Introduction

This report contains all the customer satisfaction about General Banking activities of JBL.I have collected both primary and secondary data to prepare this report and I have also completed a 3month internship at jamuna bank limited.

Background:

This report has been prepare through extensive discussion with the bank employees and clients. Different types of information and documents have needed to prepare this report. As per as the decision & direction from my honorable supervisor for submitting this report.

Rationale/Significance of the study:

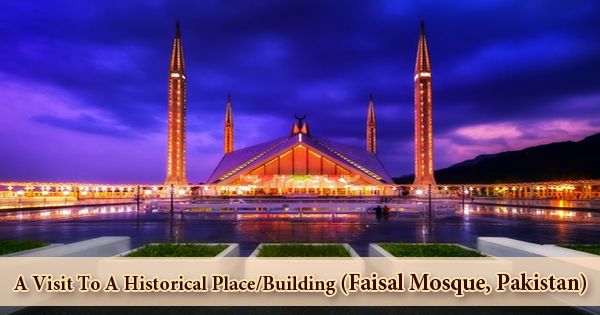

The extent of services they offer is still at the primitive level, which conversely assisted the system to cover wide range of rural customers who have basic knowledge about banking financial system. This internship report contains a survey dominating findings based on quality satisfactions of customers to the ”Jamuna Bank limited” Which is one of the leading third generation bank in Bangladesh. This report is the outcome of three months internship program. I reflected those things which I learned in internship program. My internship program started on October 21, 2012 and finished on January 16, 2013.I gathered more practical knowledge during my internship program. In future this will help me a lot because there is no alternative of practical knowledge is more long lasting and helpful than theoretical knowledge. So, I completed the report on customer satisfaction about marketing mix on the basis of internship program.

Hypothesis:

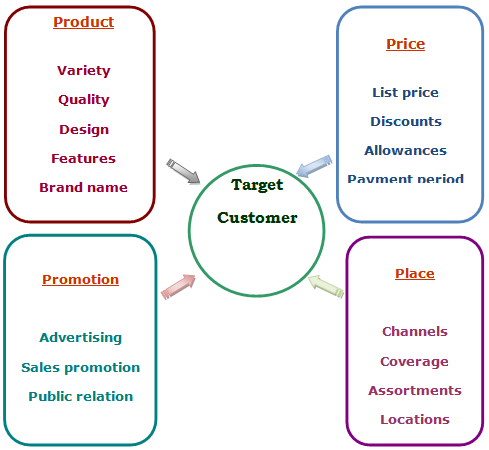

Marketing strategy: The marketing strategy consists of a very clear definition of prospective customer and their needs and the creation of marketing mix to satisfy them. Customer Relationship Management one of the marketing strategies. It is a business strategy relationship with them. CRM is done through personal visit, media advertisement and word of mouth from existing customer.

Target customer: The bank has clear idea about the customer it wants to serve it is not possible to work out products to satisfy their needs. The customer will identify in terms of their education ,occupation ,income, geographical location ,population group, age, sex, marital status ,products and services they purchase, their habits, taste and preference, their business and future prospects etc. through collecting the opinion of existing customers about the services and introduction of new services.

In achieving business goal organization has to identify their target customers groups to which they provide the products. For this, screen out their potential customers group through-

Market Segmentation- the process of dividing a market into distinct groups of buyers with different needs ,characteristics or behavior.

Target marketing- the process of evaluating each market segments, attractiveness and selecting one or more segments to enter.

Market positioning- occupying a clear, distinctive and desirable place relative to competing products in the minds of target customers.

In achieving the target effectively marketing tools are used to provide the products to the customers. Marketing tools is known as marketing mix.

Customer satisfaction :Expectations have a central role in influencing satisfaction with services, and these in turn are determined by a very wide range of factors lower expectations will result in higher satisfaction ratings for any given level of service quality. This would seem sensible; for example, poor previous experience with the service or other similar services is likely to result in it being easier to pleasantly surprise customers. However, there are clearly circumstances where negative preconceptions of a service provider will lead to lower expectations, but will also make it harder to achieve high satisfaction ratings – and where positive preconceptions and high expectations make positive ratings more likely. The expectations theory in much of the literature therefore seems to be an over-simplification.

Marketing Mix : In achieving the target, effectively marketing tools are used to provide the products to the customers. Marketing tools is known as marketing mix or 4ps.

The marketing mix is probably the most famous phrase in marketing. Marketing decisions generally fall into the following four controllable categories:

Product

Price

Place (Distribution)

Promotion

“Marketing mix” is a framework, which acts as a guideline for marketers to implement a marketing concept. It consists of a set of major decision areas that a company needs to manage in order to at least satisfy customer needs.

According to Kotler Armstrong, the marketing mix is a set of “controllable tactical marketing tools (product, price, place promotion) that the firm blends to produce the response it wants in the target market”. The marketing mix consists of everything the firm can do to influence the demand for its product.

Figure: Marketing Mix

Product: Product is something offered by marketers to customers for exchange and that can satisfy needs and wants of the targeted people.

Price: Price is the amount of money, goods or services that must be sacrificed to acquire ownership or use of a product.

Place: Place is the channel of distribution used to get products and services to the market. Place decisions are those associated with channels of distribution that serve as the means for getting the product to the target customers.

Promotion: Promotion is the personal and impersonal means used to inform, persuade, and remind customers about products and services.

7p’s in Detail:

- a. Products: The product is the most important aspect of the marketing mix. Products have both tangible and intangible benefits. Tangible benefits include benefits, which can be measured such as the top speed of a car. Intangible benefits are benefits that cannot be measured such as the enjoyment the customer will get from the product. It is important that the product is changed as necessary to bring it up to date and prevent it from being overtaken by competitors.

Exactly what product or service are you going to sell to this market? Define it in terms of what it does for your customer. How does it help your customer to achieve, avoid or preserve something? You must be clear about the benefit you offer and how the customer’s life or work will be improved if he or she buys what you sell.

The term “product” refers to tangible, physical products as well as services. Here are some examples of the product decisions to be made:

Variety

Quality

Design

Features

Brand name

Packaging

Services

Sizes

Warranties

Returns

- b. Price: It is very important that the correct price is charged for a product. If the price is too high consumers will avoid the product as they will believe it to be too expensive yet if the product is priced too low they may believe that there is something wrong with the product for it to be so cheap. Also if the company charges too low a price, it may not cover its costs. There are many different pricing strategies that companies can use to decide on a price for their product including market and psychological pricing methods.

Exactly how much are you going to charge for your product or service, and on what basis? How are you going to price it to sell at retail? How are you going to sell it at wholesale? How are you going to charge for volume discounts? Is your price correct based on your costs and the prices of your competitors?

Some examples of pricing decisions to be made include:

Pricing strategy (Skim, penetration, etc.)

Suggested retail price

Volume discounts and wholesale pricing

Cash and early payment discounts/ bonus

Seasonal pricing

Bundling

Price flexibility

Price discrimination.

- c. Place : The place is where you can expect to find your customer and consequently, where the sale is realized. Knowing this place, you have to look for a distribution channel in order to reach your customer.

The place is not where is located your business but where our customers are. For a retailer it is the same but for a boat producer located in Philippines the real place is the entire world. Do not confuse positioning and place. Here place means the real physical position of the customer in a geographic area or along a distribution channel. Distribution is about getting the products to the customer. Some examples of distribution decisions include:

Distribution channels

Market coverage (inclusive, selective, or exclusive distribution)

Specific channel members

Inventory management

Intermediaries

Distribution centers

Order processing

Transactions

Reverse logistics

In consumer marketing channels, we have to consider three main distribution channels:

Selling to the customer

Selling to the retailer

Selling to the wholesalers

- d. Promotion: In the context of the marketing mix, promotion represents the various aspects of marketing communication, that is, the communication of information about the product with the goal of generating a positive customer response. Marketing communication decisions include:

Promotional strategy (push, pull, etc.)

Advertising

Personal selling & sales force

Sales promotions

Public relations & publicity

Marketing communications budget

However, the strategies for the four P’s require some modifications when applied to services. For example, traditionally promotion is thought of as involving decisions related to sales, advertising, sales promotions and publicity. In services these factors are also important, but because services are produced and consumed simultaneously, service delivery people are involved in real-time promotion of the service even if their jobs are typically defined in terms of the operational function they perform.

- e. People: All human action that plays a part in reference and information services delivery namely the librating personnel.

- f. Process: Process means, the procedure mechanisms and flow of the activity by which the reference and information service are acquired.

- g. Physical Evidence: Physical environment means, the environment in which the reference and information service are delivered that performance and communication of the service.

Customer Satisfaction: From Theoretical View:

Customer satisfaction is the extent to which a product or service’s perceived performance matches a buyer’s expectations. If the product or service’s performance falls short of expectations, the buyer is dissatisfied. If performance matches or exceeds expectations, the buyer is satisfied or delighted.

Expectations are based on customers past buying experiences, the opinion of friends and associates, and marketer and competitor information and promises. Marketer must be careful to set the right level of expectations. If they set expectations too low, they may satisfy those who buy but fail to attract enough buyers. In contrast, if they raise expectations too high buyers are likely to be disappointed. Dissatisfaction can arise either from a decrease in product and service quality or from an increase in customer expectations. In either case, it presents an opportunity for companies that can deliver superior customer value and satisfaction.

Today’s most successful companies are rising expectations—and delivering performance to match. Such companies track their customers’ expectations, perceived company performance, and customer satisfaction. Highly satisfied customers produce several benefits for the company. Satisfied customers are fewer prices sensitive, remain customers for a longer period, and talk favorably to others about the company and its products & services.

Although the customer centered firm seeks to deliver high customer satisfaction relative to its competitors, it does not attempt to maximize customer satisfaction. A company can always increase customer satisfaction by lowering its price increasing its services, but it may result in lower profits. Thus, the purpose of marketing is to generate customer value profitably. This requires a very delicate balance: The marketer must continue to generate more customer value and satisfaction but not “give away house.”

Now, we have a very good idea regarding the importance of customer satisfaction. So, it is also important for the company to know about the satisfaction level of the customers. When any problem is identified, it becomes easier to solve the problem.

Customer satisfaction is the relation between Expected (E) and Perceived (P) value of the service, where

| Value= | Benefits | = | Outcome + Process |

| Price | Price + Cost of acquisition |

Here,

| P<E | means Dissatisfaction |

| P=E | means Satisfaction |

| P>E | means Delight |

The satisfaction or dissatisfaction of a consumer for a service depends on 5 gaps. If gap increases then customer’s dissatisfaction will also increases. Therefore, the service providers strive to breeze this gap. These gaps are

- Customer gap: Not knowing what the service actually is.

- Provider gap 1: Not knowing what the customer wants

- Provider Gap 2: Not having the right service design and standard

- Provider gap 3: Not delive Provider Gap 2: Not having the right service design and standard

- Provider gap 3: Not delivering the service standard

- Provider gap 4: Not matching performance with promises

So, far there has been no standard model for measuring customer satisfaction in the telecommunication industry. Based on the above models and theories Norizan Mohd Kassim, and Chad Perry ( 2003) of Southern Cross University developed a model with the following Five dimensions of satisfaction in telecommunication industry –

- i. Customer service,

- ii. Service coverage,

- iii. Billing integrity,

- iv. Quality of line and

- v. Customers service outlets.

Objectives of the study:

There are two types of objectives of this report. These are given below:

1.Broad Objectives

2.Specific Objective

Broad Objective:

To measure customer satisfaction about general banking activities of Jamuna Bank Limited. On the basis of data collection from its Mirpur branch.

Specific Objective:

1.To identify the general banking activities of Jamuna Bank Limited.

3.To find out customer satisfaction about general banking activities of Jamuna Bank Limited.

4.To recommended some measures for the development of general banking activities of Jamuna Bank Limited.

Methodology of the Study

Methodology:

The study requires a systematic procedure from selection of the topic to preparation of the final report. To perform the study, the data sources were to be identified and collected, to be classified, analyzed, interpreted and presented in a systematic manner and key points were to be found out. The overall process of methodology has been given below:

Research design:

It is” Descriptive” research design.

Sampling design

Sample frame:

No well-structured sample frame was found.

Sample size:

The sample size was 50 customers.

Data Collection :

Both qualitative data collection procedure has utilized in this report. The qualities data was collected by informal discussion with the officers and employees of JBL. And the quantitative data was collected through survey with a structured questionnaire. The survey was conducted among the clients of JBL. The secondary data was collected from the websites, articles, books and newspapers related to the terms of the report.

Primary Data :

a. Questionnaire survey

Secondary Data :

Annual report of the JBL

Web site of the JBL

Several books $ periodicals related to the banking sector

Different circular sent by the head office of the JBL.

Data analysis

I have used different types of statistical tools and computer software for analyzing and reporting my gathered information, such as-Microsoft office tools.

Limitations of The Study:

It is an uphill task to study the on the management so the report was completed under certain constrains which were:

Difficulty in gaining accesses to financial sector.

Non‐availability of the most recent statistical data.

As I am student it is not possible for me to collect all the necessary information.

I had to complete this report within a very short span of time that was not sufficient for investigation.

Lake of Experience.

Literature review

To provide clientele services in respect of International Trade it has established wide correspondent banking relationship withlocal and foreign banks covering major trade and financial centers at home and abroad.

Vision

To become a leading banking institution and to play a pivotal role in the development of the country.

Mission

The Bank is committed to satisfying diverse needs of its customers through an collection of products at a competitive price by sing appropriate technology and providing timely service so that a sustainable growth, reasonable return and contribution to the development of the country can be ensured with a motivated and professional work‐force.

FINDINGS

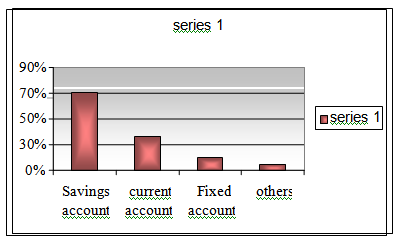

- Most of the respondents have savings account.

- Most of the respondents choose this bank because of the service and reputation of the bank.

- Most of the respondents are satisfied with the branch location.

- Most of the respondents are satisfied with the service charge of the bank.

- Most of the respondents are satisfied with the account opening procedure.

- Most of the respondents are receive cheque against a requisition within 10-15 minutes.

- Most of the respondents are satisfied with the service provided by the bank.

- Most of the respondents are satisfied with the behavior of the employees.

- Most of the respondents are card holder.

- Most of the respondents are satisfied with the number of ATM booths.

- Most of the respondents are not satisfied with the system of issue a card.

- Most of the respondents are satisfied with the technology of ATM.

- Most of the respondents are satisfied with the JBL Bank employee for solving the banking problem expertly.

- Most of the respondents are satisfied inquiring over telephone.

- Most of the respondents are satisfied about the delivery process of customer service.

RECOMMENDATIONS & CONCLUSIONS

RECOMMENDATIONS:

- Bank should improve the size, location and personal relationship.

- Number of the branch should be increased. In the rural area-bank should open their branch.

- The account opening procedure should be easier.

- The procedure should be short and the employees must be efficient to deliver the service.

- Bank should offer new produce and provide better service depends on customers needs.

- Employees of the bank should be more efficient to provide the service to the customer to reach the 100% satisfaction level of customers.

- Bank should advertise and influence the account holders to take the debit or credit card.

- Bank should increase the number of ATM booths.

- Bank should make the procedure short of issuing card and try to issue the card quickly.

CONCLUSION:

There are a number of Private Commercial Banks, Nationalized Commercial Banks and Foreign Banks operating their activities in Bangladesh. The Jamuna Bank Ltd. is one of them. For the future planning and the successful operation for achieving its prime goal in this current competitive environment this report can be a helpful guideline.

After a long period of consideration, I have come to a conclusion about the Financial Performance of Jamuna Bank Limited and if I consider about the overall performance of JBL, then I can say that the Financial Performance of Jamuna Bank is so better than that of the other banks of Bangladesh. And there is no doubt about it that JBL will achieve superior position in our banking industry but to cope with customer JBL should think how to make it services proactive to compete with other bank’s operation in Bangladesh.

As a leading bank of Bangladesh, JBL contributes in the business with promising future. I can hope that JBL can spread their business with increasing various scheme and other utility services.

References & Bibliography

- Jamuna Bank Limited (2011), “Annual report” 2010-2011, Jamuna Bank Limited, Dhaka, Bangladesh.

- Jamuna Bank Limited (2009), “JBL Products”, Retrieved as July 05, 2011, from http://bangladeshbank-bd.com/.

- Jamuna Bank Limited (2009), “History of JBL”, Retrieved as May 11, 2011, from http://bangladeshbank-bd.com/.

- Lesika, Pettit, (2004-2005), Reports Determination of Makeup, “Business Communication”, 6th Edition, New York, McGraw-Hill.

Website visits:

- www.jamunabankbd.com/profile/job.htm –

- www.jamunabankbd.com

- http://www.bangladesh-bank.org

- http://nettopdf.info/en/pdf/+Jamuna+Bank+Bangladesh-/

- http://bdjob.blogspot.com/2009/05/jobs-in-jamuna-bank-limited/v

Annexure-1 : Company Profile Jamuna Bank Limited (JBL) is a Banking Company registered under the Companies Act, 1994 with its head office at Chini Shilpa Bhaban, 33 Dilkusha, Dhaka‐1000. The Bank started its operation from 3rd June 2001.

Jamuna Bank Limited is a highly capitalized new generation Bank started its operation with an authorized capital of Tk.1900.00 million and paid up capital of Tk.390.00 million, as of December 2008 Paid up capital of the Bank raised to Tk.1072.5 million and number of branches raised to 47 (Forty seven).

JBL undertakes all type of banking transactions to support the development of trade and commerce in the country. JBL’s services are also available for the entrepreneurs to set up new ventures and BMRE for industrial units. The Bank gives special emphasis on Export, Import, Trade Finance, SME Finance, Retail Credit and Finance to Women Entrepreneurs.

Corporate information:

| Name of the Bank | Jamuna Bank Limited(JBL) |

| Date of Incorporation | 1991 in Dhaka |

| Registered office | Chini Shilpa Bhaban 3Dilkush C/A, Dhaka-1000 |

| Telephone | PABX9555141 |

| Swift code | JAMUBDDH |

| Type | Private limited company |

| Jamunabk@bdcom.com | |

| Web site | www.Jamunabankbd.com |

| Dialogue | Your Partner For Growth |

| Logo | |

| Chairman | Mr.Md. Belal Hossain |

Goal of Jamuna Bank:

Goal of the Jamuna Bank is, to maximize the interest of all concerned. Jamuna Bank wants to be the absolute market leader in the number of loans given to small and medium sized enterprises throughout Bangladesh. It will be a world-class organization in terms of service quality and establishing relationships that help is customers to develop and grow successfully. It will be the Bank of choice both for its employees and its customers, the model bank in this part of the word.

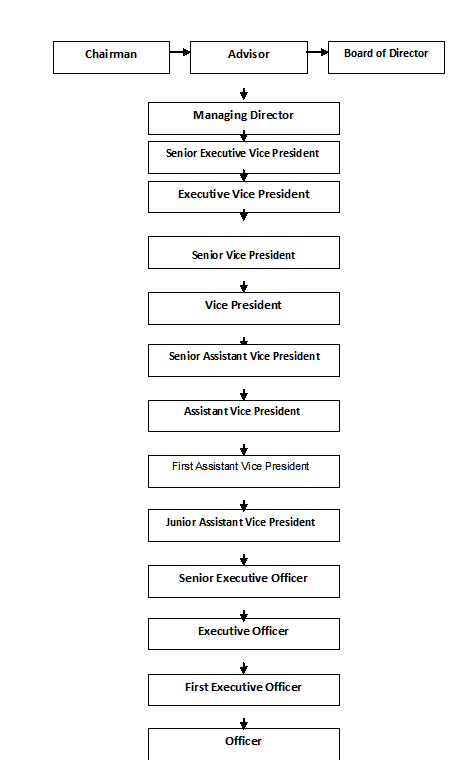

Organ gram of JBL

SWOT Analysis of JBL:

| STRENGTHSExperienced top management. Limited market share. Satisfactory capital base. Low infection in loan Prospective IT infrastructure | WEAKNESSESExposure to large loan- Excessive dependency on term deposits. exposure. Weak fund management. High cost of fund. Islamic Branch funds are not ring fenced |

| OPPORTUNITIESRegulatory environment favoring for private sector quality assets Development. Credit card.

Small and medium enterprises. | THREATSIncreased competition in the market for quality assets Supply gap of foreign currency.

Over all liquidity crises in money market. |

Annexure- 2 : Additional Chart, Graph, Table & related data

In every survey, it is essential to analyze the survey results and follow the findings as a guideline of development of the project. The survey results of competitive performance analysis is represented by tables and highlighted by graphical representation in percentage basis. Findings of each of the survey result are followed by a suggestion.

Respondent customer by type of account

From the graph, it is seen that 70% of the respondent customers are savings account holder, 36% of the respondent customers have current deposit, 10% of the respondent customers have fixed deposit and 4% have other account.

Reason for choosing the bank

From the graph, it is seen that the 4% respondent choose this bank for the size of the bank, 20% for reputation f the bank, 16% for location f the bank, 50% for service of the bank, 10% for personal relationship.

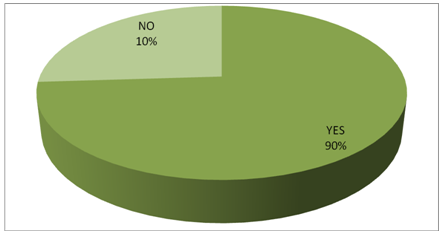

Satisfaction with the branch location

From the graph, it is seen that the 90% customers are satisfied with the branch location and 10% are not.

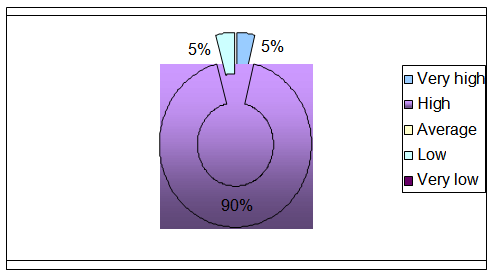

Customer satisfaction with the service charge of the bank

From the graph, it is seen that the 90% customers are satisfied with the service charge of the bank, 5% are very satisfied and 5% are dissatisfied.

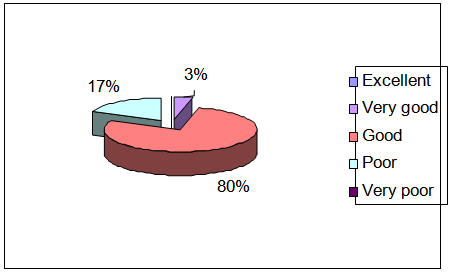

Customer satisfaction of the account opening procedure

From the graph, it is seen that the 80% customers are satisfied with the account opening procedure, 3% are very satisfied and 17% are dissatisfied.

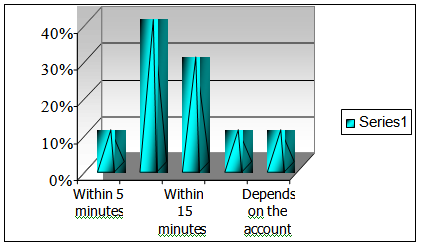

How many times it takes to give checque against a requisition?

How many times it takes to give checque against a requisition?

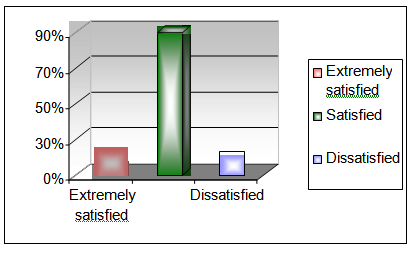

From the graph, it is seen that the 6% customers are extremely satisfied with the service provided by the bank, 90% are satisfied with the service provided by the bank, and 4% are dissatisfied with the service provided by the bank.

About the behavior of the employees

From the graph, it is seen that the 5% customers think that employees behavior are very friendly, 30% customers think that employees behavior are friendly, 50% customers think that employees behavior are satisfied and 15% customers think that employees behavior are very dissatisfied.

Are you a card holder?

From the graph, it is seen that the 70% customers are card holder and 30% customers are not.

The numbers of ATM booths are enough and available

From the graph, it is seen that the 20% customers think that the numbers of ATM booths are not enough and available, 80% customers think that the numbers of ATM booths are enough and available.

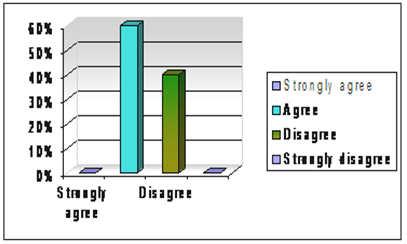

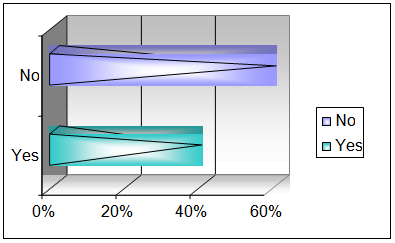

Bank takes to longer time to issue a card

From the graph, it is seen that the 60% customers agree that bank takes to longer time to issue a card and 40% are disagree.

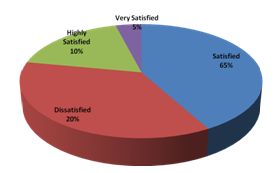

Are you satisfied with technology of ATM?

From the graph, it is seen that the 65% of the customers are satisfied with the technology of ATM, 20% are dissatisfied, and 10% are highly satisfied and 5% are very satisfied.

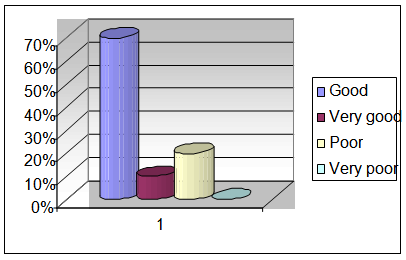

How expert the JBL bank employee is solving your banking problem

From the graph, it is seen that the 70% customers think that the JBL Bank employee can expertly solve the banking problem, 20% are dissatisfied.

Have you ever faced any problem in inquiring over telephone?

From the graph, it is seen that the 40% customers have face any problem and 60% have not face any problem in inquiring over telephone.

If yes, which type of problem?

Here 50% customers have faced difficulties to get connection, 30% customers cannot get answer properly from executives and 20% faced other problems over telephone.

What do you think about the delivery process of customer service?

From the graph, it is seen that the 40% customers think that the delivery process of customer service is quickly, 20% think it is very quickly, 35% think that it is lengthy and 5% think that it is special care.