A credit reference, just like a referral for a job, is a reference from a trusted source that lenders use to approve an application for loans or credit. The Creditor Reference is an international business standard based on ISO 11649, implemented at the end of 2008. Using Creditor Reference, a company can automatically match its remittance information to its A/R. This means that the company’s financial supply chain’s STP will be increased. When the Creditor Reference is present on your invoices, the customer will mention the Creditor Reference instead of the invoice number in the message section when he pays the invoice. Messages where Creditor Reference may be used in various payments related messages, including invoices, credit transfers direct debits.

Depending on who provides the referral, a credit reference could well mean the difference between the applicant being approved or declined for credit. The Creditor Reference was first implemented within the SEPA rulebook 3.2. Many countries have their own country-specific standards for identifiers. Purpose of RF Creditor Reference is to offer a standard that can be used instead of a country-specific identifier. This increases the STP process, especially when an identifier must cross national borders.

Implementation

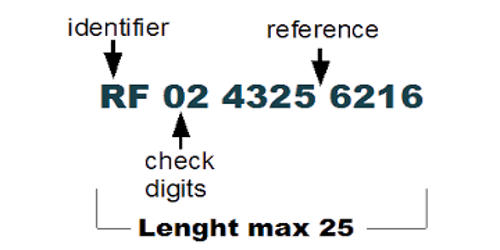

Credit references offer value to lenders that go beyond traditional credit reports – the primary tool lenders and creditors use to weigh an applicant’s credit risk. The creditor reference consists of the letters “RF”, two check digits and a reference, which is composed of the customer ID and the invoice ID. A vendor adds the Creditor Reference to its invoices. When a customer pays the invoice, the company writes the Creditor Reference instead of the invoice number in the message section or places a Creditor Reference field in its payment ledger. For example, a sales invoice with ID 100567 for customer 100025 will have Creditor Reference RF86100025100567 (RF86 1000 2510 0567).

Format

A credit reference usually comes from another creditor, a professional or personal acquaintance of the applicant’s, or a financial institution like a bank or credit union. A reference always contains a maximum of 25 characters. Positions 1-2 contain identifier “RF” (separating this reference from the myriad of others), positions 3-4 contain check digit and positions onwards may contain alphanumeric characters, forming the actual reference. Alphanumeric characters allowed are digits and upper&lower letters from A to Z.

The ISO standard under development has the objective to provide a structured creditor reference that allows regular billing parties to identify invoices and to reconcile them with the related payments made by credit transfer or direct debit. When the vendor receives the payment, it can automatically match the remittance information to its Accounts Receivable system.

Benefits in invoicing

- Applicable to both business-to-business and business-to-consumer invoicing,

- May be used in domestic and cross-border invoicing.

Benefits in invoice collection

- Efficient monitoring and reconciliation of payments,

- Fewer errors in the processing of incoming payments,

- Facilitates payment reconciliation also in cross-border invoicing,

- Brings cost savings.

Benefits in ledger management

- Supports an automated invoicing process,

- Improves the predictability of liquidity.