Determination of Working Capital

Working capital is the difference between a company’s current assets and current liabilities. Determination of working capital requirement is one of the major short-term planning which plays a very vital role in operating the business successfully. It is calculated by using the current ratio, which is current assets divided by current liabilities. The determination of working capital is to be done very effectively otherwise there may be over or underestimation of working capital. The amount of working capital should be sufficient. Following two methods can be used to determine the amount of working capital:

- Projected Balance Sheet Method

- Operating Cycle Method

(1) Projected Balance Sheet Method

It is the conventional method of calculating working capital. Total current assets and current liabilities are taken into account in calculating working capital. All the data given in the balance sheet regarding current assets and current liabilities are taken into consideration for estimating the working capital. Total current liabilities are deducted from total current assets to obtain the amount of net working capital under this method.

Net Working Capital = Total Current Assets – Total Current Liabilities

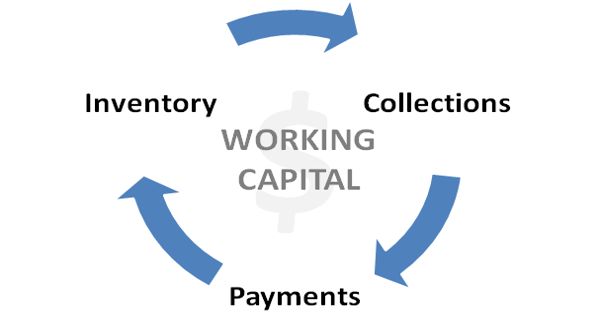

(2) Operating Cycle Method

The time which is needed to convert raw material into finished goods into sales, and account receivable into cash is called the operating cycle. Under the operating cycle method, the time needed for different types of current assets and time lag needed for payment of purchase and expenses is considered to compute the requirement of working capital. The items of current assets and current liabilities are calculated as follows:

- Raw material inventory = (Annual output x material cost per unit x inventory holding period)/Total Periods

- Work-in-progress Inventory = (Annual output x Manufacturing cost per unit x Inventory holding period)/Total periods

- Finished Goods Inventory = (Annual output x total cost per unit x inventory holding period)/Total periods

- Account Receivable (Debtors) = ( Annual credit sales units x total cost per unit x credit period allowed)/Total periods

- Prepaid Expenses = (Annual Expenses x Advance Period)/Total periods

- Account Payable (Creditors) = (Annual output x raw material cost per unit x credit period)/Total periods

- Outstanding Wages = (Annual output x labor cost per unit x time lag)/ Total periods

- Outstanding Overhead = (Annual output x overhead per unit x time lag)/Total periods

- Outstanding Expenses = (Annual expenses x Time lag)/ Total periods.

Working capital management is a critical element in the survival of every firm. While the effective management of working capital leads to value creation in firms, ineffective management of working capital, on the other hand, does not only destroy value but can lead to the eventual solvency of the firm.