An overview of Credit Risk Management of

United Commercial Bank Limited

United Commercial Bank offers all kinds of corporate and personal banking services including corporate banking, retail banking and consumer banking service for every customer. UCBL provides every kind of facilities to its customers regarding account, loan, deposit scheme, UCB earning plus, Ucash, UCB multimillionaire etc. which are different kind of services that attracts to the customers. The bank can handle a good number of customers and help them when they have any queries. Before making a customer’s account, the bank verifies all the documents for further process.

Every customer account is very sensitive issue for the bank because there may be a number of transactions happen. The general banking section has different kinds of department for customer service. They have account opening section (Savings, FDR, MSS, Bills, Detch pecth etc), clearing section, deposit section, cash department, cash management section. Besides this, the credit risk management department includes CAD (Credit Administration Department), foreign remittance section, corporate credit department etc.

Usually, the bank makes credit for corporate customers (RMG sector) the most for their business purpose. Moreover, they have individual loan system such as home loan, car loan, utility loan, furniture loan etc. The bank plays an important role in international trade by providing credit and facilitating payment, against trade with other countries. UCBL cuts a good figure in their foreign exchange department by giving credit of exporting and being a part of international business. In this regard, UCBL is well positioned to meet the challenges that it faced.

Objective of the study

The main objective of this report is to reflect the practical knowledge that is gained during my internship period and to relate the theoretical learning of BBA Program in this field. Besides this, the followings are given emphasis:

- To analyze the credit mechanism of UCBL

- To describe Credit Risk Management procedure of UCBL

- To find the problems prospect of UCBL in payment sector.

- To analyze the overall scenario of the Credit making process..

Background of United Commercial Bank Ltd

As a financial intermediary, commercial bank plays an important role to match the surplus & deficit unit. Sponsored by some dynamic and reputed entrepreneurs and eminent industries of the country and also participated by the government, united commercial bank started its operation in mid 1983 with the establishment of 115 branches in private sector. They collect deposit from surplus unit & lend it to the deficit unit. This mobilizations of deposit & allocation of credit to productive & consumer services leads towards the economic development, but commercial bank in Bangladesh was not so much careful in credit management which leads to the widespread loan default & ultimately worse the entire financial cycle. Different commercial banks, specialized banks, Islamic banks offer different types of loan to their Business & individual customer.

Especially banks now focus on lending to consumer credit because it has risk then individual consumer loan, although consumer loan is mainly unsecured. United Commercial Bank Limited (UCBL) credit department try their best in maintenance of credit. The bank, that aiming to play a leading role in the economic activities of the country is firmly engaged in the development of trade, commerce and industry through a creative credit policy.

Function of UCBL

- The bank offers so many facilities to its clients now including:-

- Term loan to industrial customer especially to small enterprise.

- Financing in import and export business like commercial banks.

- General banking facility like certificate of deposit, fixed deposit, savings account, foreign currency account are available in UCBL.

- To give facilities to the clients and shareholders in a systemic way.

- To identify customer demand and fulfill their demand by supplying them proper services.

Products & Services

- UCB Multi Millionaire

- UCB Money Maximizer

- UCB Earning Plus

- UCB DPS Plus

- Western Union Money Transfer

- SMS Banking Service

- Online Service

- Credit/Debit Card

- One Stop Service

- Time Deposit Scheme

- Monthly Savings Scheme

- Deposit Insurance Scheme

- Inward and Outward Remittance

- Export and Import Finance

- Working Capital Finance

- Loan Syndication

Information Technology of UCBL

In today’s financial services environments, technology is not an option but a necessity. United Commercial Bank is the pioneer in banking industry to provide systematic on-line banking services to its customers through the network of all 148 branches. Moreover, UCBL has entered into an agreement with Dutch Bangla Bank Ltd. for sharing ATM facilities with them to extend a wide range of banking service to its valued customers. In 2007 the bank invested substantially in improving its IT facilities for ensuring seamless, faster and secure banking transactions. The data center of the bank has been ready with the state of the modern servers. During the year, the bank has also launched services like Tele-Banking, Debit Card facilities for its customers. UCBL also introduced UCB Corporate Intranet system for quick distribution of information among its branches.

Credit Risk

Credit risk means the risk which begins for not paying the credit that has been made for the borrower. Risk arises as a result of customers not being able to fulfill their financial and contractual obligations. These requirements arise from lending, trade financing and other activities undertaken by the bank. So credit risk is the potential loss of revenue as a result of the failure of the borrower or the counter parties to meet their obligations in accordance with agreed terms. The loss may be complete or partial and can arise in a number of circumstances. For example:

- Consumer may fail to make a payment

- Company may unable to repay amounts.

- Corporate consumer may not pay a trade invoice within the due time

- An insolvent insurance company does not pay a policy obligation

- An insolvent bank may not return funds to a depositor

- A government grants bankruptcy protection to an insolvent consumer or business

To reduce the credit risk, the borrower may perform a credit check or take out appropriate insurance such as mortgage, security etc. In general, the higher the risk, the higher will be the interest rate.

Credit Risk Management

Credit risk is managed in the UCBL through a framework of policies and procedures. There is a clear division of duties between transactions in the businesses. Credit policies and standards are considered and approved by the board of directors of UCBL. The goal of credit risk management is to maximize the rate of return from the borrower. Banks need to manage the credit risk as well as the risk in individual credits. Banks should also consider the relationship between credit risk and other risks. The effective management of credit risk is an important part of the bank because a vital amount of loan goes from the bank’s account to the customer which makes a great risk for the bank. To establish an appropriate credit risk management, the bank has to follow some things that are given below:

- The board of director has the full responsibilities of approving a credit to the borrower according to the credit risk policies of the bank.

- Senior management has the responsibility to implement the strategies of credit after the approval from head office.

- Banks should identify and manage all the products and activities that may increase credit risk.

Values for Credit Risk Management

To operate a proper credit risk management, UCBL maintains some process. These are:

- Before borrowing credit the bank understands the borrower fully about the purpose, structure and the sources of payment for the credit.

- Before credit expansion, the bank ensures about the assets and properties so that the borrower will be able to pay the bank back.

- The bank has made some limitations over giving the credit to the individual customers and also the corporate customers.

- There are proper policies about the new credit and forwarding of existing credit.

Principles before making a credit

Credit is one the most vital functions of a bank. It is the most important part of making money because the interest that comes from the credit is the profit part of bank. For this reason, before making a credit, the bank follows some policies to confirm the overall background of the borrower. These principles are given below:

Safety:

Safety means the assurance of the repayment of the credit to the bank. The bank choose the borrower carefully before lending money as it becomes a risk for the bank if the lender cannot be chosen carefully.

Liquidity:

Liquidity means checking the bank’s availability of funds for making credit for the customers.

Within a short notice, the bank informs the borrower about making credit.

The integrity and reliability of the borrower:

The most important and fundamental principle of making credit is the integrity and reliability of the borrower. Before selecting the borrower, the bank justifies the five C’s of the borrower. These are:

- Character

- Capacity

- Capital

- Collateral

- Condition

Purpose:

The bank should confirm about the purpose of the credit. For which purpose the borrower is lending money is an important part of analyzing for the bank’s safety.

Credit approval process

Pre-sanction documents:

Pre-sanction documents are the first part of documentation for granting a credit is done before the credit proposal. At first, .all the documents against the credit have to be properly collected from the borrower. At the same time, the bank counts the amount of loan and not invests more than 50% of its paid up capital in a single loan.

Approval Process of a Corporate Credit:

Step-1:

At the very first, the borrower collects the credit application form from the relationship officer from the bank or head office. Later, he submits the credit application form along with all the requirements papers and documents for making the credit.

Step-2:

The relationship officer analyzes the credit application form and other documents submitted by the customer and make primary process on the credit. The relationship officer collects other information from the customer if those are necessary. If the relationship officer finds the proposal is not credit worthy, he will send a refusal letter to the customer. On the other hand, if relationship officer finds the proposal acceptable, relationship officer will forward the application with his comments to the relationship manager.

Step-3:

The relationship manager visits the business area of the borrower and acquires some proper information about the business position, reputation of the business, purpose of the credit and the sources of repayment. After that, the relationship manager will summarize all these information in a report which is called pre sanction report according to the bank’s format. The manager also asked the customer to fill CIB inquiry form which includes the policies of credit of Bangladesh Bank and send it to the credit administration department of head office.

Step 4:

The head office will receive the all the documents and analyze those documents. Then, the head office will contact with the relationship manager for further information about the borrower and send their decision about credit.

Step 5:

If the head office confirms to take the loan, the relationship manager will send the CIB inquiry report to Bangladesh Bank. Bangladesh bank will resend the CIB report immediately to the relationship manager by e-mail. If the CIB report is good, the bank will lend credit. If the CIB report is poor, the bank will make a letter of regression with proper reasons for the borrower.

Step 6:

After receiving CIB report from Bangladesh Bank, the relationship manager makes a formal credit proposal with some proper recommendations for the customer. The customer will sign on the proposal and the bank sends the proposal to the credit administration department of head office and takes a copy for the branch.

Step 7:

The head office will approve the proposal and send the copy of approval to the branch. Credit risk review department issues a sanction advice with the documentation for sending it to the branch. The sanction paper should be signed by the relationship manager and the credit administration officer.

Step 8:

After all this process, the bank will entitle the borrower with the amount of credit he applied for. The borrower can pay the money back in installment or non-installment process within a specific time. The bank updates the status of payment of the borrower to the CIB software of Bangladesh Bank.

Post sanctions documentation:

Post-sanction documents mean the sanction paper where the bank includes the approved amount the rate of interest payable, repayment procedures. The documents should be authorized by join stock company.

Disbursement:

After all the documentation process and all kinds of authorization, the disbursement process starts. The branch uses a formal loan disbursement process. After that, the bank continues monitoring process to implement the loan.

Credit monitoring process

Credit monitoring is a formal process for reviewing the existing loans regularly. When the borrower starts his payment, the monitoring process for reviewing the payments starts. It will continue until he pays the full amount. The steps of monitoring process include:

Sending Statement:

The bank should send daily statement of disbursement to the credit administration department.

Accounts activity:

Accounts activity should be monitored by the relationship manager and credit administration officer once in a month.

Monthly Statement:

The bank also should prepare monthly statement with all observation and send the report to head office.

Yearly Statement:

The relationship manager should also observe the borrowers business condition whether it is conducted successfully or not. For this reason, the manager makes the yearly statement for the credit administration department.

Records:

The bank should also record all the updates that are conducted for credit. All kinds of deposits should also be recorded.

Credit Recovery

Credit recovery process is the most important part for the bank to decrease the credit risk. The borrower may repay the whole amount at once or part by part. If the borrower fails to repay the amount, credit recovery process starts. The bank, at first, informs the borrower to pay the whole amount within a period of time. If the borrower again fails to pay, the bank will give a notice of mutation process of the borrower’s mortgage. After that, the bank will sue the borrower to the court under Money Loan Act 2003.

Competitive analysis of United Commercial Bank Limited

SWOT Analysis

SWOT analysis means analyze the bank’s strengths, weakness, opportunities and threats in the competitive market. During my internship program, I have found the bank’s overall competitive advantages and weakness compare to other banks. The strength, weakness, opportunities and threats of the bank that I found from my working experience are given below:

Strengths:

The strengths are those which can make successful banking and excellent market position in the market. Some important strength is given below:

- The bank has the capability to provide all kinds of banking products to its customers.

- The bank pays the dividends to its shareholders properly.

- The earnings per share of this bank are comparatively high.

- This bank has a good number of branches all over the country to operate.

- The employees of every department are very energetic, enthusiastic and professional.

Weakness:

The weaknesses are those which influence the banks progress to reach the goal. Some weaknesses of this bank are:

- The bank, sometimes, fails to take the right decision in the right time.

- The interaction between employees is very low.

- Sometimes, the employees fail to choose the proper customer to make an account.

- The evaluation and job rotation does not exist in this bank.

- The new software that has been operated for customer’s information record is very complicated to the employees. So that, the quantity of their daily performance decreases.

Opportunities:

The opportunities of UCBL are those which can reduce these weaknesses. Some opportunities of UCBL are given below:

- High growth rate of export and import between foreign and local market can facilitate bank’s profit.

- Diversification of different products may attract more customers.

- A huge number of customers in the market.

Threats:

The threats are those which can reduce banks success in the market. These threats are given below:

- Multinational banks and foreign banks become threats for UCBL because they gain the large portion of market share.

- The credit risks and other financial risks can also be a threat for UCBL.

- The promotion of employees from lower level to higher level is not properly happening which can motivate employees.

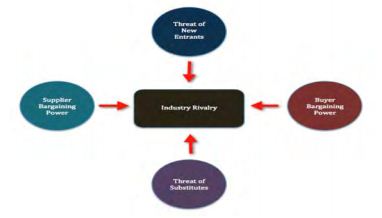

Porter’s five forces Analysis

Porter’s five forces regarding marketing analysis of any organization are very significant from point of view of strategy formulation. The potential of these forces differs from bank to bank.

From my working experience of UCBL, I came up with some unique point that can be related to analyze the marketing position of this bank by putting five forces to its competitive condition.

These five forces are:

Threats of new entrants:

United commercial bank has already gained a large number of market shares. So, the new entrants of can not affect this bank. Some factors that can be threats for the new entrants are:

- The government regulation for entering into the market

- Skilled manpower for the banking activities

- High investments

The bargaining power of buyer or customers:

The bargaining power of customers means the power to bargain or choose the bank to take services. The bargaining power of customers is very high. The factors that affect the bargaining power of buyer are:

- A number of banks as competitors in the market

- Different products offered by different banks

- The fluctuation of interest rate

The bargaining power of supplier:

United commercial bank has been trying for a long to time to grab the total customer mind by providing the best services for them. The factors that can be considered as the supplying power of UCBL are:

- The customers’ deposits in this bank

- The high switching cost to other bank

- The loan that has made for the customers

Competitive rivalry:

The competition between banks is very high now because there are a number of markets. The factors that can affect competitive rivalry are:

- Similar banking strategies of the banks

- Product differentiation is very low

- pricing strategy are also same

Availability of substitute:

Availability of substitutes is the largest obstacles for the banks. As there are so many banks and insurance companies in the market, so, many banks can fulfill the need of customers. For this reason, the availability of substitute can be great obstacles for UCBL. Moreover, insurances companies, mutual funds are also great substitutes for banks. Close customer relationship can also be a great threat for banks as it is a great cause to lose customers.

Competitive scenario

To describe the competitive scenario of united commercial bank, I want to define the marketing strategies that are followed by this bank. The marketing strategies that are followed by banks are given below:

Market leader:

Market leader are those banks who has a large number of market share in the competitive market. United commercial bank is not a market leader because the market share is not so high. Standard chartered bank is now on the position of large market share.

Market Follower:

The market followers are those banks who are following other bank’s strategies to make more market shares. In this case, united commercial bank is not following other bank’s strategies to make more market shares. It has its own strategies to follow.

Market challenger:

Market challengers are those banks which are basically finding out the more weak point to heal on that for recovery. From my point view, united commercial bank is a market challenger at this stage. It has a great number of branches all over the country. The weak point is that the connection between all the branches is not well oriented. All the branches are doing their own activities. The great challenge for this bank is to interact with all the branches when it is necessary. Another weakness of the bank is the employees’ motivation. The interaction between employees is very low in this bank which can influence the overall motivation of the employees.

Market nichers:

Market nichers are those banks which are targeting a narrow market segment of customers to fulfill their needs. United commercial bank is not the market nicher because it targets all the customers of the market to fulfill their needs.

The Responsibilities as an intern

As an intern, I have some responsibilities in the bank to gather knowledge about banking activities. I have worked in three departments of this bank within my internship period. These are general banking, credit risk management department and foreign exchange department. In general banking department, I was assigned to do some work such as:

- Account opening

- Cheque requisition

- KYC (know your customers) form fill up

- Crossing and endorsement of cheques

- Customers information input in the software

In credit risk management, I was assigned to do some work such as:

- CIB input

- Sanction paper arranging

- Learnt about different kinds of loans

In foreign exchange department, I was also assigned to do some works which are:

- Trade in-voice forms fill up

- Learnt about opening back to back LC

Findings

While working at United Commercial Bank, Principal Branch, I have attainted to the newer kind of experience. After the collecting and analyzing of my all information and from my working experience, I have got some findings. Those findings are completely from my personal point of view. Those are:

- Branch Manager makes efforts to achieve the targets and knows how to motivate employees and how to represent the Bank well in the local community.

- The employees of the bank are young, energetic, co-operative and friendly. They are dealings with the clients co-operatively and friendly which create positive perception about the bank.

- The credit analysts have a strong background in accounting financial statement analysis, business law and economics along with good negotiating skills. This lessens the possibility of bad debt.

- The Customer service of UCBL is very much impressive than other financial institution.

- The working environment of the office is not good because of shortage of open spaces.

- The bank provided online banking in all branches .The operations of the Bank are computer oriented to ensure efficient services to the customers.

- The web-site of UCBL is not updated. Only a few amount of information are given.

Recommendation

United Commercial Bank gives a minimal authority to its branches regarding giving out loans. As a result most decisions which are taken, has to be approved by the head office. United Commercial Bank is more efficient in processing legal actions against its defaulters for their nonrepayment of loans.

Therefore, it shows that United Commercial Bank is efficient in managing their credit risk. Thus I would suggest some recommendations from my own point of view. These are given below:

- Rules and regulations of the bank should be simple

- The bank should encourage employees who performs well and should motivate other employees to complete their tasks on time.

- To attract more clients, united commercial bank should implement new marketing strategy

- More information should be added in the website of the bank

- To increase the knowledge and the process to work effectively, the bank should make training programs for the employees

Conclusions

UCBL started its journey on 26 June, 1983 with the commitment of economic and social development of Bangladesh. The bank is always committed to deliver satisfaction to the customers. The bank is dedicated to provide unique service to its customers, come up with innovative products and services while emphasizing on the latest technology. The image created by the bank is very good and the total condition is almost within their control. Through this study, I myself gained some practical knowledge about credit business in Bangladesh and other banking stuffs. I am quite satisfied with their overall performance so far and wish a good success and bright future of the United Commercial Bank limited. The management of UCB is taking strategic steps to enable the bank to come out as a strong and progressive institution. With a bulk of qualified and experienced human resource, the bank can exploit any opportunity in the banking sector. It is continuing to make efforts to refine its products and operations to make them more compatible. New deposit schemes have been introduced and action plans have been taken to maintain revenue growth in future. Some kinds of changes in the entire terms can make a significant change in the total banking system.