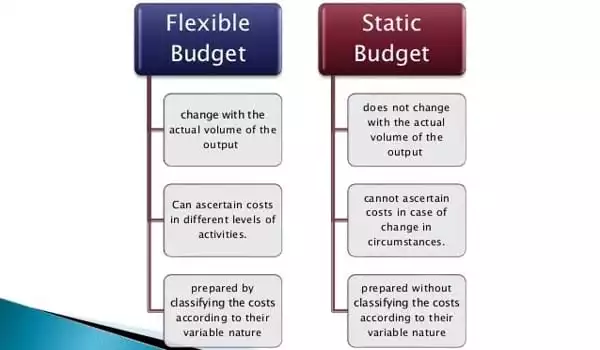

(1) Nature

- A static budget does not change with the actual volume of the output achieved. It’s is a predetermined estimate of income and expenditure of a certain period.

- A flexible budget is designed to change appropriately with the level of activity attained. It is a flexible statement of income and expenditure that is free to change according to changes in activity level.

(2) Scope

- A static budget cannot ascertain costs correctly in case of any change in circumstances. The budget is made assuming there will be no changes in the conditions.

- Flexible budget can easily ascertain costs in different levels of activities. It is designed to change according to needs.

(3) Determination Of Cost

- Static budget is prepared under the assumption that all conditions will remain unaltered. It is easier to check degree of difference between actual and assumed figures (variance) due to its static nature

- Flexible budget is prepared at different levels of activities considering the possible changes in the operational aspect of a business. It is very difficult to check variance between data as the budget itself changes according to the activity level.

(4) Assumptions

- Static budget has a limited application and is ineffective as a tool for cost control. If data varies, price fixation becomes difficult.

- Flexible budget has a wide application as an effective tool for cost control. Price fixation is easier as difference between data can be met.

(5) Pre-requisites

- Static budget is prepared without classifying the costs according to their variable nature. It is less effective as change is the only constant.

- Flexible budget is prepared by classifying the costs according to their variable nature. It is more effective due to its adaptive nature.

To summarize, a static budget is prepared with the assumption that there will be no fluctuations during the reporting period, whereas a flexible budget is designed to adapt to changes. A static budget has no adaptability, whereas a flexible budget, as the name implies, is adaptable. A flexible budget takes much more time and experience to create than a static budget, which is much simpler.